Market Overview

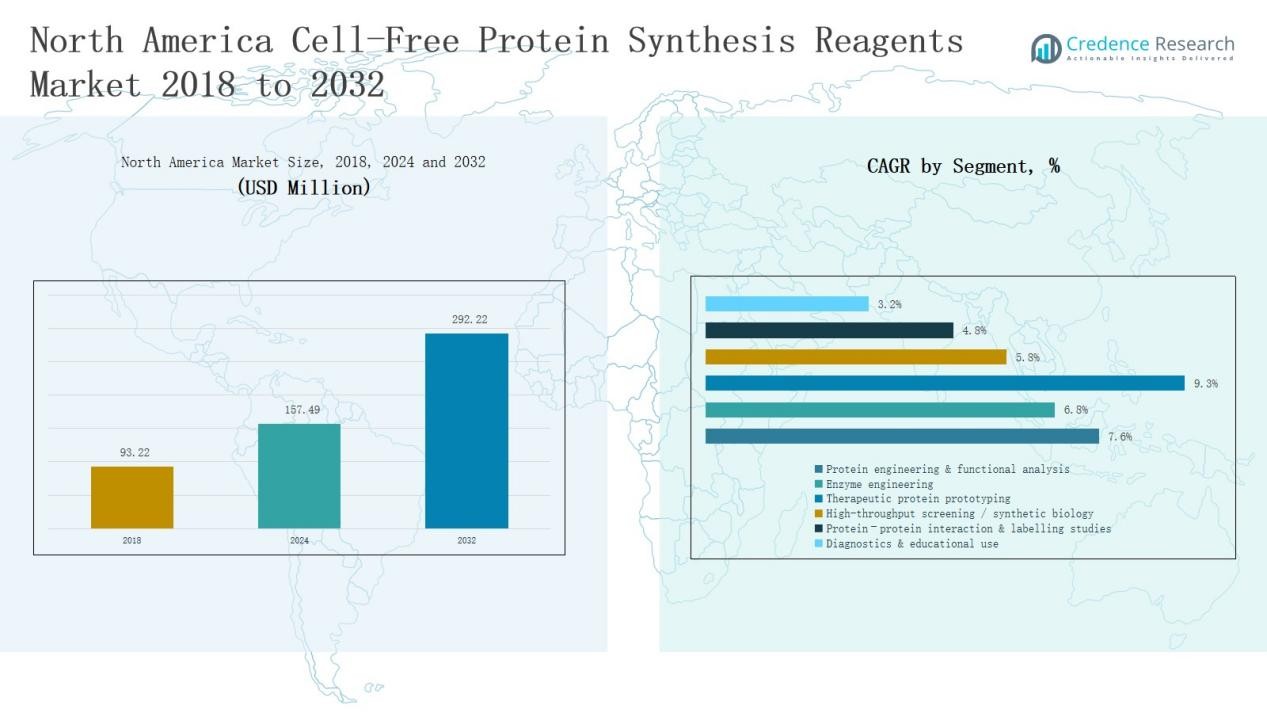

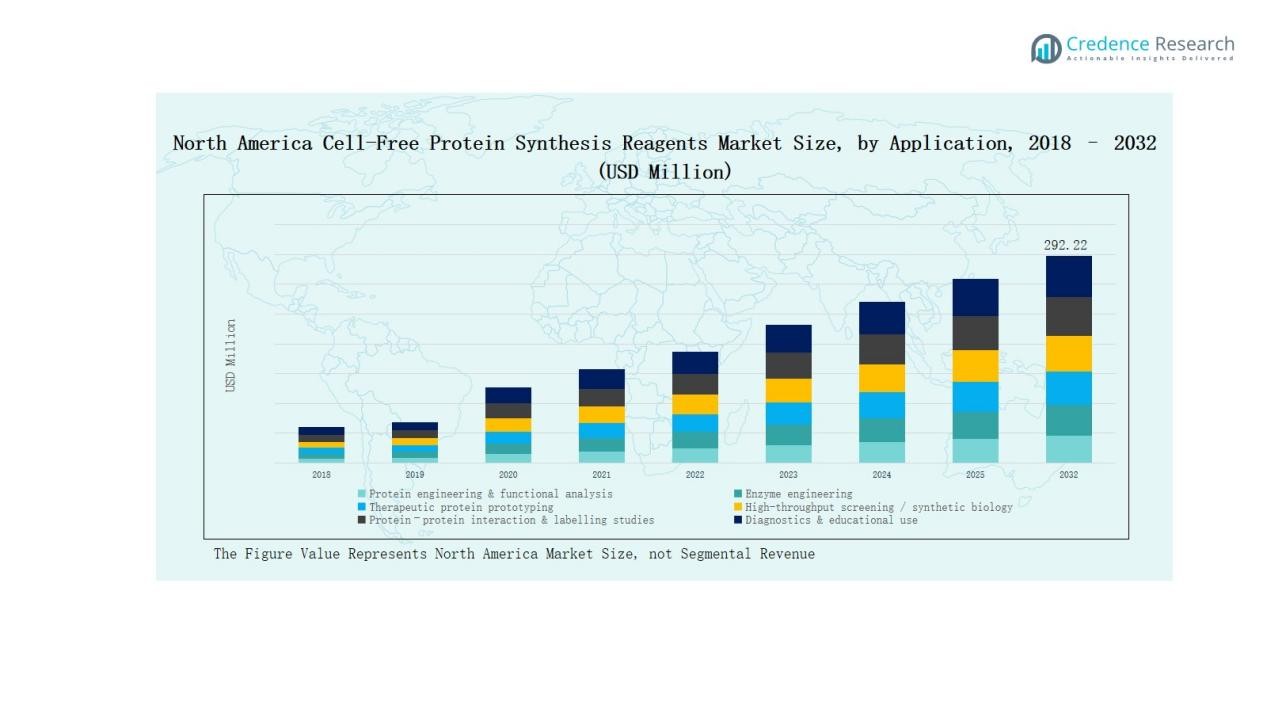

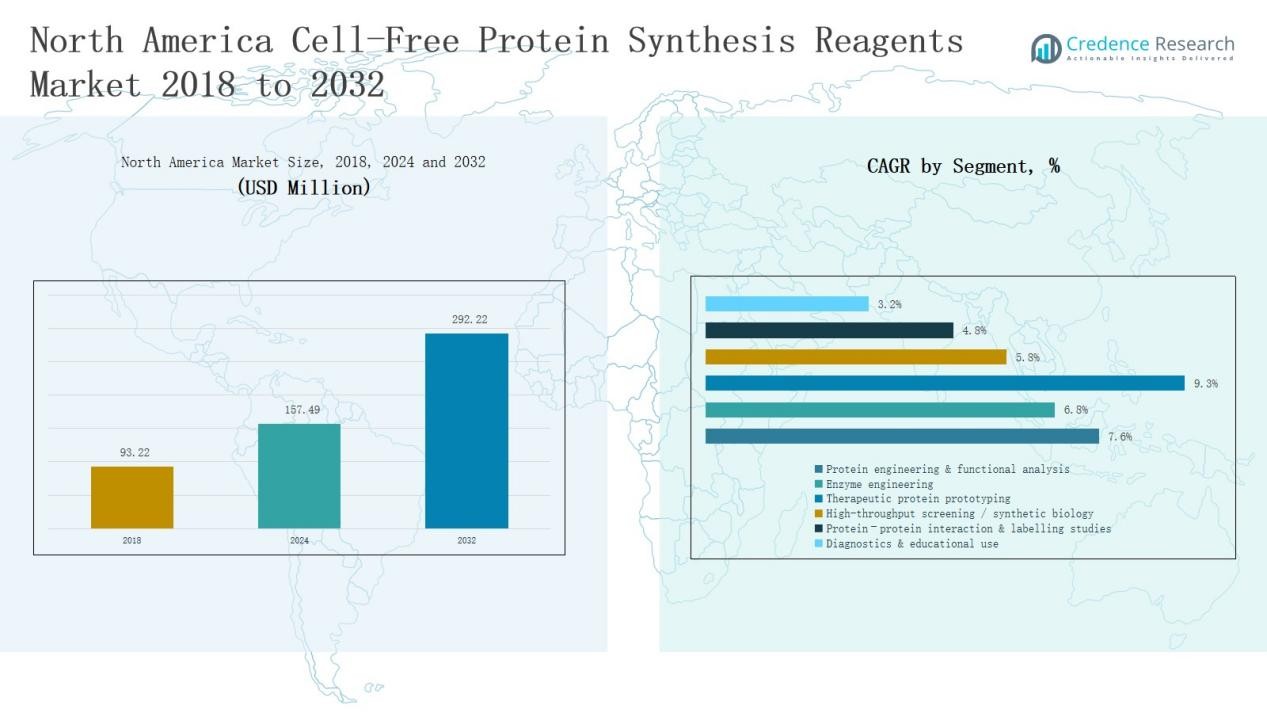

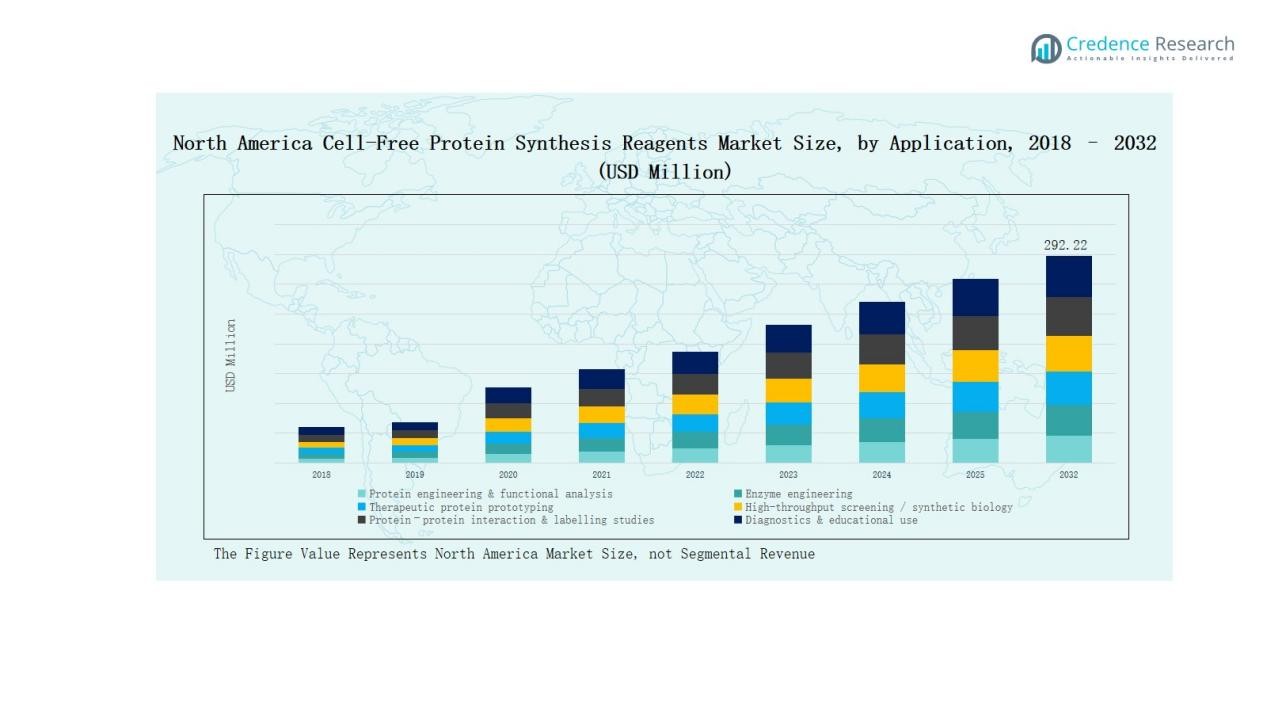

North America Cell-Free Protein Synthesis Reagents Market size was valued at USD 93.22 million in 2018 to USD 157.49 million in 2024 and is anticipated to reach USD 292.22 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Cell-Free Protein Synthesis Reagents Market Size 2024 |

