| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Biomaterials Market Size 2024 |

USD 74,183.13 Million |

| North America Biomaterials Market, CAGR |

14.84% |

| North America Biomaterials Market Size 2032 |

USD 2,24,346.95 Million |

Market Overview

North America Biomaterials Market size was valued at USD 74,183.13 million in 2024 and is anticipated to reach USD 2,24,346.95 million by 2032, at a CAGR of 14.84% during the forecast period (2024-2032).

The North American biomaterials market is primarily driven by the increasing demand for advanced medical devices, growing healthcare spending, and a rising aging population. Innovations in tissue engineering, regenerative medicine, and the development of biodegradable materials are fueling market growth. Additionally, the growing emphasis on minimally invasive surgeries, alongside the rising adoption of bio-based materials across various industries such as automotive and packaging, is shaping market dynamics. Regulatory advancements and strong R&D activities by key players further contribute to market expansion. Furthermore, there is a shift towards sustainable, eco-friendly biomaterials that align with both environmental and consumer health concerns, creating new opportunities for growth. The market is also witnessing a surge in collaborations between industry players and academic institutions, driving the innovation of novel biomaterials and expanding their application scope in diverse sectors. These trends indicate a robust growth trajectory for North America’s biomaterials market.

The North American biomaterials market is driven by key players and strategic advancements across the U.S., Canada, and Mexico. The U.S. is home to leading biomaterial manufacturers, including Stryker Corporation, Medtronic, and Invibio Biomaterial Solutions, which dominate the market through innovation, extensive R&D, and a strong healthcare infrastructure. Canada is emerging as a hub for medical research and development, with a growing number of companies focusing on natural and biodegradable biomaterials. Meanwhile, Mexico benefits from its proximity to the U.S. and a competitive cost structure, positioning itself as a manufacturing base for biomaterials, particularly in orthopedics and dental sectors. Key players in Mexico, such as Axogen and Orthofix International, are expanding their presence in the region, contributing to the growth of the market. These companies are focused on advancing biomaterial technologies, enhancing patient care, and catering to the rising demand for sustainable, high-performance materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North American biomaterials market was valued at USD 74,183.13 million in 2024 and is expected to reach USD 224,346.95 million by 2032, growing at a CAGR of 14.84% during the forecast period (2024-2032).

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Increasing demand for advanced medical devices and innovations in regenerative medicine are driving market growth.

- The growing emphasis on biodegradable and sustainable materials is reshaping the biomaterials sector across industries.

- Advancements in regenerative medicine and tissue engineering are expanding the application scope of biomaterials.

- Competitive landscape includes key players like Stryker Corporation, Medtronic, and Invibio Biomaterial Solutions, focusing on innovation and market expansion.

- High development and production costs remain a significant restraint in the growth of the market.

- The U.S. holds the largest share of the North American biomaterials market, followed by Canada and Mexico, which are experiencing steady growth driven by local manufacturing and R&D investments.

Report Scope

This report segments the North America Biomaterials Market as follows:

Market Drivers

Growing Demand for Advanced Medical Solutions

The increasing demand for advanced medical solutions is one of the primary drivers of the North American biomaterials market. The rising prevalence of chronic diseases, an aging population, and the need for improved medical treatments are significantly boosting the demand for biomaterials. Medical applications such as orthopedic implants, cardiovascular devices, and wound healing products require high-quality biomaterials with biocompatibility and durability. Furthermore, the growing number of surgical procedures, both invasive and minimally invasive, is driving the adoption of biomaterials for use in implants, prosthetics, and drug delivery systems. These factors are contributing to the substantial growth of the biomaterials market in North America, as healthcare providers increasingly rely on innovative biomaterials to enhance treatment outcomes and improve patient quality of life.

Technological Advancements in Biomaterials

Technological advancements in biomaterials are another key market driver. For instance, the development of smart biomaterials, tissue-engineered products, and biodegradable polymers is driving innovation in the sector. These innovations enable better integration with the human body, offering improved healing and recovery rates for patients. Additionally, the rise of regenerative medicine, which utilizes biomaterials to stimulate tissue regeneration, has opened new avenues for treating previously untreatable conditions. Advancements in 3D printing technology are also contributing to the market growth by enabling customized biomaterial products for individual patients, enhancing precision and reducing the risk of complications. The continuous innovation in biomaterials is thus creating opportunities for both existing and new market players to tap into a growing demand for cutting-edge medical solutions.

Regulatory Support and Research & Development (R&D) Investments

Regulatory support and increased investments in research and development (R&D) are pivotal drivers of the North American biomaterials market. For instance, regulatory agencies like the FDA are actively involved in establishing safety and efficacy standards for biomaterials. These regulations ensure that biomaterials meet safety and efficacy standards, thereby boosting market confidence and facilitating the adoption of new products. Furthermore, substantial R&D investments by key industry players and academic institutions are accelerating the discovery of new biomaterials and applications. These investments in R&D not only improve the performance and functionality of existing biomaterials but also expand the scope of their use in areas such as drug delivery, tissue engineering, and regenerative medicine. As a result, continuous advancements in R&D are further fueling the growth of the biomaterials market.

Shift Toward Sustainability and Eco-Friendly Materials

The growing emphasis on sustainability and eco-friendly materials is significantly influencing the North American biomaterials market. Consumers and industries are increasingly prioritizing environmentally conscious solutions, including the use of biodegradable and renewable biomaterials. The automotive, packaging, and consumer goods sectors are driving the adoption of eco-friendly biomaterials that minimize environmental impact. In healthcare, the demand for sustainable biomaterials, such as those derived from plant-based or biodegradable sources, is increasing. These materials not only reduce the carbon footprint but also offer better patient outcomes in terms of biocompatibility and reduced risk of long-term complications. The ongoing trend towards sustainability aligns with consumer preferences for health-conscious, eco-friendly solutions, further propelling the growth of the biomaterials market in North America.

Market Trends

Increased Adoption of Biodegradable and Sustainable Materials

One of the prominent trends in the North American biomaterials market is the growing adoption of biodegradable and sustainable materials. As environmental concerns continue to rise, there is increasing demand for eco-friendly alternatives across industries. In the medical sector, biodegradable materials are gaining popularity for their ability to minimize long-term waste and adverse environmental impacts. For instance, North America’s biomaterials market is seeing a rise in biodegradable materials derived from plant-based polymers and biodegradable metals. This shift towards sustainability is not only driven by environmental factors but also by the growing consumer preference for sustainable healthcare solutions, prompting manufacturers to invest in the development of eco-friendly biomaterials.

Advancements in Regenerative Medicine and Tissue Engineering

Regenerative medicine and tissue engineering continue to be significant growth drivers in the North American biomaterials market. With the increasing need for effective treatments for conditions such as organ failure, tissue damage, and severe burns, the demand for advanced biomaterials capable of stimulating tissue regeneration is surging. For instance, regenerative medicine is expanding rapidly, with biomaterials playing a crucial role in tissue engineering and stem cell applications. Biomaterials are playing a critical role in creating scaffolds that support tissue growth and help repair or replace damaged tissues. Stem cell therapies and tissue-engineered products are seeing widespread application in areas such as orthopedics, dermatology, and cardiovascular treatments. The ongoing advancements in regenerative medicine are expanding the potential uses of biomaterials, with a focus on improving patient outcomes and reducing the need for organ transplants.

Integration of Smart Biomaterials in Healthcare Solutions

Another emerging trend in the North American biomaterials market is the integration of smart biomaterials in healthcare solutions. Smart biomaterials, which can respond to environmental stimuli such as temperature, pH, or mechanical forces, are gaining traction due to their potential to enhance the effectiveness of medical treatments. These materials can be used in a wide range of applications, from drug delivery systems that release therapeutic agents in response to specific triggers, to wound dressings that promote healing by responding to changes in the wound environment. The ability of smart biomaterials to interact with the human body in a controlled and dynamic manner holds promise for improving patient outcomes, particularly in personalized medicine and minimally invasive treatments.

Expansion of Biomaterials Applications in Non-Medical Sectors

The use of biomaterials is extending beyond the medical field, with increasing applications in various non-medical sectors. In industries such as automotive, packaging, and consumer goods, biomaterials are being used to create lightweight, durable, and eco-friendly products. For example, biodegradable polymers are being incorporated into packaging materials to reduce plastic waste, while biocomposites are being used in automotive parts to improve fuel efficiency and reduce environmental impact. This expansion of biomaterials into non-medical applications is opening new growth opportunities for manufacturers and contributing to the overall market expansion. As industries seek sustainable alternatives to traditional materials, the demand for innovative biomaterials is expected to continue growing, further diversifying the market landscape.

Market Challenges Analysis

High Cost of Biomaterials Development and Production

One of the key challenges facing the North American biomaterials market is the high cost of research, development, and production. Developing advanced biomaterials, particularly those for specialized medical applications, requires significant investments in R&D, skilled labor, and state-of-the-art manufacturing processes. The production of high-performance biomaterials, such as tissue-engineered products or smart biomaterials, often involves complex and time-consuming procedures, driving up production costs. These high expenses can limit the affordability and accessibility of biomaterials, particularly for small and mid-sized healthcare providers. Additionally, the lengthy approval process for biomaterials by regulatory bodies, such as the FDA, can further delay time-to-market and increase development costs, putting additional pressure on manufacturers to maintain competitive pricing while ensuring compliance with stringent safety and efficacy standards.

Regulatory Complexities and Compliance Challenges

Regulatory hurdles present another significant challenge for the biomaterials market in North America. For instance, biomaterials intended for medical applications must meet rigorous safety and performance standards set by regulatory bodies such as the FDA and Health Canada. Navigating these complex regulations can be time-consuming and costly for manufacturers. The approval process for new biomaterials is often lengthy, involving extensive preclinical and clinical trials to demonstrate the material’s biocompatibility and efficacy. In addition, the evolving nature of regulatory frameworks, which must keep pace with technological advancements and new material innovations, can create uncertainty for manufacturers. Companies must invest in regulatory expertise to ensure compliance and avoid delays or penalties. The intricate and dynamic regulatory environment remains a critical challenge for biomaterials developers, especially as they work to bring innovative products to market quickly.

Market Opportunities

The North American biomaterials market presents several lucrative opportunities driven by the ongoing demand for advanced healthcare solutions and sustainable alternatives. The increasing prevalence of chronic diseases, an aging population, and the growing need for minimally invasive surgeries create significant demand for innovative biomaterials in medical applications such as implants, prosthetics, and tissue engineering. Advancements in regenerative medicine further expand these opportunities, as biomaterials play a critical role in creating scaffolds that support tissue regeneration and accelerate healing processes. The rise of personalized medicine, where treatments are tailored to individual patients, also presents a promising avenue for the development of customized biomaterial solutions. As medical technologies continue to evolve, manufacturers who invest in research and development to create high-performance biomaterials with better biocompatibility, durability, and functionality will be well-positioned to capture market share.

Additionally, the shift towards sustainability and eco-friendly materials offers considerable growth potential in both the healthcare and non-medical sectors. The increasing preference for biodegradable, renewable, and environmentally friendly biomaterials in industries such as packaging, automotive, and consumer goods is creating new opportunities for market expansion. Biomaterials derived from natural sources, such as plant-based polymers, are being adopted for their low environmental impact and versatile applications. Companies that focus on developing sustainable biomaterials that meet the demands of various industries can tap into this growing trend, offering solutions that align with both consumer preferences and regulatory standards. As industries continue to prioritize environmental responsibility, the market for eco-friendly biomaterials in North America is expected to experience robust growth in the coming years.

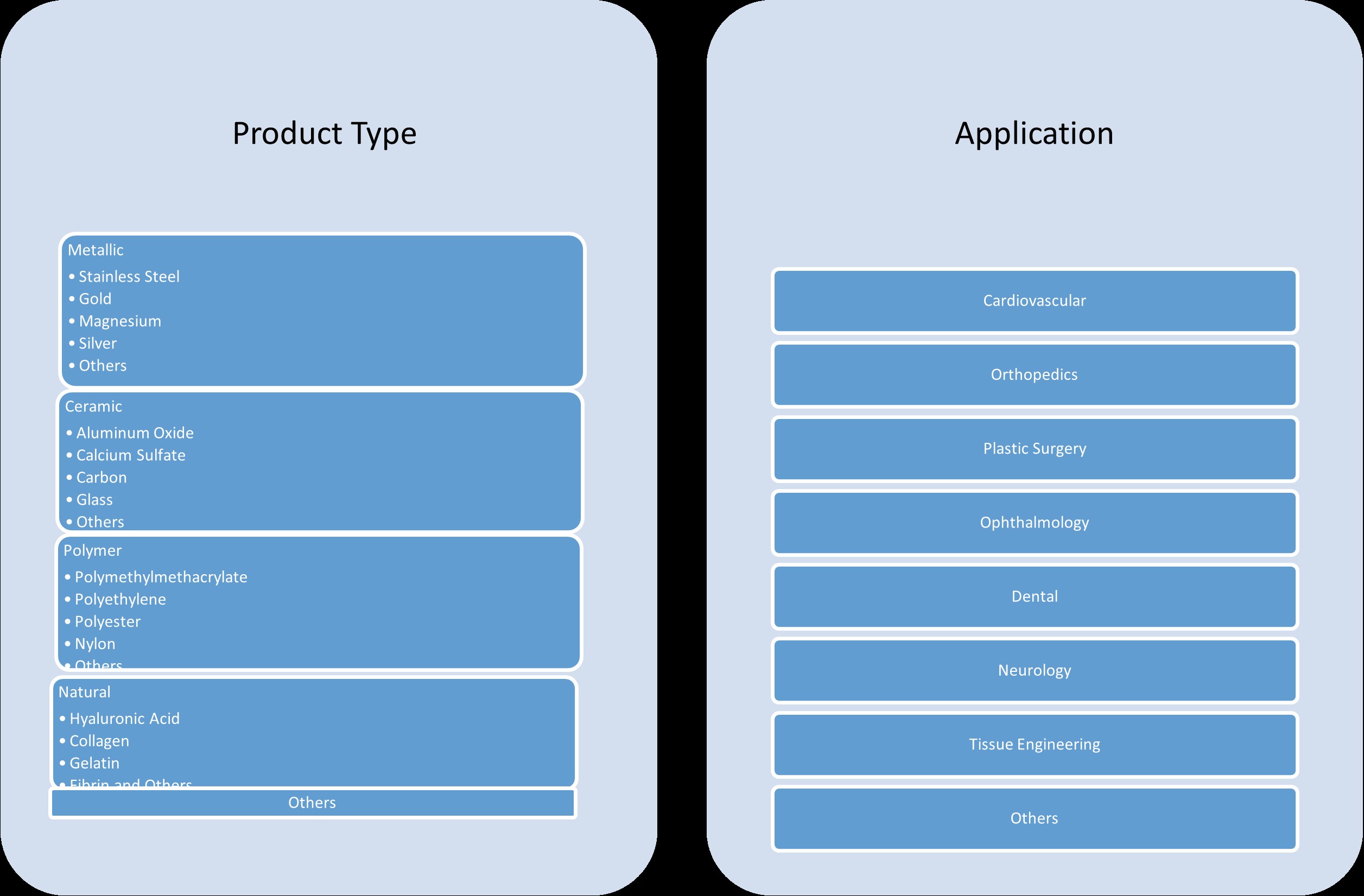

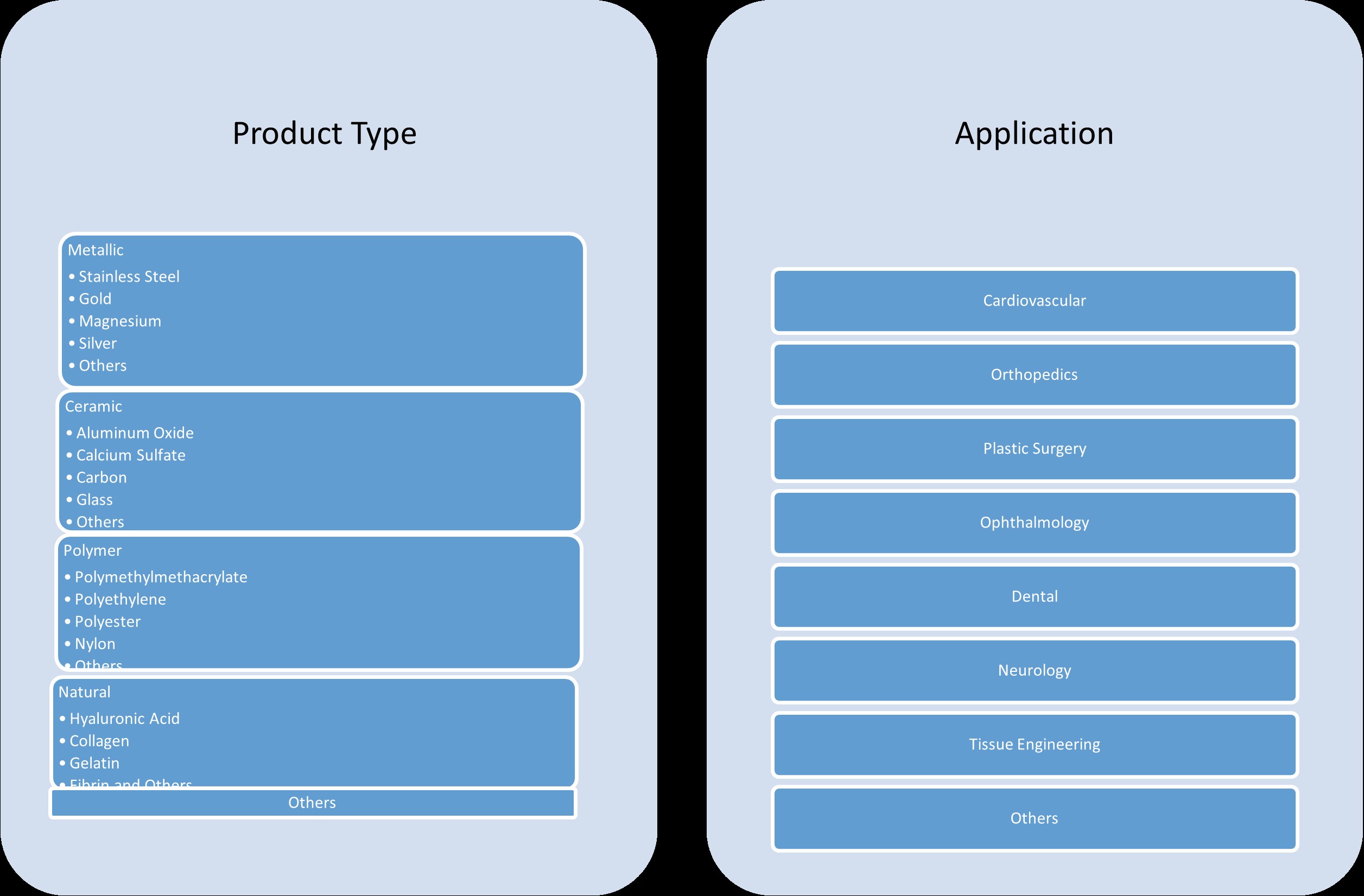

Market Segmentation Analysis:

By Product Type:

The North American biomaterials market is broadly segmented into metallic, ceramic, polymer, and natural biomaterials, each catering to different medical applications. Metallic biomaterials, including stainless steel, gold, magnesium, and silver, are widely used in implants and prosthetics due to their strength, durability, and biocompatibility. Stainless steel remains the most popular choice in orthopedic and dental implants, while magnesium is emerging as a biodegradable alternative for temporary implants. Ceramic biomaterials, such as aluminum oxide, calcium sulfate, and glass, are preferred in applications like dental implants and joint replacements due to their excellent wear resistance, biocompatibility, and ability to mimic natural bone. Polymer-based biomaterials, including polymethylmethacrylate (PMMA), polyethylene, and nylon, are commonly used in soft tissue applications and drug delivery systems, offering flexibility and ease of processing. Natural biomaterials, like hyaluronic acid, collagen, and gelatin, are gaining traction due to their compatibility with human tissues and ability to promote natural healing, particularly in wound care and regenerative medicine.

By Application:

The North American biomaterials market is also segmented by application, with significant demand across various medical fields, including cardiovascular, orthopedics, and plastic surgery. In cardiovascular applications, biomaterials are essential for producing heart valves, stents, and vascular grafts, with an increasing shift toward biocompatible and biodegradable materials. Orthopedics remains one of the largest segments, driven by the high demand for joint replacements, bone grafts, and spinal implants, where materials like metals and ceramics are heavily utilized. In plastic surgery, biomaterials play a vital role in wound healing and tissue reconstruction, with natural biomaterials like collagen and hyaluronic acid being increasingly used for their regenerative properties. Ophthalmology applications, particularly in corneal implants and contact lenses, rely on polymers for their lightweight and transparent characteristics. Dental, neurology, and tissue engineering sectors also present robust opportunities for biomaterial use, as advancements in regenerative therapies and organ replacements drive innovation in these applications.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

Regional Analysis

U.S.

U.S. holds the largest share of the North American biomaterials market, accounting for approximately 80% of the total market. The robust healthcare infrastructure, advanced research and development (R&D) capabilities, and high demand for medical devices, particularly in orthopedics, cardiovascular, and plastic surgery, contribute to the U.S.’s dominant position. The growing aging population and the increasing prevalence of chronic diseases further drive the demand for innovative biomaterials in the country. Additionally, the presence of major global biomaterial manufacturers and medical device companies in the U.S. strengthens its market leadership.

Canada

Canada holds a smaller but significant share of the North American biomaterials market, representing around 15% of the total market. Canada’s healthcare sector is growing steadily, supported by government-funded healthcare systems and increasing investments in biotechnology and medical research. The demand for biomaterials in Canada is driven by the country’s aging population and advancements in regenerative medicine. Moreover, Canada is a hub for R&D activities, particularly in the fields of natural biomaterials, such as collagen and hyaluronic acid, which are increasingly used in tissue engineering and wound care. The regulatory framework in Canada also encourages the development of novel biomaterials, making it an attractive market for both domestic and international manufacturers.

Mexico

Mexico accounts for the remaining 5% of the North American biomaterials market share. While smaller compared to the U.S. and Canada, Mexico is emerging as a key player in the biomaterials sector, particularly due to its growing medical device manufacturing industry. The country’s proximity to the U.S. and cost advantages make it an attractive location for biomaterial production and innovation. Mexico’s expanding healthcare sector, coupled with increasing demand for affordable healthcare solutions, contributes to the demand for biomaterials, especially in orthopedics and dental applications. Government initiatives to enhance healthcare infrastructure and improve accessibility to medical treatments further bolster market growth.

Key Player Analysis

- Stryker Corporation

- Invibio Biomaterial Solutions

- Axogen

- Orthofix International

- Medline Industries

Competitive Analysis

The North American biomaterials market is highly competitive, with leading players driving innovation and shaping market dynamics. Key companies include Stryker Corporation, Medtronic, Invibio Biomaterial Solutions, Axogen, Orthofix International, and Medline Industries. These companies dominate the market by leveraging their strong research and development (R&D) capabilities, extensive product portfolios, and global distribution networks. Leading players in the market continually invest in research and development to enhance product offerings and meet the growing demand for advanced biomaterials, particularly in the fields of orthopedics, cardiovascular, and regenerative medicine. Companies differentiate themselves through the development of high-performance materials with better biocompatibility, durability, and functionality. Additionally, many firms are incorporating sustainable and biodegradable solutions into their portfolios to align with consumer preferences for eco-friendly alternatives. Strategic partnerships, collaborations, and mergers and acquisitions are common strategies for expanding market reach and strengthening competitive positions. Regulatory compliance and the ability to navigate complex approval processes are also critical in maintaining a competitive edge. As the market grows, players are focusing on enhancing manufacturing capabilities, improving supply chain efficiencies, and offering customized biomaterial solutions to cater to the specific needs of healthcare providers and patients. This competitive environment fosters continuous innovation and drives the growth of the biomaterials market in North America.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The North American biomaterials market exhibits moderate to high concentration, with a few dominant players leading the industry, particularly in sectors like orthopedics, cardiovascular, and tissue engineering. However, the market is also characterized by a large number of small to mid-sized companies, especially in the fields of natural and biodegradable biomaterials, fostering a competitive and diverse landscape. The industry is driven by continuous innovation, with companies focusing on developing advanced materials that offer improved biocompatibility, durability, and functionality. As demand for personalized and regenerative medical solutions rises, there is a growing emphasis on custom-designed biomaterials tailored to specific patient needs. Market characteristics also include a strong reliance on research and development, with firms investing heavily in new material technologies, such as smart biomaterials and sustainable alternatives. Regulatory standards and a complex approval process are inherent challenges, but they also ensure high-quality products, enhancing the market’s credibility and driving long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North American biomaterials market is expected to experience sustained growth, driven by rising demand for advanced medical devices and implants.

- The increasing adoption of biodegradable and sustainable biomaterials will play a key role in shaping the market’s future.

- Advancements in regenerative medicine and tissue engineering will expand the application of biomaterials in treating complex medical conditions.

- The demand for personalized biomaterials, customized for individual patient needs, is expected to grow significantly.

- Smart biomaterials, capable of responding to environmental stimuli, will see increased adoption in drug delivery and wound healing applications.

- Ongoing investments in research and development will lead to continuous innovation in biomaterial technologies and applications.

- The aging population in North America will further drive demand for biomaterials in orthopedic and cardiovascular applications.

- Regulatory advancements and evolving standards will continue to shape the development and approval of new biomaterials.

- The market will see increased collaboration between medical device manufacturers and biomaterial suppliers to meet healthcare demands.

- The growing trend toward sustainability and eco-friendly solutions will fuel the expansion of natural and renewable biomaterials in various industries.