Market Overview

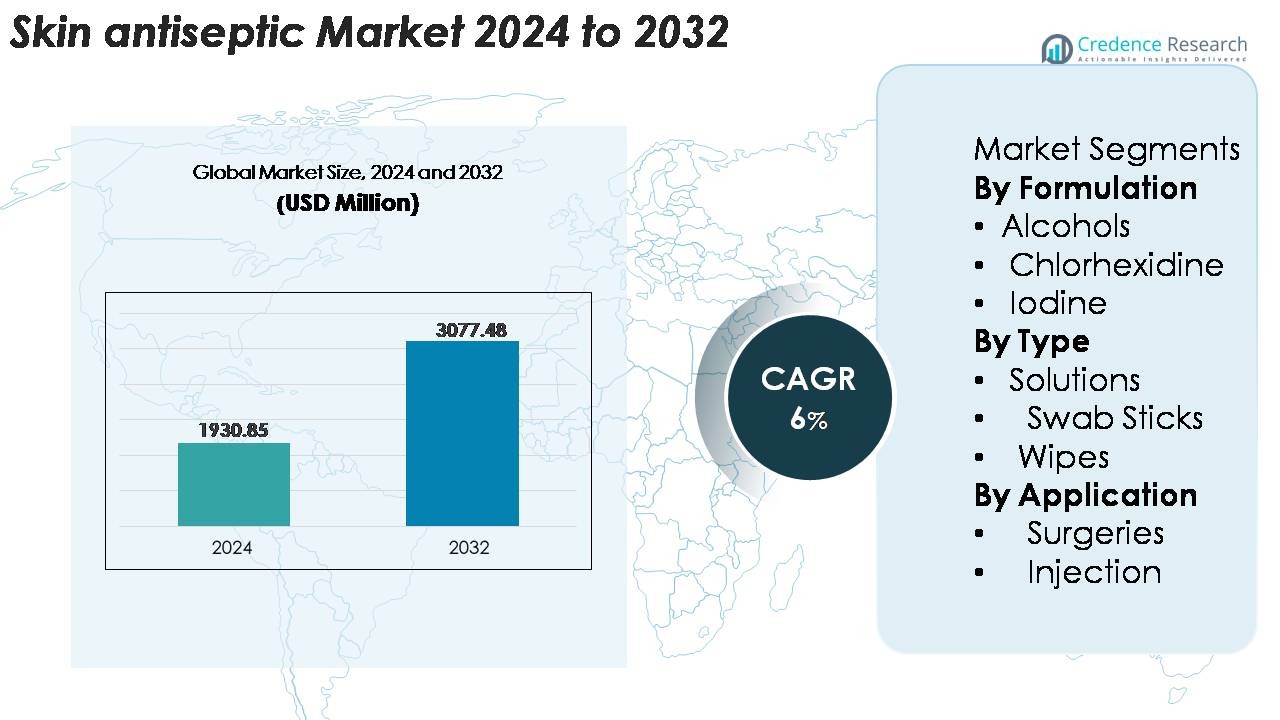

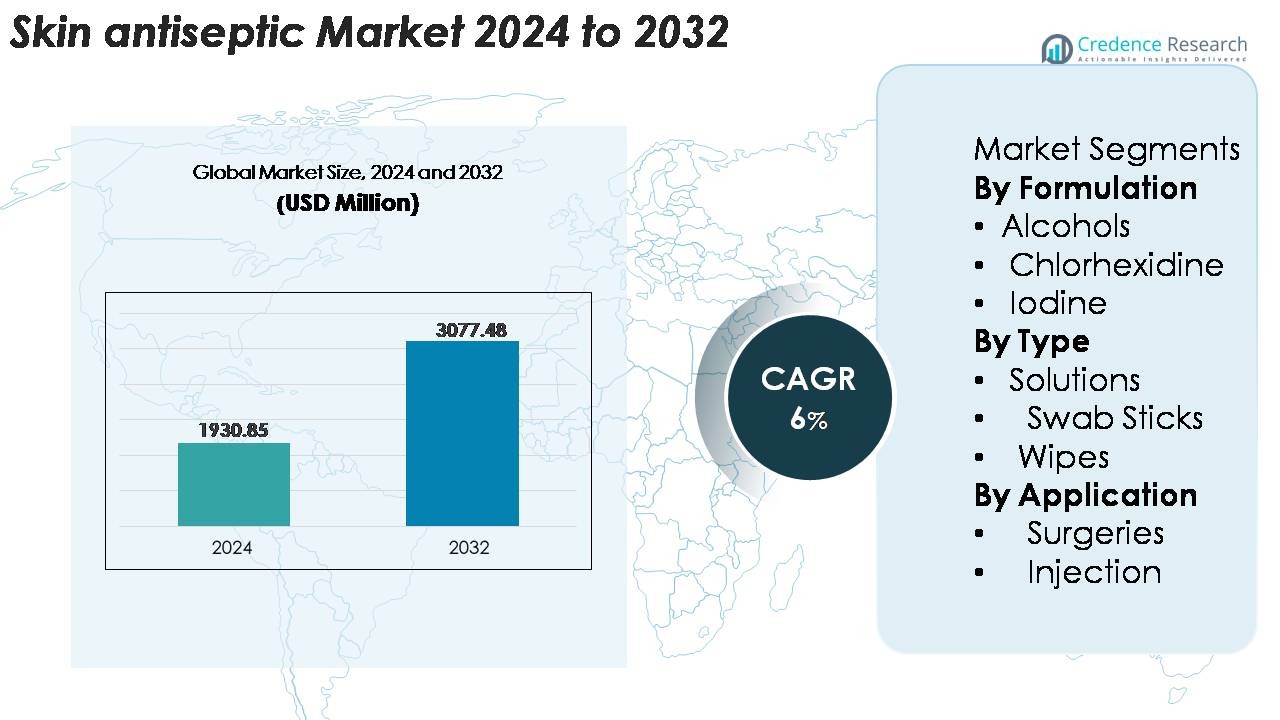

The global Skin Antiseptic Market was valued at USD 1,930.85 million in 2024 and is projected to reach USD 3,077.48 million by 2032, expanding at a CAGR of 6% over the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skin Antiseptic Market Size 2024 |

USD 1,930.85 Million |

| Skin Antiseptic Market, CAGR |

6% |

| Skin Antiseptic Market Size 2032 |

USD 3,077.48 Million |

The skin antiseptic market is dominated by major healthcare and infection-prevention companies such as 3M, BD (Becton, Dickinson and Company), Johnson & Johnson, B. Braun Melsungen AG, Ecolab, Schülke & Mayr, and Purdue Pharma’s Betadine brand, each offering extensive portfolios across alcohols, chlorhexidine, and iodine formulations. These players strengthen competitiveness through sterile single-use applicators, long-acting formulations, and hospital-focused infection-control systems. North America leads the global market with approximately 35% share, supported by high surgical volumes, strict SSI-prevention protocols, and rapid adoption of advanced antiseptic delivery formats across hospitals, ambulatory care centers, and outpatient clinics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The skin antiseptic market reached USD 1,930.85 million in 2024 and is projected to hit USD 3,077.48 million by 2032, reflecting a 6% CAGR during the forecast period.

- Growing surgical volumes, increasing outpatient procedures, and expanding immunization programs are driving strong demand for alcohol- and chlorhexidine-based antiseptics, with alcohol formulations holding the largest segment share due to rapid microbial kill rates and procedural versatility.

- Market trends highlight rising adoption of combination formulations, sterile single-use applicators, and long-acting antiseptics that support enhanced SSI-prevention protocols across hospitals and ambulatory care settings.

- Competitive activity intensifies as key players expand portfolios, optimize packaging sterilization, and strengthen distribution in high-volume clinical environments; however, raw material cost volatility and concerns over skin sensitivity present notable restraints.

- Regionally, North America leads with ~35% share, followed by Europe at ~30% and Asia Pacific at ~25%, reflecting strong surgical infrastructure, regulatory emphasis on infection control, and rapid healthcare expansion.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Formulation

Alcohol-based formulations hold the dominant share of the skin antiseptic market due to their rapid microbial kill rates, broad-spectrum efficacy, and strong adoption across surgical, procedural, and emergency-care environments. Their fast evaporation, low residual risk, and compatibility with pre-operative workflows make them the preferred choice for both hospitals and outpatient facilities. Chlorhexidine continues gaining traction for its strong residual activity, particularly in catheter procedures and high-risk surgical areas. Meanwhile, iodine and other formulations remain relevant for patients with alcohol sensitivity or when extended antimicrobial coverage is required.

- For instance, 3M’s Avagard™ hand antiseptic contains 61% w/w ethyl alcohol and delivers a log-reduction of 4.5 within 15 seconds of application, supporting high-volume surgical use.

By Type

Solutions represent the leading sub-segment in the skin antiseptic market, driven by their extensive clinical use in surgical site preparation, large-area disinfection, and pre-injection cleansing. Their cost efficiency, availability in multiple concentrations, and compatibility with alcohol and chlorhexidine formulations support widespread adoption in hospitals and specialty clinics. Swab sticks continue expanding in procedural applications that require precision, single-use sterility, and rapid workflow integration, particularly in emergency and ambulatory settings. Wipes remain important in home-care, vaccination drives, and portable medical kits where convenience, portability, and controlled dosage are key decision factors.

- For instance, Braun’s Softasept® solution is supplied in volumes up to 1,000 mL (and larger canisters) and contains a combination of alcohols as active ingredients, enabling efficient surgical skin prep across high-volume facilities.

By Application

Surgeries account for the dominant share of application-based consumption due to high procedural volumes, strict sterility protocols, and consistent demand for broad-spectrum antimicrobial protection. Hospitals prioritize skin antiseptics that deliver rapid kill, strong residual effect, and compatibility with surgical draping methods. Injection-based applications continue to expand with rising immunization programs, chronic disease management requiring frequent injections, and growing outpatient care activities. Demand for single-use wipes and swab sticks is particularly strong in this segment, driven by ease of use, standardized dosing, and improved infection prevention in high-throughput clinical workflows.

Key Growth Drivers

Rising Surgical Volumes and Expansion of Outpatient Procedures

Growing global surgical workloads significantly drive demand for skin antiseptic products, as hospitals, ambulatory surgery centers, and specialty clinics intensify infection-prevention protocols before invasive procedures. The rise in minimally invasive surgeries, orthopedic reconstructions, cardiovascular interventions, and cosmetic procedures further increases consumption of alcohol-based and chlorhexidine formulations. Outpatient and same-day procedures are expanding rapidly due to shorter recovery times, lower costs, and improved imaging and anesthesia technologies. This shift increases the need for pre-operative prep solutions that provide rapid microbial kill and long-lasting residual activity. The growing burden of surgical-site infections (SSIs) and tiered accreditation requirements reinforce consistent procurement of high-performance antiseptics. Additionally, an aging population with chronic illnesses contributes to higher intervention volumes, creating a sustained market expansion driver.

• For instance, BD’s ChloraPrep™ system combines 2% chlorhexidine gluconate with 70% isopropyl alcohol and delivers rapid microbial reduction within 30 seconds, with chlorhexidine providing residual activity on skin for up to 48 hours.

Rising Emphasis on Infection Prevention and Hospital Safety Compliance

Strengthening global focus on infection-control measures remains a central growth driver for the skin antiseptic market. Healthcare systems are under consistent pressure to reduce HAIs, especially surgical-site infections and catheter-associated bloodstream infections. Regulatory bodies and accreditation agencies have intensified compliance audits, mandating standardized antiseptic protocols across pre-surgical, pre-injection, and device-related procedures. Evidence-based guidelines increasingly favor formulations with rapid antimicrobial efficacy and persistent protection. This regulatory tightening accelerates the shift toward formulations combining alcohol with chlorhexidine or iodine for enhanced microbial suppression. Post-pandemic infection awareness among clinicians and patients further boosts consumption. Technological improvements in formulation stability, packaging sterility, and ease of application also strengthen product adoption, particularly in large hospital networks seeking outcome improvement and workflow efficiency.

- For instance, Schülke & Mayr’s octenisept® delivers a proven microbial reduction within 60 seconds and incorporates 0.1 g of octenidine dihydrochloride per 100 g, supporting high-risk procedural environments.

Increasing Vaccination Programs and Growth of Home-Based Clinical Care

The expansion of global immunization initiatives, rising usage of injectable therapies, and accelerated shift toward home-based patient management collectively propel demand for skin antiseptic wipes, swabs, and small-volume solutions. Chronic disease patients undergoing frequent injections such as insulin users or biologics recipients require consistent antiseptic application to minimize localized infections. Community health workers, mobile clinics, and telemedicine-supported home care also depend on ready-to-use antiseptic formats for decentralized patient services. Public health campaigns, emergency vaccination drives, and preparedness for future outbreaks amplify consumption at both institutional and public-health levels. These trends favor single-use, unit-dose antiseptic formats that ensure sterility, dosage accuracy, and low application error risk, strengthening long-term market growth.

Key Trends & Opportunities

Increasing Shift Toward Combination Formulations and Long-Acting Antiseptics

A major trend shaping the market is the rising adoption of combination formulations, particularly alcohol-chlorhexidine blends, which provide rapid kill rates and strong residual activity. Healthcare facilities seek multi-mechanism antiseptics to better control resistant pathogens and prevent postoperative complications. R&D advancements are enabling extended-duration products that maintain antimicrobial protection for longer periods without reapplication, improving surgical workflow efficiency. This trend creates opportunities for manufacturers developing hybrid formulations, improved film-forming agents, and optimized skin compatibility. Additionally, the growing use of antiseptics in catheter insertion, dialysis, and chronic care procedures expands the market for advanced long-acting antiseptic technologies.

- For instance, 3M’s DuraPrep™ Surgical Solution combines 0.7% iodine povacrylex with 74% isopropyl alcohol and creates a durable antimicrobial film on the skin that resists removal during extended surgical procedures, supporting consistent aseptic preparation.

Rising Demand for Single-Use, Pre-Packaged, and Sterile Delivery Formats

Growing emphasis on sterility assurance across clinical settings is driving strong adoption of pre-packaged antiseptic formats, such as swab sticks, unit-dose wipes, and sterile ampoules. Healthcare facilities prefer single-use delivery systems to reduce cross-contamination risks, improve dosing consistency, and simplify compliance with procedural standards. This trend strengthens opportunities for manufacturers offering tamper-evident packaging, latex-free materials, and clinician-friendly applicator designs. The rise of outpatient centers, mobile medical services, and emergency response units further accelerates demand for compact, portable antiseptic formats. Additionally, procurement teams increasingly prioritize products enabling faster application and reduced waste, incentivizing innovation in ergonomic applicators and environmentally responsible packaging.

- For instance, BD’s ChloraPrep™ applicators dispense a controlled 10.5 mL dose of antiseptic through a sterile sponge, enabling precise and uniform application in pre-operative workflow

Growing Penetration of Antiseptics in Homecare, Telehealth, and Chronic Disease Management

The expansion of decentralized healthcare delivery presents a significant opportunity for skin antiseptic suppliers. Homecare settings, self-injection therapies, and telemedicine-supported chronic disease programs increasingly require reliable antiseptic solutions to maintain infection safety outside clinical environments. The rise in remote patient monitoring, at-home biologic treatments, and pharmacy-led injection services is fueling demand for portable, easy-to-use antiseptic wipes and swabs. Manufacturers are exploring consumer-oriented product lines with simplified instructions, skin-sensitive formulations, and compact packaging formats. This trend is reinforced by aging populations and the growing preference for non-hospital treatment pathways, creating long-term commercial opportunities across both retail and medical distribution channels.

Key Challenges

Growing Concerns Over Antiseptic Resistance and Skin Sensitivity

The increasing occurrence of antiseptic-tolerant pathogens, particularly with repeated exposure to chlorhexidine and iodine, raises clinical concerns and may limit the widespread use of certain formulations. Healthcare facilities must balance efficacy with potential skin irritation, allergic reactions, and long-term sensitivity risks, especially among surgical patients and individuals receiving frequent injections. Regulatory agencies continue to monitor emerging resistance trends, prompting hospitals to alternate antiseptic protocols or adopt combination formulations. These factors increase pressure on manufacturers to improve dermatological safety, antimicrobial performance, and formulation stability while adhering to evolving global guidelines. Managing these clinical complexities remains a key barrier to long-term product standardization.

Raw Material Volatility, Supply Chain Pressure, and Compliance Costs

Manufacturers face challenges from fluctuating prices of alcohols, iodine derivatives, and chlorhexidine ingredients, which directly impact production costs and pricing stability. Global supply chain disruptions, shipping delays, and variable regulatory import requirements add further pressures, especially for institutions reliant on large-volume antiseptic procurement. Compliance with stringent sterility standards, packaging regulations, and chemical safety certifications increases manufacturing complexity and operational expenditure. Smaller manufacturers struggle with capital requirements for advanced sterilization, tamper-proof packaging, and contaminant-free filling processes. These structural pressures may hinder product availability, delay new formulation development, and limit competitive differentiation across the market.

Regional Analysis

North America

North America accounts for the largest share of the skin antiseptic market at approximately 35%, driven by high surgical volumes, strong infection-prevention mandates, and widespread adoption of alcohol- and chlorhexidine-based formulations. Hospitals and ambulatory surgical centers maintain strict compliance with SSI prevention guidelines, supporting steady procurement of pre-operative prep solutions, wipes, and swab sticks. The region benefits from advanced healthcare infrastructure, higher per-capita procedure rates, and rapid uptake of sterile, single-use applicators. Ongoing investments in outpatient care expansion and chronic disease management continue reinforcing strong product demand across the U.S. and Canada.

Europe

Europe holds around 30% of the global market, supported by well-established healthcare systems, strict regulatory frameworks, and strong adherence to standardized antiseptic protocols in surgical and procedural environments. Countries such as Germany, France, and the U.K. maintain high utilization of chlorhexidine- and iodine-based solutions, particularly in orthopedic, cardiac, and critical-care procedures. The region emphasizes antimicrobial stewardship, driving the use of high-efficacy formulations with reduced irritant profiles. Growing adoption of minimally invasive surgery and an aging population with chronic disease burdens further support consistent demand. Expanding outpatient facilities and strengthened HAI prevention initiatives also contribute to Europe’s stable market position.

Asia Pacific

Asia Pacific accounts for roughly 25% of global skin antiseptic consumption, fueled by rapid healthcare expansion, higher surgical workloads, and rising vaccination activities across China, India, Japan, and Southeast Asia. Increasing government investments in hospital modernization and infection-control infrastructure support stronger uptake of alcohol-based prep solutions and cost-efficient wipes. The region’s growing medical tourism sector and rising burden of chronic illnesses requiring frequent injections further elevate demand. Awareness of hospital-acquired infections is increasing, leading facilities to adopt higher-quality antiseptic formulations. As healthcare access expands in emerging economies, Asia Pacific is positioned as the fastest-growing regional market.

Latin America

Latin America represents approximately 6% of the global market, with demand concentrated in Brazil, Mexico, Argentina, and Chile. Growth is supported by rising surgical procedure volumes, improving hospital hygiene standards, and expanding immunization programs. Public health systems increasingly mandate standardized antiseptic protocols, boosting procurement of low-cost alcohol-based wipes and solutions. However, budget constraints and uneven healthcare infrastructure limit premium product penetration. Private hospitals and urban clinics lead adoption of higher-efficacy formulations such as chlorhexidine blends. Strengthening infection-prevention initiatives, coupled with expanding outpatient treatment centers, is gradually improving regional uptake of professional-grade antiseptic products.

Middle East & Africa

The Middle East & Africa accounts for about 4% of global demand, driven by developing healthcare infrastructure and increased investments in surgical care capacity across the GCC, South Africa, and North Africa. Hospitals in wealthier Gulf countries show strong adoption of advanced antiseptic formulations, while cost-effective alcohol solutions dominate in lower-income regions. Growing prevalence of chronic diseases requiring regular injections and expansion of vaccination initiatives support market growth. However, procurement constraints, limited healthcare access, and uneven regulatory enforcement temper broader adoption. Ongoing investments in hospital modernization and infection-control programs gradually strengthen demand across the region.

Market Segmentations:

By Formulation

- Alcohols

- Chlorhexidine

- Iodine

By Type

- Solutions

- Swab Sticks

- Wipes

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the skin antiseptic market is characterized by a mix of global healthcare manufacturers, pharmaceutical companies, and specialized infection-prevention solution providers. Leading players focus on expanding product portfolios across alcohol-based, chlorhexidine, and iodine formulations to meet diverse surgical and procedural requirements. Companies increasingly invest in developing sterile, single-use applicators, long-acting antiseptic blends, and skin-sensitive formulations to strengthen clinical adoption. Strategic priorities include regulatory approvals, supply chain resilience, and partnerships with hospitals and procurement networks to secure high-volume contracts. Competitive differentiation is also driven by advancements in formulation stability, packaging innovation, and compliance with stringent infection-control guidelines. Mergers, acquisitions, and regional expansions remain common as companies seek to increase distribution reach and address rising demand from outpatient centers, homecare settings, and vaccination programs. Overall, competition is intensifying as manufacturers prioritize quality assurance, manufacturing scalability, and product consistency to maintain leadership in both mature and emerging markets.

Key Player Analysis

Recent Developments

- In September 2025, Schülke & Mayr GmbH acquired Redditch Medical, a UK-based specialist in cleanroom contamination control solutions including the InSpec® range of disinfectants and detergents, to expand its Life Science capabilities for pharmaceutical and biotech customers worldwide.

- In July 2025, BD (Becton, Dickinson and Company) celebrated the 25th anniversary of its BD ChloraPrep™ Skin Preparation line highlighting its long-standing role and continued relevance in surgical skin antisepsis

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Formulation, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for skin antiseptics will continue rising as surgical volumes, outpatient procedures, and minimally invasive interventions expand globally.

- Adoption of combination formulations offering rapid kill and longer residual protection will accelerate across hospitals and ambulatory centers.

- Growth in vaccination programs and self-injection therapies will increase consumption of single-use wipes and swab sticks.

- Hospitals will increasingly prefer sterile, pre-packaged applicators that offer consistent dosing and reduce contamination risks.

- Regulatory emphasis on reducing surgical-site infections will drive procurement of higher-efficacy antiseptic solutions.

- Home-based clinical care and remote patient management will boost demand for portable antiseptic formats.

- Manufacturers will focus on skin-sensitive and pediatric-safe formulations to meet diversified clinical needs.

- Technological improvements in formulation stability and packaging sterilization will enhance product performance and adoption.

- Emerging markets will experience rapid growth due to infrastructure upgrades and broader access to surgical care.

- Sustainability initiatives will encourage development of eco-friendly packaging and reduced-waste antiseptic systems.

Market Segmentation Analysis:

Market Segmentation Analysis: