Market Overview

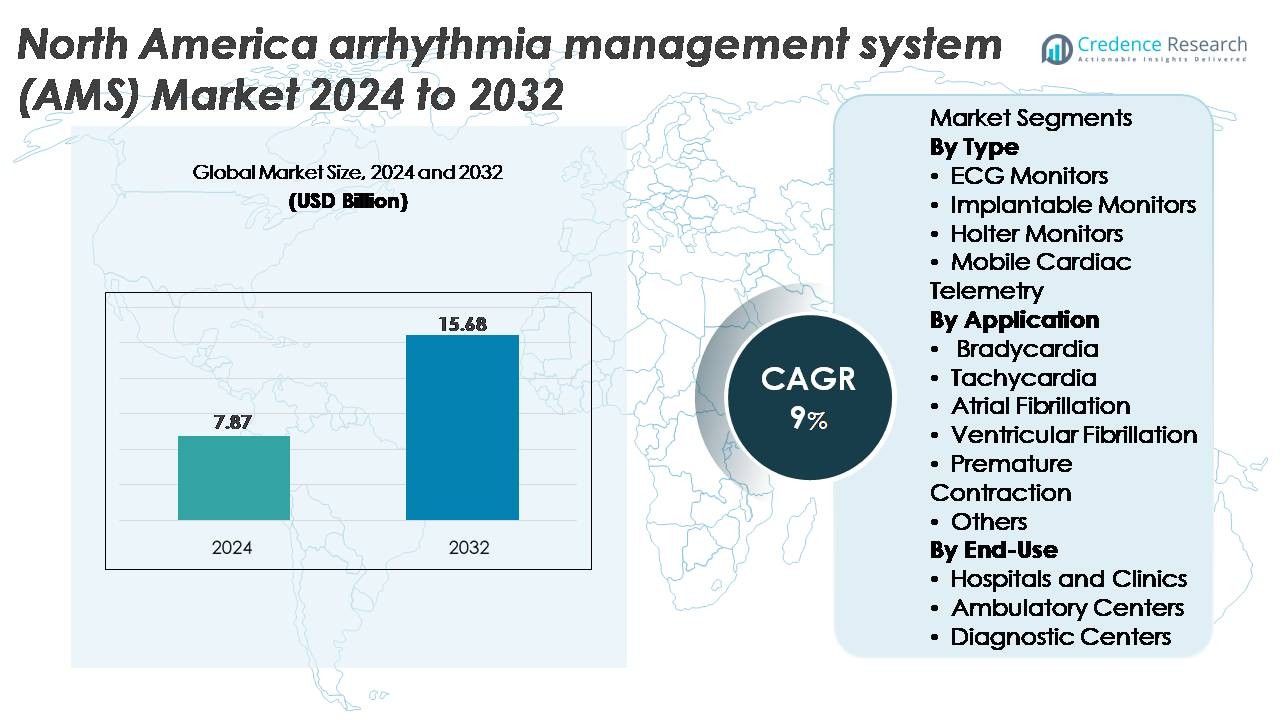

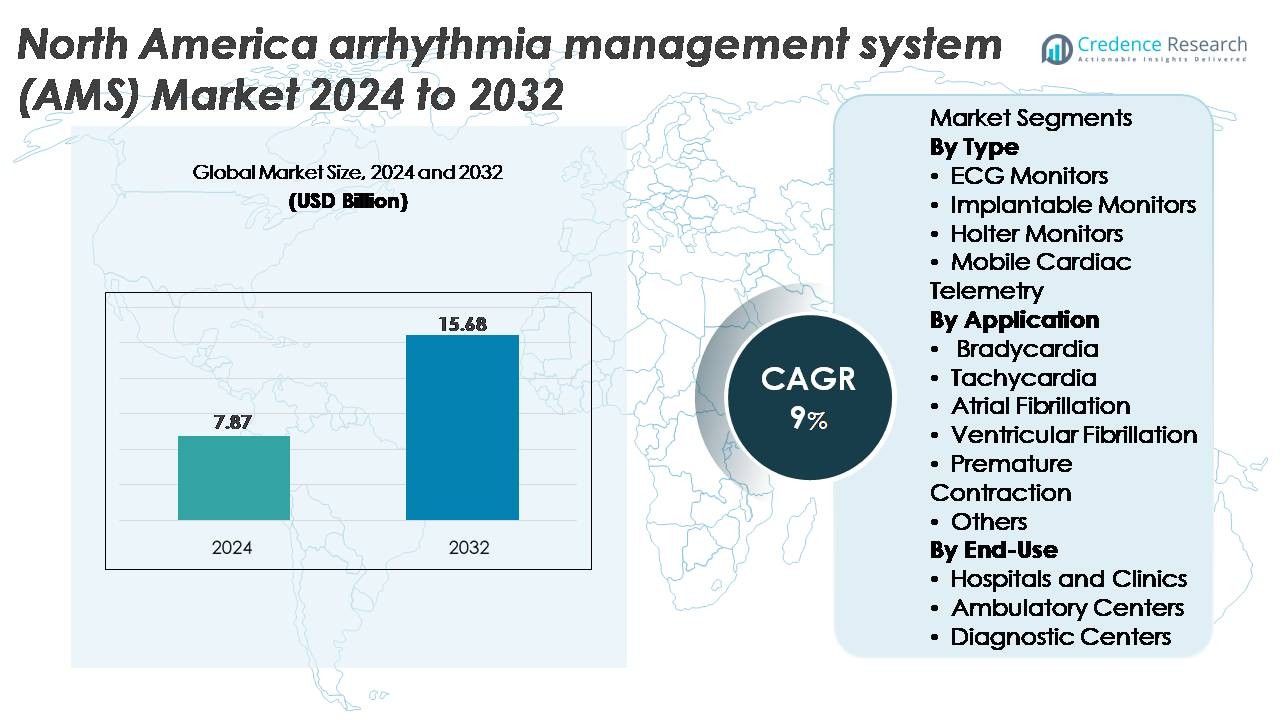

The North America arrhythmia management system (AMS) market was valued at USD 7.87 billion in 2024 and is projected to reach USD 15.68 billion by 2032, reflecting a CAGR of 9% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Arrhythmia Management System (AMS) Market Size 2024 |

USD 7.87 Billion |

| North America Arrhythmia Management System (AMS)Market, CAGR |

9% |

| North America Arrhythmia Management System (AMS) Market Size 2032 |

USD 15.68 Billion |

The North America arrhythmia management system (AMS) market is led by a strong group of established medical device manufacturers and digital monitoring innovators. Key players include GE HealthCare, AliveCor, Inc., Medtronic, ACS Diagnostics, Spacelabs Healthcare, Abbott, Biotronik, FUKUDA DENSHI, iRhythm Technologies, Inc., and Koninklijke Philips N.V. These companies drive competitiveness through advanced ECG platforms, AI-enabled analytics, implantable loop recorders, and cloud-connected mobile telemetry solutions. **The United States dominates the regional market with an estimated 85% share, supported by extensive electrophysiology infrastructure, high adoption of remote monitoring programs, and strong reimbursement coverage. Canada and Mexico collectively represent the remaining market share, driven by expanding cardiac diagnostic capabilities and growing demand for continuous rhythm surveillance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America arrhythmia management system (AMS) market was valued at USD 7.87 billion in 2024 and is projected to reach USD 15.68 billion by 2032, expanding at a 9% CAGR, supported by strong adoption of digital cardiac diagnostics and ambulatory monitoring solutions.

- Market growth is driven by rising atrial fibrillation prevalence, expanding telehealth usage, and increasing deployment of advanced ECG, Holter, implantable monitors, and mobile cardiac telemetry across hospitals and outpatient centers. ECG monitors hold the largest segment share due to broad clinical use and continuous rhythm surveillance capabilities.

- Key trends include rapid adoption of wearable cardiac patches, AI-based arrhythmia detection, and cloud-integrated monitoring platforms that streamline diagnostics and enable early intervention across high-risk patient groups.

- Competitive intensity is shaped by leaders such as GE HealthCare, Abbott, Medtronic, Philips, iRhythm, and AliveCor, while market restraints include reimbursement variability, data integration challenges, and limited access in underserved regions.

- Regionally, the United States accounts for ~85% of the market, followed by Canada (~10%) and Mexico (~5%), reflecting differences in healthcare infrastructure, remote monitoring adoption, and availability of electrophysiology services.

Market Segmentation Analysis:

By Type

ECG monitors represent the largest share within the type segment, driven by their extensive adoption in hospitals, ambulatory care, and remote monitoring programs. Their dominance is reinforced by continuous improvements in real-time waveform analysis, multi-lead configurations, and integration with cloud-based cardiac platforms. Increasing use in emergency response settings and routine cardiac screening further accelerates demand. Implantable monitors are expanding steadily as long-term diagnostic tools, while mobile cardiac telemetry systems gain traction due to superior detection accuracy and automated event transmission, supporting faster clinical decision-making and reducing diagnostic delays.

- For instance, Medtronic’s LINQ II™ insertable cardiac monitor offers a device longevity of up to 4.5 years and captures arrhythmia events continuously with a memory capacity exceeding 20,000 ECG episodes.

By Application

Atrial fibrillation (AFib) accounts for the dominant share in the application segment, supported by its high prevalence and the clinical need for continuous and early rhythm surveillance. AFib-focused monitoring solutions benefit from enhanced detection algorithms, remote management capabilities, and strong reimbursement support for long-term cardiac monitoring. Tachycardia and bradycardia monitoring devices also show sustained adoption in acute and chronic care pathways, particularly as cardiac comorbidities rise across aging populations. Growing awareness of premature contraction-related risks and technology-enabled detection of ventricular arrhythmias further broadens clinical utilization across the AMS landscape.

- For instance, iRhythm’s Zio XT monitor provides continuous single-use ECG recording for up to 14 days and its AI engine has analyzed more than 1 billion heartbeats to improve AFib detection accuracy across millions of scans.

By End-Use

Hospitals and clinics represent the dominant end-use segment, attributed to their high diagnostic workload, advanced electrophysiology capabilities, and integration of sophisticated arrhythmia monitoring systems across inpatient and outpatient settings. Their leadership is reinforced by the availability of skilled cardiologists, comprehensive emergency care, and widespread adoption of mobile telemetry for extended monitoring. Ambulatory centers continue to expand rapidly as cost-efficient hubs for outpatient cardiac evaluation, while diagnostic centers gain relevance with increased demand for non-invasive, short- and long-term arrhythmia assessments supported by digitally connected monitoring equipment.

Key Growth Drivers:

Rising Burden of Atrial Fibrillation and Age-Associated Cardiac Disorders

The increasing prevalence of atrial fibrillation (AFib), bradyarrhythmias, and tachyarrhythmias significantly accelerates demand for advanced arrhythmia management systems across North America. The region’s aging population contributes strongly, as adults over 65 experience higher rates of conduction abnormalities and electrical disturbances requiring continuous and episodic monitoring. Growing diagnosis of lifestyle-linked cardiac rhythm disorders further amplifies clinical need for long-term surveillance tools, including ECG monitors, implantable loop recorders, and mobile cardiac telemetry. Healthcare systems across the U.S. and Canada continue prioritizing early detection and preventive care, which drives adoption of AMS devices capable of analyzing multi-lead signals, identifying silent arrhythmias, and providing real-time alerts. This shift toward proactive cardiac rhythm management strengthens utilization across hospitals, ambulatory centers, and remote monitoring programs.

· For instance, Abbott’s Confirm Rx™ insertable cardiac monitor records arrhythmias using Bluetooth-enabled transmission and offers a sensing resolution of 0.1 mV, enabling continuous detection of AFib episodes through its smartphone-linked platform.

Expansion of Remote Cardiac Monitoring and Telehealth Integration

Rapid adoption of telehealth and remote cardiac care models is a major driver of AMS market growth. Mobile cardiac telemetry, smartphone-linked ECG devices, and cloud-enabled diagnostic systems support continuous rhythm analysis and timely clinician intervention without requiring frequent hospital visits. Remote monitoring platforms also automate data interpretation using AI-supported algorithms, improving diagnostic accuracy and enabling care teams to triage high-risk cases efficiently. Payers increasingly support reimbursement for extended cardiac monitoring, encouraging providers to integrate long-term arrhythmia monitoring into routine care pathways. As patient preference shifts toward home-based diagnostics and virtual follow-up, AMS manufacturers benefit from growing demand for wearable systems with improved data security, wireless transmission capabilities, and interoperable digital health infrastructure.

- For instance, AliveCor’s KardiaMobile 6L captures six leads at a sampling rate of 300 signals per second and transmits recordings directly to physicians via its cloud platform, allowing remote evaluation of tachyarrhythmias and conduction disorders.

Technological Advancements in Compact, AI-Enhanced, and Implantable Devices

Breakthroughs in device miniaturization, battery longevity, AI-based analytics, and wireless connectivity significantly enhance the performance and appeal of arrhythmia monitoring systems. Next-generation implantable monitors offer multi-year data capture, high signal clarity, and remote programming, reducing diagnostic delays and improving patient comfort. AI-driven ECG interpretation engines also enable automated detection of AFib, ventricular arrhythmias, and premature contractions with high sensitivity, lowering clinician workload. Additionally, mobile telemetry devices now integrate multi-sensor inputs and automated event transmission, supporting rapid response in critical cases. Continuous improvements in cloud-based data management, integration with electronic health records, and cybersecurity frameworks accelerate clinical adoption. These innovations collectively strengthen clinical confidence, improve workflow efficiency, and drive sustained AMS uptake across North America.

Key Trends and Opportunities:

Shift Toward Wearable, Patch-Based, and Consumer-Centric Cardiac Monitoring

A major trend reshaping the AMS landscape is the rapid shift toward discreet, patch-based, and wearable cardiac monitoring solutions that offer patient comfort, prolonged wear times, and improved compliance. These devices align with the growing consumer health ecosystem, wherein patients increasingly expect accessible, easy-to-use, and non-invasive diagnostic tools. Integration with smartphones and digital health platforms enhances visibility into personal cardiac activity, while providers leverage continuous data streams for early intervention and population-level management. Manufacturers also explore opportunities in athlete conditioning, occupational health, and preventive cardiology, widening their addressable market. The convergence of medical-grade ECG accuracy with consumer-grade usability creates new commercial growth pathways across retail, primary care, and virtual care settings.

Increasing Use of AI, Predictive Analytics, and Automated Risk Stratification

AI and advanced analytics are transforming arrhythmia management by enabling real-time, high-accuracy detection of irregular rhythms and automated triage of clinically significant events. Predictive models help identify patients at elevated risk of AFib recurrence, stroke, or ventricular instability, supporting preventive clinical strategies and targeted interventions. Automated data interpretation reduces cardiologist workload and accelerates diagnosis, especially in high-volume health systems. Vendors increasingly incorporate cloud-based analytics, adaptive learning algorithms, and anomaly detection systems into AMS platforms, making them more intelligent and actionable. This trend also opens opportunities for partnerships between medtech vendors and digital health companies to create integrated diagnostic ecosystems that boost clinical efficiency and improve patient outcomes.

- For instance, iRhythm’s deep-learning algorithm underpinning the Zio platform has been trained on a dataset exceeding 1 billion heartbeats and has analyzed more than 10 million patient ECG recordings, enabling automated classification of AFib, pauses, tachyarrhythmias, and ectopic activity.

Growing Integration with Electrophysiology (EP) Services and Interventional Cardiology

Arrhythmia management systems increasingly integrate with advanced EP labs, catheter ablation programs, and device implantation pathways. Hospitals and specialty clinics deploy AMS technologies to support pre-procedural assessment, intra-procedural guidance, and post-ablation rhythm monitoring. This creates opportunities for device companies to align product portfolios with the expanding EP service landscape across North America. Growth in minimally invasive ablation procedures, rising adoption of leadless pacemakers, and expansion of cardiac rhythm management (CRM) programs further stimulate AMS demand. Vendors who offer interoperability with EP mapping systems and CRM devices gain competitive advantage as care models shift toward a more unified, longitudinal approach to arrhythmia management.

Key Challenges:

Reimbursement Variability and High Cost of Advanced Monitoring Systems

Despite increasing adoption, reimbursement inconsistencies across private insurers and federal programs create barriers for widespread AMS utilization. Complex billing codes, varying coverage for extended monitoring durations, and limited reimbursement for emerging digital tools impede adoption across smaller clinics and ambulatory centers. High costs associated with implantable monitors, advanced telemetry systems, and cloud-based platforms further challenge budget-constrained healthcare providers. Additionally, cost pressures stemming from device maintenance, data management infrastructure, and cybersecurity compliance limit expansion in underserved regions. Manufacturers must navigate pricing pressures while demonstrating strong clinical and economic outcomes to support favorable reimbursement decisions and broader market penetration.

- For instance, Boston Scientific’s LUX-Dx™ insertable cardiac monitor uses a dual-stage arrhythmia detection algorithm and offers remote programming through the LATITUDE™ Clarity system, while its storage architecture can hold up to 46 minutes of actionable ECG snapshots to support AFib, brady, and tachyarrhythmia evaluation.

Data Security, Interoperability Limitations, and Workflow Integration Issues

As AMS platforms generate large volumes of sensitive cardiac data, healthcare providers face escalating challenges in maintaining cybersecurity, ensuring HIPAA compliance, and protecting patient information across cloud networks. Interoperability gaps hinder seamless integration with electronic health record systems, often slowing clinical workflows and reducing the efficiency benefits of real-time monitoring. Variations in data formats, interface standards, and vendor-specific platforms restrict system-wide compatibility, complicating implementation for multi-site health systems. These barriers increase operational complexity and limit advanced analytics deployment. Overcoming these challenges requires coordinated industry efforts to standardize data exchange protocols, strengthen cybersecurity measures, and implement user-friendly integration frameworks.

- For instance, Medtronic’s LINQ II™ insertable cardiac monitor uses an AI-enhanced detection algorithm that automatically classifies arrhythmia events and supports up to 4.5 years of continuous rhythm monitoring with storage capacity for more than 20,000 ECG episodes

Regional Analysis

United States

The United States holds the largest share of the North America AMS market at around 85%, driven by a high prevalence of atrial fibrillation, strong adoption of remote cardiac monitoring, and widespread availability of advanced electrophysiology services. The presence of major cardiac device manufacturers, robust reimbursement for long-term ECG and telemetry monitoring, and rapid integration of AI-enabled diagnostic tools further strengthen the country’s leadership. Expanding telehealth infrastructure and increasing demand for wearable cardiac systems support continued market acceleration. Hospitals and integrated delivery networks lead deployment, while ambulatory centers increasingly adopt mobile cardiac telemetry for early rhythm detection.

Canada

Canada accounts for approximately 10% of the North America AMS market, supported by rising diagnosis of bradyarrhythmias and atrial fibrillation across an aging population. Growth is influenced by national initiatives promoting digital health adoption, leading to increased use of mobile telemetry and remote ECG monitoring in both urban and remote communities. Canadian cardiac centers emphasize early detection and chronic disease management, stimulating demand for multi-day Holter systems and implantable loop recorders. Strong collaboration between hospitals and provincial healthcare networks enhances data sharing and accelerates adoption of AI-based interpretation tools, positioning Canada for steady, technology-led expansion in AMS adoption.

Mexico

Mexico represents roughly 5% of the North America AMS market, with growth driven by increasing awareness of cardiovascular disease, expanding access to private cardiac care, and rising deployment of ambulatory diagnostic centers. Adoption of arrhythmia monitoring remains concentrated in major metropolitan regions, where hospitals integrate ECG, Holter, and telemetry systems to support early diagnosis of tachyarrhythmias and conduction disorders. Limited reimbursement coverage and uneven access to advanced cardiac technologies slow penetration in rural areas. However, growing investment in digital health infrastructure and emergence of low-cost wearable cardiac monitoring devices are expected to support gradual market expansion.

Market Segmentations:

By Type

- ECG Monitors

- Implantable Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

By Application

- Bradycardia

- Tachycardia

- Atrial Fibrillation

- Ventricular Fibrillation

- Premature Contraction

- Others

By End-Use

- Hospitals and Clinics

- Ambulatory Centers

- Diagnostic Centers

By Geography

- United states

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America arrhythmia management system market is defined by strong participation from leading cardiac device manufacturers, digital health companies, and remote monitoring service providers. Major players focus on expanding portfolios across ECG monitors, implantable loop recorders, mobile cardiac telemetry, and AI-driven diagnostic platforms. U.S.-based manufacturers maintain a dominant position through continuous R&D, advanced electrophysiology solutions, and broad reimbursement coverage. Partnerships between hospitals, cardiology groups, and remote monitoring providers strengthen service delivery models, while emerging digital health firms introduce cloud-based analytics and wearable technologies to enhance diagnostic accuracy. Competition increasingly centers on device miniaturization, long battery life, automated arrhythmia detection, and seamless integration with electronic health records. Market players also invest heavily in cybersecurity, data interoperability, and telehealth capabilities to meet evolving provider and patient expectations. As clinical demand grows for early detection and remote rhythm surveillance, companies that deliver scalable, AI-enabled, end-to-end monitoring ecosystems gain a clear competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE HealthCare

- AliveCor, Inc.

- Medtronic

- ACS Diagnostics

- Spacelabs Healthcare

- Abbott

- Biotronik

- FUKUDA DENSHI

- iRhythm Technologies, Inc.

- Koninklijke Philips N.V.

Recent Developments

- In July 2024, Octagos Health, an AI-powered cardiac device monitoring company, secured a funding worth USD 43 million led by Morgan Stanley. This investment was expected to fuel its mission to revolutionize cardiac care with advanced patient monitoring powered by AI.

- In June 2024, AliveCor announced a dual-clearance by the U.S. FDA of its new AI-powered 12-lead ECG system a significant step that expands its arrhythmia detection capabilities beyond prior devices.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-enhanced arrhythmia detection tools will accelerate clinical decision-making across care settings.

- Remote monitoring platforms will expand as hospitals prioritize continuous, home-based cardiac surveillance.

- Miniaturized implantable monitors will gain wider use due to longer battery life and improved data transmission.

- Mobile cardiac telemetry solutions will see increased integration with cloud-based analytics platforms.

- Hospitals will continue shifting toward interoperable AMS systems that link seamlessly with EHR ecosystems.

- Wearable ECG technologies will strengthen their role in early diagnosis and long-term rhythm assessment.

- Predictive analytics will drive proactive arrhythmia risk stratification and individualized treatment planning.

- Diagnostic centers will adopt higher-resolution ECG and Holter devices to improve detection accuracy.

- Hybrid in-person and virtual arrhythmia management models will expand as telecardiology matures.

- Industry collaborations between device manufacturers and digital health firms will accelerate innovation in connected AMS solutions.