Market Overview:

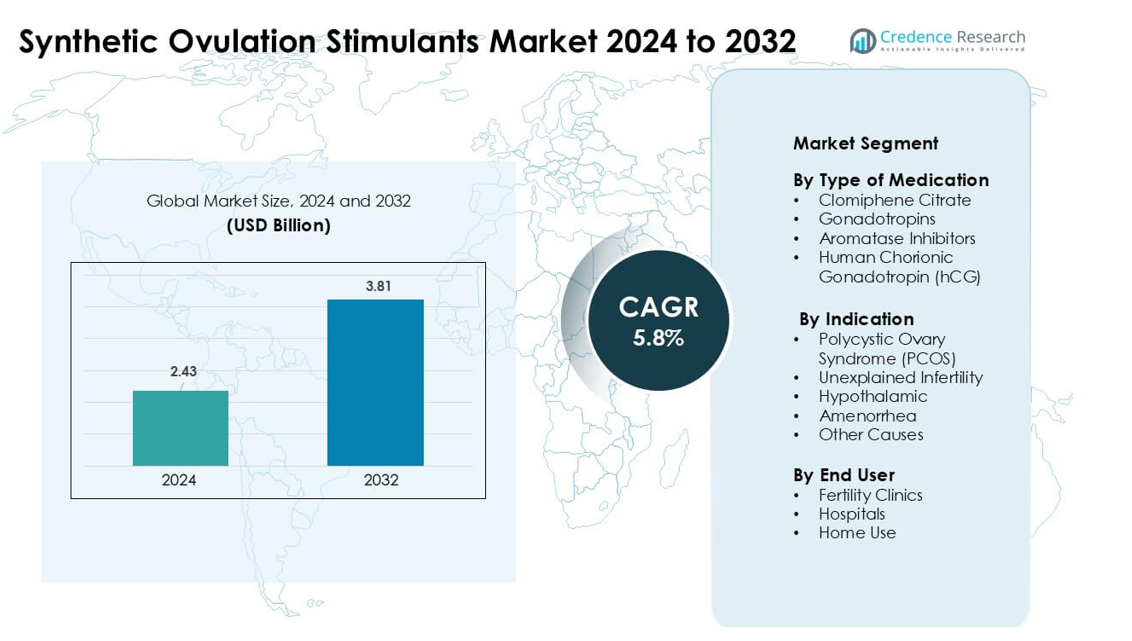

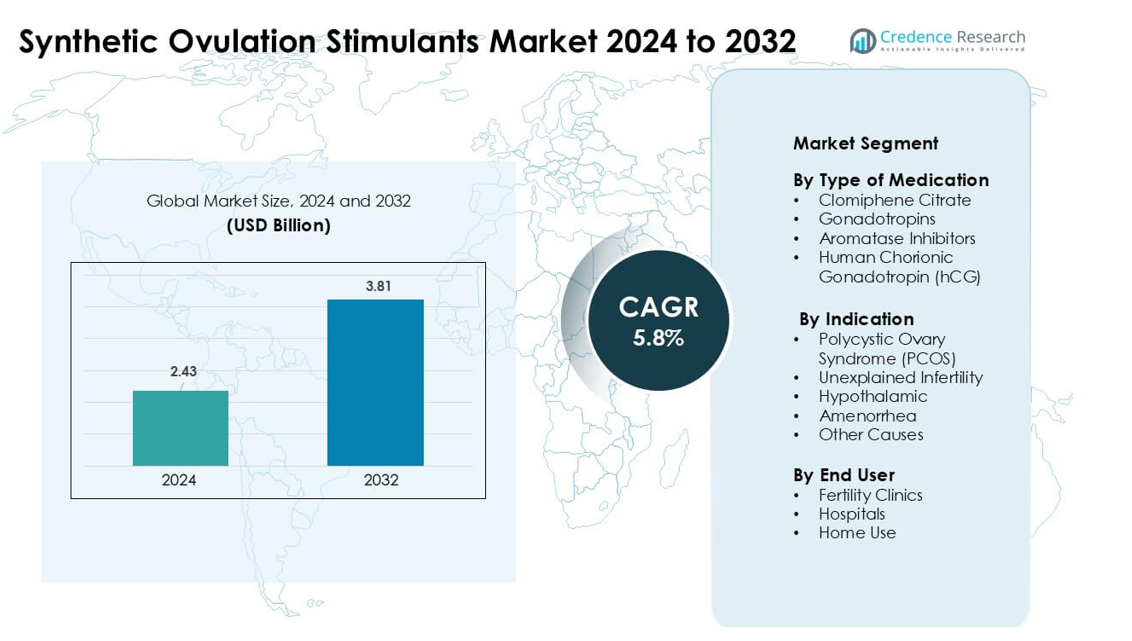

Synthetic Ovulation Stimulants Market was valued at USD 2.43 billion in 2024 and is anticipated to reach USD 3.81 billion by 2032, growing at a CAGR of 5.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

Synthetic Ovulation Stimulants Market Size 2024

|

USD 2.43 billion |

| Synthetic Ovulation Stimulants Markett, CAGR |

5.8% |

| Synthetic Ovulation Stimulants Market Size 2032 |

USD 3.81 billion |

The Synthetic Ovulation Stimulants Market features major companies such as Merck KGaA, Ferring Pharmaceuticals, Novartis AG, Sanofi Aventis Ltd., Serum Institute Pvt. Ltd., Merck & Co. Inc., AstraZeneca plc, Organon & Co., EMD Serono, Inc., and Kosher Pharmaceuticals. These firms compete through improved hormone formulations, wider clinical partnerships, and expanded global distribution. North America led the market in 2024 with an estimated 38% share, supported by strong fertility-clinic networks, high treatment awareness, and broader access to reproductive diagnostics. Continuous product innovation and rising infertility evaluations across the region reinforce its leadership in the global landscape.

Market Insights:

- The Synthetic Ovulation Stimulants Market was valued at USD 2.43 billion in 2024 and is projected to reach USD 3.81 billion by 2032, growing at a CAGR of 5.8%.

- Rising infertility cases driven by PCOS, lifestyle disorders, and delayed pregnancies lifted demand, with clomiphene citrate holding the largest share among medication types.

- Personalized hormone-based treatment protocols and digital cycle-tracking tools shaped market trends, while clinics adopted optimized dosing to improve ovulation success.

- Strong competition came from Merck KGaA, Ferring Pharmaceuticals, Novartis AG, Sanofi Aventis Ltd., and Merck & Co. Inc., as companies expanded clinical partnerships and enhanced formulation safety.

- North America led the market with a 38% share in 2024, followed by Europe, while Asia-Pacific grew fastest due to rising diagnostic access and expanding fertility clinics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type of Medication

Clomiphene citrate held the dominant share in 2024 with wide use as a first-line therapy. Doctors preferred this drug because it offered strong ovulation induction, low cost, and easy oral dosing. Demand stayed steady in regions with rising infertility assessments and broader access to reproductive care. Gonadotropins and aromatase inhibitors grew as second-line options for patients who showed limited response to clomiphene citrate. Human chorionic gonadotropin supported treatment cycles by triggering ovulation and helped improve overall protocol success rates across clinics.

- For instance, a randomized multicenter study comparing low-dose follicle‑stimulating hormone (gonadotropin) vs clomiphene citrate in women with Polycystic Ovary Syndrome (PCOS)‑related anovulation found that pregnancy rate per first treatment cycle was 30 % in the low-dose FSH group versus 14.6 % in the clomiphene citrate group.

By Indication

Polycystic ovary syndrome (PCOS) led the indication segment in 2024 with the highest share due to its strong link to anovulation. Clinics used ovulation stimulants to improve cycle regularity and enhance fertility in women with hormonal imbalance. Rising diagnosis rates, lifestyle-linked metabolic issues, and earlier reproductive consultations supported this leadership. Unexplained infertility and hypothalamic amenorrhea continued to expand as more couples sought detailed evaluations and evidence-based treatment plans.

