Market Overview:

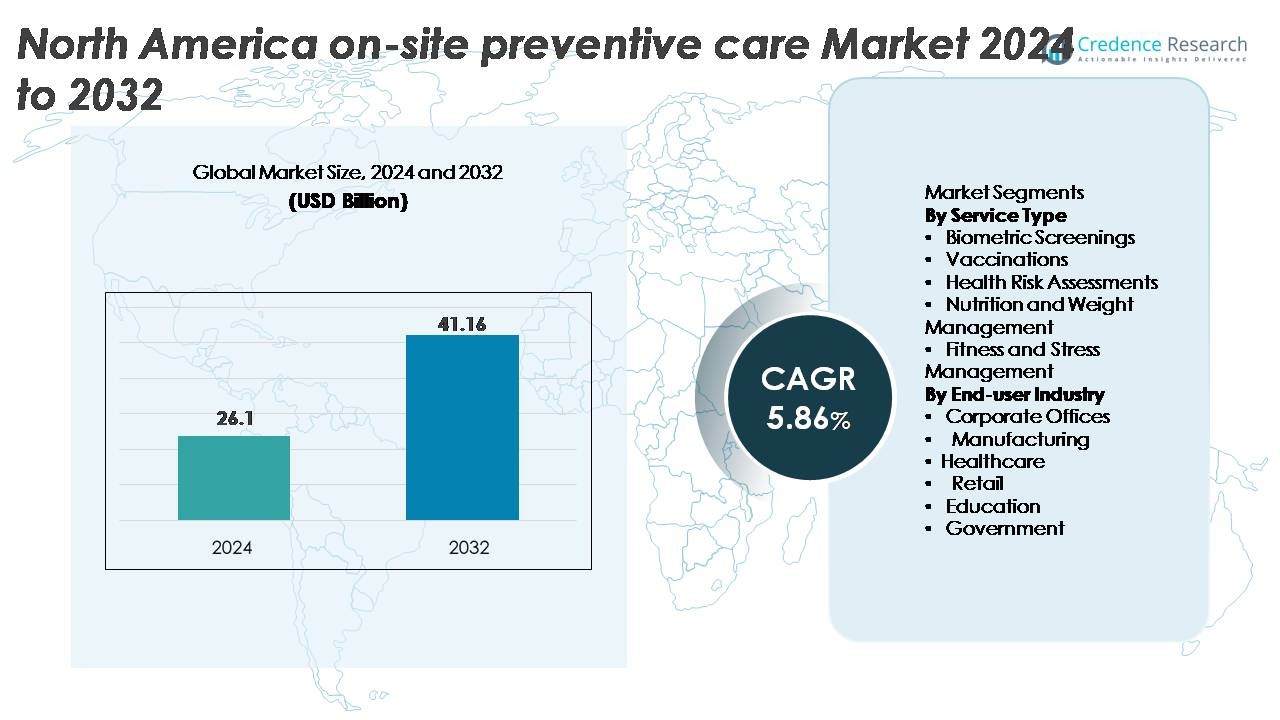

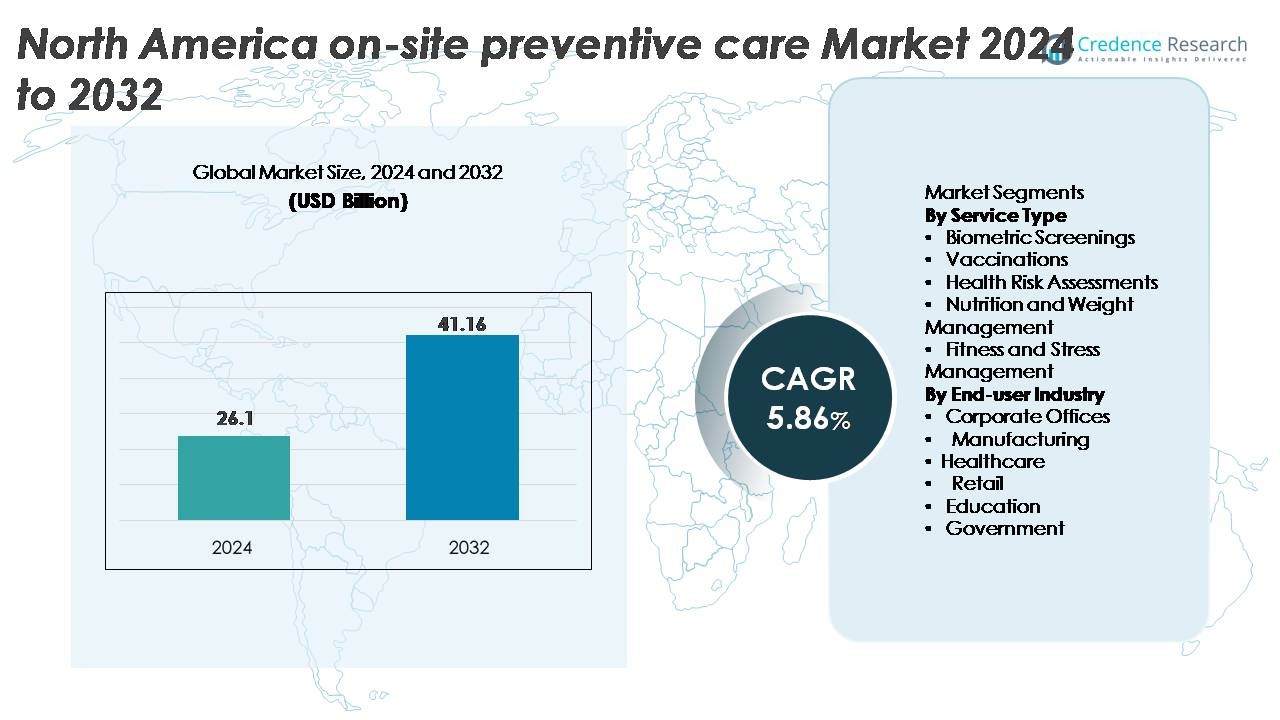

The North America On-Site Preventive Care Market was valued at USD 26.1 billion in 2024 and is projected to reach USD 41.16 billion by 2032, reflecting a CAGR of 5.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America On-Site Preventive Care Market Size 2024 |

USD 26.1 Billion |

| North America On-Site Preventive Care Market, CAGR |

5.86% |

| North America On-Site Preventive Care Market Size 2032 |

USD 41.16 Billion |

The North America on-site preventive care market is shaped by a strong group of established providers, including Wellness Corporate Solutions, Medcor, Inc., Concentra (Select Medical), Marathon Health, TotalWellness Health, QuadMed, Worksite Medical, Premise Health, Cigna Onsite Health, LLC, and Interactive Health. These companies compete by offering integrated preventive services such as biometric screenings, vaccinations, chronic disease risk management, and wellness coaching tailored to corporate and industrial workforces. The United States leads the regional market with approximately 78% share, driven by extensive employer adoption and advanced occupational health infrastructure. Canada follows with about 15% share, while Mexico and Caribbean territories collectively contribute the remaining portion, reflecting growing but emerging demand across multinational operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America on-site preventive care market reached USD 1 in 2024 and is projected to grow at a CAGR 5.86%, supported by expanding employer-led wellness and early-risk detection initiatives.

- Growing demand for biometric screenings, vaccinations, and mental-wellness programs drives adoption across corporate offices, manufacturing facilities, and healthcare institutions, with biometric screenings holding the largest segment share due to their role in early detection and workforce risk profiling.

- Technology integration such as digital health dashboards, mobile clinics, and AI-enabled risk assessments continues to shape market trends, improving accessibility for hybrid and distributed workforces.

