Market Overview:

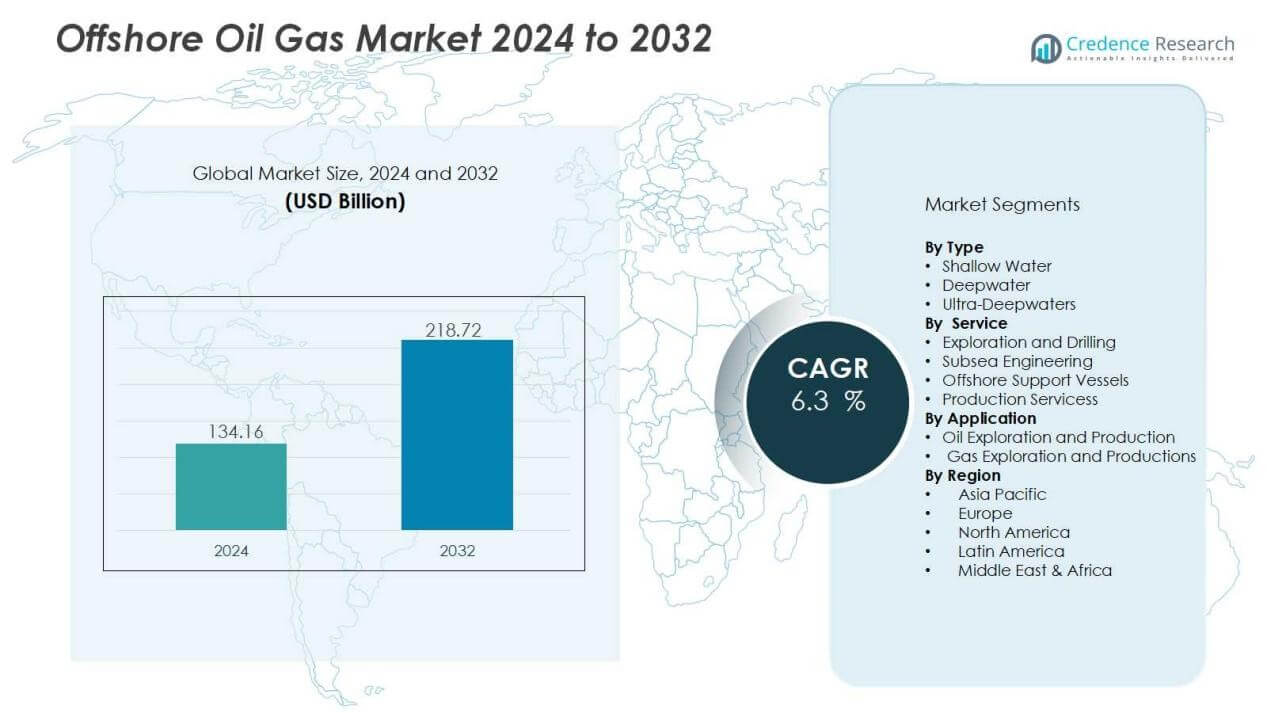

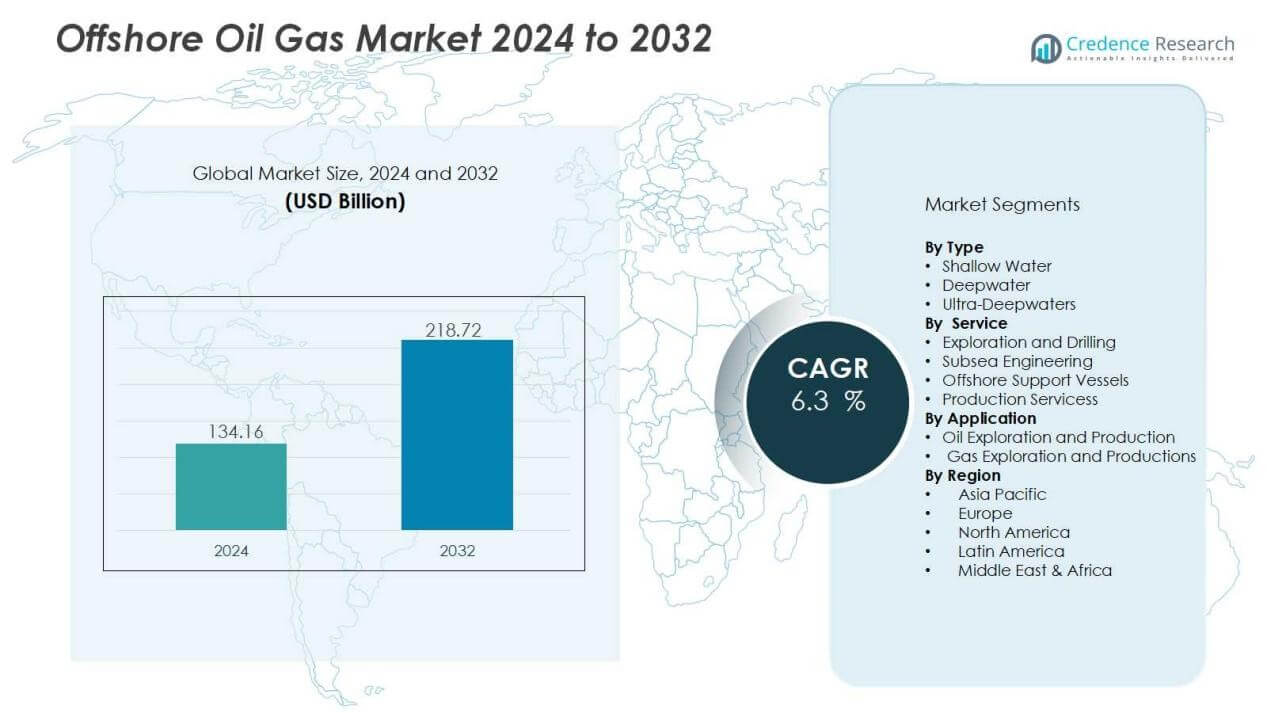

The offshore oil and gas market size was valued at USD 134.16 billion in 2024 and is anticipated to reach USD 218.72 billion by 2032, at a CAGR of 6.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Oil and Gas Market Size 2024 |

USD 134.16 Billion |

| Offshore Oil and Gas Market, CAGR |

6.3% |

| Offshore Oil and Gas Market Size 2032 |

USD 218.72 Billion |

Key drivers include the increasing need for reliable energy supply, especially as economies transition to mixed energy portfolios. Offshore reserves remain critical for meeting global oil and gas consumption, with many regions relying on these projects to balance energy security. Advances in subsea systems, digital monitoring, and offshore drilling efficiency are reducing operational risks and costs, improving project viability. Supportive government policies and continued investments in floating production units also drive the market forward.

Regionally, the Middle East and Africa dominate offshore activities due to vast reserves and ongoing national projects. North America follows, led by the Gulf of Mexico, while Europe remains strong with activity in the North Sea and emerging Arctic ventures. Asia-Pacific is witnessing rapid growth, particularly in countries like India, China, and Malaysia, driven by domestic consumption and energy diversification strategies.

Market Insights:

- The offshore oil gas market was valued at USD 134.16 billion in 2024 and is expected to reach USD 218.72 billion by 2032, growing at a CAGR of 6.3%.

- Rising global energy demand continues to drive the market, with offshore reserves playing a vital role in securing long-term supply.

- Deepwater and ultra-deepwater projects are expanding rapidly, supported by technological advances that improve efficiency and reduce risks.

- Innovations in subsea systems, digital monitoring, and automation are improving safety standards and lowering operational costs.

- Government policies and strategic investments in floating production units and subsea equipment are enhancing project viability.

- High capital costs, operational risks, and environmental regulations remain key challenges that impact profitability and investment cycles.

- Regionally, Middle East and Africa hold 36% share, North America 28%, and Europe 22%, while Asia-Pacific is growing quickly with 14% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Energy Demand and Dependence on Offshore Reserves:

The offshore oil gas market is strongly driven by increasing global energy needs. With population growth and industrial expansion, demand for oil and gas remains high. Offshore reserves provide a critical share of global supply, making their development vital. It benefits from continued reliance on hydrocarbons, even amid the energy transition.

- For Instance, The Shenandoah field, located in the U.S. Gulf of Mexico, is operated by Beacon Offshore Energy, not Chevron. Production at the field began in July 2025, with its floating production system having a peak capacity of 120,000 barrels per day.

Expansion of Deepwater and Ultra-Deepwater Exploration Projects:

Advances in technology have unlocked reserves in deeper and more challenging waters. Companies are investing heavily in ultra-deepwater fields to secure long-term production. The offshore oil gas market gains momentum from these projects, as they contribute significantly to global output. It also benefits from improved drilling techniques that reduce operational risks.

- For instance, Petrobras’s P-67 FPSO in the Lula Norte pre-salt field operates at a water depth of 2,130 meters.

Technological Advancements Improving Efficiency and Safety:

Cutting-edge subsea systems, digital monitoring, and automation are transforming offshore operations. These innovations increase efficiency, reduce downtime, and enhance safety standards. The offshore oil gas market is supported by technology that lowers production costs and extends field life. It allows operators to maximize recovery while meeting stricter regulatory requirements.

Government Policies and Strategic Investments Supporting Offshore Development:

Many governments view offshore resources as key to energy security and economic stability. Policies that encourage exploration, production, and infrastructure development boost industry growth. The offshore oil gas market benefits from investments in floating production units, pipelines, and subsea equipment. It also receives support from partnerships between national oil companies and global energy leaders.

Market Trends:

Growing Focus on Deepwater Exploration and Integration of Digital Technologies:

The offshore oil gas market is witnessing a strong shift toward deepwater and ultra-deepwater projects. Energy companies are prioritizing these fields to secure untapped reserves and long-term production. High investments in advanced rigs, floating production systems, and subsea technologies are driving this trend. Digital solutions, including predictive analytics, real-time monitoring, and AI-driven platforms, are being adopted to enhance efficiency and reduce risks. It is also benefiting from automation in drilling operations, which improves accuracy and reduces downtime. The integration of digital twins and remote asset management strengthens operational performance and ensures regulatory compliance.

- For instance, Chevron’s Anchor project in the U.S. Gulf of Mexico uses 20,000 psi high-pressure technology for reservoir depths of 34,000 feet, producing 75,000 barrels of oil and 28 million cubic feet of gas per day, showing advanced capability in deepwater extraction.

Rising Emphasis on Sustainability and Expansion of Offshore Wind Synergies:

The industry is aligning with global sustainability goals by reducing carbon intensity and promoting cleaner offshore operations. Companies are deploying low-emission drilling systems, electrified platforms, and carbon capture solutions to meet stricter environmental standards. The offshore oil gas market is experiencing a trend where synergies between traditional oil projects and offshore wind farms are expanding. Shared infrastructure, hybrid energy models, and renewable integration are shaping future offshore developments. It is also seeing increased collaboration between oil majors and renewable energy companies to balance energy supply and transition goals. This trend reflects the sector’s strategy to remain resilient while adapting to long-term energy shifts.

- For instance, COSL Drilling reduced fuel consumption on their rigs by nearly 50%, cutting daily fuel use from about 27 tons to as low as 7.6 tons per day, resulting in significant CO2 emission savings in the North Sea.

Market Challenges Analysis:

High Capital Costs and Operational Risks in Offshore Projects:

The offshore oil gas market faces significant challenges from high capital investment requirements. Developing deepwater and ultra-deepwater reserves demands advanced rigs, subsea equipment, and floating production units, which involve billions of dollars in upfront costs. It also encounters operational risks tied to harsh marine environments, equipment failures, and extreme weather conditions. Delays in project timelines and cost overruns often impact profitability. Limited access to financing for smaller operators further complicates expansion. These financial and operational burdens restrict market entry and slow down development cycles.

Environmental Regulations and Volatility in Global Oil Prices:

Tightening environmental regulations create hurdles for offshore operators worldwide. Governments are imposing stricter emission norms, safety standards, and carbon reduction targets, raising compliance costs. The offshore oil gas market is directly impacted by global oil price fluctuations that influence investment decisions. When prices fall, exploration budgets shrink, delaying project approvals and reducing new investments. It also struggles with balancing environmental concerns and the need for stable supply. Market volatility combined with regulatory pressure forces companies to adopt cautious investment strategies. This uncertainty often undermines long-term planning and project sustainability.

Market Opportunities:

Expansion of Deepwater Reserves and Adoption of Advanced Technologies:

The offshore oil gas market offers strong opportunities through the development of deepwater and ultra-deepwater reserves. Many untapped fields across Africa, South America, and Asia hold significant production potential. It is supported by advancements in drilling, subsea robotics, and floating production storage systems that make these projects more viable. Operators can maximize recovery rates while reducing downtime and operational risks. Digital technologies such as AI-driven monitoring, predictive maintenance, and digital twins further enhance efficiency. The combination of resource availability and technological innovation positions offshore exploration as a profitable long-term opportunity.

Rising Energy Demand and Integration with Low-Carbon Solutions:

Global energy consumption continues to rise, creating consistent demand for offshore supply. The offshore oil gas market benefits from emerging economies that rely on expanding energy infrastructure. It also gains opportunities through integration with renewable energy, including offshore wind and hybrid energy models. Companies investing in carbon capture and electrified platforms can strengthen compliance and sustainability credentials. Growing partnerships between oil majors, technology providers, and governments foster innovation and accelerate project execution. These opportunities help balance traditional hydrocarbon demand with global energy transition goals, ensuring the sector remains strategically important.

Market Segmentation Analysis:

By Type:

The offshore oil gas market is segmented into shallow water, deepwater, and ultra-deepwater projects. Shallow water continues to dominate due to established infrastructure and lower costs. It is supported by consistent production levels and steady demand. Deepwater and ultra-deepwater segments are expanding quickly, driven by untapped reserves and technological advances. These projects attract major investments due to their long-term production potential.

- For instance, the Thunder Horse deepwater platform in the Gulf of Mexico operates at a water depth of 6,050 feet and produces over 200,000 barrels of oil per day, enabled by advanced subsea production systems.

By Service:

Exploration and drilling, subsea engineering, offshore support vessels, and production services define the service landscape. Exploration and drilling lead the segment, supported by rising demand for energy security and new reserve discoveries. It benefits from high investments in advanced rigs and seismic technologies. Subsea engineering follows with strong growth, supported by robotics, pipelines, and well intervention services. Offshore support vessels and production services remain vital to ensure operational continuity.

- For instance, Bourbon’s fleet-wide optimization initiative successfully reduced average monthly CO₂ emissions by 45-50 tons per vessel across a 25-vessel pilot in their offshore support vessel operations, demonstrating the impact of data-driven performance improvements.

By Application:

Oil exploration and production dominate the application segment, accounting for the majority of offshore activity. It continues to support global hydrocarbon demand despite the rise of renewable alternatives. Offshore gas projects are gaining importance, with rising investments in LNG and cleaner energy supply. Gas production offers opportunities for regions focusing on reducing coal dependence. Both oil and gas applications reinforce the strategic importance of offshore reserves in global energy supply.

Segmentations:

By Type:

- Shallow Water

- Deepwater

- Ultra-Deepwater

By Service:

- Exploration and Drilling

- Subsea Engineering

- Offshore Support Vessels

- Production Services

By Application:

- Oil Exploration and Production

- Gas Exploration and Production

By Region:

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Middle East and Africa:

Middle East and Africa held 36% share of the offshore oil gas market in 2024, supported by vast reserves and strong government-led projects. It benefits from large-scale developments in Saudi Arabia, the United Arab Emirates, and Nigeria. The region continues to attract investments in ultra-deepwater drilling and floating production systems. National oil companies lead expansion plans, often partnering with global majors for technology and financing. Rising energy demand from Asia further strengthens export potential. Enhanced recovery methods and new licensing rounds also sustain long-term growth.

North America:

North America accounted for 28% share of the offshore oil gas market in 2024, largely driven by activity in the Gulf of Mexico. It remains a hub for advanced deepwater projects supported by robust infrastructure and technology leadership. Shale production complements offshore output, ensuring diversified supply. The United States leads investment in subsea systems and digital technologies that enhance efficiency. It also benefits from favorable regulatory frameworks that encourage continued exploration. Stable project economics and new discoveries further reinforce regional competitiveness.

Europe and Asia-Pacific:

Europe represented 22% share of the offshore oil gas market in 2024, supported by mature projects in the North Sea and rising Arctic exploration. Asia-Pacific captured 14% share, with strong activity in China, India, Malaysia, and Indonesia. It benefits from growing domestic consumption and government-backed initiatives to enhance energy security. Europe focuses on integrating renewable energy with offshore operations, creating hybrid energy models. Asia-Pacific emphasizes expanding reserves to meet rising industrial and residential demand. Regional strategies highlight the balance between traditional hydrocarbon supply and energy transition objectives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Repsol

- Saipem

- Halliburton

- Schlumberger

- Eni

- BP

- Royal Dutch Shell

- Equinor

- Petrobras

- TotalEnergies

- Baker Hughes

Competitive Analysis:

The offshore oil gas market is highly competitive, shaped by global energy demand and technological advances. Key players include Repsol, Saipem, Halliburton, Schlumberger, Eni, BP, Royal Dutch Shell, and Equinor. These companies focus on expanding offshore reserves, improving drilling efficiency, and investing in subsea systems to maintain leadership. It remains driven by large-scale projects in deepwater and ultra-deepwater basins where high capital investment favors established players. Partnerships between national and international oil companies strengthen resource access and technology transfer. Service providers such as Halliburton and Schlumberger lead in offering advanced engineering, drilling, and well intervention solutions. Major operators like Shell, BP, and Equinor continue to integrate digital platforms and low-carbon technologies to meet regulatory and sustainability goals. This competitive landscape reflects a balance of resource strength, service expertise, and innovation that defines long-term market positioning.

Recent Developments:

- In July 2025, Repsol’s Corporate Venture arm acquired a minority stake in Stargate Hydrogen, a company specializing in green hydrogen electrolyzers to accelerate renewable hydrogen technology development.

- In July 2025, Saipem announced a binding merger agreement with Subsea7 to form Saipem7, a global energy services leader expected to complete in the second half of 2026.

Report Coverage:

The research report offers an in-depth analysis based on Type, Service, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The offshore oil gas market will expand with increasing investments in deepwater and ultra-deepwater projects.

- It will experience stronger integration of digital technologies, including AI, IoT, and predictive analytics, to optimize operations.

- Operators will prioritize low-emission platforms, electrification, and carbon capture to align with global climate goals.

- It will gain resilience through partnerships between national oil companies and international energy firms for large-scale projects.

- The market will witness steady demand from emerging economies seeking reliable energy supply to fuel growth.

- It will see increasing collaboration with offshore wind projects, creating hybrid energy hubs and shared infrastructure.

- Technological advances in subsea robotics and automation will reduce costs and extend field life cycles.

- It will continue to adapt to regulatory pressures, ensuring safety and environmental compliance through innovation.

- The market will face ongoing volatility in oil prices, driving cautious but strategic investment decisions.

- It will remain vital to global energy security, balancing hydrocarbon demand with long-term energy transition strategies.