Market Overview

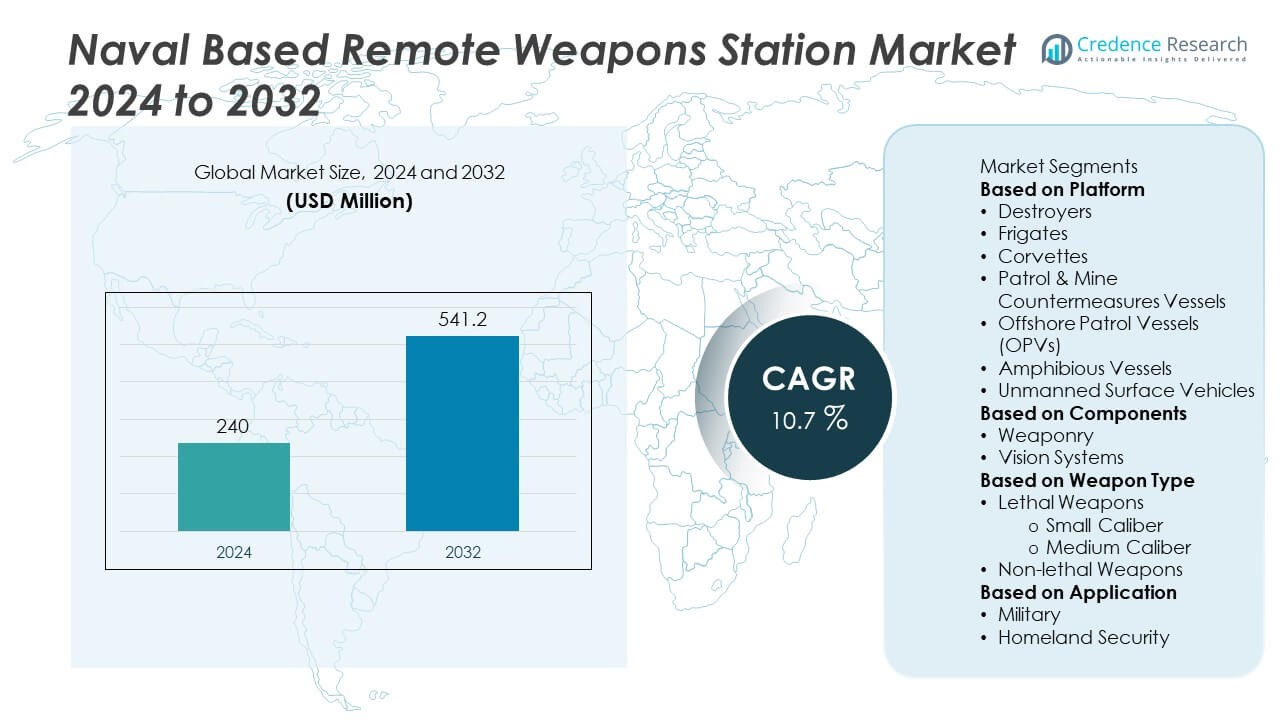

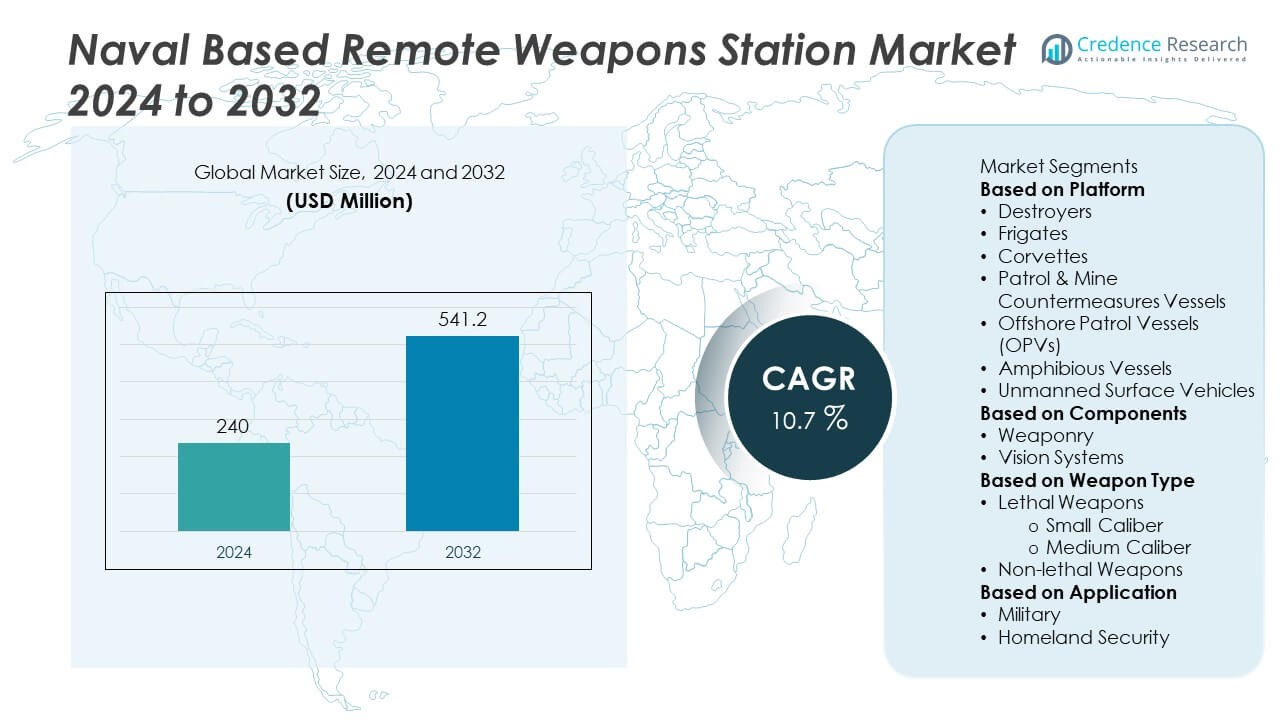

The Naval-Based Remote Weapons Station Market was valued at USD 240 million in 2024 and is anticipated to reach USD 541.2 million by 2032, growing at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Naval-Based Remote Weapons Station Market Size 2024 |

USD 240 Million |

| Naval-Based Remote Weapons Station Market, CAGR |

10.7% |

| Naval-Based Remote Weapons Station Market Size 2032 |

USD 541.2 Million |

The Naval-Based Remote Weapons Station Market is driven by increasing demand for enhanced naval defense capabilities, emphasizing safety, precision, and real-time response. Advancements in autonomous systems, multi-sensor integration, and AI technology are improving targeting accuracy and operational efficiency.

The Naval-Based Remote Weapons Station Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with significant investments in defense technology, with the U.S. Navy being a key adopter of advanced remote weapons systems. Europe follows with countries like the UK, Germany, and France investing in naval modernization and enhanced defense capabilities. In Asia-Pacific, countries such as China, India, and Japan focus on upgrading their naval fleets, driving the demand for these systems. Latin America and the Middle East & Africa show emerging interest, particularly in maritime security applications. Key players in the market include BAE Systems, known for its advanced naval weapon systems; Kongsberg Gruppen, a leader in remote weapons stations for naval defense; Elbit Systems, specializing in advanced defense solutions; and General Dynamics, providing cutting-edge technologies for naval combat systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Naval-Based Remote Weapons Station Market was valued at USD 240 million in 2024 and is expected to reach USD 541.2 million by 2032, growing at a CAGR of 10.7%.

- Rising demand for advanced defense solutions and maritime security drives market adoption, particularly in coastal defense and border patrol applications.

- Integration of autonomous systems and AI enhances the targeting accuracy and efficiency of remote weapons stations, improving overall operational performance.

- Increasing investments in naval fleet modernization by key defense powers such as the U.S., China, and India fuel demand for these systems.

- The market faces challenges from high development costs, complex integration processes, and limited standardization across different naval platforms.

- Europe, North America, and Asia-Pacific are the key regions driving market growth, with North America leading due to defense budgets and naval modernization programs.

- Competition is intensifying with major players like BAE Systems, Kongsberg Gruppen, Elbit Systems, and General Dynamics investing in innovative technologies to capture market share and enhance system capabilities.

Market Drivers

Rising Defense Expenditures and Modernization Initiatives

The Naval-Based Remote Weapons Station Market benefits from increasing defense budgets and modernization initiatives by nations worldwide. Governments are investing heavily in upgrading naval fleets with advanced weaponry and surveillance systems. These systems enhance operational efficiency and combat readiness, particularly in maritime security and coastal defense. The growing emphasis on modernizing naval forces in regions such as the Middle East, Asia-Pacific, and North America drives the demand for remote weapons stations. These systems improve combat safety by keeping operators at a distance from direct threats, making them a valuable asset in modern naval warfare.

- For instance, Kongsberg’s Protector RS4 and Nexter’s NARWHAL20 are competing remote weapon systems from different companies used in maritime defense. While the NARWHAL20 is naval-specific, the Protector RS4 has a navalized version that, like the NARWHAL20, offers precision targeting and operational efficiency.

Technological Advancements and Integration of Autonomous Systems

Technological innovations and the integration of autonomous systems drive the adoption of remote weapons stations in naval applications. These systems leverage advanced sensors, AI, and robotics to enhance the precision, accuracy, and effectiveness of naval defense strategies. The ability to operate weapons remotely reduces human risk and supports real-time decision-making. With the integration of autonomous functions, these stations allow for more flexible and rapid responses to threats. The naval forces increasingly recognize the strategic advantage of automating critical functions, further accelerating the market’s growth.

- For instance, The Elbit Systems Seagull is an Unmanned Surface Vehicle (USV) designed for various maritime missions. It is capable of performing tasks such as anti-submarine warfare, mine countermeasures, and electronic warfare. The Seagull can be operated remotely or autonomously, providing enhanced situational awareness and reducing risk to personnel.

Increased Focus on Maritime Security and Border Control

Maritime security and border control initiatives are key drivers for the adoption of naval-based remote weapons stations. Countries facing growing concerns over piracy, illegal fishing, and territorial disputes are deploying these systems to safeguard their coasts and exclusive economic zones. Remote weapons stations offer enhanced surveillance and rapid response capabilities without requiring a physical presence near the threat. This capability is particularly essential for securing vast maritime territories, providing governments and defense organizations with reliable and efficient means of maintaining control over their waters.

Growing Demand for Operational Safety and Crew Protection

The demand for increased safety and crew protection also drives the growth of the Naval-Based Remote Weapons Station Market. Remote weapons stations reduce the need for personnel to operate weaponry in hazardous or combat situations, significantly enhancing crew safety during operations. These systems allow for efficient targeting and firing without exposing naval personnel to enemy fire. This safety aspect is particularly crucial in high-risk zones, such as active conflict areas or naval patrol missions in hostile environments. The growing emphasis on reducing casualties while maintaining high operational performance boosts the adoption of these systems.

Market Trends

Integration of Advanced Autonomous Systems

The Naval-Based Remote Weapons Station Market is seeing increasing integration with autonomous systems. These systems enhance the performance and capabilities of remote weapons stations by automating key functions such as targeting, firing, and decision-making. Advanced artificial intelligence (AI) and machine learning algorithms enable these systems to adapt to dynamic threats, providing faster responses. This trend reduces reliance on human intervention, improves accuracy, and boosts operational efficiency. The adoption of autonomous systems allows for more agile defense strategies, ensuring quicker deployment and response during critical naval operations. The integration of autonomy aligns with the growing trend toward reducing human exposure to risk during combat.

- For instance, Elbit Systems’ Seagull Unmanned Surface Vessel (USV) demonstrated a 100% target detection rate during the Royal Navy’s mine hunting trials in 2022, showcasing its advanced autonomous capabilities. These systems leverage artificial intelligence and machine learning algorithms to adapt to dynamic threats, providing faster responses and reducing reliance on human intervention.

Emphasis on Multi-Sensor Integration

Multi-sensor integration is a key trend in the development of naval-based remote weapons stations. It allows these systems to process data from various sources, such as radar, infrared, and optical sensors, to make real-time, informed decisions. This trend enhances the station’s ability to track and engage targets with higher precision, even in complex or cluttered environments. Companies like Raytheon and Lockheed Martin continue to develop systems with integrated sensors that improve targeting accuracy and situational awareness. The growing emphasis on multi-sensor systems helps to improve the operational effectiveness of remote weaponry, particularly in challenging maritime environments.

Adoption of Modular and Scalable Systems

The trend toward modular and scalable systems is gaining momentum in the naval-based remote weapons station market. Modular designs allow for easy upgrades and customization, enabling naval forces to adapt to evolving security challenges and technological advancements. These systems can be tailored to meet specific mission requirements, whether for coastal defense or active combat operations. The flexibility of modular systems also enhances their cost-effectiveness, allowing navies to implement gradual upgrades instead of complete overhauls. This trend is critical for military fleets looking to extend the lifecycle of their weapons systems while maintaining high operational standards.

- For instance, BAE Systems’ Mk 38 Mod 3 offers seamless upgrades to include advanced targeting systems without needing to replace the entire system. This trend allows military fleets to extend the lifecycle of their weapons systems, reducing the need for complete overhauls while maintaining high operational standards.

Increased Deployment in Coastal and Border Security

The growing need for enhanced coastal and border security is another key trend in the market. Remote weapons stations are increasingly deployed in non-combat zones to protect vital maritime assets, such as oil rigs, ports, and territorial waters. These systems offer a cost-effective and efficient solution to safeguard vast maritime areas, providing high security without direct human involvement. Remote operation capabilities, coupled with long-range target detection, make these systems ideal for surveillance and defensive purposes in border patrol operations. This trend highlights the expanding role of naval-based remote weapons stations in national security and defense beyond traditional warfare scenarios.

Market Challenges Analysis

High Development Costs and Integration Complexity

The Naval-Based Remote Weapons Station Market faces significant challenges due to high development costs and integration complexities. Advanced remote weapons systems require cutting-edge technologies, such as multi-sensor integration, AI-driven targeting, and autonomous operations, all of which contribute to high R&D expenses. These systems must be compatible with existing naval platforms, demanding extensive testing and customization. This complexity increases the overall cost of production and deployment, limiting the accessibility of these systems for smaller defense budgets. The need for continuous upgrades to keep pace with technological advancements further exacerbates these challenges, slowing the adoption of these systems in cost-sensitive markets.

Limited Standardization and Interoperability Issues

Limited standardization and interoperability issues also hinder the widespread adoption of naval-based remote weapons stations. Different naval forces and manufacturers often use varying system architectures, making it difficult to integrate new systems with existing fleets. Lack of universal standards for remote weapons stations complicates the process of ensuring compatibility across various platforms. This variability limits the effectiveness of these systems in joint operations or coalition defense efforts. The absence of standardized frameworks further delays deployment and increases long-term maintenance costs, affecting the overall market growth and adoption rates.

Market Opportunities

Growing Demand for Coastal and Border Defense Solutions

The Naval-Based Remote Weapons Station Market presents significant opportunities driven by the growing need for enhanced coastal and border security. Governments are increasingly investing in solutions that can safeguard critical infrastructure, such as ports, offshore platforms, and territorial waters. These systems provide effective surveillance and protection without putting personnel at risk. With increasing maritime threats such as piracy, illegal fishing, and territorial disputes, naval forces are turning to remote weapons stations to bolster defense capabilities. The ability to deploy these systems in non-combat zones or remote areas makes them an attractive choice for nations with extensive coastlines and maritime interests.

Technological Advancements and Integration with Autonomous Systems

Opportunities in the Naval-Based Remote Weapons Station Market are also driven by rapid advancements in autonomous and artificial intelligence technologies. As these systems become more sophisticated, they offer higher efficiency, better targeting accuracy, and reduced operational costs. The integration of AI and machine learning into remote weapons stations enhances their capabilities to identify and respond to threats in real-time. This trend creates new opportunities in defense sectors that require smarter, faster, and more adaptable solutions. The continuous improvement in autonomous technologies opens avenues for the adoption of these systems in both naval and commercial applications, providing growth potential for the market.

Market Segmentation Analysis:

By Platform

The Naval-Based Remote Weapons Station Market is segmented by platform, which includes surface ships, submarines, and unmanned naval vehicles. Surface ships remain the dominant platform, driven by their extensive use in naval fleets for defense and surveillance missions. Remote weapons stations are integrated into these vessels to enhance combat capabilities and improve crew safety. Submarines, on the other hand, are increasingly adopting remote weapon systems for defense purposes while submerged, focusing on underwater security. Unmanned naval vehicles are seeing growing adoption as they provide increased flexibility for reconnaissance and targeted operations. The rise of autonomous vessels further increases demand for remote weapons stations, offering effective solutions for long-range patrols and coastal defense missions. These platforms align with the broader trend of modernizing fleets to increase operational efficiency.

- For instance, Kongsberg Gruppen produces a range of Remote Weapon Systems (RWS) for different applications. The PROTECTOR RS4 is the company’s most advanced and widely fielded RWS model, designed for small and medium-caliber weapons. However, the figure of over 20,000 delivered units applies to the entire PROTECTOR family of RWS. These systems are predominantly used on ground vehicles such as armored transports and tanks but can also be integrated into naval and static platforms.

By Components

The components segment of the Naval-Based Remote Weapons Station Market includes sensors, controllers, actuators, and communication systems. Sensors are critical to the operation of remote weapons stations, enabling accurate target detection and tracking, often through multi-sensor fusion. Controllers and actuators are essential for remotely operating the weapons, offering precision targeting and system management in real-time combat scenarios. Communication systems play a pivotal role in ensuring that these stations maintain connectivity and coordination with command centers or other ships in the fleet. These components work together to ensure that naval forces can engage targets accurately and with minimal latency, which is critical for modern warfare.

- For instance, Raytheon’s Phalanx Close-In Weapon System (CIWS) is a last-line-of-defense system that automatically detects, tracks, and engages incoming threats with a radar-guided 20mm Gatling cannon. The Block 1B version, introduced in 1999, added a Forward-Looking Infrared (FLIR) sensor to improve its capabilities against surface vessels, helicopters, and drones. While the Block 1B integrates both radar and infrared data, the original Phalanx used only radar for tracking and engagement.

By Weapon Type

The weapon type segment includes small-caliber guns, medium-caliber guns, and missile systems. Small-caliber guns are commonly used for short-range defense and to engage smaller threats such as drones, boats, or missiles. Medium-caliber guns are favored for both air and surface defense in maritime operations, providing a balance of firepower and precision. Missile systems are increasingly integrated into remote weapons stations for long-range strike capabilities, particularly in anti-ship and anti-aircraft roles. The growing focus on increasing firepower in naval defense systems and extending engagement ranges contributes to the rising adoption of missile-based remote weaponry in modern naval fleets.

Segments:

Based on Platform

- Destroyers

- Frigates

- Corvettes

- Patrol & Mine Countermeasures Vessels

- Offshore Patrol Vessels (OPVs)

- Amphibious Vessels

- Unmanned Surface Vehicles

Based on Components

Based on Weapon Type

- Small Caliber

- Medium Caliber

Based on Application

- Military

- Homeland Security

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the global naval-based remote weapons station market, accounting for approximately 38% of the market share in 2024. The United States plays a pivotal role, with extensive deployments of advanced systems like the Kongsberg Protector RS4 (CROWS) on various naval platforms. The U.S. Navy’s focus on modernization and integration of unmanned surface vessels (USVs) further drives demand. Canada also contributes significantly, investing in next-generation coastal defense systems and aligning with NATO standards. The region’s dominance is underpinned by high defense budgets and a commitment to technological advancements.

Europe

Europe holds a substantial share of the market, estimated at 27% in 2024. Countries like Germany and France are at the forefront, with Germany’s Bundeswehr integrating remote weapon stations into its naval fleet modernization programs. France’s Nexter Systems provides the NARWHAL20 naval RWS, enhancing operational capabilities. The European Union’s defense initiatives and collaborative projects, such as the European Defence Fund, foster innovation and standardization, promoting widespread adoption across member states.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth, capturing about 22% of the market share in 2024. China leads with significant investments in naval modernization, including the development of advanced remote weapon systems for its expanding fleet. India follows suit, enhancing its maritime defense capabilities through strategic acquisitions and indigenous development. Japan’s focus on advanced naval platforms, such as the Aegis System Equipped Vessels, further bolsters the region’s prominence. Australia’s defense initiatives also contribute to the region’s growing market share.

Latin America

Latin America accounts for approximately 7% of the global market share. Brazil leads the region, integrating remote weapon stations into its naval modernization efforts to address piracy and territorial disputes. Mexico is also enhancing its coastal defense strategies, focusing on the acquisition of advanced naval systems. While the region’s market share is currently modest, increasing security concerns and modernization programs indicate potential for growth in the coming years.

Middle East & Africa

The Middle East and Africa collectively hold about 6% of the market share. Countries like Saudi Arabia and the United Arab Emirates are investing in advanced naval systems to secure strategic maritime routes and bolster defense capabilities. South Africa’s defense initiatives also contribute to the region’s market presence. Despite challenges such as political instability, the strategic importance of maritime security drives investments in remote weapons stations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Israel Aerospace Industries

- Kongsberg Gruppen

- FN Herstal

- Elbit Systems

- General Dynamics

- BAE Systems

- Copenhagen Sensor Technology

- EVPU Defense

- Bharat Electronics

- Aselsan

Competitive Analysis

The competitive landscape of the Naval-Based Remote Weapons Station Market is shaped by BAE Systems, Kongsberg Gruppen, Elbit Systems, General Dynamics, Bharat Electronics, Aselsan, FN Herstal, Israel Aerospace Industries, Copenhagen Sensor Technology, and EVPU Defense. These companies are driving growth through advanced technological innovations, with a focus on multi-sensor integration, AI-driven targeting, and autonomous system capabilities. Strong emphasis is placed on enhancing precision, safety, and adaptability to meet the dynamic requirements of modern naval operations. Market leaders maintain their edge by investing heavily in R&D, ensuring their systems remain reliable under diverse operational conditions while offering improved situational awareness and faster response times. Expansion strategies target both established and emerging defense markets, supported by rising naval modernization programs and increasing global defense budgets. Strategic partnerships and contracts with governments and defense organizations play a crucial role in strengthening their positioning, enabling large-scale deployments and long-term collaborations. These players also prioritize modular and customizable solutions, allowing adaptability across different vessel classes and mission profiles. By integrating next-generation technologies, maintaining compliance with stringent naval standards, and leveraging strong industrial partnerships, they ensure sustained competitiveness and reinforce leadership within the global defense sector.

Recent Developments

- In February 2025, Elbit Systems introduced a lightweight, dual-axis 12.7mm caliber remote-controlled naval weapon station compatible with a wide variety of naval platforms, including patrol vessels, frigates, and missile boats.

- In January 2025, General Dynamics Information Technology secured a $143 million contract with the Naval Air Warfare Center to provide advanced electronic warfare systems, enhancing the capabilities of naval remote weapon stations.

- In November 2024, BAE Systems showcased its Littoral Strike Craft at Euronaval 2024, demonstrating a new ship-to-shore capability delivery concept, enhancing the operational flexibility of naval remote weapon stations.

- In March 2024, Kongsberg delivered its PROTECTOR RS4 remote weapon stations to Sweden and Finland for integration into Patria’s Common Armoured Vehicle Systems (CAVS), with deliveries starting in 2025 and continuing into the 2030s.

Report Coverage

The research report offers an in-depth analysis based on Platform, Components, Weapon Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advancements in artificial intelligence and machine learning will enhance autonomous targeting and threat identification capabilities.

- Integration with unmanned surface vessels (USVs) and drones will expand operational reach and flexibility.

- Modular and scalable designs will allow for easier upgrades and adaptability to various naval platforms.

- Increased demand for cost-effective solutions will drive the development of lightweight and energy-efficient systems.

- Enhanced interoperability with allied forces’ systems will be prioritized to support joint operations.

- Focus on cybersecurity will intensify to protect remote operations from potential threats.

- Integration of advanced sensor fusion technologies will improve situational awareness and decision-making.

- Development of non-lethal capabilities will provide options for crowd control and peacekeeping missions.

- Increased emphasis on rapid deployment and ease of maintenance will be key design considerations.

- Collaborations between defense contractors and naval forces will accelerate innovation and deployment of next-generation systems.