Market Overview:

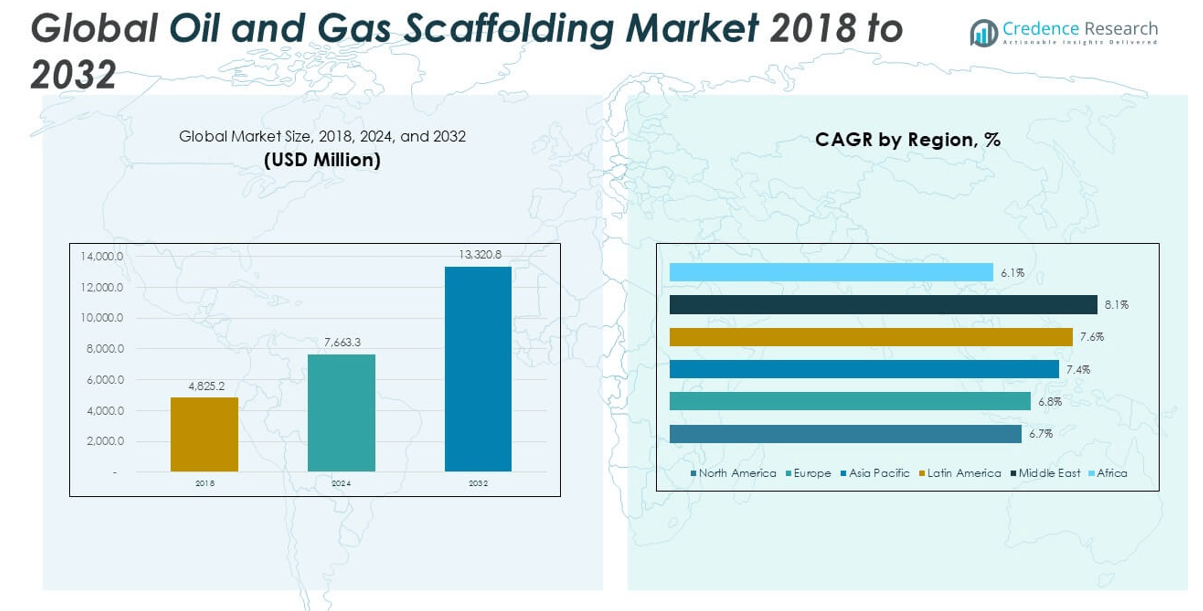

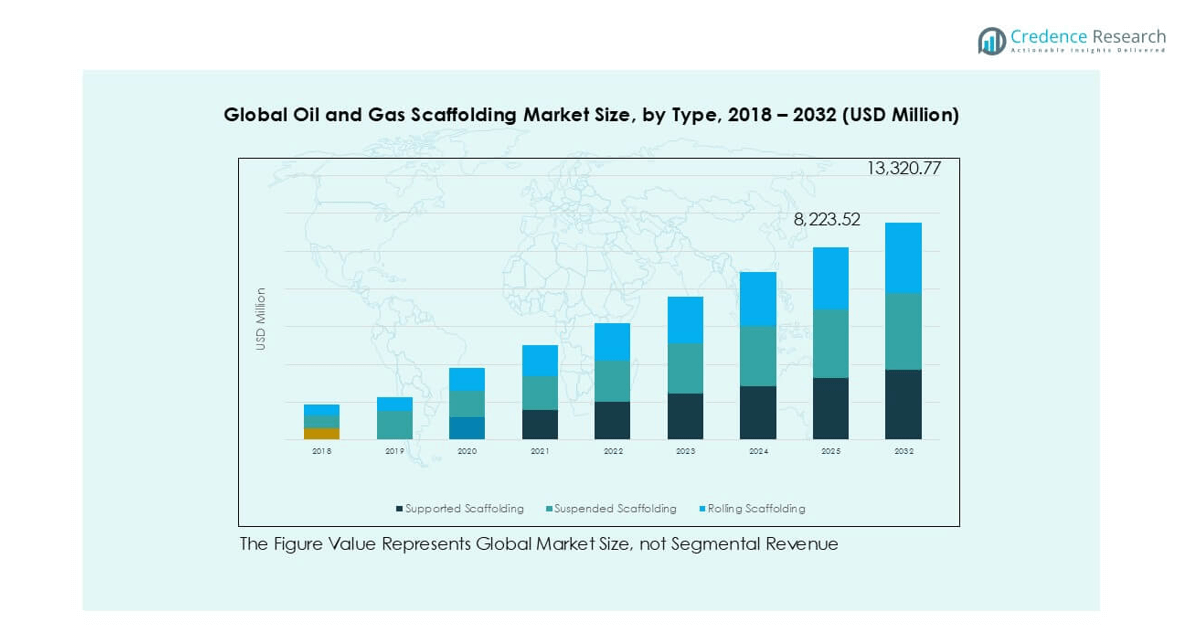

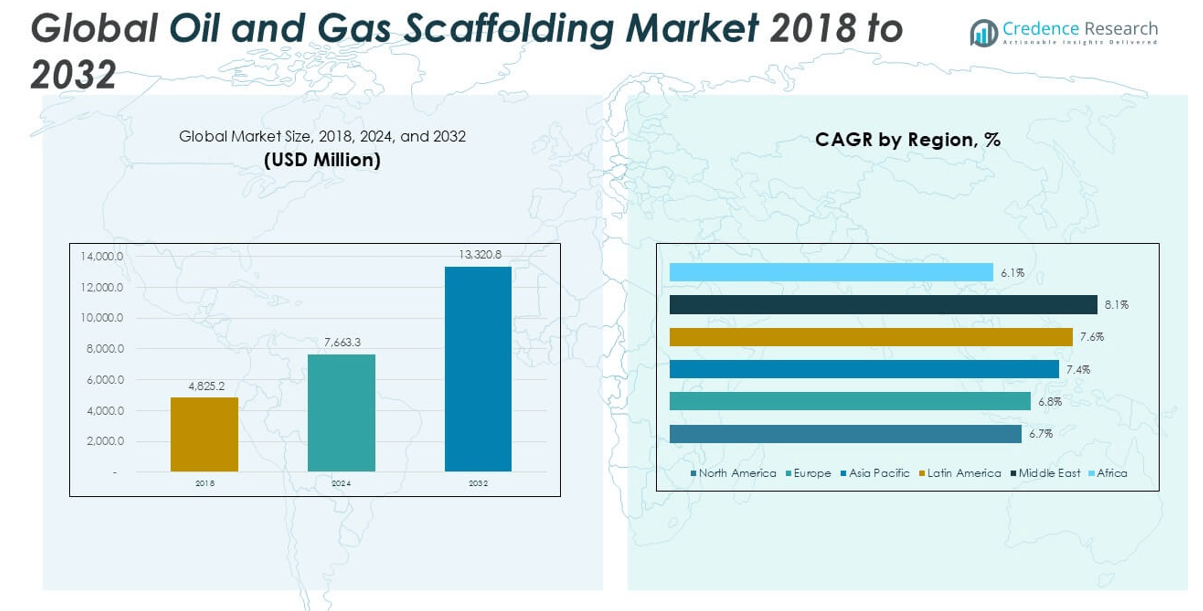

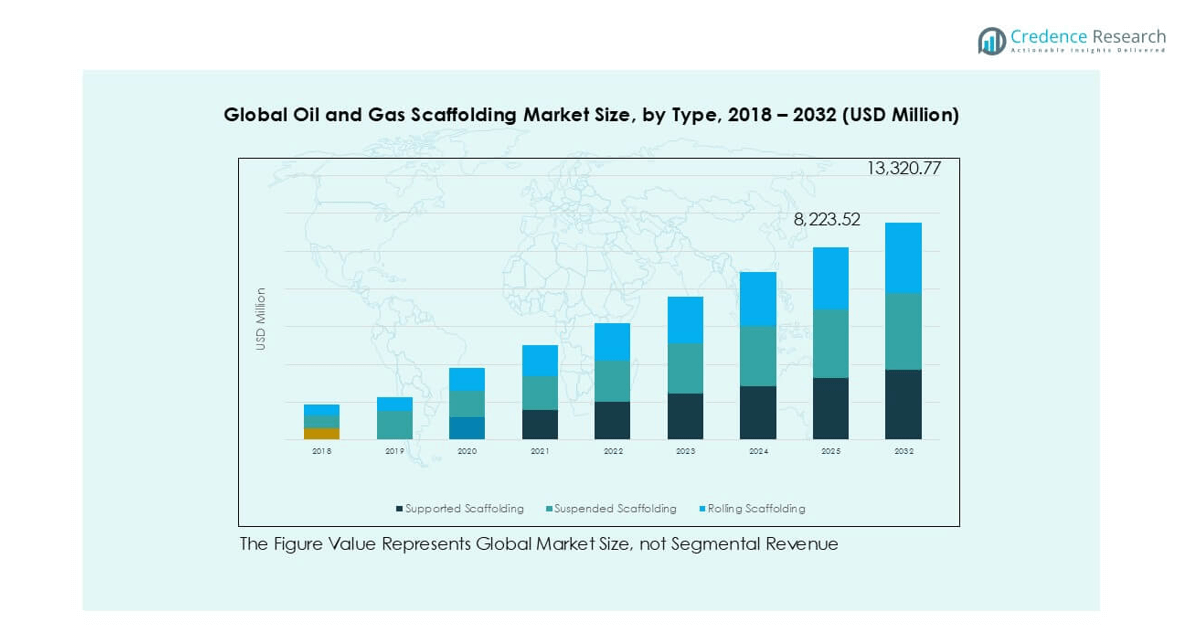

The Oil and Gas Scaffolding market size was valued at USD 4,825.2 million in 2018, increased to USD 7,663.3 million in 2024, and is anticipated to reach USD 13,320.8 million by 2032, at a CAGR of 7.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil and Gas Scaffolding Market Size 2024 |

USD 7,663.3 million |

| Oil and Gas Scaffolding Market, CAGR |

7.13% |

| Oil and Gas Scaffolding Market Size 2032 |

USD 13,320.8 million |

The Oil and Gas Scaffolding market is characterized by the presence of several key players, including PRISMEC, BrandSafway, Saudi Scaffolding Factory, Layher, C J Scaffold Service Inc, Nassaco, Wellmade Scaffold, Qingdao Scaffolding, Guangzhou AJ Building Material Co., Ltd, and EK Scaffolding. These companies play a vital role in delivering high-quality, safety-compliant scaffolding solutions to support complex oil and gas operations globally. Asia Pacific emerges as the leading regional