- For instance, a global burden‑of‑disease analysis estimated that infertility attributable to PCOS reached approximately 12.13 million women worldwide by 2019 up from about 6.00 million in 1990 indicating a doubling of absolute case numbers over that period.

By End User

Fertility clinics dominated the end-user segment in 2024 as they handled most medically supervised ovulation-induction cycles. Clinics preferred controlled stimulation protocols and provided monitoring through ultrasound and hormonal tests. Higher treatment success rates, wider adoption of assisted reproductive technologies, and improved patient pathways reinforced their share. Hospitals supported complex cases requiring specialist care, while home-use options gained gradual traction as digital platforms promoted guided treatment and remote monitoring for select patient groups.

Key Growth Drivers:

Rising Global Infertility Prevalence

Growing infertility rates remain a major growth driver for the Synthetic Ovulation Stimulants Market. Many couples face delayed childbearing, lifestyle changes, metabolic disorders, and hormonal issues that raise ovulation-related problems. Higher cases of PCOS, thyroid imbalance, obesity, and stress-linked reproductive dysfunction increase demand for medical ovulation support. Women now seek earlier evaluation, while awareness campaigns highlight the benefits of timely fertility treatment. Clinics report more first-time consultations among women in their late twenties and early thirties. Rising availability of structured diagnostic pathways, broader insurance inclusion in select regions, and expanding fertility chains help more patients access care. These shifts push sustained adoption across both oral and injectable stimulants.

- For instance, the World Health Organization (WHO) estimates that about 1 in 6 people globally roughly 17.5% of the adult population will experience infertility at some point in their lives.

Increasing Access to Fertility Services and Specialized Clinics

The global expansion of fertility clinics continues to drive strong uptake of synthetic ovulation stimulants. Many regions now invest in reproductive-health infrastructure, making advanced care available outside major cities. Clinics offer standardized stimulation protocols, reliable monitoring tools, and tailored treatment plans that improve success rates. Growing teleconsultation platforms help reach women who previously lacked access to reproductive specialists. More clinics partner with diagnostic labs to support quick hormone testing and cycle tracking. The rise of medical tourism hubs also boosts treatment volumes, especially where procedures remain affordable. With better-trained specialists and higher adoption of evidence-based therapy, clinics prescribe more stimulants for first-line and second-line ovulation induction.

- For instance, a comprehensive global burden analysis utilizing data from the Global Burden of Disease Study 2021 (GBD 2021) and published in journals throughout 2025 reported that the number of women of childbearing age with PCOS worldwide reached 65.77 million in 2021, and among them, about 12.47 million women suffered from PCOS-related infertility, illustrating an expanding patient pool for fertility services.

Shift Toward Early Diagnosis and Proactive Fertility Management

A clear shift toward early fertility assessment supports market growth. Women increasingly monitor reproductive health through hormone tests, ovulation tracking apps, and routine gynecologic evaluations. Early detection of conditions like PCOS, hypothalamic dysfunction, and luteal phase issues leads to timely intervention using synthetic stimulants. Public health programs encourage fertility screening as part of women’s wellness plans, further increasing awareness. Many providers teach lifestyle modification and counsel patients on optimal timing, improving treatment outcomes. With proactive management gaining acceptance, more women begin therapy before conditions worsen. This reduces cycle failures, enhances ovulation predictability, and drives steady stimulant usage across global markets.

Key Trend & Opportunity:

Rising Use of Personalized and Protocol-Optimized Treatments

Personalized stimulation protocols show strong growth as clinics tailor medication dosing and cycle planning based on hormone levels, ovarian reserve, age, and comorbidities. Doctors rely on data-driven tools to choose between clomiphene, aromatase inhibitors, or gonadotropins to optimize success rates. Monitoring technologies, including automated hormone analyzers and ultrasound-based follicle tracking, help deliver safer, more precise cycles. As individualized care expands, more women prefer clinics offering protocol optimization. This trend reduces overstimulation risks, supports predictable outcomes, and strengthens trust in pharmaceutical options.

