Market Overview

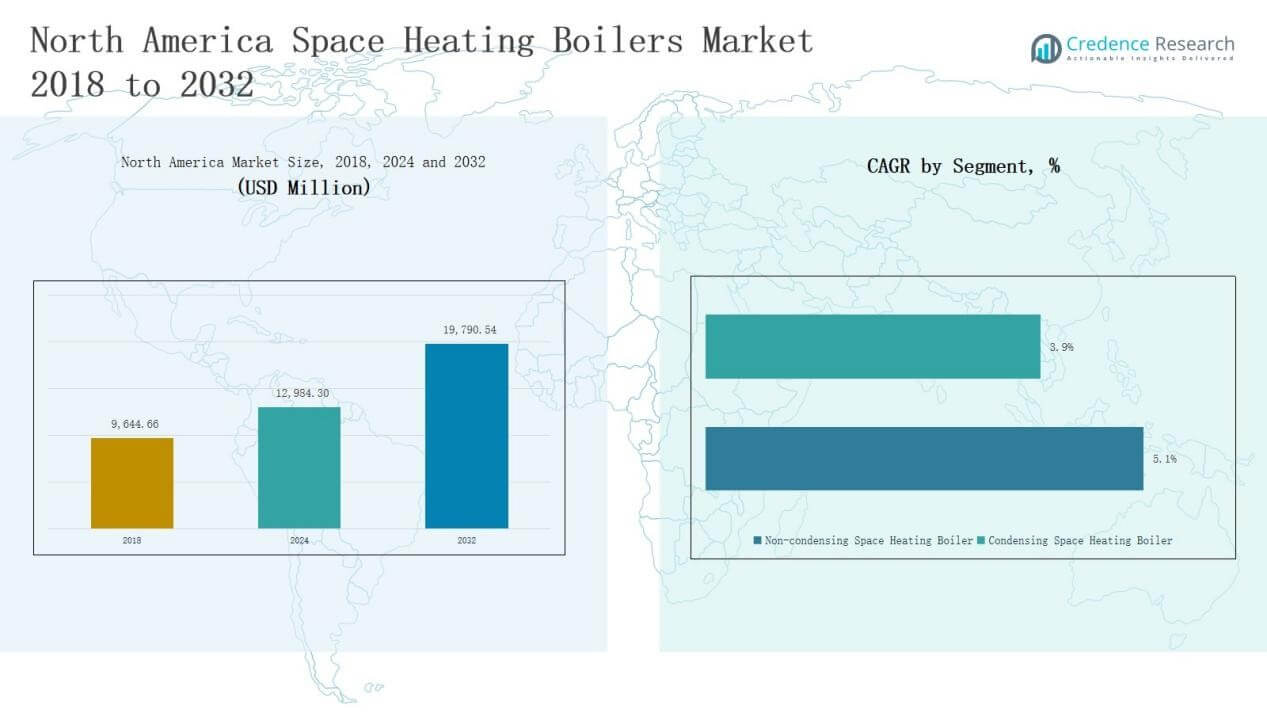

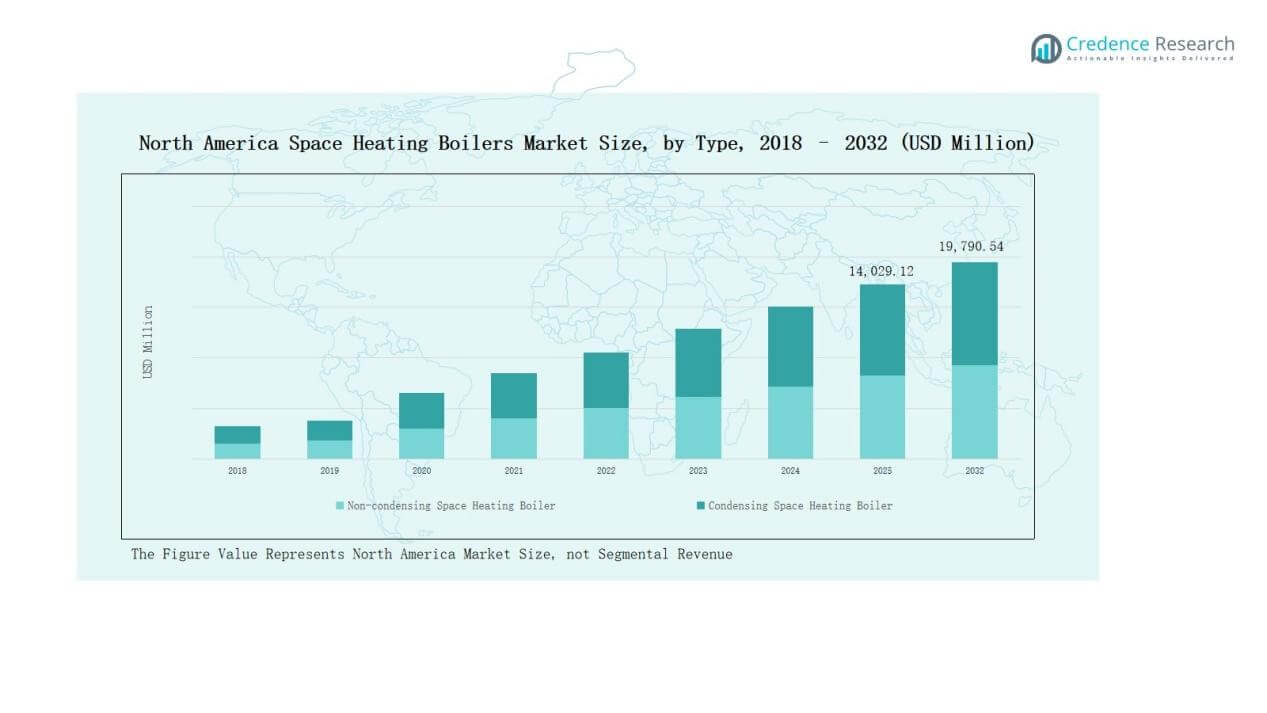

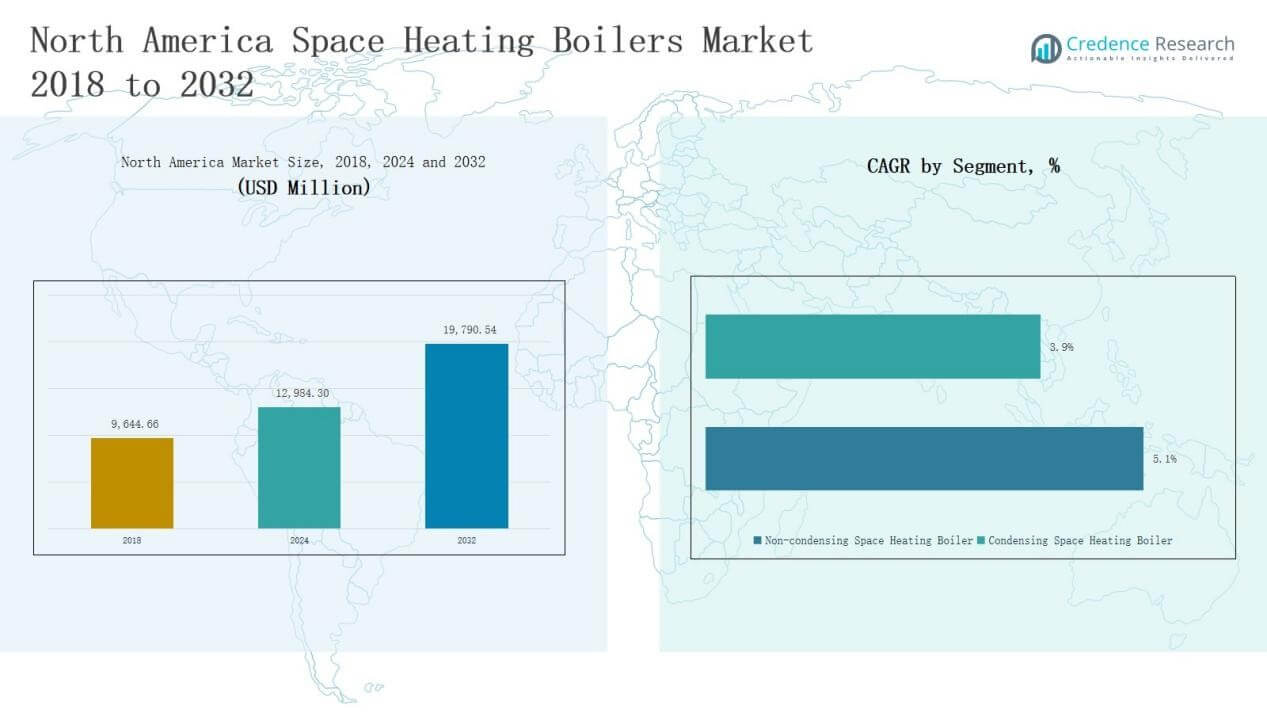

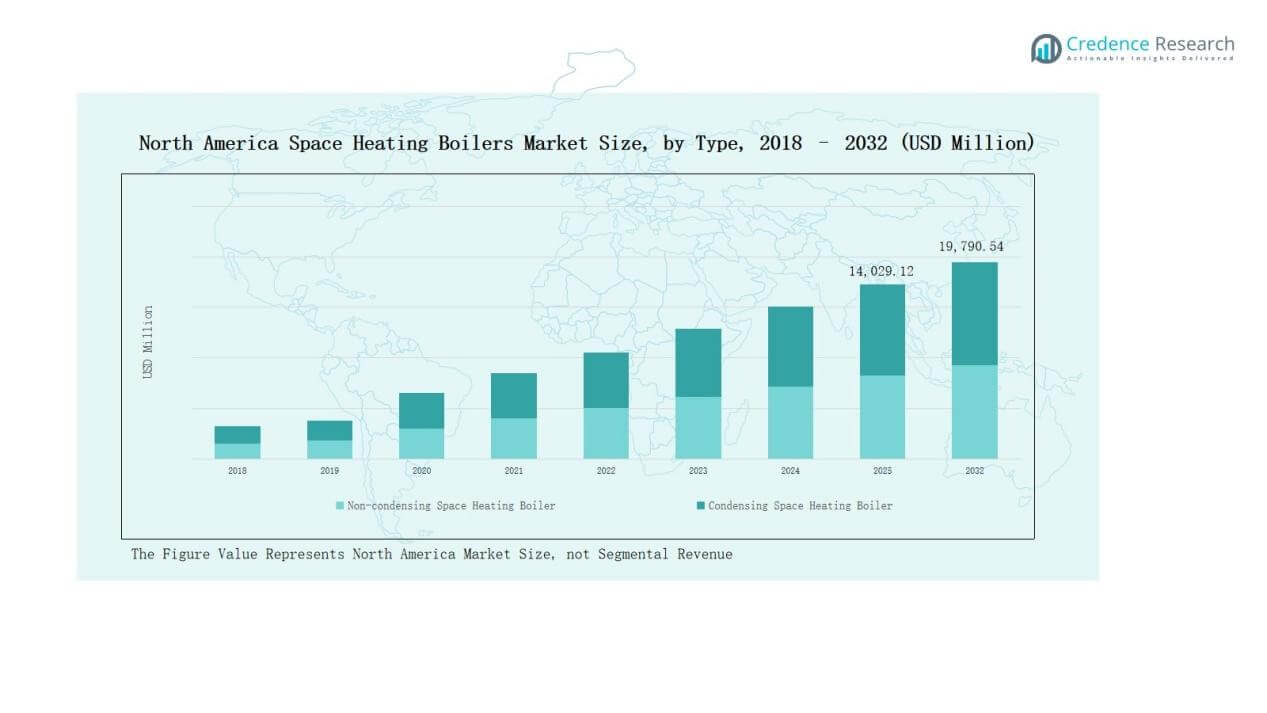

North America Space Heating Boilers Market size was valued at USD 9,644.66 million in 2018 to USD 12,984.30 million in 2024 and is anticipated to reach USD 19,790.54 million by 2032, at a CAGR of 5.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Space Heating Boilers Market Size 2024 |

USD 12,984.30 Million |

| North America Space Heating Boilers Market, CAGR |

5.0% |

| North America Space Heating Boilers Market Size 2032 |

USD 19,790.54 Million |

The North America Space Heating Boilers Market is shaped by strong competition among leading players such as Carrier Global Corporation, Johnson Controls, Lennox International, Viessmann Manufacturing Company, Bosch Thermotechnology, Burnham Holdings, Lochinvar, Slant/Fin, Peerless of America, and AERCO International. These companies focus on energy-efficient technologies, condensing boiler innovations, and digital integration to strengthen their market positions across residential, commercial, and industrial segments. The United States leads the regional landscape with a commanding 72% share in 2024, supported by advanced gas infrastructure, strict regulatory standards, and strong replacement demand.

Market Insights

- The North America Space Heating Boilers Market was USD 9,644.66 million in 2018 and is projected to reach USD 19,790.54 million by 2032, growing at 5.0%.

- Leading players include Carrier Global, Johnson Controls, Lennox International, Viessmann Manufacturing, Bosch Thermotechnology, Burnham Holdings, Lochinvar, Slant/Fin, Peerless of America, and AERCO International.

- Condensing boilers dominate with 65% share in 2024, driven by strict efficiency regulations, while non-condensing models hold 35% share but face declining demand.

- Residential applications lead with 58% share, followed by commercial at 27% and industrial at 15%, reflecting strong household replacements and rising construction activity.

- The United States leads the region with 72% share in 2024, while Canada accounts for 18% and Mexico 10%, each showing distinct growth drivers and adoption trends

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

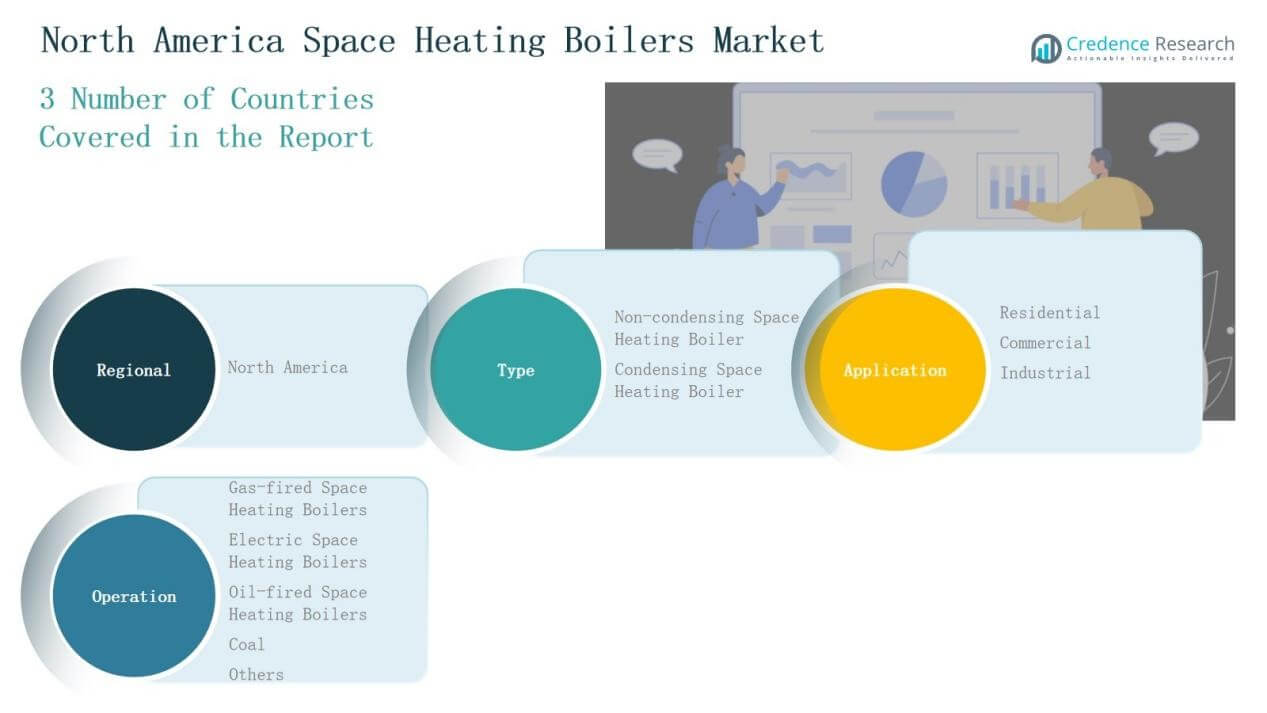

By Type

Condensing space heating boilers dominate the North America market with nearly 65% share in 2024. Their growth is driven by strict energy efficiency regulations, rebate programs, and consumer demand for low-emission heating. Non-condensing boilers, holding around 35% share, still serve cost-sensitive buyers and older building retrofits but face declining adoption due to regulatory shifts. Manufacturers are actively phasing out outdated models, and rising installation of smart heating systems further accelerates the transition toward condensing technology.

- For instance, Bosch Thermotechnology introduced its Greenstar series condensing boilers with AFUE ratings of up to 95%, aligning with ENERGY STAR® requirements.

By Application

The residential segment leads with 58% share of the market, supported by rising housing construction and replacement demand in existing homes. Commercial applications account for 27% share, with demand from office complexes, educational institutions, and healthcare facilities prioritizing efficient heating. Industrial applications, holding the remaining 15% share, grow steadily due to facility heating and process-support requirements, though efficiency upgrades remain limited compared to residential and commercial.

- For instance, Trane Technologies reduced the carbon impact of HVAC through a partnership with U.S. Steel, which manufactures VerdeX steel with up to 70–80% lower CO2 emissions.

By Operation

Gas-fired boilers remain the dominant operation type, accounting for 62% share of the North America space heating boilers market. This dominance stems from widespread gas infrastructure, affordability, and government support for gas heating in colder regions. Electric boilers hold 20% share, gaining traction in urban areas with decarbonization goals and stricter emission standards. Oil-fired boilers capture 10% share, mainly in rural zones with limited gas access. Coal and other fuel-based options together represent less than 8% share, reflecting their decline due to environmental restrictions.

Market Overview

Key Growth Drivers

Rising Demand for Energy Efficiency

The shift toward energy-efficient heating solutions drives strong adoption of condensing boilers across North America. Governments promote upgrades through tax credits, rebates, and stringent building codes. Consumers increasingly replace outdated units to reduce energy bills and carbon footprints. This demand reinforces the dominance of condensing models, which now account for over 65% of installations. Enhanced thermal efficiency, coupled with emission-reduction benefits, positions high-efficiency boilers as a central driver in meeting sustainability targets and supporting long-term growth in both residential and commercial segments.

- For instance, ENERGY STAR data from the U.S. Environmental Protection Agency confirms that certified condensing gas boilers achieve annual fuel utilization efficiency (AFUE) ratings of 90–98%, compared to around 80% for non-condensing units.

Expanding Residential Construction and Renovation

Growth in residential construction and renovations significantly boosts boiler demand across the U.S. and Canada. Rising population, urban expansion, and increased household incomes support installations in new housing projects. Replacement demand is also strong as older boilers reach end-of-life, especially in colder states. Homeowners increasingly favor energy-efficient and smart heating systems, fueling product upgrades. This steady expansion in residential infrastructure not only sustains market volume but also shapes long-term sales cycles, ensuring a stable revenue stream for manufacturers and distributors.

- For instance, Navien Inc. introduced its NFB-H Fire Tube Boilers in 2021, designed with high-efficiency condensing technology (up to 95% AFUE), aligning with the growing homeowner preference for eco-friendly upgrades in residential heating.

Technological Advancements in Heating Systems

Rapid technological improvements strengthen market competitiveness and adoption rates in North America. Smart boilers integrated with IoT-enabled controls, remote diagnostics, and predictive maintenance deliver higher convenience and performance. These solutions help reduce downtime and optimize energy consumption, appealing to both households and enterprises. Innovations such as hybrid heating systems and modular boiler designs expand applications across commercial and industrial users. As manufacturers invest heavily in R&D, these advancements accelerate the replacement cycle and align with regional decarbonization and energy-management objectives.

Key Trends & Opportunities

Decarbonization and Electrification of Heating

A major trend is the shift from fossil fuel–based heating toward electrification. Electric boilers are gaining market share, particularly in urban regions focused on decarbonization. Utilities and state governments incentivize electric solutions through carbon reduction programs and renewable energy integration. This transition creates opportunities for manufacturers to develop low-emission electric models tailored to residential and light commercial use. While gas remains dominant, electrification marks a strong growth frontier as policy frameworks increasingly favor clean energy and carbon-neutral heating systems.

- For example, Vaillant launched its aroTHERM plus heat pump using a natural refrigerant (R290), which has a global warming potential (GWP) of only 3. This is more than 99% lower than the GWP of 2,088 found in older heat pumps that use the synthetic refrigerant R410A

Integration of Smart Heating Solutions

The adoption of smart heating technologies represents a significant opportunity for market players. Consumers prefer boilers equipped with Wi-Fi controls, energy monitoring, and AI-driven efficiency optimization. These features improve comfort, enable predictive maintenance, and reduce operational costs. Commercial facilities also benefit from central monitoring and integration with building management systems. With digitalization shaping user preferences, companies investing in intelligent heating platforms can secure stronger customer loyalty. This trend also aligns with rising demand for sustainable solutions that combine efficiency with real-time performance management.

- For instance, Bosch Thermotechnology introduced its EasyControl smart thermostat, which uses AI to learn household routines and cut heating costs by up to 20% according to company trials.

Key Challenges

High Initial Installation Costs

The high upfront costs of condensing and advanced boilers remain a barrier to broader adoption. Despite long-term energy savings, many residential and small commercial buyers hesitate due to steep purchase and installation expenses. Retrofitting older buildings with modern boilers often requires additional piping and venting upgrades, further raising costs. These financial hurdles slow replacement rates, especially in price-sensitive segments, and limit penetration in emerging urban areas. Addressing affordability through financing models and government incentives remains a critical challenge for the market.

Dependence on Natural Gas Infrastructure

North America’s heavy reliance on natural gas infrastructure poses a structural challenge for market diversification. Gas-fired boilers dominate due to cost-efficiency and established supply networks, but this dependence reduces adoption of alternative technologies. Regions without gas access, especially rural or remote areas, face limited options, often relying on oil or electric systems. The imbalance constrains market adaptability to environmental policies pushing for decarbonization. Overcoming this challenge requires expanding electric heating infrastructure and investing in hybrid or renewable-compatible boiler systems.

Stringent Environmental Regulations

Tightening environmental policies present compliance challenges for boiler manufacturers and users. Regulations targeting emissions, fuel efficiency, and carbon footprints raise costs for product design, certification, and testing. Smaller manufacturers struggle with compliance, limiting their competitive presence. For users, stricter standards accelerate replacement needs but also increase ownership costs, particularly in commercial and industrial sectors. Meeting these evolving requirements demands continuous R&D and innovation, which adds financial strain. Balancing regulatory compliance while ensuring affordability remains a key challenge for the industry.

Regional Analysis

United States

The United States holds the largest share of the North America Space Heating Boilers Market at 72% in 2024. Strong residential replacement demand and advanced gas infrastructure strengthen its position. It benefits from strict energy efficiency regulations, rebate programs, and widespread adoption of condensing boilers. Commercial and industrial sectors further add to the demand through retrofits and modernization projects. Manufacturers actively expand their presence through smart and high-efficiency models tailored for U.S. consumers. It remains the most competitive market in the region, supported by leading global and domestic players.

Canada

Canada accounts for 18% share of the North America Space Heating Boilers Market in 2024. Harsh winters drive significant heating requirements across provinces, creating steady demand in both residential and commercial sectors. The market emphasizes energy-efficient and environmentally friendly boilers, supported by national energy transition initiatives. Gas-fired boilers dominate due to accessible infrastructure, while electric boilers gain traction under decarbonization policies. It benefits from active replacement of outdated oil-based systems in favor of modern, cleaner alternatives. Manufacturers target this market with models designed for efficiency and durability in cold climates.

Mexico

Mexico represents 10% share of the North America Space Heating Boilers Market in 2024. Demand is concentrated in colder high-altitude regions where heating needs are more pronounced. The residential sector drives most installations, while commercial adoption grows in urban centers. Limited gas infrastructure constrains wider penetration, creating opportunities for electric and hybrid systems. Government-led energy reforms encourage modernization, but price sensitivity remains a key barrier for advanced models. It shows potential for gradual expansion as awareness of efficiency and sustainability increases among households and businesses.

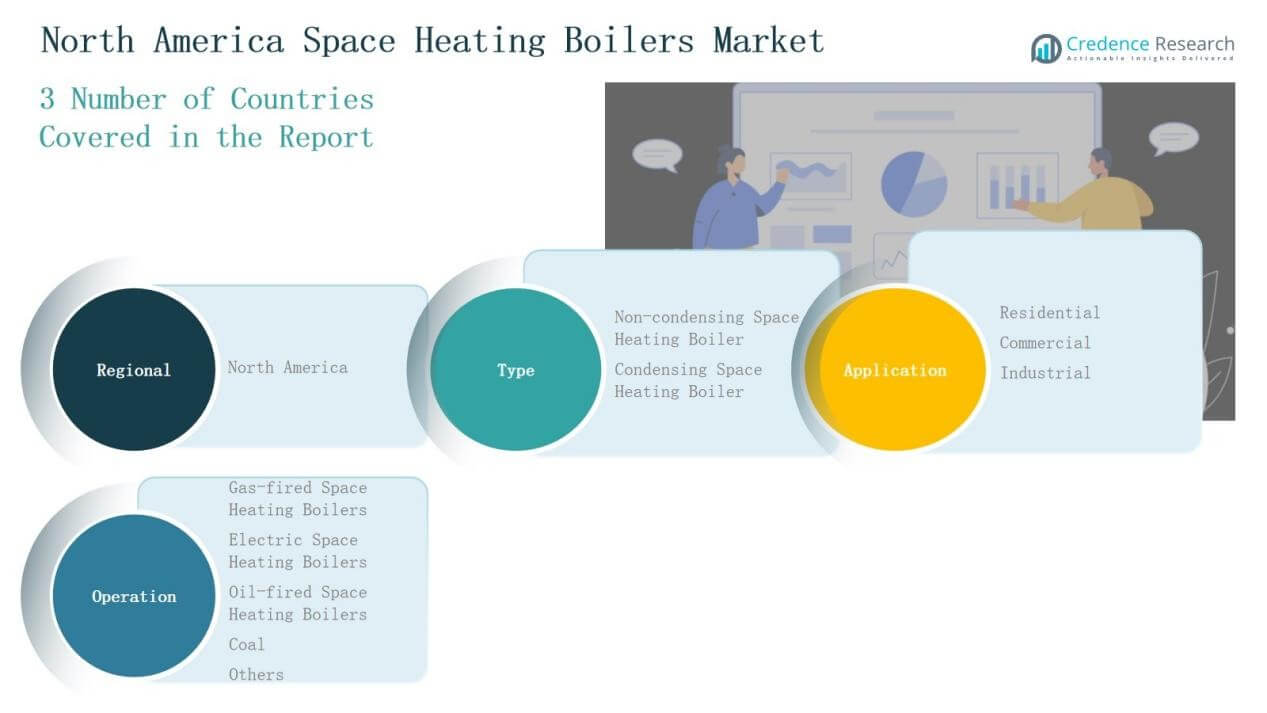

Market Segmentations:

By Type

- Non-condensing Space Heating Boiler

- Condensing Space Heating Boiler

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Space Heating Boilers

- Electric Space Heating Boilers

- Oil-fired Space Heating Boilers

- Coal

- Others

By Region

Competitive Landscape

The North America Space Heating Boilers Market is highly competitive, with global and regional players focusing on energy efficiency, technological innovation, and market expansion. Leading companies such as Carrier Global Corporation, Johnson Controls, Lennox International, Viessmann Manufacturing, Bosch Thermotechnology, and Burnham Holdings dominate through strong product portfolios and widespread distribution networks. Their strategies emphasize condensing boilers, digital integration, and smart control systems to align with regulatory frameworks and consumer demand for sustainable heating. Mid-sized manufacturers including Lochinvar, Slant/Fin, Peerless of America, and AERCO International strengthen competition by offering tailored solutions for residential and commercial sectors. Mergers, partnerships, and product launches are central to maintaining market position and capturing new customer bases. The industry shows rising consolidation, with larger firms acquiring niche players to expand product lines and regional presence. It remains a market defined by technological upgrades, compliance-driven innovation, and strong rivalry across both residential and institutional heating applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Carrier Global Corporation

- Johnson Controls (York International)

- Lennox International Inc.

- Viessmann Manufacturing Company Inc. (U.S. subsidiary)

- Bosch Thermotechnology Corporation

- Burnham Holdings Inc.

- Lochinvar LLC

- Slant/Fin Corporation

- Peerless of America, Inc.

- AERCO International, Inc.

Recent Developments

- In May 2025, Lennox and Ariston Group announced a joint venture called Ariston Lennox Water Heating North America. The collaboration aims to launch residential water heaters in the U.S. and Canada under the Lennox brand starting in 2026. Ariston USA holds a 50.1% stake, while Lennox holds 49.9%.

- In August 2025, Samsung HVAC North America partnered with Powrmatic of Canada Ltd. to expand distribution in Eastern Canada. The agreement enhances Samsung’s regional presence and supports greater availability of its heating products, including integrated boiler and HVAC solutions.

- In July 2024, Bosch announced its acquisition of Johnson Controls’ residential and light commercial HVAC business, including key space heating boiler brands like York and Coleman, in a deal valued at around $8 billion.

- In April 2025, SPX Technologies acquired Sigma & Omega. This deal expanded SPX’s HVAC solutions to include vertical heat pumps and self‑contained units.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Opeartion and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Condensing boilers will continue to strengthen their dominance due to regulatory support.

- Residential replacements will remain the largest revenue driver across the region.

- Electric boilers will gain traction with decarbonization initiatives and urban adoption.

- Gas-fired systems will maintain strong demand where infrastructure is widely available.

- Smart and connected boilers will see growing uptake in residential and commercial buildings.

- Manufacturers will focus on hybrid systems to balance efficiency and emission goals.

- Canada will advance adoption of eco-friendly boilers through sustainability programs.

- Mexico will emerge as a growth opportunity in high-altitude and urban regions.

- Partnerships and acquisitions will shape competitive strategies among leading players.

- Innovation in design and predictive maintenance will drive customer preference and loyalty.