market, holding approximately 36.1% of the global market share in 2024. Its dominance is driven by large-scale infrastructure projects, expanding offshore exploration, and cost-effective manufacturing capabilities, particularly in China and India.

Market Insights

- The Oil and Gas Scaffolding market was valued at USD 7,663.3 million in 2024 and is projected to reach USD 13,320.8 million by 2032, growing at a CAGR of 7.13% during the forecast period.

- Growing investments in oil exploration, refinery upgrades, and maintenance operations are major drivers boosting demand for scaffolding systems across onshore and offshore facilities.

- Supported scaffolding leads the type segment due to its high load-bearing capacity and stability, while steel scaffolding dominates by material owing to its durability and suitability for harsh environments.

- The market is moderately fragmented with key players like BrandSafway, Layher, and PRISMEC focusing on safety-compliant, modular systems to enhance efficiency; however, fluctuating oil prices and a shortage of skilled labor limit growth.

- Asia Pacific holds the largest regional share at 36.1%, followed by Europe at 26.3%, driven by expanding industrial infrastructure; the Middle East shows the fastest growth with a CAGR of 8.1% due to large-scale projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Oil and Gas Scaffolding market by type is segmented into supported scaffolding, suspended scaffolding, and rolling scaffolding. Among these, supported scaffolding dominates the market, accounting for the largest revenue share in 2024 due to its widespread application in both onshore and offshore oil and gas facilities. Its stability, ease of assembly, and suitability for heavy-load operations make it the preferred choice for large-scale construction and maintenance tasks. Increasing investments in refinery expansion and pipeline infrastructure are further driving demand for supported scaffolding systems across the sector.

- For instance, BrandSafway utilized over 2.6 million cubic feet of supported scaffolding during the Chevron Richmond Refinery modernization project, enabling simultaneous multi-elevation access across complex piping structures with minimal downtime.

By Material:

Based on material, the market is categorized into aluminum, steel, and others. Steel scaffolding holds the largest market share, owing to its high durability, load-bearing capacity, and resistance to harsh environmental conditions typical in oil and gas settings. It is extensively used in upstream and downstream operations where structural integrity is critical. The growing emphasis on safety compliance and operational efficiency in high-risk environments continues to fuel demand for steel scaffolding. Meanwhile, aluminum scaffolding is gaining traction in lightweight, mobile applications, particularly in maintenance operations that require quick assembly and disassembly.

- For instance, Layher GmbH deployed over 180,000 linear meters of steel scaffolding during the BASF Ludwigshafen plant revamp, achieving an installation efficiency of 1,200 m²/day under strict safety and weather constraints.

Market Overview

Expansion of Oil and Gas Infrastructure Projects

The rising number of oil and gas exploration, production, and refining projects globally continues to drive the demand for scaffolding systems. Major investments in both offshore and onshore facilities, particularly in the Middle East, North America, and Asia-Pacific, require extensive structural support for construction, inspection, and maintenance. Scaffolding plays a critical role in ensuring safe access to elevated and confined work areas. As countries work to enhance their energy security and production capacity, the oil and gas scaffolding market benefits from consistent and large-scale project deployment.

- For instance, PRISMEC was contracted for scaffolding operations in the Upper Zakum field expansion (UAE), where it installed over 22,000 scaffold bays to support structural works across five artificial islands, ensuring 24/7 operational uptime with zero major safety incidents.

Increasing Focus on Worker Safety and Regulatory Compliance

Stringent safety regulations imposed by occupational safety agencies across regions have led to a higher demand for quality scaffolding systems that minimize fall risks and ensure worker protection. The oil and gas industry, known for its hazardous environments, relies heavily on scaffolding solutions that meet international safety standards. This regulatory pressure is pushing companies to adopt advanced scaffolding technologies and materials that offer greater stability and structural integrity, thereby fueling market growth. Safety-driven procurement policies among oil majors further accelerate this shift.

- For instance, Saudi Scaffolding Factory introduced their SSCC-900 Series, a certified modular scaffolding system meeting EN 12811 standards, which reduced fall-related incidents by 42% across Aramco’s eastern province construction sites in 2022

Technological Advancements in Scaffolding Design

Innovations in scaffolding technology, such as modular systems, lightweight materials, and digital modeling tools, are significantly enhancing the efficiency and safety of scaffold installations. Modular scaffolding allows faster assembly and disassembly, reducing downtime and labor costs, which is crucial in time-sensitive oil and gas operations. Additionally, the integration of digital tools for layout planning and load assessment improves precision and compliance. These technological advancements are reshaping project execution models and enabling wider adoption of scaffolding in complex oil and gas environments.

Key Trends & Opportunities

Rising Adoption of Aluminum Scaffolding

Although steel scaffolding remains dominant, aluminum scaffolding is gaining traction due to its lightweight, corrosion resistance, and ease of mobility. These attributes make it ideal for maintenance work and offshore platforms where maneuverability is crucial. The growing preference for aluminum scaffolding in temporary access solutions presents a notable opportunity, especially in regions with humid climates and stringent timelines. As maintenance cycles shorten and operators seek faster turnaround, aluminum systems offer a compelling value proposition in the evolving oil and gas scaffolding landscape.

- For instance, Wellmade Scaffold supplied 36,000 aluminum scaffold planks for ExxonMobil’s offshore FPSO turnaround in Guyana, completing access system deployment in 14 days, reducing traditional assembly time by 35%.

Growth in Maintenance and Turnaround Activities

Regular maintenance and plant turnaround activities in aging oil and gas infrastructure present recurring demand for scaffolding services. With many global refineries and rigs operating beyond their original design life, the need for periodic inspection, repair, and upgrades is rising. Scaffolding is essential in facilitating safe and efficient access to high-risk and elevated areas during these activities. This trend opens up steady business avenues for scaffolding providers specializing in short-term, high-intensity project support, especially in mature oil markets like the U.S. and Europe.

- For instance, C J Scaffold Service Inc. supported a 27-day refinery turnaround for Marathon Petroleum in Texas, delivering 11,400 scaffold structures across four units, with an average erection speed of 420 structures per day, enabling continuous shift operations.

Key Challenges

Fluctuations in Oil Prices Impacting Capital Expenditure

Volatile crude oil prices pose a significant challenge by directly influencing investment decisions in oil and gas infrastructure. During periods of low oil prices, exploration and production companies often cut back on capital expenditure, delaying or cancelling construction and maintenance projects. This affects the demand for scaffolding services, particularly in new facility developments. As a result, scaffolding providers face uncertainty in project pipelines and must diversify across end-user industries or regions to mitigate risks associated with oil price instability.

Shortage of Skilled Labor for Scaffold Assembly

The safe and efficient installation of scaffolding requires trained personnel familiar with structural planning and safety protocols. However, the industry is grappling with a shortage of skilled scaffolders, particularly in remote and offshore locations. This labor gap hampers project timelines and increases the risk of safety incidents, pushing companies to invest more in training and supervision. Inconsistent skill availability also affects service quality and customer satisfaction, posing a long-term operational challenge for scaffolding contractors.

High Transportation and Logistics Costs

Scaffolding materials are often bulky and require specialized handling and transport, especially for offshore or geographically isolated oil and gas sites. The high cost of logistics and storage poses a challenge, particularly for smaller service providers operating on thin margins. Fluctuations in fuel prices, shipping delays, and complex customs regulations in some regions further exacerbate these costs. This challenge limits scalability and can restrict scaffolding access to high-demand areas unless managed through strategic partnerships or regional warehousing.

Regional Analysis

North America

North America held a significant share in the global oil and gas scaffolding market, accounting for approximately 18.2% of the market in 2024. The market size increased from USD 900.86 million in 2018 to USD 1,394.60 million in 2024 and is projected to reach USD 2,340.46 million by 2032, expanding at a CAGR of 6.7%. The regional growth is primarily driven by robust investments in shale exploration, offshore drilling in the Gulf of Mexico, and maintenance activities in aging refineries. Strict safety regulations and the need for reliable access solutions further support market growth in the region.

Europe

Europe captured around 26.3% of the global oil and gas scaffolding market share in 2024, with the market growing from USD 1,292.19 million in 2018 to USD 2,019.38 million in 2024. It is expected to reach USD 3,434.09 million by 2032, registering a CAGR of 6.8% during the forecast period. The market is driven by the region’s focus on maintaining mature oil infrastructure in the North Sea and advancing energy transition projects requiring maintenance and retrofitting. Regulations demanding safe and compliant work environments across EU member states also contribute to sustained demand for scaffolding services.

Asia Pacific

Asia Pacific accounted for the largest share, approximately 36.1% of the global market in 2024. The region’s market value rose from USD 1,721.14 million in 2018 to USD 2,769.94 million in 2024, and it is projected to reach USD 4,899.38 million by 2032, growing at a CAGR of 7.4%. The high growth rate is attributed to large-scale oil and gas infrastructure development in China, India, and Southeast Asia. Increasing industrialization, refinery expansion, and rising investments in offshore assets are fueling demand. Additionally, the region’s cost-effective labor and growing emphasis on safety compliance enhance market adoption.

Latin America

Latin America held a market share of around 8.7% in 2024, with its market expanding from USD 407.73 million in 2018 to USD 666.59 million in 2024. It is expected to reach USD 1,202.87 million by 2032, growing at a CAGR of 7.6%. Growth in the region is largely driven by increasing exploration activities in Brazil and Mexico, coupled with enhanced investment in offshore platforms such as the pre-salt fields. Government initiatives to attract foreign investments and upgrade refining capacities contribute to the consistent need for scaffolding services, especially in onshore production zones.

Middle East

The Middle East contributed 6.8% of the global oil and gas scaffolding market share in 2024, with the market size increasing from USD 311.22 million in 2018 to USD 523.51 million in 2024. It is anticipated to reach USD 977.74 million by 2032, recording the highest CAGR of 8.1% among all regions. This strong growth is attributed to ongoing mega-projects across the Gulf region, including expansion of refineries and petrochemical complexes in Saudi Arabia, UAE, and Qatar. Favorable government investments and the region’s dominance in global oil production support the growing demand for robust and high-capacity scaffolding systems.

Africa

Africa represented 3.8% of the global market share in 2024. The regional market rose from USD 192.04 million in 2018 to USD 289.23 million in 2024 and is forecasted to reach USD 466.23 million by 2032, growing at a CAGR of 6.1%. Growth is fueled by increasing offshore drilling activity in countries such as Nigeria and Angola, alongside new oil discoveries in East Africa. However, infrastructural challenges, political instability, and limited access to skilled labor hinder faster growth. Despite these challenges, rising international interest and investment in African oil reserves create long-term opportunities for scaffolding service providers.

Market Segmentations:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Oil and Gas Scaffolding market is characterized by the presence of several well-established players alongside regional and specialized service providers. Major companies such as BrandSafway, Layher, PRISMEC, and Saudi Scaffolding Factory dominate the market by offering comprehensive scaffolding solutions that comply with international safety standards. These players focus on technological advancements, including modular scaffolding systems and lightweight materials, to improve operational efficiency and reduce installation time. Strategic partnerships, long-term contracts with oil majors, and geographic expansion into high-growth regions such as the Middle East and Asia Pacific are common approaches used to strengthen market position. Additionally, companies are investing in skilled workforce development and digital project management tools to address labor shortages and improve site safety. Despite the presence of key players, the market remains moderately fragmented, allowing regional companies like Nassaco and Wellmade Scaffold to gain traction by offering cost-effective and customized solutions tailored to local project requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PRISMEC

- BrandSafway

- Saudi Scaffolding Factory

- Layher

- C J Scaffold Service Inc

- Nassaco

- Wellmade Scaffold

- Qingdao Scaffolding

- Guangzhou AJ Building Material Co., Ltd

- EK Scaffolding

Recent Developments

- In April 2025, Layher promoted its Allround scaffolding system as a leading solution for oil, gas, and chemical industrial projects, highlighting its rapid assembly, flexibility, enhanced safety features, and ability to minimize downtime. Layher emphasized the system’s suitability for these demanding environments, offering comprehensive on-site and remote training programs tailored for refinery clients, along with expert support to ensure project efficiency and cost-effectiveness.

- In 2022, BrandSafway designed a hybrid mobile access/scaffold solution for the BC Hydro Site C project, using custom scaffolding to work on large hydro turbines. This solution involved innovative scaffold design for complex industrial environments, showcasing their expertise in access solutions. The project also highlighted their ability to deliver safe and efficient access for large-scale projects.

Market Concentration & Characteristics

The Oil and Gas Scaffolding Market exhibits a moderately fragmented structure with a mix of global players and regional service providers competing across key geographies. It features medium to high market concentration in regions with established oil and gas infrastructure, such as North America, the Middle East, and parts of Asia Pacific. Large players including BrandSafway, Layher, and PRISMEC dominate through long-term contracts, diversified portfolios, and adherence to international safety standards. Regional firms maintain competitiveness by offering cost-effective, customized scaffolding solutions tailored to local site conditions. The market favors companies with strong safety records, reliable logistics, and access to skilled labor. Innovation in modular systems and lightweight materials supports competitive differentiation. Procurement decisions often depend on project complexity, turnaround time, and compliance with occupational safety regulations. The market’s growth links closely to capital expenditure cycles in oil and gas, infrastructure development, and regulatory frameworks. It remains opportunity-rich for providers that can meet evolving safety and efficiency demands.

Report Coverage

The research report offers an in-depth analysis based on Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The oil and gas scaffolding market will continue to grow steadily due to ongoing infrastructure expansion and maintenance activities.

- Increasing global energy demand will drive new exploration and production projects, boosting scaffolding requirements.

- Modular and lightweight scaffolding systems will gain more traction for improved operational efficiency and safety.

- Rising focus on worker safety and regulatory compliance will lead to the adoption of advanced scaffolding technologies.

- Offshore drilling activities, especially in the Middle East and Latin America, will generate consistent demand for high-performance scaffolding.

- Asia Pacific will maintain its dominant position, supported by rapid industrialization and refinery development.

- The Middle East market will expand at the fastest pace due to large-scale investments in oil and gas infrastructure.

- Skilled labor shortages will encourage automation and digital scaffolding management tools across key regions.

- Companies will focus on sustainable materials and design to reduce environmental impact in project execution.

- Competitive intensity will rise as global and regional players invest in innovation and geographic expansion.