Market Overview

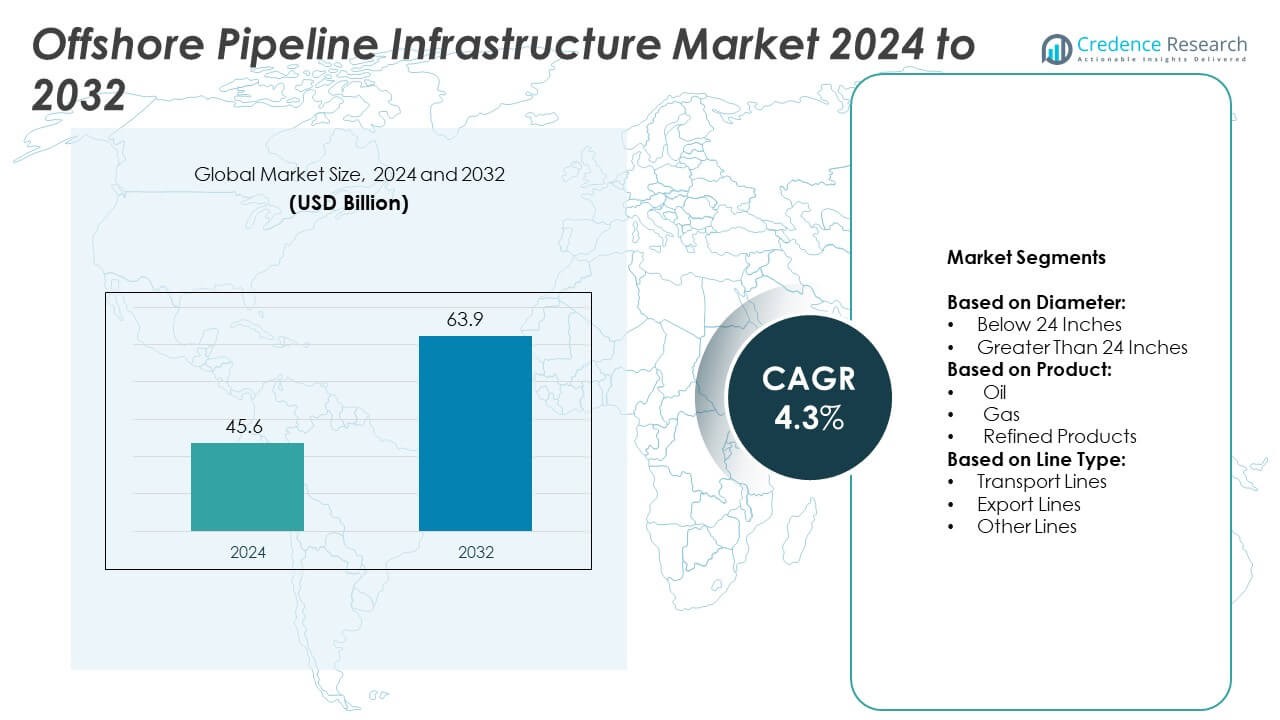

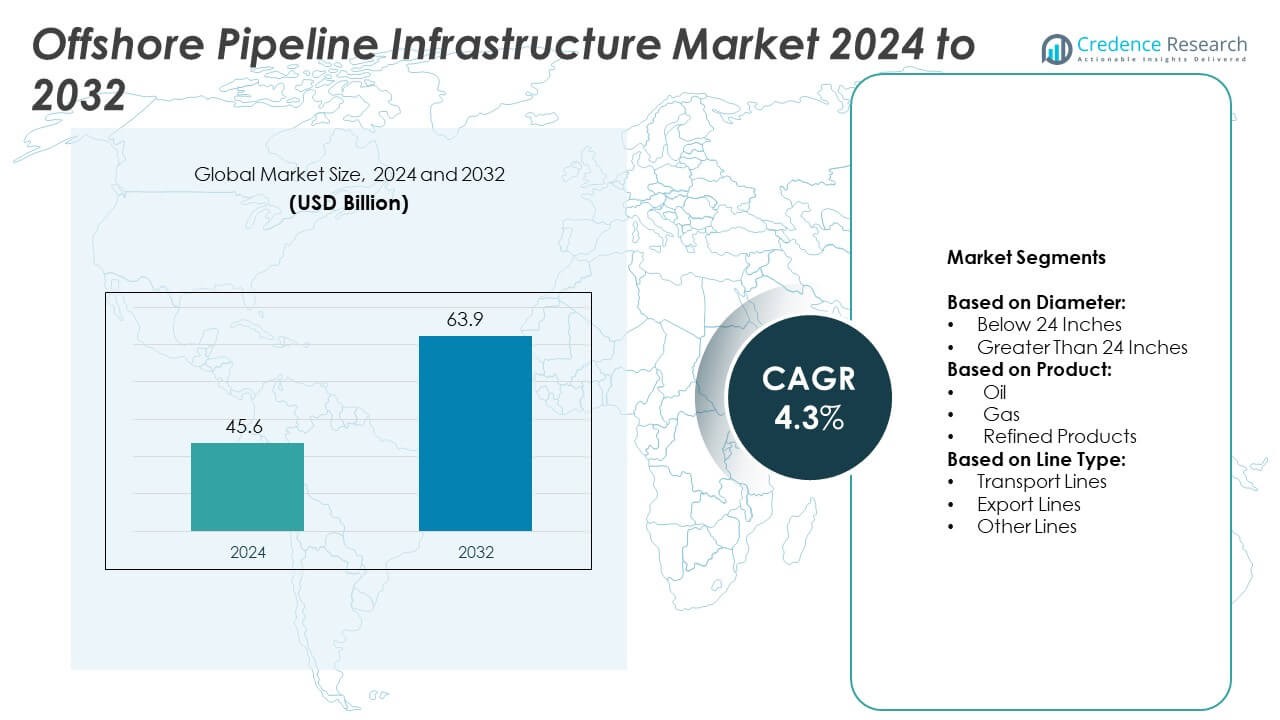

Offshore Pipeline Infrastructure Market size was valued at USD 45.6 billion in 2024 and is anticipated to reach USD 63.9 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Pipeline Infrastructure Market Size 2024 |

USD 45.6 Billion |

| Offshore Pipeline Infrastructure Market, CAGR |

4.3% |

| Offshore Pipeline Infrastructure Market Size 2032 |

USD 63.9 Billion |

The Offshore Pipeline Infrastructure market is driven by rising offshore oil and gas exploration, increasing energy demand, and expanding deepwater and ultra-deepwater projects. Advancements in subsea engineering, corrosion-resistant materials, and digital monitoring technologies enhance pipeline efficiency and safety. It benefits from growing investments in renewable energy integration, including offshore wind and hydrogen transport systems. Trends focus on smart infrastructure, automation, and predictive analytics to reduce operational risks. Strategic collaborations and cross-border energy connectivity further strengthen market growth prospects globally.

The Offshore Pipeline Infrastructure market shows strong geographical presence, with North America leading due to extensive offshore exploration and advanced technological adoption, while Europe focuses on sustainable energy integration and cross-border connectivity. Asia-Pacific is rapidly growing, supported by rising energy demand and large-scale offshore projects. The Middle East & Africa leverage abundant oil and gas reserves, whereas Latin America expands through deepwater developments. Key players shaping the market include TechnipFMC, Saipem, National Oilwell Varco, and CRC Evans Pipeline.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Offshore Pipeline Infrastructure market was valued at USD 45.6 billion in 2024 and is projected to reach USD 63.9 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

- Rising offshore oil and gas exploration, increasing demand for energy, and expanding deepwater and ultra-deepwater projects are driving significant market growth globally.

- Advancements in subsea engineering, automation, digital monitoring, and corrosion-resistant materials are shaping trends by improving pipeline safety, reliability, and operational efficiency.

- The competitive landscape is defined by key players focusing on innovation, partnerships, and large-scale project execution, including TechnipFMC, Saipem, National Oilwell Varco, and CRC Evans Pipeline.

- High installation costs, complex engineering requirements, and strict regulatory frameworks act as major restraints, creating challenges for smaller players entering the market.

- North America leads the market due to extensive offshore activities and advanced infrastructure, while Europe emphasizes sustainable solutions and cross-border energy networks.

- Asia-Pacific shows rapid growth supported by industrial expansion and offshore energy developments, whereas the Middle East, Africa, and Latin America contribute steadily through investments in untapped reserves and deepwater projects.

Market Drivers

Growing Global Energy Demand and Expanding Offshore Exploration

The Offshore Pipeline Infrastructure market benefits from rising global energy demand and increased investment in offshore oil and gas exploration projects. Energy companies are focusing on tapping deepwater and ultra-deepwater reserves to meet consumption needs. It drives the demand for advanced subsea pipeline systems that enable efficient transportation of crude oil, natural gas, and other hydrocarbons. Government approvals and favorable policies support large-scale offshore developments, accelerating infrastructure deployment. Technological advancements in subsea engineering enhance pipeline reliability and reduce operational costs. The trend toward accessing challenging reserves strengthens the market’s growth potential.

- For instance, the Langeled pipeline, operated by Gassco, spans 1,166 km from Nyhamna in Norway to Easington in the UK, enabling substantial subsea natural gas transport to meet demand

Advancements in Subsea Technologies and Material Innovation

The market gains momentum from continuous innovations in subsea technologies and material development for enhanced pipeline performance. The introduction of high-strength, corrosion-resistant materials extends pipeline lifespan and improves safety in extreme conditions. It leverages automation and advanced monitoring systems to optimize maintenance and reduce downtime. Subsea robots and remote inspection tools increase operational efficiency and ensure pipeline integrity. Growing adoption of digital twins and predictive analytics aids in real-time performance assessment. These technological advancements create opportunities for seamless integration of infrastructure with evolving offshore energy projects.

- For instance, Equinor supplies gas through the Langeled system, and its digital twin platform increased Ormen Lange field gas production by more than 1 %—a clear demonstration of real‑time optimization using virtual models

Rising Investments in Renewable Energy and Subsea Gas Projects

Expanding renewable energy projects, particularly offshore wind farms and subsea gas infrastructure, significantly influence the Offshore Pipeline Infrastructure market. The demand for subsea power cables and integrated pipelines increases to connect offshore facilities with onshore grids. It supports the energy transition by facilitating transport of natural gas, hydrogen, and other cleaner fuels. Strategic partnerships between energy developers and pipeline contractors drive innovation and cost optimization. Governments and private players are increasing funding for projects that strengthen offshore energy networks. The shift toward sustainable solutions further boosts infrastructure development in this sector.

Growing Focus on Energy Security and Regional Connectivity

Energy security initiatives and cross-border pipeline projects strengthen the demand for advanced offshore pipeline infrastructure. Rising geopolitical considerations and supply chain diversification strategies are encouraging investment in multi-country subsea networks. It enables efficient energy distribution and reduces dependency on single supply routes. Infrastructure development focuses on increasing capacity and enhancing operational safety standards. Advanced leak detection and monitoring solutions ensure compliance with strict environmental regulations. Regional collaboration between governments and operators fosters growth opportunities and supports long-term energy resilience.

Market Trends

Integration of Digital Technologies and Smart Monitoring Solutions

The Offshore Pipeline Infrastructure market observes a strong trend toward adopting advanced digital technologies and intelligent monitoring systems. Operators deploy IoT-enabled sensors, AI-driven analytics, and predictive maintenance tools to improve efficiency and safety. It allows real-time tracking of pressure, temperature, and potential leak points across subsea pipelines. Remote monitoring capabilities minimize manual inspections and enhance response times to operational risks. The integration of digital twins supports accurate modeling and performance optimization. This shift toward smart infrastructure strengthens reliability and cost-effectiveness in complex offshore environments.

- For instance, the Norpipe natural gas pipeline, operated by Gassco, runs 440 km from the Ekofisk oil field to Germany, supporting cross‑border subsea energy transport

Expansion of Deepwater and Ultra-Deepwater Pipeline Projects

Growing demand for energy is accelerating investments in deepwater and ultra-deepwater exploration, driving significant opportunities in the Offshore Pipeline Infrastructure market. Energy companies are developing long-distance subsea pipelines to transport hydrocarbons from challenging reserves to onshore facilities. It demands advanced engineering solutions and specialized materials to withstand extreme pressures and temperatures. Technological innovations improve installation techniques, reducing project timelines and operational costs. Global collaborations between operators and equipment providers enable access to cutting-edge expertise. This expansion of deepwater infrastructure positions the market for steady growth in upcoming years.

- For instance, Shell’s Stones project in Walker Ridge deployed production facilities at depths of approximately 2,900 m (around 9,500 ft), marking one of the deepest subsea installations of its time.

Rising Adoption of Environmentally Sustainable Solutions

Sustainability-focused practices are shaping trends across the Offshore Pipeline Infrastructure market, with operators prioritizing eco-friendly designs and energy-efficient systems. Companies adopt advanced corrosion-resistant coatings and materials to reduce maintenance frequency and environmental risks. It also drives demand for low-emission construction techniques and green technologies in pipeline development. Regulatory frameworks and industry standards emphasize minimizing ecological impact while ensuring safe operations. Collaboration between governments and private stakeholders supports innovations in sustainable infrastructure. The industry’s alignment with global energy transition goals continues to influence design and deployment strategies.

Increasing Focus on Cross-Border Energy Transportation Networks

The market experiences a surge in multi-country subsea pipeline projects designed to enhance energy connectivity between regions. Growing energy security concerns encourage nations to collaborate on shared infrastructure for transporting natural gas, crude oil, and renewable energy resources. It leads to investments in advanced engineering solutions and large-scale construction capabilities. Enhanced interoperability standards improve operational integration between international energy grids. Partnerships between energy companies, contractors, and governments strengthen cross-border pipeline development strategies. This rising emphasis on connectivity positions the market as a critical enabler of global energy diversification.

Market Challenges Analysis

High Project Costs and Complex Installation Requirements

The Offshore Pipeline Infrastructure market faces significant challenges due to the high capital investments required for design, engineering, and installation. Offshore environments demand advanced equipment, specialized vessels, and skilled labor, which increase project expenses. It becomes more complex when dealing with deepwater and ultra-deepwater installations that require cutting-edge technologies and longer timelines. Delays caused by harsh weather conditions, equipment failures, or supply chain disruptions impact operational efficiency. Rising costs of raw materials and fluctuating energy prices further affect project feasibility. Companies are under pressure to balance profitability while maintaining high safety and quality standards.

Regulatory Barriers and Environmental Concerns

Strict regulatory frameworks and growing environmental awareness create hurdles for pipeline infrastructure expansion. The Offshore Pipeline Infrastructure market faces increased scrutiny over ecological impact, especially in sensitive marine ecosystems. It must comply with multiple international, regional, and local regulations, which often prolong approval timelines and increase operational risks. Environmental activists and local communities are raising concerns over potential spills and habitat disruptions. Implementing advanced safety mechanisms and monitoring systems becomes critical but adds to project costs. Balancing infrastructure development with sustainability goals remains a key challenge for industry stakeholders.

Market Opportunities

Rising Demand for Offshore Energy and Subsea Infrastructure Expansion

The Offshore Pipeline Infrastructure market presents strong opportunities driven by growing global energy demand and investments in offshore oil, gas, and renewable projects. Energy companies are increasing exploration in deepwater and ultra-deepwater reserves, creating higher requirements for advanced pipeline systems. It supports efficient transportation of hydrocarbons and power between offshore facilities and onshore terminals. Expanding offshore wind farms and subsea gas networks further accelerate infrastructure development. Strategic collaborations between operators, contractors, and technology providers foster innovation and reduce operational costs. The growing focus on energy diversification strengthens long-term growth prospects in this sector.

Technological Advancements and Transition Toward Cleaner Energy

Advances in subsea technologies and material innovation create significant opportunities for improving pipeline performance and reliability. The Offshore Pipeline Infrastructure market benefits from digital monitoring tools, predictive analytics, and automation that enhance safety and operational efficiency. It also supports emerging projects in hydrogen transportation and carbon capture, aligning with global clean energy goals. Development of corrosion-resistant materials and efficient installation techniques reduces maintenance challenges and project risks. Growing partnerships between governments and private stakeholders accelerate adoption of innovative solutions. The shift toward sustainable energy infrastructure positions the industry for strong future expansion.

Market Segmentation Analysis:

By Diameter:

Pipelines with below 24 inches dominate small-scale offshore projects, mainly used for shorter transport distances and connecting production platforms to nearby facilities. It offers cost-efficient installation and maintenance, making it suitable for regional energy distribution and marginal field developments. Pipelines with a greater than 24 inches diameter are designed for large-scale, long-distance transportation of oil and gas from deepwater and ultra-deepwater reserves. These systems require advanced engineering to handle higher pressures and volumes, supporting the expansion of energy supply to onshore terminals and processing units.

- For instance, the Grane oil pipeline, operated by Statoil, passes through a maximum sea depth of 355 m and involved over 110,000 tonnes of rock and gravel for seabed stabilization—underscoring extensive measures to minimize environmental impact.

By Product:

The market covers oil, gas, and refined products. The oil pipeline segment leads due to the growing demand for offshore crude extraction and transportation from mature and emerging fields. It enables efficient movement of large volumes of crude to refineries and storage hubs. The gas pipeline segment experiences strong growth, supported by rising demand for liquefied natural gas (LNG) and natural gas liquids (NGL) globally. Expanding offshore gas projects and subsea networks contribute significantly to the segment’s development. Pipelines for refined products such as diesel, petrol, and petrochemical derivatives hold a niche role, primarily serving integrated offshore production and distribution systems.

- For instance, during the Langeled project, 835 km of pipeline (approx. 630,000 tonnes) were supplied by EUROPIPE, and the procurement, corrosion coating, and logistics involved “lots of around 30,000 t per month” of pipes being shipped and coated.

By Line Type:

The market is classified into transport lines, export lines, and other lines. Transport lines dominate the segment by supporting bulk energy movement between offshore facilities and onshore processing units. Export lines are increasingly critical for global energy trade, connecting offshore production zones with international terminals. It supports cross-border collaborations and long-distance energy supply chains. Other lines, including feeder lines and interconnecting pipelines, play a vital role in linking smaller platforms, storage facilities, and floating production systems. Together, these segments highlight the growing complexity of offshore pipeline systems and their role in supporting energy security, efficient resource utilization, and global connectivity.

Segments:

Based on Diameter:

- Below 24 Inches

- Greater Than 24 Inches

Based on Product:

Based on Line Type:

- Transport Lines

- Export Lines

- Other Lines

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant position in the Offshore Pipeline Infrastructure market, accounting for 32% of the global market share in 2024. The region benefits from extensive offshore oil and gas exploration activities, particularly in the Gulf of Mexico. It invests heavily in developing advanced subsea pipeline systems to transport crude oil, natural gas, and refined products efficiently to onshore facilities. Technological advancements in deepwater drilling and pipeline monitoring systems support faster project implementation and improved operational safety. Stringent regulatory frameworks ensure high standards of environmental protection, which drive innovation in leak detection and maintenance solutions. Growing demand for energy security and the expansion of LNG export terminals further strengthen the regional market. Strategic collaborations between operators and engineering firms enhance pipeline performance and boost offshore infrastructure capabilities.

Europe

Europe contributes to 28% of the global Offshore Pipeline Infrastructure market, driven by rising offshore activities in the North Sea, Norwegian Continental Shelf, and Mediterranean regions. The continent focuses on expanding cross-border energy networks to improve energy security and interconnectivity. It leverages cutting-edge technologies for subsea pipeline construction to withstand harsh environmental conditions and deepwater challenges. Increasing investments in natural gas infrastructure and renewable energy integration, including hydrogen pipelines, shape future growth strategies. Regulatory policies emphasizing carbon reduction and sustainability push operators toward adopting energy-efficient and eco-friendly solutions. Joint ventures between European oil majors and engineering companies accelerate innovation, reducing construction costs and improving pipeline integrity. The region’s balanced approach to oil, gas, and emerging energy sources positions it as a leader in advanced offshore energy transport solutions.

Asia-Pacific

Asia-Pacific holds a 22% share of the global Offshore Pipeline Infrastructure market, supported by rapid industrialization, rising energy consumption, and significant offshore resource development. The region witnesses strong demand for subsea pipelines to connect offshore oil and gas fields to expanding onshore refineries and power plants. Countries like China, India, Indonesia, and Australia are heavily investing in deepwater exploration projects to secure long-term energy supply. It focuses on modernizing pipeline infrastructure with smart monitoring technologies and high-strength materials to improve operational efficiency. The surge in LNG imports and offshore gas production drives continuous investments in transport and export lines. Government-led initiatives and private partnerships play a critical role in accelerating large-scale offshore energy infrastructure projects. Asia-Pacific’s growing reliance on offshore energy sources makes it a highly dynamic and competitive market.

Middle East & Africa

The Middle East & Africa region represents 12% of the Offshore Pipeline Infrastructure market, primarily driven by abundant oil and gas reserves in the Persian Gulf, Red Sea, and offshore West Africa. The region invests heavily in subsea pipeline projects to facilitate crude oil and natural gas transportation from offshore platforms to refineries and export terminals. It also focuses on expanding cross-border pipeline networks to meet rising global energy demands. High investments from national oil companies and international operators fuel infrastructure development, supported by strategic partnerships and long-term agreements. Advanced engineering solutions and robust safety measures are adopted to manage extreme offshore conditions and ensure operational reliability. With growing exploration activities in untapped offshore fields, the region continues to emerge as a vital contributor to global energy connectivity.

Latin America

Latin America holds a 6% share of the Offshore Pipeline Infrastructure market, supported by rising offshore activities in Brazil, Mexico, and Argentina. The region benefits from expanding deepwater exploration projects, particularly in Brazil’s pre-salt oil reserves, which require advanced subsea pipeline solutions. It focuses on integrating automation and digital monitoring systems to improve pipeline safety and reduce operational risks. Growing government incentives and foreign investments accelerate project execution timelines and infrastructure expansion. Export-oriented pipelines are gaining importance due to increasing crude oil and natural gas trade within the region and internationally. Strategic collaborations between local operators and international contractors foster innovation and cost optimization, positioning Latin America as a steadily growing contributor to the global offshore energy supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saipem (a subsidiary of Eni)

- National Oilwell Varco

- Chelpipe Group

- Welspun Corp

- TechnipFMC

- APA Group

- Engas

- CRC Evans Pipeline

- MRC Global

- General Electric (GE Oil & Gas)

Competitive Analysis

The competitive landscape of the Offshore Pipeline Infrastructure market is defined by leading players such as TechnipFMC, CRC Evans Pipeline, APA Group, General Electric (GE Oil & Gas), Saipem (a subsidiary of Eni), MRC Global, National Oilwell Varco, Welspun Corp, Engas, and Chelpipe Group. These companies focus on expanding their market presence through strategic partnerships, technological innovations, and large-scale offshore project executions. Intense competition drives continuous advancements in subsea engineering, pipeline materials, and monitoring systems to improve efficiency and reliability. Companies invest heavily in automation, digital twin technologies, and smart inspection tools to reduce operational risks and optimize project timelines. Rising demand for deepwater and ultra-deepwater infrastructure encourages firms to strengthen their global footprints by securing multi-billion-dollar contracts. Manufacturers are enhancing production capabilities to meet the growing need for high-strength, corrosion-resistant pipelines and advanced installation solutions. Strategic collaborations between engineering contractors, equipment suppliers, and energy operators foster innovation and cost efficiency across the value chain. With increasing energy demand and the expansion of offshore exploration projects worldwide, the market remains highly dynamic, with established players competing to secure long-term agreements while focusing on sustainability, safety, and operational excellence to maintain a competitive edge.

Recent Developments

- In June 2025, Brazil’s Energy Research Company (EPE) gave its approval to a key technical milestone for Equinor’s proposed offshore pipeline project, which aims to take natural gas from Equinor’s Raia fields in the pre-salt area of the Campos Basin to the domestic grid. This would open up the way for the start of early-stage construction and installation works.

- In April 2024,TechnipFMC Secured a large contract to supply subsea production systems (48 subsea trees) for ExxonMobil’s Whiptail project in Guyana’s Stabroek Block

- In February 2024, CRC Evans Pipeline Completed welding work on a hydrogen pipeline (over 50 km) in Romania’s Black Sea region, developing expertise in “hydrogen ready” infrastructure

Report Coverage

The research report offers an in-depth analysis based on Diameter, Product, Line Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising offshore oil and gas exploration will drive consistent demand for advanced pipeline infrastructure.

- Increasing adoption of digital monitoring technologies will enhance operational safety and efficiency.

- Expansion of deepwater and ultra-deepwater projects will create opportunities for high-performance pipeline solutions.

- Growing investments in subsea gas transportation networks will strengthen infrastructure development.

- Rising integration of hydrogen pipelines will support the global energy transition and cleaner fuel usage.

- Increasing focus on sustainable materials and eco-friendly designs will shape future infrastructure strategies.

- Strong government support for renewable energy projects will boost offshore pipeline installations.

- Advancements in automation and robotics will reduce project timelines and maintenance costs.

- Cross-border energy connectivity initiatives will enhance demand for long-distance subsea pipelines.

- Strategic partnerships between operators and technology providers will accelerate innovation and improve project scalability.