Market Overview:

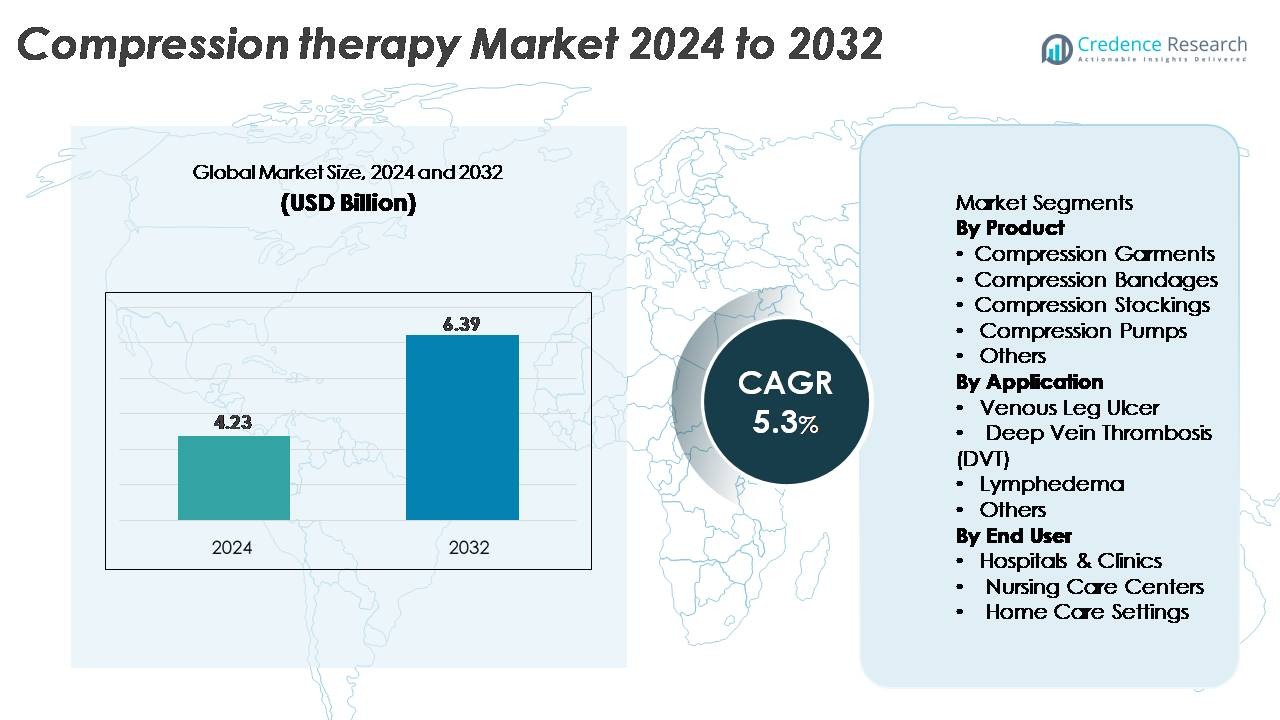

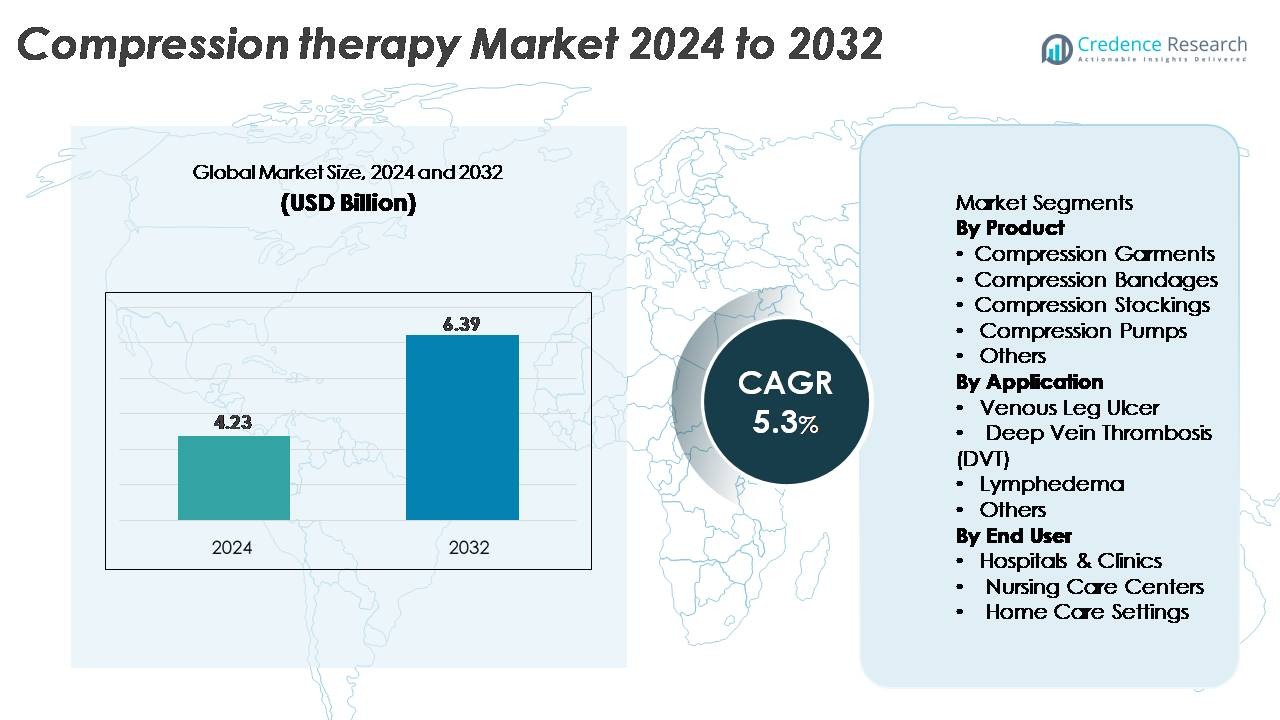

The global Compression Therapy Market was valued at USD 4.23 billion in 2024 and is projected to reach USD 6.39 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compression Therapy Market Size 2024 |

USD 4.23 Billion |

| Compression Therapy Market, CAGR |

5.3% |

| Compression Therapy Market Size 2032 |

USD 6.39 Billion |

The compression therapy market is shaped by a strong group of global manufacturers, including Tactile Systems Technology, Inc., PAUL HARTMANN Pty. Ltd, Smith & Nephew, Essity Aktiebolag (publ), SIGVARIS, Bio Compression Systems, Inc., medi GmbH & Co. KG, Arjo, and 3M. These companies compete through innovations in graduated compression garments, multilayer bandaging systems, and advanced pneumatic compression devices designed for chronic venous disorders and lymphedema management. Product portfolios increasingly emphasize comfort, pressure accuracy, and home-use suitability. North America leads the market with an approximate 38% share, supported by advanced wound-care infrastructure, strong reimbursement systems, and high clinical adoption of compression therapy solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The compression therapy market was valued at USD 4.23 billion in 2024 and is projected to reach USD 6.39 billion by 2032, registering a CAGR of 5.3% during the forecast period.

- Market growth is driven by the rising prevalence of venous leg ulcers, lymphedema, and post-surgical edema, along with increasing adoption of compression garments, stockings, and pneumatic pumps across clinical and home-care settings.

- Key trends include the emergence of smart compression systems, breathable multi-layer fabrics, and portable pneumatic devices that enhance patient comfort, compliance, and at-home treatment accessibility.

- The competitive landscape features strong activity from SIGVARIS, Essity Aktiebolag, 3M, Smith & Nephew, medi GmbH & Co. KG, and Tactile Systems Technology, with companies expanding through innovation, partnerships, and broader distribution networks.

- Regionally, North America leads with 38% market share, followed by Europe at 30% and Asia-Pacific at 20%, while compression garments hold the dominant product share due to their widespread clinical use and patient preference.

Market Segmentation Analysis:

By Product:

Compression garments represent the dominant sub-segment, accounting for the largest market share due to their widespread use in managing venous disorders, lymphedema, and sports-related recovery needs. Their leadership is driven by the availability of graduated compression levels, improved fabric breathability, and patient-friendly designs that support long-term adherence. Compression bandages and stockings continue to see stable demand in clinical wound-care settings, while compression pumps gain traction for advanced lymphedema management. Growing innovation in smart textiles and adjustable compression systems strengthens product adoption across both hospital and home-care environments.

- For instance, SIGVARIS produces graduated compression stockings that deliver clinically validated pressure ranges of 15–20 mmHg, 20–30 mmHg, and 30–40 mmHg.

By Application:

Venous leg ulcers hold the dominant market share, supported by a rising global burden of chronic venous insufficiency and the clinical effectiveness of compression therapy in accelerating ulcer healing. Demand is further propelled by growing diabetic populations and increasing use of multi-layer compression systems in wound-care protocols. Lymphedema represents another significant segment, driven by rising cancer survivorship and post-surgical lymphatic complications. Deep vein thrombosis applications benefit from preventive therapy adoption, particularly among immobile and elderly patients. Overall, clinical guidelines promoting compression as a first-line therapy reinforce segment growth.

- For instance, Smith & Nephew’s PROFORE multilayer compression system is engineered to deliver a sustained therapeutic pressure of 40 mmHg at the ankle in venous leg ulcer management, while Essity’s JOBST FarrowWrap provides adjustable compression bands with a tensioning system calibrated to maintain 20–50 mmHg during mobility.

By End User:

Hospitals and clinics account for the largest market share, driven by high patient inflow, advanced wound-care programs, and the use of multi-layer bandaging systems and pneumatic compression devices in acute care settings. Nursing care centers exhibit steady growth as chronic venous disorders and lymphedema management remain essential in long-term care populations. Home-care settings continue to expand rapidly, supported by user-friendly compression garments and portable pumps that enable decentralized treatment. Increased focus on cost-effective, self-managed therapy and telehealth-guided wound monitoring strengthens the shift toward home-based compression solutions.

Key Growth Drivers:

Rising Prevalence of Venous Disorders and Lymphedema

The growing global burden of chronic venous insufficiency, venous leg ulcers, and lymphedema remains a primary catalyst for the expansion of compression therapy. Aging populations, prolonged sedentary lifestyles, and rising obesity rates significantly increase the occurrence of vascular complications requiring long-term compression management. Healthcare systems are increasingly integrating compression therapy into standard treatment pathways due to its clinically proven ability to improve venous return, reduce edema, and accelerate wound healing. Additionally, cancer-related lymphedema continues to push demand for advanced compression solutions, including gradient garments and pneumatic pumps. With recurring usage requirements, particularly in chronic conditions, compression therapy maintains strong and consistent adoption across hospitals, wound-care centers, and home settings.

- For instance, Tactile Medical’s Flexitouch Plus system delivers pneumatic therapy through 32 independently controlled chambers and provides adjustable pressure settings between 20 and 40 mmHg, enabling targeted decongestion for patients with chronic or cancer-related lymphedema.

Expansion of Home-Based Care and Patient Self-Management

The shift toward decentralized healthcare and home-based treatment has accelerated the adoption of compression garments, stockings, and portable compression pumps. Patients increasingly prefer solutions that allow comfortable, continuous therapy without frequent clinical visits, especially those managing chronic venous diseases and lymphedema. Advancements in lightweight materials, ergonomic designs, and adjustable pressure features enhance adherence and make self-management more practical. Healthcare professionals also support at-home compression therapy to reduce hospital burden and cut treatment costs. Growing access to telehealth-based remote wound monitoring and virtual consultations further strengthens the feasibility of home-based care. This transition not only empowers patients but also expands the commercial opportunity for manufacturers focusing on consumer-friendly compression products.

- For instance, For uniform and sequential calf/thigh compression, the system operates on a 60-second automatically timed cycle consisting of approximately 12 seconds of inflation followed by 48 seconds of deflation. For foot compression, the cycle is 3 seconds inflation followed by 27 seconds deflation.

Technological Advancements in Smart and Adaptive Compression Systems

Technological innovation is reshaping the compression therapy landscape, particularly with the emergence of smart compression devices, advanced fabrics, and adaptive pneumatic systems. Manufacturers are integrating features such as pressure sensors, automated inflation cycles, microprocessor-based pressure control, and breathable multilayer fabrics to enhance therapeutic outcomes and user comfort. These technologies enable more precise dosing of compression, improve patient compliance, and support personalized therapy key outcomes for chronic and post-surgical care. Additionally, digitally connected compression pumps facilitate compliance tracking and provide clinicians with real-time data to adjust treatment plans. Continuous R&D investments and the growing commercialization of advanced pneumatic devices are positioning technology-enhanced compression therapy as a major driver of long-term market growth.

Key Trends & Opportunities:

Growing Integration of Smart Textiles and Wearable Compression Technologies

Smart compression wearables represent a transformative trend, offering opportunities for manufacturers to integrate electronics, sensors, and responsive materials into garments. These innovations enable real-time measurement of limb circumference, pressure distribution, and swelling patterns allowing garments to automatically adjust compression levels throughout the day. Such capabilities significantly improve adherence, especially among elderly or mobility-limited patients who struggle with traditional garments. Collaboration between textile engineers, medical device companies, and digital health firms is accelerating the development of these next-generation solutions. As healthcare shifts toward personalized and data-driven treatment, smart textiles open substantial commercial opportunities within chronic disease management, sports recovery, and rehabilitation markets.

- For instance, Essity’s JOBST Confidence line uses ContourFit technology, incorporating 23 limb measurement points and advanced 3D knitting to deliver precise anatomical shaping and consistent compression throughout wear.

Rising Adoption of Portable Pneumatic Compression Devices

Portable pneumatic compression pumps are gaining traction due to their ease of use, mobility, and ability to deliver consistent therapeutic pressure. These devices address growing patient demand for home-based, noninvasive treatment options and provide a compelling alternative to clinic-based pneumatic systems. Their lightweight, battery-powered designs make them suitable for daily activities while maintaining consistent edema reduction. Market opportunities are increasing as manufacturers integrate intuitive interfaces, programmable pressure modes, and compliance-tracking features. With the rise of lymphedema awareness campaigns and insurance coverage improvements across multiple regions, portable pneumatic technologies are becoming increasingly accessible, creating strong long-term growth potential.

- For instance, Tactile Medical’s Nimbl portable pneumatic system controller weighs less than 2 pounds (approximately 0.9 kg) and features multiple pressure modes determined by a healthcare provider for individualized treatment, while its rechargeable battery option enables true mobility for at-home users.

Key Challenges:

Low Patient Compliance and Difficulty in Long-Term Adherence

Despite their clinical effectiveness, compression garments and stockings face persistent challenges related to patient adherence. Many patients struggle with donning and doffing garments due to stiffness, tightness, or discomfort leading to inconsistent use and reduced therapeutic outcomes. Issues such as heat retention, skin irritation, and improper fit further discourage long-term adherence. In chronic conditions requiring continuous therapy, poor compliance significantly limits effectiveness and increases the risk of ulcer recurrence or uncontrolled edema. Healthcare providers must spend additional time educating patients on proper application, and manufacturers must continuously innovate to improve comfort, adjustability, and usability. Overcoming adherence barriers remains crucial for maximizing clinical success and market penetration.

Reimbursement Limitations and Variation Across Regions

Reimbursement policies for compression therapy vary widely across countries, creating challenges for both patients and providers. In several regions, compression garments and advanced pneumatic pumps are either under-reimbursed or not covered at all, resulting in high out-of-pocket costs. These financial barriers discourage patients from purchasing medically necessary garments or replacing them at recommended intervals. Inconsistent reimbursement structures also affect healthcare provider recommendations and limit adoption of advanced compression devices in clinical settings. This economic disparity slows market growth, particularly in low- and middle-income regions, despite a high disease burden. Addressing reimbursement inconsistencies is essential to improving access and supporting broader therapeutic adoption.

Regional Analysis:

North America

North America holds the largest share of the compression therapy market, accounting for approximately 38% of global revenue. Strong prevalence of chronic venous insufficiency, lymphedema, and lifestyle-related vascular disorders drives widespread adoption of compression garments and pneumatic pumps. The region benefits from advanced wound-care infrastructure, high awareness among clinicians, and strong reimbursement support for compression devices. Manufacturers continue to introduce technologically advanced systems with enhanced comfort, pressure control, and digital integration. The presence of major market players and extensive home healthcare adoption further reinforces North America’s leadership position.

Europe

Europe represents the second-largest regional market with roughly 30% share, supported by well-established vascular care protocols and a high prevalence of venous leg ulcers among aging populations. Countries such as Germany, the U.K., and France maintain strong clinical adoption due to standardized guidelines recommending compression as a first-line therapy for venous disorders. Reimbursement coverage for stockings, bandages, and multi-layer systems also fuels steady usage. Technological advancements in breathable fabrics and adaptive compression solutions continue to gain traction across both hospital settings and community-based wound-care programs. Rising patient preference for home-based therapy further supports market growth.

Asia-Pacific

Asia-Pacific holds approximately 20% of the market and is the fastest-growing region, driven by expanding healthcare access, rising chronic disease burden, and increasing awareness of compression therapy benefits. Countries such as China, Japan, and India show growing demand for compression garments in managing lymphedema, post-surgical edema, and diabetic ulcer-related complications. Improvements in wound-care services, combined with the proliferation of affordable compression products, expand adoption across hospitals and home settings. Urbanization and lifestyle changes continue to elevate the risk of venous conditions, strengthening long-term demand. Regional manufacturing capabilities further enhance product availability and affordability.

Latin America

Latin America accounts for approximately 7% of the global market, supported by increasing diagnosis of venous disorders and expanding access to specialty wound-care services. Brazil and Mexico lead regional adoption, driven by growing healthcare investments and availability of cost-effective compression garments and bandages. Clinical awareness of compression therapy continues to rise, particularly in managing chronic ulcers and lymphedema. However, inconsistent reimbursement structures limit adoption of advanced pneumatic devices. Despite these constraints, the market benefits from improving chronic disease management programs and broader acceptance of home-based compression solutions.

Middle East & Africa

The Middle East & Africa region holds an estimated 5% market share, with gradual growth driven by rising incidence of diabetes, obesity, and vascular diseases. Higher adoption is seen in Gulf countries with advanced healthcare infrastructure, whereas broader market penetration remains limited by affordability challenges and limited clinical awareness in lower-income areas. Hospitals increasingly integrate compression bandages and stockings into wound-care protocols, particularly for diabetic foot complications. International manufacturers are expanding distribution partnerships to improve regional availability. Growing investments in specialty clinics and chronic disease care support long-term market potential.

Market Segmentations:

By Product

- Compression Garments

- Compression Bandages

- Compression Stockings

- Compression Pumps

- Others

By Application

- Venous Leg Ulcer

- Deep Vein Thrombosis (DVT)

- Lymphedema

- Others

By End User

- Hospitals & Clinics

- Nursing Care Centers

- Home Care Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the compression therapy market is characterized by the strong presence of global medical device companies and specialized wound-care manufacturers focusing on product innovation, clinical efficacy, and patient comfort. Leading players compete through advancements in graduated compression garments, multilayer bandaging systems, and next-generation pneumatic compression pumps with enhanced pressure control and digital monitoring capabilities. Companies continue to invest in breathable fabrics, adjustable designs, and ergonomic features that improve long-term adherence for chronic venous and lymphedema patients. Strategic initiatives such as product launches, mergers, and geographic expansion remain central to strengthening market presence, while partnerships with wound-care centers and home healthcare providers support wider distribution. Increasing emphasis on value-based care also encourages manufacturers to develop cost-efficient solutions that reduce ulcer recurrence and enhance patient outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In November 2025, PAUL HARTMANN Pty. Ltd (HARTMANN Group) announced that it increased sales to EUR 1,826.0 million in the first nine months of 2025, with organic growth of 2.0%, supported by gains in its core segments including wound- and patient-care products.

- In June 2025, Tactile Medical presented new clinical results at the ASCO Annual Meeting 2025 demonstrating that its advanced pneumatic device Flexitouch Plus significantly improves quality-of-life and reduces swelling in head-and-neck cancer–related lymphedema, compared to usual care.

- In October 2024, Tactile Systems Technology, Inc. (Tactile Medical) launched a next-generation pneumatic compression platform called Nimbl, now commercially available in the U.S. for treatment of upper extremity lymphedema.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see increasing adoption of smart compression garments equipped with sensors for real-time pressure monitoring and personalized therapy.

- Portable pneumatic compression devices will gain wider traction as home-based care continues to expand globally.

- Advancements in breathable and antimicrobial fabrics will improve patient comfort and long-term adherence to compression therapy.

- AI-enabled platforms will enhance remote monitoring for chronic venous diseases, supporting more proactive and data-driven clinical management.

- Manufacturers will intensify research into adaptive compression systems that automatically adjust pressure throughout daily activity.

- Growth in aging populations will elevate demand for compression solutions targeting venous insufficiency and ulcer prevention.

- Increasing awareness of lymphedema management will drive broader adoption of compression products in oncology aftercare.

- Reimbursement improvements in developing regions will support higher adoption of compression garments and pumps.

- Cross-industry collaborations between textile innovators and medical device companies will accelerate product advancements.

- Expansion of digital wound-care ecosystems will integrate compression therapy more seamlessly into chronic wound management pathways.