Market Overview

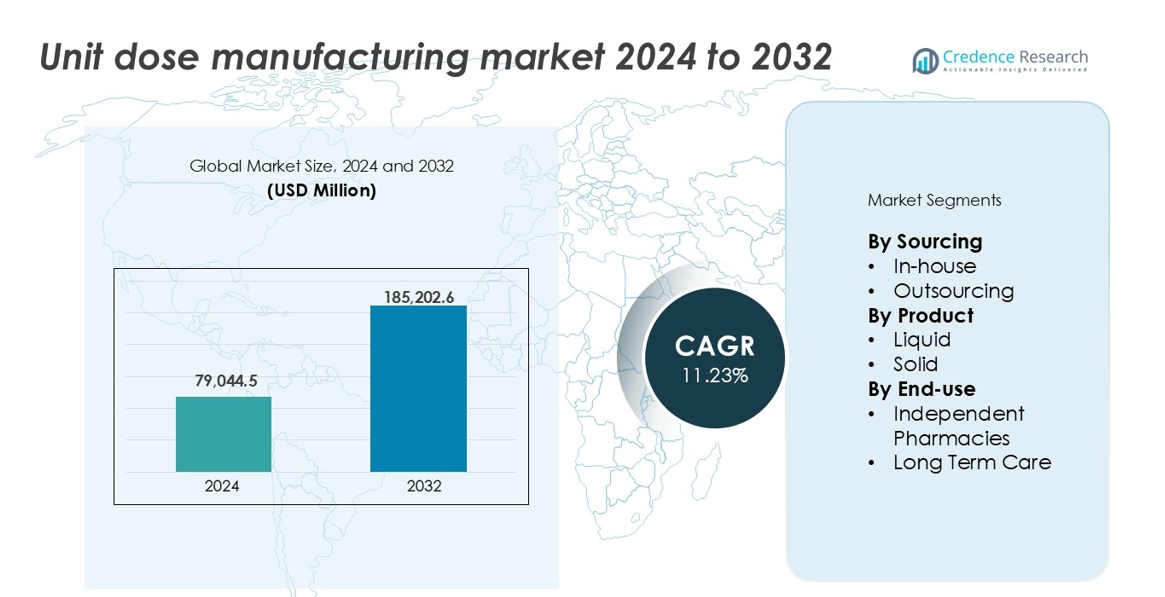

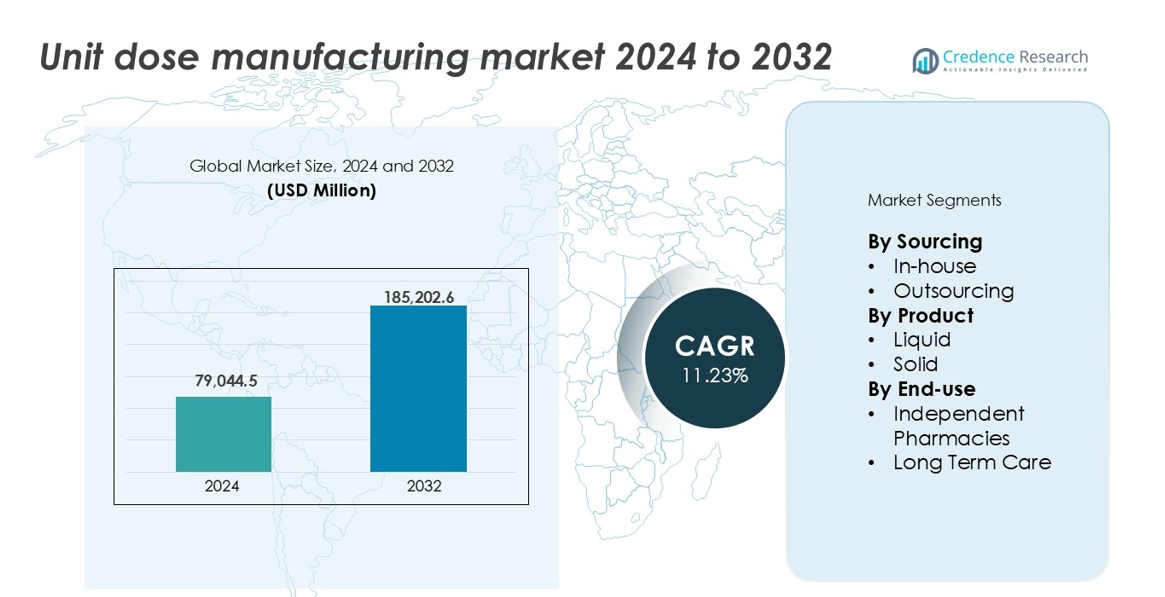

The Unit Dose Manufacturing Market size was valued at USD 79,044.5 million in 2024 and is anticipated to reach USD 185,202.6 million by 2032, growing at a CAGR of 11.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unit Dose Manufacturing Market Size 2024 |

USD 79,044.5 million |

| Unit Dose Manufacturing Market, CAGR |

11.23% |

| Unit Dose Manufacturing Market Size 2032 |

USD 185,202.6 million |

North America led the unit dose manufacturing market in 2024, capturing over 35% of the global share, driven by advanced healthcare infrastructure, regulatory mandates, and strong hospital adoption. Key players such as Catalent Inc., Thermo Fisher Scientific, Pfizer Inc., and West Pharmaceutical Services operate major facilities across the U.S., offering scalable in-house and contract packaging solutions. Amcor PLC and PCI Pharma Services support demand through specialized unit dose formats and compliance packaging. Europe followed with a 28% share, supported by firms like Unither Pharmaceuticals and Bristol-Myers Squibb, while AbbVie Inc., Amgen, and Merck & Co. Inc. continue expanding global unit dose capabilities across therapeutic areas.

Market Insights

- The Unit Dose Manufacturing Market was valued at USD 79,044.5 million in 2024 and is expected to reach USD 185,202.6 million by 2032, growing at a CAGR of 11.23%.

- Increasing demand for error-free medication delivery in hospitals and long-term care drives market growth, particularly among elderly patients and chronic care settings.

- Key trends include rising automation in packaging lines and growing outsourcing opportunities for independent pharmacies and small manufacturers.

- The market is competitive, with top players including Pfizer, Catalent, Thermo Fisher, and Amcor focusing on scalable production, safety compliance, and digital integration.

- North America led with over 35% market share, followed by Europe at 28% and Asia-Pacific at 20%. Liquid unit dose formats dominated with a 55% share, while long-term care facilities led end-use with over 58% of the market

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sourcing

In-house unit dose manufacturing dominated the market with the largest share in 2024, accounting for over 60% of total revenue. Hospitals and large pharmaceutical firms increasingly invest in in-house capabilities to maintain control over packaging standards, ensure timely medication dispensing, and reduce third-party dependency. This segment benefits from the integration of automation systems that enhance output speed and accuracy. Regulatory compliance and traceability further support internal production adoption. Outsourcing continues to grow among smaller firms and independent pharmacies seeking cost efficiency without heavy capital investments.

- For instance, Novartis implemented serialization-ready packaging lines at its Schaftenau site to meet EU FMD and U.S. DSCSA standards.

By Product

Liquid unit dose products led the market, contributing more than 55% share in 2024. High demand for accurate, pre-measured liquid medications in hospital and elderly care settings drives this dominance. Liquid formats are preferred for pediatric, geriatric, and chronic disease patients who face challenges swallowing solid forms. Increasing adoption of blister packs and prefilled syringes strengthens this segment. Solid unit doses such as tablets and capsules retain steady demand for over-the-counter and chronic treatments, supported by ease of handling, long shelf life, and standardized dosage.

- For instance, West Pharmaceutical’s SmartDose® wearable injector delivers 3.5 mL to 10 mL of liquid drug doses with controlled release, enhancing patient adherence.

By End-use

Long Term Care (LTC) facilities emerged as the dominant end-use segment, capturing over 58% market share in 2024. Rising elderly populations and increasing chronic disease cases boost demand for pre-measured, error-reducing medication formats in these settings. Unit dose formats reduce nurse workload and medication errors, improving safety. Adoption of electronic medication administration systems (eMARs) complements this trend. Independent pharmacies show notable growth as they embrace unit dose packaging for customer convenience, especially in home care or assisted living setups, though scale limits their overall share.

Key Growth Drivers

Rising Focus on Medication Safety and Error Reduction

The push for safer drug administration continues to drive the adoption of unit dose manufacturing. Healthcare providers and regulators emphasize minimizing medication errors, especially in hospitals and long-term care settings. Unit dose packaging ensures accurate dosage delivery, improves drug traceability, and simplifies administration. This approach reduces cross-contamination and enhances accountability through barcoding and tracking systems. As patient volumes rise and staffing pressures increase, especially in nursing care, unit dose systems offer process efficiency and risk mitigation. Government mandates and hospital accreditation bodies often include unit dose protocols as part of quality compliance. These safety advantages strongly position the market for long-term growth.

- For insance, Omnicell’s XT Automated Dispensing Cabinets support barcode scanning and generate over 120 million medication transactions monthly in U.S. hospitals.

Growing Demand from Long-Term Care and Aging Population

The expanding elderly population globally continues to fuel demand for long-term care, directly supporting the rise of unit dose packaging. Elderly patients typically require complex medication regimens with multiple daily doses, raising the risk of administration errors. Unit dose packaging simplifies the process for caregivers by offering pre-sorted, single-use formats. This enhances adherence and reduces hospital readmissions due to incorrect medication intake. Facilities also gain efficiency in inventory control and waste reduction. With rising investments in assisted living centers and nursing homes, especially in North America, Europe, and Japan, the demand for unit dose solutions will likely remain strong throughout the forecast period.

