Market Overview:

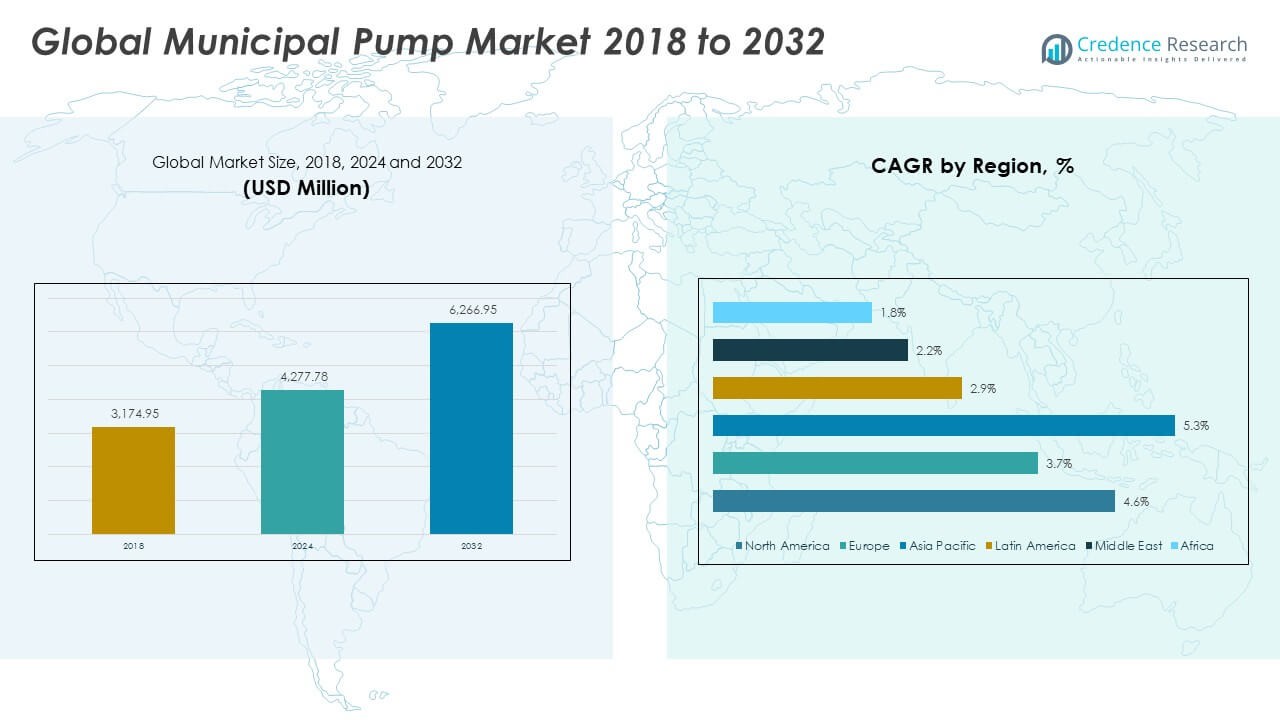

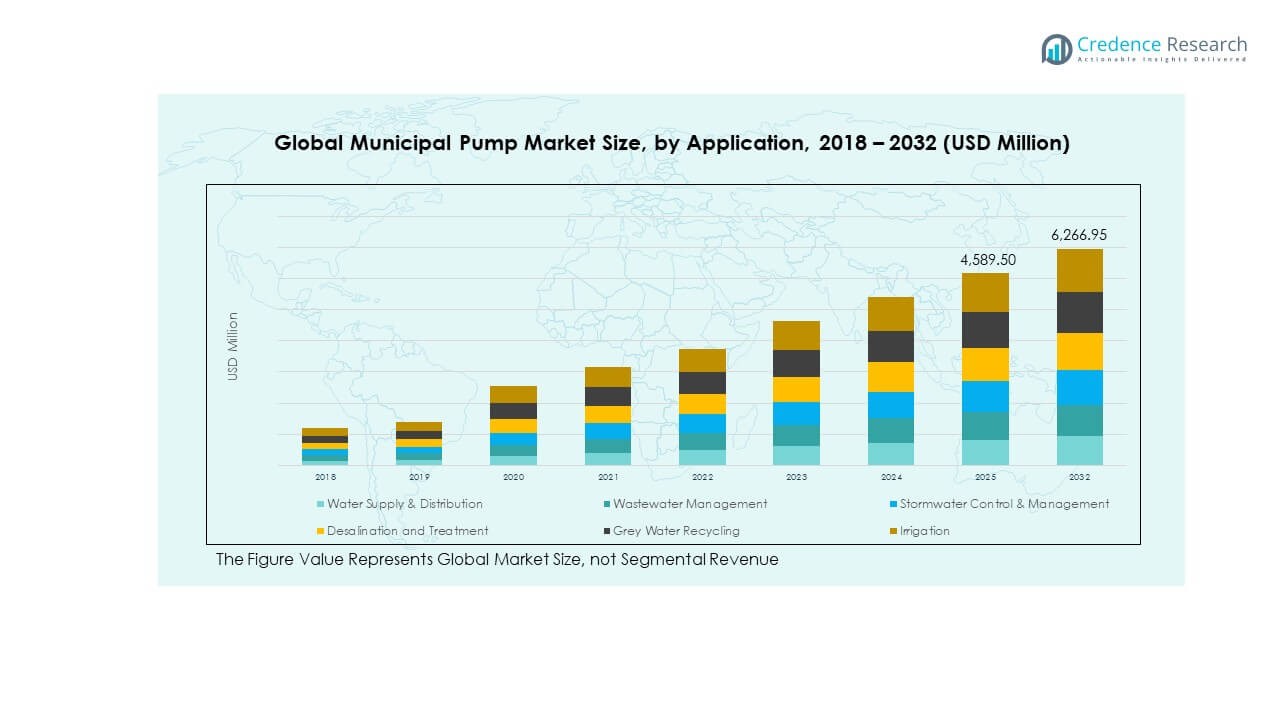

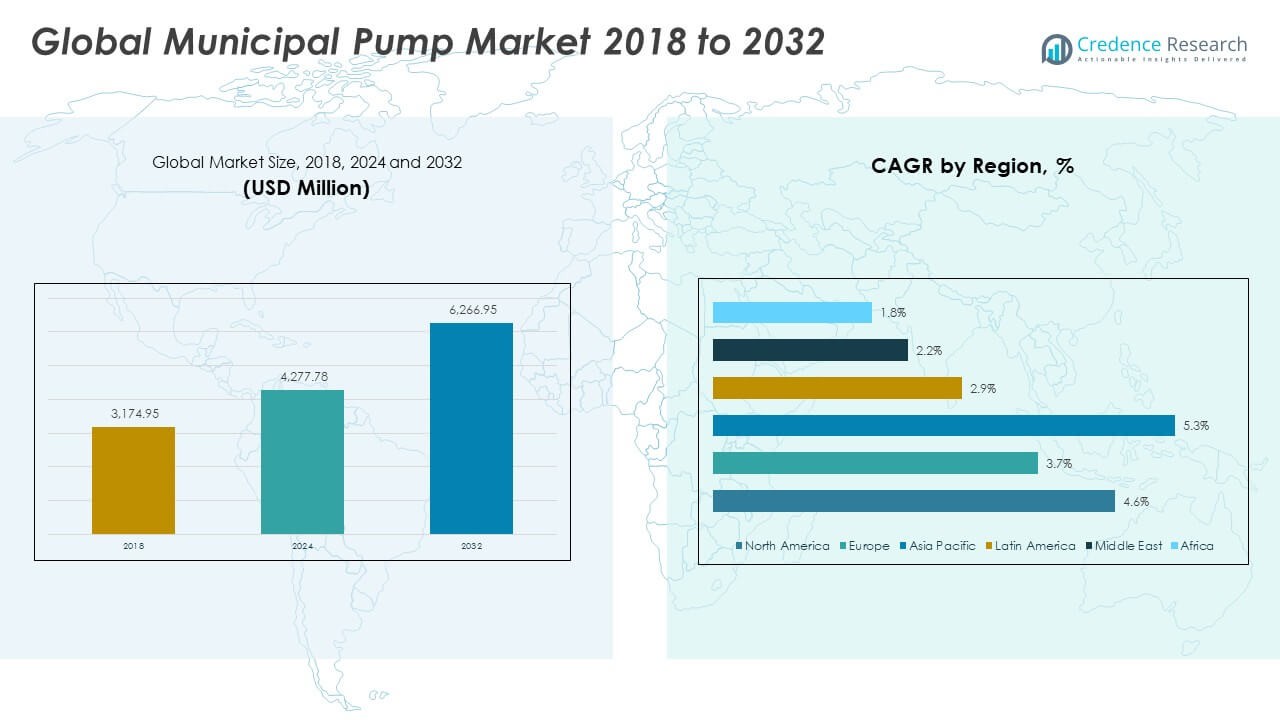

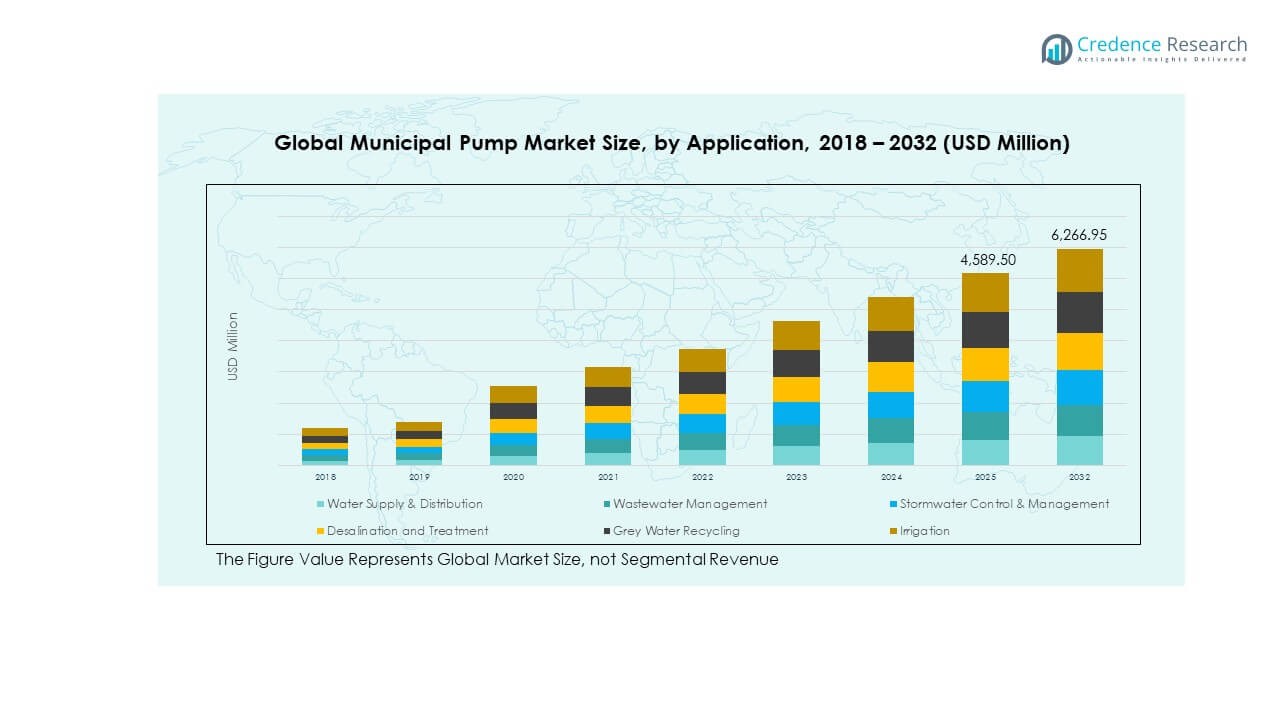

The Global Municipal Pump Market size was valued at USD 3,174.95 million in 2018 to USD 4,277.78 million in 2024 and is anticipated to reach USD 6,266.95 million by 2032, at a CAGR of 4.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Municipal Pump Market Size 2024 |

USD 4,277.78 Million |

| Municipal Pump Market, CAGR |

4.55% |

| Municipal Pump Market Size 2032 |

USD 6,266.95 Million |

Municipal pump demand is supported by rapid urbanization, population growth, and expanding municipal infrastructure projects. Rising focus on reliable water supply, wastewater treatment, and flood management drives adoption. Increasing environmental concerns and stricter government regulations on water management encourage municipalities to invest in energy-efficient and smart pumping systems. The market benefits from technological advances, including remote monitoring, automation, and IoT-enabled pumps, which improve operational efficiency and reduce downtime, supporting strong growth across both developed and developing regions.

Regionally, North America and Europe lead the market due to well-established water management infrastructure and strong adoption of advanced pumping technologies. Asia-Pacific emerges as the fastest-growing region, supported by urban expansion, industrialization, and large-scale government investments in water treatment and sanitation projects in China, India, and Southeast Asia. Latin America and the Middle East & Africa are also showing rising demand, driven by infrastructure modernization and increasing focus on addressing water scarcity and municipal wastewater treatment challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Municipal Pump Market was valued at USD 3,174.95 million in 2018, estimated at USD 4,277.78 million in 2024, and is projected to reach USD 6,246.95 million by 2032, registering a CAGR of 4.55% during 2024–2032.

