Market Overview

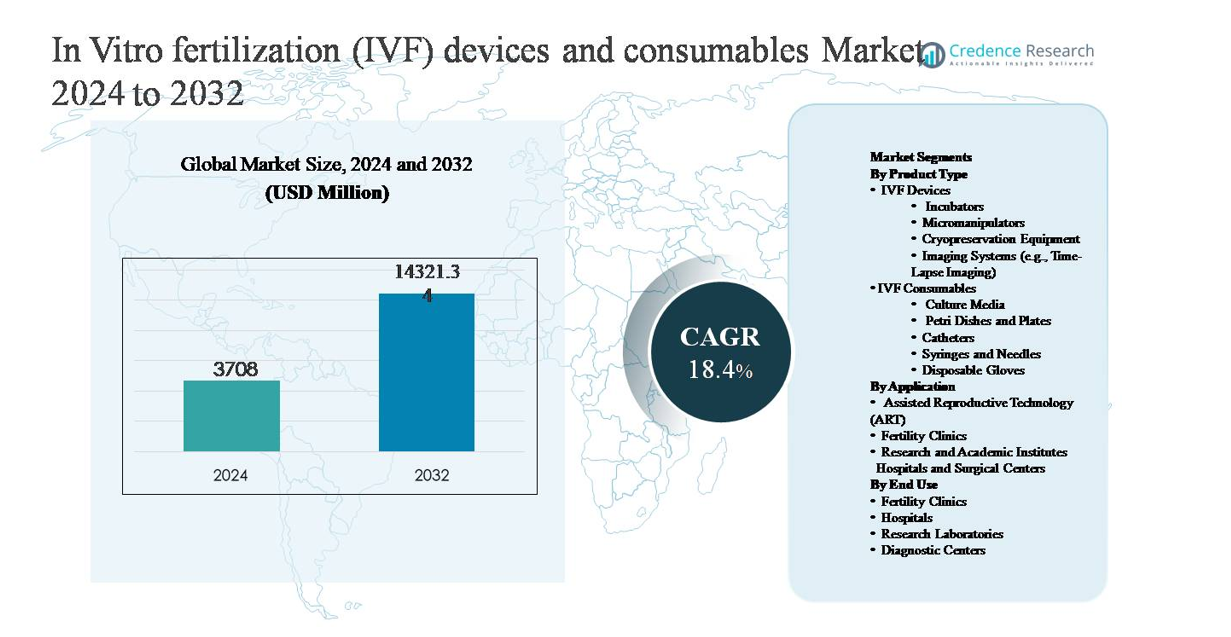

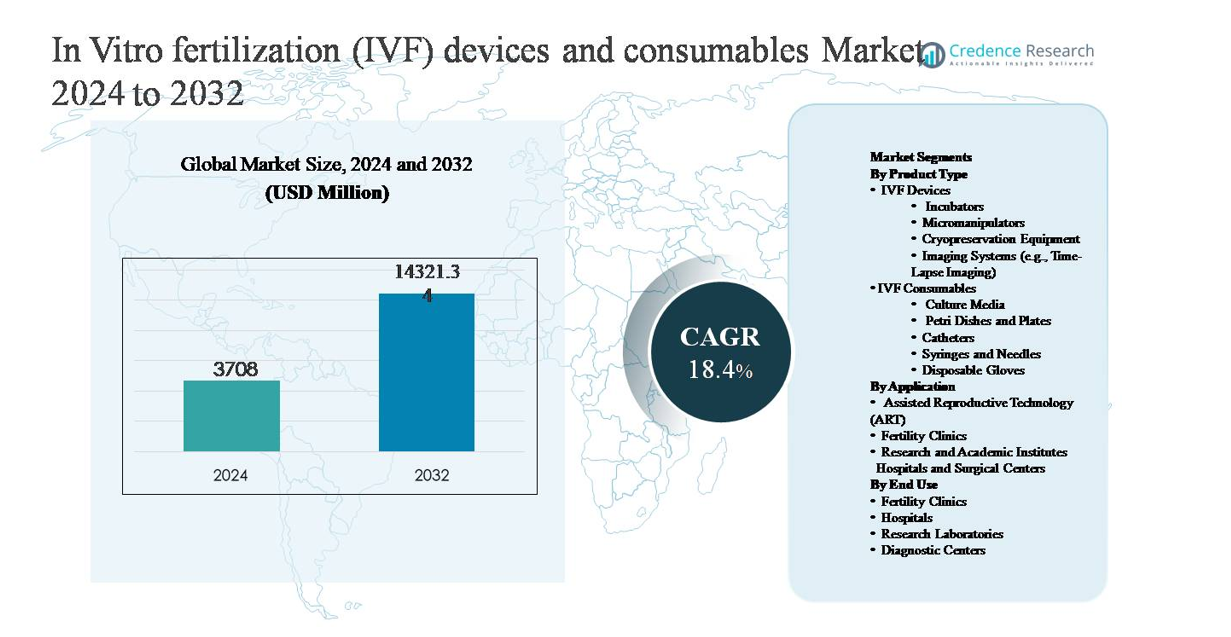

The in vitro fertilization (IVF) devices and consumables market was valued at USD 3,708 million in 2024 and is projected to reach USD 14,321.34 million by 2032, expanding at a compound annual growth rate (CAGR) of 18.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In Vitro Fertilization (IVF) Devices and Consumables Market Size 2024 |

USD 3,708 million |

| In Vitro Fertilization (IVF) Devices and Consumables Market, CAGR |

18.4% |

| In Vitro Fertilization (IVF) Devices and Consumables Market Size 2032 |

USD 14,321.34 million |

The IVF devices and consumables market is led by a group of specialized and diversified life-science companies with strong portfolios across laboratory equipment and consumables. Key players include Vitrolife AB, CooperSurgical and its subsidiary Origio, Merck KGaA (MilliporeSigma), Cook Medical, Irvine Scientific, Esco Micro Pte Ltd, Hamilton Thorne Ltd, Kitazato Corporation, and Genea Biomedx. These companies compete through continuous product innovation, high-quality culture media, advanced incubators, micromanipulation systems, and comprehensive workflow solutions for fertility laboratories. North America is the leading region, holding approximately 38% of the global market share, driven by high IVF procedure volumes, advanced clinical infrastructure, and strong adoption of premium devices and consumables. Europe and Asia-Pacific follow, supported by established ART frameworks and rapidly expanding fertility clinic networks.

Market Insights

- The in vitro fertilization (IVF) devices and consumables market was valued at USD 3,708 million in 2024 and is projected to reach USD 14,321.34 million by 2032, growing at a CAGR of 18.4% during the forecast period.

- Market growth is primarily driven by rising infertility prevalence, delayed parenthood, and increasing acceptance of assisted reproductive technologies, which are significantly expanding IVF cycle volumes and driving recurring demand for consumables such as culture media and disposables.

- Key market trends include rapid adoption of advanced incubators and time-lapse imaging systems, alongside a strong shift toward standardized, ready-to-use consumables; IVF consumables represent the dominant product segment due to high repeat usage across treatment cycles.

- The competitive landscape is shaped by players such as Vitrolife AB, CooperSurgical, Merck KGaA, and Cook Medical, which compete on integrated portfolios, laboratory automation, consumable quality, and long-term partnerships with fertility clinics.

- Regionally, North America leads with about 38% market share, followed by Europe at 30% and Asia-Pacific at 24%, with fertility clinics remaining the dominant end-use segment globally due to high procedural concentration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The IVF devices and consumables segment is led by IVF consumables, which account for the dominant market share due to their recurring use across every treatment cycle and laboratory workflow. Among consumables, culture media represents the leading sub-segment, driven by its critical role in embryo viability, blastocyst development, and clinical success rates. On the devices side, incubators hold the largest share, supported by growing adoption of advanced benchtop and time-lapse enabled systems that maintain stable culture environments. Continuous procedural demand, stringent quality requirements, and increasing IVF cycle volumes collectively sustain consumables’ market leadership.

- For instance, Vitrolife AB’s G-Series culture media are optimized for extended embryo culture up to day 6, supporting blastocyst development under controlled pH and osmolality ranges validated across thousands of clinical cycles.

By Application:

The assisted reproductive technology (ART) segment dominates the application landscape, holding the largest market share as IVF remains the core clinical procedure within ART services globally. Growth is driven by rising infertility prevalence, delayed parenthood, and broader acceptance of ART across developed and emerging economies. Fertility clinics represent the primary application setting within ART, as they concentrate specialized infrastructure, skilled embryologists, and high procedure throughput. Meanwhile, research and academic institutes contribute steadily through protocol optimization and technology validation, while hospitals and surgical centers support ART expansion by integrating IVF services into multidisciplinary reproductive care frameworks.

- For instance, Genea Biomedx has reported clinical deployment of its Geri® time-lapse incubator across large fertility clinic networks, where each incubator supports up to six individual culture chambers with continuous embryo imaging every five minutes, improving workflow efficiency for embryologists.

By End Use:

Fertility clinics constitute the dominant end-use segment, accounting for the largest market share due to their specialization in IVF procedures and high utilization of both devices and consumables. These clinics invest heavily in advanced incubators, micromanipulation systems, and premium consumables to improve clinical outcomes and patient success rates. Hospitals follow as a significant end user, particularly in regions where IVF services are integrated into tertiary care settings. Research laboratories and diagnostic centers contribute through preclinical testing, gamete analysis, and treatment planning, supporting the broader IVF ecosystem but with comparatively lower consumption intensity.

Key Growth Drivers

Rising Global Infertility Rates and Delayed Parenthood

The increasing prevalence of infertility is a primary growth driver for the IVF devices and consumables market. Lifestyle changes, rising obesity rates, stress, environmental exposure, and higher incidence of reproductive disorders have contributed to fertility challenges across both developed and emerging economies. In parallel, delayed parenthood particularly among urban populations has significantly increased demand for assisted reproductive procedures, as age-related decline in fertility elevates the need for IVF interventions. This trend directly fuels sustained utilization of IVF consumables such as culture media, catheters, and disposables, while also driving investments in advanced laboratory devices. As infertility shifts from a niche concern to a mainstream healthcare issue, IVF procedures are increasingly viewed as a standard clinical solution, reinforcing long-term market expansion.

- “For instance, CooperSurgical Wallace IVF catheters are engineered with inner diameters of approximately 76 mmto enable precise embryo transfer while minimizing uterine trauma, supporting consistent clinical outcomes in high-volume clinics.”

Technological Advancements in IVF Laboratory Equipment

Continuous innovation in IVF devices is accelerating market growth by improving clinical outcomes and laboratory efficiency. Advanced incubators with stable environmental controls, time-lapse imaging systems for continuous embryo monitoring, and precision micromanipulators have significantly enhanced embryo selection and success rates. These innovations encourage fertility clinics to upgrade laboratory infrastructure, driving replacement demand alongside new installations. Technological differentiation also increases procedure confidence among patients and clinicians, expanding IVF adoption across broader demographic groups. As IVF outcomes improve through technology-driven precision and automation, clinics experience higher patient throughput, further intensifying consumption of associated consumables and reinforcing the devices and consumables market ecosystem.

- For instance, Esco Medical’s MIRI® incubator provides six individually controlled culture chambers with separate gas mixing, reducing cross-contamination risk while supporting parallel embryo culture.

Expanding Access to Fertility Treatments and Medical Tourism

Growing awareness of fertility treatments and improving access to reproductive healthcare are strongly supporting market growth. Several countries are expanding insurance coverage, reimbursement policies, and public healthcare support for infertility treatments, reducing cost barriers for patients. Additionally, the rise of fertility-focused medical tourism particularly in Asia-Pacific, Latin America, and parts of Europe has increased procedural volumes in cost-competitive regions. Fertility clinics serving international patients invest heavily in high-quality devices and standardized consumables to meet global clinical expectations. This cross-border treatment demand sustains high utilization rates and accelerates infrastructure development, directly supporting long-term growth of IVF devices and consumables.

Key Trends & Opportunities

Shift Toward Time-Lapse Imaging and Data-Driven Embryo Selection

The growing adoption of time-lapse imaging systems represents a major trend and opportunity in the IVF market. These systems allow continuous, non-invasive monitoring of embryo development, enabling embryologists to make more informed selection decisions without disturbing culture conditions. As clinics increasingly prioritize outcome optimization and single-embryo transfer strategies, demand for imaging-integrated incubators and analytical software is rising. This trend creates opportunities for device manufacturers to integrate imaging, artificial intelligence, and workflow automation, while also increasing consumable usage through higher procedural confidence and expanded patient acceptance of advanced IVF protocols.

- For instance, Irvine Scientific’s single-step culture media support uninterrupted embryo culture from fertilization through day-5 blastocyst stages, aligning with time-lapse-based workflows and reinforcing confidence in advanced IVF protocols.

Rising Demand for High-Quality, Ready-to-Use Consumables

There is a clear trend toward standardized, ready-to-use IVF consumables that minimize variability and contamination risk in laboratory environments. Clinics increasingly prefer validated culture media, sterile disposables, and single-use accessories that ensure consistency across cycles. This shift supports premiumization within the consumables segment and creates opportunities for suppliers offering regulatory-compliant, quality-certified products. As IVF laboratories scale operations and prioritize efficiency, recurring demand for high-margin consumables continues to rise, making this segment a key revenue generator and innovation focus within the overall market.

- For instance, Origio’s single-use IVF pipettes and ICSI dishes are gamma-sterilized at validated doses exceeding 25 kGy to eliminate cross-contamination risk. Kitazato Corporation’s vitrification straws support ultra-rapid cooling protocols exceeding 10,000 °C per minute, enabling reliable cryopreservation workflows aligned with high-throughput laboratory operations.

Growth of Specialized Fertility Clinics and Laboratory Networks

The expansion of standalone fertility clinics and multi-location laboratory networks presents a significant growth opportunity. These centers focus exclusively on reproductive medicine, driving concentrated demand for IVF-specific devices and consumables. Network-based clinics benefit from standardized protocols and bulk procurement, encouraging long-term supplier partnerships. As consolidation increases within the fertility care landscape, vendors that can support scalable deployments, training, and after-sales service gain a competitive advantage, reinforcing sustained market opportunities.

Key Challenges

High Cost of IVF Procedures and Limited Affordability

Despite growing awareness, the high cost of IVF procedures remains a major challenge restraining broader market penetration. Advanced laboratory devices, premium consumables, and multiple treatment cycles significantly increase overall patient expenditure, particularly in regions with limited insurance coverage. Cost sensitivity restricts access among middle- and lower-income populations, limiting procedure volumes and slowing adoption in price-conscious markets. For clinics, high capital investment requirements for advanced devices can delay technology upgrades, while patients may opt out of treatment altogether, creating structural constraints on market expansion despite strong underlying demand drivers.

Regulatory Complexity and Quality Compliance Requirements

Stringent regulatory frameworks governing reproductive technologies pose ongoing challenges for market participants. IVF devices and consumables must comply with strict quality, safety, and traceability standards, which vary significantly across regions. Regulatory approvals, product validations, and compliance audits increase time-to-market and operational costs for manufacturers. For fertility clinics, maintaining compliance requires continuous investment in training, documentation, and laboratory controls. These complexities can slow innovation adoption and limit product availability in certain regions, creating barriers to uniform global market growth.

Regional Analysis

North America

North America holds the largest share of the IVF devices and consumables market, accounting for approximately 38% of global revenue. The region contributes high IVF procedure volumes supported by advanced clinical infrastructure, strong adoption of technologically sophisticated incubators and imaging systems, and consistent consumption of premium consumables. The United States dominates regional demand due to widespread availability of fertility clinics, higher treatment awareness, and continuous laboratory upgrades. Favorable reimbursement for specific infertility treatments and strong private healthcare spending further sustain device replacement cycles and recurring consumables demand, reinforcing North America’s leadership position.

Europe

Europe represents around 30% of the global IVF devices and consumables market, driven by established reproductive medicine frameworks and high ART utilization across Western and Northern Europe. Countries such as Germany, France, the UK, and Spain support IVF demand through regulated treatment protocols and partial public funding in select markets. The region shows strong adoption of standardized consumables and precision laboratory devices to ensure compliance with strict quality and safety norms. Growth remains steady as fertility clinics expand capacity, cross-border reproductive care increases, and aging demographics continue to drive sustained IVF treatment demand.

Asia-Pacific

Asia-Pacific accounts for approximately 24% of the global market and represents the fastest-growing regional segment. Rising infertility rates, delayed parenthood, expanding middle-class populations, and growing awareness of assisted reproductive technologies strongly support demand. Countries such as China, India, Japan, South Korea, and Australia are witnessing rapid growth in fertility clinics and laboratory infrastructure. Cost-competitive treatment options and medical tourism further accelerate IVF procedure volumes, driving high consumption of disposables and culture media. Increasing private investment in reproductive healthcare positions Asia-Pacific as a key long-term growth engine.

Latin America

Latin America holds nearly 5% of the global IVF devices and consumables market, supported by gradually improving access to fertility treatments and expanding private healthcare networks. Brazil, Mexico, and Argentina are key contributors, driven by growing awareness of infertility treatments and increasing adoption of ART services in urban centers. While overall procedure volumes remain lower than in developed regions, fertility clinics are steadily investing in modern IVF equipment and standardized consumables. Medical tourism within the region and regulatory progress in reproductive health continue to support moderate but consistent market expansion.

Middle East & Africa

The Middle East & Africa region accounts for about 3% of the global market, reflecting early-stage but improving adoption of IVF technologies. Demand is concentrated in Gulf Cooperation Council countries, where high disposable income, rising infertility prevalence, and growing acceptance of assisted reproduction support market development. Investments in specialized fertility centers and modern laboratory infrastructure are increasing device uptake and consumables usage. In contrast, adoption across parts of Africa remains limited due to affordability constraints and uneven healthcare access, resulting in slower growth but emerging long-term opportunities.

Market Segmentations:

By Product Type

- IVF Devices

- Incubators

- Micromanipulators

- Cryopreservation Equipment

- Imaging Systems (e.g., Time-Lapse Imaging)

- IVF Consumables

- Culture Media

- Petri Dishes and Plates

- Catheters

- Syringes and Needles

- Disposable Gloves

By Application

- Assisted Reproductive Technology (ART)

- Fertility Clinics

- Research and Academic Institutes

- Hospitals and Surgical Centers

By End Use

- Fertility Clinics

- Hospitals

- Research Laboratories

- Diagnostic Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the in vitro fertilization (IVF) devices and consumables market is characterized by the presence of established medical technology companies and specialized reproductive health suppliers competing on product quality, technological innovation, and portfolio breadth. Market participants focus on offering integrated solutions encompassing incubators, micromanipulation systems, imaging platforms, and high-quality consumables to support end-to-end IVF workflows. Continuous investment in research and development enables vendors to enhance culture stability, automation, and embryo assessment capabilities. Strategic initiatives such as product launches, laboratory upgrades, distribution partnerships, and geographic expansion are common, particularly in high-growth regions. Companies also emphasize regulatory compliance and standardized manufacturing to meet stringent clinical and laboratory requirements. As competition intensifies, suppliers increasingly differentiate through service support, training programs, and long-term collaborations with fertility clinics, reinforcing customer loyalty and sustained market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vitrolife AB

- Merck KGaA (MilliporeSigma)

- CooperSurgical (subsidiary of a private equity firm)

- Origio (part of CooperSurgical)

- Cook Medical

- Irvine Scientific (part of JXTG Holdings)

- Esco Micro Pte Ltd

- Hamilton Thorne Ltd

- Kitazato Corporation

- Genea Biomedx

Recent Developments

- In October 2025, Merck’s healthcare division EMD Serono announced plans to file the combined recombinant human follicle-stimulating hormone and luteinizing hormone therapy Pergoveris® for expedited FDA review under the National Priority Voucher program, positioning it as a novel single-pen ovarian stimulation option for medically assisted reproductive cycles in the U.S.

- In February 2025, Vitrolife reported that its time-lapse incubation systems (EmbryoScope and EmbryoScope+) have been installed to support over 1.4 million IVF treatment cycles worldwide annually, and the company has manufactured more than 2,500 instruments across its time-lapse portfolio, underscoring broad clinical adoption of continuous embryo monitoring technology.

- In July 2024 at ESHRE 2024, CooperSurgical introduced Embryo Options℠, a specialized lab cryo-management and billing solution designed to streamline IVF lab operations, alongside a new sperm selection medium (SpermSLow™) tailored for hyaluronan-based selection in ICSI workflows.

Report Coverage

The research report offers an in-depth analysis based on Product type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- IVF procedure volumes will continue to rise globally as infertility awareness and delayed parenthood increase across both developed and emerging economies.

- Fertility clinics will accelerate adoption of advanced incubators, micromanipulation systems, and imaging platforms to improve clinical outcomes and laboratory efficiency.

- Consumables will remain the largest and most stable revenue-generating segment due to their mandatory, recurring use in every IVF cycle.

- Time-lapse imaging and data-driven embryo assessment will increasingly become standard practice in modern IVF laboratories.

- Manufacturers will focus on workflow-integrated solutions that combine devices, consumables, and software to support standardized laboratory operations.

- Expansion of private fertility clinic networks will drive sustained demand for scalable and high-throughput IVF laboratory infrastructure.

- Asia-Pacific will emerge as the fastest-growing region, supported by medical tourism and expanding access to fertility treatments.

- Regulatory harmonization and quality standardization will shape product development and market entry strategies.

- Automation and laboratory process optimization will gain importance to address embryologist workload and consistency challenges.

- Strategic partnerships between suppliers and fertility clinics will strengthen long-term customer retention and competitive positioning.