- For instance, McKesson’s PACMED strip packaging systems support long-term care (LTC) and retail pharmacies by automating multi-med regimens into organized, customizable pouches. These high-speed systems can produce up to 120 pouches per minute, allowing pharmacies to manage complex adherence needs with unlimited administration times per patient each day.

Expansion of Hospital Infrastructure and Digital Health Integration

Hospitals increasingly adopt unit dose systems to streamline pharmacy operations and integrate with electronic health records (EHRs). The expansion of hospital infrastructure in developing regions supports this shift. Integrated systems with automated dispensing and eMAR (electronic medication administration records) improve accuracy, reduce manual handling, and align with broader digital health initiatives. These technologies support closed-loop medication processes that rely on unit dose packaging to ensure end-to-end drug safety. Growing healthcare investments in automation, especially in urban centers, are pushing hospitals toward scalable, in-house or outsourced unit dose solutions. As digital workflows replace manual tracking, unit dose models become essential for improving operational efficiency.

Key Trends & Opportunities

Adoption of Automation and Robotics in Packaging Lines

Automation in unit dose manufacturing is transforming packaging operations, enabling higher output and consistent quality. Robotics, vision systems, and AI-based inspection tools are increasingly integrated into filling, sealing, and labeling processes. These systems reduce human error, ensure batch traceability, and enhance production scalability. Pharmaceutical firms investing in high-speed lines can meet large-volume hospital or institutional demand while maintaining compliance with FDA and EU regulations. As labor shortages affect manufacturing globally, automation offers an effective solution for both cost control and quality assurance. Small and mid-sized firms are also adopting semi-automated solutions to balance efficiency and affordability.

- For instance, Gerteis employs automated roll compaction lines with integrated HMI and SCADA interfaces, reaching throughput levels of up to 400 kg/hour in tablet unit dose processing.

Rising Outsourcing Opportunities for Small Pharmacies and CMOs

The growing complexity and cost of compliance have created a strong opportunity for outsourcing unit dose manufacturing. Small-scale pharmacies, independent hospitals, and regional care centers often lack the infrastructure to manage in-house packaging. Contract Manufacturing Organizations (CMOs) offer tailored services with flexible batch sizes, regulatory certifications, and customizable formats. This trend allows firms to reduce capital investment while focusing on patient care or distribution. The outsourcing model also supports faster market entry for specialty drugs or compounding pharmacies. As awareness of these services grows, particularly in emerging markets, outsourcing will likely become a key growth avenue.

Key Challenges

Regulatory Compliance and Validation Burdens

Unit dose manufacturing must meet stringent regulatory standards for labeling, sterility, traceability, and material integrity. Compliance with FDA, EU GMP, and local health authority regulations demands consistent validation, documentation, and auditing. This presents challenges for both in-house facilities and CMOs. Changes in drug formulations, pack sizes, or materials require revalidation, adding time and cost. Small operators may struggle to maintain compliance without dedicated quality assurance teams. Meeting serialization and barcoding requirements also adds complexity. These regulatory burdens can slow product rollouts and restrict the flexibility of unit dose packaging across different drug types or healthcare settings.

High Initial Setup and Equipment Costs

The cost of establishing a unit dose manufacturing line remains a key barrier for many players. Investments include specialized filling machines, blister packaging systems, labeling units, and integrated track-and-trace solutions. These machines must meet medical-grade validation standards, increasing capital expenditure. Operating costs are also higher compared to bulk packaging, especially for low-volume or custom medications. Smaller pharmacies and regional hospitals often lack the resources for such investments, limiting adoption. While outsourcing is an option, recurring service fees can accumulate, reducing long-term cost advantage. These high upfront and ongoing costs limit widespread penetration, especially in resource-constrained regions.

Regional Analysis

North America

North America held the largest share in the unit dose manufacturing market, accounting for over 35% in 2024. Strong regulatory focus on medication safety, coupled with widespread adoption in hospitals and long-term care facilities, supports market leadership. The U.S. drives regional demand through investments in automated pharmacy systems and eMAR integration. Growing geriatric population and chronic disease prevalence further increase reliance on pre-measured dosing. Canada follows with rising uptake across public health institutions. The presence of major pharmaceutical players and outsourcing service providers also contributes to sustained growth across both in-house and contract-based manufacturing models.

Europe

Europe captured around 28% of the global unit dose manufacturing market in 2024, supported by stringent medication safety regulations and rising healthcare digitalization. Germany, France, and the UK are leading adopters of unit dose packaging in hospitals and elderly care settings. EU-wide directives on pharmaceutical packaging and traceability drive compliance-led adoption. The region benefits from robust healthcare infrastructure and widespread e-health integration. Independent pharmacies increasingly partner with contract manufacturers to manage packaging complexity. Growth in Eastern Europe is notable as investment in care facilities and hospital automation rises. Overall, the region remains a key contributor to market expansion.