- North America holds 32% share, driven by advanced infrastructure and strong regulatory compliance. Europe accounts for 28%, supported by modern utilities and sustainability goals. Asia-Pacific represents 25%, led by large-scale urbanization and industrial expansion.

- Asia-Pacific is the fastest-growing region with 25% share, fueled by rapid urban growth, infrastructure investments, and increasing demand for wastewater and flood management solutions in China and India.

- Water Supply & Distribution contributes 30% of the market, supported by rising urban water demand and modern pipeline networks.

- Wastewater Management holds 25% share, reflecting stricter environmental regulations and higher investment in municipal sanitation systems.

Market Drivers:

Rapid Urbanization, Population Growth, and Rising Need for Municipal Water Infrastructure:

The Global Municipal Pump Market gains momentum from rapid urbanization and steady population growth worldwide. Cities demand reliable water distribution systems to meet residential and industrial needs. Municipalities invest heavily in water treatment facilities to secure access to clean water. Expanding cities require modern pump installations for wastewater management and flood control. Governments emphasize water quality and efficient delivery to reduce risks to public health. Urban planning strategies integrate advanced pump systems to support sustainable development goals. Growing municipal budgets fuel procurement of high-capacity and energy-efficient pumps. These dynamics reinforce the sector’s long-term importance in supporting essential infrastructure.

- For instance, Xylem’s Jabsco Sensor-Max II freshwater pump is designed for use in boats and RVs. It adjusts motor speed dynamically to provide consistent, quiet water flow for up to five outlets, with a maximum flow rate of 5 gallons per minute (GPM). This feature minimizes energy consumption and eliminates the need for a bulky accumulator tank, enhancing water system efficiency for marine and recreational vehicle applications.

Government Regulations, Sustainability Goals, and Focus on Water Conservation Policies:

The Global Municipal Pump Market experiences strong regulatory push due to water conservation mandates and environmental sustainability policies. Governments implement strict rules on water usage efficiency and wastewater recycling. Energy conservation initiatives encourage municipalities to adopt pumps with lower operational costs. Authorities promote smart monitoring systems to minimize leakages and optimize resource allocation. Pump upgrades align with national commitments toward climate change mitigation. Compliance with international water standards accelerates procurement of advanced technologies. Sustainability frameworks create opportunities for replacement demand in aging infrastructures. These regulations ensure long-term stability and growth in municipal pumping operations.

- For instance, Grundfos incorporates ECM (electronically commutated motors) technology in its ALPHA2 26-99FC pump, which can reduce electrical energy consumption by up to 85% through intelligent control of pump speed and adaptive software AUTOADAPT, optimizing energy use while maintaining flow requirements.

Rising Demand for Flood Management and Stormwater Control Solutions:

The Global Municipal Pump Market witnesses increased demand for stormwater management and flood control systems. Climate change drives higher risks of extreme rainfall and flooding. Municipalities adopt high-capacity pumps to protect urban areas from waterlogging. Infrastructure projects prioritize flood mitigation measures through drainage and pumping stations. Disaster preparedness initiatives strengthen pump installations in coastal and flood-prone cities. Governments allocate funds for emergency response systems with robust pumping capacity. Insurance and risk management firms push for preventive infrastructure investments. This focus on resilience enhances growth prospects for municipal pumping solutions worldwide.

Technological Advancements in Automation, IoT, and Smart Pumping Systems:

The Global Municipal Pump Market benefits from strong technological innovation in pumping systems. IoT-enabled pumps provide real-time monitoring and predictive maintenance features. Automation helps reduce manual intervention and operational downtime. Energy-efficient designs lower electricity consumption and align with cost-saving goals. Remote-controlled systems enhance safety and allow rapid response to failures. Integration of AI-based analytics supports smarter water distribution networks. Digital twins and simulation models optimize system performance. These advancements attract municipalities aiming to modernize infrastructure while enhancing sustainability.

Market Trends:

Integration of Renewable Energy Sources with Pumping Infrastructure:

The Global Municipal Pump Market reflects a shift toward renewable-powered pump solutions. Solar-powered systems are increasingly installed in regions with limited electricity access. Hybrid designs ensure operational continuity during power shortages. Wind and solar integration reduces dependency on fossil fuels. Green initiatives support the transition to sustainable energy-based pump operations. Developing economies adopt renewable pump projects to cut fuel costs. Municipalities benefit from reduced operational expenses and compliance with carbon reduction goals. The trend creates fresh momentum for eco-friendly infrastructure upgrades.

- For example, Flowserve’s INNOMAG TB-MAG Dual Drive Pump launched in 2025 offers a sealless magnetic drive pump with dual hermetic sealing and secondary independent containment, enabling safer, leak-free operation optimized for renewable energy-powered sites and minimizing environmental impact.

Expansion of Decentralized Water and Wastewater Management Systems:

The Global Municipal Pump Market sees growth in decentralized solutions for water and wastewater. Smaller, modular pumping stations are being deployed in peri-urban and rural areas. These systems reduce dependence on centralized infrastructure and speed up project implementation. Localized facilities enhance community-level resilience and reliability. Compact pump systems cater to specific regional or industrial needs. Decentralization supports efficient allocation of municipal resources. Rising population density in satellite towns drives adoption of such networks. The trend provides flexible alternatives to traditional large-scale projects.

- For instance, KSB’s Ama-Porter 503 NE submersible wastewater pump offers a compact design with a maximum flow rate of 15 cubic meters per hour and operation up to 55°C fluid temperature, supporting smaller station installations with robust performance and low maintenance requirements.

Rising Adoption of Advanced Materials and Corrosion-Resistant Components:

The Global Municipal Pump Market incorporates advanced materials to extend product life and reliability. Corrosion-resistant alloys and composites enhance durability in harsh water conditions. Pumps designed with lighter materials improve energy efficiency. Wear-resistant coatings reduce maintenance requirements. Manufacturers introduce advanced seals and bearings to boost operational performance. Innovations help reduce lifecycle costs for municipalities. Improved design standards extend replacement cycles and reduce downtime. This trend increases trust in technologically advanced municipal pumps across global regions.

Growing Focus on Digital Twin Technology and Predictive Asset Management:

The Global Municipal Pump Market shows strong adoption of digital twin platforms for asset management. Virtual models replicate pumping infrastructure and enable continuous performance analysis. Predictive maintenance powered by AI prevents unexpected breakdowns. Utilities monitor pump health to optimize resource allocation. Smart sensors gather operational data for real-time adjustments. Municipalities use digital insights to plan upgrades and replacements more effectively. Remote monitoring supports workforce safety and efficiency. This trend strengthens operational resilience and maximizes pump reliability.

Market Challenges Analysis:

High Capital Investment and Rising Maintenance Costs for Municipal Pump Infrastructure:

The Global Municipal Pump Market faces challenges linked to high initial investment and operational expenses. Large-scale pumping projects require significant financial resources, which strain municipal budgets. Many cities struggle to secure funding for upgrading outdated infrastructure. The cost of modern, energy-efficient pumps increases procurement difficulties in developing regions. Maintenance demands add recurring financial pressure, especially in older facilities. Unscheduled repairs often disrupt water supply and wastewater management. Limited technical expertise in smaller municipalities exacerbates inefficiencies. These barriers limit adoption rates despite rising infrastructure needs.

Vulnerability to Climate Change Impacts and Supply Chain Disruptions:

The Global Municipal Pump Market encounters risks from climate change and global supply chain volatility. Extreme weather events accelerate wear and tear on pump systems. Floods, droughts, and hurricanes create unpredictable demand for emergency installations. Rising raw material costs affect manufacturing and delay project timelines. Dependence on imported pump components leaves municipalities exposed to trade restrictions. Supply chain disruptions raise procurement costs and extend lead times. Smaller cities struggle to balance urgency with affordability. These challenges highlight the sector’s vulnerability to external shocks and evolving risks.

Market Opportunities:

Growth in Smart City Initiatives and Investments in Digital Infrastructure:

The Global Municipal Pump Market gains opportunities from smart city development projects. Governments invest in intelligent water management systems to enhance urban living. Integration of sensors and automation improves efficiency and water distribution. Smart city frameworks encourage adoption of IoT-enabled pumps. Digital platforms streamline monitoring, reducing losses and energy use. Municipalities benefit from optimized asset utilization and improved service delivery. Expanding global urbanization ensures long-term demand for advanced pump solutions. These opportunities align with the broader push toward modernized infrastructure.

Emerging Demand from Developing Regions with Rising Infrastructure Needs:

The Global Municipal Pump Market benefits from increasing infrastructure projects in developing economies. Rapid urbanization in Asia, Africa, and Latin America drives fresh demand. Governments prioritize clean water supply and sanitation to improve public health. International funding supports large-scale water treatment and flood management projects. Local municipalities adopt modular and cost-effective pump systems for quick deployment. Rising middle-class populations strengthen municipal budgets. The opportunity lies in providing affordable yet advanced pumping solutions. Growing focus on sustainable development makes these regions attractive for future growth.

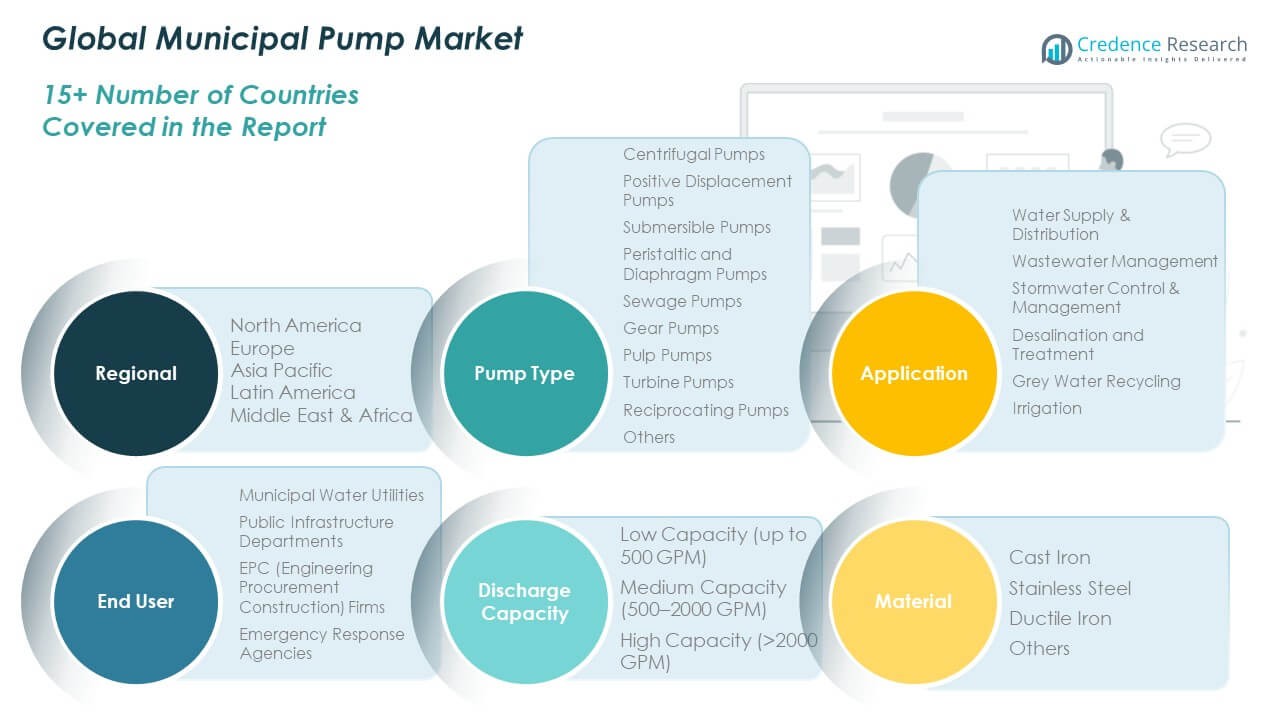

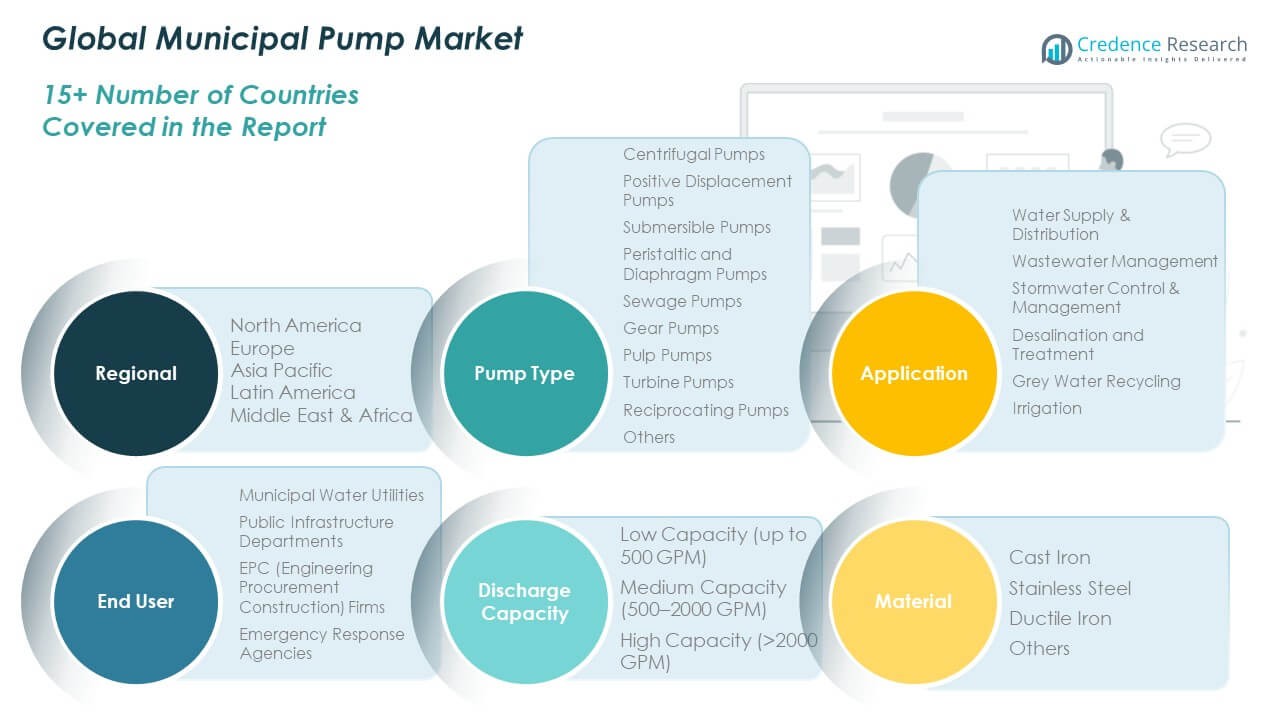

Market Segmentation Analysis:

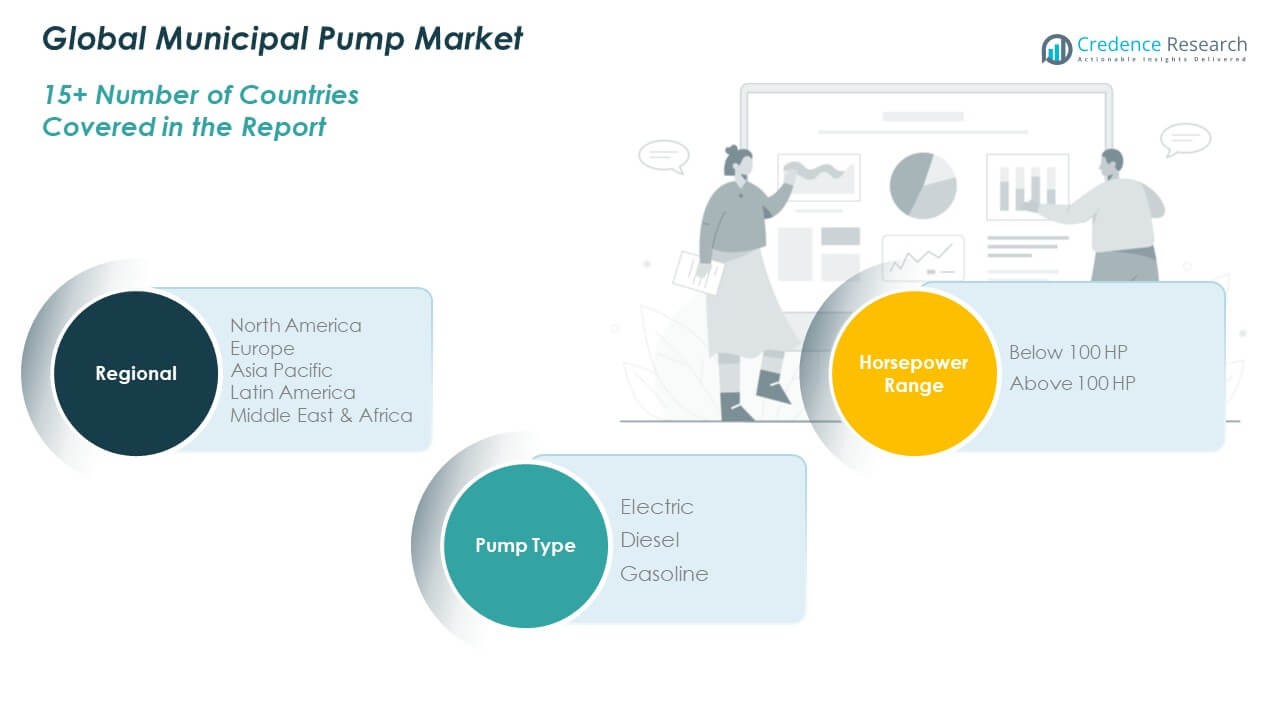

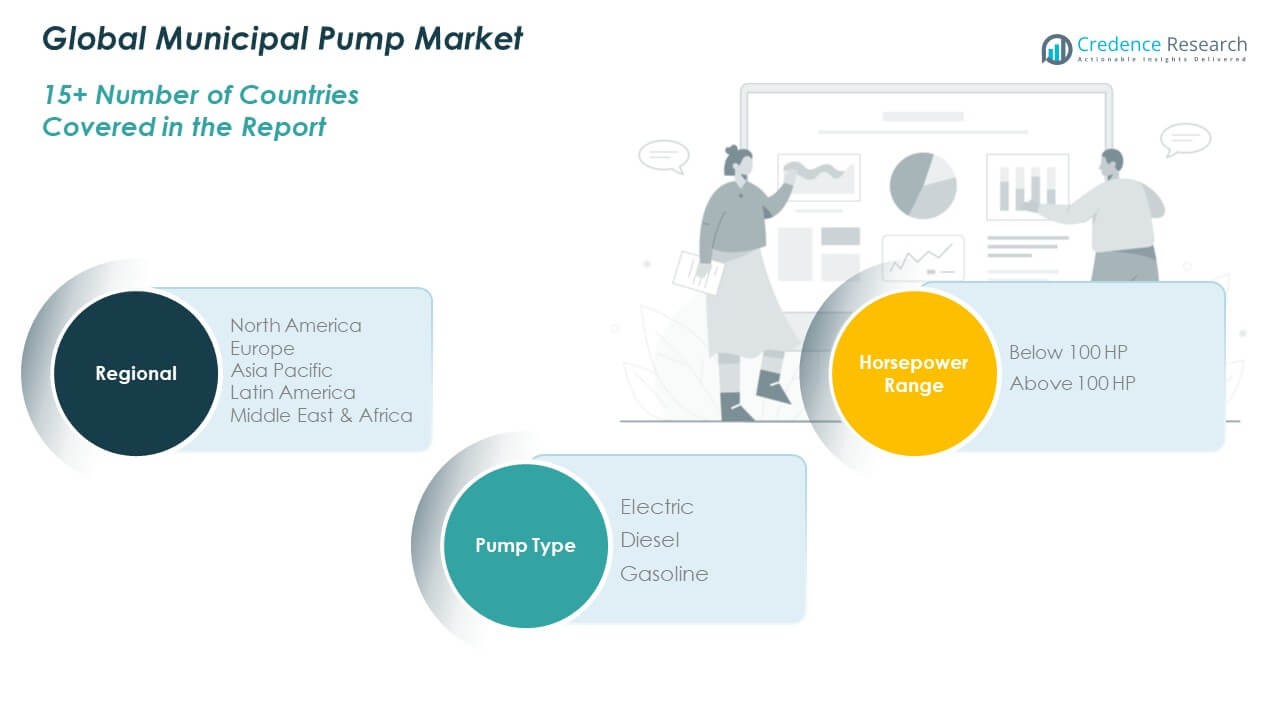

By Pump Type

The Global Municipal Pump Market shows strong demand across multiple pump categories. Centrifugal pumps dominate due to high efficiency in large water distribution networks. Submersible pumps are widely used in wastewater and sewage systems. Positive displacement pumps serve critical roles where steady flow is required. Turbine pumps are gaining traction in large municipal projects with high-capacity needs. Peristaltic, diaphragm, gear, pulp, and reciprocating pumps meet niche applications, ensuring flexibility across diverse infrastructure requirements. This variety underscores the market’s ability to cater to specialized municipal needs.

- For instance, Ebara’s DLFU series submersible sewage pumps, such as the 25 HP model, deliver efficiency levels exceeding at flow rates close to 1000 gallons per minute with heads up to 120 feet, offering high performance for wastewater treatment.

By Application

Water supply and distribution leads the market, supported by growing urban populations and expanded pipeline systems. Wastewater management follows closely, reflecting strict environmental regulations and heavy investments in sanitation. Stormwater control and management continues to grow as municipalities respond to increasing climate-driven flooding risks. Desalination and treatment are vital in regions facing water scarcity, particularly in the Middle East and coastal areas. Grey water recycling and irrigation emerge as sustainable applications, supporting water conservation and resource efficiency across developing and developed economies.

- For instance, ITT Goulds Pumps’ SSV series of vertical multi-stage pumps for residential and commercial applications demonstrates flow rates ranging from 2 to over 500 gallons per minute (GPM), offering reliable solutions optimized for varied water distribution, irrigation, and recycling systems.

By End User

Municipal water utilities remain the largest end-user group, supported by large-scale budgets for infrastructure upgrades. Public infrastructure departments integrate pumps into projects addressing water supply, drainage, and treatment. EPC firms act as vital partners, managing design and deployment in turnkey municipal contracts. Emergency response agencies adopt mobile and high-capacity pumps for disaster management and rapid recovery needs. It benefits from a wide range of stakeholders prioritizing reliability, operational efficiency, and compliance with water management regulations.

Segmentation:

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

- Submersible Pumps

- Peristaltic and Diaphragm Pumps

- Sewage Pumps

- Gear Pumps

- Pulp Pumps

- Turbine Pumps

- Reciprocating Pumps

- Others

By Application

- Water Supply & Distribution

- Wastewater Management

- Stormwater Control & Management

- Desalination and Treatment

- Grey Water Recycling

- Irrigation

By End User

- Municipal Water Utilities

- Public Infrastructure Departments

- EPC (Engineering, Procurement, Construction) Firms

- Emergency Response Agencies

By Discharge Capacity

- Low Capacity (up to 500 GPM)

- Medium Capacity (500–2000 GPM)

- High Capacity (>2000 GPM)

By Material

- Cast Iron

- Stainless Steel

- Ductile Iron

- Others

By Power Source

By Horsepower Range

- Below 100 HP

- Above 100 HP

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Municipal Pump Market size was valued at USD 619.86 million in 2018 to USD 815.77 million in 2024 and is anticipated to reach USD 1,202.62 million by 2032, at a CAGR of 4.6% during the forecast period. North America accounts for 19.2% share of the global market in 2024. The region benefits from advanced water infrastructure and strong regulatory frameworks. Municipalities invest in energy-efficient pumps to align with sustainability mandates. The U.S. drives growth through modernization of wastewater treatment plants and flood management systems. Canada and Mexico contribute with expanding urban centers and infrastructure spending. Smart technologies, IoT-enabled monitoring, and predictive maintenance gain traction across utilities. High replacement demand arises from aging municipal systems. It strengthens growth through a steady focus on modernization and resilience.

Europe

The Europe Municipal Pump Market size was valued at USD 883.38 million in 2018 to USD 1,146.47 million in 2024 and is anticipated to reach USD 1,579.31 million by 2032, at a CAGR of 3.7% during the forecast period. Europe represents 26.8% share of the global market in 2024. The region emphasizes sustainability and efficient water management. Strict EU directives drive investments in wastewater recycling and flood prevention. Countries like Germany, France, and the UK lead through technological adoption. Infrastructure upgrades address aging water systems in Southern and Eastern Europe. Advanced materials and digital solutions improve pump reliability. Climate-driven challenges increase spending on stormwater control and flood defenses. It benefits from robust regulatory frameworks and advanced municipal practices.

Asia Pacific

The Asia Pacific Municipal Pump Market size was valued at USD 1,388.55 million in 2018 to USD 1,939.89 million in 2024 and is anticipated to reach USD 3,015.16 million by 2032, at a CAGR of 5.3% during the forecast period. Asia Pacific contributes the largest share, accounting for 45.4% of the global market in 2024. The region leads due to rapid urbanization and industrial growth. China and India drive infrastructure development, prioritizing clean water and sanitation. Japan and South Korea adopt advanced technologies to modernize utilities. Southeast Asia benefits from international funding for water treatment and flood management. Growing climate challenges create demand for resilient pumping systems. Affordable pump solutions gain popularity in emerging economies. It sustains leadership through rising public investment and growing urban demand.

Latin America

The Latin America Municipal Pump Market size was valued at USD 143.26 million in 2018 to USD 190.51 million in 2024 and is anticipated to reach USD 245.51 million by 2032, at a CAGR of 2.9% during the forecast period. Latin America holds 4.5% share of the global market in 2024. Brazil dominates with large-scale urban centers and industrial expansion. Mexico and Argentina follow with growing municipal infrastructure. Limited budgets slow adoption in smaller countries. International aid supports water treatment and sanitation projects. Rising urban flooding risks increase demand for stormwater management systems. Energy-efficient pump adoption is rising gradually. It shows moderate growth with opportunities in targeted infrastructure projects.

Middle East

The Middle East Municipal Pump Market size was valued at USD 86.11 million in 2018 to USD 105.73 million in 2024 and is anticipated to reach USD 129.83 million by 2032, at a CAGR of 2.2% during the forecast period. The region represents 2.5% share of the global market in 2024. Water scarcity drives demand for desalination and treatment pumps. GCC countries lead investments in large-scale projects. Israel focuses on advanced water recycling technologies. Infrastructure expansion supports demand in Turkey and the rest of the region. Energy-efficient pump solutions align with sustainability strategies. International partnerships foster advanced technology adoption. It shows stable demand linked to strategic water security initiatives.

Africa

The Africa Municipal Pump Market size was valued at USD 53.79 million in 2018 to USD 79.40 million in 2024 and is anticipated to reach USD 94.52 million by 2032, at a CAGR of 1.8% during the forecast period. Africa accounts for 1.9% share of the global market in 2024. Limited infrastructure investment restricts large-scale adoption. South Africa leads with urban water supply and treatment projects. Egypt expands demand through Nile water management and flood control initiatives. Many sub-Saharan countries face funding gaps for municipal utilities. International aid and development programs support targeted deployments. Affordable pumps gain traction in rural and peri-urban communities. It shows gradual growth shaped by infrastructure deficits and regional disparities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Xylem Inc.

- Grundfos

- KSB SE & Co. KGaA

- Ebara Corporation

- Wilo SE

- ITT Goulds

- Flowserve Corporation

Competitive Analysis:

The Global Municipal Pump Market is moderately consolidated, with key players focusing on expanding portfolios and strengthening global presence. Leading companies such as Xylem, Grundfos, KSB, Ebara, Wilo, Flowserve, and ITT Goulds dominate through advanced technologies, energy-efficient systems, and integrated digital solutions. Competition revolves around product reliability, cost efficiency, and compliance with water regulations. Regional players target niche applications and localized infrastructure projects, creating a fragmented competitive landscape. It gains momentum from innovation in IoT-enabled pumps and predictive maintenance platforms. Partnerships with municipalities and EPC firms enhance visibility in large infrastructure projects. Market leaders continue to invest in R&D, capacity expansion, and sustainability-focused solutions to maintain a competitive edge.

Recent Developments:

- Grundfos completed the acquisition of Newterra, a water and wastewater treatment solutions company based in Pittsburgh, in August 2025. This acquisition significantly expands Grundfos’s water treatment portfolio and strengthens its position in the US and Canadian markets, supporting its ambition to become a global water treatment leader.

- In July 2025, KSB SE & Co. KGaA launched the AmaCan P type series of submersible motor pumps with axial propellers designed for large volume transport of municipal or industrial water and wastewater. The pumps feature corrosion resistance options, high hydraulic efficiency, and advanced sensor monitoring for predictive maintenance.

- In April 2024, Xylem Inc. launched the Jabsco PureFlo 21 Single Use Pump, a breakthrough product featuring an adjustable integrated pressure relief valve designed to minimize contamination risk and maximize operator safety in pharmaceutical manufacturing. This pump supports sustainable manufacturing by using less material and aims to speed up product development while reducing environmental impact. Additionally, in February 2025, Xylem introduced the Jabsco Sensor-Max II freshwater pump, powered by a variable speed drive for enhanced efficiency in boat and RV applications. This pump adjusts motor speed based on flow requirements, reducing energy consumption and improving performance.

Report Coverage:

The research report offers an in-depth analysis based on pump type, application, end user, discharge capacity, material, power source, horsepower range, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising urbanization will drive continuous demand for municipal water supply systems.

- Adoption of IoT-enabled and smart pumping solutions will strengthen operational efficiency.

- Sustainability initiatives will push utilities to adopt energy-efficient pump technologies.

- Wastewater treatment investments will expand demand in both developed and emerging economies.

- Stormwater management projects will gain importance due to climate-related flooding risks.

- Desalination and water recycling will create new opportunities in water-scarce regions.

- Public-private partnerships will enhance funding and accelerate infrastructure deployment.

- Advanced materials and corrosion-resistant designs will improve product durability.

- Regional diversification will expand market presence for mid-sized manufacturers.

- Continuous R&D investments will shape innovation in predictive maintenance and automation.