USD 157.49 Million |

| North America Cell-Free Protein Synthesis Reagents Market, CAGR |

7.5% |

| North America Cell-Free Protein Synthesis Reagents Market Size 2032 |

USD 292.22 Million |

The North America Cell-Free Protein Synthesis Reagents Market is driven by established players such as Thermo Fisher Scientific, Promega Corporation, New England Biolabs, Takara Bio, and Moderna Therapeutics, along with emerging innovators including Creative Biolabs, Sutro Biopharma, Arbor Biosciences, GeneCopoeia, BioCentury, Labscoop, and Tierra Biosciences. These companies compete through product diversification, partnerships, and investments in scalable, high-throughput reagent systems. The United States leads the regional market with a commanding 68% share in 2024, supported by advanced biopharmaceutical R&D infrastructure and strong demand for protein engineering solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Cell-Free Protein Synthesis Reagents Market grew from USD 93.22 million in 2018 to USD 157.49 million in 2024 and is projected to reach USD 292.22 million by 2032 at a CAGR of 7.5%.

- Leading companies include Thermo Fisher Scientific, Promega Corporation, New England Biolabs, Takara Bio, and Moderna Therapeutics, alongside innovators such as Creative Biolabs, Sutro Biopharma, Arbor Biosciences, GeneCopoeia, BioCentury, Labscoop, and Tierra Biosciences.

- By product type, cell extracts and lysates dominate with 38% share in 2024, followed by transcription–translation mixes (22%), amino acids and nucleotides (14%), enzymes and polymerases (11%), kits (9%), and accessories (6%).

- By method, extract-based systems lead with 72% share, while reconstituted PURE systems account for 28%, growing in adoption for synthetic biology and structural studies requiring high-purity protein synthesis.

- The United States leads regionally with 68% share in 2024, followed by Canada at 20% and Mexico at 12%, reflecting diverse growth drivers across biopharma R&D, academic research, and diagnostics.

Market Segment Insights

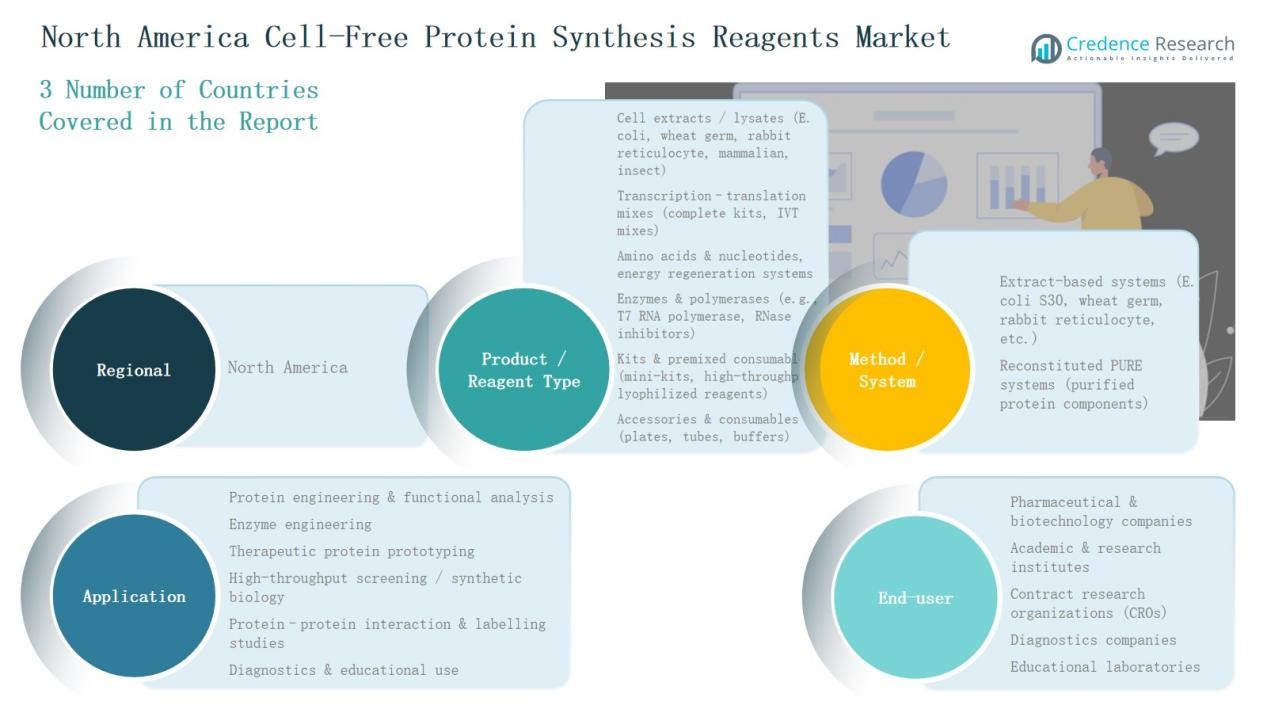

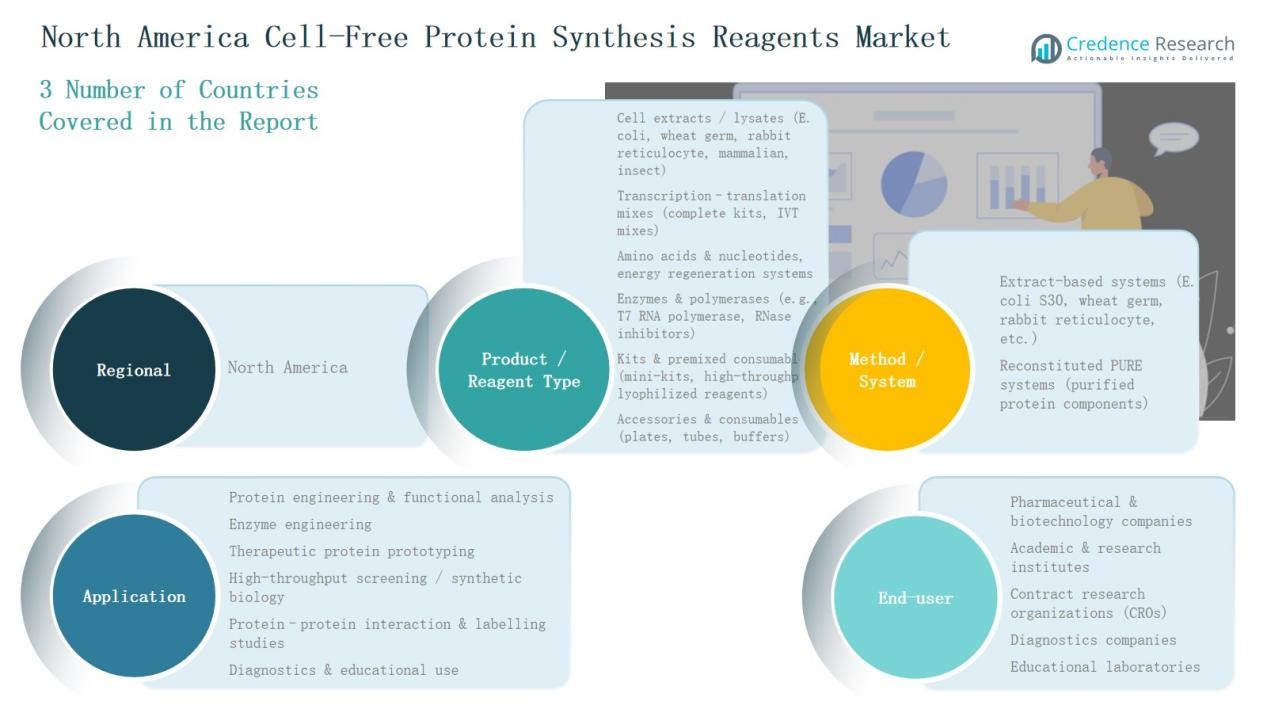

By Product / Reagent Type

Cell extracts and lysates dominate the North America market with 38% share in 2024, supported by their affordability and efficiency in recombinant protein production. E. coli and wheat germ extracts remain the most used due to strong compatibility across applications. Transcription–translation mixes hold 22% share, driven by demand for complete IVT kits. Other segments, including amino acids and nucleotides (14%), enzymes and polymerases (11%), kits (9%), and accessories (6%) show steady growth.

- For instance, Promega has long offered an E. coli S30 Extract System for Circular DNA, which facilitates in vitro transcription and translation of genes from circular plasmid or lambda vectors.

By Method / System

Extract-based systems lead the North America market with 72% share, reflecting their scalability and ability to deliver high yields across protein applications. E. coli S30, wheat germ, and rabbit reticulocyte extracts remain the preferred systems for research and industrial use. Reconstituted PURE systems hold 28% share, valued in synthetic biology and structural studies where high-purity synthesis and precise control are essential. Their adoption continues to rise with advancements in protein engineering techniques.

By Application

Protein engineering and functional analysis dominate with 30% share, supported by growing investment in protein design and drug discovery. Enzyme engineering follows at 18%, as biotechnology firms focus on optimizing industrial enzymes. Therapeutic protein prototyping captures 16% share, driven by pharma’s reliance on rapid antibody and biologic development. High-throughput screening holds 14% share, supported by automation. Protein–protein interaction studies account for 12%, while diagnostics and educational use together represent 10% of the market.

- For instance, Bristol Myers Squibb expanded its biologics pipeline by leveraging high-throughput protein screening technologies to accelerate antibody candidate selection in immunology and oncology programs.

Key Growth Drivers

Expanding Biopharmaceutical R&D

The rapid expansion of biopharmaceutical research is a major driver for the North America cell-free protein synthesis reagents market. Pharmaceutical and biotechnology companies increasingly adopt cell-free systems to accelerate drug discovery and therapeutic protein prototyping. These systems reduce development timelines and support the design of antibodies, vaccines, and biologics. High research funding across the United States, combined with advanced laboratory infrastructure, strengthens adoption. This demand aligns with growing emphasis on precision medicine and targeted biologics.

- For instance, GenScript launched a commercial cell-free protein synthesis kit optimized for rapid prototyping of therapeutic proteins, supporting vaccine and antibody development.

Rising Need for High-Throughput Screening

High-throughput screening is gaining prominence across pharmaceutical and academic research settings, boosting demand for cell-free protein synthesis reagents. Laboratories value these systems for their ability to quickly test large protein libraries without relying on cell culture. North America’s strong automation adoption further supports growth in high-throughput applications. Increasing use of cell-free systems in synthetic biology and functional genomics enhances productivity. This demand is also reinforced by collaborations between academia and industry for accelerated drug discovery pipelines.

- For instance, New England Biolabs (NEB) reported that its PURExpress cell-free system was increasingly being adopted by academic labs for high-throughput enzyme characterization, supporting faster synthetic biology workflows.

Advantages of Flexible and Scalable Systems

Flexibility and scalability of cell-free protein synthesis platforms are key drivers in this market. Researchers favor these reagents for their ability to produce proteins difficult to express in traditional systems, including toxic or unstable proteins. Scalable formats allow seamless transition from small-scale research to large-scale production. The North American market benefits from established supply chains and strong presence of leading reagent providers. Growing reliance on these systems reduces bottlenecks in drug development and industrial enzyme engineering.

Key Trends & Opportunities

Growth of Synthetic Biology Applications

Synthetic biology represents a major opportunity, with cell-free protein synthesis reagents enabling faster prototyping and gene circuit testing. In North America, significant investments in synthetic biology startups and research consortia are accelerating adoption. The ability to engineer complex biological pathways outside living cells supports innovation in metabolic engineering, vaccine development, and biomaterials. This trend is further strengthened by advances in automation and robotics that streamline high-throughput workflows in research and industry.

- For instance, the U.S. Department of Energy’s Bioenergy Technologies Office committed over $178 million to synthetic biology and biomanufacturing R&D projects, including consortia using cell-free systems to advance sustainable biofuels and biomaterials.

Increasing Educational and Diagnostic Use

The adoption of cell-free protein synthesis reagents in educational laboratories and diagnostics is creating new growth avenues. Universities and research institutes in North America integrate these reagents into teaching laboratories to train students in molecular biology and biochemistry. Diagnostic firms use them in rapid assays for protein interactions and labeling studies. Affordable mini-kits and lyophilized formats expand accessibility. This trend not only builds technical capacity but also broadens future adoption in commercial and clinical applications.

- For instance, Takara Bio offers certain lyophilized reagents and master mixes, including those for PCR and qPCR assays, that enable use without cold-chain logistics.

Key Challenges

High Cost of Reagents and Kits

The high cost of reagents and complete kits remains a major challenge for market expansion in North America. Many academic and smaller research institutes face budget constraints that limit large-scale adoption. While cell-free systems save time compared to traditional methods, the upfront investment in specialized kits can be restrictive. Cost sensitivity particularly impacts widespread use in education and smaller diagnostics companies, creating reliance on subsidies or funding programs to sustain growth.

Limited Protein Folding and Post-Translational Modifications

A persistent challenge lies in the limited ability of cell-free systems to replicate complex post-translational modifications and correct protein folding. Many therapeutic proteins require glycosylation and other structural modifications that are difficult to achieve outside cellular environments. This limits their application in certain biopharmaceutical pipelines. Although technological advancements are improving yields, the incomplete mimicry of cellular conditions continues to restrict broader use of these reagents for highly complex protein products.

Intense Market Competition and Supply Constraints

The North America cell-free protein synthesis reagents market faces growing competition among established players and emerging startups. Intense competition exerts pricing pressure, especially in standardized kits and consumables. Furthermore, supply chain disruptions for specialized enzymes, nucleotides, and high-purity reagents can hinder consistent delivery. Dependence on imports for some raw materials increases vulnerability to shortages. These factors pose operational challenges for manufacturers, limiting scalability and creating uncertainty in research timelines for end users.

Regional Analysis

United States

The United States leads the North America Cell-Free Protein Synthesis Reagents Market with 68% share in 2024. Strong biopharmaceutical R&D investments, advanced research infrastructure, and robust funding from public and private sources fuel growth. The country benefits from the presence of major players and academic institutes driving protein engineering and therapeutic prototyping. Demand is further supported by expanding synthetic biology applications and large-scale adoption of high-throughput screening. It continues to act as the primary hub for product innovation, clinical research, and commercial expansion across North America.

Canada

Canada accounts for 20% share in 2024, supported by its growing biotechnology sector and government-backed research programs. The country has invested in life sciences clusters that drive adoption of cell-free protein synthesis reagents across academic institutes and pharmaceutical companies. Canadian universities and innovation hubs use these systems for protein interaction studies and enzyme engineering. The market is also benefitting from collaborations with U.S.-based firms that expand access to advanced kits and consumables. It shows consistent progress in integrating cell-free technologies for research and commercial applications.

Mexico

Mexico holds 12% share in 2024, reflecting its emerging role in the regional market. Growing demand from academic institutions and diagnostic laboratories drives adoption of cell-free reagents. The government’s focus on expanding healthcare and biotechnology infrastructure supports steady market growth. Pharmaceutical outsourcing and partnerships with North American firms help increase access to advanced systems. It also benefits from rising training programs that incorporate cell-free platforms in education. Mexico continues to strengthen its position as an important contributor to regional demand.

Market Segmentations:

By Product / Reagent Type

- Cell extracts / lysates (E. coli, wheat germ, rabbit reticulocyte, mammalian, insect)

- Transcription–translation mixes (complete kits, IVT mixes)

- Amino acids & nucleotides, energy regeneration systems

- Enzymes & polymerases (T7 RNA polymerase, RNase inhibitors)

- Kits & premixed consumables (mini-kits, high-throughput, lyophilized reagents

- Accessories & consumables (plates, tubes, buffers)

By Method / System

- Extract-based systems (E. coli S30, wheat germ, rabbit reticulocyte, etc.)

- Reconstituted PURE systems (purified protein components)

By Application

- Protein engineering & functional analysis

- Enzyme engineering

- Therapeutic protein prototyping

- High-throughput screening / synthetic biology

- Protein–protein interaction & labelling studies

- Diagnostics & educational use

By End-User

- Pharmaceutical & biotechnology companies

- Academic & research institutes

- Contract research organizations (CROs)

- Diagnostics companies

- Educational laboratories

By Region

Competitive Landscape

The North America Cell-Free Protein Synthesis Reagents Market is highly competitive, shaped by the presence of global leaders and regional innovators. Companies such as Thermo Fisher Scientific, Promega Corporation, New England Biolabs, and Takara Bio maintain strong positions through extensive product portfolios and continuous R&D investments. Their strategies focus on high-throughput kits, advanced enzymes, and scalable solutions tailored for pharmaceutical and academic research. Emerging players like Tierra Biosciences and Creative Biolabs expand competition with specialized synthetic biology and protein prototyping services. Partnerships, collaborations, and licensing agreements remain central strategies to broaden access and accelerate innovation. The market is also influenced by startups offering cost-effective solutions for diagnostics and education, intensifying competition across diverse customer segments. It is characterized by a balance of established suppliers and niche firms, driving innovation while creating pricing pressure. This dynamic environment ensures steady advancements and broader adoption of cell-free technologies across North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Promega Corporation

- New England Biolabs (NEB)

- GeneCopoeia, Inc.

- Creative Biolabs

- Sutro Biopharma

- Takara Bio

- BioCentury Inc.

- Arbor Biosciences

- Moderna Therapeutics

- Labscoop

- Tierra Biosciences

Recent Developments

l In June 2024, Daicel Arbor Biosciences introduced enhanced myTXTL Pro Kit and myTXTL Antibody/DS Kit to advance cell-free protein expression. These launches aim to accelerate antibody discovery and protein engineering by offering faster and more versatile solutions for high-throughput research workflows.

l In July 2024, LenioBio signed a supply agreement with Touchlight to integrate doggybone DNA (dbDNA™), supporting rapid vaccine development under CEPI’s 100 Days Mission.

l In 2025, Thermo Fisher Scientific launched a new optimized cell-free expression kit in North America. This kit reportedly boosts protein yield by around 20%, improving efficiency for various biopharmaceutical applications.

l In January 2025, Sutro Biopharma and Boehringer Ingelheim BioXcellence established a commercial-scale collaboration leveraging Sutro’s modular cell-free protein synthesis platform.

Report Coverage

The research report offers an in-depth analysis based on Product / Reagent Type, Method / System, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase with rising investment in biopharmaceutical research and therapeutic protein development.

- Synthetic biology applications will drive wider adoption across academic and industrial laboratories.

- High-throughput screening will expand, supported by automation and robotics integration.

- Diagnostic firms will adopt cell-free platforms for rapid protein analysis and assay development.

- Educational institutions will integrate cost-effective kits to strengthen training in molecular biology.

- Advancements in PURE systems will improve protein purity and post-translational modification capabilities.

- Strategic collaborations between biotechnology firms and academic centers will accelerate innovation.

- Market competition will intensify as startups introduce affordable and specialized reagents.

- Supply chain resilience will become a focus to address enzyme and nucleotide availability.

- North America will remain the global hub for innovation, supported by strong funding and infrastructure.