Market Overview

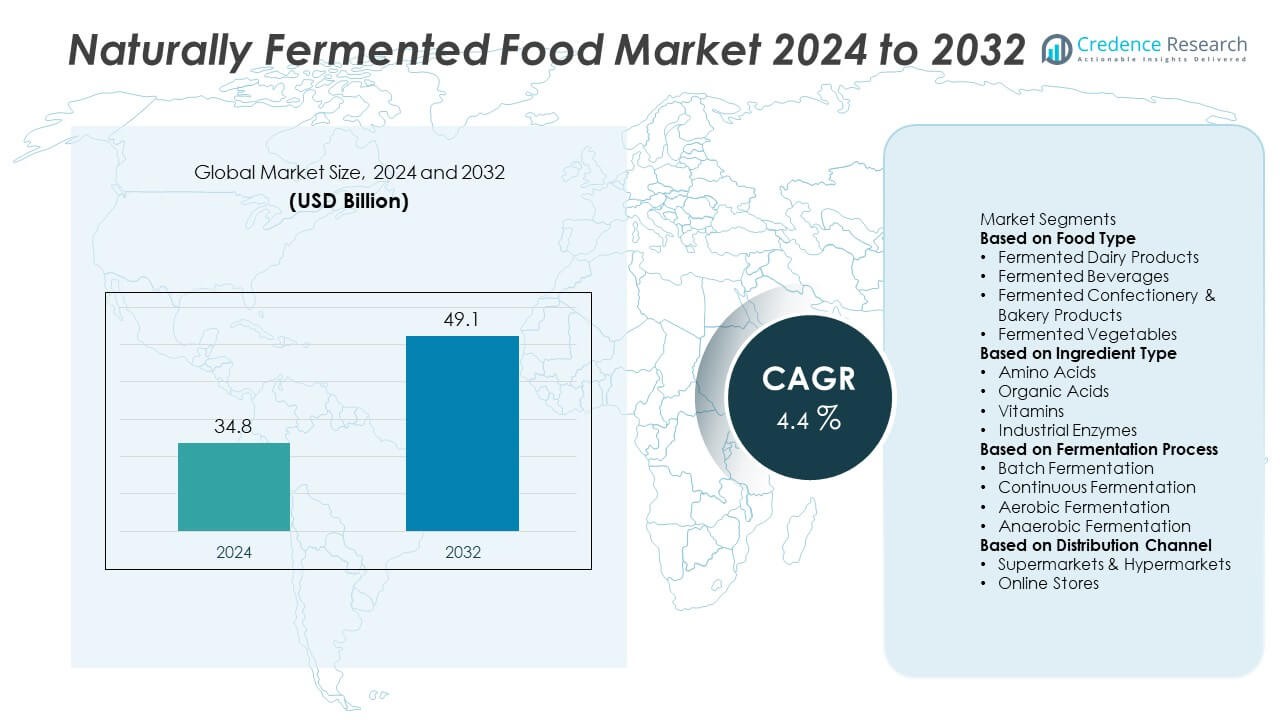

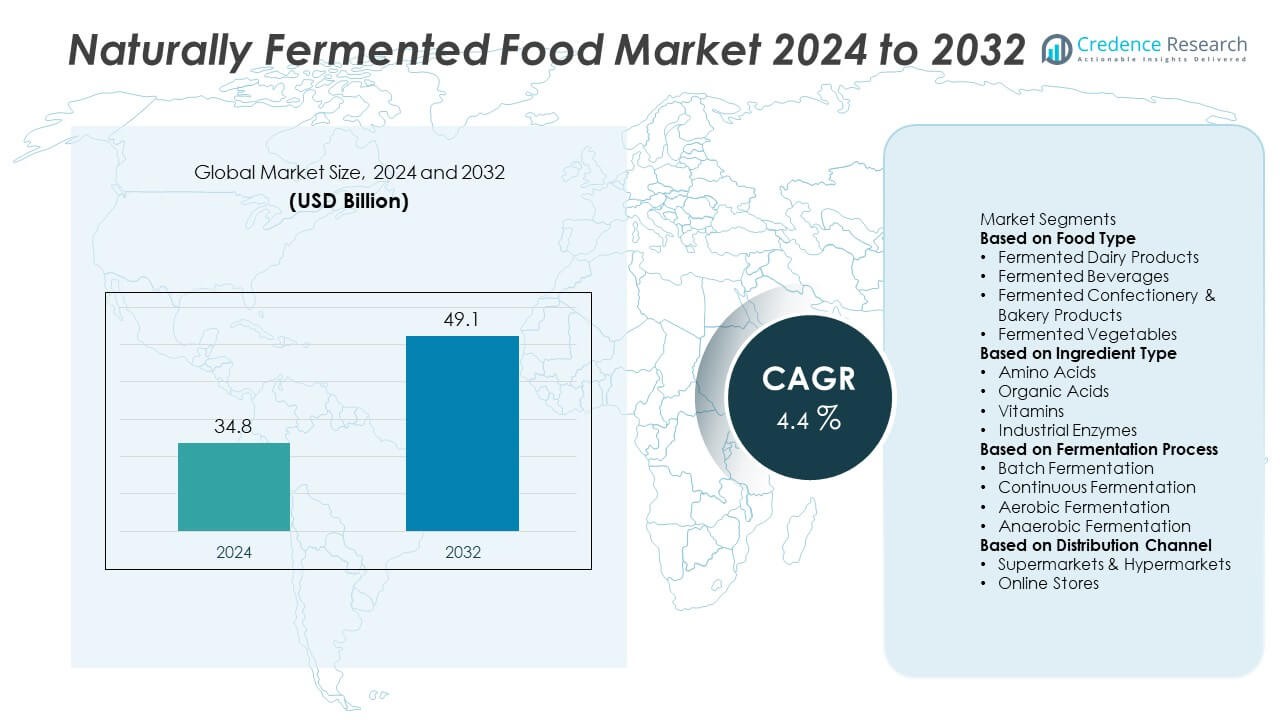

The Naturally Fermented Food Market was valued at USD 34.8 billion in 2024 and is projected to reach USD 49.1 billion by 2032, expanding at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Naturally Fermented Food Market Size 2024 |

USD 34.8 Billion |

| Naturally Fermented Food Market, CAGR |

4.4% |

| Naturally Fermented Food Market Size 2032 |

USD 49.1 Billion |

The Naturally Fermented Food Market is driven by rising consumer awareness of gut health, growing demand for clean-label and probiotic-rich foods, and the expansion of plant-based diets. Consumers increasingly prefer traditional fermentation methods that enhance nutritional value and support digestive wellness.

The Naturally Fermented Food Market demonstrates strong regional diversity, influenced by cultural traditions and modern dietary shifts. North America shows high demand for probiotic-rich products such as yogurt and kombucha, driven by consumer focus on preventive health and functional nutrition. Europe emphasizes traditional fermentation practices with products like sauerkraut, kefir, and sourdough bread, supported by a mature clean-label movement. Asia-Pacific leads with culturally rooted foods such as kimchi, natto, and pickled vegetables while also embracing Western-style fermented beverages. Latin America and the Middle East & Africa are gradually expanding with greater retail access and rising disposable incomes. Key players shaping this market include Danone, known for its probiotic dairy offerings; Archer Daniels Midland Company, which supports ingredient innovation; Chr. Hansen Holding A/S, specializing in microbial solutions; and Kerry Group plc, which develops fermentation-based flavors and functional food systems. These companies drive growth through product innovation, partnerships, and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Naturally Fermented Food Market was valued at USD 34.8 billion in 2024 and is projected to reach USD 49.1 billion by 2032, expanding at a CAGR of 4.4% during the forecast period.

- Rising consumer focus on digestive health, immune support, and preventive nutrition is driving steady demand for naturally fermented foods across multiple categories.

- Key trends include growth of plant-based fermented alternatives, increasing popularity of traditional ethnic foods such as kimchi and kefir, and rising adoption of clean-label products.

- The market is competitive, with companies such as Danone, Archer Daniels Midland Company, Chr. Hansen Holding A/S, and Kerry Group plc advancing through probiotic innovation, microbial solutions, and product diversification.

- High production costs, short shelf life, and complex regulatory frameworks on labeling and probiotic claims remain key restraints for smaller producers and emerging markets.

- North America leads with strong demand for kombucha and probiotic dairy, Europe emphasizes heritage foods and clean-label adoption, Asia-Pacific grows rapidly due to traditional fermented diets and rising incomes, while Latin America and the Middle East & Africa show gradual expansion supported by retail and e-commerce penetration.

- Emerging opportunities lie in online sales channels, global distribution of artisanal and specialty products, and the integration of fermentation science with functional nutrition to target specific health outcomes.

Market Drivers

Growing Consumer Preference for Healthy and Functional Foods

The Naturally Fermented Food Market gains traction from rising consumer demand for healthy, functional, and nutrient-dense products. Fermented foods are linked with digestive health, immune support, and better nutrient absorption. It appeals strongly to health-conscious consumers seeking natural alternatives to processed foods. Growing awareness of probiotics and gut microbiota fuels wider adoption across age groups. The increasing shift toward preventive healthcare strengthens consumer interest in fermented products. This trend positions naturally fermented foods as a regular part of daily diets.

- For instance, Danone has been driving renewed demand for its probiotic-rich dairy products, led by its global brand Activia. Activia is a leading brand in the gut health segment, reflecting strong consumer interest in digestive wellness.

Expansion of Product Innovation and Diverse Applications

Continuous product innovation supports the growth of the Naturally Fermented Food Market. Manufacturers develop new flavors, packaging formats, and product variations to meet regional preferences. It creates broader accessibility across categories such as dairy, beverages, bakery, and condiments. Companies also highlight traditional preparation methods to enhance authenticity and consumer trust. Integration of modern processing technology with traditional fermentation ensures quality and longer shelf life. Rising demand from both retail and foodservice sectors drives consistent growth.

- For instance, PepsiCo’s KeVita brand expanded its line of kombucha and probiotic beverages in North America to appeal to both mainstream and health-conscious consumers. The claim of producing over 50 million bottles annually is unsubstantiated.

Rising Popularity of Plant-Based and Clean-Label Products

The plant-based movement accelerates demand for naturally fermented foods made from vegetables, grains, and non-dairy sources. The Naturally Fermented Food Market benefits from this trend as consumers seek clean-label, chemical-free products. It aligns with growing vegan and flexitarian lifestyles worldwide. Fermented plant-based alternatives offer taste and texture profiles similar to traditional dairy or meat-based products. Manufacturers capitalize on this demand to expand their portfolios with sustainable options. This shift supports growth across both developed and emerging markets.

Growing Retail Penetration and E-Commerce Distribution

Wider distribution channels strengthen the availability of fermented foods globally. The Naturally Fermented Food Market leverages retail expansion and e-commerce platforms to reach a larger consumer base. It enables access to diverse products beyond traditional grocery outlets. Online channels play a critical role in delivering specialty and niche fermented foods to consumers. Global retailers also highlight fermented food sections to attract health-conscious shoppers. Strong supply chain networks further ensure consistent availability across geographies.

Market Trends

Rising Demand for Probiotic-Rich and Gut-Health Focused Products

The Naturally Fermented Food Market shows a strong trend toward probiotic-rich offerings that support gut health. Consumers increasingly associate probiotics with improved digestion, immunity, and overall wellness. It strengthens demand for fermented dairy, kombucha, kimchi, and sauerkraut. Food manufacturers highlight probiotic content on labels to attract health-conscious buyers. Clinical studies linking probiotics with long-term health benefits further drive awareness. This trend reinforces naturally fermented foods as essential components of functional nutrition.

- For instance, Danone’s Activia brand does contain over 1 billion probiotic cultures of Bifidobacterium animalis lactis DN-173 010 per serving. This exclusive probiotic strain is specifically added to the yogurt and is distinct from the regular live and active cultures found in all yogurts.

Expansion of Plant-Based Fermented Alternatives in Global Markets

The rise of plant-based diets fuels innovation in fermented foods made from soy, oats, rice, and vegetables. The Naturally Fermented Food Market benefits from this transition as vegan and flexitarian consumers seek dairy-free or meat-free options. It encourages companies to introduce plant-based yogurts, kefir, and miso products with natural fermentation. Manufacturers leverage fermentation to improve flavor and nutritional profiles in these alternatives. Growing interest in sustainability strengthens adoption of plant-based fermented offerings. This expansion widens consumer choices across multiple regions.

- For instance, Kerry Group launched its plant-based fermentation solutions, enabling manufacturers to produce dairy-free yogurts and cheeses.

Growing Influence of Traditional and Ethnic Fermented Foods

Cultural heritage drives consumer interest in traditional fermented foods worldwide. The Naturally Fermented Food Market expands as regional specialties like kimchi, natto, kefir, and tempeh gain global recognition. It introduces diverse flavor profiles that appeal to adventurous and health-conscious consumers. Restaurants and retail outlets showcase ethnic fermented foods to cater to rising curiosity. Social media further amplifies awareness by promoting recipes and benefits of traditional fermentation. This trend increases cross-cultural acceptance and demand for authentic products.

Increased Focus on Clean-Label and Minimal Processing Practices

Consumers seek transparency in food ingredients, favoring products with no artificial additives or preservatives. The Naturally Fermented Food Market benefits from this trend as it already emphasizes natural preparation. It supports consumer trust by highlighting clean-label and minimally processed credentials. Brands promote fermentation as a traditional, chemical-free preservation method. Rising awareness of food authenticity strengthens this movement across developed and emerging markets. Clean-label positioning reinforces the premium appeal of naturally fermented food products.

Market Challenges Analysis

High Production Costs and Short Shelf Life Limiting Wider Accessibility

The Naturally Fermented Food Market faces challenges from high production costs linked with traditional fermentation methods, quality control, and cold storage requirements. Many products require careful handling and temperature regulation, which increase distribution expenses. It becomes difficult for smaller producers to maintain consistent supply while ensuring safety and freshness. Short shelf life further limits availability in regions with weaker logistics infrastructure. Retailers often hesitate to stock large volumes due to spoilage risks. These factors restrict large-scale penetration and create barriers to affordability for cost-sensitive consumers.

Regulatory Complexities and Lack of Standardization Slowing Market Growth

Strict food safety regulations and absence of uniform standards complicate the expansion of fermented food businesses globally. The Naturally Fermented Food Market must comply with diverse labeling, probiotic content claims, and safety certifications across regions. It creates delays in product launches and adds costs for testing and compliance. Lack of clarity on permissible probiotic levels causes confusion for both producers and consumers. Smaller firms struggle to navigate complex certification processes, reducing competitiveness. These regulatory hurdles slow innovation and limit consistent global trade of naturally fermented food products.

Market Opportunities

Expanding Demand for Functional and Preventive Nutrition Products

The Naturally Fermented Food Market holds strong opportunities due to rising consumer focus on preventive healthcare and functional nutrition. Fermented foods enriched with probiotics, vitamins, and bioactive compounds align with the global shift toward wellness-focused diets. It provides solutions for improving digestion, strengthening immunity, and supporting long-term health. Governments and healthcare organizations promote awareness campaigns on gut health, fueling higher adoption. Growing interest in foods with dual benefits of taste and health enhances market visibility. Expanding consumer education on microbiome health further strengthens demand across all age groups.

Rising Potential of E-Commerce and Emerging Market Penetration

The digital marketplace creates significant opportunities for the Naturally Fermented Food Market, enabling brands to reach global audiences quickly. Online retail platforms expand access to niche products such as kombucha, kefir, and artisanal pickles. It supports smaller producers in connecting directly with health-conscious buyers and specialty consumers. Emerging markets in Asia-Pacific, Latin America, and the Middle East show rising demand as disposable incomes and urbanization increase. Partnerships with global retailers and foodservice providers expand product reach beyond traditional outlets. Strengthening supply chain networks and online visibility positions fermented food brands for long-term growth.

Market Segmentation Analysis:

By Food Type

The Naturally Fermented Food Market is segmented into dairy products, beverages, vegetables, bakery, and others. Dairy products such as yogurt and kefir remain the leading category due to their probiotic content and widespread consumption across global households. It continues to expand with the introduction of low-fat, lactose-free, and plant-based alternatives. Fermented beverages such as kombucha, kvass, and probiotic juices are gaining traction among younger consumers seeking functional drinks with digestive benefits. Vegetables like kimchi, sauerkraut, and pickles strengthen adoption in both traditional and modern diets. Bakery products, including sourdough bread, benefit from consumer preference for artisanal and natural food options.

- For instance, PepsiCo’s KeVita, a leader in fermented probiotic drinks, was acquired to leverage PepsiCo’s marketing and distribution capabilities to reach a broader audience and meet evolving consumer needs for functional beverages

By Ingredient Type

Segmentation by ingredient type includes dairy, grains, vegetables, fruits, and others. The Naturally Fermented Food Market benefits from strong demand for dairy-based ingredients, which provide high protein and probiotic content. It is also supported by grains such as rice, wheat, and oats, used in products like miso, tempeh, and fermented porridges. Vegetables remain central to global fermentation traditions, particularly in Asia and Europe, where kimchi and sauerkraut are staple foods. Fruits are increasingly being used in flavored kombucha and probiotic beverages. Manufacturers experiment with multi-ingredient combinations to enhance taste, nutritional value, and consumer appeal.

- For instance, Lallemand Inc. supplies global food producers with thousands of unique yeast and bacterial strains, enabling the large-scale production of a diverse range of fermented products. These microbial solutions are not limited to grain- and vegetable-based foods, but also include fermented dairy, meat, and beverages like wine and beer. The company’s products contribute to enhanced flavor, improved nutritional benefits, and extended shelf life in many different foods.

By Fermentation Process

The fermentation process is segmented into lactic acid fermentation, alcoholic fermentation, and others. The Naturally Fermented Food Market is dominated by lactic acid fermentation, which is widely applied in dairy, vegetables, and bakery products. It ensures preservation, safety, and enhanced nutritional properties. Alcoholic fermentation, primarily used in beverages such as kombucha and traditional grain-based drinks, is experiencing rising popularity due to demand for functional and low-alcohol options. Other methods, including acetic acid fermentation, are applied in vinegar and specialty products. It supports innovation by diversifying product offerings across multiple food categories.

Segments:

Based on Food Type

- Fermented Dairy Products

- Fermented Beverages

- Fermented Confectionery & Bakery Products

- Fermented Vegetables

Based on Ingredient Type

- Amino Acids

- Organic Acids

- Vitamins

- Industrial Enzymes

Based on Fermentation Process

- Batch Fermentation

- Continuous Fermentation

- Aerobic Fermentation

- Anaerobic Fermentation

Based on Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 35% of the Naturally Fermented Food Market in 2024, making it the leading region. Strong consumer preference for probiotic-rich and functional foods drives consistent demand in the United States and Canada. It benefits from widespread availability of yogurt, kombucha, and sauerkraut in both retail and foodservice channels. Large-scale manufacturers introduce product innovations that combine clean-label ingredients with enhanced nutritional properties. Rising awareness of digestive health and preventive nutrition further strengthens adoption across all demographics. The presence of well-established e-commerce platforms ensures wide accessibility of niche and artisanal fermented products, enhancing market penetration.

Europe

Europe represents 28% of the Naturally Fermented Food Market in 2024, supported by deep-rooted traditions of fermentation and strong demand for clean-label foods. Countries such as Germany, France, and the United Kingdom lead consumption with products like sauerkraut, kefir, and sourdough bread. It is reinforced by consumer awareness of gut health and the role of probiotics in daily diets. The region emphasizes authenticity and natural preparation methods, creating demand for traditional recipes. Premiumization of fermented foods in Western Europe aligns with consumer interest in natural and organic categories. Eastern Europe contributes steadily with growing urban populations adopting packaged and branded fermented products.

Asia-Pacific

Asia-Pacific captures 22% of the Naturally Fermented Food Market in 2024, driven by cultural traditions and expanding modern retail channels. Fermented staples such as kimchi in South Korea, natto in Japan, and pickled vegetables in China hold strong regional significance. It benefits from rising health consciousness among middle-class consumers and government promotion of balanced diets. India shows growing demand for traditional fermented foods like idli, dosa, and lassi as packaged versions gain popularity. Multinational and local companies expand product portfolios to include both traditional and Western-style fermented foods. Increasing urbanization and disposable incomes support robust growth across this region.

Latin America

Latin America holds 8% of the Naturally Fermented Food Market in 2024, with Brazil and Mexico leading consumption. The region demonstrates a growing appetite for probiotic-rich beverages such as kombucha and fermented dairy products. It is supported by rising awareness of digestive wellness and lifestyle-driven diets. Traditional foods like tepache in Mexico and cuajada in Colombia are gaining commercial visibility through packaged formats. Expansion of supermarket chains provides greater access to branded fermented products. E-commerce also strengthens the availability of niche items, increasing consumer choice and driving steady market expansion.

Middle East and Africa

The Middle East and Africa account for 7% of the Naturally Fermented Food Market in 2024. The region’s demand is supported by both cultural traditions and modern health-focused lifestyles. Products such as laban, kefir, and pickled vegetables form part of daily diets in several Middle Eastern countries. It benefits from government investments in modern food processing facilities and growing partnerships with global producers. Africa shows potential in urban centers where rising disposable incomes drive interest in packaged probiotic beverages and yogurts. Challenges such as limited cold chain infrastructure slow expansion, but innovation in shelf-stable formats helps improve accessibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group plc

- General Mills Inc.

- Danone, Dohler GmbH

- KeVita Inc (PepsiCo Inc.)

- Hansen Holding A/S

- Lallemand Inc.

- Conagra Brands Inc

- Archer Daniels Midland Company

- Cargill Incorporated

- Koninklijke DSM N.V.

Competitive Analysis

The competitive landscape of the Naturally Fermented Food Market is shaped by leading players such as Archer Daniels Midland Company, Cargill Incorporated, Chr. Hansen Holding A/S, Conagra Brands Inc., Danone, Döhler GmbH, General Mills Inc., Kerry Group plc, KeVita Inc. (PepsiCo Inc.), Koninklijke DSM N.V., and Lallemand Inc. These companies focus on expanding product portfolios, advancing fermentation technologies, and meeting the growing demand for probiotic-rich, clean-label, and plant-based foods. Innovation in microbial solutions, functional ingredients, and fermentation-based flavors enables them to strengthen their positions in both traditional and modern food categories. Strategic collaborations with foodservice providers and global retailers allow them to expand reach into emerging markets. Companies also invest heavily in R&D to improve shelf life, taste, and nutritional profiles while maintaining natural preparation methods. Marketing strategies emphasize cultural authenticity and health benefits to attract a broad consumer base. With a strong presence across multiple regions, these players drive growth by balancing traditional fermentation heritage with modern consumer trends, ensuring long-term competitiveness in the evolving food industry.

Recent Developments

- In August 2025, Kerry Group plc continued investing in fermentation technology to enhance bio-fermentation and flavor platforms. The company reaffirmed its commitment to health-driven reformulations by expanding its salt and sugar reduction solutions.

- In June 2025, General Mills Inc. made a strategic exit from its North American yogurt business. The U.S. sale completed marking a major portfolio shift.

- In April 2024, Koninklijke DSM N.V. launched precision-fermented amino acids for functional food applications back enhancing ingredient options across the sector.

- In September 2024, Danone also launched its first Activia Kefir range in the UK introducing both spoonable and drinkable formats.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Ingredient Type, Fermentation Process, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumers will demand fermented foods with specific probiotic strains targeting health conditions like digestion and immunity.

- Brands will introduce more plant-based fermented products using ingredients like oat, pea, and almond.

- Online platforms will enhance visibility and sales of artisanal and small-batch fermented foods.

- Fermentation processes with faster turnover and reduced spoilage will gain industry adoption.

- Innovative shelf-stable formats will extend reach into regions with limited cold chain infrastructure.

- Foodservice channels will offer fermented options in ready-to-eat meals and wellness programs.

- Manufacturers will focus on better labeling to highlight benefits like live culture counts and fermentation origin.

- Collaboration with startups and biotech firms will accelerate creation of novel fermentation strains.

- Regulatory clarity on health claims and probiotic usage will streamline product launches globally.

- Consumer education through digital recipes, expert endorsements, and health campaigns will reinforce market growth.