Market Overview

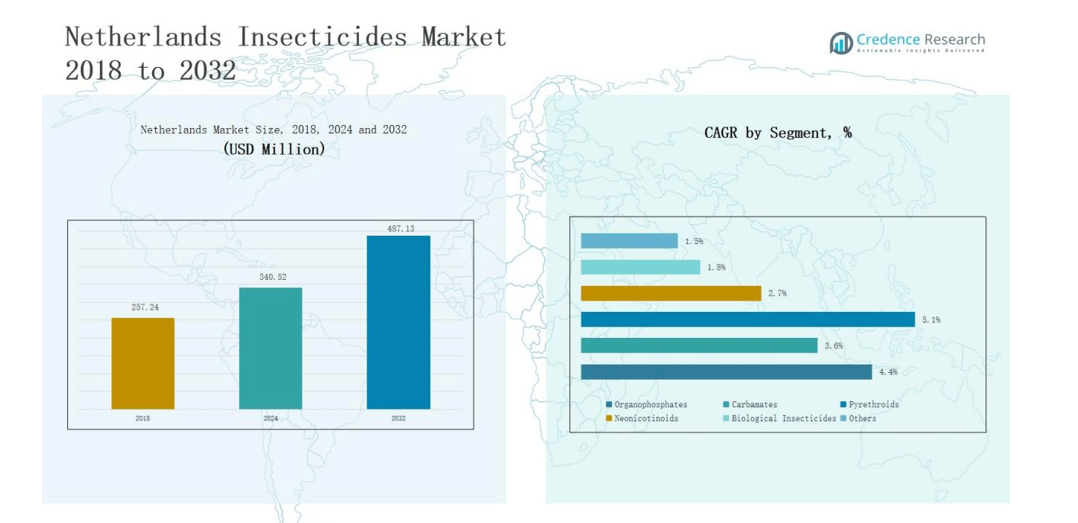

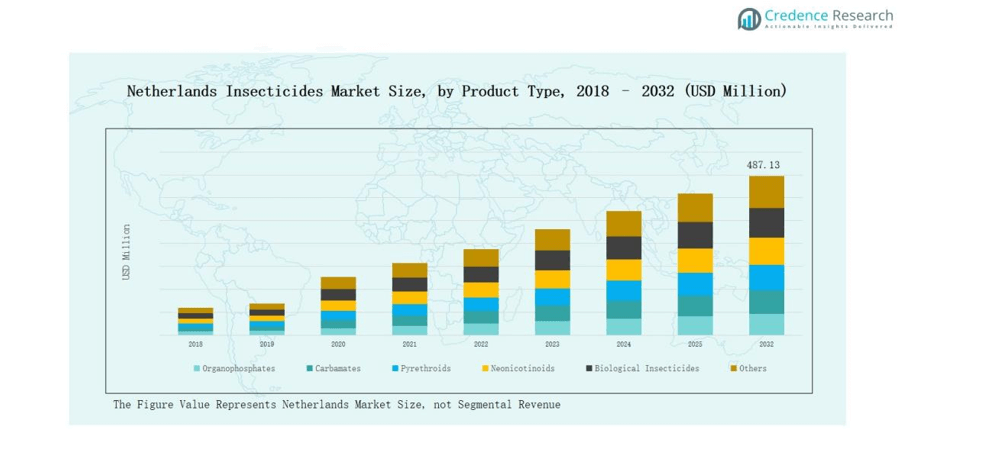

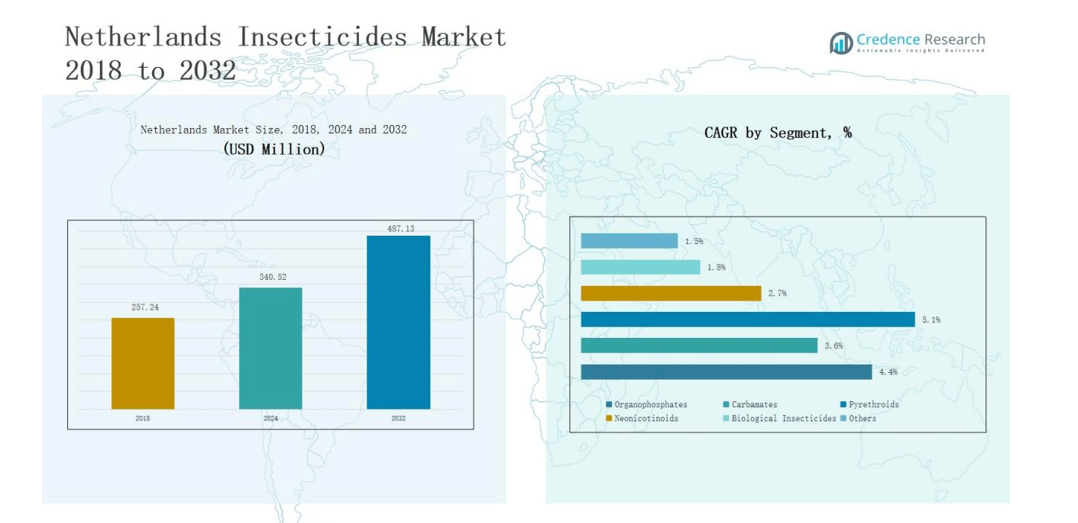

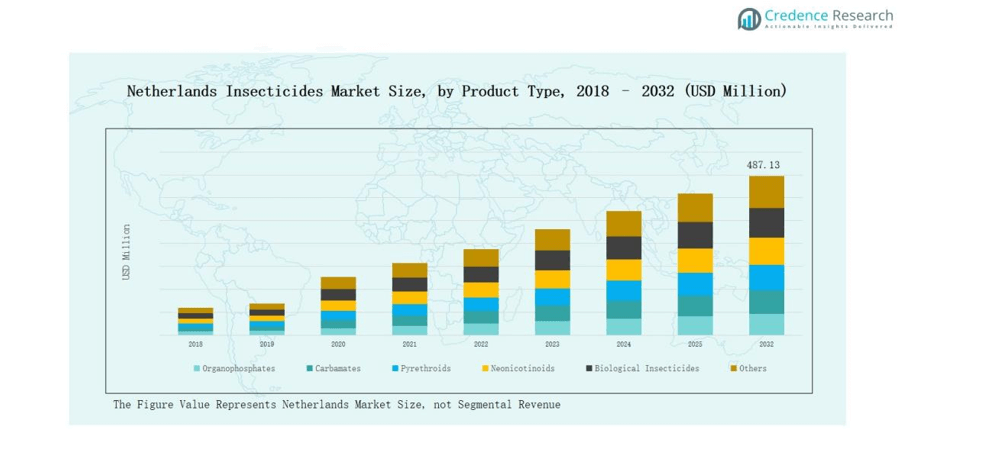

Netherlands Insecticides Market size was valued at USD 257.24 million in 2018 to USD 340.52 million in 2024 and is anticipated to reach USD 487.13 million by 2032, at a CAGR of 4.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherlands Insecticides Market Size 2024 |

USD 340.52 million |

| Netherlands Insecticides Market, CAGR |

4.49% |

| Netherlands Insecticides Market Size 2032 |

USD 487.13 million |

The Netherlands Insecticides Market is shaped by global leaders and strong regional firms offering diverse crop protection solutions. Major players include BASF SE, Bayer AG, Syngenta, Corteva Agriscience, ADAMA Agricultural Solutions, Nufarm, UPL Limited, Biobest, Koppert Biological Systems, and Agronutrition, each focusing on innovation, regulatory compliance, and sustainable product portfolios. Multinationals dominate through chemical and hybrid insecticides, while local firms strengthen the market with biological solutions, meeting rising demand for eco-friendly alternatives. Regionally, Western Netherlands led with 38% market share in 2024, supported by intensive greenhouse cultivation of vegetables, fruits, and ornamentals requiring high insecticide usage.

Market Insights

- The Netherlands Insecticides Market grew from USD 257.24 million in 2018 to USD 340.52 million in 2024 and is projected to reach USD 487.13 million by 2032, expanding at 4.49% CAGR.

- Leading companies include BASF SE, Bayer AG, Syngenta, Corteva Agriscience, ADAMA Agricultural Solutions, Nufarm, UPL Limited, Biobest, Koppert Biological Systems, and Agronutrition, focusing on innovation and sustainability.

- By product type, organophosphates led with 32% share in 2024, followed by pyrethroids at 21%, carbamates at 15%, neonicotinoids at 12%, biological insecticides at 14%, and others at 6%.

- By application, agriculture dominated with 68% share in 2024, while public health held 14%, turf & landscape 9%, forestry 6%, and other uses 3%, reflecting diverse adoption.

- Regionally, Western Netherlands led with 38% share in 2024, followed by Eastern Netherlands at 24%, Southern Netherlands at 20%, and Northern Netherlands at 18%, highlighting regional strengths in cultivation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

In 2024, organophosphates dominated the Netherlands insecticides market with a 32% share, driven by their broad-spectrum effectiveness and strong demand in greenhouse vegetable and fruit cultivation. Pyrethroids followed with a 21% share, supported by efficiency and compatibility with integrated pest management systems. Carbamates held 15% share, mainly in horticulture, while neonicotinoids accounted for 12%, though their growth is restricted by EU regulations on pollinator safety. Biological insecticides captured 14% share, reflecting rising adoption of eco-friendly solutions, while others contributed 6%, covering niche formulations.

- For instance, Bayer introduced the biocontrol solution Serenade ASO (containing Bacillus subtilis) for use in Dutch greenhouse horticulture, addressing rising adoption of microbial-based insecticides.

By Application

The agriculture segment led with 68% market share in 2024, fueled by intensive greenhouse farming, horticulture, and high-value crop protection. Public health accounted for 14% share, supported by municipal pest control initiatives and rising demand for safe formulations. Turf & landscape applications contributed 9%, primarily for urban green spaces, while forestry captured 6%, reflecting moderate adoption. The remaining 3% share came from other uses, including household and commercial pest management.

- For instance, Syngenta launched the PLINAZOLIN® technology-based insecticide in Europe to protect high-value crops such as tomatoes and cucumbers, targeting resistant pests with improved safety profiles.

Market Overview

Strong Greenhouse Cultivation Base

The Netherlands leads Europe in greenhouse vegetable and flower production, creating consistent demand for insecticides. Farmers rely heavily on chemical and biological formulations to protect high-value crops such as tomatoes, cucumbers, and ornamentals. This intensive cultivation system requires targeted pest control solutions that maintain crop quality and yield. The strong greenhouse sector, combined with year-round cultivation cycles, remains a primary growth engine for the insecticides market.

- For instance, Koppert Biological Systems launched its updated Spical Ulti-Mite formulation in the Netherlands, offering longer-lasting control against spider mites for year-round greenhouse crops such as cucumbers and roses.

Shift Toward Biological Insecticides

The rising adoption of eco-friendly and sustainable crop protection is accelerating market growth. Biological insecticides accounted for 14% of the Dutch market in 2024, driven by consumer preference for residue-free produce and regulatory support. Local companies like Koppert Biological Systems are expanding innovative microbial and biocontrol solutions, strengthening this segment. Increasing EU funding for sustainable agriculture and alignment with the Farm-to-Fork strategy further push farmers toward biological alternatives.

- For instance, the European Commission allocated €185.9 million to programs promoting sustainable farming practices, directly funding biological crop protection and integrated pest management initiatives across member states.

Technological Advancements in Crop Protection

Precision farming and digital agriculture practices are supporting the effective use of insecticides. Dutch farmers increasingly adopt data-driven pest monitoring, drone-based spraying, and AI-supported crop protection systems. These technologies optimize dosage, minimize chemical waste, and improve pest resistance management. By integrating insecticides with precision tools, farmers enhance efficiency while meeting sustainability requirements. This technological shift improves productivity and creates opportunities for advanced formulations in the market.

Key Trends & Opportunities

Rising Demand for IPM Solutions

Integrated Pest Management (IPM) is gaining traction as farmers combine chemical and biological solutions for sustainable pest control. This approach reduces resistance buildup and aligns with EU pesticide reduction goals. Companies offering product portfolios that integrate synthetic insecticides with biocontrol agents stand to benefit. The Netherlands’ expertise in advanced farming makes it an ideal testing ground for such hybrid solutions.

- For instance, BASF launched Exponus® insecticide in the EU, designed for use within IPM systems, as it can be combined with beneficial insects for resistant pest management.

Expansion of Organic Farming Practices

The Netherlands is witnessing steady growth in organic farming acreage, boosting demand for biological insecticides. Organic farmers require alternatives free from synthetic residues, creating opportunities for microbial, botanical, and pheromone-based products. Government incentives and EU regulations favoring sustainable production further enhance market potential. This trend presents a strong growth avenue for companies focused on green chemistry innovations.

- For instance, Certis Belchim introduced the botanical-based bioinsecticide NeemAzal-T/S in the Netherlands as part of integrated pest management programs for organic growers.

Key Challenges

Stringent EU Regulations

The EU’s regulatory framework is among the strictest worldwide, significantly impacting insecticide approvals. Several neonicotinoids and conventional chemistries face usage bans or restrictions due to environmental risks. Compliance requires high R&D investments, limiting smaller companies’ ability to compete. This regulatory pressure is reshaping the market toward sustainable but often costlier solutions.

Rising Pest Resistance

Intensive greenhouse and open-field farming practices in the Netherlands increase the risk of pest resistance. Overreliance on specific insecticide classes such as pyrethroids accelerates resistance development. Farmers face yield losses and higher costs when products lose efficacy. This challenge drives the need for rotation strategies and innovation in novel modes of action.

High Adoption Costs of Biologicals

While biological insecticides offer sustainability advantages, their high cost compared to conventional chemicals limits adoption. Small and mid-sized farmers often hesitate to shift due to budget constraints. Moreover, biologicals may require specialized application methods and training, adding operational complexity. Balancing affordability with sustainability goals remains a key market barrier.

Regional Analysis

Western Netherlands

Western Netherlands accounted for 38% share of the insecticides market in 2024, driven by intensive greenhouse farming. The region leads in vegetable, fruit, and ornamental crop cultivation, which demands reliable pest control. Farmers here increasingly adopt a mix of synthetic and biological insecticides to meet export quality standards. Strong research institutions and innovation hubs support advanced crop protection practices. The Netherlands Insecticides Market benefits from this concentration of technology and farming expertise, making the western region a growth hub.

Northern Netherlands

Northern Netherlands represented 18% share in 2024, supported by potato and cereal cultivation. The region relies on insecticides to protect crops against soil pests and seasonal infestations. Farmers use a combination of organophosphates and pyrethroids, with gradual interest in biological alternatives. While less intensive than the western zone, the northern market remains steady. It reflects stable demand tied to staple crop protection and sustainable practices encouraged by regional policies.

Eastern Netherlands

Eastern Netherlands held 24% share in 2024, led by mixed farming systems including livestock and arable crops. Crop diversity drives demand for a wide range of insecticide formulations. The region shows increasing preference for eco-friendly solutions, particularly in horticulture and fruit farming. Strong government monitoring of pesticide usage ensures compliance with EU standards. It remains an important contributor to the Netherlands Insecticides Market through its balanced crop profile.

Southern Netherlands

Southern Netherlands captured 20% market share in 2024, driven by high-value fruit, vegetable, and specialty crop cultivation. The region maintains consistent use of insecticides to protect export-oriented production. Biological insecticides see strong adoption here due to growing organic farming practices. Farmers also integrate precision technologies to improve efficiency and reduce residues. It demonstrates strong alignment with sustainability goals while maintaining productivity in the Netherlands Insecticides Market.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region

- West Netherlands

- North Netherlands

- East Netherlands

- Southern Netherlands

Competitive Landscape

The Netherlands Insecticides Market is highly competitive, shaped by global leaders and strong regional companies offering diverse solutions. Major players such as BASF SE, Bayer AG, Syngenta, Corteva Agriscience, and ADAMA Agricultural Solutions maintain dominance through extensive product portfolios, innovation in eco-friendly formulations, and adherence to EU regulatory standards. Local firms like Koppert Biological Systems and Biobest strengthen the market with biological insecticides, catering to the rising demand for sustainable and residue-free solutions. Companies focus on strategic collaborations, research investments, and tailored solutions for greenhouse farming, which is central to Dutch agriculture. The competitive environment is marked by growing emphasis on integrated pest management and precision farming technologies, pushing firms to combine chemical and biological products. Increasing regulatory scrutiny and consumer demand for sustainability further drive competition, compelling companies to differentiate through product safety, efficiency, and alignment with the country’s sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In March 2025, Syngenta launched NETURE, a biological insecticide targeting sap-sucking pests, supporting sustainable crop protection in the Netherlands market.

- In 2024, BASF extended the use-label of its Velifer Bioinsecticide/miticide by adding dip-and-drench application options and expanding crop compatibility—making it easier to use throughout production cycles.

- On June 19, 2025, Koppert Biological Systems entered a strategic partnership with Insect Science, appointing them as its preferred supplier of semiochemical solutions. This collaboration aims to strengthen sustainable pest management tools, including monitoring lures and mating disruption techniques.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Aplication and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will grow due to strict EU sustainability targets.

- Greenhouse farming will remain the primary driver of insecticide consumption.

- Integrated pest management practices will gain stronger adoption across crop systems.

- Digital tools and precision agriculture will shape insecticide application strategies.

- Regulatory restrictions will continue to phase out several conventional chemistries.

- Research and innovation will focus on safer and residue-free formulations.

- Partnerships between global firms and local players will expand biological portfolios.

- Public health insecticide demand will rise with urbanization and vector control needs.

- Organic farming growth will accelerate the shift toward microbial and botanical products.

- Competitive pressure will push companies to balance cost, efficiency, and sustainability.