Market Overview

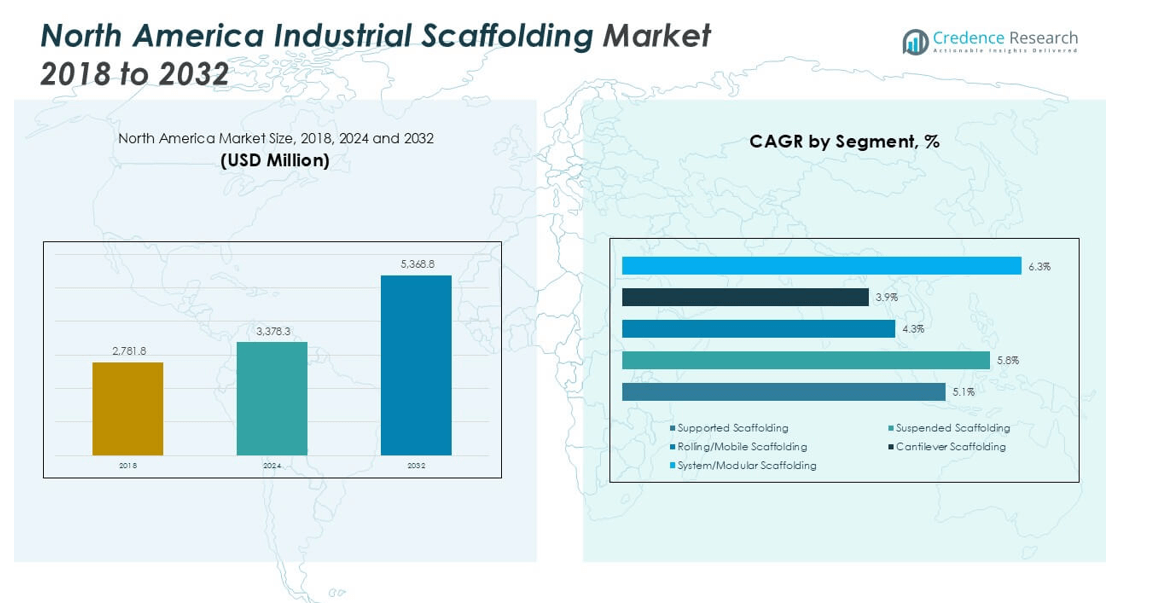

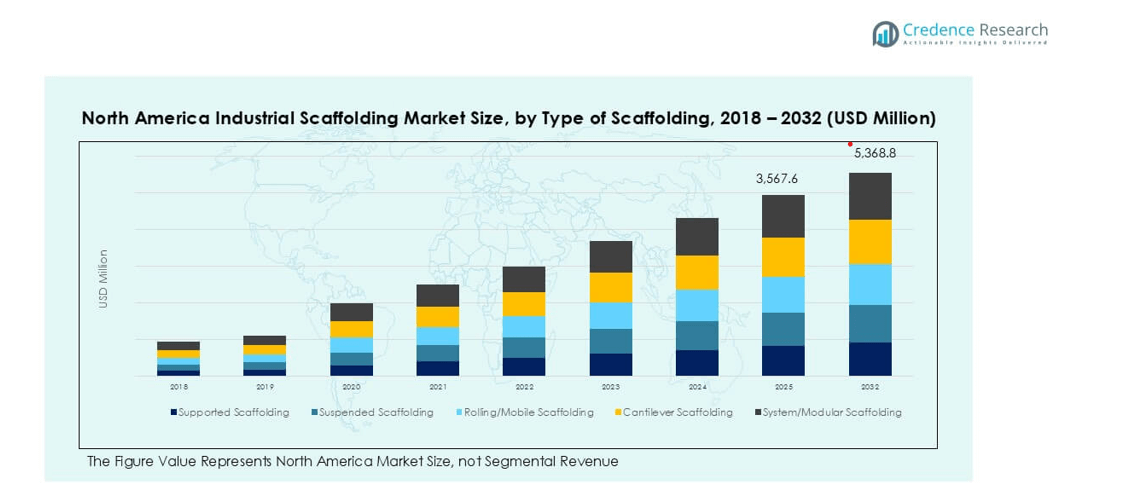

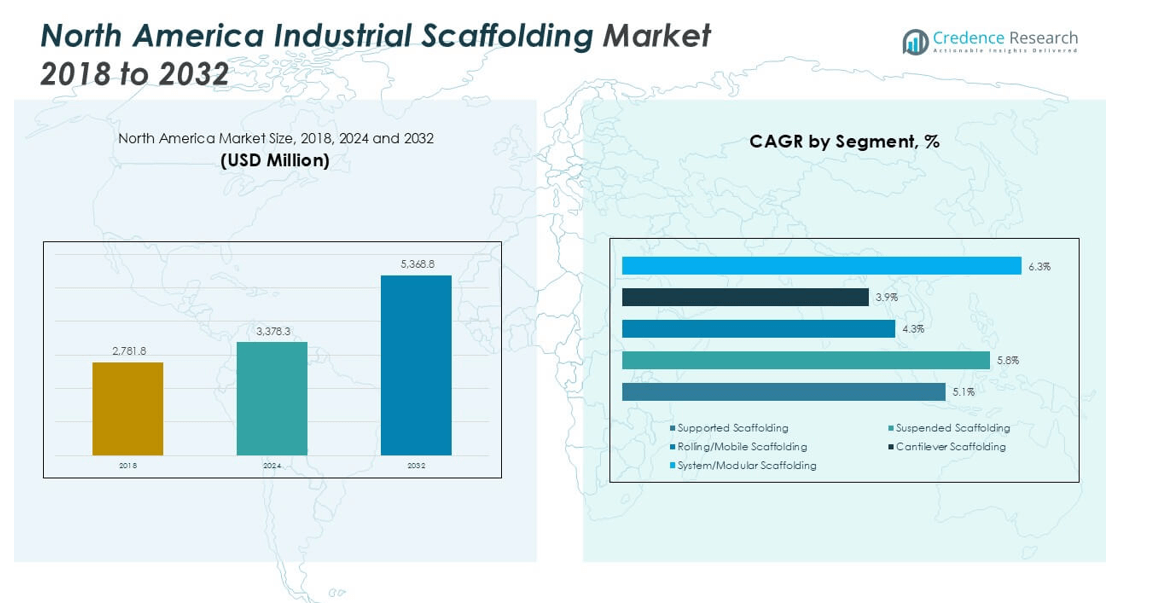

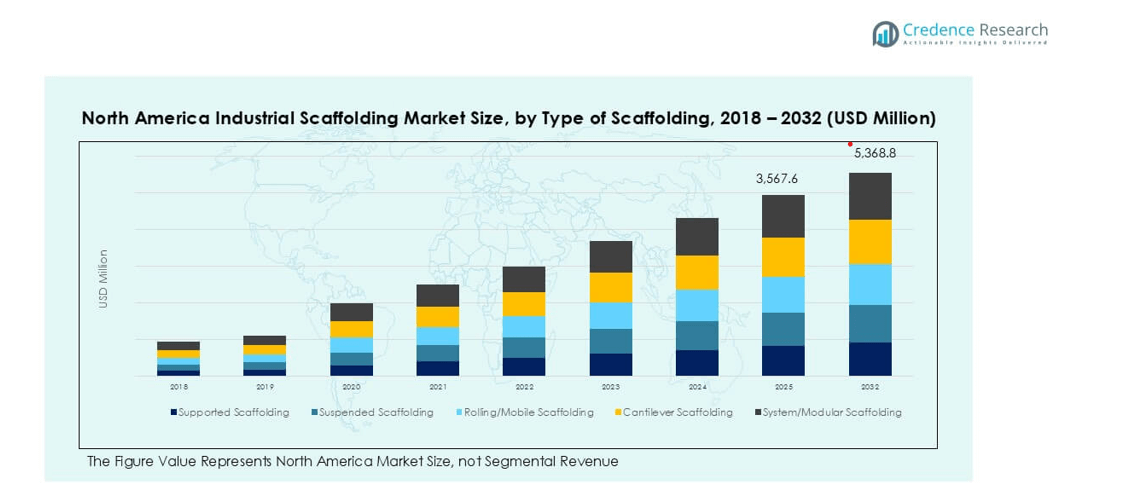

North America Industrial Scaffolding market size was valued at USD 2,781.84 million in 2018, reached USD 3,378.30 million in 2024, and is anticipated to reach USD 5,368.83 million by 2032, at a CAGR of 5.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Scaffolding Market Size 2024 |

USD 3,378.30 million |

| North America Industrial Scaffolding Market, CAGR |

5.96% |

| North America Industrial Scaffolding Market Size 2032 |

USD 5,368.83 million |

The North America industrial scaffolding market is led by major players including BrandSafway, SafwayAtlantic, Universal Manufacturing Corp, Granite Industries, Bil-Jax (Haulotte Group), Bee Access Products, Doka USA Ltd., Associated Scaffolding Co., Skyway Canada Ltd., AGF Access Group Inc., and Brock Canada Industrial Ltd. These companies dominate through extensive rental networks, modular scaffolding systems, and turnkey project support. The U.S. leads the market with over 70% share, driven by large-scale infrastructure upgrades, refinery maintenance, and power plant projects. Canada holds about 20% of regional demand, supported by oil sands, mining, and hydro projects, while Mexico accounts for nearly 10%, fueled by refinery modernization and manufacturing expansion.

Market Insights

- North America Industrial Scaffolding market was valued at USD 3,378.30 million in 2024 and is projected to reach USD 5,368.83 million by 2032, growing at a CAGR of 5.96%.

- Rising demand from oil and gas, power generation, and chemical sectors drives the adoption of supported scaffolding, which holds over 50% share.

- Key trends include the shift toward modular scaffolding systems, use of lightweight aluminum materials, and integration of digital planning tools to improve efficiency and safety compliance.

- Leading players such as BrandSafway, SafwayAtlantic, Universal Manufacturing, and Doka USA Ltd. focus on rental services, turnkey solutions, and strategic partnerships to strengthen market presence across industrial sectors.

- The U.S. leads with more than 70% market share, followed by Canada at around 20% and Mexico at 10%, with steel scaffolding dominating over 60% share across applications due to its durability and cost-effectiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

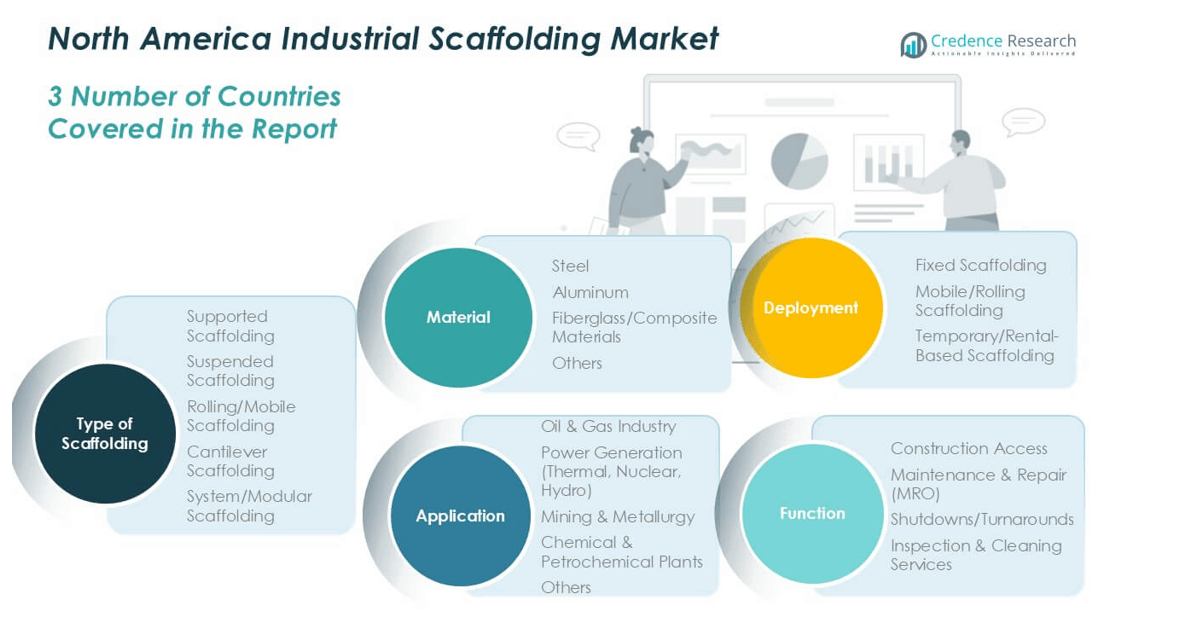

By Type of Scaffolding

Supported scaffolding dominates the North America industrial scaffolding market, accounting for over 50% share. Its stability, high load-bearing capacity, and suitability for complex construction projects drive adoption. The segment benefits from strong demand in large-scale infrastructure development, refinery maintenance, and plant turnarounds. Rolling and system scaffolding are gaining traction due to their modular design and ease of assembly, reducing downtime for industrial operators. Suspended scaffolding serves niche applications in high-rise maintenance and façade work. Cantilever scaffolding remains a smaller segment, used primarily in restricted workspaces where ground support is limited.

- For instance, a Layher Allround steel ledger in a 2.57-meter bay can handle significantly higher loads than 4.1 kN/m, depending on the specific load class. According to manufacturer specifications, the Layher Allround system has a high load-bearing capacity, with some components exceeding 6.0 kN/m².

By Application

The oil and gas industry leads the market, capturing nearly 40% of total demand. Extensive use of scaffolding in offshore platforms, refinery shutdowns, and pipeline construction supports this dominance. Power generation, including thermal, nuclear, and hydro facilities, follows closely as utilities invest in upgrades and maintenance. Mining and metallurgy applications contribute steadily, driven by expansion projects in the U.S. and Canada. Chemical and petrochemical plants also represent a significant share, relying on scaffolding for plant inspections and equipment installation. The “others” category includes infrastructure, shipbuilding, and industrial manufacturing, which collectively provide consistent growth opportunities.

- For example, Layher Allround Shoring/Propping towers of 6 m height sustain loads through combined use of reinforced base jacks, achieving capacity suitable for large industrial repair jobs.

By Material

Steel scaffolding holds the largest market share, exceeding 60%, due to its strength, reusability, and ability to handle heavy-duty applications. The material’s durability and cost-effectiveness make it the preferred choice for long-term industrial projects. Aluminum scaffolding is gaining popularity for its lightweight design, enhancing portability and reducing labor fatigue. Fiberglass and composite scaffolding see rising demand in industries requiring non-conductive and corrosion-resistant solutions, such as chemical plants and power facilities. Other materials, though niche, cater to specialized applications where project-specific requirements dictate alternative solutions. The shift toward safer, high-performance materials supports growth across all categories.

Market Overview

Infrastructure Expansion and Industrial Maintenance

Rising investments in infrastructure development and maintenance activities fuel demand for scaffolding in North America. Government spending on bridges, highways, and commercial construction boosts supported and modular scaffolding usage. Regular maintenance shutdowns in refineries, chemical plants, and power facilities require temporary access structures. These projects drive steady procurement of scaffolding systems with higher load-bearing capacity. Industrial operators favor reusable steel scaffolding to minimize operational costs. The growing focus on safety compliance across industries also supports demand for standardized, durable, and OSHA-compliant scaffolding solutions across construction and industrial applications.

- For example, Superior Scaffold logs 45,000-50,000 man-hours annually on industrial scaffold jobs including refinery and chemical plant maintenance.

Oil & Gas and Power Sector Growth

The oil and gas industry remains a major driver, with consistent need for scaffolding during refinery turnarounds, offshore platform maintenance, and pipeline construction. Expanding LNG terminals and shale gas exploration projects create sustained demand for modular and supported scaffolding. Similarly, the power generation sector invests in new plants and upgrades of thermal, nuclear, and hydro facilities. These projects require extensive scaffolding for equipment installation, inspection, and repair. Increased adoption of system scaffolding ensures faster assembly and dismantling, improving operational efficiency and reducing downtime during critical industrial activities.

- For instance, a flare stack inspection by Acuren using drone tech performed what used to take 3 days in only 2 hours, avoiding scaffolding for a major part of the job.

Shift Toward Safer and Modular Systems

The industry is witnessing a transition toward modular and pre-engineered scaffolding systems that improve efficiency and safety. Modular scaffolding offers versatility, allowing quick adaptation to different structures and layouts. This reduces labor hours and minimizes risk during assembly and dismantling. Growing awareness of workplace safety regulations and stricter OSHA compliance requirements push companies to adopt reliable, high-quality scaffolding solutions. Digital tools for scaffold planning and inspection also support this driver by reducing project delays. The demand for safer, standardized systems strengthens adoption among contractors and industrial operators.

Key Trends and Opportunities

Sustainability and Material Innovation

Demand for recyclable and eco-friendly scaffolding materials is rising as industries adopt sustainable construction practices. Steel and aluminum scaffolding see extended usage due to reusability, reducing waste generation. Manufacturers are introducing corrosion-resistant coatings and lightweight composites to improve lifecycle performance. These advancements align with corporate sustainability goals and regulatory requirements for greener operations. The growing adoption of environmentally friendly scaffolding solutions creates opportunities for suppliers offering innovative materials with lower environmental impact and longer service life, supporting the shift toward circular economy models in construction and industry.

- For instance, in China, scaffolding tubes are often reused over many work cycles. While a common standard for new tubes is an outside diameter of 48.3mm with a 3.5mm wall thickness, one study of reused tubes found their average wall thickness had been reduced to 3.29mm, with some falling below 2.5mm. This reduction in thickness significantly lowers the tubes’ load-bearing capacity, which presents a serious safety risk.

Integration of Digital Tools and Automation

Digital transformation is reshaping the scaffolding industry, with software-driven design, planning, and inspection tools gaining popularity. 3D modeling helps optimize scaffolding layouts, reducing material usage and setup time. IoT-enabled sensors monitor structural stability and worker safety in real time. These technologies enhance productivity and reduce risks, aligning with industry focus on predictive maintenance. Companies that invest in digital platforms gain a competitive edge by offering faster, safer, and more cost-efficient scaffolding services, opening opportunities for technology providers and integrated service contractors.

Key Challenges

High Labor and Installation Costs

Scaffolding projects in North America face significant labor cost pressures, particularly for large-scale industrial installations. Skilled labor shortages further raise expenses, as experienced crews are needed to ensure safe and efficient assembly. Complex structures, such as refineries or power plants, require time-intensive setup, increasing project budgets. Companies are adopting modular scaffolding to reduce assembly hours, but high initial investment limits adoption for smaller contractors. Rising wages and regulatory compliance costs remain key challenges, affecting profit margins for service providers and contractors in competitive project environments.

Regulatory Compliance and Safety Risks

Strict OSHA regulations and industry safety standards create compliance challenges for scaffolding operators. Non-compliance can lead to project delays, penalties, and reputational damage. Scaffolding failures due to improper assembly or substandard materials pose worker safety risks, driving demand for higher-quality systems. Frequent inspections, training, and documentation increase administrative burden and costs. Companies must balance compliance efforts with cost efficiency, pushing them to invest in certified scaffolding products and skilled labor. Maintaining consistent safety standards across multiple job sites remains a critical challenge for market participants.

Regional Analysis

U.S.

The U.S. holds the dominant share of over 70% in the North America industrial scaffolding market. Strong demand stems from extensive infrastructure upgrades, refinery maintenance, and large-scale power plant projects. The country invests heavily in oil and gas exploration, LNG terminals, and renewable energy facilities, boosting supported and modular scaffolding usage. Strict OSHA regulations drive adoption of high-quality, certified scaffolding systems to ensure worker safety. Growth is further supported by industrial turnarounds and plant modernization across petrochemical and manufacturing sectors. Increasing adoption of digital scaffolding planning tools enhances project efficiency and reduces installation downtime.

Canada

Canada accounts for around 20% of the regional industrial scaffolding market, driven by energy and mining activities. The country’s oil sands operations and pipeline expansions create steady demand for robust steel scaffolding. Infrastructure investment programs and construction of hydroelectric projects further contribute to market growth. Harsh weather conditions encourage the use of durable, corrosion-resistant scaffolding materials. Compliance with Canadian Centre for Occupational Health and Safety (CCOHS) standards pushes operators to adopt safer, standardized systems. Modular scaffolding solutions are increasingly favored to reduce setup time and support cost-effective maintenance in remote and challenging project sites.

Mexico

Mexico represents nearly 10% of the North America industrial scaffolding market, with growth supported by expanding petrochemical and manufacturing sectors. Rising investments in refinery modernization and new industrial facilities fuel demand for supported and mobile scaffolding. Government infrastructure programs, including energy reform projects, encourage foreign investments that boost construction activities. Adoption of aluminum and modular scaffolding systems is rising due to their lightweight design and ease of transport. Increasing alignment with international safety standards and training programs is improving workplace compliance. This supports market growth and attracts global scaffolding service providers to enter the Mexican market.

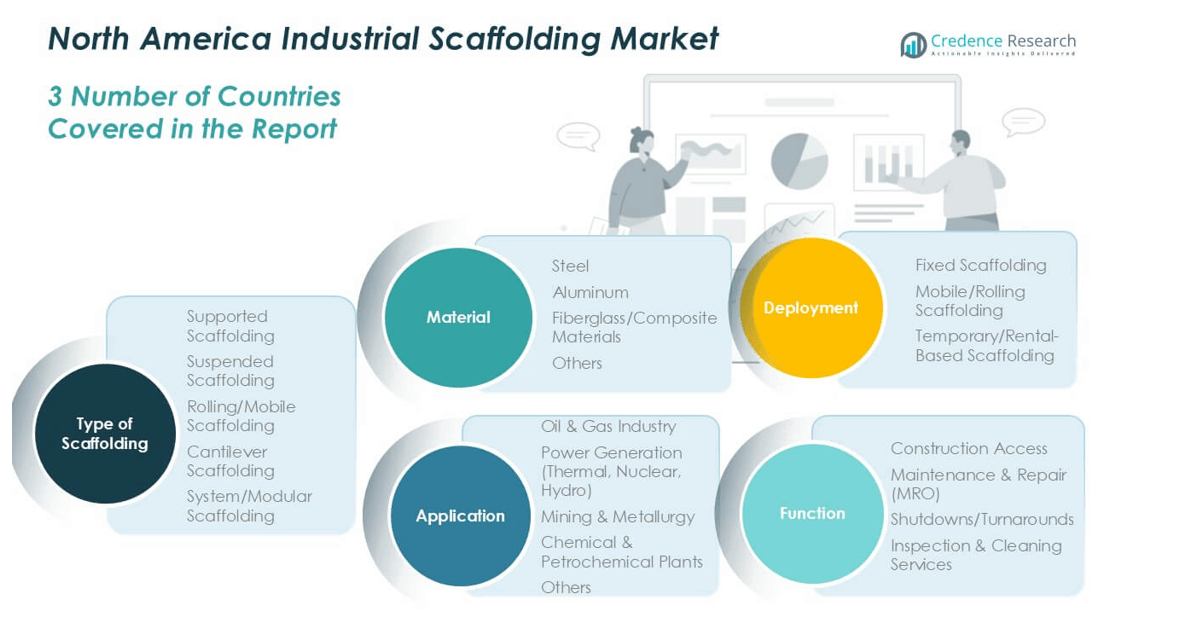

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

Competitive Landscape

The North America industrial scaffolding market is moderately consolidated, with key players focusing on large-scale projects and service contracts. Leading companies such as BrandSafway, SafwayAtlantic, Universal Manufacturing Corp, Granite Industries, Bil-Jax (Haulotte Group), Bee Access Products, Doka USA Ltd., Associated Scaffolding Co., Skyway Canada Ltd., Matakana Scaffolding, Northern Scaffold Access Inc., AGF Access Group Inc., and Brock Canada Industrial Ltd. dominate through extensive product portfolios and rental services. These players invest in modular and system scaffolding solutions to meet diverse industrial requirements and improve assembly efficiency. Strategic partnerships with construction and energy companies strengthen their regional presence. Many focus on safety-certified products and digital planning tools to comply with OSHA and CCOHS regulations. Competitive differentiation is driven by cost-effective solutions, on-site support, and integrated project management services, enabling suppliers to cater to oil and gas, power generation, and infrastructure projects efficiently while expanding their footprint across the U.S., Canada, and Mexico.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BrandSafway

- SafwayAtlantic

- Universal Manufacturing Corp

- Granite Industries

- Bil-Jax (a Haulotte Group brand)

- Bee Access Products, Inc.

- Doka USA Ltd.

- Associated Scaffolding Co.

- Skyway Canada Ltd.

- Matakana Scaffolding

- Northern Scaffold Access Inc.

- AGF Access Group Inc.

- Brock Canada Industrial Ltd.

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with strong demand from oil and gas maintenance projects.

- Modular and system scaffolding adoption will rise due to faster assembly and dismantling.

- Digital design and 3D modeling tools will improve project planning and reduce setup errors.

- Rental services will expand as companies prefer cost-efficient short-term scaffolding solutions.

- Safety compliance will drive investment in certified scaffolding systems and worker training programs.

- Aluminum and composite scaffolding demand will increase for lightweight and corrosion-resistant applications.

- Infrastructure upgrades in highways, bridges, and commercial buildings will boost market growth.

- Strategic partnerships between scaffolding suppliers and EPC contractors will strengthen service networks.

- Canada and Mexico will see rising demand from energy and manufacturing projects.

- Market competition will intensify with players focusing on turnkey solutions and integrated project support.