Market Overview:

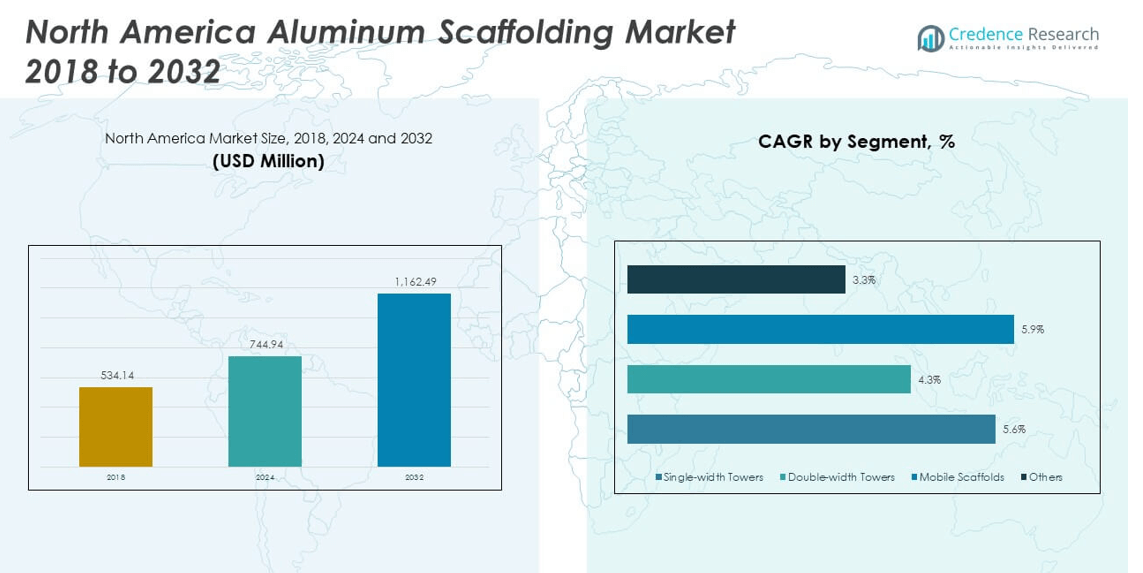

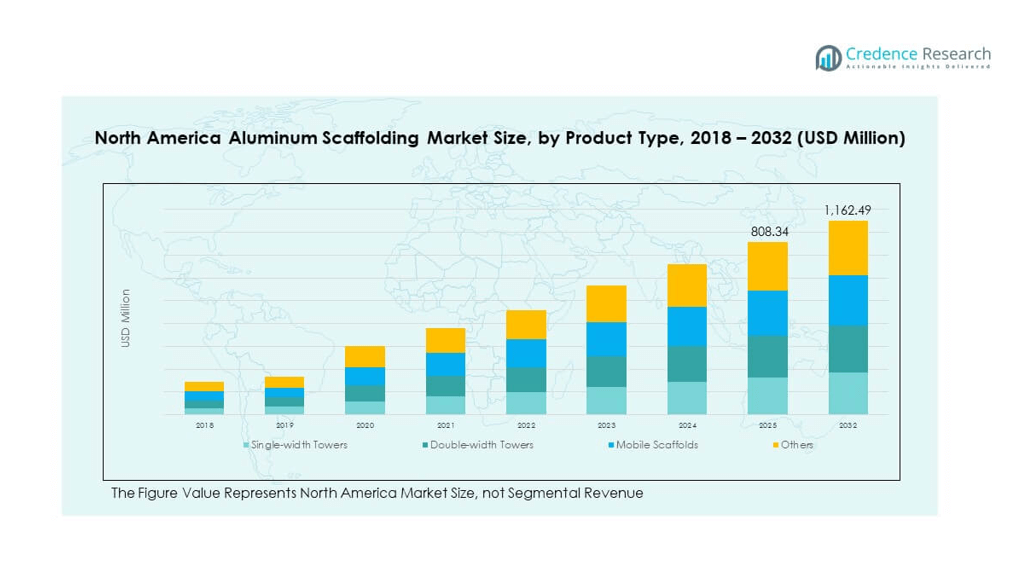

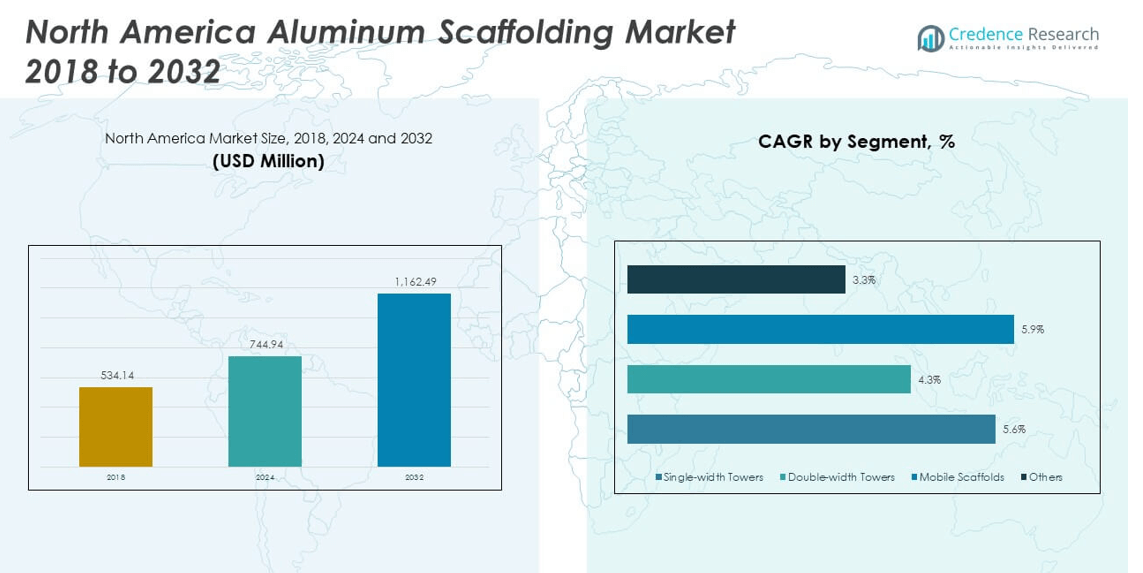

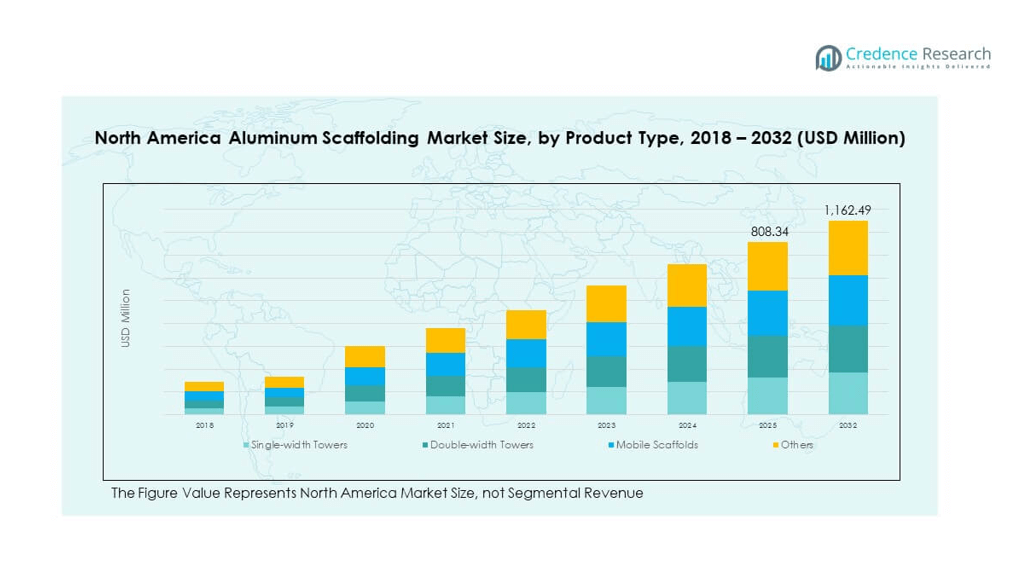

The North America Aluminum Scaffolding Market size was valued at USD 534.14 million in 2018 to USD 744.94 million in 2024 and is anticipated to reach USD 1,162.49 million by 2032, at a CAGR of 5.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| INorth America Aluminum Scaffolding Market Size 2024 |

USD 744.94 million |

| North America Aluminum Scaffolding Market, CAGR |

5.30% |

| North America Aluminum Scaffolding Market Size 2032 |

USD 1,162.49 million |

The market is primarily driven by the growing demand for lightweight, corrosion-resistant, and easy-to-assemble scaffolding solutions across residential, commercial, and industrial sectors. The rise in infrastructure renovation projects, increasing emphasis on worker safety, and stringent regulations regarding construction standards are pushing contractors to adopt aluminum scaffolding. Additionally, rapid urbanization and the growth of smart city initiatives have elevated construction volumes, encouraging the preference for durable and reusable scaffolding systems that reduce long-term operational costs and support efficient site operations.

Within North America, the United States remains the dominant contributor to market growth due to its advanced construction sector, high rate of commercial real estate development, and adoption of innovative building technologies. Canada is also emerging as a strong market, supported by its expanding residential construction and industrial maintenance activities. Both countries benefit from stringent worker safety regulations and a shift toward sustainable and modular building systems. The demand is also increasing in Mexico, particularly in urban centers where infrastructure upgrades and industrial expansion are ongoing.

Market Insights:

- The North America Aluminum Scaffolding Market was valued at USD 744.94 million in 2024 and is projected to reach USD 1,162.49 million by 2032, growing at a CAGR of 5.30%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Rising demand for lightweight, corrosion-resistant scaffolding in urban construction projects is fueling steady market expansion.

- Safety regulations and compliance standards across North America are pushing contractors to adopt certified aluminum scaffolding systems.

- High initial investment costs and price sensitivity among small contractors remain key restraints in market penetration.

- The United States dominates the North America Aluminum Scaffolding Market with over 68% share, supported by large-scale commercial development.

- Canada is emerging as a strong market due to increasing infrastructure upgrades and favorable regulatory alignment.

- Mexico is witnessing gradual growth, driven by industrial expansion and the shift from steel to modular aluminum systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in Infrastructure Redevelopment Across Urban and Suburban Zones

Rapid redevelopment of aging infrastructure across North America drives strong demand for aluminum scaffolding. Governments and private developers continue to invest in commercial renovations, public works, and urban upgrades. The North America Aluminum Scaffolding Market benefits from this consistent volume of construction and maintenance. It supports the need for lightweight and corrosion-resistant platforms in tight project schedules. Contractors prefer aluminum over steel due to faster assembly and improved portability. Public-sector investments in schools, bridges, and transit stations further expand scaffolding requirements. Safety-compliant systems see high adoption in projects that operate under strict timelines. Firms seek scaffold platforms that minimize labor and maximize mobility on-site.

- For instance, Safway, now operating under BrandSafway, has been involved in multiple high-profile infrastructure projects across the U.S., providing aluminum scaffolding systems designed for rapid assembly and disassembly in complex environments.

Shift Toward Safer and Standardized Work Platforms in Construction Projects

The market grows due to the prioritization of worker safety and site compliance. Regulatory bodies enforce stricter standards for height work and fall protection. The North America Aluminum Scaffolding Market responds with certified, structurally stable solutions for elevated work areas. It caters to both large-scale commercial ventures and residential jobsites requiring OSHA-compliant platforms. Enhanced design features like guardrails, toe boards, and slip-resistant surfaces gain preference. Safety-conscious buyers actively choose tested aluminum units to mitigate workplace risks. Contractors rely on modular scaffold designs for adaptable configurations. The industry’s push toward zero-accident records increases usage of aluminum scaffolding in construction safety programs.

- For instance, Layher’s Allround Lightweight (LW) aluminum scaffolding system complies with OSHA standard 1926.451, including requirements for integrated guardrails, toeboards, and fully decked platforms. Layher confirms that Erection, use, and maintenance of its Allround system must conform to Layher instructions and OSHA scaffolding safety regulations

Rising Popularity of Modular and Customizable Scaffolding Units in Dynamic Projects

Demand grows for modular scaffold units tailored to complex project geometries and layouts. Construction professionals prefer systems that adapt to structural conditions without delay. The North America Aluminum Scaffolding Market supports this demand with pre-engineered, easily extendable frameworks. It enables project managers to modify scaffold height, shape, and reach based on project phases. Industrial, commercial, and façade restoration work all require non-standard access solutions. Contractors gain operational flexibility when they can customize assemblies without needing unique tools. Reusability and quick-disassembly features reduce downtime across sites. The shift to multi-phase and vertical construction enhances the appeal of versatile scaffolding systems.

Expansion of Smart Cities and Real Estate Corridors Across the Region

Urbanization accelerates the need for scaffold-supported construction across smart city corridors and vertical real estate. Metropolitan development plans include mixed-use towers, mobility hubs, and digital infrastructure. The North America Aluminum Scaffolding Market caters to these developments through mobility-focused, height-flexible scaffold systems. It aligns with the architectural demands of energy-efficient and prefabricated buildings. Public-private partnerships in city planning lead to simultaneous infrastructure rollouts. Scaffold manufacturers witness demand from transit stations, data centers, and urban housing clusters. Easy-to-move scaffolding units help accelerate these projects. Contractors require reliable aluminum systems for consistent performance in evolving site environments.

Market Trends:

Integration of Advanced Safety Mechanisms and Digital Compliance Systems

New scaffolding designs incorporate sensor-based systems that alert users to unsafe conditions. Manufacturers embed load-monitoring and stability-indication features within aluminum frames. The North America Aluminum Scaffolding Market aligns with these innovations to meet evolving contractor expectations. It adapts to the demand for intelligent compliance management tools during elevated work. Cloud-based reporting platforms assist site managers in tracking scaffold inspection status. Digital tags and QR-code access labels are now visible on modular systems. Smart scaffolding contributes to faster safety audits and workforce accountability. Trends favor scaffold types that reduce human error in site operations.

Preference for Foldable, Lightweight Systems for Maintenance and Quick Access

Technicians require compact, quick-deploy scaffolding for HVAC, MEP, and facility inspections. The North America Aluminum Scaffolding Market supports this preference with foldable, tool-free frame designs. It sees increased adoption in sectors where access is temporary but frequent. Lightweight models that fit service elevators and narrow shafts gain attention. Trends show rising demand for transportable scaffold towers among maintenance crews. Rental firms invest in multi-height units that store easily in compact areas. Aluminum scaffold’s weight-to-strength ratio remains a key advantage. The trend favors ergonomic designs that simplify repetitive setup.

- For instance, OrangeLocation’s Baker Scaffold offers a fully foldable, tool-free aluminum design that weighs just 63lbs (28.6kg), enabling technicians to quickly deploy it in tight indoor spaces, including elevators and narrow shafts.

Growth in Scaffold Rentals by SMEs and Specialized Trade Contractors

The rental segment grows rapidly as smaller firms avoid capital expenditure on equipment. Contractors rent aluminum scaffold towers on a project-specific basis to reduce asset liability. The North America Aluminum Scaffolding Market sees revenue diversification from short-term lease models. It accommodates customers who need modular systems for short-duration jobs. Rental companies provide certified scaffolds with on-site delivery and installation support. This trend enhances scaffold availability across suburban and remote locations. Aluminum’s durability ensures repeat usability over several lease cycles. The market experiences a shift toward service-based scaffold solutions.

- For instance, Waco Scaffolding, with over 70 years of experience, offers certified rental aluminum scaffolding solutions that include delivery, professional installation, and OSHA/SAIA-compliant safety training, helping SMEs and specialized contractors reduce equipment ownership costs.

Sustainable Construction Practices Drive Demand for Recyclable Scaffold Systems

Green building initiatives emphasize materials with lower environmental impact. The North America Aluminum Scaffolding Market supports eco-conscious projects with recyclable aluminum structures. It enables companies to meet LEED and BREEAM targets in construction. Firms now evaluate lifecycle emissions and resource recovery potential before procurement. Aluminum scaffolds, unlike steel or wood alternatives, retain high scrap value. Trends show contractors prefer platforms that reduce disposal and carbon offset costs. Prefabricated aluminum modules allow zero-waste assembly. Manufacturers develop scaffold systems with extended service life and reduced ecological footprint.

Market Challenges Analysis:

High Initial Procurement Costs and Competitive Price Sensitivity Among Buyers

One major challenge stems from the high upfront cost of aluminum scaffolding units. While aluminum offers durability and ease of use, its material cost remains significantly higher than steel. Buyers in price-sensitive segments hesitate to invest in high-grade modular systems. The North America Aluminum Scaffolding Market faces pressure from low-cost imported alternatives. It struggles to appeal to small firms with limited equipment budgets. Cost-conscious buyers sometimes choose second-hand or outdated models. This behavior limits the penetration of advanced, regulation-compliant scaffolds. Manufacturers must justify premium pricing through long-term operational savings.

Limited Awareness Among End-Users Regarding Technological and Safety Advancements

Another challenge involves a lack of awareness about the latest scaffold safety standards and innovation. Many users rely on outdated practices, missing out on new features like digital inspections or modular compatibility. The North America Aluminum Scaffolding Market finds resistance in sectors where safety upgrades are not enforced strictly. It sees slow adoption among traditional contractors and small-scale builders. Training gaps and language barriers hinder the correct usage of modern scaffolds. This creates risks at job sites and affects product reputation. Bridging the knowledge gap is essential to achieve consistent market expansion.

Market Opportunities:

Rise in Public Infrastructure Investments and Utility Upgrades Across Urban Nodes

Government-funded infrastructure upgrades offer growth opportunities across multiple sectors. These include transportation terminals, energy grid maintenance, and bridge restoration. The North America Aluminum Scaffolding Market positions itself as a key enabler for safe and efficient access. It supports utility service providers and municipal contractors seeking corrosion-free scaffolds. Project cycles aligned with regulatory mandates ensure steady demand for certified scaffolding systems. It capitalizes on maintenance contracts and safety-driven procurement in public assets.

Demand Upsurge from Film, Events, and Media Production for Temporary Elevated Platforms

New opportunities arise in non-construction sectors such as media, film, and live events. These industries demand modular aluminum platforms for stage rigging, lighting, and camera positioning. The North America Aluminum Scaffolding Market meets these temporary elevation needs with transportable, secure systems. It benefits from seasonal event setups, trade shows, and production shoots. Fast deployment, low weight, and aesthetic adaptability make aluminum scaffolds a preferred choice.

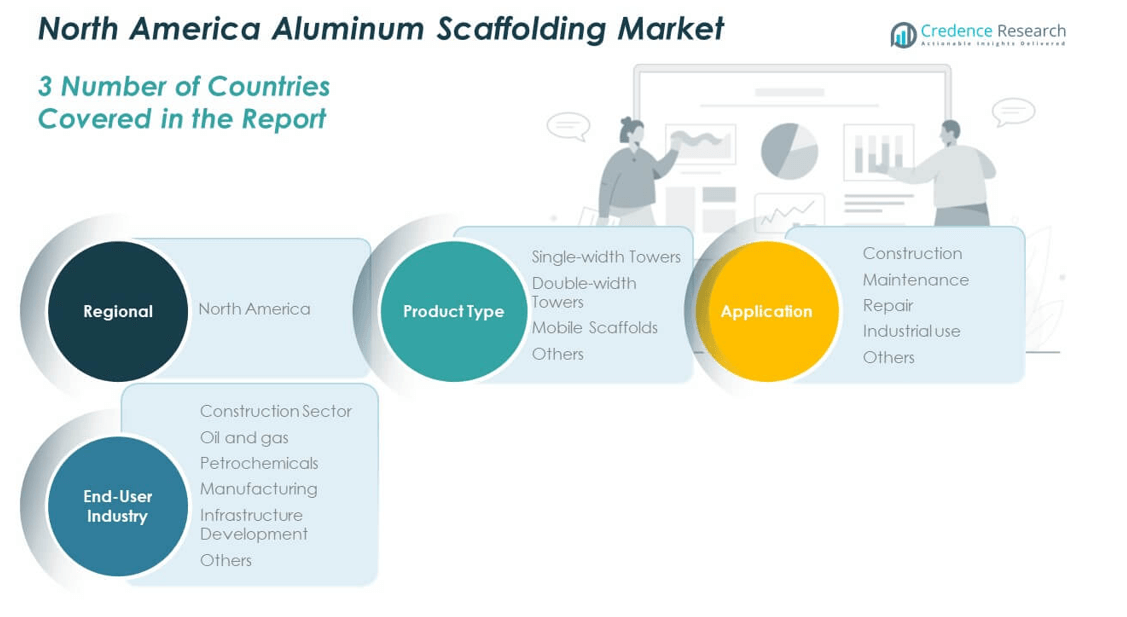

Market Segmentation Analysis:

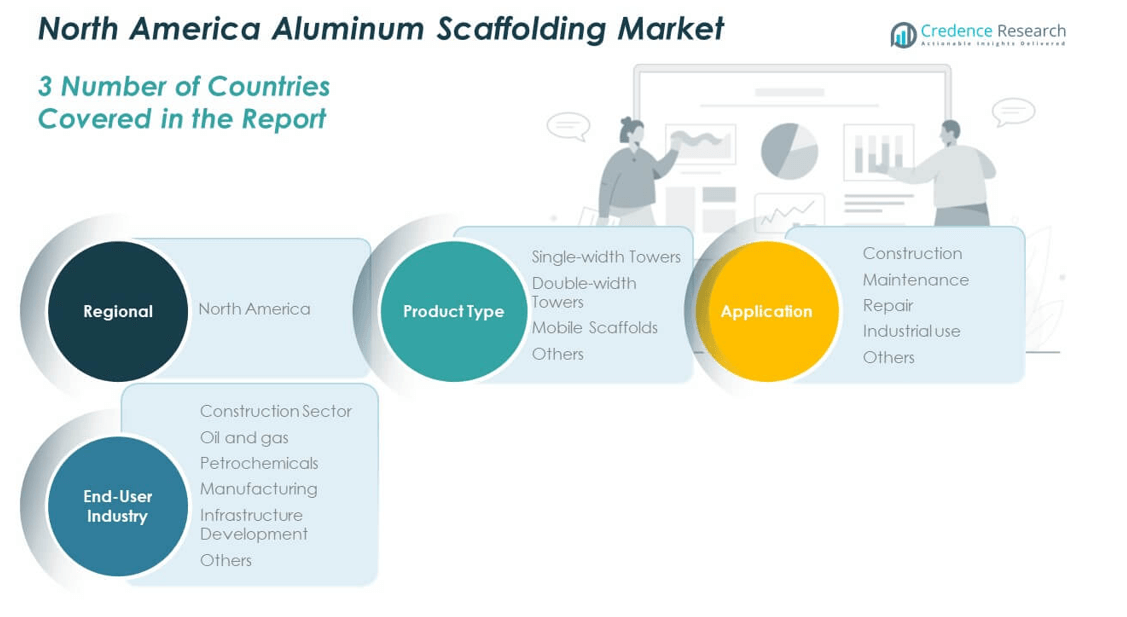

The North America Aluminum Scaffolding Market features a diverse product landscape tailored to varying project scales and access requirements.

By product types, mobile scaffolds hold a dominant share due to their ease of mobility and adaptability on dynamic construction sites. Double-width towers are preferred for stability and increased workspace, while single-width towers serve compact and narrow access areas. The “Others” category includes foldable and custom-designed scaffolds that cater to specific industrial needs.

- For instance, Instant UpRight’s “Span 500” mobile aluminum scaffold tower features a fast-track design with 500 mm rung spacing and integral ladder frames, enabling platform heights up to 12 m indoors for double‑width configurations and 8 m for single‑width versions.

By application, construction leads demand, driven by ongoing residential and commercial development across urban centers. Maintenance follows closely, supported by infrastructure upkeep and facility management activities. Repair and industrial use segments continue to grow, supported by aging assets and safety-compliant scaffolding requirements in operational environments. The “Others” category includes applications in event setups and temporary installations.

By end-user perspective, the construction sector remains the primary contributor to market revenue. Oil and gas, petrochemicals, and manufacturing sectors show growing interest in modular scaffolding for operational efficiency and site safety. Infrastructure development projects also generate steady demand, especially in public works and transportation networks. It serves a wide base of industries that require fast, reliable, and compliant elevation access solutions.

- For instance, Altrex’s modular aluminum scaffolding systems are widely used in North America for high-rise and complex construction environments due to their Quickpin connections, high load capacity, and compliance with OSHA and ANSI safety standards.

Segmentation:

By Product Type

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

By Region

- United States

- Canada

- Mexico

Regional Analysis:

The United States holds the largest share of the North America Aluminum Scaffolding Market, accounting for over 68% of the regional revenue in 2024. Its well-established construction sector, strict worker safety regulations, and adoption of modular and lightweight equipment contribute to strong market growth. High investments in commercial infrastructure, government building renovations, and transportation projects continue to support demand. The presence of major scaffold manufacturers and rental providers enables widespread access to advanced systems across states. Urban centers such as New York, Los Angeles, and Chicago exhibit elevated demand due to ongoing high-rise developments. The U.S. maintains leadership in integrating safety-certified, mobile aluminum scaffolding solutions in complex work environments.

Canada represents approximately 23% of the regional market share and remains an important contributor to growth within the North America Aluminum Scaffolding Market. It shows steady adoption of aluminum scaffolding driven by increased residential housing projects, industrial plant maintenance, and public infrastructure upgrades. Construction companies in Canada prefer modular and weather-resistant scaffolds suitable for varying climate conditions. Urban regions including Toronto, Vancouver, and Calgary see rising deployment of quick-assembly scaffold systems for both new constructions and retrofits. Regulatory alignment with U.S. safety standards has helped standardize equipment usage across provinces. It continues to attract investment from international scaffold manufacturers due to its favorable business environment and infrastructure initiatives.

Mexico accounts for nearly 9% of the regional market and is gradually emerging as a high-potential segment of the North America Aluminum Scaffolding Market. Industrialization and expansion of commercial zones in cities such as Monterrey, Guadalajara, and Mexico City are creating increased demand for scaffolding systems. Contractors are beginning to shift from steel to aluminum to reduce setup time and transportation challenges. The rental model is gaining traction, especially among small and medium-sized firms operating under budget constraints. Infrastructure modernization projects supported by public and private partnerships contribute to this market evolution. Mexico continues to adopt aluminum scaffolding technologies that support safe and efficient construction across both urban and semi-urban zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Layher NA

- Safway Group

- WernerCo

- ULMA Form Works, Inc.

- Aluma Systems

- Penn Tool Co.

- Ver Sales, Inc.

- Associated Scaffolding Co., Inc.

- QuickAlly Access Solutions

- Advanced Ladders and Scaffold

Competitive Analysis:

The North America Aluminum Scaffolding Market features a moderately consolidated landscape with several prominent players competing on product innovation, safety compliance, and rental service coverage. Key companies such as WernerCo, Altrex, Instant Upright, and Bil-Jax maintain strong brand presence through extensive distribution networks and reliable customer support. It witnesses continuous product development in modular scaffolding systems, lightweight materials, and tool-free assembly designs to meet evolving contractor needs. Market participants focus on strengthening partnerships with construction firms and rental agencies to increase regional penetration. Smaller players compete by offering cost-effective solutions for residential and small-scale commercial projects. Strategic acquisitions and regional expansions support competitive positioning among established brands.

Recent Developments:

- In May 2025, ULMA Packaging debuted the TFX line of thermoforming machines focused on speed, sustainability, and packaging quality improvements within manufacturing. While not strictly scaffolding, this demonstrates their active innovation pipeline in North America.

- In March 2025, Aluma Systemsentered a new strategic partnership with Liberty Defense to help achieve the SAFETY Act designation for the HEXWAVE concealed weapon detection system for urban security markets in the United States. This collaboration aims to accelerate the deployment of advanced AI security screening technology, benefiting public and private sector clients seeking enhanced site safety.

- In January 2025, PERI Group announced the launch of two new formwork solutions, SKYFLEX and LEVO, which were introduced at the World of Concrete 2025 event. This marks a significant step as the company continues to innovate and expand its product offerings in the North American aluminum scaffolding sector, focusing on enhancing construction efficiency and jobsite safety.

- In August 2024, WernerCo, a major manufacturer in the access and safety equipment sector, announced its rebranding to ProDriven Global Brands. This name change marks the completion of WernerCo’s transformation into an integrated portfolio of professional-oriented brands, aimed at strengthening their product and service offering for the construction, industrial, and automotive sectors.

Market Concentration & Characteristics:

The North America Aluminum Scaffolding Market exhibits medium-to-high market concentration, with a few key players controlling a significant share. It reflects characteristics of a mature yet innovation-driven industry, supported by recurring demand from maintenance, construction, and industrial sectors. The market values certifications, safety standards, and ease of assembly as core product differentiators. Rental services account for a growing portion of revenue, driven by contractors seeking short-term, flexible scaffold access. Demand patterns align with regional construction cycles, regulatory shifts, and urban development programs. It continues to attract both local manufacturers and global entrants targeting niche applications. Product standardization and compliance with regional safety norms remain central to sustaining competitive advantage.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight scaffolding systems is expected to rise due to increasing adoption in multi-story construction projects across urban centers.

- Regulatory focus on worker safety will drive the use of certified aluminum scaffolds across residential and commercial job sites.

- Growth in infrastructure rehabilitation and maintenance will sustain consistent demand for mobile and modular scaffolding solutions.

- The rental segment will expand as small and mid-sized contractors prioritize flexibility and cost control over ownership.

- Technological advancements will introduce smart scaffolding systems equipped with load monitoring and safety alert features.

- Increased construction activity in secondary cities will broaden the geographic footprint of scaffolding suppliers and rental firms.

- Manufacturers are likely to invest in corrosion-resistant and weather-durable aluminum variants to meet regional climate challenges.

- Public-private partnerships in infrastructure development will create long-term opportunities for scaffold service providers.

- Customizable and tool-free assembly designs will gain traction in time-sensitive projects requiring rapid deployment.

- Strategic collaborations between global manufacturers and local distributors will enhance product availability and service reach.