Market Overview

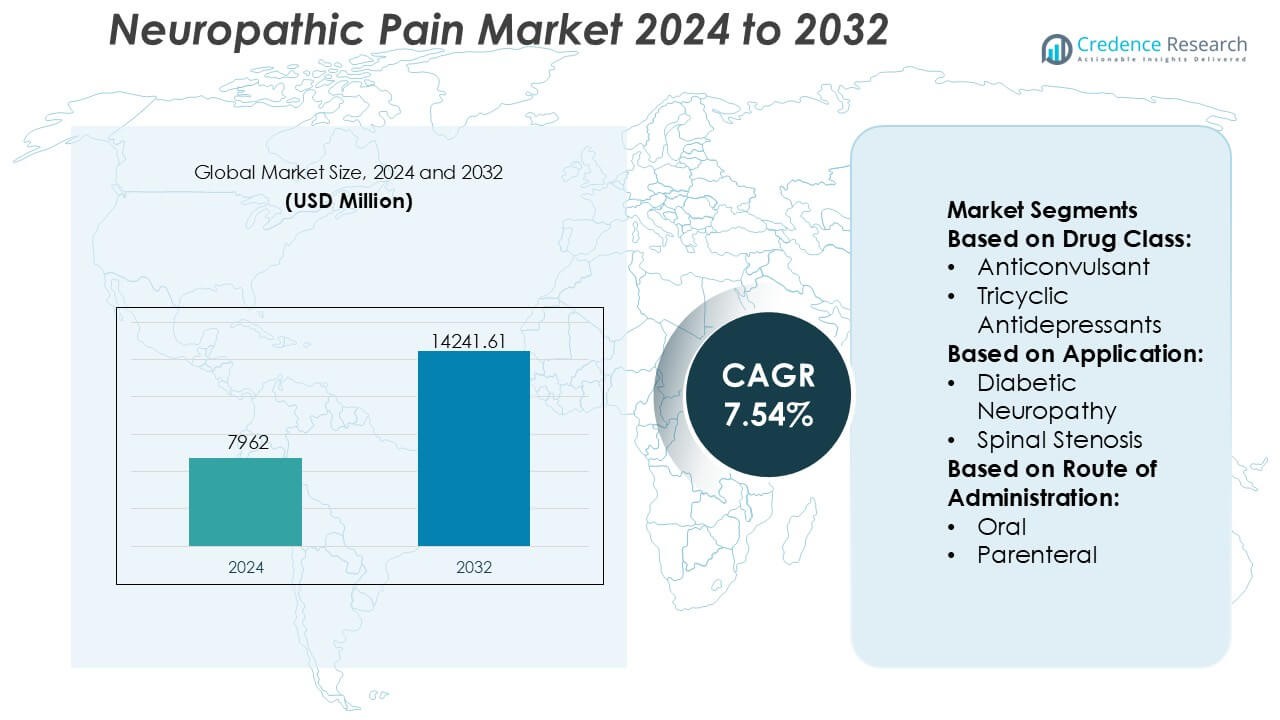

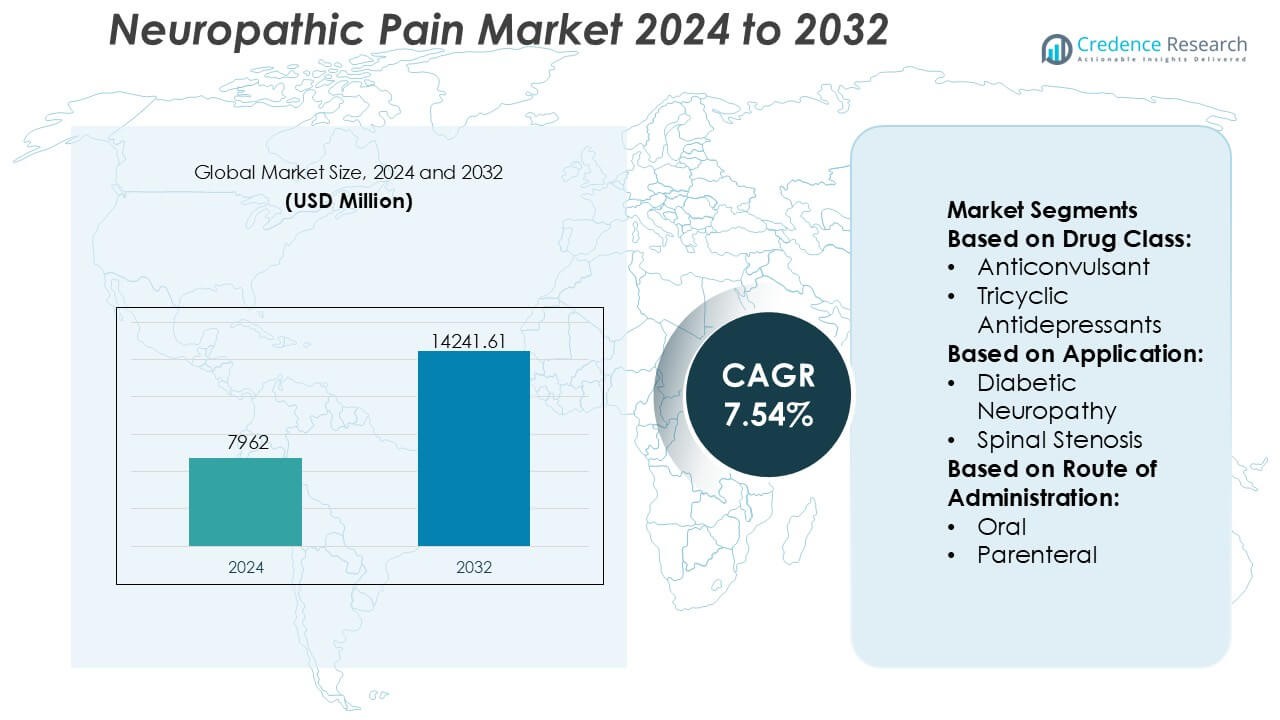

Neuropathic Pain Market size was valued USD 7962 million in 2024 and is anticipated to reach USD 14241.61 million by 2032, at a CAGR of 7.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neuropathic Pain Market Size 2024 |

USD 7962 Million |

| Neuropathic Pain Market, CAGR |

7.54% |

| Neuropathic Pain Market Size 2032 |

USD 14241.61 Million |

The neuropathic pain market is led by well-established pharmaceutical players with broad portfolios spanning branded and generic therapies, supported by strong manufacturing scale, regulatory expertise, and extensive distribution networks. Competition focuses on optimizing safety profiles, expanding non-opioid treatment options, and improving long-term tolerability for chronic use. Lifecycle management of mature molecules, formulation enhancements, and real-world evidence generation remain central to sustaining market positioning amid rising generic pressure. Regionally, North America dominates the market with an exact 41% share, driven by high disease prevalence, advanced diagnostic capabilities, strong specialist access, and widespread adoption of evidence-based treatment guidelines. Favorable reimbursement frameworks and early uptake of innovative therapies further reinforce the region’s leadership position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The neuropathic pain market was valued at USD 7,962 million in 2024 and is projected to reach USD 14,241.61 million by 2032, expanding at a CAGR of 7.54% during the forecast period.

- Rising prevalence of diabetes, cancer-related neuropathy, and post-surgical nerve damage acts as a primary market driver, increasing long-term therapy demand across hospital, clinic, and homecare settings.

- Treatment trends favor non-opioid therapies and combination regimens, with anticonvulsants emerging as the dominant segment holding an estimated 38% share, supported by strong clinical efficacy and guideline adoption.

- Competitive dynamics emphasize lifecycle management, generic portfolio expansion, and formulation optimization to improve tolerability amid pricing pressure from mature molecules.

- Regionally, North America leads with an exact 41% market share, driven by advanced diagnostics, specialist access, strong reimbursement frameworks, and early adoption of evidence-based neuropathic pain therapies.

Market Segmentation Analysis:

By Drug Class

The neuropathic pain market by drug class shows anticonvulsants as the dominant sub-segment, accounting for an estimated 38% market share, driven by their established efficacy in modulating neuronal excitability and broad guideline support. Agents such as gabapentinoids remain widely prescribed due to predictable dosing and suitability for long-term use. Tricyclic antidepressants follow, supported by dual analgesic and mood-stabilizing benefits, while opioids maintain a limited role due to safety and dependency concerns. Capsaicin and steroids address niche indications, whereas other classes expand options for refractory patient populations.

