Market Overview:

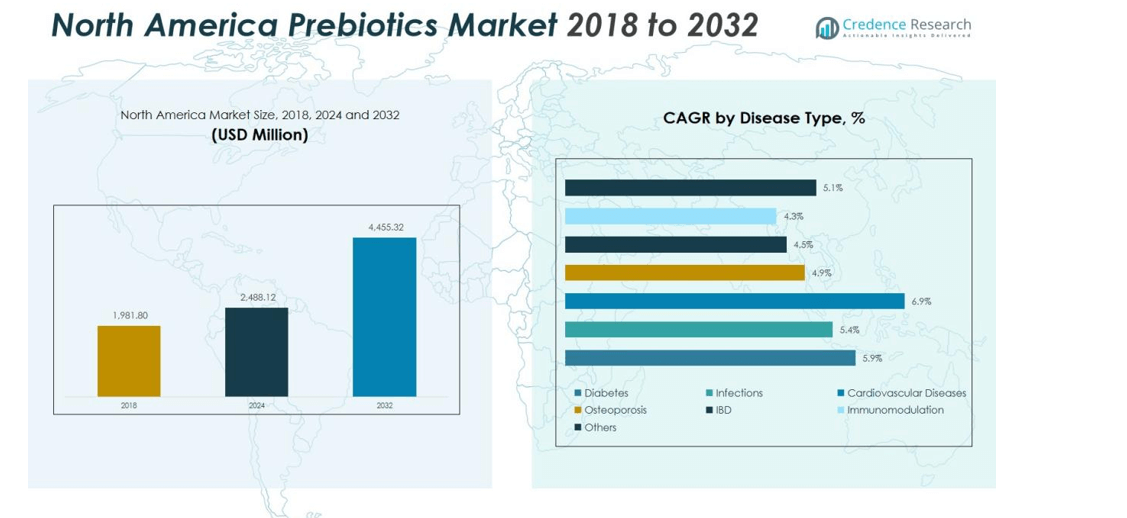

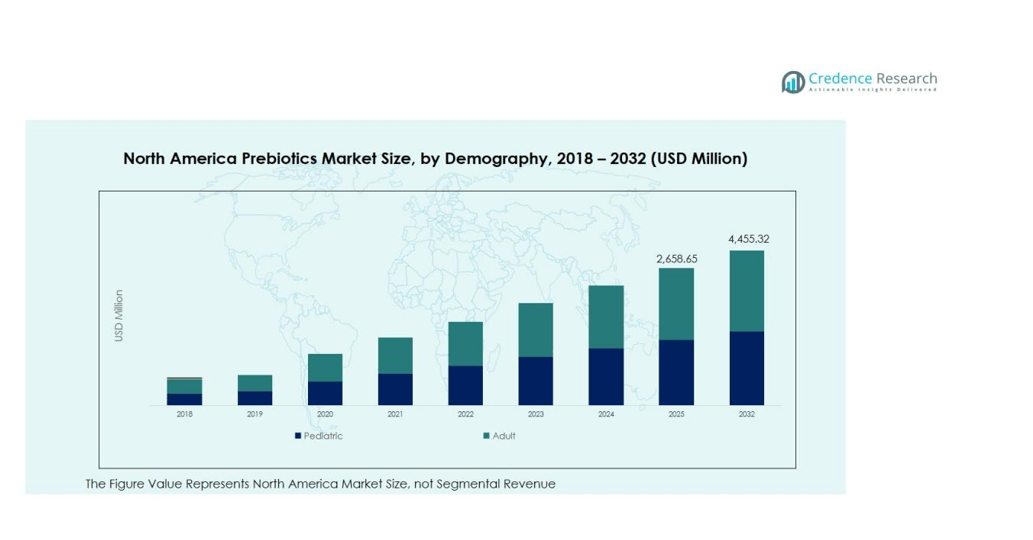

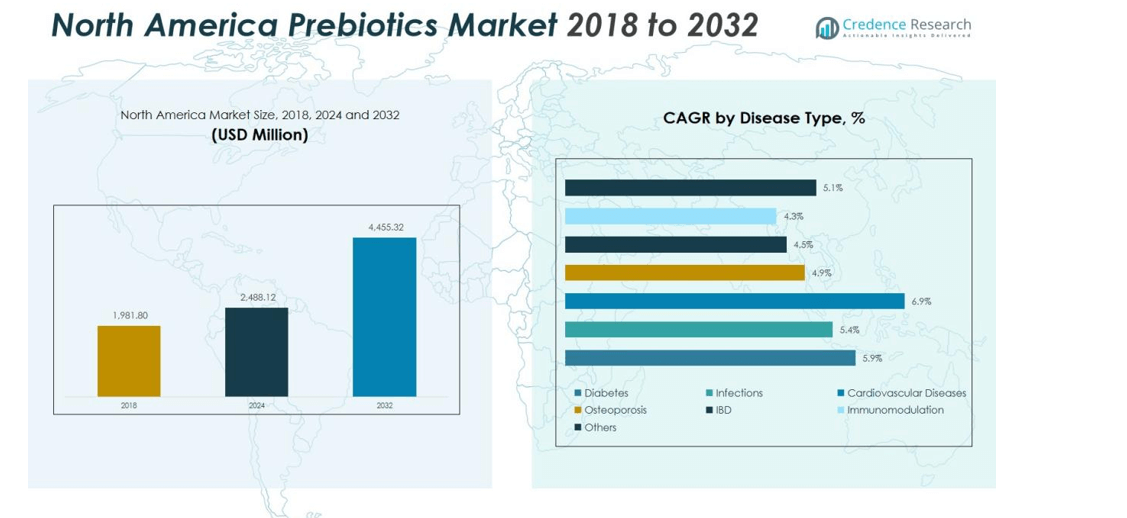

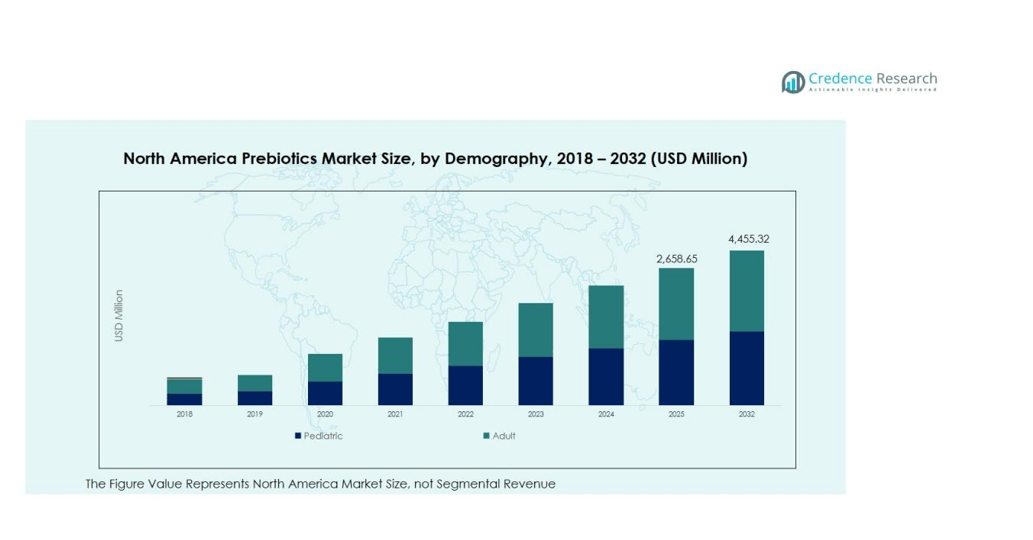

The North America Prebiotics Market size was valued at USD 1,981.80 million in 2018 to USD2,488.12 million in 2024 and is anticipated to reach USD 4,455.32 million by 2032, at a CAGR of 6.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Prebiotics Market Size 2024 |

USD 2,488.12 million |

| North America Prebiotics Market, CAGR |

6.12% |

| North America Prebiotics Market Size 2032 |

USD 4,455.32 million |

Key drivers include a growing preference for natural and clean-label food products, driven by consumers’ focus on digestive wellness and immunity. Food and beverage manufacturers are increasingly incorporating inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) to enhance nutritional value. Additionally, advancements in food processing and the expansion of personalized nutrition trends continue to stimulate product innovation and demand for prebiotic ingredients.

Regionally, the United States dominates the North America Prebiotics Market, supported by strong consumer awareness, a large base of health-conscious populations, and established nutraceutical and functional food sectors. Canada follows with increasing research investments and rising consumption of fortified foods. Mexico is witnessing growing adoption driven by urbanization, dietary diversification, and increasing health expenditure, collectively positioning North America as a major contributor to global prebiotic consumption growth.

Market Insights:

- The North America Prebiotics Market was valued at USD 1,981.80 million in 2018, reached USD 2,488.12 million in 2024, and is projected to attain USD 4,455.32 million by 2032, growing at a CAGR of 6.12% during the forecast period.

- The United States held the largest regional share of 68% in 2024, driven by high consumer awareness of gut health, advanced food processing infrastructure, and strong demand for functional foods.

- Canada accounted for 20% of the regional market, supported by government-backed R&D initiatives and growing preference for clean-label products. Mexico captured a 12% share, benefitting from dietary diversification and increased health expenditure.

- Mexico is expected to be the fastest-growing country, supported by expanding urbanization, younger health-conscious consumers, and adoption of fortified foods and beverages.

- Inulin accounted for 36% of product share, followed by fructo-oligosaccharides at 28%, reflecting strong demand in food, beverage, and dietary supplement applications promoting digestive and immune health.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Awareness of Gut Health and Wellness

The North America Prebiotics Market is driven by a surge in awareness about digestive wellness and immune health. Consumers increasingly recognize the link between gut microbiota balance and overall wellbeing. Food manufacturers and supplement brands are promoting prebiotic-enriched products to support digestive function and nutrient absorption. The trend toward preventive health management further boosts product adoption across dietary supplements and functional foods.

- For Instance, NutriLeads B.V. launched its prebiotic supplement Wecarrot, which contains Benicaros, a prebiotic fiber derived from carrots. Clinical studies conducted prior to the launch showed that Benicaros can boost beneficial gut bacteria and support the immune system.

Expanding Use of Prebiotics in Functional Foods and Beverages

Growing integration of prebiotics in everyday food products fuels market expansion. It benefits from demand for clean-label and plant-based ingredients, especially among health-conscious consumers. Manufacturers are incorporating inulin, galacto-oligosaccharides (GOS), and fructo-oligosaccharides (FOS) into bakery, dairy, and beverage formulations. These inclusions improve taste, texture, and nutritional profiles, creating broader acceptance and long-term consumption trends.

- For Instance, BENEO invested millions of euros to increase its chicory root fiber production capacity by more than 40%, with phased expansions occurring from late 2021 through 2023.

Technological Innovations in Ingredient Development and Formulation

Ongoing advancements in ingredient extraction and fermentation technologies are reshaping prebiotic production. Companies invest in R&D to enhance product stability, solubility, and compatibility with various food matrices. It helps manufacturers deliver superior prebiotic efficacy while maintaining sensory appeal. The focus on innovation supports product differentiation and strengthens competitiveness in both food and pharmaceutical applications.

Supportive Regulatory Environment and Investment Growth

Supportive food safety standards and government initiatives promote innovation and market confidence. The United States and Canada have established favorable regulations for functional ingredients, enabling faster product approvals. Increased investment from nutraceutical and biotechnology firms strengthens regional supply capabilities. This regulatory and financial environment ensures steady growth and diversification across the North America Prebiotics Market.

Market Trends:

Increasing Demand for Synbiotic and Personalized Nutrition Products

The North America Prebiotics Market is experiencing strong growth due to the shift toward personalized and functional nutrition. Consumers are seeking products that combine prebiotics and probiotics, known as synbiotics, to enhance digestive and immune health. Manufacturers are investing in personalized nutrition solutions that target specific gut microbiota compositions. It supports the development of customized supplements and food products designed for individual health goals. The trend aligns with the growing popularity of at-home microbiome testing and DNA-based diet plans. Functional foods fortified with prebiotics are gaining visibility across retail and e-commerce platforms, expanding consumer access and awareness.

- For Instance, Persephone Biosciences launched two synbiotic products, Bloom and Thrive, designed to restore missing Bifidobacteria in infants and toddlers across the U.S..

Rising Focus on Clean-Label, Plant-Based, and Sustainable Ingredients

The growing demand for clean-label and plant-based ingredients continues to shape product innovation. It drives companies to explore natural prebiotic sources such as chicory root, bananas, and whole grains. The sustainability focus across the food industry strengthens the adoption of eco-friendly ingredient sourcing and production practices. Manufacturers emphasize transparency in labeling and traceability to meet consumer expectations for ethical and health-oriented products. Prebiotics derived from renewable sources align with environmental goals and corporate sustainability commitments. The trend encourages partnerships between food producers and agricultural suppliers to create scalable, sustainable ingredient solutions in the North America Prebiotics Market.

- For Instance, The global prebiotic ingredients market was valued significantly higher than USD 1.3 billion in 2024, with various reports placing it between $7.2 billion and $10.4 billion.

Market Challenges Analysis:

High Production Costs and Complex Supply Chain Structure

The North America Prebiotics Market faces challenges due to high production costs and a complex supply chain. Extraction and purification of prebiotic compounds such as inulin and oligosaccharides require advanced technology and strict quality control. It limits participation for small and mid-sized producers and raises product prices. Supply chain inefficiencies, including raw material shortages and transportation delays, affect consistent availability. Rising energy and logistics costs further pressure manufacturers. Maintaining profitability while ensuring affordability remains a critical concern for market stability.

Limited Consumer Awareness and Product Differentiation Issues

Limited public knowledge of prebiotic benefits hinders broader market adoption across certain consumer segments. Many consumers still confuse prebiotics with probiotics, reducing brand clarity and purchase confidence. It restricts the expansion of niche applications in sports nutrition, infant formula, and animal feed. Companies struggle to differentiate products in a crowded functional food and supplement market. Regulatory labeling complexities add difficulty in conveying scientifically accurate claims. Addressing education gaps and improving marketing communication are essential for sustainable growth in the North America Prebiotics Market.

Market Opportunities:

Growing Integration of Prebiotics in Functional Foods and Nutraceuticals

The North America Prebiotics Market presents strong opportunities through expanding use in functional foods, beverages, and nutraceuticals. Consumers are seeking convenient formats such as snack bars, yogurts, and fortified drinks that support digestive health. It encourages food manufacturers to innovate with natural prebiotic ingredients like inulin, FOS, and GOS. The trend toward preventive healthcare drives demand for nutrition-rich products that enhance immunity and gut balance. Collaborations between food technologists and health experts are improving formulation efficiency and product appeal. Wider retail penetration and rising acceptance of digestive wellness products support future revenue growth.

Expanding Applications in Animal Nutrition and Pharmaceutical Formulations

Prebiotics are gaining traction in animal feed and pharmaceutical industries for their health-promoting properties. It supports the development of antibiotic-free feed solutions and enhances gut microbiota in livestock and companion animals. Pharmaceutical companies are exploring prebiotic compounds for use in metabolic and immune-related therapies. The rising focus on gut-brain axis research further widens potential medical applications. Investment in biotechnology and sustainable ingredient sourcing strengthens long-term industry prospects. These factors create multiple pathways for innovation and diversification within the North America Prebiotics Market.

Market Segmentation Analysis:

By Product

The North America Prebiotics Market is segmented into fructo-oligosaccharides, inulin, pyrodextrins, galacto-oligosaccharides, soya oligosaccharides, lactulose, isomalto-oligosaccharides, and others. Inulin holds the largest share due to its wide use in functional foods, beverages, and dietary supplements. It supports digestive health and aids in calcium absorption, driving its popularity among consumers. Galacto-oligosaccharides and fructo-oligosaccharides are gaining traction for their effectiveness in promoting beneficial gut bacteria. The growing demand for clean-label and plant-based products strengthens the adoption of these natural ingredients.

- For Instance, With rising U.S. demand for dietary fibers, the global inulin market was valued at approximately USD 1.8 billion in 2024. Major suppliers like Cargill and others continue to meet this demand, contributing to the market’s growth.

By Disease Type

This market segment includes diabetes, infections, cardiovascular diseases, osteoporosis, inflammatory bowel disease (IBD), immunomodulation, and others. Prebiotics play a significant role in managing metabolic and digestive disorders. It is increasingly used in formulations targeting diabetes and cardiovascular health, driven by rising lifestyle-related health issues. Demand for prebiotic-rich supplements addressing immunity and gut inflammation is increasing across all age groups. The strong clinical validation of prebiotic efficacy supports expansion across multiple therapeutic applications.

- For instance, in May 2024, Myota conducted a clinical trial involving 66 prediabetic patients where a 20 g/day dose of its prebiotic fibre supplement reduced HbA1c levels by 0.17% and improved insulin sensitivity significantly compared to the placebo group, as published in the British Journal of Nutrition.

By Demography

The demography segment is categorized into pediatric, adult, and geriatric groups. Adults account for the dominant share due to growing consumption of functional foods and dietary supplements. Pediatric applications are expanding, with rising inclusion of prebiotics in infant formula for digestive and immune support. The geriatric group represents a high-growth category due to its focus on digestive balance and chronic disease management. It drives innovation in easy-to-consume, nutritionally enriched prebiotic formulations.

Segmentations:

By Product:

- Fructo-Oligosaccharides

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type:

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- Inflammatory Bowel Disease (IBD)

- Immunomodulation

- Others

By Demography:

- Pediatric

- Adult

- Geriatric

By Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

By Country:

Regional Analysis:

United States Leading Market Share Driven by High Health Awareness

The North America Prebiotics Market is led by the United States, supported by advanced food processing industries and a strong focus on health-oriented products. Consumers show high awareness of digestive wellness and preventive nutrition, driving demand for prebiotic-enriched foods and supplements. It benefits from established players investing in R&D to develop innovative formulations with inulin, FOS, and GOS. The country’s robust retail infrastructure and online distribution strengthen accessibility across all consumer segments. Partnerships between food manufacturers and nutraceutical firms further enhance market penetration and product diversification.

Canada Exhibiting Steady Growth Through Innovation and Research Support

Canada represents a growing segment due to government-backed initiatives in nutrition research and food innovation. The country is witnessing a steady rise in demand for functional foods promoting digestive and immune health. It benefits from collaborations between universities, biotechnology firms, and ingredient suppliers that focus on developing clean-label prebiotic solutions. Expanding consumer preference for natural ingredients is driving new product introductions across the market. Increasing investments in food safety and labeling transparency further support long-term adoption of prebiotic-based products in Canada.

Mexico Emerging as a High-Growth Market with Rising Health Awareness

Mexico is emerging as a key growth contributor to the regional market due to rising disposable incomes and urbanization. Growing awareness of gut health and dietary improvement is fueling interest in prebiotic-rich products. It benefits from the expansion of local food processing industries adopting functional ingredients to meet evolving consumer needs. Health-conscious younger populations are driving demand for fortified foods and beverages. Government programs promoting nutrition and wellness create favorable conditions for market expansion across retail and healthcare channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Prebiotics Market features strong competition among multinational ingredient suppliers and regional manufacturers. Key companies include Abbott Laboratories, Archer Daniels Midland Company, BASF SE, Beghin Meiji, BENEO GmbH, Biopolis Life Sciences Private Limited, Ciranda, Inc., and Clasado Limited. These players focus on expanding product portfolios and enhancing formulations with high-purity prebiotic ingredients such as inulin and oligosaccharides. It emphasizes innovation in functional food and nutraceutical applications to meet evolving consumer needs. Strategic partnerships, mergers, and R&D investments remain central to strengthening market positions. Companies are also prioritizing sustainability, traceability, and clean-label production to align with regulatory standards and consumer expectations.

Recent Developments:

- In October 2025, Abbott Laboratories announced strong third-quarter 2025 results emphasizing major growth in its Medical Devices and Diabetes Care segments, particularly due to its FreeStyle Libre technology and expanding device portfolio in global markets.

- In October 2025, BASF SE and Carlyle Group, partnered with Qatar Investment Authority, entered into a binding agreement valued at €7.7 billion for Carlyle’s acquisition of a majority stake in BASF’s coatings business, which includes automotive OEM and refinish coatings and surface treatment operations, with BASF retaining a 40% equity stake; the transaction is expected to close in the second quarter of 2026.

Report Coverage:

The research report offers an in-depth analysis based on Product, Disease Type, Demography, Distribution Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer focus on digestive wellness will continue to drive demand for prebiotic-enriched products across food and supplement sectors.

- Growing applications in functional foods, beverages, and nutraceuticals will strengthen market penetration across mainstream retail.

- Manufacturers will increase investment in advanced extraction and fermentation technologies to improve product quality and stability.

- Clean-label and plant-based ingredient trends will support the development of sustainable and transparent prebiotic solutions.

- Collaborations between food producers, biotech firms, and research institutions will accelerate innovation and formulation diversity.

- Integration of prebiotics with probiotics in synbiotic products will expand consumer reach and clinical validation.

- E-commerce and direct-to-consumer channels will play a larger role in product visibility and brand loyalty.

- Prebiotic use in animal feed and pharmaceutical formulations will open new revenue opportunities for manufacturers.

- Government initiatives promoting nutrition and gut health awareness will enhance regulatory clarity and consumer trust.

- The North America Prebiotics Market will evolve toward personalized nutrition, focusing on microbiome-based dietary solutions and precision health products.