- Competitive intensity increases as leading providers, including Premise Health, Marathon Health, Concentra, QuadMed, and Cigna Onsite Health, expand multi-site capabilities while smaller firms focus on flexible, mobile, and cost-efficient preventive services; key restraints include high setup costs and privacy compliance challenges.

- Regionally, the S. leads with ~78% share, followed by Canada at ~15%, with Mexico and Caribbean territories accounting for the remaining share as adoption grows among multinational and industrial employers.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service Type

Biometric Screenings hold the largest share at around 32%, driven by strong employer demand for early detection of diabetes, hypertension, and cardiovascular risks. Their convenience, standardized protocols, and integration with digital dashboards make them the anchor service across corporate wellness strategies. Vaccinations continue to gain momentum across healthcare, education, and large enterprises focused on reducing absenteeism and infection risks. Health Risk Assessments expand steadily as employers adopt data-driven wellness planning supported by digital analytics. Nutrition and Weight Management programs grow due to rising obesity-related concerns. Fitness and Stress Management accelerates with increasing focus on mental health and workplace burnout reduction.

- For instance, Premise Health offers annual preventive screenings across its onsite and nearsite network. The company leverages technology and clinical workflows that support efficient point-of-care testing for biometric data, including A1c and lipid profiles, to facilitate timely diagnosis, monitoring, and treatment. Premise Health emphasizes efficiency and improved patient experience, with a focus on comprehensive primary care that includes laboratory services.

By End-User Industry

Corporate Offices dominate the market with nearly 38% share, supported by large employers investing heavily in screenings, HRAs, and wellness programs to enhance productivity and retention. Manufacturing shows strong adoption driven by safety compliance, fatigue monitoring, and on-site health readiness. Healthcare institutions rely on preventive services to protect clinical staff and meet immunization requirements. Retail adopts mobile preventive solutions to reduce turnover and absenteeism across distributed locations. Education integrates screenings and stress-management programs to safeguard staff in high-contact environments. Government entities maintain stable demand for on-site preventive care to ensure operational continuity and workforce resilience.

- For instance, Premise Health reported delivering more than 1.1 million annual patient encounters across employer-sponsored corporate clinics, supported by over 2,500 clinicians embedded within onsite and nearsite centers nationwide.

Key Growth Drivers

Rising Employer Investment in Workforce Health and Productivity

North American enterprises increasingly prioritize on-site preventive care as a strategic investment to reduce absenteeism, elevate productivity, and improve long-term employee wellness outcomes. Organizations view on-site screenings, vaccination drives, and chronic disease risk assessments as cost-effective interventions that lower healthcare claims and support healthier workplace cultures. The growing prevalence of lifestyle-related conditions—such as obesity, diabetes, hypertension, and mental fatigue—encourages employers to integrate preventive services directly within corporate campuses to facilitate convenient access. Additionally, competitive labor markets push companies to differentiate through wellness benefits that enhance employee retention and satisfaction. This shift aligns with human capital strategies emphasizing early detection, personalized health coaching, and ongoing risk monitoring. As employers continue tying wellness metrics to operational performance indicators, demand strengthens for embedded preventive care solutions that streamline resource use while demonstrating measurable impact on workforce health trends.

- For instance, Wellness Corporate Solutions (WCS) operates onsite biometric screening programs using FDA-approved analyzers capable of completing full lipid panels in under 7 minutes and handling up to 600 employee screenings per day in large corporate locations.

Expansion of Chronic Disease Management and Early Detection Programs

The escalating burden of chronic illnesses in North America drives sustained adoption of on-site preventive services that identify early-stage risk factors among working-age adults. Employers and insurers increasingly champion biometric screenings, lifestyle monitoring, cardiovascular risk profiling, and disease management interventions to mitigate long-term medical expenditures. On-site models enable structured health surveillance and immediate referrals, ensuring faster intervention for conditions that would otherwise progress. This emphasis on early detection aligns with value-based care frameworks that reward proactive risk reduction and improved health outcomes. At the same time, digital health tools—from mobile health apps to remote patient monitoring dashboards—enhance providers’ ability to track trends and tailor interventions for employees. Together, these elements create an ecosystem where on-site preventive programs form the cornerstone of chronic disease mitigation strategies adopted by corporations, healthcare partners, and benefit administrators across North America.

- For instance, Quest Diagnostics reports that its employer biometric programs use Cardio IQ® advanced lipid and inflammation panels capable of quantifying 22 cardiometabolic biomarkers, enabling detection of early-stage dyslipidemia and metabolic syndrome with high analytical precision.

Increasing Integration of Mental Health, Fitness, and Wellness Programs

The region’s growing awareness of workplace mental health challenges—ranging from burnout and stress to anxiety—propels organizations to expand on-site preventive care beyond physical screenings. Employers increasingly incorporate counseling access, stress-management workshops, physical activity programs, and weight-management services to promote holistic well-being. Rapid lifestyle changes, high-pressure work environments, and hybrid work models intensify demand for integrated wellness solutions available directly at the workplace. Fitness and nutrition programs complement traditional preventive care offerings by helping employees adopt sustainable lifestyle improvements, leading to better long-term outcomes and reduced health risks. Furthermore, companies recognize that comprehensive wellness programs contribute to organizational resilience, lower turnover rates, and improved morale. This shift toward whole-person care positions on-site preventive services as a central pillar of workplace health ecosystems, driving broader acceptance and budget allocation across industries.

Key Trends & Opportunities

Growth of Technology-Enabled Preventive Care Models

Digital transformation accelerates opportunities for technology-enabled on-site preventive care solutions across North America. Advanced health kiosks, remote diagnostics, AI-driven risk assessment platforms, and integrated health dashboards enhance the accuracy and efficiency of preventive screenings. Wearables and mobile health apps feed continuous data into employer wellness systems, enabling personalized insights and timely health alerts. These innovations also streamline data management, allowing employers to efficiently track population health metrics and identify emerging risk patterns. As automation reduces administrative burdens, service providers can allocate more resources toward personalized care delivery. The integration of analytics and telehealth further expands access to behavioral counseling, chronic disease support, and follow-up care without requiring extensive on-site infrastructure. Collectively, these technological advancements create substantial opportunities for scalable, hybrid preventive care models that improve engagement and long-term health outcomes.

- For instance, Higi (a subsidiary of Modivcare) deploys its FDA-cleared Smart Health Stations capable of performing blood pressure, BMI, and pulse screenings, with its network now having completed hundreds of millions of biometric screenings cumulatively through a nationwide network of nearly 10,000 stations.

Rising Adoption of Hybrid and Mobile On-Site Care Clinics

The shift toward remote and hybrid work arrangements has generated an opportunity for more flexible on-site preventive care delivery formats. Mobile clinics, pop-up screening centers, roving wellness teams, and hybrid telehealth-supported programs allow employers to reach distributed workforces cost-effectively. These models offer targeted preventive services—including vaccinations, biometric tests, and health coaching—without requiring permanent clinic installations. They are particularly valuable for industries with multi-site operations such as retail, logistics, and manufacturing. The flexibility of mobile and hybrid solutions also helps employers scale their preventive programs based on seasonal needs, workforce size changes, or geographic dispersion. As organizations emphasize employee accessibility and convenience, mobile and pop-up care are expected to gain wider traction, opening new opportunities for service providers that specialize in modular care delivery.

- For instance, Premise Health operates mobile wellness fleets as part of its network of over 800 wellness centers, which are integrated with enterprise scheduling software capable of coordinating multi-site deployments across numerous employer campuses, supported by telehealth modules that provide remote follow-ups through encrypted HD video sessions.”

Increasing Demand for Personalized and Data-Driven Wellness Programs

North America’s on-site preventive care landscape increasingly moves toward personalized wellness pathways driven by health analytics and individualized risk profiling. Employers and service providers are leveraging data collected from health screenings, digital platforms, and lifestyle monitoring devices to tailor intervention strategies for employees. Personalized coaching, nutrition plans, and fitness programs improve engagement and compliance, positioning preventive care as a valuable employee benefit. Data-driven models also enable predictive risk assessment, helping organizations identify high-risk cohorts and deploy targeted programs to mitigate long-term health issues. As regulatory frameworks support secure data sharing and privacy compliance, service providers have opportunities to expand highly customized preventive care packages that align with workforce demographic patterns and corporate health goals.

Key Challenges

Data Privacy, Regulatory Compliance, and Employee Trust Barriers

Despite growing adoption, the market faces significant challenges related to data privacy, HIPAA compliance, and employee trust regarding the handling of sensitive health information. Employees often express concerns about sharing personal health data with employers, fearing misuse or bias in performance evaluations. Preventive care providers must navigate stringent regulations around consent, data security, and protected health information management, requiring robust cybersecurity frameworks and transparent data-handling policies. Failure to meet these standards exposes organizations to legal risks and reputational damage. Moreover, building trust requires consistent communication, ethical data practices, and clear separation between employer access and medical information. These privacy and compliance burdens slow adoption rates, particularly among small to mid-sized enterprises with limited resources for secure IT infrastructure.

High Operational Costs and Limited Access for Small & Mid-Sized Enterprises

The implementation of on-site preventive care programs often demands substantial investment in infrastructure, staffing, medical equipment, and ongoing service contracts. Large enterprises can absorb these costs, but small and mid-sized companies frequently struggle to justify such expenditures despite recognizing the long-term benefits. Additionally, variability in workforce size, geographic distribution, and industry-specific needs complicates the development of standardized, cost-effective models for smaller employers. Providers face challenges in delivering scalable packages without compromising service quality or ROI. These financial and logistical limitations restrict market penetration and slow expansion into sectors that would benefit significantly from preventive care but lack resources to adopt traditional on-site service frameworks.

Regional Analysis

United States

The United States dominates the North America on-site preventive care market with approximately 78% share, driven by strong employer spending on workforce health, widespread corporate wellness programs, and high adoption of biometric screenings and vaccination services. Large enterprises in technology, manufacturing, healthcare, and logistics actively integrate on-site preventive care to reduce insurance costs and improve productivity. The country’s advanced digital health ecosystem further supports data-driven risk assessments and telehealth-enabled follow-up care. Growing attention to chronic disease management, mental well-being, and preventive screenings continues to expand service demand across both urban and suburban employment hubs.

Canada

Canada accounts for around 15% of the regional market, supported by employer initiatives that complement the public healthcare system with workplace-based preventive services. Demand is growing across corporate offices, industrial operations, and educational institutions as organizations seek to reduce absenteeism and enhance early risk identification. Canadian employers increasingly adopt on-site vaccinations, health risk assessments, ergonomic consultations, and stress-management programs. Strong regulatory frameworks and high health awareness among employees also encourage uptake. The expansion of mobile clinics and hybrid wellness models further improves accessibility for distributed workforces, strengthening Canada’s contribution to the North American preventive care landscape.

Mexico

Mexico represents roughly 5% of the regional market, with adoption concentrated in multinational corporations, export manufacturing zones, and large industrial clusters. As companies prioritize occupational health compliance and early risk detection, on-site preventive care offerings such as biometric screenings, basic diagnostics, and vaccination campaigns are gradually expanding. Growth is supported by rising employer interest in minimizing workplace injuries and improving productivity in high-intensity sectors such as automotive, electronics, and logistics. Although penetration remains lower than in the U.S. and Canada, increased investment from global companies and improving awareness of preventive workforce health are expected to accelerate market expansion.

Caribbean Territories

Caribbean territories collectively contribute an estimated 2% to the North American market, with adoption led by tourism, hospitality, aviation, and public-sector organizations. Preventive care services primarily focus on vaccinations, fitness and stress-management programs, and routine health assessments aimed at maintaining workforce readiness in service-driven industries. Limited healthcare infrastructure in some islands increases the value of employer-led on-site programs, particularly for chronic disease screening and wellness promotion. Although market scale is comparatively small, demand is gradually rising as regional employers seek to reduce medical leave rates and enhance workforce resilience through structured preventive health initiatives.

Market Segmentations:

By Service Type

- Biometric Screenings

- Vaccinations

- Health Risk Assessments

- Nutrition and Weight Management

- Fitness and Stress Management

By End-user Industry

- Corporate Offices

- Manufacturing

- Healthcare

- Retail

- Education

- Government

By Geography

- United States

- Canada

- Mexico

- Caribbean Territories

Competitive Landscape:

The North America on-site preventive care market features a competitive mix of integrated healthcare providers, occupational health specialists, wellness service companies, and digital health platforms. Leading players including Premise Health, Cigna/Evernorth, Optum, Marathon Health, Concentra, and Wellness Corporate Solutions focus on expanding multi-site service networks, enhancing clinical depth, and integrating data-driven wellness programs. Competition intensifies as providers leverage advanced analytics, mobile screening units, and hybrid preventive care solutions to serve distributed and hybrid workforces. Digital platforms offering AI-based risk assessments, virtual coaching, and remote monitoring increasingly complement traditional on-site models, prompting providers to invest in technology partnerships. Large enterprises prefer full-service vendors capable of delivering comprehensive offerings such as biometric screenings, vaccinations, chronic disease management, and mental wellness programs. Meanwhile, regional providers differentiate through cost-effective mobile solutions and industry-specific preventive care packages. As employers emphasize measurable outcomes and employee engagement, vendors compete on service quality, clinical capabilities, scalability, and data integration strength.

Key Player Analysis:

- Wellness Corporate Solutions

- Medcor, Inc.

- Concentra (a subsidiary of Select Medical)

- Marathon Health

- TotalWellness Health

- QuadMed (part of Quad/Graphics)

- Worksite Medical

- Premise Health

- Cigna Onsite Health, LLC

- Interactive Health

Recent Developments:

- In February 2025, Premise Health, in partnership with another healthcare player, launched a new primary-care–centered health plan for employers and unions, signaling expansion of its service offerings into tailored care models beyond traditional onsite clinics.

- In September 2024, Marathon Health announced a significant expansion of its “Open Access Primary Care Network,” noting that it operates nearly 100 care centers across 46 U.S. markets a major scaling up of its onsite/near-site preventive care capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Service type, End-User industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Employers will increasingly expand onsite wellness infrastructure to reduce long-term healthcare costs and improve workforce productivity.

- Adoption of digital diagnostics and connected screening tools will accelerate real-time risk detection and personalized interventions.

- Preventive care programs will integrate mental-health and stress-management modules to address rising workplace burnout.

- Demand for mobile onsite clinics will grow as organizations seek flexible, scalable preventive care delivery models.

- Data-driven population-health analytics will strengthen targeted outreach and chronic-disease prevention strategies.

- Partnerships between employers, insurers, and occupational-health providers will deepen to streamline preventive service delivery.

- Onsite immunization and infectious-disease preparedness programs will expand with strengthened corporate health compliance.

- Nutrition, weight-management, and lifestyle-coaching services will gain prominence as employers prioritize long-term wellness outcomes.

- AI-enabled triage and predictive-risk models will enhance early identification of high-risk employees.

- Hybrid onsite-virtual preventive care ecosystems will evolve to support continuous monitoring and sustained employee engagement.

Market Segmentation Analysis:

Market Segmentation Analysis: