Market Overview:

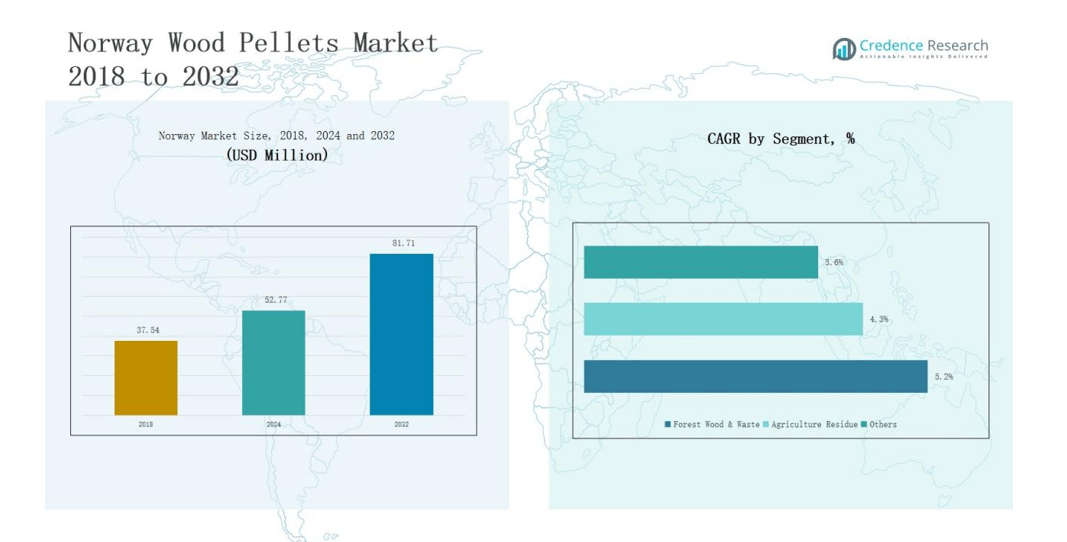

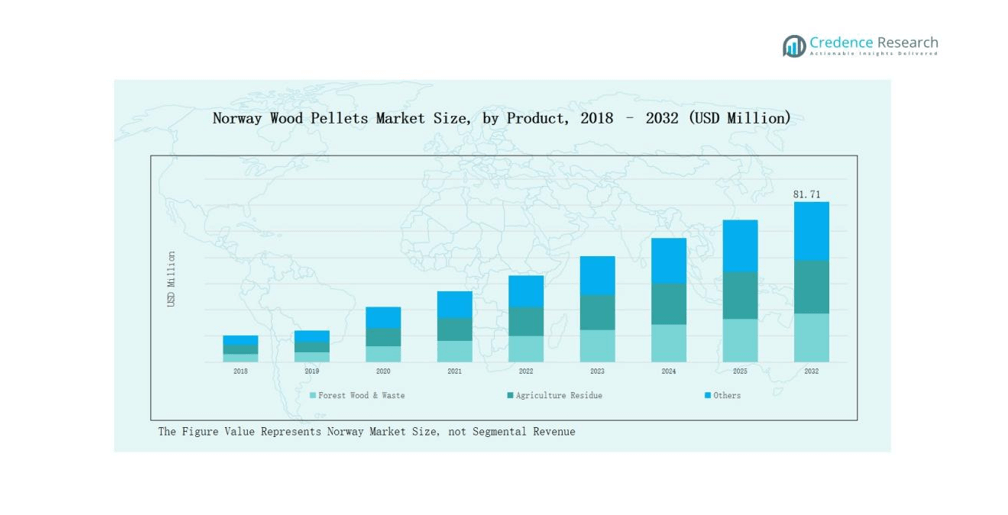

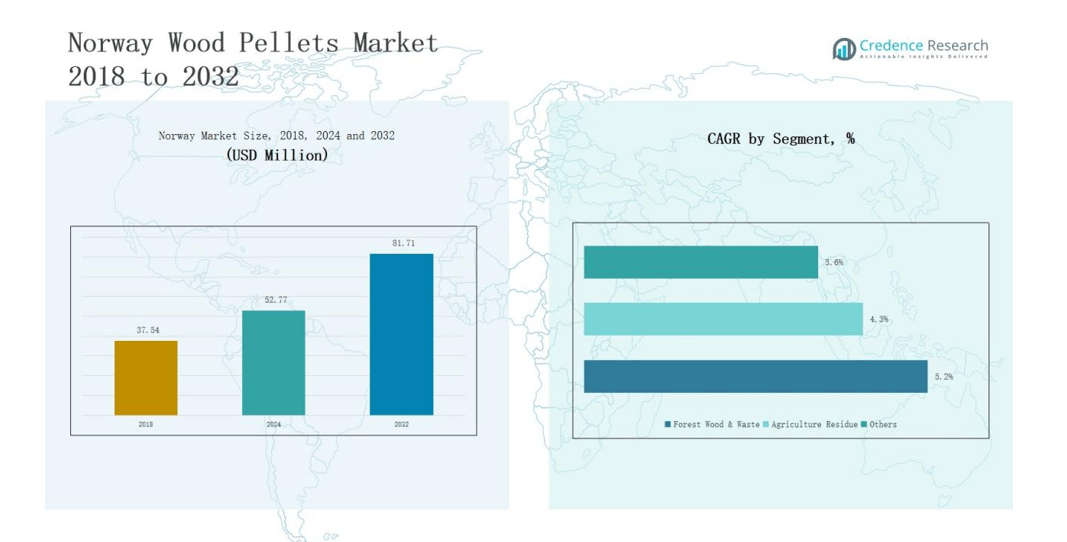

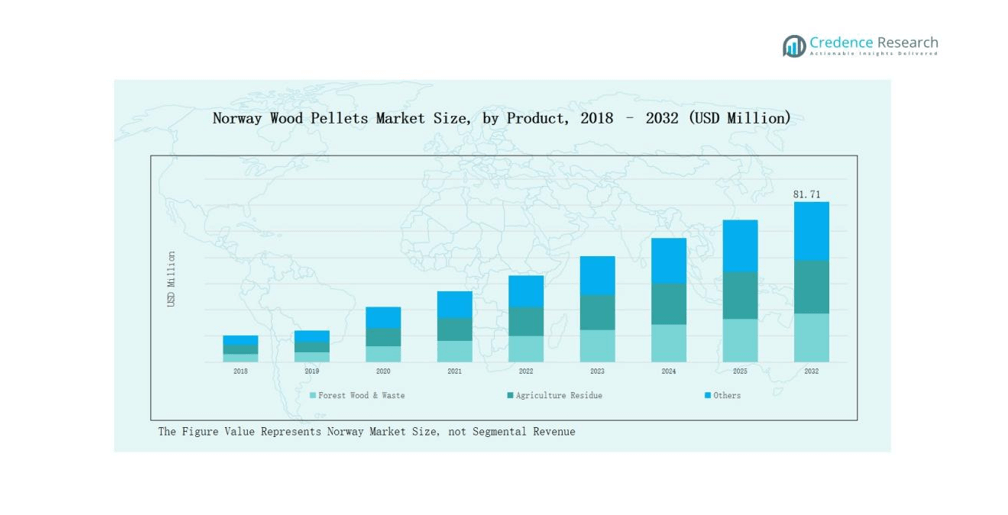

Norway Wood Pellets Market size was valued at USD 37.54 million in 2018 to USD 52.77 million in 2024 and is anticipated to reach USD 81.71 million by 2032, at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Norway Wood Pellets Market Size 2024 |

USD 52.77 million |

| Norway Wood Pellets Market, CAGR |

5.23% |

| Norway Wood Pellets Market Size 2032 |

USD 81.71 million |

The Norway Wood Pellets Market features a competitive landscape led by established players such as Bioenergi Norge, Norsk Pellets, Glommen Skog, Stora Enso Skog, Norske Skog, PelletsNor AS, Viken Skog, and Hedmarken Pellets. These companies maintain strong positions through integration with forestry operations, sustainable sourcing practices, and reliable supply to district heating networks. Larger firms leverage advanced pelletizing facilities and export capacity, while mid-sized producers serve residential and commercial markets with certified eco-friendly products. Northern Norway leads the market with 42% share in 2024, driven by abundant forest resources, high heating demand, and robust district heating infrastructure, reinforcing its dominance in both production and consumption.

Market Insights

- The Norway Wood Pellets Market grew from USD 236.43 million in 2018 to USD 77 million in 2024 and is expected to reach USD 81.71 million by 2032 at a CAGR of 5.23%.

- Leading players include Bioenergi Norge, Norsk Pellets, Glommen Skog, Stora Enso Skog, Norske Skog, PelletsNor AS, Viken Skog, and Hedmarken Pellets, focusing on sustainable sourcing and reliable supply.

- By product, Forest Wood & Waste dominates with 70% share in 2024, followed by Agriculture Residue at 20% and Others at 10%, supported by strong forestry resources.

- By application, Industrial Pellet for CHP/District Heating leads with 58% share, while Residential/Commercial heating contributes 25%, Co-Firing accounts for 12%, and Others represent 5%.

- Northern Norway holds the largest regional share at 42% in 2024, followed by Eastern Norway at 28%, Western Norway at 18%, and Southern Norway at 12%, reflecting strong geographic distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Norway Wood Pellets Market is dominated by the Forest Wood & Waste segment, holding nearly 70% share in 2024. Its dominance is supported by Norway’s rich forestry resources, advanced pelletizing facilities, and strong emphasis on sustainable biomass utilization. The Agriculture Residue segment, with about 20% share, benefits from growing interest in circular economy practices and efficient use of crop by-products. The Others category, accounting for the remaining 10%, includes mixed biomass sources but remains limited due to lower supply consistency and higher processing costs.

- For instance, Statkraft has invested in biomass-based district heating plants across Norway, utilizing wood chips and pellets sourced from local forestry residues to support renewable energy integration.

By Application

The Industrial Pellet for CHP/District Heating segment leads the Norway market with around 58% share in 2024, driven by the country’s extensive district heating infrastructure and government support for renewable heat solutions. The Pellet for Heating Residential/Commercial segment holds close to 25% share, reflecting steady demand from households and small businesses seeking cost-effective, eco-friendly heating options. The Industrial Pellet for Co-Firing segment captures about 12% share, supported by utilities integrating biomass with coal to reduce emissions. The Others segment represents the remaining 5%, comprising niche uses such as animal bedding and small-scale exports, with limited growth prospects.

- For instance, Bio Wood Norway AS commissioned a large-scale wood pellet plant in 2010 with an annual capacity of 450,000 tonnes, though operations have since closed.

Market Overview

Strong Forestry Resources and Sustainable Supply

Norway’s extensive forest cover provides a reliable feedstock base for wood pellet production. The availability of certified forest wood and waste ensures consistent supply while aligning with sustainability regulations. Government initiatives promoting sustainable forestry practices further strengthen raw material availability. This strong resource base reduces reliance on imports and enhances competitiveness, making the forest wood & waste segment the dominant product category.

Expanding District Heating Infrastructure

The expansion of district heating networks has become a major driver for wood pellet demand in Norway. Combined heat and power (CHP) plants use pellets as a cost-effective renewable fuel, supporting decarbonization targets. Municipalities increasingly invest in pellet-based CHP projects to reduce reliance on fossil fuels. These developments reinforce pellets as the leading energy source in large-scale heating applications, particularly in northern and urban regions with established district heating facilities.

- For instance, PetroBio, a Swedish company, supplied wood pellet burners for a new district heating plant in Jessheim, Norway, helping advance pellet technology in urban heating solutions.

Supportive Government Policies and Climate Goals

Norway’s climate commitments and renewable energy policies create a favorable environment for pellet adoption. Subsidies, tax incentives, and carbon reduction targets encourage industries and households to shift from fossil fuels to biomass energy. Pellets contribute to meeting EU renewable energy directives, ensuring compliance and sustainability. Regulatory support also fosters investment in pellet production capacity, helping domestic players scale operations. Such measures directly stimulate demand and position Norway as a strong biomass-driven energy market.

- For instance, Norway’s Enova SF, a state-owned enterprise, provides financial support for households installing bioenergy heating systems, directly boosting pellet stove installations.

Key Trends & Opportunities

Rising Adoption of Bioenergy in Residential Heating

Growing consumer preference for clean and affordable heating solutions is driving pellet demand in homes and commercial buildings. The pellet stove market is gaining traction, offering convenience and reduced emissions compared to traditional fuels. Advancements in pellet-burning technology enhance efficiency, making it a viable alternative to electric and oil-based heating systems. This shift presents strong opportunities for market players to expand offerings in household and small-scale heating applications.

- For instance, MCZ has developed smart pellet stoves with remote controls and app integration, enhancing user convenience and operational efficiency.

Increasing Potential for Biomass Exports

Norway’s pellet producers are exploring opportunities in international markets, particularly within the EU, where demand for biomass energy is accelerating. Surplus production capacity and access to shipping infrastructure enable Norwegian firms to target export growth. Rising carbon taxes across Europe make wood pellets a competitive solution for utilities transitioning away from coal. Export expansion not only diversifies revenue streams but also strengthens Norway’s position in the global renewable energy supply chain.

- For instance, Biowood Norway AS operates a 450,000‑tonne-per-year pellet plant in Averøy and has exported large volumes to the Netherlands and the UK, where cofiring in power plants is incentivized to cut emissions.

Key Challenges

Seasonal Demand Fluctuations

Wood pellet consumption in Norway is highly seasonal, peaking during winter months. This creates uneven demand cycles that strain logistics and inventory management. Producers face the challenge of balancing supply during off-peak seasons while maintaining profitability. Such fluctuations can lead to underutilization of production capacity and higher storage costs, affecting operational efficiency.

Competition from Alternative Renewable Sources

The rise of hydropower, wind, and solar energy in Norway presents a significant challenge to pellet growth. These renewable options often receive more government support and consumer preference due to lower emissions profiles. As energy policies increasingly favor electrification, biomass may face slower adoption in certain segments. This competition pressures pellet producers to innovate and highlight biomass’s complementary role in Norway’s energy transition.