Asia-Pacific

Asia-Pacific accounted for approximately 20% of the unit dose manufacturing market in 2024, with strong growth potential. Japan and Australia lead adoption due to aging populations and high healthcare standards. China and India show rapid uptake fueled by expanding hospital infrastructure and rising pharmaceutical output. Governments support digitization and medication error reduction, creating opportunities for in-house and outsourced unit dose solutions. Contract manufacturing gains traction among smaller players aiming to meet global packaging norms. Despite lower initial penetration compared to Western regions, ongoing healthcare reforms and investment in pharmacy automation drive sustained regional market growth.

Latin America

Latin America represented nearly 9% of the global unit dose manufacturing market in 2024, with Brazil and Mexico as major contributors. The region sees growing investment in hospital automation and long-term care centers. Public health systems increasingly prioritize medication safety, especially for chronic disease management. Adoption is higher in urban hospitals and private facilities, while rural coverage remains limited. Outsourcing plays a key role due to infrastructure constraints in smaller pharmacies. Local packaging regulations are evolving to align with international norms. While current market share is moderate, improved healthcare access and digital tools are expected to boost future growth.

Middle East & Africa (MEA)

The Middle East & Africa held a 5% share in the unit dose manufacturing market in 2024, with Gulf countries driving regional adoption. The UAE and Saudi Arabia lead investments in smart hospitals and pharmacy automation. Rising burden of chronic diseases and expansion of elderly care services encourage the use of unit dose packaging. However, adoption remains limited in parts of Africa due to infrastructure and cost barriers. Outsourced solutions are gaining popularity among private hospitals and specialty clinics. Government efforts to improve healthcare delivery and align with global best practices are expected to gradually increase market penetration.

Market Segmentations:

By Sourcing

By Product

By End-use

- Independent Pharmacies

- Long Term Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The unit dose manufacturing market is characterized by a mix of pharmaceutical giants, packaging specialists, and contract manufacturing organizations (CMOs). Companies such as Pfizer Inc., Catalent Inc., and Thermo Fisher Scientific play dominant roles by leveraging in-house production and large-scale contract packaging services. Catalent, for instance, supports high-volume solid and liquid unit dose lines integrated with serialization and compliance solutions. West Pharmaceutical Services and Amcor PLC focus on advanced packaging components and barrier materials tailored for single-dose formats. Meanwhile, firms like PCI Pharma Services and American Health Packaging provide flexible outsourcing options for independent pharmacies and mid-sized drug developers. Innovation, regulatory compliance, and facility expansion remain key strategies among leading players. With rising demand from long-term care and hospital channels, companies invest in automation, robotics, and eMAR-compatible packaging systems. Competitive advantage is shaped by operational scale, turnaround speed, and quality assurance capabilities, especially in regulated markets across North America and Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pfizer Inc.

- Amcor PLC

- Catalent Inc.

- AbbVie Inc.

- West Pharmaceutical Services

- Thermo Fisher Scientific

- Merck & Co. Inc.

- PCI Pharma Services

- Amgen

- Unither Pharmaceuticals

- Bristol-Myers Squibb

- American Health Packaging

Recent Developments

- In February 2024, Mikart LLC announced the addition of advanced Fette double-sided tablet presses to broaden its oral solid dosage production capacity. This integration enables Mikart to enhance its operation capabilities in a significant market.

- In February 2024, Catalent, Inc. upgraded its capsule filling of dry powders for inhalation and capsule blistering facilities in Boston. The facility aimed to handle potent drugs, enhancing the operational capabilities of the company.

- In September 2023, Mikart LLC acquired the advanced Flexpack NF-150 Horizontal Sachet-Packaging Machine, strengthening its production capabilities and commitment to high-quality pharmaceutical manufacturing

Report Coverage

The research report offers an in-depth analysis based on Sourcing, Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated packaging systems will increase to improve accuracy and production speed.

- Hospitals and long-term care centers will expand in-house unit dose capabilities for safety and control.

- Demand for outsourcing will grow among small pharmacies and regional care providers.

- Integration of unit dose systems with electronic health records will become more widespread.

- Liquid unit dose formats will remain dominant due to ease of use for elderly and pediatric patients.

- Regulations will continue to drive investment in compliant labeling and traceability technologies.

- Asia-Pacific markets will experience strong growth due to expanding healthcare infrastructure.

- Contract manufacturers will offer more flexible batch sizes to meet personalized medication needs.

- Investments in tamper-proof and eco-friendly packaging materials will increase across regions.

- Strategic partnerships between drug manufacturers and packaging firms will shape competitive dynamics.