Market Overview

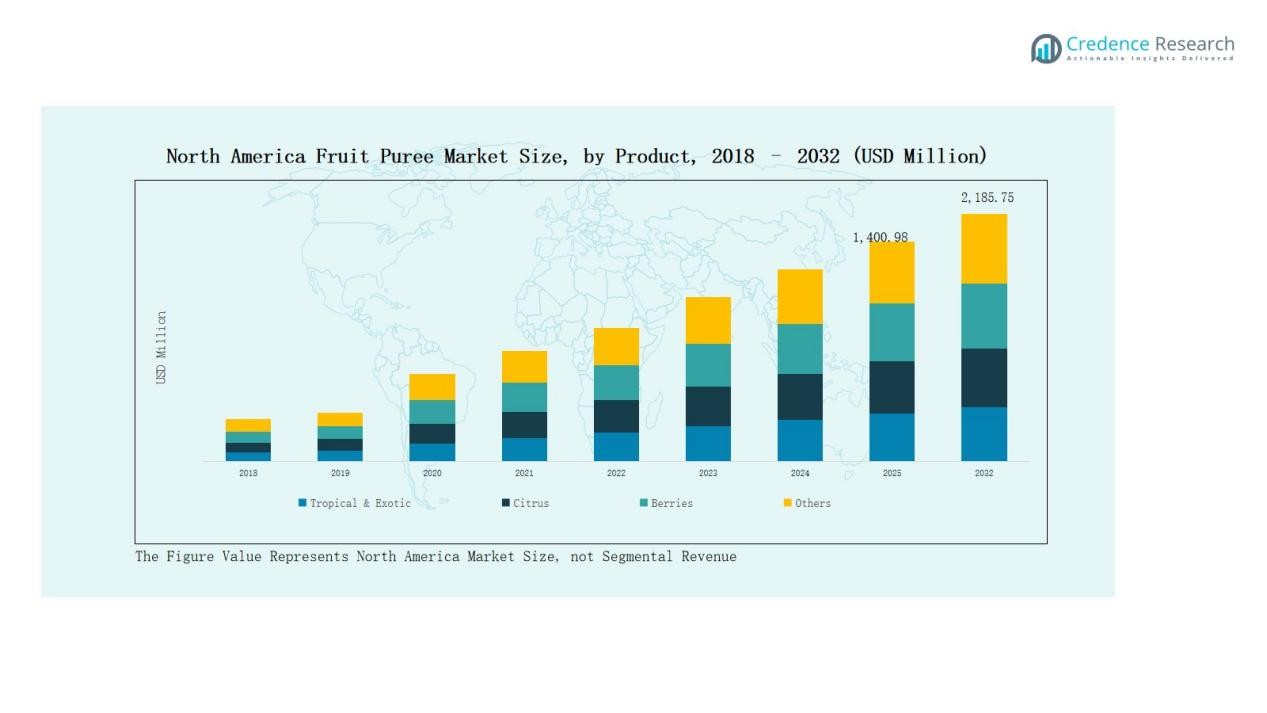

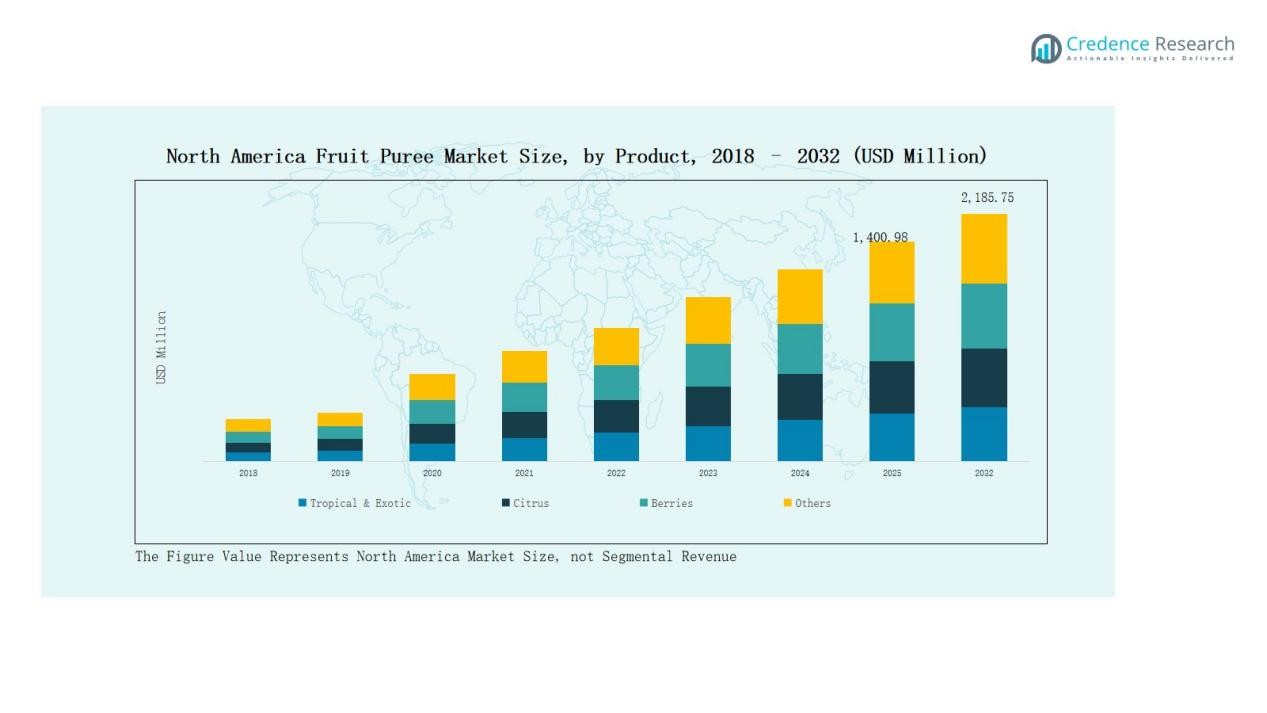

North America Fruit Puree Market size was valued at USD 1,144.80 million in 2018, reaching USD 1,330.43 million in 2024, and is anticipated to reach USD 2,185.75 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Fruit Puree Market Size 2024 |

USD 1,330.43 Million |

| North America Fruit Puree Market, CAGR |

6.6% |

| North America Fruit Puree Market Size 2032 |

USD 2,185.75 Million |

The North America Fruit Puree Market is shaped by global leaders and regional specialists focusing on innovation, sustainability, and diversified product portfolios. Key players include Tree Top Inc., Ingredion Incorporated (Kerr Concentrates), AGRANA Beteiligungs-AG, Döhler Group SE, Dennick FruitSource LLC, Nestlé S.A., Danone S.A., Uren Food Group Limited, Milne Fruit Products Inc., Fenix S.A., Kiril Mischeff, Aseptic Fruit Puree, B&G Foods, Tropicana Products, and Ceres Solutions. These companies strengthen their positions through clean-label, organic, and fortified puree offerings while leveraging strategic partnerships with food and beverage manufacturers. The U.S. leads the regional market with a 61% share in 2024, supported by advanced processing facilities, strong retail infrastructure, and high consumer demand for natural fruit-based products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Fruit Puree Market grew from USD 1,144.80 million in 2018 to USD 1,330.43 million in 2024 and will reach USD 2,185.75 million by 2032.

- Tropical & Exotic fruits led with 39% share in 2024, driven by strong demand for mango, papaya, and guava in beverages and infant food across the region.

- Beverages dominated applications with 42% share in 2024, supported by rising consumption of smoothies, juices, and fortified drinks among health-conscious consumers.

- The U.S. led the market with 61% share in 2024, benefiting from advanced processing, retail infrastructure, and high adoption of clean-label fruit-based foods.

- Key players such as Tree Top Inc., AGRANA, Döhler, Nestlé, and Danone focus on organic, fortified offerings and strategic partnerships to strengthen market presence.

Market Segment Insights

Market Segment Insights

By Product