- For instance, a recent study introduced an AI-powered model that predicts individualized daily FSH doses for controlled ovarian stimulation with 73.7% accuracy significantly higher than conventional clinician‑guided dosing.

Integration of Digital Platforms and Remote Monitoring

Digital health tools support new opportunities for the Synthetic Ovulation Stimulants Market. Mobile apps now track follicular changes, predict ovulation windows, and send reminders for medication timing. Clinics use teleconsultations for follow-up visits, prescription adjustments, and cycle reviews. Wearable devices measure basal temperature and hormone fluctuations, helping doctors fine-tune medication plans. Remote support reduces travel needs and enables more women to manage therapy from home. As digital platforms expand, they improve adherence, reduce cycle dropouts, and increase overall treatment success.

- For instance, a 2025 qualitative systematic review, which examined findings across 29 relevant articles and papers, observed that users frequently employ digital fertility tools alongside clinical fertility treatments. This indicates an emerging trend toward hybrid care models that combine in-clinic and digital monitoring, although the authors cautioned that research is still nascent and poorly designed apps may pose risks to patients.

Growing Expansion in Emerging Healthcare Markets

Emerging regions present large growth potential due to rising infertility awareness and improving reproductive-care access. Governments invest in women’s health programs, while private clinics introduce affordable stimulation packages. Educational outreach reduces stigma and encourages timely treatment. Pharmaceutical firms expand distribution networks, making stimulants more widely available. As income levels increase and diagnostic services improve, more women pursue structured ovulation-induction therapy. This unlocks significant long-term expansion for market stakeholders.

Key Challenge:

High Cost of Advanced Treatment and Monitoring

Treatment with synthetic ovulation stimulants often requires frequent monitoring, hormone testing, and specialist visits. These steps raise overall costs, limiting access for women in low-income regions. Injectable stimulants such as gonadotropins also cost more, leading to affordability concerns. Many countries lack insurance coverage for fertility care, creating financial barriers for repeated cycles. Cost-related treatment discontinuation remains common and restricts consistent market adoption. Without broader reimbursement and low-cost alternatives, access gaps will persist across key regions.

Safety Concerns and Risk of Adverse Outcomes

Safety concerns pose another challenge for the Synthetic Ovulation Stimulants Market. Improper dosing may increase risks of ovarian hyperstimulation, multiple pregnancies, or cycle irregularities. Some women experience hormonal side effects that lead to early withdrawal from therapy. Clinics must ensure accurate monitoring, yet resource-limited areas often lack advanced diagnostic tools. Concerns about complex protocols also discourage some patients from starting treatment. These factors highlight the need for safer dosing strategies, clearer guidance, and wider clinical oversight to maintain patient confidence.

Regional Analysis

North America – ~38% Market Share (2024)

North America held the largest share of about 38% in 2024, supported by strong infertility awareness and wide access to reproductive specialists. Clinics used structured diagnostic steps and advanced monitoring tools, which raised demand for synthetic ovulation stimulants. Rising PCOS cases, delayed pregnancies, and broader insurance coverage also pushed growth. The United States led due to large clinic networks and high treatment adoption. Canada showed steady uptake driven by more fertility consultations and better care access.

Europe – ~30% Market Share (2024)

Europe captured around 30% of the market in 2024, supported by robust healthcare systems and a strong focus on reproductive health. Germany, France, and the U.K. recorded more treatment cycles due to delayed family planning and higher PCOS rates. Public health programs encouraged early fertility checks, supporting stimulant prescriptions. Broader access to fertility clinics and structured monitoring improved treatment success. Southern and Eastern Europe saw higher demand as private clinics expanded services and improved affordability.

Asia-Pacific – ~22% Market Share (2024)

Asia-Pacific held nearly 22% of the market in 2024, with rapid growth driven by rising infertility rates and lifestyle changes. China, India, and Japan led adoption as urban women sought early evaluations and evidence-based treatment. Expanding fertility chains, medical tourism hubs, and wider hormone testing supported this rise. Affordability improved as local clinics offered cost-effective stimulation plans. Broader diagnostic access and increasing PCOS incidence strengthened long-term demand.

Latin America – ~6% Market Share (2024)

Latin America accounted for about 6% of the market in 2024, supported by improved infertility awareness and broader clinic networks. Brazil, Mexico, and Argentina recorded higher treatment adoption due to rising reproductive consultations and structured care. Private fertility centers offered affordable ovulation-stimulation options, making care more accessible. Economic pressures slowed uptake in some areas, yet expanding diagnostics and growing PCOS rates helped the region gain share.

Middle East & Africa – ~4% Market Share (2024)

The Middle East & Africa region held roughly 4% of the market in 2024, with gradual growth driven by rising demand for fertility services. Gulf countries invested in advanced reproductive centers and attracted cross-border patients. Awareness programs improved early diagnosis of ovulation issues, increasing stimulant use. In Africa, adoption stayed limited due to cost and infrastructure gaps, but urban clinics expanded access. Growing PCOS cases and wider consultation options supported long-term growth potential.

Market Segmentations:

By Type of Medication

- Clomiphene Citrate

- Gonadotropins

- Aromatase Inhibitors

- Human Chorionic Gonadotropin (hCG)

By Indication

- Polycystic Ovary Syndrome (PCOS)

- Unexplained Infertility

- Hypothalamic

- Amenorrhea

- Other Causes

By End User

- Fertility Clinics

- Hospitals

- Home Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The Synthetic Ovulation Stimulants Market features leading players such as Merck KGaA, Ferring Pharmaceuticals, Novartis AG, Sanofi Aventis Ltd., Serum Institute Pvt. Ltd., Merck & Co. Inc., AstraZeneca plc, Organon & Co., EMD Serono, Inc., and Kosher Pharmaceuticals. These companies strengthen their position by expanding product portfolios, improving hormone-based formulations, and supporting evidence-based ovulation-induction protocols used in fertility clinics. Many firms invest in research to refine dosing accuracy, reduce side effects, and enhance success rates for women with PCOS, unexplained infertility, and hormonal imbalance. Strategic partnerships with fertility centers and diagnostic networks help widen patient access across developed and emerging regions. Continuous improvement in oral and injectable stimulants, along with global distribution expansion, supports strong competition

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Merck KGaA

- Ferring Pharmaceuticals

- Novartis AG

- Sanofi Aventis Ltd.

- Serum Institute Pvt. Ltd.

- Merck & Co. Inc.

- AstraZeneca, plc

- Organon & Co.

- EMD Serono, Inc.

- Kosher Pharmaceuticals

Recent Developments:

- In October 2025, EMD Serono signed an agreement with the U.S. government to offer its full IVF-therapy portfolio including ovulation stimulants such as Gonal‑F, Ovidrel, and Cetrotide via the new TrumpRx.gov direct-purchase platform. This move will allow eligible patients to obtain these therapies at up to 84% discount off list price.

- In May 2025, Ferring Pharmaceuticals: Presented results from the IRIS study (individualised vs conventional dosing of follitropin delta) showing comparable efficacy and safety and numerically higher ongoing pregnancy/live-birth rates for follitropin delta in an Indian IVF population; results were presented at ASPIRE (adds clinical real-world evidence supporting Ferring’s follitropin-delta portfolio).

Report Coverage:

The research report offers an in-depth analysis based on Type of medication, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise as infertility assessments increase across emerging and developed regions.

- Clinics will adopt more personalized stimulation protocols based on hormone profiles.

- Digital cycle-tracking tools will support better adherence and dosing accuracy.

- Access to fertility services will expand through new clinic networks and teleconsultations.

- Safer formulations with fewer side effects will gain stronger clinical preference.

- Early diagnosis of PCOS and hormonal disorders will drive higher treatment volumes.

- Home-based monitoring devices will support selected stimulation cycles.

- Partnerships between pharma companies and reproductive centers will strengthen distribution.

- Awareness campaigns will encourage earlier reproductive health evaluations.

- Growth will remain strong as more women delay childbirth and seek structured fertility care.