| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neuromorphic and Analog AI ASIC Market Size 2024 |

USD 4,326.00 Million |

| Neuromorphic and Analog AI ASIC Market, CAGR |

19.15% |

| Neuromorphic and Analog AI ASIC Market Size 2032 |

USD 19,270.73Million |

Market Overview:

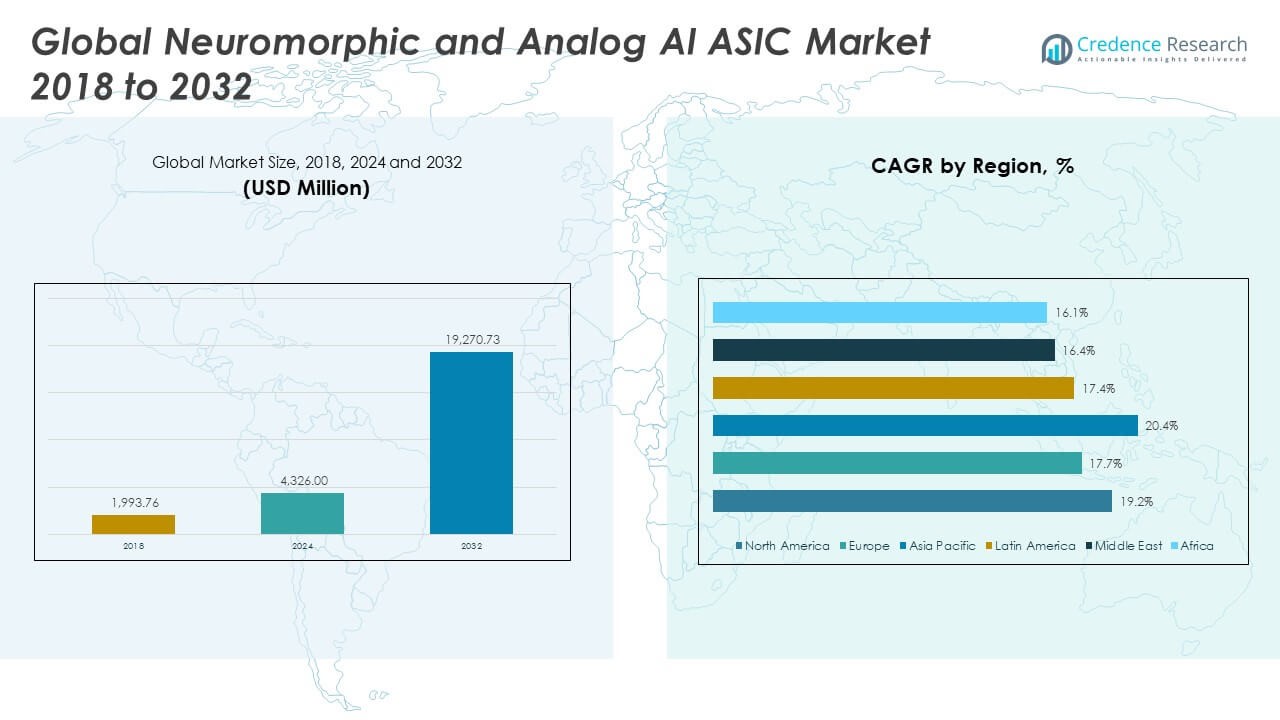

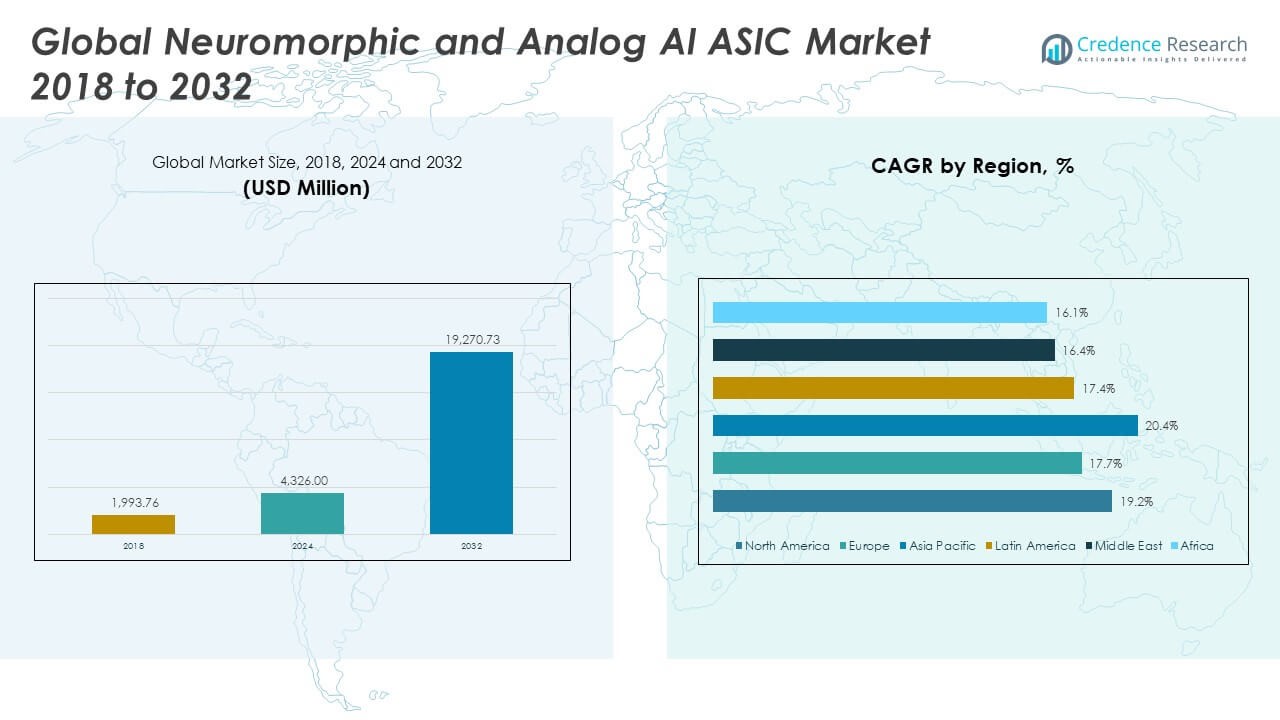

The Global Neuromorphic and Analog AI ASIC Market size was valued at USD 1,993.76 million in 2018 to USD 4,326.00 million in 2024 and is anticipated to reach USD 19,270.73million by 2032, at a CAGR of 19.15% during the forecast period.

The global neuromorphic and analog AI ASIC market is gaining momentum due to increasing demand for ultra-low-power, high-speed processing at the edge. Neuromorphic chips, inspired by the human brain, offer substantial energy efficiency and parallel processing benefits that conventional digital architectures struggle to match. Their applications span autonomous vehicles, robotics, wearables, surveillance systems, and advanced healthcare devices—industries where real-time decision-making and minimal power usage are crucial. Another major driver is the accelerated growth of AI-driven devices in both consumer and industrial settings, creating opportunities for analog AI ASICs that support rapid, local inferencing without the need for cloud connectivity. Furthermore, the rise of smart sensors and neuromorphic vision systems in automotive safety and industrial automation continues to push market demand. Strategic investments by semiconductor leaders, academic institutions, and governments in neuromorphic research and commercial deployment further bolster growth prospects across global markets.

Regionally, North America holds a commanding position in the neuromorphic and analog AI ASIC market, fueled by robust R&D infrastructure, early adoption of edge AI, and presence of key players such as Intel, IBM, and BrainChip. The region benefits from government-backed initiatives like the U.S. CHIPS Act, promoting innovation in low-power computing and AI hardware. Meanwhile, Asia-Pacific is witnessing the fastest growth, particularly in China, Japan, South Korea, and India, where demand for edge intelligence in smart manufacturing, autonomous systems, and consumer electronics is soaring. China’s focus on self-reliance in semiconductor production and its national AI strategy amplify regional market acceleration. Europe maintains a moderate but growing share, driven by academic-industry collaborations and use of neuromorphic technology in robotics and defense. Latin America and the Middle East & Africa remain emerging markets, where rising digital infrastructure and interest in AI-based automation suggest potential long-term opportunities for neuromorphic chip adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market is expected to grow from USD 4,326.00 million in 2024 to USD 19,270.73 million by 2032, expanding at a CAGR of 19.15%.

- Rising demand for ultra-low-power edge AI solutions across IoT, wearables, and smart cameras is a key growth driver.

- Autonomous vehicles, robotics, and ADAS systems increasingly adopt neuromorphic processors for real-time environmental sensing and decision-making.

- Continuous innovation in memristors, spintronics, and spiking neural networks is reshaping chip architecture and performance benchmarks.

- Governments and major firms are investing heavily in neuromorphic R&D, supported by initiatives like the U.S. CHIPS Act and China’s AI roadmap.

- Lack of standardization, proprietary frameworks, and limited commercial awareness pose significant barriers to large-scale adoption.

- North America leads in R&D and early adoption, while Asia-Pacific emerges as the fastest-growing region, driven by AI integration in manufacturing and consumer electronics.

Market Drivers:

Increasing Demand for Edge AI and Ultra-Low Power Processing Capabilities

The rising demand for edge AI applications is a primary driver of the Global Neuromorphic and Analog AI ASIC Market. Devices at the edge require rapid data processing with minimal latency and extremely low power consumption. Neuromorphic and analog AI ASICs offer these advantages by mimicking biological neural systems and leveraging event-driven architectures. This efficiency makes them ideal for smart cameras, autonomous vehicles, industrial IoT systems, and wearable devices. Edge applications rely on real-time decision-making without cloud dependence, which these chips support effectively. As companies seek to scale intelligent devices, demand for energy-efficient, high-speed ASICs continues to grow rapidly.

- For example, BrainChip’s Akida 1000 chip is a prominent example: it integrates 1.2 million artificial neurons and 10 billion artificial synapses in a single device. Akida’s event-driven processing enables inference and incremental learning directly on the device, achieving operational power consumption of just a few hundred microwatts for always-on keyword spotting in smart sensors.

Surging Adoption in Autonomous Vehicles, Robotics, and Smart Vision Systems

Autonomous systems across automotive, robotics, and industrial sectors increasingly depend on intelligent sensing and localized processing. The Global Neuromorphic and Analog AI ASIC Market benefits from this shift as companies adopt chips that can process visual and spatial data efficiently. These chips enable machines to react to their environment with greater precision and reduced latency. Neuromorphic vision sensors offer advantages in motion detection and obstacle recognition, which are essential in ADAS and robotic applications. Their integration improves system responsiveness and reduces the computational burden on centralized units. It enables better energy efficiency and supports safer, more reliable autonomous functions.

Technological Advancements in Materials, Architectures, and AI Hardware Design

Innovation in neuromorphic and analog computing architectures plays a crucial role in expanding this market. Researchers and engineers are developing novel materials such as memristors and spintronic devices that enhance analog computing performance. These innovations improve processing speed, reduce energy demands, and increase integration density. Companies and academic institutions are collaborating to design next-generation ASICs optimized for cognitive workloads and spiking neural networks. The Global Neuromorphic and Analog AI ASIC Market continues to attract R&D funding to develop flexible, scalable, and biologically inspired hardware. These advancements are pushing the boundaries of what AI chips can achieve beyond conventional digital limitations.

- For example, TDK, in collaboration with CEA and Tohoku University, has developed a spin-memristor neuromorphic device that enables real-time unsupervised learning and sound separation with ultralow power consumption (well below 1 mW). TDK has confirmed successful AI circuit integration and outlined a roadmap for future volume manufacturing.

Rising Government and Industry Investments in AI Hardware and Semiconductor Self-Reliance

Governments across North America, Europe, and Asia are supporting neuromorphic hardware through AI development policies and semiconductor investment programs. Initiatives like the U.S. CHIPS Act and China’s AI innovation framework emphasize the importance of next-generation computing technologies. It benefits from funding aimed at strengthening local chip production and reducing reliance on legacy architectures. Large technology companies are also investing heavily in commercializing neuromorphic platforms. This coordinated push from both public and private sectors accelerates the commercialization of analog AI ASICs. It ensures the market remains a key pillar in future-ready, energy-efficient AI hardware systems.

Market Trends:

Shift Toward Event-Driven and Spike-Based Neural Network Models in Chip Architectures

One of the most notable trends in the Global Neuromorphic and Analog AI ASIC Market is the growing shift from conventional frame-based AI processing to event-driven neural architectures. These models, based on spiking neural networks (SNNs), process information only when significant data is received, which mirrors biological brain function more accurately. This design conserves power and improves computational efficiency, especially in sensor-rich environments. Developers are increasingly implementing SNNs in neuromorphic ASICs to improve performance in tasks like pattern recognition and adaptive learning. The market continues to evolve toward hardware that supports asynchronous and sparse data processing. This trend reflects the industry’s focus on biologically realistic and resource-efficient AI models.

- For example, Intel’s Loihi processorcontains 131,072 artificial neurons and over 130 million synapses and is able to process information adaptively in sensor-rich environments. Loihi achieves significant efficiency gains: idle power consumption is far lower than that of traditional GPUs, and the processor performs well on tasks such as pattern recognition and adaptive learning without relying on constant, frame-based processing.

Integration of On-Device Learning Capabilities for Adaptive Intelligence

Emerging neuromorphic chips are moving beyond inference-only operations by integrating on-device learning capabilities. This shift enables chips to update their models in real time based on new inputs, without requiring cloud connectivity or retraining on central servers. It is especially relevant in dynamic environments such as mobile robotics and adaptive control systems, where behavior changes frequently. The Global Neuromorphic and Analog AI ASIC Market is adopting architectures that support continual learning, Hebbian learning, and plasticity-based updates. These capabilities enable devices to personalize and evolve over time, enhancing autonomy and resilience. The trend supports new classes of intelligent devices that go beyond static AI deployments.

Convergence of Neuromorphic Hardware with Brain–Computer Interface (BCI) Technologies

Neuromorphic chips are finding growing relevance in the development of brain–computer interface (BCI) systems. The convergence of these technologies is creating opportunities in assistive devices, cognitive monitoring, and neural signal processing. The Global Neuromorphic and Analog AI ASIC Market is increasingly aligned with neuroscience research, where low-latency, low-power chips are critical for interpreting brain activity in real time. Researchers are exploring co-designed systems where analog AI ASICs translate neural data into actionable outputs for prosthetics and communication aids. This intersection is fostering a multidisciplinary ecosystem between chipmakers, medical researchers, and neurotechnology startups. It is setting the stage for commercial deployment of cognitive augmentation devices.

- For example, Academic and industry collaborations, along with companies like Neuralink, have demonstrated real-time decoding of neural spike data into prosthetic control signals, with system latencies reported as low as sub-10 milliseconds in advanced brain-computer interface setups.

Exploration of Neuromorphic Solutions in Financial, Security, and Energy-Sensitive Applications

Neuromorphic computing is expanding beyond traditional tech sectors into finance, cybersecurity, and energy grid management. The market is seeing growing interest from industries that require pattern recognition, anomaly detection, and predictive analytics in real-time, with minimal energy consumption. The Global Neuromorphic and Analog AI ASIC Market is enabling financial firms to detect fraud patterns and trade anomalies using hardware-accelerated AI. Security firms are adopting neuromorphic systems for biometric processing, facial recognition, and threat detection with high accuracy and low power usage. In the energy sector, utilities are testing these chips to monitor system health and predict failures. This trend reflects a diversification of use cases and sectoral demand.

Market Challenges Analysis:

Lack of Standardization and Compatibility Across Neuromorphic Architectures

One of the key challenges in the Global Neuromorphic and Analog AI ASIC Market is the absence of standardized frameworks and design protocols. Each manufacturer often develops proprietary chip architectures and software interfaces, making it difficult to establish interoperability. This fragmentation hinders broader adoption, especially among developers and industries seeking scalable, platform-agnostic solutions. The lack of widely accepted programming models, benchmarking tools, and application libraries slows the integration of neuromorphic chips into mainstream AI workflows. It also raises concerns for long-term support, cross-vendor compatibility, and development costs. The market must address this challenge to facilitate ecosystem growth and ensure seamless deployment across diverse use cases.

Limited Commercial Readiness and Market Awareness in End-Use Industries

Despite promising capabilities, the Global Neuromorphic and Analog AI ASIC Market faces hurdles in commercial readiness and customer adoption. Many organizations remain unaware of the tangible benefits or fail to understand how to implement these technologies within existing systems. It struggles with a steep learning curve, as neuromorphic computing requires a shift in design thinking and application development. Limited case studies, underdeveloped toolchains, and a shortage of trained engineers contribute to slower market penetration. High initial development costs and uncertain return on investment further deter early adoption. The market must overcome these perception and knowledge barriers to transition from research-focused deployment to widespread commercial use.

Market Opportunities:

Expansion of Neuromorphic AI into Consumer Electronics and IoT Ecosystems

The integration of neuromorphic and analog AI ASICs into consumer electronics presents a major opportunity for market expansion. Devices such as smartphones, AR/VR headsets, smart home appliances, and wearable health monitors increasingly demand low-latency, energy-efficient AI capabilities. The Global Neuromorphic and Analog AI ASIC Market can meet these demands by enabling real-time sensory processing and local decision-making without cloud reliance. It opens doors for seamless, responsive user experiences with minimal energy usage. As OEMs prioritize edge intelligence, demand for adaptive and low-power chips is set to increase significantly. This shift aligns with the broader trend toward decentralized AI processing in the consumer tech space.

Adoption in Defense, Space, and Biomedical Engineering Applications

The Global Neuromorphic and Analog AI ASIC Market holds strong potential in high-impact domains such as aerospace, defense, and biomedical engineering. Governments and private agencies are investing in neuromorphic chips for mission-critical systems that require fast processing in constrained environments. These chips suit satellite navigation, drone autonomy, and battlefield analytics where power and speed are critical. In healthcare, neuromorphic ASICs support neural interfaces and diagnostic tools that operate in real time. It creates new commercial pathways for vendors targeting specialized, high-value applications with stringent performance requirements.

Market Segmentation Analysis:

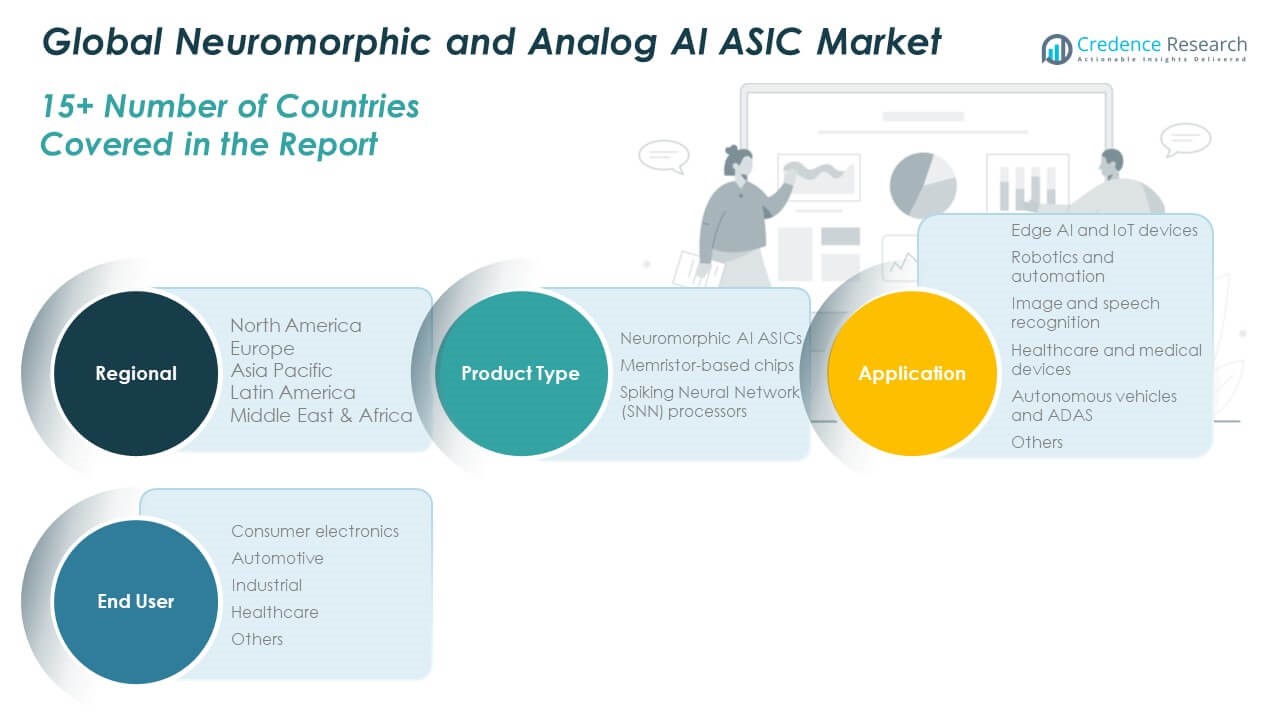

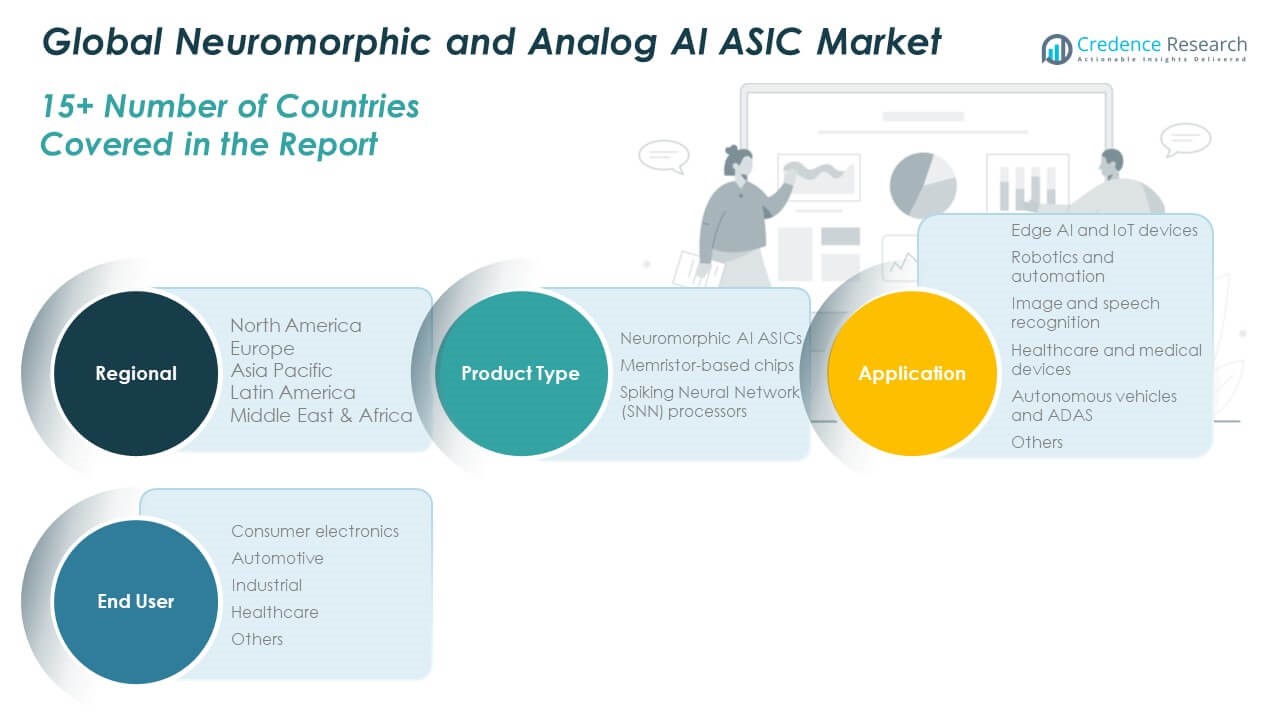

The Global Neuromorphic and Analog AI ASIC Market is segmented by product type, application, and end user, reflecting its diverse and expanding use cases.

By product type, Neuromorphic AI ASICs lead the market due to their compatibility with brain-inspired computing models. Memristor-based chips are gaining traction for their ability to store and process data simultaneously, while Spiking Neural Network (SNN) processors offer promising advances in event-driven computing with ultra-low power consumption.

By application, Edge AI and IoT devices dominate, driven by demand for localized, energy-efficient processing. Robotics and automation follow closely, leveraging real-time learning and adaptability in dynamic environments. Image and speech recognition systems utilize neuromorphic chips for improved pattern recognition and faster inference. The healthcare and medical devices segment benefits from precise signal interpretation and low latency. Autonomous vehicles and ADAS require real-time sensory integration, making them key adopters.

- For example, GrAI Matter Labs’ GrAI VIP processor is an ultra-low-latency AI chip designed for edge applications, with demonstrated capabilities in real-time vision processing.

By end user, consumer electronics account for a significant share, followed by automotive and industrial sectors. Healthcare and other specialized fields continue to open new growth avenues.

- For example, Sony’s IMX500 is a stacked CMOS image sensor with integrated AI processing, capable of performing on-chip object detection with low latency and power consumption. It enables smart vision applications in smartphones and security systems by processing inference directly on the sensor, making it a relevant component of the Global Neuromorphic and Analog AI ASIC Market.

Segmentation:

By Product Type Segments

- Neuromorphic AI ASICs

- Memristor-based Chips

- Spiking Neural Network (SNN) Processors

By Application Segments

- Edge AI and IoT Devices

- Robotics and Automation

- Image and Speech Recognition

- Healthcare and Medical Devices

- Autonomous Vehicles and ADAS

- Others

By End User Segments

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Others

By Regional Segments

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America

The North America Neuromorphic and Analog AI ASIC Market size was valued at USD 849.81 million in 2018 to USD 1,824.27 million in 2024 and is anticipated to reach USD 8,149.57 million by 2032, at a CAGR of 19.2% during the forecast period. North America holds the largest share in the Global Neuromorphic and Analog AI ASIC Market, contributing approximately 34% of the global revenue in 2024. This dominance stems from strong R&D investments, well-established semiconductor infrastructure, and the presence of major players such as Intel, IBM, and BrainChip. The region leads in early adoption across sectors like defense, autonomous systems, and AI research. It benefits from supportive government initiatives, including the CHIPS and Science Act, which promote advanced semiconductor manufacturing and AI innovation. North American universities and labs continue to drive neuromorphic advancements, ensuring the region maintains technological leadership.

Europe

The Europe Neuromorphic and Analog AI ASIC Market size was valued at USD 373.08 million in 2018 to USD 765.25 million in 2024 and is anticipated to reach USD 3,100.58 million by 2032, at a CAGR of 17.7% during the forecast period. Europe accounts for around 14% of the global market share in 2024, with growing momentum driven by collaborations between research institutes, universities, and industrial automation companies. Countries like Germany, France, and the Netherlands are focusing on neuromorphic computing for robotics, automotive, and secure communications. The Global Neuromorphic and Analog AI ASIC Market in Europe benefits from EU-funded programs and technology accelerators that support next-generation chip development. European firms are prioritizing energy efficiency and edge intelligence, aligning well with neuromorphic solutions. The region also fosters open-source innovation and neuromorphic software ecosystems to broaden adoption.

Asia Pacific

The Asia Pacific Neuromorphic and Analog AI ASIC Market size was valued at USD 588.84 million in 2018 to USD 1,347.44 million in 2024 and is anticipated to reach USD 6,534.99 million by 2032, at a CAGR of 20.4% during the forecast period. Asia Pacific represents roughly 25% of the global market in 2024 and is the fastest-growing region. The market benefits from rising AI chip investments in China, Japan, South Korea, and India, supported by large-scale government programs and manufacturing incentives. The Global Neuromorphic and Analog AI ASIC Market is expanding here due to high demand for intelligent consumer electronics, industrial automation, and automotive safety systems. Regional players are actively developing neuromorphic chips for edge AI and smart devices. Strong collaboration between academia and chipmakers is driving innovation and accelerating commercialization.

Latin America

The Latin America Neuromorphic and Analog AI ASIC Market size was valued at USD 95.95 million in 2018 to USD 205.64 million in 2024 and is anticipated to reach USD 812.76 million by 2032, at a CAGR of 17.4% during the forecast period. Latin America holds around 4% of the global market share in 2024, with growing interest in AI adoption across agriculture, energy, and public safety sectors. Countries like Brazil and Mexico are exploring neuromorphic technologies for real-time monitoring and automation. The Global Neuromorphic and Analog AI ASIC Market in this region is supported by the gradual expansion of digital infrastructure and government-backed AI frameworks. Academic research and pilot programs are emerging across major universities. Though commercialization is still in early stages, the market shows long-term potential for specialized deployments.

Middle East

The Middle East Neuromorphic and Analog AI ASIC Market size was valued at USD 52.30 million in 2018 to USD 103.08 million in 2024 and is anticipated to reach USD 382.09 million by 2032, at a CAGR of 16.4% during the forecast period. The region contributes nearly 2% to the global market share and is building interest in advanced AI applications in security, logistics, and smart cities. The Global Neuromorphic and Analog AI ASIC Market is growing in the Middle East due to national AI strategies in countries like the UAE and Saudi Arabia. Investments in tech hubs and partnerships with international research organizations are expanding capabilities. Market growth remains modest but steady, supported by broader digitization efforts and interest in energy-efficient computing solutions.

Africa

The Africa Neuromorphic and Analog AI ASIC Market size was valued at USD 33.79 million in 2018 to USD 80.32 million in 2024 and is anticipated to reach USD 290.74 million by 2032, at a CAGR of 16.1% during the forecast period. Africa holds approximately 1.5% of the global market in 2024 and is at an early stage of neuromorphic technology adoption. The Global Neuromorphic and Analog AI ASIC Market in Africa is beginning to see demand from sectors like telecommunications, healthcare, and remote sensing. Regional governments and universities are initiating AI and digital transformation programs, laying groundwork for future adoption. Infrastructure challenges and limited technical expertise currently restrict large-scale deployments. However, rising mobile device penetration and increasing awareness of AI benefits are creating new growth opportunities across select countries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IBM

- Intel

- BrainChip Holdings

- Qualcomm

- GrAI Matter Labs

- SynSense

- Nepes

- AiM Future

- Hailo

- NVIDIA

- Samsung Electronics

- STMicroelectronics

Competitive Analysis:

The Global Neuromorphic and Analog AI ASIC Market features a competitive landscape driven by innovation, strategic partnerships, and product differentiation. Leading companies such as Intel, IBM, BrainChip, Qualcomm, and Samsung focus on developing energy-efficient, high-performance ASICs tailored for edge AI and neuromorphic applications. It is marked by continuous R&D investments aimed at enhancing real-time learning, adaptive processing, and spiking neural network integration. Startups and academic spin-offs contribute with niche technologies, creating a dynamic environment for collaboration and licensing. Players compete on scalability, latency reduction, power optimization, and support for emerging use cases such as robotics, vision systems, and brain–machine interfaces. Strategic alliances with AI software vendors and academic institutions strengthen competitive positions. The market continues to evolve with growing patent activity, government support, and cross-sector demand, challenging established players to innovate rapidly. Competitive intensity remains high as companies race to define standards and secure early market leadership.

Recent Developments:

- In July 2025, IBM launched the IBM Power11server line, marking a significant advancement in enterprise IT for the AI era. The Power11 series, debuting on July 25, 2025, introduces innovations in processing, hardware architecture, and virtualization, targeting high availability and hybrid cloud flexibility.

- In Jan 2024, BrainChip Holdings entered into a strategic partnership with MYWAI, an AIoT solutions provider, to develop next-generation Edge AI solutions leveraging neuromorphic compute. Combining BrainChip’s Akida platform with MYWAI’s AIoT services, the partnership aims to accelerate Edge AI adoption in industrial and robotic markets.

- In January 2024, Intel announced a definitive agreement to acquire Silicon Mobility SAS, a company specializing in system-on-chips for EV energy management. The acquisition awaiting regulatory approval is intended to strengthen Intel’s position for in-vehicle AI and energy-efficient chips within the automotive sector.

Market Concentration & Characteristics:

The Global Neuromorphic and Analog AI ASIC Market exhibits a moderately concentrated structure, with leading semiconductor giants capturing the majority of revenue while specialized startups compete through niche innovations. It features high entry barriers due to advanced research requirements and capital intensity. Market participants focus on power efficiency, processing speed, scalability, and edge-device integration. R&D investment and intellectual property portfolios shape competitive advantage. Partnerships with academic institutions and AI software firms drive technology adoption and accelerate product launches. Custom solutions for sector-specific applications further differentiate providers. Frequent technology updates and rising patent filings indicate a dynamic environment where top-tier firms hold dominant positions while emergent players deliver targeted advancements.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for energy-efficient AI hardware will drive widespread adoption in edge computing applications.

- Integration of neuromorphic chips in consumer electronics and IoT devices will expand use cases.

- Real-time learning capabilities will enhance performance in autonomous systems and robotics.

- Advancements in spiking neural networks will improve processing accuracy and scalability.

- Increasing government funding will accelerate R&D and commercial deployment globally.

- Cross-industry collaborations will strengthen innovation pipelines and application diversity.

- Standardization efforts will improve interoperability and streamline software development.

- Healthcare and brain–machine interface technologies will offer new revenue opportunities.

- Emerging markets in Asia Pacific, Latin America, and Africa will support long-term growth.

- Leading vendors will prioritize edge intelligence and develop industry-specific chip solutions.