Rising Production and Logistics Costs

Producers in Norway face increasing costs related to raw materials, energy consumption, and transportation. Supply chain disruptions and higher fuel expenses for logistics can impact pellet pricing. Smaller players, in particular, struggle to maintain cost competitiveness against larger producers with economies of scale. These rising costs limit profitability and could constrain investment in new capacity unless mitigated by efficiency improvements or stronger policy support.

Regional Analysis

Northern Norway

Northern Norway leads the Norway Wood Pellets Market with a 42% share in 2024. Abundant forestry resources, cold climate, and high heating demand drive consumption in this region. Strong district heating infrastructure supports industrial pellet usage, particularly for CHP plants. Producers benefit from access to raw materials and proximity to export routes. Investments in pelletizing facilities strengthen supply capabilities and secure long-term contracts. It maintains dominance due to its balance of resource availability and growing domestic demand.

Eastern Norway

Eastern Norway holds a 28% share supported by dense forest cover and strong industrial presence. This region benefits from large-scale forestry operations, which ensure consistent feedstock supply for pellet production. Demand is rising from both district heating networks and residential heating systems. Urban centers within Eastern Norway also contribute to consumption through adoption of pellet stoves and boilers. It plays a key role in meeting both domestic needs and export opportunities. Strong infrastructure and established players reinforce growth potential.

Western Norway

Western Norway accounts for 18% share, supported by a growing residential heating market. While forestry resources are less concentrated compared to northern and eastern regions, steady demand comes from small businesses and households seeking cleaner heating alternatives. Maritime access provides export opportunities to nearby European markets. It is witnessing gradual adoption of biomass energy, supported by government incentives for renewable fuel use. The region continues to expand its role in residential and small-scale pellet consumption.

Southern Norway

Southern Norway contributes 12% share with demand primarily centered on commercial and residential heating. The milder climate limits overall pellet consumption compared to colder regions. However, the area benefits from strong logistics networks and access to international ports. Producers in Southern Norway often focus on supplying niche markets, including exports to EU countries. It maintains a smaller role in national pellet demand but supports Norway’s presence in regional biomass trade.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern Norway

- Eastern Norway

- Western Norway

- Southern Norway

Competitive Landscape

The Norway Wood Pellets Market is characterized by a mix of established forestry groups, dedicated pellet producers, and regional cooperatives competing on sustainability, efficiency, and supply reliability. Leading companies such as Bioenergi Norge, Norsk Pellets, Glommen Skog, Stora Enso Skog, Norske Skog, PelletsNor AS, Viken Skog, and Hedmarken Pellets dominate through strong integration with forestry operations and long-term contracts with district heating networks. Large players leverage economies of scale, advanced pelletizing facilities, and access to export routes to secure their positions. Mid-sized producers focus on certified products for residential and commercial heating, addressing growing consumer demand for eco-friendly energy solutions. Competition is shaped by price, quality, and sustainable sourcing, with firms increasingly investing in ENplus certification and low-emission processes. It remains a moderately consolidated market where established players hold significant share, while smaller firms target niche segments and localized demand to stay competitive.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Bioenergi Norge

- Norsk Pellets

- Glommen Skog

- Stora Enso Skog

- Norske Skog

- PelletsNor AS

- Viken Skog

- Hedmarken Pellets

- Others

Recent Developments

- In 2024, Arbaflame signed a five-year deal with Terval to supply 200,000 tonnes of Arbacore wood pellets, with deliveries starting in Q2 2024.

- In February 2025, PEARL Infrastructure Capital II SCA acquired 65 percent of Arbaflame AS, a Norway-based producer of advanced black pellets (ArbaCore). The company specializes in steam-treated black pellets that can replace coal in industrial applications.

- In September 2024, Moelven Pellets began commissioning its new pellet plant at Valåsen (Norway‑headed Moelven Group). The plant has an 80,000 t/year capacity, using sawmill residues.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for pellets in district heating will continue to strengthen due to decarbonization goals.

- Residential and commercial heating adoption will rise with greater awareness of clean energy solutions.

- Export opportunities will expand as EU countries seek reliable biomass suppliers.

- Investments in advanced pelletizing facilities will enhance production efficiency and output quality.

- Government incentives will encourage wider use of biomass across industrial and domestic applications.

- Producers will focus on certified sustainable sourcing to meet stricter environmental regulations.

- Rising energy costs will push households and small businesses toward pellet-based heating.

- Partnerships between forestry cooperatives and energy firms will secure long-term supply contracts.

- Digital monitoring and automation in pellet plants will improve operational reliability.

- Competition from alternative renewables will drive innovation in pellet efficiency and value-added applications.