Market Overview

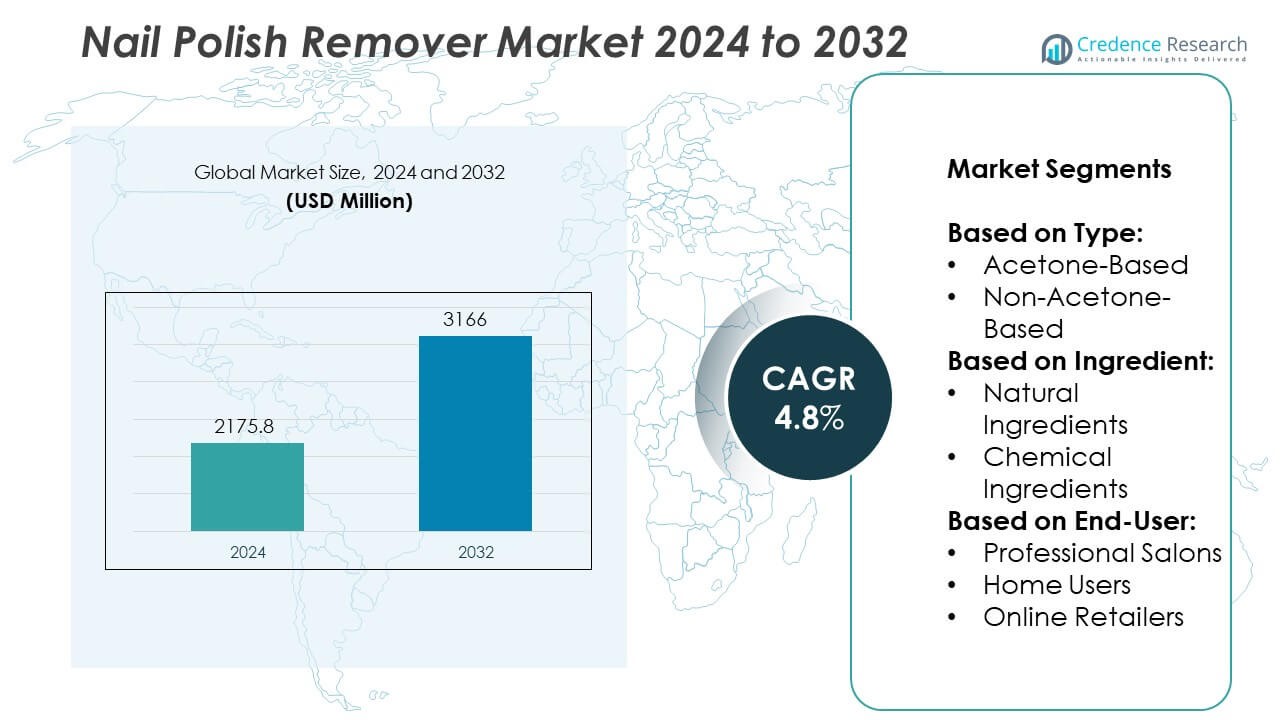

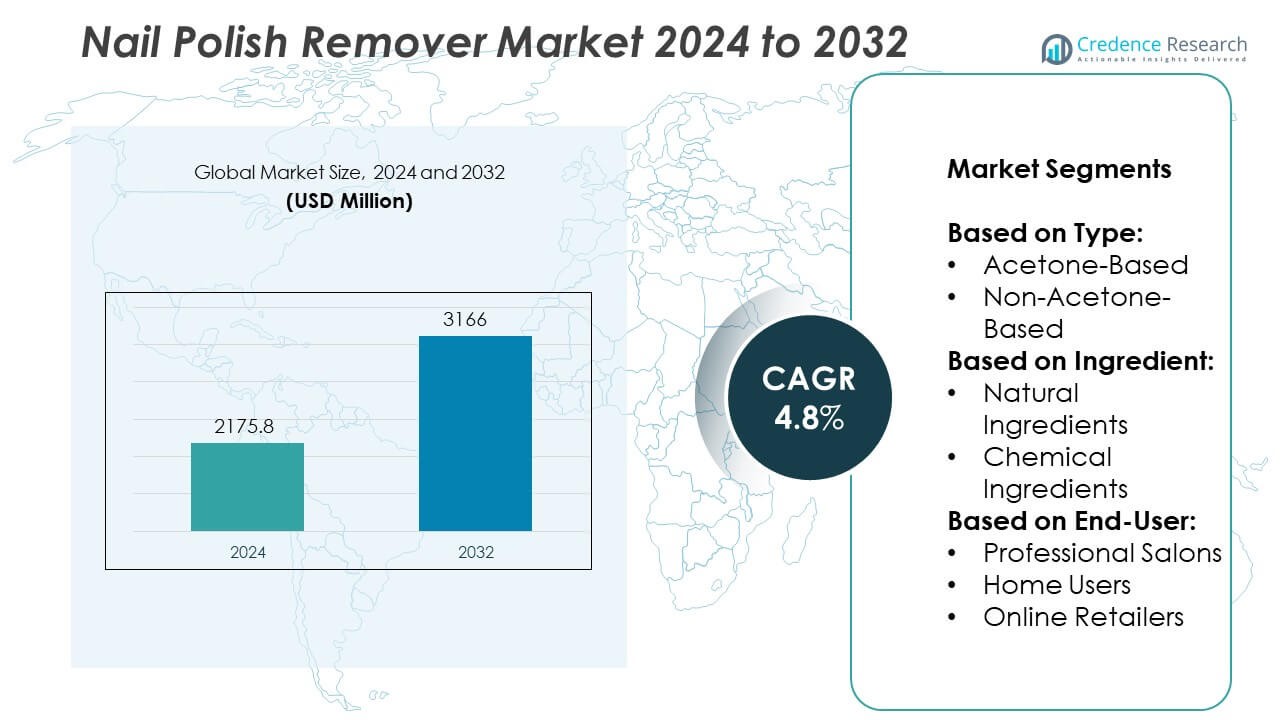

Nail Polish Remover Market size was valued at USD 2175.8 million in 2024 and is anticipated to reach USD 3166 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nail Polish Remover Market Size 2024 |

USD 2175.8 Million |

| Nail Polish Remover Market, CAGR |

4.8% |

| Nail Polish Remover Market Size 2032 |

USD 3166 Million |

The Nail Polish Remover market grows through rising demand for personal grooming, increased frequency of nail polish usage, and the expanding popularity of at-home manicures. Consumers prioritize acetone-free and skin-friendly formulations due to health and wellness concerns. It benefits from innovation in travel-friendly packaging, vitamin-enriched solutions, and product bundling with nail care kits. The market aligns with trends toward clean-label beauty, sustainable packaging, and gender-neutral branding.

The Nail Polish Remover market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads in product innovation and premium offerings due to high consumer awareness and established beauty retail networks. Europe follows with strong regulatory focus on safe ingredients and sustainable packaging. Asia-Pacific exhibits rapid growth driven by increasing urbanization, expanding beauty culture, and rising demand from emerging economies like China and India. Latin America and the Middle East & Africa show steady demand supported by growing personal care adoption and retail expansion. Leading players shaping the market include L’Oréal, known for its broad portfolio and innovation in clean beauty.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nail Polish Remover market was valued at USD 2175.8 million in 2024 and is projected to reach USD 3166 million by 2032, growing at a CAGR of 4.8% during the forecast period.

- The market grows due to increasing beauty consciousness, rising frequency of nail polish usage, and growing demand for at-home grooming solutions across urban and semi-urban populations.

- Consumers prefer acetone-free, vitamin-enriched, and skin-friendly formulations, driving a shift toward natural ingredients and non-toxic product innovation.

- Key players such as L’Oréal, Kao Corporation, Revlon, and OPI Products focus on expanding their product portfolios with travel-friendly packaging, sustainable materials, and bundled offerings.

- Regulatory concerns over chemical ingredients, environmental impact of volatile organic compounds, and packaging waste create operational and compliance challenges for manufacturers.

- North America leads with advanced retail infrastructure and strong demand for premium products, while Asia-Pacific experiences fastest growth due to rising urbanization and beauty market expansion in China and India.

- The market responds to clean-label trends, gender-neutral branding, and digital promotion strategies as brands compete on product safety, user convenience, and environmental responsibility.

Market Drivers

Rising Beauty Product Consumption Among Young Adults and Urban Consumers Driving Routine Nail Care

The Nail Polish Remover market gains momentum from increasing use of cosmetic products among young, urban populations. It benefits from higher disposable incomes, social media influence, and greater emphasis on grooming and personal style. Regular use of nail polish creates recurring demand for effective removal solutions. The shift toward personal care routines at home also supports frequent product use. Growth in beauty subscription services and online tutorials further accelerates product adoption. The market aligns with consumer interest in maintaining professional appearance and hygiene standards.

- For instance, Revlon reported that its nail care product line, including removers, grew by 11% in urban markets across the U.S. due to higher engagement from Gen Z consumers through digital platforms.

Consumer Preference for Acetone-Free, Gentle, and Skin-Friendly Formulations Supporting Product Shift

The Nail Polish Remover market evolves with rising demand for non-toxic, skin-sensitive formulations. It reflects broader wellness and safety priorities among consumers seeking products without harsh chemicals. Acetone-free removers with added moisturizers or vitamins appeal to users concerned with nail and cuticle health. Brands position these products as clean-label alternatives, often certified vegan or dermatologically tested. Ingredient transparency becomes a key buying factor in this segment. The market adapts by expanding portfolios to meet health-conscious preferences.

- For instance, Sally Hansen’s Miracle Gel collection launched over ten years ago, and the line has since expanded to offer more than 100 shades, making it a mainstay for at-home manicure enthusiasts.

Growth in Nail Salons, DIY Nail Kits, and At-Home Care Products Creating Steady Demand

Expansion in professional nail services and home-based manicure kits drives consistent growth in the Nail Polish Remover market. It supports both salon professionals and at-home users seeking high-efficiency, residue-free removal solutions. With growing interest in nail art and gel polish, consumers require specialized products for varied polish types. The availability of removers in wipes, sponges, and single-use formats enhances convenience. Retailers bundle removers with nail care kits to create value-added offerings. The market grows alongside beauty trends that emphasize customization and accessibility.

Wider Distribution Through Online Retail Channels and Beauty Chains Increasing Market Penetration

Improved product availability across e-commerce platforms and retail beauty chains boosts the Nail Polish Remover market. It reaches broader demographics by leveraging digital channels and global shipping capabilities. Online reviews and influencer recommendations shape brand visibility and consumer trust. Beauty retailers highlight removers through seasonal promotions and curated product lines. Manufacturers expand retail partnerships to ensure presence in both premium and mass-market categories. The market strengthens through diverse distribution strategies tailored to evolving consumer purchase behavior.

Market Trends

Rising Popularity of Natural and Organic Ingredients in Nail Care Formulations

The Nail Polish Remover market shows a clear shift toward natural and organic ingredient adoption to meet growing consumer concerns around chemical exposure. It integrates plant-derived solvents such as ethyl lactate, soy-based oils, and aloe vera to deliver effective performance with reduced skin irritation. Brands actively position these offerings as safer alternatives to traditional acetone-based products. Clean-label transparency influences purchasing behavior, especially among health-conscious and eco-aware consumers. Certification labels such as USDA Organic or vegan claims enhance credibility in crowded shelves. The market responds by expanding portfolios that emphasize safety and ingredient traceability.

- For instance, Londontown’s Strengthening Lacquer Remover earns an average rating of 4.8 out of 5 stars from 435 customer reviews on its official site, with many comments praising its hydrating, plant-infused formula that supports nail health.

Increased Demand for Multipurpose and Travel-Friendly Packaging Across Demographics

Compact, mess-free, and multifunctional formats gain traction in the Nail Polish Remover market due to changing consumer routines and mobility needs. It introduces wipes, pen-style removers, and pre-soaked pads to cater to frequent travelers and on-the-go professionals. These innovations provide convenience without sacrificing efficacy or safety. Product design increasingly focuses on spill-proof containers and portable packaging to improve user experience. Brands capitalize on this trend by bundling removers with manicure kits or positioning them as essentials in cosmetic travel bags. Consumer feedback plays a key role in optimizing form factor and functionality.

- For instance, L’Oréal was awarded Cradle to Cradle certification for 557 products on the US market, including 20 new launches in 2023.

Growth of Sustainable Packaging Initiatives Driven by Regulatory and Consumer Pressure

Sustainability concerns influence packaging design strategies across the Nail Polish Remover market. It adopts recyclable materials, glass containers, and biodegradable labels to reduce environmental impact. Regulatory frameworks and eco-labeling schemes prompt manufacturers to align with green packaging norms. Brands highlight minimal waste and carbon footprint in marketing to appeal to environmentally aware buyers. Refillable and reusable packaging formats emerge as differentiators in premium product lines. Retailers also push for shelf-ready designs that meet both aesthetic and sustainability benchmarks.

Expansion of Gender-Neutral and Inclusive Marketing Strategies Across Product Lines

The Nail Polish Remover market adopts inclusive positioning to appeal to diverse consumer segments beyond traditional female buyers. It supports this trend by removing gender-specific design cues and promoting universal appeal in messaging and visuals. Social campaigns and influencer partnerships help normalize nail care for all identities, including men and non-binary individuals. Packaging becomes more minimalist and neutral to cater to wider preferences. Brands invest in community-driven marketing to build loyalty and relevance. Market expansion aligns with evolving definitions of beauty and self-care.

Market Challenges Analysis

Health and Safety Concerns Over Chemical Ingredients Limiting Consumer Confidence and Adoption

The Nail Polish Remover market faces scrutiny due to concerns over harsh ingredients such as acetone, ethyl acetate, and isopropyl alcohol. It must address consumer apprehension about skin dryness, allergic reactions, and long-term nail damage. Regulatory agencies in various regions enforce strict labeling and chemical usage standards, increasing compliance burdens on manufacturers. Negative perception of chemical-based removers discourages adoption among health-conscious users. Brands need to balance product efficacy with gentler formulations that meet safety benchmarks. The market competes with alternative nail care methods that reduce dependency on chemical removers.

Environmental Impact of Packaging Waste and Volatile Organic Compounds Creating Regulatory Pressure

The Nail Polish Remover market encounters challenges linked to sustainability, particularly in packaging waste and air quality impact from volatile organic compounds (VOCs). It requires manufacturers to rethink container materials and reduce emissions during production and use. Growing environmental regulations in key markets demand eco-friendly practices across the product lifecycle. Consumers increasingly prefer recyclable or biodegradable packaging, pressuring brands to innovate without inflating costs. Refill formats and reduced-plastic solutions remain underutilized across mass-market segments. The market must reconcile environmental expectations with performance and affordability.

Market Opportunities

Innovation in Natural, Vitamin-Enriched, and Sensitive-Skin Formulations to Expand Product Appeal

The Nail Polish Remover market presents strong opportunities in developing gentle, plant-based, and vitamin-enriched variants targeted at sensitive-skin users. It can capture demand from consumers who avoid acetone and prioritize non-irritating ingredients. Formulations with nourishing oils, aloe vera, and antioxidant blends appeal to users focused on nail health and wellness. Brands can differentiate through dermatological testing and clean-label positioning. Expanding these offerings across mass and premium segments creates access to broader demographics. The market has room to grow by aligning with evolving preferences in skin-safe and wellness-oriented beauty solutions.

Growth Potential Through Personalization, Gifting Formats, and Cross-Selling with Nail Care Kits

Creative product bundling and personalization strategies offer new growth paths for the Nail Polish Remover market. It gains value by integrating with manicure kits, gift boxes, and seasonal promotions tailored to different user profiles. Custom fragrances, skin-type-specific variants, and themed packaging enhance consumer engagement. Retailers and brands can cross-sell removers with nail polishes, cuticle oils, and buffers to increase basket size. Limited edition collections and co-branded offerings add further revenue potential. The market can strengthen customer loyalty through targeted, lifestyle-driven positioning and curated beauty experiences.

Market Segmentation Analysis:

By Type:

The Nail Polish Remover market is divided into acetone-based and non-acetone-based products. Acetone-based removers dominate due to their high efficiency in removing gel and glitter nail polishes. It maintains strong usage in professional environments where performance and speed are critical. However, non-acetone-based variants are gaining popularity among consumers with sensitive skin and nails. These alternatives provide gentler removal and are often enriched with moisturizers. The shift in consumer preference toward less aggressive formulations supports growth in this sub-segment.

- For instance, OPI’s Acetone-Free Polish Remover comes in a 110 ml bottle and offers gentle formula benefits along with hydrating properties.

By Ingredient:

Product formulations based on natural and chemical ingredients define the next segmentation in the Nail Polish Remover market. Chemical ingredients, including acetone and ethyl acetate, continue to lead due to cost-effectiveness and immediate results. It remains the preferred choice in mass-market products and salons requiring high-volume performance. Natural ingredient-based removers, often featuring soy extracts, aloe vera, and essential oils, attract a growing segment of eco-conscious and health-aware consumers. These products align with clean beauty trends and rising demand for non-toxic solutions. The market adapts to these shifts by introducing hybrid formulations that balance efficacy and safety.

- For instance, the Aliver Gel Nail Polish Remover has received over 4,000 five‑star ratings on Amazon, signaling strong consumer approval among online users.

By End-User:

End-user segmentation in the Nail Polish Remover market includes professional salons, home users, and online retailers. Professional salons account for consistent bulk demand for strong, fast-acting solutions. It supports this segment by offering large-volume packaging and industrial-grade formulations. Home users drive volume in the retail sector, preferring user-friendly, spill-proof, and nourishing variants. The rise in at-home manicures has boosted this segment’s demand for quality and convenience. Online retailers serve as both a distribution and end-user category, offering personalized kits, subscription models, and exclusive product launches. The market leverages digital platforms to target consumers seeking curated nail care solutions.

Segments:

Based on Type:

- Acetone-Based

- Non-Acetone-Based

Based on Ingredient:

- Natural Ingredients

- Chemical Ingredients

Based on End-User:

- Professional Salons

- Home Users

- Online Retailers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 26.4% of the global street sweeper market, driven by advanced infrastructure, strict municipal regulations, and well-established urban sanitation systems. The United States leads the region, with widespread deployment of mechanical, vacuum, and regenerative air sweepers across cities and counties. It emphasizes cleaner streets to comply with Environmental Protection Agency (EPA) dust control standards and PM10/PM2.5 emission limits. Large fleets operate in major cities such as New York, Los Angeles, and Chicago, supported by public procurement and private contractor models. Canada contributes to the regional share through growing investments in sustainable sweeping solutions and clean transportation programs in cities like Toronto and Vancouver. The market continues to adopt electric sweepers and automated technologies in line with green infrastructure goals and smart city initiatives.

Europe

Europe accounts for 21.7% of the street sweeper market, driven by environmental regulations, low-emission zones, and urban sustainability targets. Countries including Germany, France, the UK, Italy, and the Netherlands show high demand for electric and hybrid sweepers, particularly in compact and noise-sensitive models for inner-city applications. It benefits from long-standing public sanitation frameworks and robust municipal budgets. Adoption of smart monitoring systems for route optimization and fuel efficiency supports operational upgrades. The EU’s Clean Vehicles Directive and net-zero carbon goals accelerate fleet electrification across major cities. Cross-border technological collaboration among manufacturers and policy support from national governments position Europe as a key innovator in clean street sweeping solutions.

Asia-Pacific

Asia-Pacific dominates the global street sweeper market with a 35.6% share, supported by rapid urbanization, large-scale infrastructure development, and expanding municipal capacities. China leads the region with extensive deployment of automated street sweeping vehicles across tier 1 and tier 2 cities, driven by national clean air initiatives and large government budgets. It has scaled electric sweeper production and adoption through both domestic and export-oriented players. India shows increasing adoption in urban zones under the Swachh Bharat Mission, where local bodies upgrade from manual to mechanized systems. Japan and South Korea prioritize compact, high-efficiency electric sweepers tailored to dense urban layouts. Demand continues to rise in Southeast Asian countries through public-private collaborations and donor-funded urban renewal programs.

Middle East & Africa

The Middle East and Africa hold a combined 9.0% share of the global street sweeper market, with growth led by infrastructure development, tourism-centric urban beautification, and environmental awareness. The UAE and Saudi Arabia account for the largest regional demand through national visions and megacity projects such as NEOM and Dubai Smart City. It focuses on large-capacity, high-durability models to manage sand, dust, and heat-intensive environments. South Africa, Egypt, and Kenya represent growing markets, driven by urban sanitation reforms and gradual procurement modernization. Budget constraints and inconsistent urban policy enforcement remain challenges, but investments in public cleanliness and environmental health continue to support market expansion.

Latin America

Latin America captures 7.3% of the street sweeper market, with demand driven by population growth, rising urban density, and efforts to improve public sanitation. Brazil leads the region through municipal contracts for mechanical street sweepers in major cities like São Paulo and Rio de Janeiro. It continues to expand urban maintenance services despite occasional budgetary constraints. Mexico follows with increased adoption of compact sweepers through public-private partnerships and smart city programs. Argentina, Chile, and Colombia also show signs of market maturity, emphasizing cost-effective models and localized servicing. It addresses environmental and cleanliness concerns by gradually transitioning from manual labor to mechanized sweeping systems, particularly in high-traffic urban areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- OPI Products

- Zoya

- Procter and Gamble

- Estée Lauder

- Henkel

- Revlon

- China Glaze

- Orly

- L’Oréal

- Coty

- Sally Hansen

- Kao Corporation

- Mary Kay

- Sinful Colors

- Nail Care

Competitive Analysis

The Nail Polish Remover market features strong competition among key players including L’Oréal, Revlon, Kao Corporation, Estée Lauder, OPI Products, and Coty.These companies maintain their competitive edge through brand recognition, global distribution, and continuous product innovation. They focus on expanding their portfolios with acetone-free, nourishing, and natural ingredient-based formulations to meet the rising demand for non-toxic beauty products. Product diversification through wipes, pads, pens, and liquid forms supports consumer convenience and helps brands reach both professional and at-home users. Leading manufacturers invest in R&D to develop fast-acting, skin-friendly removers that align with clean beauty and dermatological safety standards. Strategic partnerships with salons and beauty retailers strengthen retail presence, while digital campaigns and influencer collaborations enhance brand visibility across online channels. Sustainability efforts in packaging and eco-certifications offer an added advantage in mature markets. Competitive pricing, strong e-commerce presence, and tailored marketing for different regions allow these players to scale globally while addressing local preferences and regulatory standards.

Recent Developments

- In 2025, Zoya Remove Plus nail polish remover received recognition, earning an Allure Best of Beauty Award for combining gentle removal with hydration and conditioning properties

- In 2025, OPI faced heightened attention, when a TikTok‑sparked debate over its at‑home gel nail kit spotlighted safety and pricing concerns. In response, the brand emphasized its educational platforms like Geliversity and robust product testing to ensure safe at‑home usage.

- In 2023, Henkel also updated its outlook for fiscal performance, reporting organic sales growth despite market headwinds.

Market Concentration & Characteristics

The Nail Polish Remover market exhibits moderate to high concentration, with a few multinational companies controlling a significant portion of global sales. It includes a mix of established beauty brands, personal care conglomerates, and niche players focusing on clean-label and specialty formulations. The market is characterized by product differentiation, where performance, skin-friendliness, and ingredient transparency define brand positioning. Manufacturers compete on convenience-driven formats, including wipes, pads, and pen applicators, along with traditional liquid removers. Consumer preferences influence innovation, pushing brands to develop acetone-free and natural alternatives with moisturizing benefits. The market also reflects strong retail integration, supported by offline presence in drugstores and supermarkets and online availability through e-commerce platforms. Seasonality, frequent product use, and bundling with nail care kits contribute to consistent demand. Regulatory compliance related to chemical content, labeling, and environmental packaging standards remains a defining factor in product development. It continues to evolve through sustainability efforts, health-conscious innovation, and targeted marketing.

Report Coverage

The research report offers an in-depth analysis based on Type, Ingredient, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for acetone-free and skin-friendly formulations will continue to rise among health-conscious consumers.

- Natural and organic ingredient-based products will gain traction across both premium and mass-market segments.

- Compact, travel-friendly formats such as wipes and pen applicators will see increased adoption.

- Sustainability in packaging and biodegradable material use will become a standard requirement.

- E-commerce will play a larger role in product distribution and consumer engagement.

- Innovation in multifunctional removers with added nail care benefits will expand brand portfolios.

- Emerging markets in Asia-Pacific and Latin America will offer strong growth opportunities.

- Brands will increase focus on gender-neutral marketing and inclusive product design.

- Regulatory pressure on chemical content and VOC emissions will shape formulation strategies.

- Strategic partnerships with salons and digital influencers will strengthen brand positioning globally.