Market Overview

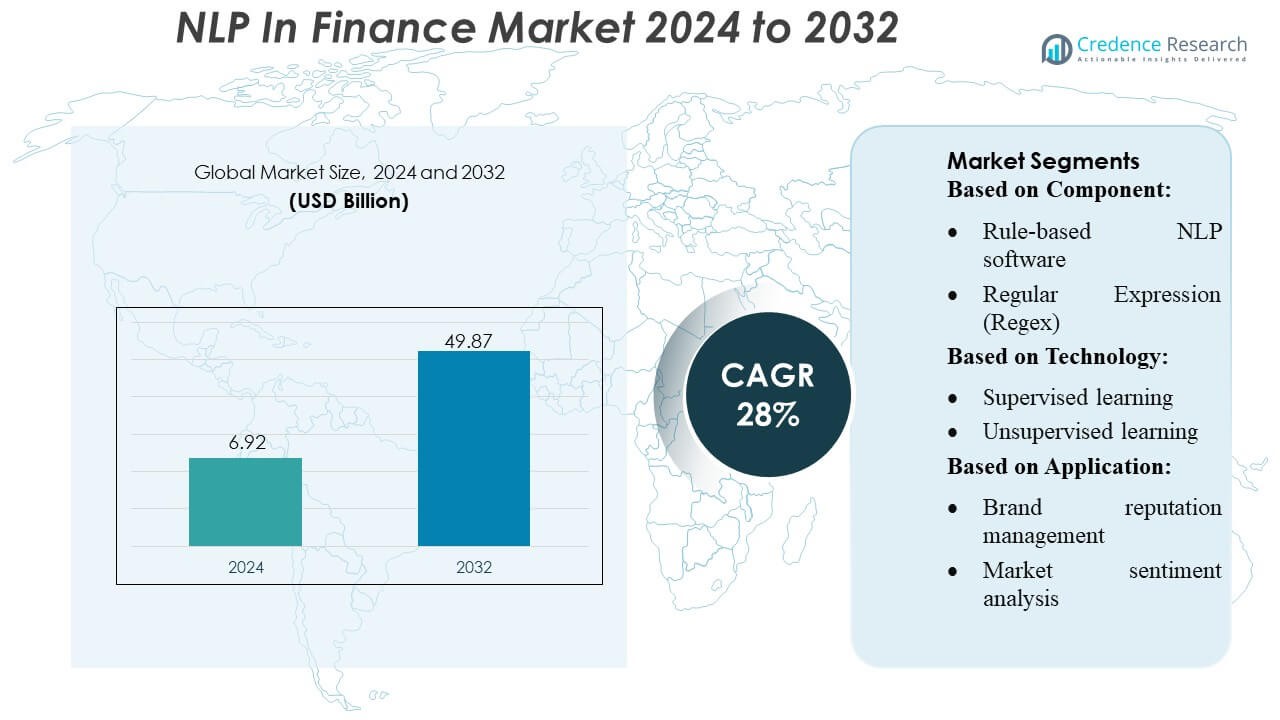

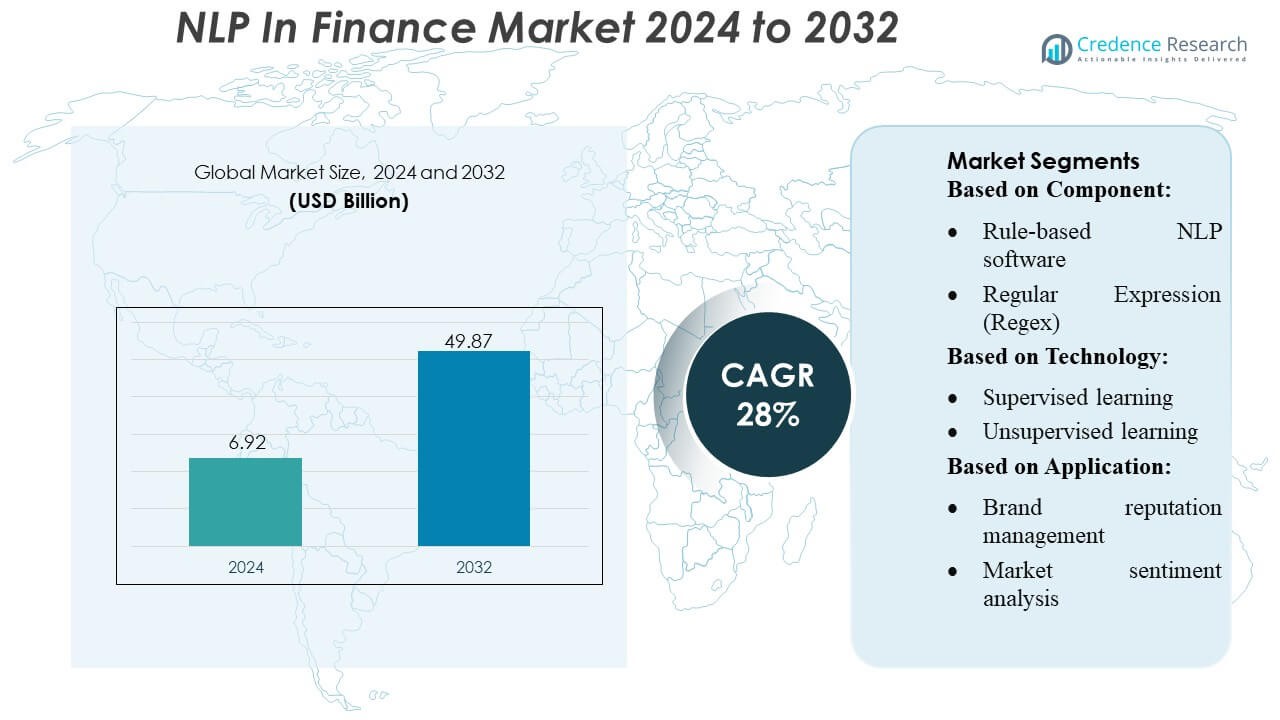

NLP In Finance Market size was valued USD 6.92 billion in 2024 and is anticipated to reach USD 49.87 billion by 2032, at a CAGR of 28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| NLP In Finance Market Size 2024 |

USD 6.92 Billion |

| NLP In Finance Market, CAGR |

28% |

| NLP In Finance Market Size 2032 |

USD 49.87 Billion |

The NLP in Finance Market is highly competitive, with top players including Google LLC, Inbenta, Apple Inc., IBM Corporation, 3M, Crayon Data, Amazon Web Services, Inc., IQVIA, Baidu Inc., and Health Fidelity driving innovation and adoption. These companies focus on enhancing AI-powered customer service, automating compliance, improving fraud detection, and delivering advanced analytics solutions for financial institutions. Strategic collaborations, cloud-based NLP platforms, and continuous investment in machine learning models enable these firms to maintain competitive advantages. North America emerges as the leading region, accounting for approximately 45% of the global market share, supported by advanced technological infrastructure, early adoption of AI solutions, and strong presence of major financial institutions. The combination of established technology providers and innovative fintech startups ensures the region remains at the forefront of NLP deployment in banking, insurance, and investment sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The NLP in Finance Market size was valued at USD 6.92 billion in 2024 and is projected to reach USD 49.87 billion by 2032, growing at a CAGR of 28% during the forecast period.

- Market growth is driven by increasing adoption of AI and NLP solutions in banking, insurance, and investment sectors to automate compliance, enhance customer experience, and improve fraud detection.

- Trends indicate rising investment in cloud-based NLP platforms, multilingual capabilities, and advanced machine learning models to support real-time financial analytics and scalable solutions.

- The market is highly competitive, with leading companies leveraging strategic partnerships, continuous innovation, and technology-driven differentiation to maintain their positions. North America leads with approximately 45% of the global share, followed by Europe and Asia-Pacific, while segment adoption is highest in banking and financial services applications.

- Restraints include data privacy concerns, high implementation costs, and regulatory compliance challenges, which may slow adoption in emerging regions despite growing fintech initiatives.

Market Segmentation Analysis:

By Component

The software segment dominates the NLP in Finance market, driven primarily by advanced statistical and hybrid NLP tools. Within this segment, Statistical NLP software—particularly Recurrent Neural Networks (RNNs) and Support Vector Machines (SVMs)—holds the largest share due to its ability to process large-scale financial text data with high accuracy. Rule-based NLP tools like Regex and Named Entity Recognition (NER) support regulatory compliance and transaction analysis. Growth is fueled by the need for automated document processing, real-time risk assessment, and precision in credit risk evaluation, enabling financial institutions to reduce operational costs and enhance analytical efficiency.

- For instance, Inbenta reports that its AI‑powered Search functionality delivers over 95% search accuracy and supports a self‑service rate of over 90% for customer queries, reducing reliance on live agents.

By Technology

Machine learning-based technologies are the dominant driver in NLP adoption within finance, with Transformer models such as BERT and GPT-series leading the market. These models excel in tasks like sentiment analysis, intent classification, and automated financial report generation. Supervised learning supports structured predictive modeling, while unsupervised and reinforcement learning facilitate anomaly detection and fraud prevention. The expansion of AI-driven customer communication and automated compliance monitoring drives demand, as firms seek faster, more reliable decision-making tools capable of extracting actionable insights from unstructured financial data.

- For instance, The Bobcat T7X all-electric compact track loader features a 62-kilowatt-hour lithium-ion battery and can run for up to four hours of continuous operation on a single charge. The machine is also designed to last a full workday with intermittent use due to an intelligent power management system.

By Application

Sentiment analysis emerges as the leading application segment, capturing the highest market share in NLP for finance. Financial institutions leverage sentiment and market analysis to monitor brand reputation, evaluate customer feedback, and predict market trends. Risk management applications, including credit risk assessment, fraud detection, and AML compliance, are also gaining traction due to increasing regulatory pressure. The segment growth is propelled by rising demand for real-time social media monitoring, automated audit trail generation, and trade surveillance, enabling organizations to enhance decision-making, reduce financial fraud, and ensure regulatory compliance.

Key Growth Drivers

- Increasing Demand for Automated Risk Management

Financial institutions are adopting NLP solutions to automate risk assessment, fraud detection, and compliance monitoring. Advanced NLP models analyze vast volumes of unstructured data, including financial statements, news articles, and social media, to identify early warning signals and detect anomalies. This automation reduces operational costs, minimizes human error, and enhances decision-making speed. The growing regulatory landscape and the need for real-time monitoring of credit risk, AML, and cybersecurity threats further accelerate the adoption of NLP technologies across banks, insurance firms, and investment platforms.

- For instance, Abbott’s HeartMate 3 heart pump, in the MOMENTUM 3 trial involving more than 1,000 patients, showed that the five-year survival rate was 58.4%, compared to 43.7% in the control arm with HeartMate II.

- Adoption of AI-Powered Customer Interaction Solutions

NLP technologies are increasingly leveraged for customer communication, including chatbots, automated report generation, and sentiment analysis. Financial institutions deploy NLP-driven tools to enhance client engagement, deliver personalized financial advice, and respond to queries efficiently. Advanced models like Transformers and RNNs enable accurate intent recognition and emotion detection, improving customer satisfaction while reducing response times. The growing demand for digital banking services, combined with remote advisory needs, drives the integration of NLP systems into CRM platforms and online banking solutions globally.

- For instance, Henry Schein’s Blood Control IV Catheter 20-Gauge has a 1-inch beveled tip and comes 50 units per box, 4 boxes per case, ensuring standardization and ease of supply chain handling.

- Growing Volume of Unstructured Financial Data

The exponential growth of financial text data, including news, analyst reports, research papers, and social media content, fuels the need for NLP solutions capable of real-time analysis. NLP software, including statistical, rule-based, and hybrid models, converts unstructured data into actionable insights, enabling predictive analytics, market sentiment evaluation, and trade surveillance. As organizations aim to make faster, data-driven decisions, the requirement for scalable NLP platforms with high accuracy in named entity recognition, topic modeling, and sentiment classification continues to drive market expansion.

Key Trends & Opportunities

- Integration of Deep Learning and Transformer Models

Deep learning and transformer-based architectures, such as BERT and GPT models, are increasingly integrated into finance-specific NLP applications. These models enable advanced sentiment analysis, automated report writing, and real-time fraud detection with high accuracy. The ability to process multilingual data and understand contextual nuances opens opportunities for global financial institutions. Growing investments in AI research and cloud-based NLP deployment further enhance scalability and performance, creating avenues for innovative financial analytics, automated compliance monitoring, and AI-driven decision support systems.

- For instance, Terumo’s MEDISAFE WITH patch pump’s main unit dimensions are 77.9 mm x 40.1 mm x 18.9 mm, weight is 34 g. Also, its remote control measures 136.2 mm x 75.0 mm x 14.3 mm, weighs 152 g with 2 AAA batteries.

- Expansion into Regulatory Compliance and AML Solutions

NLP adoption is expanding into regulatory compliance, KYC, and anti-money laundering monitoring. Automated systems can parse transaction records, contracts, and legal documents to identify potential compliance violations efficiently. As regulatory scrutiny intensifies across regions, financial institutions increasingly leverage NLP to reduce manual workloads, improve audit accuracy, and ensure adherence to global standards. This trend creates opportunities for NLP vendors to develop specialized solutions addressing evolving regulatory frameworks, including cross-border reporting, trade surveillance, and automated documentation management.

- For instance, Ascor S.A.’s AP31 volumetric infusion pump handles infusion volumes from 9 ml to 999 ml, adjustable in 0.1 ml increments. The flow rate range is programmable from 1 ml/h to 1000 ml/h, with a user-selectable drug library and the ability to store up to 2,000 events in real-time or as XML files.

- Enhanced Social Media and Market Sentiment Analysis

Financial firms are using NLP to extract actionable insights from social media, news feeds, and customer reviews. Sentiment classification, topic modeling, and emotion detection allow institutions to monitor market trends, detect reputational risks, and anticipate investor behavior. The increasing availability of alternative data sources, combined with advanced NLP algorithms, presents opportunities for predictive trading strategies, competitive benchmarking, and proactive customer engagement, enabling organizations to make faster, informed decisions in highly volatile financial markets.

Key Challenges

- Data Privacy and Security Concerns

The implementation of NLP in finance requires access to sensitive customer information and proprietary financial data, raising significant privacy and security concerns. Ensuring compliance with global data protection regulations, including GDPR and CCPA, is complex and resource-intensive. Financial institutions must invest in secure NLP platforms, encrypted data storage, and strict access controls, which can increase operational costs and slow deployment. Additionally, balancing data utility for AI-driven analytics with confidentiality requirements remains a persistent challenge for widespread NLP adoption.

- Complexity in Model Training and Accuracy

High-performance NLP models, particularly deep learning and hybrid architectures, demand large annotated datasets and extensive computational resources. Training models to accurately recognize domain-specific terminology, context, and regulatory nuances is challenging. Misinterpretation of financial text can result in flawed risk assessment or erroneous decision-making. Organizations face obstacles in recruiting skilled AI experts, maintaining model performance, and continuously updating NLP algorithms to handle evolving market language, making effective deployment both technically and operationally demanding.

Regional Analysis

North America

North America dominates the NLP in Finance Market, holding approximately 45% of global market share. The region benefits from advanced technological infrastructure, widespread adoption of AI-driven financial services, and strong investment in research and development. Financial institutions, including leading banks and fintech firms, increasingly leverage NLP for fraud detection, risk assessment, regulatory compliance, and automated customer support. Additionally, the presence of major NLP software providers and AI startups accelerates solution deployment. High awareness of digital transformation and continued innovation in machine learning models and NLP algorithms ensure North America remains the most mature and competitive region in the global market.

Europe

Europe commands around 28% of the NLP in Finance Market. Growth in this region is driven by financial institutions adopting NLP for regulatory compliance, multilingual document processing, and customer engagement through chatbots. Countries such as the UK, Germany, and France emphasize data privacy, secure AI implementations, and automation, creating strong demand for NLP solutions. Banks and insurers invest heavily in AI-powered analytics for credit scoring, fraud detection, and risk management. Collaborations between technology providers and financial institutions foster innovation, while supportive government policies encourage digital banking adoption, making Europe a robust and steadily growing market for NLP applications in finance.

Asia‑Pacific

Asia‑Pacific holds roughly 12% of the global market but is experiencing rapid growth due to digital transformation initiatives in countries like China, India, and Japan. Banks, fintechs, and large corporations are deploying NLP for customer support, multilingual financial services, fraud detection, and compliance automation. Increasing mobile banking penetration, rising internet adoption, and supportive government policies accelerate NLP adoption. Additionally, regional startups are innovating in AI-driven finance solutions, enhancing accessibility for small and medium-sized financial institutions. With a growing tech-savvy population and expanding fintech ecosystem, Asia‑Pacific is expected to see one of the fastest adoption rates globally over the next few years.

Latin America

Latin America represents around 5% of the global NLP in Finance Market. While adoption has been slower than in other regions, increasing fintech activity and digital banking initiatives are driving demand. Banks and financial institutions are implementing NLP solutions for customer service automation, fraud detection, and document analysis. Countries such as Brazil, Mexico, and Argentina are witnessing growing investments in AI-powered finance tools. Multilingual and regional-specific NLP solutions are critical for adoption, given the diverse languages spoken across the region. As digital transformation accelerates and financial institutions modernize their operations, Latin America is expected to experience steady growth in NLP deployment over the coming years.

Middle East & Africa

The Middle East & Africa accounts for approximately 6% of the NLP in Finance Market. Adoption remains emerging but is steadily increasing as banks, insurers, and fintech firms explore NLP solutions for customer support, automated chatbots, and fraud detection. Gulf countries are leading investment in digital banking and AI-powered financial services, while African markets show growing interest in mobile banking and digital payment solutions. Regulatory initiatives and smart city programs are further driving demand for NLP. The region’s growth potential lies in modernizing legacy banking systems and expanding access to AI-driven financial tools across diverse markets, which will gradually increase NLP adoption.

Market Segmentations:

By Component:

- Rule-based NLP software

- Regular Expression (Regex)

By Technology:

- Supervised learning

- Unsupervised learning

By Application:

- Brand reputation management

- Market sentiment analysis

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The NLP in Finance Market include Google LLC, Inbenta, Apple Inc., IBM Corporation, 3M, Crayon Data, Amazon Web Services, Inc., IQVIA, Baidu Inc., and Health Fidelity. The NLP in Finance Market is highly competitive, driven by rapid technological advancements and increasing demand for AI-driven financial solutions. Companies in the market focus on enhancing customer engagement, automating compliance processes, improving fraud detection, and enabling advanced data analytics. Continuous innovation in machine learning models, cloud-based NLP platforms, and multilingual capabilities allows firms to differentiate their offerings. Strategic partnerships, mergers, and acquisitions are common as organizations seek to expand their market presence and capabilities. Additionally, the rise of fintech adoption and digital transformation initiatives across banking, insurance, and investment sectors intensifies competition, prompting firms to deliver scalable, efficient, and secure NLP solutions that meet evolving regulatory requirements and customer expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Google LLC

- Inbenta

- Apple Inc.

- IBM Corporation

- 3M

- Crayon Data

- Amazon Web Services, Inc.

- IQVIA

- Baidu Inc.

- Health Fidelity

Recent Developments

- In May 2025, Twilio Inc., a U.S.-based cloud communications company, announced a partnership with Microsoft to accelerate conversational AI solutions using Microsoft Azure AI Foundry and Twilio’s customer engagement platform.

- In June 2024, Apple Inc. partnered with OpenAI to integrate ChatGPT into its devices through Apple Intelligence, enhancing Siri and offering advanced AI features while maintaining strong user privacy. This partnership aims to bring generative AI to billions of Apple users, balancing innovative capabilities with cautious data handling and user consent.

- In March 2023, Kensho Technologies launched Kensho Classify, a Natural Language Processing (NLP) solution designed to extract value from large volumes of text by making content easier to find and analyze. This solution enhances discoverability, powers smart search, and streamlines research and analysis by enabling users to develop custom concept models without needing machine learning expertise.

- In February 2023, Oracle introduced Oracle Banking Cloud Services, a fresh suite of modular, adaptable cloud-native services. This launch includes six new services designed to offer banks scalable solutions for corporate demand deposit account processing, enterprise-wide limits & collateral management, real-time ISO20022 global payment processing, API management, retail onboarding & originations, and enhanced self-service digital experiences.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of NLP in financial services is expected to grow rapidly across banking, insurance, and investment sectors.

- AI-driven automation will continue to enhance regulatory compliance and reporting efficiency.

- Multilingual NLP solutions will expand to cater to diverse global customer bases.

- Fraud detection and risk management will increasingly rely on advanced NLP algorithms.

- Integration of NLP with cloud platforms will enable scalable and real-time financial analytics.

- Fintech startups will drive innovation and competition in NLP-based solutions.

- Demand for AI-powered customer support and chatbots will increase significantly.

- Collaboration between technology providers and financial institutions will accelerate market adoption.

- Continuous improvements in machine learning models will enhance accuracy and predictive capabilities.

- Investment in secure and privacy-compliant NLP solutions will remain a key focus for financial organizations.