- For instance, Novartis announced a definitive agreement to acquire Avidity Biosciences for approximately 12 billion. This deal significantly strengthens its neuroscience and neuromuscular portfolio with a new class of RNA-based therapies.

By Application

By application, diabetic neuropathy represents the leading sub-segment with an exact 42% market share, supported by the high global prevalence of diabetes and early pharmacological intervention practices. Continuous symptom burden and chronic disease progression sustain long-term therapy demand in this group. Chemotherapy-induced and peripheral neuropathy segments gain traction due to rising cancer survivorship and aging populations, respectively. Spinal stenosis-related neuropathic pain remains clinically significant but more episodic in treatment duration. The “others” category benefits from improved diagnostic accuracy across mixed and idiopathic neuropathic conditions.

- For instance, Teva Pharmaceutical Industries Ltd. manufactures generic pregabalin capsules in 25 mg, 50 mg, 75 mg, 100 mg, 150 mg, 200 mg, 225 mg, and 300 mg strengths, enabling fine dose escalation protocols commonly applied in diabetic neuropathy management.

By Route of Administration

The market by route of administration is dominated by the oral segment, holding approximately 71% market share, driven by ease of use, patient adherence, and suitability for chronic outpatient management. Oral formulations support flexible titration and combination therapy, aligning with long-term neuropathic pain control strategies. Parenteral administration serves acute, severe, or refractory cases, particularly in hospital settings where rapid onset is required. Growth in this segment links to complex pain management protocols, but limited convenience and higher care costs keep oral therapies as the preferred first-line route.

Key Growth Drivers

Rising Prevalence of Chronic Diseases and Aging Population

The increasing incidence of diabetes, cancer, spinal disorders, and post-surgical complications continues to elevate the burden of neuropathic pain globally. Aging populations face higher risks of nerve damage due to metabolic disorders, degenerative conditions, and prolonged exposure to neurotoxic therapies. Improved survival rates in oncology and chronic disease management expand the patient pool requiring long-term pain control. Healthcare systems increasingly recognize neuropathic pain as a distinct clinical condition, supporting earlier diagnosis, sustained treatment, and broader adoption of pharmacological and non-pharmacological therapies.

- For instance, Abbott has advanced non-pharmacological neuropathic pain management through its Proclaim™ XR spinal cord stimulation (SCS) system, which delivers BurstDR™ stimulation consisting of 5 pulses per burst at an intra-burst rate of 500 Hz with a burst frequency of 40 Hz, designed to mimic natural neuronal firing patterns.

Advancements in Pharmacological Therapies and Treatment Guidelines

Continuous innovation in drug development strengthens treatment outcomes in neuropathic pain management. Expanded use of anticonvulsants, antidepressants, topical agents, and combination therapies improves symptom control and patient adherence. Updated clinical guidelines emphasize mechanism-based therapy selection and personalized dosing strategies, encouraging optimized prescribing practices. Extended-release formulations and improved safety profiles reduce adverse events and enhance long-term use. These advancements support wider physician acceptance and reinforce the role of evidence-based pharmacotherapy in routine neuropathic pain care.

- For instance, Depomed’s FDA-approved labeling, GRALISE is administered once daily at a total dose of 1,800 mg, delivered via 600 mg tablets, and achieves a median time to peak plasma concentration of approximately 8 hours following the evening meal.

Improved Diagnosis, Awareness, and Access to Care

Growing clinical awareness and enhanced diagnostic tools contribute to earlier identification of neuropathic pain conditions. Standardized pain assessment scales and improved differentiation between nociceptive and neuropathic pain support accurate treatment decisions. Educational initiatives targeting healthcare professionals increase adherence to best-practice protocols. Simultaneously, expanding access to specialty care, pain clinics, and telemedicine platforms improves treatment reach in both urban and semi-urban settings, driving sustained demand for neuropathic pain therapies.

Key Trends & Opportunities

Shift Toward Personalized and Multimodal Pain Management

Treatment strategies increasingly favor personalized approaches that combine pharmacological, behavioral, and interventional therapies. Clinicians adopt multimodal regimens tailored to pain etiology, severity, and patient comorbidities. Genetic profiling, patient-reported outcomes, and digital monitoring tools support individualized therapy optimization. This trend enhances treatment efficacy and reduces trial-and-error prescribing. Opportunities emerge for therapies positioned within integrated care models that address both pain intensity and functional improvement.

- For instance, GSK leverages one of the world’s largest human genetics datasets, which has expanded to over 15 million anonymized genomic records (far exceeding the 2 million cited in older reports).

Growing Adoption of Non-Opioid and Topical Therapies

Concerns over opioid dependence accelerate the shift toward non-opioid alternatives in neuropathic pain management. Anticonvulsants, antidepressants, capsaicin patches, and topical lidocaine gain traction due to favorable safety profiles. Healthcare providers prioritize long-term tolerability and reduced systemic exposure. This transition creates opportunities for innovative formulations, combination products, and localized delivery systems that provide sustained relief while minimizing adverse effects and regulatory constraints.

- For instance, Merck research disclosures, its pain discovery programs have screened more than 1.2 million small-molecule compounds against validated peripheral nerve targets, including voltage-gated sodium channels implicated in neuropathic pain signaling.

Expansion of Digital Health and Remote Pain Management Solutions

Digital therapeutics, remote monitoring, and teleconsultations increasingly complement conventional neuropathic pain treatments. Mobile applications enable symptom tracking, medication adherence, and real-time clinician feedback. Remote care models improve continuity of treatment for chronic pain patients and expand access in underserved regions. These solutions support data-driven decision-making and long-term disease management, opening opportunities for technology-enabled care platforms integrated with pharmacological therapies.

Key Challenges

Heterogeneity of Disease Presentation and Variable Treatment Response

Neuropathic pain encompasses diverse etiologies, symptoms, and progression patterns, complicating standardized treatment approaches. Patients often exhibit variable responses to the same therapy, requiring multiple adjustments and prolonged titration periods. Comorbidities such as depression, anxiety, and sleep disorders further influence outcomes. This clinical complexity increases treatment duration, healthcare utilization, and patient dissatisfaction, posing challenges to achieving consistent therapeutic success across broad patient populations.

Adverse Effects and Long-Term Treatment Limitations

Many neuropathic pain medications associate with side effects including dizziness, sedation, cognitive impairment, and gastrointestinal disturbances. These issues limit dose escalation and long-term adherence, particularly among elderly patients. Concerns over drug interactions in polypharmacy settings further restrict use. Balancing efficacy with tolerability remains a persistent challenge, emphasizing the need for safer therapies that deliver sustained pain relief without compromising quality of life.

Regional Analysis

North America

North America leads the neuropathic pain market with an estimated 41% market share, supported by a high prevalence of diabetes, cancer-related neuropathy, and post-surgical nerve injuries. Strong clinical awareness, early diagnosis, and widespread adoption of evidence-based treatment guidelines drive consistent therapy utilization. Advanced healthcare infrastructure enables broad access to neurologists, pain specialists, and multidisciplinary clinics. High prescription volumes of branded and generic neuropathic pain drugs further reinforce regional dominance. Ongoing innovation in non-opioid therapies and digital pain management solutions continues to sustain market leadership across the United States and Canada.

Europe

Europe accounts for approximately 27% of the global neuropathic pain market, driven by an aging population and rising incidence of chronic neurological and metabolic disorders. Well-established public healthcare systems support standardized diagnosis and long-term pain management. Strong adherence to clinical guidelines promotes the use of antidepressants, anticonvulsants, and topical therapies as first-line treatments. Increased focus on reducing opioid dependence accelerates adoption of alternative therapies. Countries such as Germany, the UK, France, and Italy contribute significantly due to advanced pain clinics, reimbursement coverage, and growing investment in chronic pain research.

Asia-Pacific

Asia-Pacific holds around 21% market share and represents the fastest-growing regional market for neuropathic pain. Rising diabetes prevalence, increasing cancer survival rates, and expanding elderly populations significantly enlarge the patient base. Improving healthcare infrastructure, greater physician awareness, and expanding access to affordable generic medications support market expansion. Urbanization and lifestyle changes further elevate neuropathic pain incidence. Countries including China, India, Japan, and South Korea drive growth through improving diagnostic capabilities and increased adoption of pharmacological therapies, while government initiatives enhance access to chronic pain treatment services.

Latin America

Latin America captures an estimated 7% share of the neuropathic pain market, supported by gradual improvements in healthcare access and chronic disease management. Increasing diagnosis of diabetic neuropathy and post-traumatic nerve pain drives therapy demand. Brazil and Mexico remain the key contributors due to expanding hospital networks and growing availability of prescription pain medications. Although access to advanced therapies remains uneven, rising awareness among healthcare professionals and patients supports steady uptake. Ongoing investments in public healthcare programs and generic drug availability continue to strengthen regional market presence.

Middle East & Africa

The Middle East & Africa region represents approximately 4% of the global neuropathic pain market. Market growth remains moderate due to limited specialist access and underdiagnosis in several countries. However, improving healthcare infrastructure in Gulf Cooperation Council nations supports increased adoption of neuropathic pain treatments. Rising diabetes prevalence and cancer-related nerve pain contribute to demand growth. Government-led healthcare modernization, expanding private hospitals, and growing physician awareness gradually improve treatment access. While disparities persist, long-term investments in healthcare systems are expected to enhance market penetration across the region.

Market Segmentations:

By Drug Class:

- Anticonvulsant

- Tricyclic Antidepressants

By Application:

- Diabetic Neuropathy

- Spinal Stenosis

By Route of Administration:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The neuropathic pain market features Mallinckrodt Pharmaceuticals, Novartis, Teva Pharmaceutical, Abbott, Depomed, GlaxoSmithKline, Merck, Endo International, Pfizer, and AstraZeneca. The neuropathic pain market demonstrates a competitive structure characterized by a mix of established therapies and ongoing incremental innovation. Competition centers on product differentiation, safety profile optimization, and long-term tolerability in chronic use. Market participants prioritize non-opioid treatment options, extended-release formulations, and combination therapies to improve patient adherence and clinical outcomes. Pricing pressure from generic alternatives influences portfolio strategies, encouraging lifecycle management and formulation enhancements. Regulatory compliance, reimbursement alignment, and real-world evidence generation play critical roles in sustaining market presence. Additionally, companies increasingly focus on expanding access through broader geographic coverage and integration of digital health tools, supporting more comprehensive and patient-centered neuropathic pain management approaches.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mallinckrodt Pharmaceuticals

- Novartis

- Teva Pharmaceutical

- Abbott

- Depomed

- GlaxoSmithKline

- Merck

- Endo International

- Pfizer

- AstraZeneca

Recent Developments

- In September 2025, Lexicon Pharmaceuticals (U.S.) announced encouraging clinical findings for its AAK1 inhibitor Pilavapadin in diabetic peripheral neuropathic pain. The data showcased meaningful pain relief and improved nerve function, positioning the candidate as a next-generation oral therapy aimed at addressing the unmet needs of chronic neuropathic pain patients.

- In July 2025, AlzeCure Pharma (Sweden) presented new Phase IIa clinical data for its investigational drug ACD440, a TRPV1 antagonist gel, at the NeuPSIG 2025 Pain Conference. Results demonstrated promising efficacy in reducing peripheral neuropathic pain with minimal adverse effects, reinforcing the company’s leadership in topical, non-opioid pain therapies.

- In April 2025, Lyka Labs (India) was granted a patent for its Pregabalin Gel 8% topical formulation designed to treat diabetic neuropathic pain. The innovation offers a localized, non-systemic approach, reducing side effects associated with oral formulations.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Application, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Neuropathic pain management will increasingly focus on non-opioid therapies to address long-term safety and dependence concerns.

- Personalized treatment approaches will gain importance, supported by better patient stratification and mechanism-based therapy selection.

- Continued innovation in extended-release and targeted drug delivery systems will improve adherence and symptom control.

- Digital health tools will play a larger role in monitoring pain intensity, treatment response, and medication compliance.

- Clinical guidelines will further standardize diagnosis and treatment pathways across healthcare settings.

- Growing awareness among healthcare professionals will support earlier diagnosis and timely initiation of therapy.

- Combination therapies will see wider adoption to address complex and refractory neuropathic pain conditions.

- Expanding access to care in emerging markets will increase treatment penetration over the forecast period.

- Real-world evidence will increasingly influence prescribing decisions and reimbursement considerations.

- Ongoing research into novel mechanisms of action will support the development of safer and more effective therapies.