Tropical & Exotic fruits dominated the North America Fruit Puree Market with a 39% share in 2024. Mango, papaya, and guava purees are widely favored in beverages, smoothies, and baby food due to their rich flavor and nutritional value. Rising imports and consumer interest in exotic fruit blends drive strong adoption across the U.S. and Canada. Berries followed closely with significant demand from the bakery and snack industry, while citrus and other categories maintain steady but smaller shares, supported by flavor innovation and seasonal consumption trends.

For instance, SVZ International introduced citrus-based puree ingredients in North America to support seasonal innovation in juices and plant-based food products.

By Application

Beverages accounted for the largest share of 42% in 2024 within the North America Fruit Puree Market. High consumption of smoothies, juices, and fortified drinks supports this segment’s dominance. Consumer preference for natural flavoring and reduced sugar options further accelerates demand. Infant food represented another strong segment, driven by parental demand for safe, nutritious, and convenient puree-based products. Bakery and snacks also gained traction, with purees used for flavor enhancement and sugar reduction, while other niche applications continued to contribute steadily to overall market growth.

For instance, Tropicana launched its Essentials Fruit & Veggie Blends in India, expanding its fortified juice range with fruit puree-based options aimed at health-conscious consumers.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Health-Oriented Foods

The North America fruit puree market benefits from a rising focus on health and nutrition. Consumers increasingly favor natural, minimally processed ingredients, boosting demand for purees in smoothies, yogurts, and functional beverages. Purees serve as clean-label alternatives to artificial flavors, appealing to health-conscious and younger demographics. The shift toward plant-based diets also reinforces adoption in dairy alternatives and healthy snacks. This preference aligns with broader wellness trends, encouraging food manufacturers to innovate with fruit-based formulations and reinforcing steady growth in demand across the region.

For instance, Döhler expanded its U.S. portfolio with fruit puree concentrates for clean-label beverages, highlighting applications in smoothies and plant-based drinks.

Expansion of Infant Food and Convenience Products

The growing infant population and parents’ preference for safe, nutritious foods strongly support fruit puree demand. Purees are widely used in baby food formulations due to their easy digestibility and natural nutritional value. At the same time, convenience-driven consumers favor ready-to-use puree-based snacks, beverages, and meal kits. Increasing product launches in resealable pouches and single-serve formats highlight this trend. Retailers and brands emphasize convenience packaging and fortified variants, ensuring steady consumption growth across supermarkets, online channels, and specialty stores throughout North America.

For instance, Gerber, a subsidiary of Nestlé, introduced the “Plant-tastic” line of organic, plant-based foods, including fruit and veggie purees in single-serve pouches. These products were specifically designed to meet the growing demand from U.S. parents seeking plant-based and convenient baby food options

Growth in Bakery, Confectionery, and Beverage Applications

The bakery, confectionery, and beverage industries are major growth engines for fruit puree usage in North America. Purees offer natural sweetness, flavor, and color while reducing the need for added sugar. Growing consumer demand for artisanal bakery products, premium confectionery, and fruit-based beverages enhances market adoption. Manufacturers leverage purees to develop innovative product lines in alcoholic and non-alcoholic beverages. Rising investments in specialty coffee chains, smoothie bars, and craft beverage segments further expand the market footprint, making these applications critical for sustained long-term growth.

Key Trends & Opportunities

Rise of Clean-Label and Organic Purees

Clean-label and organic fruit purees are gaining traction as consumers prioritize transparency and sustainability. The U.S. and Canada show high adoption rates for organic-certified products, especially in premium baby food and beverage categories. Food processors actively source non-GMO and organic raw materials to address consumer concerns over additives and pesticides. This trend encourages producers to expand their organic offerings and align with eco-conscious packaging practices. Growing demand for traceability and environmentally responsible sourcing represents a key opportunity for brands to strengthen market presence.

For instance, Danone’s Happy Family Organics announced the launch of clear pouch fruit purees with transparent packaging to enhance traceability and clean-label assurance.

Innovation in Distribution and E-Commerce Channels

- commerce and direct-to-consumer platforms are reshaping fruit puree distribution in North America. Online grocery platforms, subscription services, and digital marketplaces offer wider access to puree-based baby food, beverages, and snacks. Consumers increasingly prefer doorstep delivery and the ability to compare products online, boosting sales through digital channels. This shift provides opportunities for niche and regional brands to compete alongside global players. Strategic collaborations with retailers and e-commerce platforms help companies expand product visibility, foster brand loyalty, and capture the growing demand from digitally active consumers.

For instance, Once Upon a Farm, co-founded by Jennifer Garner, announced a direct-to-consumer subscription service for its cold-pressed fruit and veggie purees, allowing customized delivery plans across the U.S. with free shipping on bulk orders.

Key Challenges

High Price Volatility of Raw Materials

Fruit puree production relies heavily on seasonal fruits, which face price fluctuations due to weather, pests, and supply disruptions. Unpredictable agricultural yields raise production costs and affect consistent supply. These price swings reduce profitability for manufacturers and create uncertainty in long-term contracts with buyers. Import dependence on tropical fruits adds further vulnerability to global market changes. Companies often face difficulty in balancing competitive pricing with maintaining quality standards, posing a significant challenge to sustained growth in the North American market.

Short Shelf Life and Storage Limitations

Despite advancements in aseptic packaging, fruit purees remain perishable and require careful storage and transportation. Improper handling can lead to spoilage, reducing product availability and increasing waste. This short shelf life creates challenges in distribution across long supply chains, particularly in cross-border trade within North America. Retailers and distributors must invest in cold chain infrastructure, which raises operational costs. Limited storage stability also restricts the ability of smaller producers to scale operations, making logistics and shelf management a persistent challenge in the industry.

Intense Competition from Alternative Ingredients

Fruit purees face growing competition from alternative sweeteners, concentrates, and artificial flavorings that offer longer shelf life and lower costs. Food and beverage companies often substitute purees with these alternatives to control production expenses. Additionally, plant-based extracts and syrups compete as functional ingredients in bakery and beverage sectors. This competitive landscape pressures puree producers to differentiate through quality, innovation, and value-added claims such as organic or fortified content. Without clear positioning, fruit puree manufacturers risk losing market share to more cost-effective substitutes.

Regional Analysis

U.S.

The U.S. leads the North America Fruit Puree Market with a 61% share in 2024. Strong demand for natural ingredients in beverages, infant food, and bakery segments drives market growth. Consumers favor clean-label and organic products, creating opportunities for domestic producers and international suppliers. The market benefits from advanced processing facilities and strong retail distribution networks. It also gains momentum from rising consumption of smoothies, juices, and fortified snacks. High innovation in product formulations strengthens adoption across multiple applications. It is expected to maintain dominance through ongoing investments in functional and convenient fruit-based products.

Canada

Canada accounts for 23% of the regional market share in 2024. Growing health awareness and demand for plant-based diets encourage wider adoption of fruit purees across beverages and baby food categories. The Canadian market is shaped by strong consumer preference for sustainable and organic products. Local producers emphasize eco-friendly packaging and traceable sourcing practices to meet consumer expectations. Expanding retail and e-commerce platforms increase product visibility and accessibility nationwide. It also benefits from rising imports of tropical and exotic fruits to diversify product offerings. Consistent demand across both urban and suburban populations supports steady long-term growth.

Mexico

Mexico holds a 16% share of the North America Fruit Puree Market in 2024. Its position is supported by abundant fruit cultivation, particularly mangoes, papayas, and berries, which are widely processed into purees. The market benefits from cost advantages in fruit production and export opportunities to the U.S. and Canada. Rising disposable incomes and urbanization contribute to growing domestic consumption of puree-based beverages and snacks. Local producers play a key role in supplying both regional and global markets. It faces challenges in logistics and cold chain infrastructure but continues to expand through strong agricultural output. Increasing focus on value-added processing enhances competitiveness and growth prospects.

Market Segmentations:

Market Segmentations:

By Product

- Tropical & Exotic

- Citrus

- Berries

- Others

By Application

- Beverages

- Bakery & Snacks

- Infant Food

- Others

By Country

Competitive Landscape

The North America Fruit Puree Market is highly competitive, shaped by multinational corporations, regional producers, and specialized suppliers. Leading companies such as Tree Top Inc., Ingredion Incorporated (Kerr Concentrates), AGRANA Beteiligungs-AG, Döhler Group SE, and Nestlé S.A. hold significant positions through broad product portfolios and established distribution networks. These players emphasize innovation in organic, clean-label, and fortified fruit purees to meet evolving consumer preferences. Regional companies like Milne Fruit Products Inc. and Dennick FruitSource LLC strengthen competition by offering niche and value-added products tailored to local demand. Strategic partnerships with beverage, bakery, and infant food manufacturers are common, enabling companies to expand product reach and secure long-term supply contracts. Investments in advanced processing technologies, sustainable sourcing, and eco-friendly packaging remain critical competitive strategies. The market also experiences pressure from private labels and smaller producers, requiring established brands to differentiate through quality assurance, branding, and continuous product innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Tree Top Inc.

- Ingredion Incorporated (Kerr Concentrates)

- AGRANA Beteiligungs-AG

- Döhler Group SE

- Dennick FruitSource LLC

- Nestlé S.A.

- Danone S.A.

- Uren Food Group Limited

- Milne Fruit Products Inc.

- Fenix S.A.

- Kiril Mischeff

- Aseptic Fruit Puree

- B&G Foods

- Tropicana Products

- Ceres Solutions

Recent Developments

- In February 2025, The Perfect Purée of Napa Valley launched two new fruit purees, Camu and Soursop, in the North America market.

- In November 2024, Oregon Fruit Products introduced a new Sicilian lemon puree as a limited release product for Fall 2024. This citrus puree is aimed at seasonal brewing applications and beverage innovations in the region.

- In April 2025, Döhler North America completed the acquisition of Premier Juices to expand its portfolio of natural fruit-based purees and concentrates.

- In July 2025, Abaca introduced a new range of premium fruit purées tailored for cocktail applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and clean-label purees will continue to strengthen across key applications.

- Infant food will remain a core growth driver supported by rising health awareness among parents.

- Beverages will see higher fruit puree integration as consumers shift toward natural formulations.

- Bakery and confectionery sectors will adopt purees for flavor innovation and sugar reduction.

- E-commerce platforms will expand market access and visibility for regional and niche producers.

- Sustainable sourcing and eco-friendly packaging will become critical factors in brand positioning.

- Tropical and exotic fruit purees will gain traction through imports and diversified product offerings.

- Foodservice channels such as cafes and smoothie bars will increase puree utilization in menus.

- Technological advancements in processing will improve shelf life and distribution efficiency.

- Competition will intensify, with companies focusing on product differentiation and strategic partnerships.

Market Segment Insights

Market Segment Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: