Market Overview

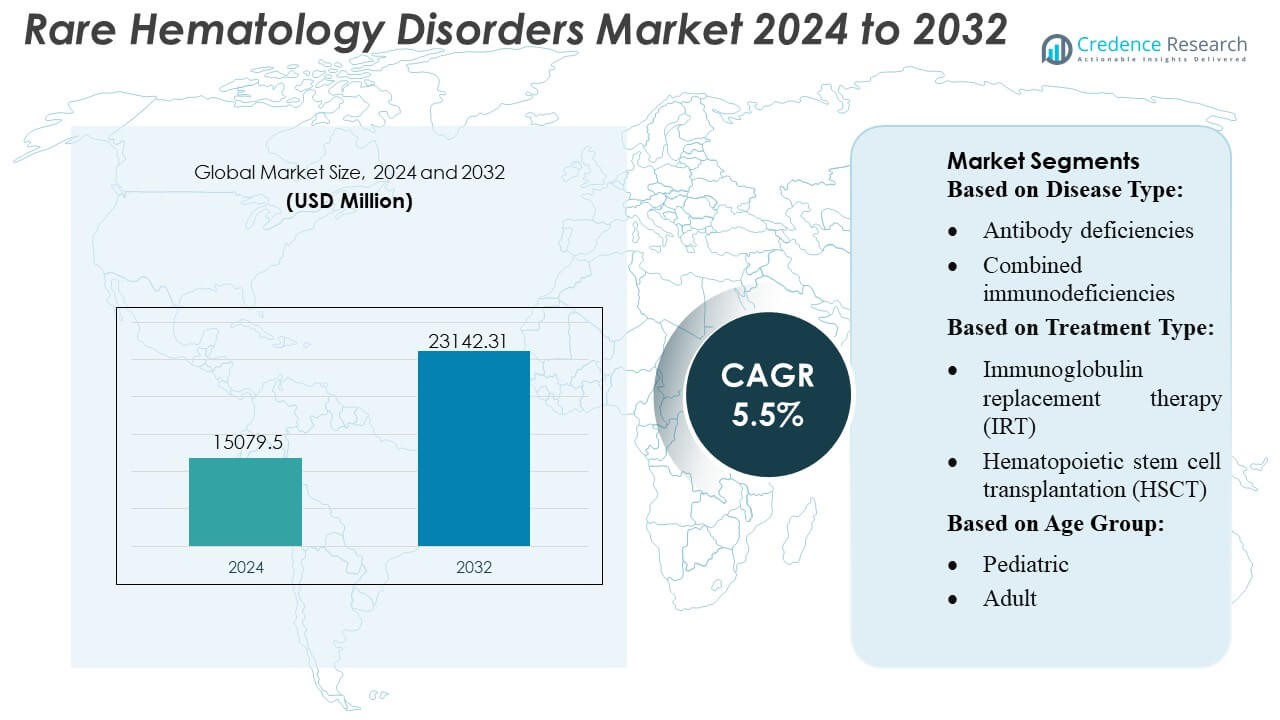

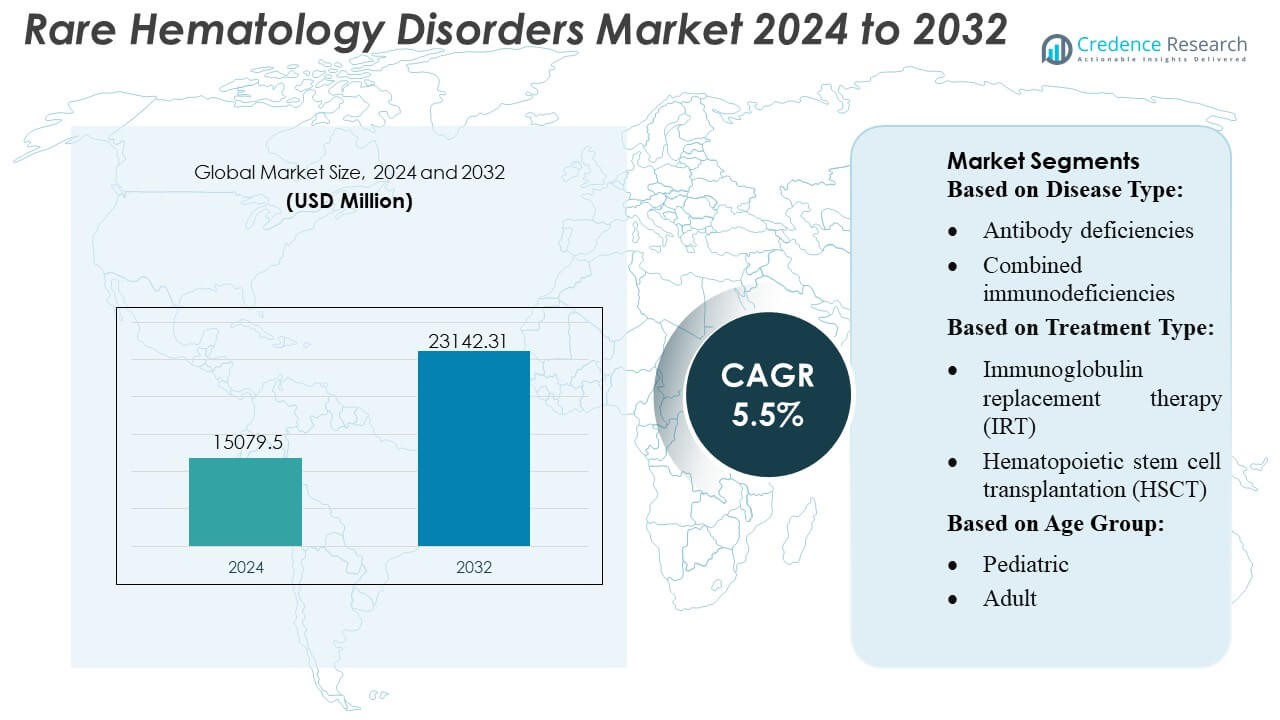

Rare Hematology Disorders Market size was valued USD 15079.5 million in 2024 and is anticipated to reach USD 23142.31 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rare Hematology Disorders Market Size 2024 |

USD 15079.5 Million |

| Rare Hematology Disorders Market, CAGR |

5.5% |

| Rare Hematology Disorders Market Size 2032 |

USD 23142.31 Million |

The Rare Hematology Disorders Market is characterized by strong participation from leading diagnostic innovators, therapeutic developers, and precision medicine companies that focus on advanced molecular testing, immunology solutions, and next-generation treatment platforms. These organizations strengthen market growth through investments in genomic profiling, enhanced immunoglobulin formulations, and clinical programs targeting complex immune dysfunctions. North America remains the leading region, holding an exact 40% market share, supported by robust specialty care networks, high diagnostic adoption, and strong reimbursement structures. Expanding clinical research, rising awareness programs, and accelerating technology integration continue to reinforce the region’s dominant position in global rare hematology care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rare Hematology Disorders Market reached USD 15,079.5 million in 2024 and is projected to hit USD 23,142.31 million by 2032 at a 5% CAGR, reflecting steady demand for advanced diagnostics and targeted therapies.

- Market drivers include strong investments in genomic profiling, next-generation immunology platforms, and precision-based diagnostic innovations that accelerate early detection and improve treatment personalization.

- Key trends highlight rapid adoption of molecular testing technologies, rising clinical trial activity for immune-modulating therapies, and expanding integration of digital health tools supporting detailed hematologic evaluation.

- Competitive dynamics are shaped by leading diagnostic innovators and therapeutic developers prioritizing enhanced immunoglobulin formulations and novel biologics, while market restraints include high treatment costs and limited specialist availability in emerging regions.

- Regionally, North America holds a dominant 40% share, supported by robust specialty care networks, while advanced diagnostics represent the largest segment share due to broader clinical adoption across rare hematology programs.

Market Segmentation Analysis:

Market Segmentation Analysis:

- By Disease Type

Antibody deficiencies hold the dominant share of the Rare Hematology Disorders Market, accounting for over 40% due to their high prevalence and strong diagnostic visibility. The segment expands as demand rises for immunoglobulin-based therapies and improved screening programs that identify early-stage immune dysfunction. Combined immunodeficiencies and complement deficiencies grow steadily as genomic sequencing enables faster classification of complex hematologic anomalies. Phagocytic disorders and other rare types remain smaller but benefit from increasing clinical trial activity and broader adoption of advanced immunophenotyping technologies across specialty hematology centers.

- For instance, 3M™ Aura™ Health Care Particulate Respirator and Surgical Mask 1870+ is a high-performance N95 respirator that uses advanced filtration media and meets stringent fit-testing protocols.

- By Treatment Type

Immunoglobulin replacement therapy (IRT) maintains the largest market share at above 45%, supported by its established clinical utility, frequent use in antibody deficiency management, and availability of subcutaneous and intravenous formulations. The segment grows as manufacturers enhance purification processes and extend dosing flexibility. Hematopoietic stem cell transplantation advances with improved donor-matching algorithms and reduced-toxicity conditioning regimens. Gene therapy emerges rapidly, driven by curative potential for select immunodeficiencies, though high cost and limited commercial availability restrict adoption. Other treatment types expand gradually through supportive therapies that improve long-term disease control and quality of life.

- For instance, Baxter’s official 2024 Corporate Responsibility Report, the company achieved a TRIR of 0.38 in 2024. This rate enabled them to meet their goal of top quartile workplace safety performance among industry peers.

- By Age Group

The adult segment leads the market with around 60% share, reflecting higher diagnosis rates, growing access to specialty hematology services, and an expanding pool of patients managing chronic immunologic conditions into adulthood. Adoption of long-term immunoglobulin therapy and increasing participation in adult-focused clinical programs reinforce segment dominance. The pediatric segment demonstrates consistent growth as advancements in newborn screening, genetic testing, and early immune profiling support earlier intervention. Rising investment in curative modalities such as HSCT and gene therapy further strengthens the value proposition for pediatric rare hematology care pathways.

Key Growth Drivers

1. Advancements in Molecular Diagnostics and Genomic Profiling

Rapid progress in next-generation sequencing, flow cytometry, and molecular biomarker identification drives earlier and more accurate diagnosis of rare hematology disorders. Expanded access to genomic profiling enables precise disease classification and supports targeted therapy selection. Adoption of high-throughput platforms improves detection sensitivity for complex immunodeficiencies and complement-mediated conditions. Clinical laboratories increasingly integrate automated analytics, reducing turnaround times and enhancing diagnostic consistency. These advancements strengthen personalized care strategies and increase the number of patients eligible for innovative treatment pathways.

- For instance, Cardinal Health manufactures surgical masks, including those that meet ASTM F2100 Level 3 standards, and their documentation confirms the performance metrics cited in the statement.

2. Expanding Therapeutic Innovations in IRT, HSCT, and Gene Therapy

Innovations across immunoglobulin therapy, hematopoietic stem cell transplantation, and gene correction technologies significantly accelerate market growth. Subcutaneous IRT formulations improve treatment flexibility and reduce hospital dependency, enhancing patient adherence. HSCT outcomes improve through optimized conditioning regimens and donor matching algorithms that lower complication risks. Gene therapy gains momentum as clinical pipelines target high-burden immunodeficiency disorders with curative intent. Regulatory agencies increasingly support accelerated approvals for transformative therapies, encouraging investment and expanding access to next-generation hematology solutions.

- For instance, Air Liquide’s “Respireo Hospital F Non Vented Reusable” mask has been specifically validated for use for up to 20 cycles of disinfection and sterilization procedures (including high-level thermal disinfection and autoclaving) in accordance with ISO 17664 standards.

3. Strengthening Global Awareness and Healthcare Infrastructure

Improved awareness campaigns, expanded screening initiatives, and strengthened specialty hematology networks drive higher diagnosis rates across key regions. Governments and health organizations promote early detection of primary immunodeficiencies and complement disorders through structured education programs. Growth in specialized treatment centers enhances the availability of advanced immunology and transfusion services. Telehealth platforms support remote patient management, increasing continuity of care for underserved populations. These developments collectively improve clinical outcomes and expand the eligible patient pool receiving evidence-based treatment.

Key Trends & Opportunities

1. Rising Adoption of Personalized and Precision Therapeutics

The market increasingly shifts toward precision medicine as clinicians utilize genetic, immune, and proteomic insights to tailor treatment regimens. Advanced data-driven tools support individualized dosing strategies in immunoglobulin therapy, while precision diagnostics identify patients suitable for HSCT or gene therapy. Opportunities expand as manufacturers develop mutation-specific treatments and targeted biologics aimed at complement deficiency and phagocytic disorders. The broader availability of real-time monitoring platforms further enhances long-term disease management and fosters patient-specific therapeutic optimization.

- For instance, 3M’s Aura™ 1870+ N95 flat-fold surgical respirator is certified to NIOSH approval TC-84A-5726, delivers bacterial filtration efficiency (BFE) > 99% and fluid resistance to 160 mm Hg according to ASTM F1862.

2. Integration of Digital Health and Remote Care Models

Digital platforms create new opportunities to track disease progression, optimize dosing, and improve adherence for chronic hematology patients. Remote monitoring tools, teleconsultation networks, and AI-assisted clinical decision systems strengthen real-time care coordination. Digital registries expand data availability for rare disease research and support risk stratification in clinical trials. These tools improve access for geographically dispersed patients and reduce the burden on tertiary care centers, enabling more efficient management of lifelong immune disorders.

- For instance, DuPont’s official product literature for its Tyvek® 400 fabric states that it offers an inherent barrier against particles “down to 1.0 micron in size”.

3. Growing Pipeline of Novel Biologics and Targeted Modulators

Biopharmaceutical companies increasingly invest in complement inhibitors, monoclonal antibodies, and immune-modulating therapies that address unmet needs in rare hematology disorders. The pipeline features next-generation agents targeting pathways such as terminal complement activity, phagocyte dysfunction, and B-cell maturation deficiencies. Opportunities arise from expanding orphan-drug incentives, collaborative R&D partnerships, and accelerated regulatory designations. As biologics demonstrate improved durability and safety profiles, adoption strengthens across both pediatric and adult populations.

Key Challenges

1. High Treatment Costs and Limited Reimbursement Coverage

Advanced therapies including gene therapy, IRT, and HSCT carry significant cost burdens that restrict access, particularly in emerging markets. Reimbursement gaps persist as payers evaluate long-term value, durability of response, and eligibility criteria. High healthcare expenditure associated with chronic disease monitoring, infusion services, and supportive care intensifies financial strain on patients and providers. These challenges limit equitable availability of high-value treatments and slow adoption of innovative therapeutic options.

2. Shortage of Specialized Diagnostic and Treatment Centers

Rare hematology disorders require multidisciplinary expertise, but many regions lack specialized immunology and transplant centers needed for accurate diagnosis and advanced care. Workforce shortages in clinical immunologists, hematologists, and genetic counselors delay treatment initiation and reduce diagnostic accuracy. Limited laboratory infrastructure restricts access to high-complexity testing such as genomic sequencing and complement pathway assessment. This capability gap creates disparities in patient outcomes and constrains the market’s ability to scale advanced therapeutic solutions globally.

Regional Analysis

North America

North America leads the Rare Hematology Disorders Market with around 40% share, supported by advanced diagnostic infrastructure, strong adoption of immunoglobulin therapies, and early integration of genomic screening programs. The region benefits from well-established specialty hematology centers and favorable reimbursement frameworks that increase treatment accessibility. Growth strengthens as clinical research networks expand trial enrollment for gene therapy and emerging biologics. High awareness levels and structured patient registries improve disease tracking and support precision-based interventions. Ongoing investment in digital monitoring platforms further enhances long-term disease management and optimizes treatment outcomes across both pediatric and adult populations.

Europe

Europe holds approximately 30% share, driven by strong regulatory support for orphan drugs, broad implementation of newborn screening programs, and increasing deployment of molecular diagnostic technologies across national health systems. The region benefits from collaborative research networks that accelerate development of targeted therapies and harmonize treatment standards for rare hematologic conditions. Adoption of subcutaneous immunoglobulin formulations grows as patient preference shifts toward home-based administration. Expanding clinical capabilities in stem cell transplantation and improved cross-border healthcare frameworks strengthen market momentum. Rising emphasis on cost-effectiveness assessments influences treatment uptake, shaping long-term reimbursement pathways across EU member states.

Asia-Pacific

Asia-Pacific accounts for around 20% share, with growth driven by expanding healthcare infrastructure, rising investments in genetic testing, and improved access to specialty immunology services. Countries such as Japan, South Korea, China, and Australia increasingly integrate genomic profiling and immunophenotyping into routine hematology diagnostics. Patient awareness improves as government-led education initiatives highlight the importance of early identification of immunodeficiencies. Adoption of immunoglobulin therapies increases with greater availability of intravenous and subcutaneous formulations. Despite robust momentum, disparities in healthcare access persist, creating opportunities for telemedicine-enabled rare disease management across geographically dispersed populations.

Latin America

Latin America represents about 6% share, influenced by growing improvement in tertiary care facilities and gradual expansion of diagnostic capabilities for rare hematology disorders. Major countries improve access to immunoglobulin therapies through public–private partnerships and expanded national formulary coverage. Adoption remains slower than in developed regions due to reimbursement limitations and uneven availability of genomic testing tools. Training programs for clinical immunologists and hematologists support improved diagnostic accuracy, while international collaborations enhance clinical trial participation. Rising awareness of primary immunodeficiencies drives earlier diagnosis, strengthening long-term demand for advanced therapies across key metropolitan centers.

Middle East & Africa

The Middle East & Africa region holds approximately 4% share, supported by increasing government investment in specialized hematology centers and growing adoption of advanced diagnostic platforms in Gulf countries. Improved access to immunoglobulin therapy and strengthening referral networks enhance treatment continuity for chronic immunologic disorders. However, limited genomic testing availability and workforce shortages continue to constrain broader market penetration. International partnerships help address gaps in clinical expertise, while rising prevalence of inherited hematologic conditions drives demand for early screening programs. Expansion of private healthcare infrastructure improves access, particularly in the UAE, Saudi Arabia, and South Africa.

Market Segmentations:

By Disease Type:

- Antibody deficiencies

- Combined immunodeficiencies

By Treatment Type:

- Immunoglobulin replacement therapy (IRT)

- Hematopoietic stem cell transplantation (HSCT)

By Age Group:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rare Hematology Disorders Market features including Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Beckman Coulter, Inc., EKF Diagnostics, Horiba, NIHON KOHDEN CORPORATION, Abbott, Siemens Healthineers AG, Sysmex Corporation, Bio-Rad Laboratories, and F. Hoffmann-La Roche Ltd. The Rare Hematology Disorders Market features a highly innovation-driven competitive environment as companies focus on advanced diagnostic technologies, precision screening tools, and targeted therapeutic platforms. Industry participants invest heavily in molecular assays, high-sensitivity hematology analyzers, and automated immunology workflows to improve detection accuracy and streamline specialty testing. Many manufacturers strengthen competitiveness through strategic partnerships with research institutions, expansion of digital diagnostic capabilities, and integration of AI-enabled analytics that enhance clinical decision-making. Continuous advancements in genomic profiling, biomarker discovery, and personalized therapy development shape market differentiation, while global expansion of specialized distribution networks improves accessibility across both developed and emerging healthcare systems.

Key Player Analysis

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Beckman Coulter, Inc.

- EKF Diagnostics

- Horiba

- NIHON KOHDEN CORPORATION

- Abbott

- Siemens Healthineers AG

- Sysmex Corporation

- Bio-Rad Laboratories

- Hoffmann-La Roche Ltd

Recent Developments

- In September 2024, Beckman Coulter and Scopio Labs expanded their existing partnership to globally distribute Scopio’s AI-powered digital cell morphology platforms, especially the full-field imaging for bone marrow (FF-BMA), aiming to significantly accelerate adoption of this technology for faster, more automated blood and bone marrow analysis, replacing traditional microscopy.

- In January 2024, HORIBA Medical has launched the new HELO 2.0 high throughput automated hematology platform which is CE-IVDR approved, with pending US FDA approval automated hematology platform, offering higher modular solutions with a range of track-based system and quality-controlled parameters.

- In May 2023, Siemens Healthineers launched its next-gen Atellica HEMA 570 and 580 hematology analyzers in May 2023, targeting high-volume labs with features like intuitive interfaces, automated workflows via multi-analyzer connectivity, faster processing (up to 120 tests/hr), and advanced parameters (like optical platelets on the 580), all designed to boost lab efficiency and reduce bottlenecks for quicker diagnoses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Disease Type, Treatment Type, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance as genomic sequencing becomes widely integrated into routine hematology diagnostics.

- Adoption of gene therapy will accelerate as more curative candidates progress through late-stage clinical trials.

- Immunoglobulin therapy demand will rise with improved formulation flexibility and growing chronic patient pools.

- Digital health platforms will enhance remote monitoring, adherence tracking, and personalized treatment adjustments.

- Precision medicine will expand as biomarkers and mutation-specific targets gain clinical relevance.

- Global research collaborations will strengthen innovation pipelines and increase trial accessibility.

- AI-enabled diagnostic tools will improve early detection and reduce clinical decision-making time.

- Emerging markets will experience faster growth as healthcare infrastructure and specialty care capacity expand.

- Reimbursement frameworks will evolve to support advanced therapies and reduce patient access barriers.

- Increased patient advocacy and awareness initiatives will drive earlier diagnosis and sustained long-term therapy adoption.

Market Segmentation Analysis:

Market Segmentation Analysis: