Market Overview:

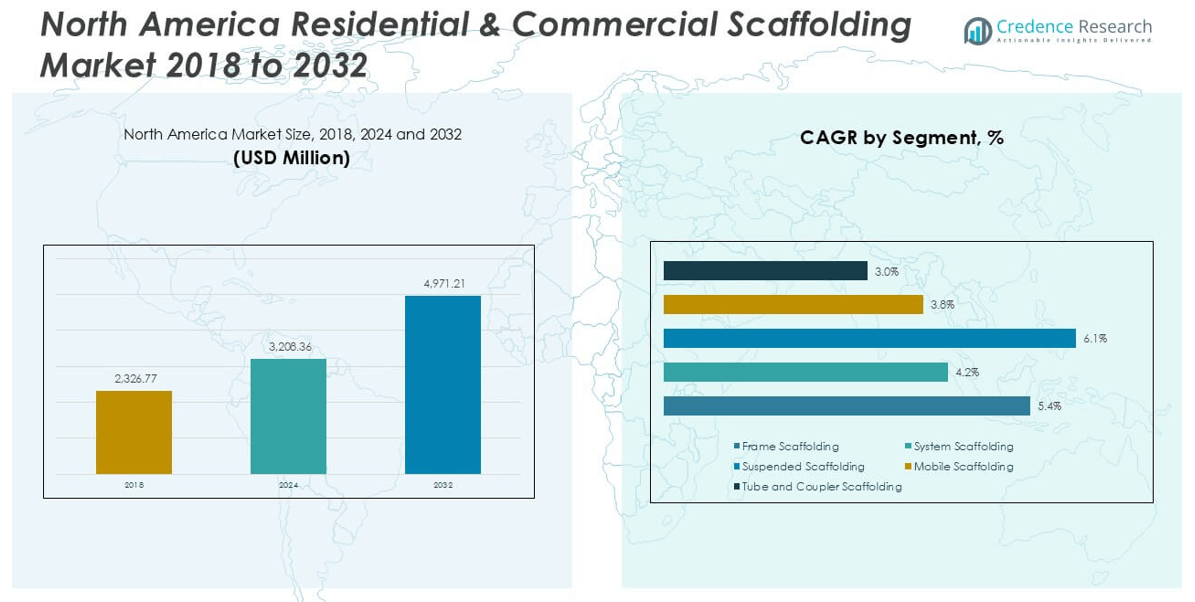

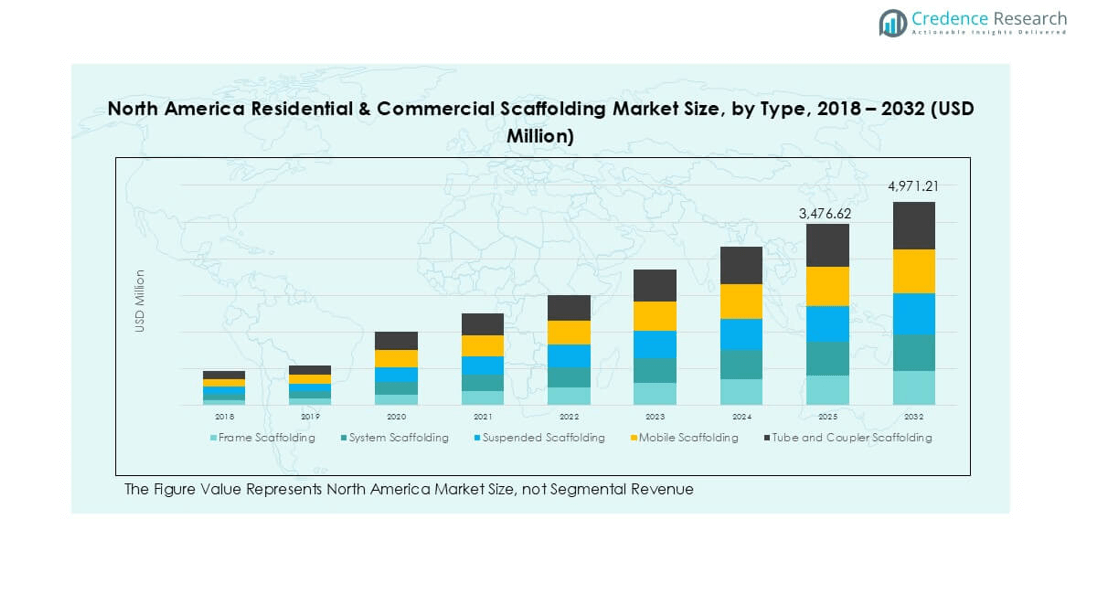

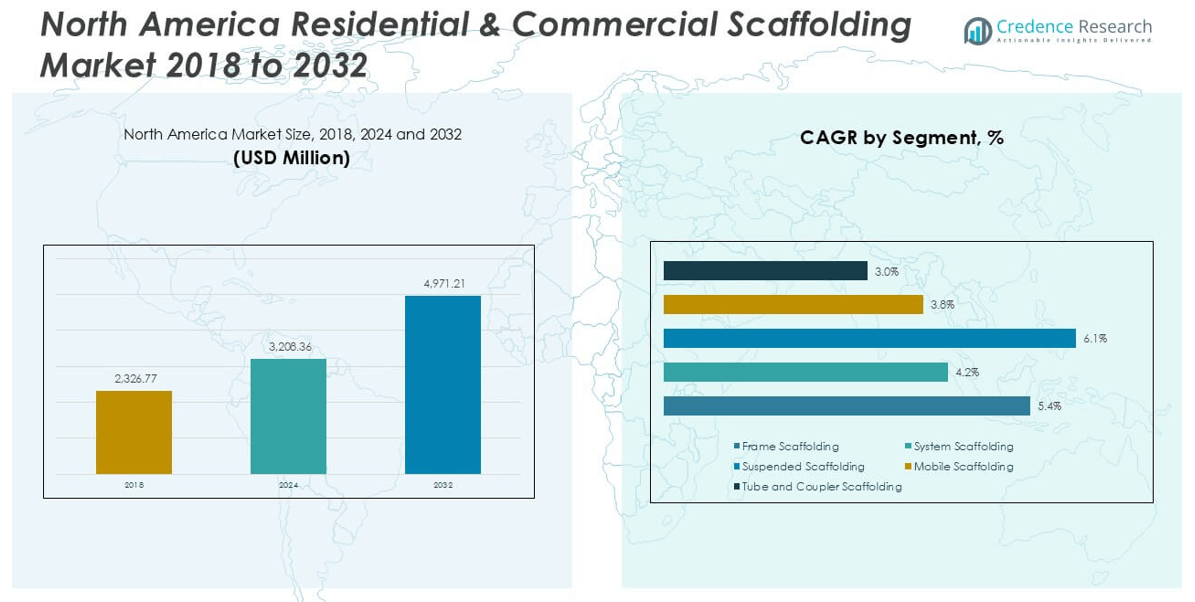

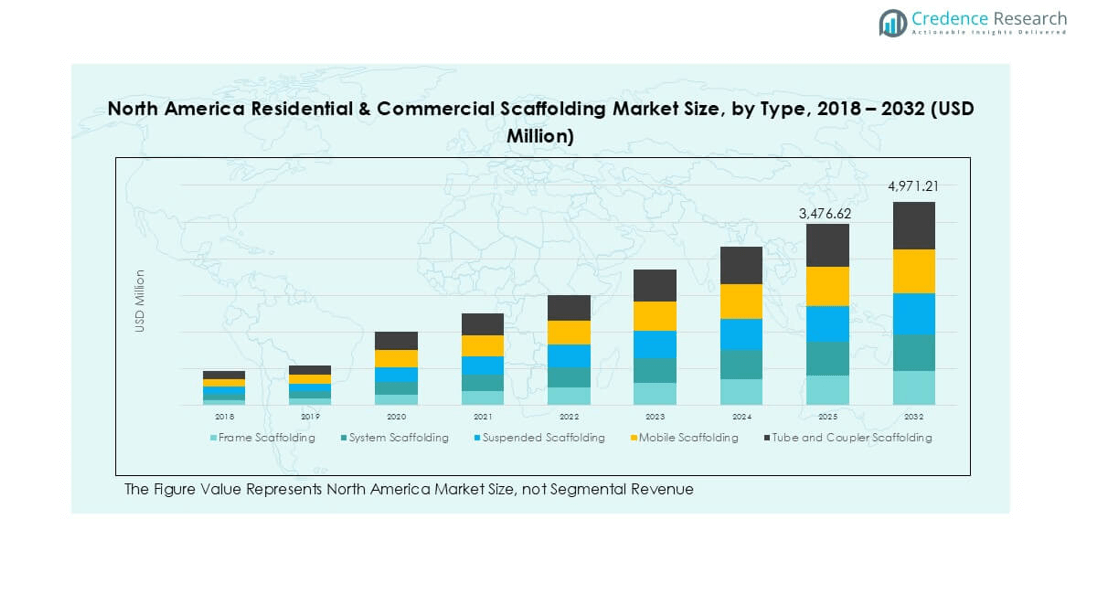

North America Residential & Commercial Scaffolding market size was valued at USD 2,326.77 million in 2018, increased to USD 3,208.36 million in 2024, and is anticipated to reach USD 4,971.21 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Residential & Commercial Scaffolding Market Size 2024 |

USD 3,208.36 million |

| North America Residential & Commercial Scaffolding Market, CAGR |

5.2% |

| North America Residential & Commercial Scaffolding Market Size 2032 |

USD 4,971.21 million |

The North America Residential & Commercial Scaffolding market is led by key players such as Brand Industrial Services, Inc., WernerCo, Layher North America, ULMA Form Works, Inc., and Mattison Scaffolding Ltd, who collectively command a significant share through expansive product portfolios, rental services, and strong project execution capabilities. These companies leverage advanced modular systems and safety-compliant solutions to address growing construction demands. Among regional markets, the United States dominates with over 70% market share in 2024, driven by robust infrastructure development, high-rise residential projects, and stringent safety regulations. Canada and Mexico follow, with approximately 20% and 10% market shares respectively, supported by ongoing urbanization and infrastructure investments.

Market Insights

- The North America Residential & Commercial Scaffolding market was valued at USD 3,208.36 million in 2024 and is projected to reach USD 4,971.21 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Market growth is driven by increasing urban infrastructure development, rising demand for high-rise buildings, and stringent safety regulations encouraging the use of standardized scaffolding systems.

- A notable trend includes the growing adoption of modular and prefabricated scaffolding systems that reduce labor dependency and accelerate construction timelines.

- The market is moderately fragmented, with leading players such as Brand Industrial Services, WernerCo, and Layher North America dominating through large-scale operations, while regional firms compete on service specialization and rental offerings.

- Regionally, the United States accounts for over 70% of the market share, followed by Canada at 20% and Mexico at 10%; by type, frame scaffolding leads due to its adaptability and cost-effectiveness in residential and mid-rise projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

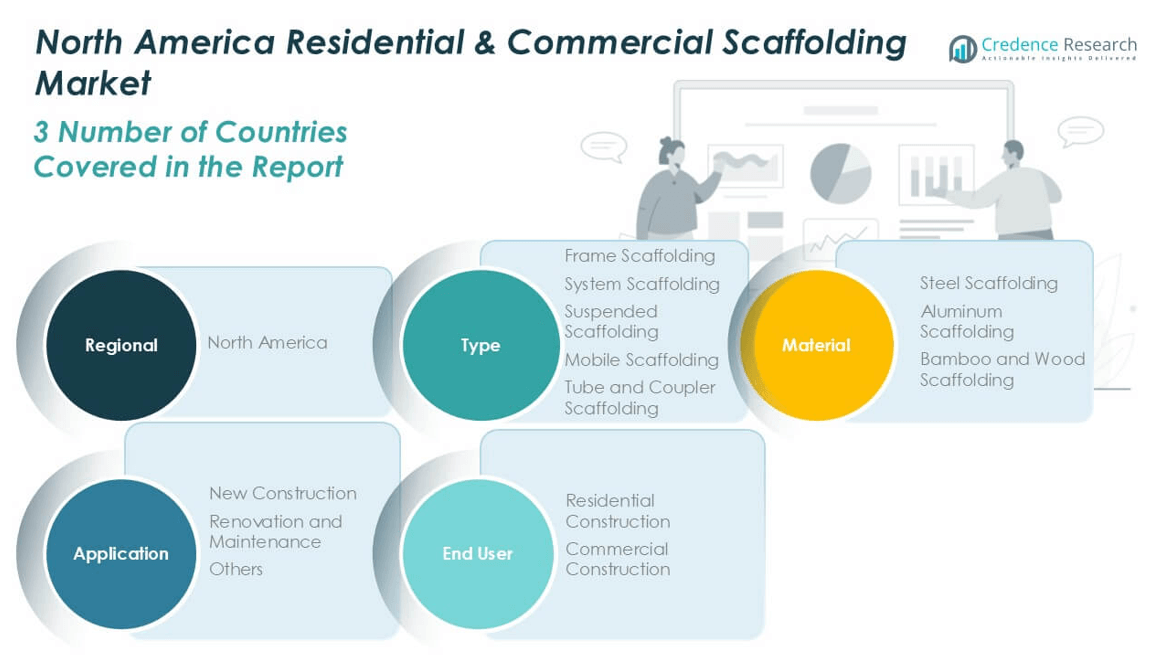

By Type

In the North America residential and commercial scaffolding market, frame scaffolding holds the dominant market share among type segments. Its popularity stems from ease of assembly, cost-effectiveness, and adaptability across residential and low to mid-rise commercial projects. Frame scaffolding is widely used in both interior and exterior construction due to its modular structure and enhanced worker safety. The increasing number of urban construction and renovation projects is fueling demand for frame systems. Meanwhile, system scaffolding is gaining traction for complex commercial applications due to its high load-bearing capacity and flexible configuration.

- For instance, Layher North America’s Allround Scaffolding System supports load classes up to 6 (6.0 kN/m²), and the company has successfully deployed over 10,000 tons of frame scaffolding for major commercial renovations in cities like New York and Toronto.

By Material

Steel scaffolding leads the material segment with the highest market share, primarily due to its superior strength, durability, and load capacity. It is widely adopted across both residential and commercial projects that require robust, long-term support, especially in high-rise and heavy-duty construction. The material’s resistance to environmental stress and longer lifecycle justifies its higher upfront cost. In contrast, aluminium scaffolding is gaining momentum for lightweight applications, driven by ease of handling and corrosion resistance, particularly in maintenance works. Bamboo and wood scaffolding, though still present, have limited use due to safety and durability concerns.

- For instance, WernerCo produces over 1 million linear feet of steel scaffolding components annually in its North American facilities, including its ProSeries steel scaffolds used extensively in commercial construction across more than 1,200 active U.S. job sites.

By Application

New construction dominates the application segment in the North American scaffolding market, accounting for the largest share due to consistent demand in urban infrastructure expansion and housing development. Ongoing residential and commercial building projects in metropolitan areas continue to drive the need for scaffolding systems. Additionally, the rise of mixed-use developments and vertical expansion trends further boosts this segment. Renovation and maintenance activities also contribute significantly, propelled by aging infrastructure and stricter building regulations requiring periodic upgrades. However, new construction remains the key growth engine, supported by investments in real estate and public infrastructure projects.

Market Overview

Urban Infrastructure Expansion and Residential Development

Rapid urbanization and population growth across major North American cities are driving significant investment in residential and commercial construction. Governments and private developers are focusing on high-density housing and smart infrastructure projects, which require extensive scaffolding systems for structural support, worker safety, and efficient project execution. This expansion in both new housing units and commercial real estate is fueling the demand for adaptable and cost-effective scaffolding solutions, particularly frame and steel-based structures suitable for high-rise and mid-rise buildings.

- For instance, BrandSafway has supported over 2,800 major residential and commercial projects across North America using its SafMax™ Frame Scaffolding, contributing to large-scale developments such as the Hudson Yards complex in New York.

Increasing Renovation and Retrofit Activities

The aging infrastructure in the U.S. and Canada has created a substantial market for renovation and maintenance work, particularly in commercial buildings and urban residential units. Older structures require safety upgrades, facade repairs, and compliance modifications, all of which rely on scaffolding systems for access and worker safety. The rise of government initiatives to modernize buildings and meet energy-efficiency standards further accelerates this trend. This driver significantly benefits the suspended and mobile scaffolding segments, which offer flexible access solutions in constrained or vertical working environments.

- For instance, Mattison Scaffolding Ltd completed over 1,400 suspended scaffold installations across urban high-rise buildings in 2023 alone, supporting façade restorations and energy-efficiency upgrades in cities such as Chicago and Los Angeles.

Emphasis on Worker Safety and Regulatory Compliance

Stringent OSHA and local safety regulations across North America are encouraging construction companies to adopt reliable and compliant scaffolding systems. Enhanced focus on worker safety has pushed demand for scaffolding with superior stability, load-bearing capacity, and modular features. Manufacturers are also innovating with design enhancements such as anti-slip platforms and integrated fall protection, aligning with the regulatory push for safer job sites. This regulatory landscape serves as a key growth driver by promoting equipment upgrades and encouraging adoption of modern, standardized scaffolding systems.

Key Trends & Opportunities

Rising Adoption of Modular and Prefabricated Scaffolding Systems

Contractors are increasingly adopting modular and prefabricated scaffolding solutions to improve operational efficiency and reduce on-site labor costs. These systems allow quicker installation, dismantling, and enhanced reusability across multiple projects. System scaffolding, in particular, is gaining popularity in complex commercial structures due to its ease of customization and adaptability. This trend offers a strong growth opportunity for manufacturers offering modular components designed for faster assembly without compromising safety or strength.

- For instance, ULMA Form Works delivered modular MK System scaffolding for over 350 projects in North America in 2023, enabling setup time reductions of up to 40% on multi-story commercial sites.

Integration of Digital Technologies in Scaffolding Operations

Digital innovations such as Building Information Modeling (BIM), RFID tracking, and real-time safety monitoring are gradually transforming the scaffolding industry. Contractors and site managers are utilizing these technologies to optimize scaffolding layouts, enhance inventory management, and monitor safety compliance. This trend is creating new opportunities for scaffolding service providers and manufacturers to offer value-added solutions that integrate with smart construction platforms, contributing to productivity and safety improvements across project lifecycles.

- For instance, SafwayAtlantic integrated RFID tracking into over 18,000 scaffolding units in 2023, enabling real-time monitoring and reducing material loss by 23% across urban redevelopment projects in the Northeast U.S.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

The scaffolding industry is highly dependent on raw materials like steel and aluminum, whose prices are subject to global volatility. Trade disruptions, tariffs, and geopolitical factors further intensify cost pressures on manufacturers. These fluctuations can affect profit margins and limit small and medium enterprises’ ability to compete effectively. Additionally, supply chain bottlenecks may delay project timelines, undermining contractors’ confidence in scaffolding availability and pricing consistency.

Labor Shortage and Skilled Workforce Constraints

A persistent labor shortage in the construction industry, particularly for skilled scaffolding assembly and inspection roles, poses a significant challenge. Improper installation due to inadequate training can lead to workplace accidents and project delays. Although automation and prefabrication help address this issue partially, the industry still relies heavily on experienced labor for safe and efficient scaffolding operations. This constraint hampers scalability, especially during peak construction seasons.

Environmental and Waste Management Concerns

Scaffolding operations often generate metal waste, packaging debris, and other construction-related refuse. Increasing environmental scrutiny and sustainability standards are compelling contractors to adopt eco-friendly scaffolding solutions or recycling practices. However, implementing sustainable processes requires additional investment in material recycling, waste segregation, and low-emission transportation—factors that increase operational complexity and cost. Adapting to these requirements remains a challenge, particularly for smaller players with limited resources.

Regional Analysis

United States

The United States dominates the North America residential and commercial scaffolding market, accounting for over 70% of the regional market share in 2024. This leadership is driven by the country’s expansive construction sector, robust infrastructure investments, and strong demand for both residential and commercial real estate. Urbanization, high-rise developments, and ongoing renovation projects in major cities such as New York, Los Angeles, and Chicago significantly boost demand for durable and efficient scaffolding systems. Additionally, stringent safety regulations and increased emphasis on worker protection drive adoption of modern, compliant scaffolding. Technological advancements and labor efficiency further support market growth.

Canada

Canada holds approximately 20% of the North America scaffolding market, supported by stable residential construction activity and growing infrastructure modernization efforts. Demand is particularly strong in provinces like Ontario, British Columbia, and Alberta, where urban growth and institutional developments are prevalent. The country’s focus on sustainable construction and energy-efficient building upgrades contributes to the rise in scaffolding needs, especially for renovation and retrofitting projects. Increased investments in commercial real estate and public infrastructure, along with adherence to Canadian safety codes, propel the demand for both frame and system scaffolding solutions across key metropolitan regions.

Mexico

Mexico contributes close to 10% of the North America scaffolding market share, with growing demand spurred by urban infrastructure development, industrial expansion, and commercial construction projects. Cities like Mexico City, Monterrey, and Guadalajara are experiencing increasing construction activities, especially in the commercial and mixed-use segments. Although the market is comparatively smaller, it is witnessing steady growth due to a rising middle-class population, housing demand, and government-led infrastructure projects. Cost-effective scaffolding solutions such as frame and tube & coupler systems are widely adopted. However, challenges such as regulatory enforcement and skilled labor availability somewhat restrain rapid market expansion.

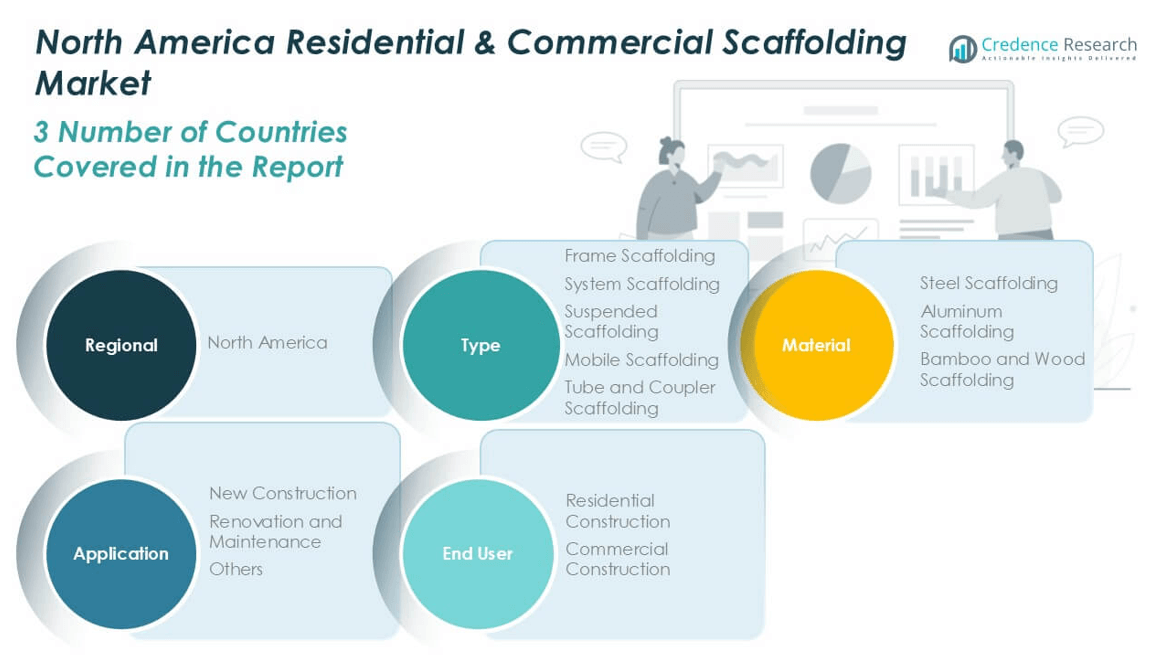

Market Segmentations:

By Type

- Frame Scaffolding

- System Scaffolding

- Suspended Scaffolding

- Mobile Scaffolding

- Tube and Coupler Scaffolding

By Material

- Steel Scaffolding

- Aluminium Scaffolding

- Bamboo and Wood Scaffolding

By Application

- New Construction

- Renovation and Maintenance

- Others

By End User

- Residential Construction

- Commercial Construction

By Geography

Competitive Landscape

The North America residential and commercial scaffolding market exhibits a moderately fragmented competitive landscape, characterized by the presence of both multinational corporations and regional players. Key companies such as Brand Industrial Services, WernerCo, and Layher North America dominate through extensive product portfolios, strategic partnerships, and large-scale project capabilities. These players invest in technological advancements, such as modular and lightweight scaffolding systems, to enhance operational efficiency and safety compliance. Smaller firms like Mattison Scaffolding Ltd and Associated Scaffolding Co., Inc. compete by offering localized services, quick turnaround times, and customized solutions. Mergers, acquisitions, and geographic expansions remain common strategies to strengthen market position and increase customer reach. Additionally, players are focusing on rental services, which are gaining popularity due to cost-effectiveness and flexibility. As safety regulations become stricter and demand for efficient construction practices rises, competition intensifies, pushing companies to prioritize innovation, service differentiation, and sustainability in product development and deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mattison Scaffolding Ltd

- Brand Industrial Services, Inc.

- WernerCo

- ULMA Form Works, Inc.

- Penn Tool Co.

- Ver Sales, Inc.

- Associated Scaffolding Co., Inc.

- QuickAlly Access Solutions

- Layher North America

- Safway Atlantic

Recent Developments

- In April 2025, Brand Industrial Services is expected to maintain its strong position in the U.S. scaffolding contractors market, driven by sustained demand across various construction sectors. This includes commercial, infrastructure, and some residential applications. The construction industry in the U.S. is projected to experience continued growth, further contributing to the demand for scaffolding services.

- In April 2025, Layher North America continues to lead with innovations in lightweight, fast-assembly, and strong scaffolding systems. They offer modular scaffolding solutions optimized for commercial, industrial, and construction projects with safety and profitability in focus. Product highlights include the Keder XL Roof System for weather protection, cassette roof scaffolding for spanning large gaps, and heavy-duty scaffold towers with enhanced load capacities. They supply stairway and access solutions compliant with US safety regulations and emphasize digital design, engineering support, and logistics capabilities within North America.

Market Concentration & Characteristics

The North America Residential & Commercial Scaffolding Market exhibits moderate market concentration, with a mix of large multinational players and specialized regional firms competing across diverse project scales. Major companies such as Brand Industrial Services, WernerCo, and Layher North America maintain a strong presence through extensive rental networks, advanced product offerings, and compliance with safety regulations. The market is characterized by growing demand for modular, easy-to-assemble scaffolding systems that support efficiency and worker safety in both new construction and renovation activities. It supports a wide range of applications, from large-scale commercial buildings to mid-rise residential structures. Demand remains highest in the United States, driven by urban development and infrastructure investments, while Canada and Mexico contribute through steady growth in residential upgrades and commercial expansion. Pricing pressure from fluctuating raw material costs and labor shortages challenge smaller firms, yet regional players remain competitive by offering responsive service and localized expertise. The market continues to evolve with greater emphasis on standardization, safety, and rental-based business models.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing demand for urban infrastructure and high-rise residential projects.

- Adoption of modular and prefabricated scaffolding systems will rise to improve efficiency and reduce labor requirements.

- Rental-based scaffolding services will gain popularity due to cost-effectiveness and operational flexibility.

- Regulatory focus on worker safety will continue to drive the demand for compliant and advanced scaffolding solutions.

- Technological integration, such as digital modeling and tracking, will enhance project planning and safety management.

- The United States will maintain its dominant position due to strong construction activity and infrastructure investments.

- Canada will experience gradual growth with increased renovation and institutional building developments.

- Mexico’s market will expand steadily, supported by urbanization and commercial construction growth.

- Manufacturers will invest more in lightweight, durable materials to meet sustainability and performance goals.

- Competitive intensity will increase as companies focus on innovation, strategic partnerships, and geographic expansion.