Market Overview

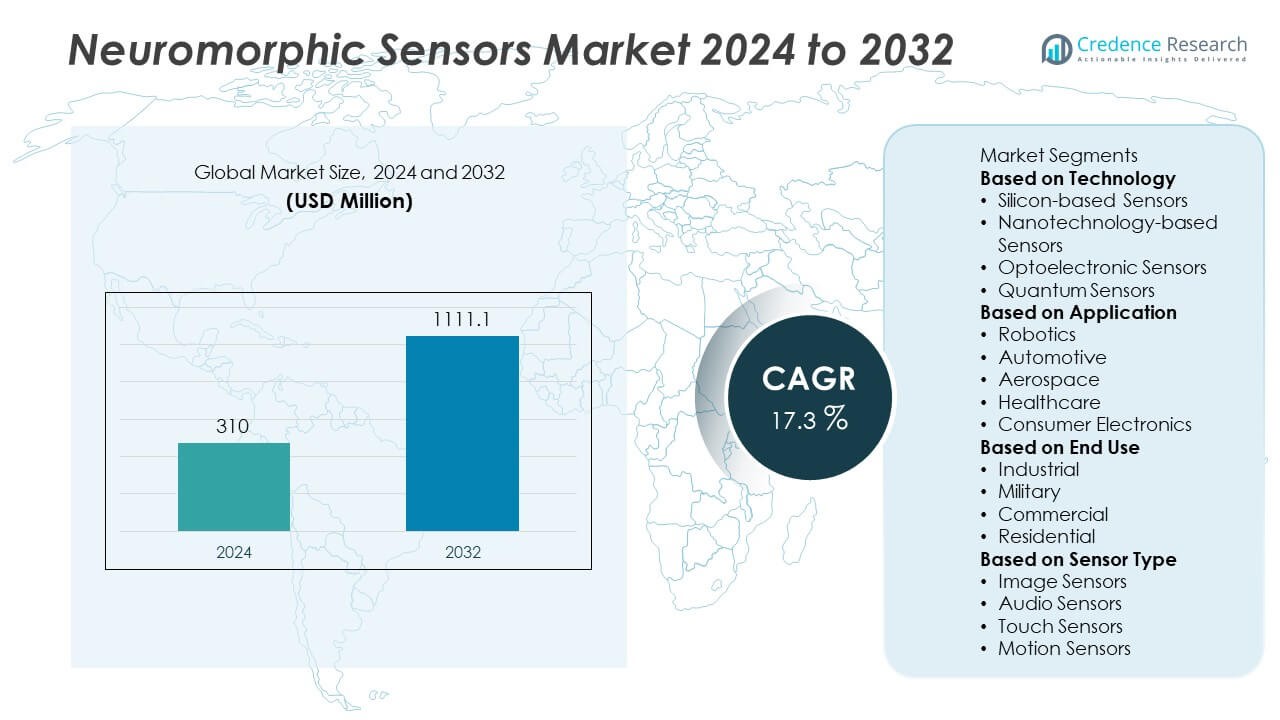

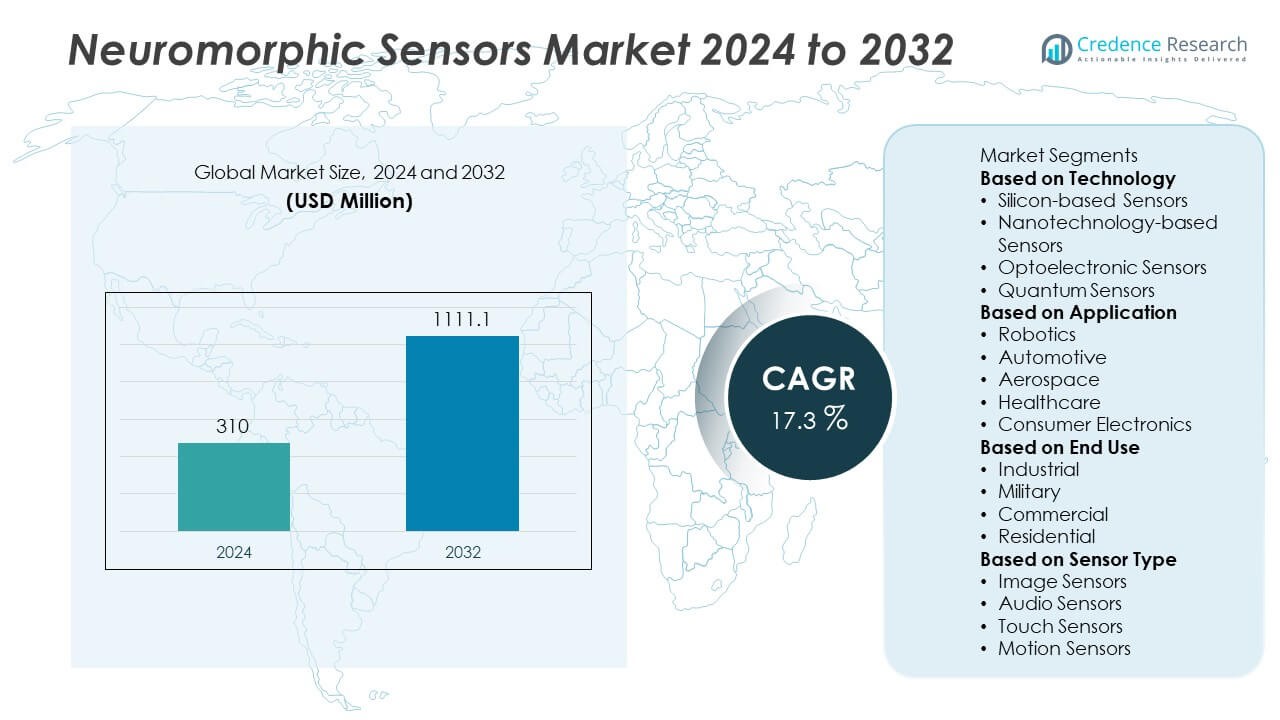

The Neuromorphic Sensors Market size was valued at USD 310 million in 2024 and is anticipated to reach USD 1,111.1 million by 2032, expanding at a CAGR of 17.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neuromorphic Sensors Market Size 2024 |

USD 310 Million |

| Neuromorphic Sensors Market, CAGR |

17.3% |

| Neuromorphic Sensors Market Size 2032 |

USD 1,111.1 Million |

The Neuromorphic Sensors Market grows steadily, driven by rising demand for edge AI, low-power computing, and real-time data processing across industries. Event-based vision sensors enable faster response times in autonomous vehicles, robotics, and surveillance, reducing energy use while improving efficiency.

The Neuromorphic Sensors Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads growth with advanced research ecosystems, strong adoption in defense, healthcare, and autonomous vehicles. Europe follows with investments in Industry 4.0, robotics, and automotive automation, supported by active research institutions. Asia-Pacific demonstrates rapid expansion through China, Japan, and South Korea, where robotics, consumer electronics, and semiconductor innovations drive adoption. Latin America and the Middle East & Africa gradually build demand in defense, healthcare, and smart infrastructure projects. Key players shaping the market include Intel, known for neuromorphic chip innovations; IBM Research, with advancements in cognitive computing; BrainChip, focusing on event-based AI processing; and Qualcomm, leveraging neuromorphic sensing in edge AI applications. These companies, alongside others like Samsung and Hewlett Packard Enterprise, continue to expand research collaborations and product development, strengthening market potential worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Neuromorphic Sensors Market was valued at USD 310 million in 2024 and is expected to reach USD 1,111.1 million by 2032, growing at a CAGR of 17.3%.

- Rising demand for low-power, real-time data processing solutions drives adoption across robotics, autonomous vehicles, healthcare, and defense.

- Event-based vision sensors and miniaturized, energy-efficient designs shape key technology trends, enabling faster response times and extended device lifespans.

- Competitive activity intensifies with leading companies such as Intel, IBM Research, BrainChip, Qualcomm, and Samsung investing in neuromorphic innovations and AI-driven integration.

- High development costs, complex manufacturing processes, and limited industry awareness remain major restraints, slowing adoption in cost-sensitive sectors.

- North America leads innovation through defense, healthcare, and autonomous driving, while Europe emphasizes automotive automation and industrial robotics, and Asia-Pacific expands rapidly in consumer electronics and semiconductor production.

- Strategic collaborations between governments, research institutes, and private players create long-term opportunities, strengthening the role of neuromorphic sensors in both commercial and defense applications worldwide.

Market Drivers

Rising Demand for Edge AI and Low-Power Processing

The Neuromorphic Sensors Market benefits from the growing need for efficient edge AI systems. Traditional sensors struggle with power limits in data-heavy applications. Neuromorphic designs use event-driven processing, which cuts energy use significantly. This capability supports devices in robotics, drones, and autonomous vehicles that must run for longer on limited battery power. Edge AI adoption expands rapidly across industries, and neuromorphic sensors match the performance needs of these systems. It positions itself as a preferred solution for energy-efficient intelligence at the device level.

- For instance, Launched in 2021, Intel’s Loihi 2 neuromorphic processor demonstrated significantly faster performance and up to 100x better energy efficiency than conventional CPUs on specific sparse, brain-like workloads. It is designed for energy-efficient AI, particularly for real-time applications at the device level.

Increasing Use in Autonomous Vehicles and Robotics

Autonomous driving and advanced robotics fuel strong demand for neuromorphic sensors. These technologies require real-time perception and rapid decision-making in complex environments. Neuromorphic sensors process visual and motion data quickly without relying heavily on cloud infrastructure. This speed improves safety, reduces latency, and supports precise navigation in dynamic surroundings. Automakers and robotics developers recognize the value of neuromorphic architectures in reducing computational strain. The market gains momentum as it integrates into commercial and industrial robotic platforms.

- For instance, The BrainChip Akida processor’s performance figures are based on the company’s own benchmarks and depend on the specific, low-complexity AI model used. The core claim is plausible because the neuromorphic design focuses on low-power, event-based processing for edge AI applications like robotics and automotive systems. This niche market for efficient, on-device AI is currently experiencing growing momentum.

Expanding Role in Smart Devices and IoT Applications

The Neuromorphic Sensors Market grows through integration into smart consumer and industrial devices. IoT ecosystems depend on sensors that manage data with minimal energy use. Neuromorphic systems meet this demand by mimicking brain-like efficiency in handling sensory input. Applications range from wearable devices and home automation to predictive maintenance tools in factories. These sensors enhance device performance without draining energy resources. It continues to align with the global push for more intelligent and sustainable IoT solutions.

Growing Support from Research and Defense Investments

Government funding and defense programs strengthen opportunities for neuromorphic technologies. Defense applications such as surveillance, navigation, and target recognition require advanced, low-latency sensing solutions. Research institutions drive innovation by testing neuromorphic models in complex scenarios. Strong partnerships between public agencies and private firms accelerate adoption across strategic sectors. The market benefits from policy-driven initiatives that encourage AI and semiconductor innovation. It secures long-term growth potential through continued investments in both academic and military projects.

Market Trends

Adoption of Event-Based Vision Sensors for Real-Time Applications

The Neuromorphic Sensors Market shows a clear shift toward event-based vision sensors. Unlike frame-based cameras, these sensors capture only changes in a scene, reducing data loads. This efficiency supports real-time processing in autonomous systems, drones, and security solutions. Event-driven vision improves response time and lowers energy use in continuous monitoring tasks. Industries rely on these sensors to achieve faster decision-making without stressing computing resources. It positions event-based vision as a core technology trend in neuromorphic sensing.

- For instance, Prophesee’s Metavision sensor demonstrated the ability to detect motion events at a temporal resolution of 1 microsecond, enabling high-speed tracking in industrial robotics and autonomous driving applications while lowering data rates by up to 1000× compared to traditional frame-based cameras. It positions event-based vision as a core technology trend in neuromorphic sensing.

Integration with Artificial Intelligence and Machine Learning Models

Neuromorphic sensors increasingly integrate with AI and ML frameworks to expand use cases. This integration allows pattern recognition, anomaly detection, and adaptive learning in dynamic environments. Industries such as healthcare, automotive, and industrial automation leverage these capabilities for advanced predictive insights. The combination of AI with neuromorphic architectures reduces dependence on cloud infrastructure. It enhances system resilience and lowers latency during critical operations. The market advances as more companies adopt AI-enabled neuromorphic platforms for smarter applications.

- For instance, IBM’s 2023 NorthPole chip is an AI inference accelerator with memory and computing intertwined on a single chip. This design achieves a 25x higher energy efficiency and 22x lower latency for image recognition compared to traditional GPUs of a similar 12nm node. The “4000x faster” figure was a comparison to IBM’s older TrueNorth chip.

Miniaturization and Energy-Efficient Sensor Designs

The Neuromorphic Sensors Market trends toward compact and energy-optimized devices. Miniaturization enables wider use in wearable technology, smart consumer electronics, and portable defense tools. Energy efficiency remains a strong priority as industries seek longer device lifespans with reduced power requirements. Neuromorphic designs achieve low-power performance while maintaining high data accuracy. This balance supports sustainability goals and broadens adoption across connected ecosystems. It strengthens the role of neuromorphic technology in next-generation electronics.

Expansion Across Healthcare and Defense Applications

Healthcare and defense sectors emerge as strong adopters of neuromorphic sensors. In healthcare, these sensors improve medical imaging, prosthetics, and neural interfaces by enabling adaptive responses. Defense agencies use neuromorphic designs for surveillance, navigation, and rapid threat detection. These high-value applications demand low latency, accuracy, and reliability. It highlights neuromorphic sensing as a transformative solution in mission-critical environments. The market gains long-term stability through diversification into both commercial and strategic domains.

Market Challenges Analysis

High Development Costs and Complex Manufacturing Processes

The Neuromorphic Sensors Market faces challenges due to high development expenses and complex production methods. Neuromorphic designs require advanced materials, specialized fabrication, and integration with AI hardware. These demands raise costs and limit access for small and mid-sized companies. Mass production remains difficult, slowing adoption in cost-sensitive industries. Limited availability of skilled engineers further adds to design and deployment barriers. It creates a gap between research-level innovation and large-scale commercialization.

Limited Standardization and Industry Awareness

Lack of standardization slows the global adoption of neuromorphic sensors. Industries need clear guidelines for performance benchmarks, interoperability, and testing protocols. Without standards, integration into existing platforms becomes complex and inconsistent. Market awareness also remains limited outside research and defense sectors, reducing potential demand. Companies struggle to educate end-users on the value and differentiation of neuromorphic solutions. It restricts broader commercialization, keeping growth concentrated in niche applications for now.

Market Opportunities

Expanding Applications in Healthcare, Automotive, and Consumer Electronics

The Neuromorphic Sensors Market holds strong opportunities across healthcare, automotive, and consumer devices. In healthcare, neuromorphic sensors support prosthetics, brain-computer interfaces, and real-time diagnostics. Automotive systems benefit from advanced perception technologies that enable safer autonomous driving. Consumer electronics such as wearables and smart home devices can integrate neuromorphic designs for energy-efficient intelligence. These sectors demand adaptive and low-power sensing solutions that conventional sensors cannot provide. It positions neuromorphic sensors as a disruptive enabler across multiple industries.

Growing Potential in Edge AI, IoT, and Defense Systems

Neuromorphic sensors unlock opportunities in edge AI, IoT networks, and defense programs. Edge devices require energy-efficient sensing to process data locally without heavy reliance on cloud servers. IoT ecosystems expand rapidly and depend on low-power, compact sensors to handle massive connected networks. Defense agencies seek neuromorphic designs for surveillance, navigation, and autonomous mission systems. These applications align with global investments in AI, semiconductors, and smart infrastructure. It creates a pathway for large-scale adoption and long-term growth opportunities worldwide.

Market Segmentation Analysis:

By Technology

The Neuromorphic Sensors Market by technology includes event-based sensors, vision sensors, and auditory sensors. Event-based technology dominates due to its ability to capture only relevant changes in the environment. This reduces data volumes and improves efficiency in real-time decision-making. Vision sensors gain traction in autonomous vehicles, robotics, and surveillance systems where fast object recognition is critical. Auditory sensors expand opportunities in speech recognition and human–machine interface applications. It highlights strong adoption of specialized neuromorphic technologies that mimic brain-like processing.

- For instance, The Sony IMX636 event-based vision sensor, co-developed with Prophesee, delivers HD resolution and high-speed, low-latency performance with microsecond-precise timestamps. Unlike conventional cameras, its pixel latency is also very low (under 100 μs), as data is only sent when a change in brightness is detected.

By Application

Applications span robotics, automotive systems, consumer electronics, healthcare, and defense. Robotics benefits from neuromorphic sensing through precise navigation and real-time motion detection. Automotive applications rely on event-driven vision sensors for lane detection, obstacle recognition, and autonomous driving support. Healthcare integrates these sensors into prosthetics, neural monitoring, and adaptive imaging systems. Consumer electronics such as AR/VR devices and wearables enhance performance with low-power neuromorphic designs. The Neuromorphic Sensors Market strengthens its position through growing multi-sector integration.

- For instance, BrainChip, the manufacturer, confirms this by describing Akida as an “ultra-low-power neuromorphic processor” that uses event-based processing. This approach is ideal for edge AI because it allows devices to process data efficiently without a constant connection to the cloud.

By End Use

End-use adoption is driven by industries such as automotive, defense, healthcare, consumer electronics, and industrial automation. The automotive sector leads demand, supported by rising investments in self-driving vehicles. Defense agencies deploy neuromorphic sensors for surveillance, secure navigation, and advanced battlefield intelligence. Healthcare providers explore opportunities in neuromorphic-enabled devices that deliver personalized and adaptive responses. Consumer electronics and IoT devices create demand for compact, energy-efficient sensors with smart processing capabilities. It continues to diversify across industries, ensuring broad market reach and long-term growth potential.

Segments:

Based on Technology

- Silicon-based Sensors

- Nanotechnology-based Sensors

- Optoelectronic Sensors

- Quantum Sensors

Based on Application

- Robotics

- Automotive

- Aerospace

- Healthcare

- Consumer Electronics

Based on End Use

- Industrial

- Military

- Commercial

- Residential

Based on Sensor Type

- Image Sensors

- Audio Sensors

- Touch Sensors

- Motion Sensors

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Neuromorphic Sensors Market, accounting for around 38% of the global revenue in 2024. The region benefits from advanced research ecosystems, strong investments in artificial intelligence, and early adoption of emerging semiconductor technologies. The United States leads growth with major contributions from automotive, defense, and healthcare applications. Federal agencies, such as DARPA, fund neuromorphic research for military and aerospace programs, while private companies integrate sensors into robotics and autonomous platforms. Canada supports growth with initiatives in smart manufacturing and medical technology. The region maintains dominance due to collaboration between universities, startups, and established technology firms.

Europe

Europe represents about 27% of the global Neuromorphic Sensors Market share. The region benefits from strong government-backed programs focused on artificial intelligence, sustainable electronics, and robotics. Countries like Germany, the UK, and France drive adoption through investments in automotive automation, Industry 4.0 projects, and defense modernization. German automakers lead in integrating neuromorphic vision sensors for autonomous driving and driver-assistance technologies. The UK and France focus on healthcare and surveillance applications, supporting early trials of neuromorphic-enabled medical devices. European research institutions play a significant role in advancing standards and interoperability. The region’s commitment to low-power electronics and AI ethics further strengthens long-term opportunities.

Asia-Pacific

Asia-Pacific captures about 22% of the global market share in 2024, with strong growth prospects expected over the forecast period. China leads adoption through state-led funding in defense, robotics, and semiconductor innovation. Japan invests heavily in robotics, healthcare, and industrial automation where neuromorphic sensors improve performance and efficiency. South Korea supports growth through consumer electronics, integrating neuromorphic sensing in smart devices and wearables. India emerges as a fast-growing market, driven by rising investments in AI research and expanding defense initiatives. Regional manufacturing capabilities give Asia-Pacific an advantage in scaling production and reducing costs. The region’s competitive environment ensures rapid adoption across both commercial and industrial domains.

Latin America

Latin America holds about 7% of the Neuromorphic Sensors Market share. Growth in the region remains moderate but steady, supported by investments in smart cities, healthcare modernization, and industrial automation. Brazil leads demand with applications in surveillance, medical imaging, and robotics for manufacturing. Mexico follows with increasing use in automotive and defense programs. Limited research infrastructure and higher costs restrict widespread adoption, but growing collaborations with North American firms improve access to technology. Governments support digital transformation initiatives, which provide opportunities for neuromorphic integration in future projects. The region shows potential as awareness and infrastructure improve.

Middle East & Africa

The Middle East & Africa account for about 6% of the global Neuromorphic Sensors Market share. Defense and security programs in countries such as Israel, Saudi Arabia, and the UAE drive initial adoption. Israel leads with research in neuromorphic AI and defense applications, supported by active startups and academic centers. The UAE and Saudi Arabia explore smart city projects that could integrate neuromorphic-enabled IoT and surveillance solutions. Africa shows limited adoption, but healthcare and industrial automation present future opportunities. Market expansion faces challenges due to limited semiconductor infrastructure and lower awareness. However, strategic partnerships with global players position the region for gradual growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cerebras Systems

- IBM Research

- BrainChip

- Inspirata

- Intel

- Hewlett Packard Enterprise

- Numenta

- Samsung

- IBM

- Qualcomm

Competitive Analysis

The competitive landscape of the Neuromorphic Sensors Market is shaped by leading players such as Intel, IBM Research, BrainChip, Qualcomm, Samsung, Hewlett Packard Enterprise, Cerebras Systems, Numenta, and Inspirata. The market is innovation-driven, with companies focusing on advanced chip designs, event-based vision technology, and AI integration to enhance efficiency and real-time performance. Strategic collaborations between research institutes, defense agencies, and commercial sectors support faster development and adoption. Firms emphasize energy-efficient, miniaturized solutions suitable for robotics, autonomous vehicles, consumer electronics, and healthcare devices. Investments in semiconductor advancements, software frameworks, and cognitive computing platforms further strengthen market competitiveness. The industry shows a strong focus on scaling production, improving interoperability, and expanding applications across both commercial and defense domains. Competitive intensity continues to rise, driven by continuous R&D spending and the race to establish leadership in edge AI and neuromorphic processing solutions.

Recent Developments

- In July 2025, Samsung introduced its latest neuromorphic AI chips aimed at edge devices and wearables, delivering real-time on-device processing for smart sensors, healthcare monitoring, and mobile applications.

- In April 2024, Medtronic introduced 14 new AI-driven algorithms to its Touch Surgery Performance Insights platform, enhancing post-operative analysis for laparoscopic and robotic-assisted procedures.

- In April 2024, Intel launched “Hala Point,” the world’s largest neuromorphic system built from Loihi 2 chips.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End Use, Sensor Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Widespread adoption of real-time, ultra-energy-efficient edge computing devices will accelerate neuromorphic sensors.

- IoT and wearable technology will rely more on always-on, low-power neuromorphic sensing for responsiveness and battery life improvement.

- Automotive and robotics sectors will adopt neuromorphic sensors for faster perception and safer autonomy with lower energy consumption.

- Standardized interfaces and frameworks will drive wider integration into commercial systems over time.

- Biologically inspired neuromorphic designs, such as organic electrochemical neurons, will open new applications in soft robotics and bio-integrated devices.

- Event-driven neuromorphic processing will enable smarter, more efficient local data interpretation in smart devices.

- Edge device architectures will integrate neuromorphic sensors with local learning capabilities, reducing dependence on cloud computations.

- Defense, healthcare, and industrial automation sectors will drive adoption through investments in intelligent, low-latency sensing solutions.

- Research in neuromorphic systems integration will enable scalable deployment across distributed sensor networks.

- Ethical and privacy gains from localized processing will support consumer trust and regulatory acceptance of neuromorphic sensor deployment.