Market Overview

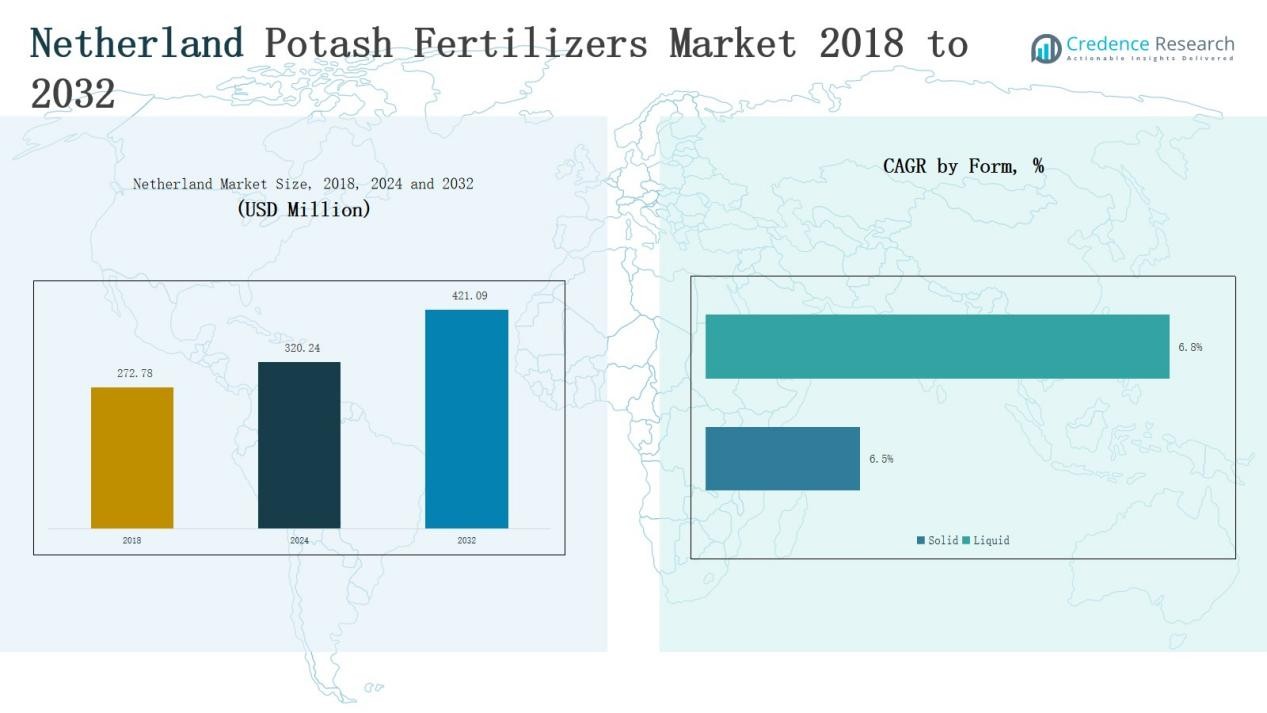

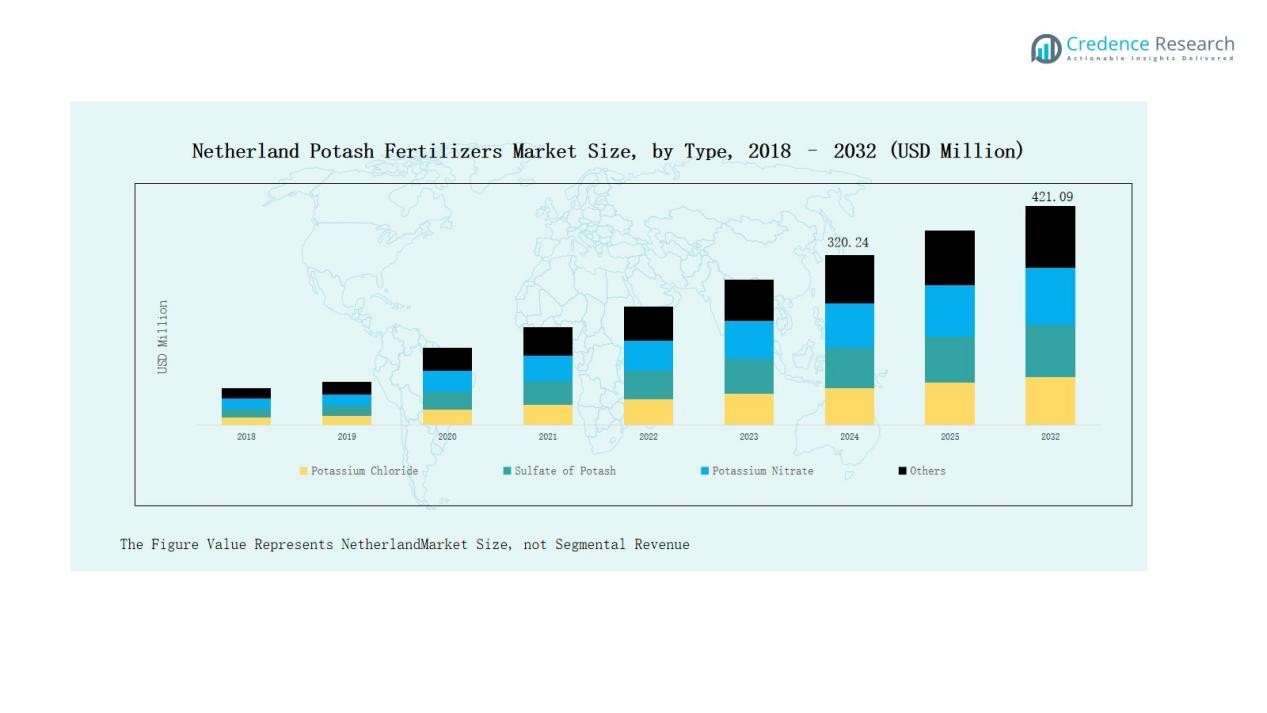

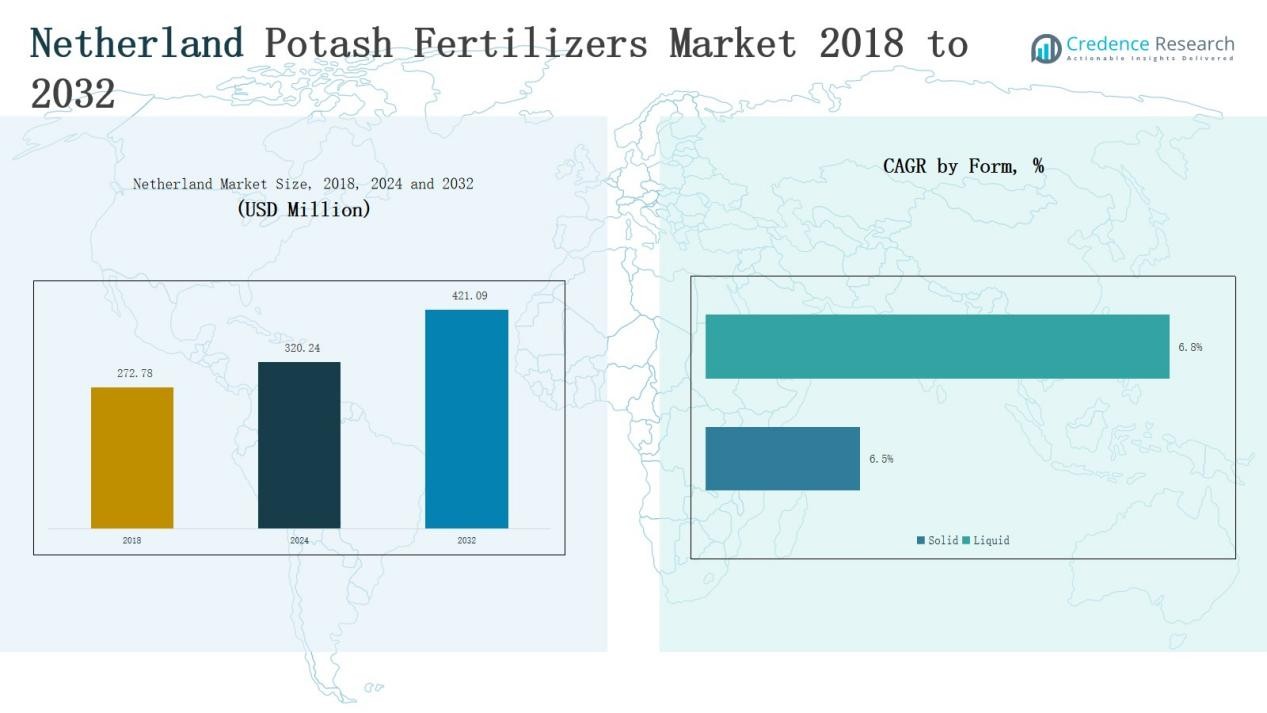

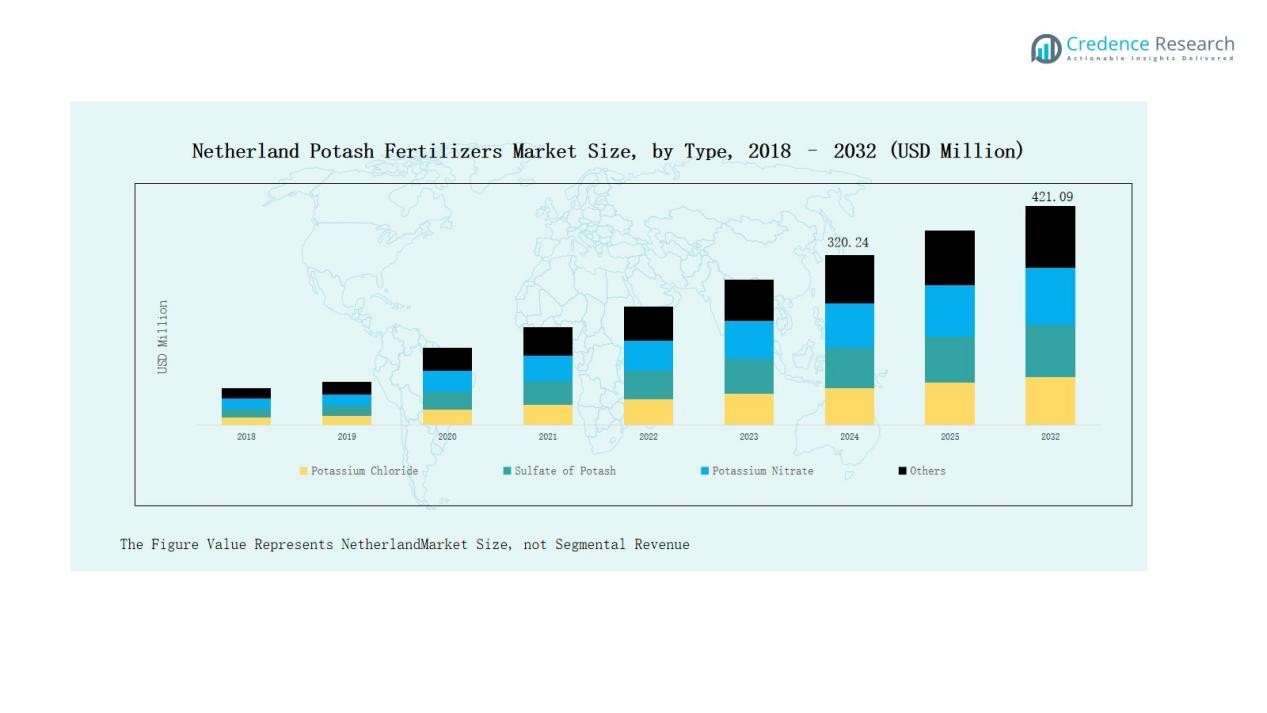

Netherland Potash Fertilizers Market size was valued at USD 272.78 million in 2018 to USD 320.24 million in 2024 and is anticipated to reach USD 421.09 million by 2032, at a CAGR of 3.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherland Potash Fertilizers Market Size 2024 |

USD 320.24 Million |

| Netherland Potash Fertilizers Market, CAGR |

3.48% |

| Netherland Potash Fertilizers Market Size 2032 |

USD 421.09 Million |

The Netherland Potash Fertilizers Market is shaped by leading players such as The Mosaic Company, Van Iperen International, K+S Aktiengesellschaft, Helm, CF Industries, and ICL, each competing through broad product portfolios and strong distribution networks. These companies focus on chloride-free and specialty formulations to support high-value crops and greenhouse farming, aligning with sustainability goals and precision agriculture practices. Among regions, Northern Netherlands emerged as the clear leader, commanding a 36% market share in 2024, driven by extensive cereal cultivation, mechanized farming, and expanding irrigation systems.

Market Insights

Market Insights

- The Netherland Potash Fertilizers Market grew from USD 272.78 million in 2018 to USD 320.24 million in 2024 and is projected to reach USD 421.09 million by 2032.

- Potassium Chloride led the type segment with a 53% share in 2024, driven by affordability and effectiveness in cereal and grain cultivation, while Sulphate of Potash gained demand in horticulture.

- Broadcasting dominated application methods with a 46% share in 2024, supported by cost efficiency in cereals, while fertigation and foliar applications expanded in high-value and greenhouse crops.

- Solid fertilizers accounted for 68% of the market in 2024 due to long shelf life and low storage cost, while liquid formulations gained traction in greenhouse farming and precision systems.

- Northern Netherlands led regionally with a 36% share in 2024, followed by Western Netherlands at 28%, Southern Netherlands at 22%, and Eastern Netherlands contributing 14%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Potassium Chloride dominated the Netherland Potash Fertilizers Market with a 53% share in 2024, supported by its affordability and effectiveness in large-scale cereal and grain production. Farmers prefer it for consistent yield improvement and compatibility with mechanized farming practices. Sulphate of Potash captured notable demand from fruit and vegetable growers who seek chloride-free fertilizers to enhance crop quality and market value. Potassium Nitrate showed steady adoption in high-value horticulture due to its dual supply of potassium and nitrogen, while other niche blends remained minor.

For instance, K+S Minerals and Agriculture AG reported rising demand for Sulphate of Potash among Dutch greenhouse vegetable growers, as trials showed enhanced tomato firmness and longer shelf life versus chloride-based alternatives.

By Application Method

Broadcasting held the largest market share of 46% in 2024, as it is widely used for cereals and open-field crops due to its ease of application and lower operational costs. This method benefits farmers managing large farmlands where efficiency is critical. Fertigation gained traction in greenhouses and modern farms equipped with advanced irrigation systems, supporting high-value crops. Foliar application strengthened its position in vineyards and horticulture, where targeted nutrient delivery enhances quality. Other methods contributed marginally to overall adoption and remained region-specific.

For instance, Netafim offers Precision Fertigation Systems to growers in Spain, which enable the optimization of fertilizer use and improvement of yields for crops like tomatoes and peppers grown in greenhouse conditions.

By Form

Solid fertilizers dominated the market with a 68% share in 2024, reflecting their long shelf life, low storage cost, and broad adoption in open-field crops. Their strong presence stems from affordability and ease of handling for cereal and grain farmers. However, liquid fertilizers gained momentum with faster nutrient absorption and uniform distribution in fertigation and foliar methods. Greenhouse farmers increasingly favored liquid products to improve crop quality. Despite being smaller in share, the liquid segment is expected to grow faster with modern farming adoption.

Key Growth Drivers

Key Growth Drivers

Rising Demand from High-Value Crops

The increasing cultivation of fruits, vegetables, and greenhouse crops in the Netherlands drives demand for potash fertilizers. Farmers focus on chloride-free formulations like Sulphate of Potash and Potassium Nitrate to enhance crop quality and export competitiveness. These fertilizers improve yield, taste, and storage life, which are critical for premium produce. The shift toward high-value horticulture underpins stable growth, particularly in regions with advanced protected farming systems and intensive agricultural practices.

Expansion of Greenhouse Farming

The Netherlands is a global leader in greenhouse farming, and expanding greenhouse acreage boosts fertilizer use. Greenhouse production requires precise nutrient management, and potash fertilizers play a central role in supporting controlled irrigation and fertigation. Liquid formulations and soluble fertilizers are particularly in demand, aligning with modern greenhouse systems. With increasing investment in sustainable, year-round cultivation, potash fertilizers remain essential for productivity, efficient water use, and high-quality harvests, strengthening long-term market potential in the region.

For instance, ICL Specialty Fertilizers expanded its Netherlands portfolio by introducing water-soluble potash blends under the Solinure range, designed specifically for high-tech greenhouses.

Emphasis on Sustainable Agriculture

Sustainability initiatives are reshaping the Netherland Potash Fertilizers Market as farmers adopt eco-friendly practices. Demand for water-soluble, low-chloride, and specialty formulations continues to rise, reducing environmental impact while ensuring nutrient efficiency. Government support for reducing nitrogen and phosphate pollution also indirectly drives higher reliance on potash to balance soil nutrition. Fertilizer companies are focusing on sustainable blends and precision application technologies, aligning with the Netherlands’ commitment to green agriculture and meeting consumer demand for environmentally responsible food production.

For instance, ICL Group launched its eqo.x controlled‑release fertilizer technology across Northern Europe, designed to cut nutrient leaching and support Dutch farmers under EU green regulations.

Key Trends & Opportunities

Growing Adoption of Precision Farming

Precision farming technologies are gaining traction, creating opportunities for optimized potash fertilizer use. Farmers employ soil mapping, drones, and smart sensors to monitor crop nutrition accurately. This trend enhances fertilizer efficiency and reduces waste, improving sustainability and profitability. Companies that integrate digital solutions with customized fertilizer offerings can strengthen their market presence. The Netherlands’ highly advanced farming infrastructure makes it a leading market for precision-based applications, driving long-term opportunities for both local and global fertilizer suppliers.

For instance, Nutrien partnered with Pattern Ag to integrate soil microbiome data into digital crop models, allowing growers to apply fertilizer more precisely and improve nutrient efficiency.

Increasing Shift Toward Liquid Fertilizers

The market is experiencing a strong shift toward liquid formulations, particularly for greenhouse and specialty crops. Liquid fertilizers allow faster nutrient absorption and are compatible with fertigation and foliar application systems. Their adoption improves efficiency, crop uniformity, and ease of application. This trend supports opportunities for companies focusing on innovative liquid potash blends tailored to specific crop requirements. The growing role of controlled-environment agriculture in the Netherlands further reinforces the expansion of this high-potential market segment.

For instance, Greenlive offers a range of liquid fertilizers specifically formulated for different plant species used in greenhouse agriculture, enhancing nutrient delivery efficiency through fertigation systems.

Key Challenges

Environmental Regulations and Compliance

Strict environmental policies in the Netherlands challenge fertilizer usage, particularly regarding nutrient runoff and soil contamination. Farmers must comply with limits on nitrogen and phosphate emissions, which indirectly affect balanced potash application strategies. Regulatory pressure increases compliance costs for producers and limits fertilizer overuse. Companies must adapt by developing sustainable, low-impact formulations while ensuring farmers maintain productivity. These regulations create hurdles for traditional products but also drive innovation in eco-friendly potash solutions.

Dependence on Imports

The Netherlands depends heavily on imports to meet domestic potash fertilizer demand, creating vulnerabilities in supply chains. Fluctuations in global potash prices, geopolitical tensions, and logistics disruptions directly influence availability and farmer costs. Reliance on imports reduces market stability and increases exposure to foreign supplier risks. Companies operating in this market must strengthen distribution channels and explore localized blending facilities to reduce dependency and stabilize fertilizer access for farmers.

High Costs of Specialty Fertilizers

While demand for chloride-free and water-soluble formulations is growing, their higher costs limit adoption among small and medium-scale farmers. Specialty potash products such as Sulphate of Potash and Potassium Nitrate require significant investment compared to basic potassium chloride. Farmers cultivating cereals and grains often avoid these premium fertilizers due to budget constraints. This challenge restricts overall market penetration of advanced products, requiring companies to balance pricing strategies and develop cost-effective options to reach broader farmer segments.

Regional Analysis

Northern Netherlands

Northern Netherlands led the Netherland Potash Fertilizers Market with a 36% share in 2024, driven by extensive cereal and grain cultivation supported by mechanized farming practices. Farmers in this region prefer cost-efficient potassium chloride due to its suitability for large-scale field crops. The presence of advanced irrigation systems also encourages fertigation, boosting liquid fertilizer adoption. Greenhouse horticulture is expanding in certain areas, further supporting demand for chloride-free formulations such as Sulphate of Potash and Potassium Nitrate. Strong infrastructure and export-oriented farming enhance fertilizer utilization.

Western Netherlands

Western Netherlands accounted for a 28% share in 2024, largely supported by intensive greenhouse farming and high-value horticultural production. The region is a hub for fruits, vegetables, and floriculture, creating strong demand for chloride-free and water-soluble potash fertilizers. Fertigation and foliar applications dominate, as farmers seek precise nutrient delivery in controlled environments. Liquid formulations continue to grow faster due to compatibility with greenhouse systems. The region’s export-driven agriculture encourages the adoption of advanced potash products to ensure consistent quality and meet global standards.

Southern Netherlands

Southern Netherlands held a 22% share in 2024, supported by a mix of open-field farming and horticulture. Cereals and grains occupy significant acreage, encouraging the use of potassium chloride as a dominant product. However, pulses, oilseeds, and vegetables are also cultivated widely, fueling selective adoption of Sulphate of Potash and other specialty fertilizers. Farmers in this region are increasingly integrating precision farming technologies, which enhances fertilizer efficiency. Growing awareness of sustainable practices is further shaping fertilizer choices among producers in this area.

Eastern Netherlands

Eastern Netherlands represented a 14% share in 2024, making it the smallest regional contributor. The area is characterized by fragmented farmlands and smaller-scale agricultural activities, where traditional broadcasting remains the primary application method. Potassium chloride maintains strong demand due to cost advantages, but limited adoption of advanced fertilizers restrains growth. Regional farmers face challenges from higher costs of specialty formulations, which reduces uptake of premium fertilizers. However, modernization efforts and government support for sustainable farming practices offer future potential in this region.

Market Segmentations:

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Region

- Northern Netherlands

- Western Netherlands

- Southern Netherlands

- Eastern Netherlands

Competitive Landscape

The Netherland Potash Fertilizers Market is characterized by a mix of global leaders and regional suppliers competing on product innovation, distribution reach, and sustainability-focused offerings. Key players such as The Mosaic Company, K+S Aktiengesellschaft, ICL Group, CF Industries, and Helm maintain strong positions through diverse portfolios that include potassium chloride, sulphate of potash, and specialty water-soluble formulations. Van Iperen International leverages its local expertise and tailored crop solutions to strengthen competitiveness in greenhouse and horticulture segments. Companies focus on expanding chloride-free products and liquid fertilizers to address demand from high-value crops and controlled-environment farming. Strategic partnerships with cooperatives, advancements in precision agriculture, and compliance with strict environmental regulations shape market strategies. Competition remains intense, with firms balancing cost efficiency against innovation to meet the needs of both large-scale cereal producers and specialty crop farmers. Sustainability and precision application are emerging as key differentiators for long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- The Mosaic Company

- Van Iperen International

- K+S Aktiengesellschaft

- Helm

- CF Industries

- ICL

Recent Developments

- In September 2024, Cinis Fertilizer partnered with Van Iperen International to deliver the first shipment of GreenSwitch® Potassium Sulphate to the Netherlands. The water-soluble SOP fertilizer, produced through a circular process, is designed to cut emissions and support sustainable farming practices.

- In January 2025, K+S Aktiengesellschaft introduced its C:LIGHT product line, featuring CO₂-reduced potassium and magnesium fertilizers aimed at sustainable agriculture.

- In August 2025, The Mosaic Company finalized an agreement to sell its Taquari-Vassouras potash mining operations in Brazil to VL Mineração.

- In July 2025, Cinis Fertilizer shipped about 4,900 tons of water-soluble potassium sulfate to Van Iperen International in the Netherlands.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Methods, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chloride-free fertilizers will rise with expanding fruit, vegetable, and horticulture production.

- Greenhouse farming will continue to strengthen liquid and water-soluble potash fertilizer adoption.

- Precision agriculture practices will drive efficient nutrient application and reduce wastage.

- Farmers will increasingly shift to sustainable formulations to align with environmental policies.

- Broadcasting will remain significant but fertigation will gain wider adoption in modern farms.

- Solid fertilizers will dominate, while liquid products will record faster growth in specialized crops.

- Dependence on imports will push companies to secure stable global supply partnerships.

- High-value crop exports will encourage investment in premium potash fertilizer solutions.

- Small-scale farmers will face cost barriers in adopting advanced potash formulations.

- Innovation in eco-friendly blends and digital farming integration will shape future competitiveness.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: