Market Overview:

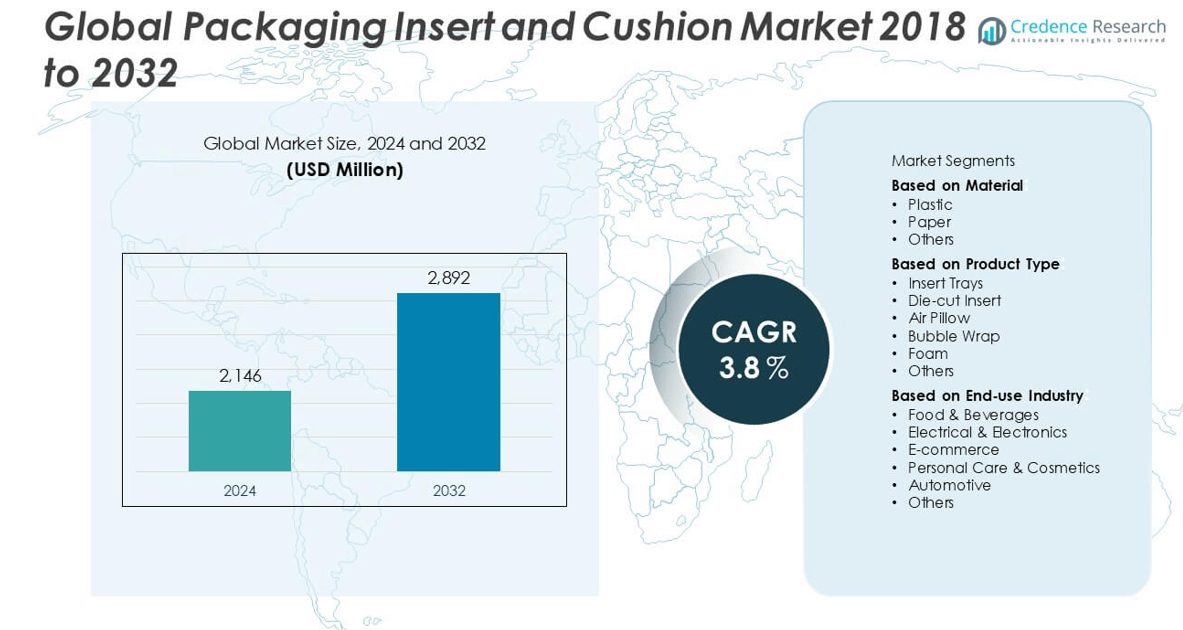

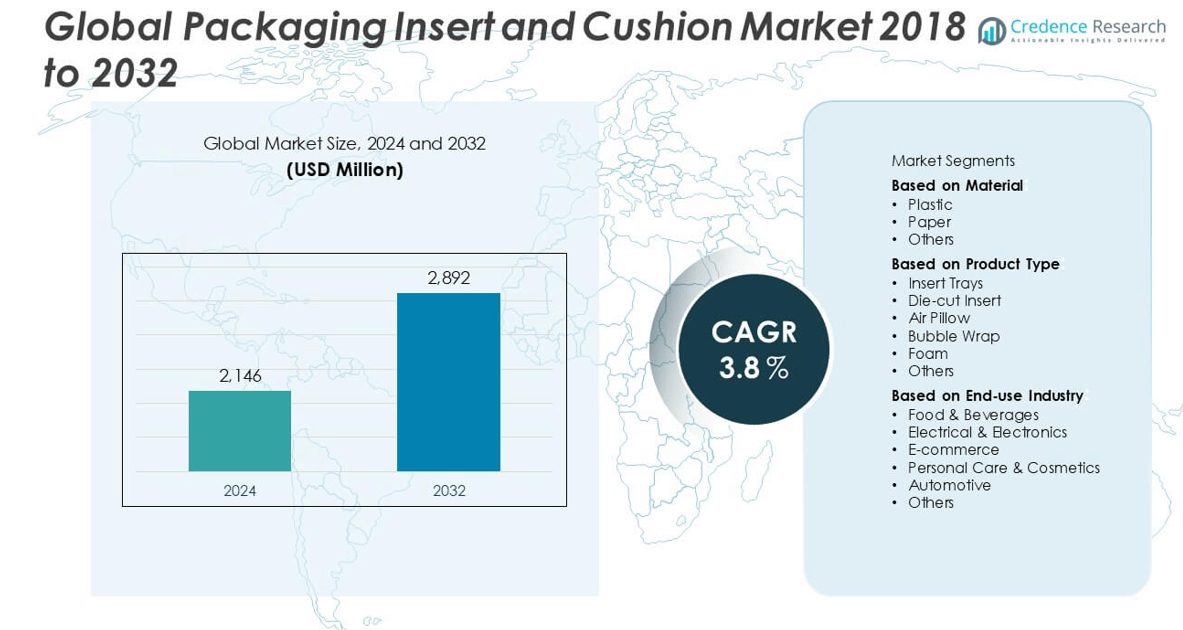

The Packaging Insert and Cushion market size was valued at USD 2,146 million in 2024 and is anticipated to reach USD 2,892 million by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Insert and Cushion Market Size 2024 |

USD 2,146 million |

| Packaging Insert and Cushion Market, CAGR |

3.8% |

| Packaging Insert and Cushion Market Size 2032 |

USD 2,892 million |

The Packaging Insert and Cushion market is characterized by the presence of several key players driving innovation and competitive strategies. Prominent companies include DS Smith, Reflex Packaging Inc., Pregis, Sonoco, Huhtamaki, Index Packaging, Inc., Smurfit Kappa, Salazar Packaging, Visipak, and EcoEnclose. These players focus on sustainable materials, customized solutions, and supply chain efficiency to meet evolving industry demands. Asia Pacific emerged as the leading region in 2024, accounting for 34% of the global market share, driven by rapid industrialization, high e-commerce growth, and robust manufacturing activity. North America and Europe followed, fueled by technological advancement and sustainability regulations.

Market Insights

- The Packaging Insert and Cushion market was valued at USD 2,146 million in 2024 and is projected to reach USD 2,892 million by 2032, growing at a CAGR of 3.8% during the forecast period.

- Rising demand for protective packaging in e-commerce, electronics, and food & beverages sectors is driving market growth, with plastic material holding the largest share due to its durability and shock-absorption properties.

- The market is witnessing a shift toward sustainable and biodegradable materials, with paper-based inserts gaining popularity in Europe due to stringent environmental regulations.

- Key players such as DS Smith, Pregis, Smurfit Kappa, Reflex Packaging Inc., and Sonoco are focusing on eco-friendly innovations and expanding their regional footprint to gain competitive advantage.

- Asia Pacific leads the market with a 34% share, followed by North America (28%) and Europe (24%), while the foam segment dominates the product type category due to its superior cushioning capability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material:

In 2024, the plastic segment held the largest share of the packaging insert and cushion market, accounting for over 45% of the global revenue. The dominance of plastic materials is driven by their superior cushioning properties, durability, and versatility across diverse packaging formats. High demand from electronics and e-commerce sectors continues to reinforce plastic’s market position, especially due to its lightweight nature and shock-absorbing capabilities. However, increasing environmental concerns and tightening regulations are encouraging a gradual shift toward paper-based alternatives, particularly in food, personal care, and eco-conscious packaging applications.

- For instance, Pregis has expanded its line of plastic-based AirSpeed systems, with more than 20,000 units deployed globally for void fill and cushioning applications.

By Product Type:

Among product types, foam inserts emerged as the leading segment in 2024, capturing nearly 30% of the total market share. Foam offers excellent shock absorption and protection for fragile and high-value items, making it a preferred choice in electronics, automotive components, and sensitive medical equipment packaging. Its adaptability in custom-fit designs and lightweight features further enhance its appeal. Meanwhile, air pillows and bubble wraps are gaining popularity in e-commerce for their cost-efficiency and ease of use, especially for void fill and cushioning during shipment of varied product sizes.

- For instance, Sealed Air’s Instapak foam technology protects over 80 million packages annually, particularly in medical and electronics sectors.

By End-use Industry:

The e-commerce industry dominated the packaging insert and cushion market in 2024, holding a significant market share of approximately 35%. The surge in online shopping and direct-to-consumer logistics has fueled demand for reliable protective packaging that ensures product safety during transit. Insert trays, air pillows, and bubble wraps are increasingly used for a wide range of products, from electronics to personal care items. Additionally, food & beverages and electronics sectors are key contributors, driven by the need for hygienic, secure, and impact-resistant packaging materials to maintain product quality and reduce damage rates.

Market Overview

Rapid Expansion of E-commerce and Online Retail

The growing prominence of e-commerce has significantly boosted the demand for protective packaging solutions such as inserts and cushions. With increasing consumer expectations for damage-free deliveries and the rising volume of shipments, retailers are investing in packaging solutions that offer safety, cost-efficiency, and sustainability. Inserts like air pillows and bubble wraps are widely used to protect products during transit, especially in electronics, cosmetics, and consumer goods. As global e-commerce continues to expand, the need for innovative and adaptable protective packaging is expected to grow in parallel.

- For instance, DS Smith supported over 500 million e-commerce deliveries in 2023 across Europe alone, offering customized insert solutions.

Increasing Demand from the Electronics and Automotive Industries

The electronics and automotive sectors require high-precision, impact-resistant packaging to safeguard fragile and expensive components during transportation and handling. Foam inserts, custom-fit trays, and die-cut cushions offer superior protection and stability, making them ideal for these industries. As global production and export of electronic devices and automotive parts increase, so does the demand for advanced packaging materials that meet technical standards and regulatory requirements. This trend is particularly strong in Asia Pacific and North America, where electronics manufacturing and automotive assembly plants are concentrated.

- For instance, Reflex Packaging Inc. supplies over 10 million units annually of custom ESD (electrostatic discharge) foam inserts to semiconductor and automotive clients worldwide.

Rising Consumer and Regulatory Focus on Sustainability

Sustainability is becoming a crucial factor in packaging decisions, driving innovation in biodegradable and recyclable cushioning materials. Paper-based inserts and eco-friendly foams are gaining traction as companies align with environmental regulations and consumer preferences. Regulatory frameworks in Europe and North America, along with global sustainability goals, are encouraging the shift from traditional plastic-based packaging toward greener alternatives. This transformation is opening new opportunities for material innovation, driving market growth through the development of low-impact, recyclable packaging insert and cushion solutions.

Key Trends & Opportunities

Innovation in Sustainable and Biodegradable Materials

There is a growing trend toward using sustainable, biodegradable, and compostable materials in insert and cushion packaging. Manufacturers are exploring molded pulp, recycled paper, and plant-based foams to reduce environmental impact. This shift is driven by both regulatory mandates and increasing consumer demand for eco-friendly products. Brands adopting sustainable packaging are gaining a competitive edge by enhancing their environmental credentials, creating opportunities for material developers and converters to capitalize on the transition from single-use plastics to green alternatives.

- For instance, Huhtamaki launched over 3 billion fiber-based trays and inserts globally in 2023, replacing conventional plastic alternatives.

Advancements in Custom and Smart Packaging Solutions

Customization and intelligent packaging are gaining traction as brands seek to improve unboxing experiences and ensure product integrity. Custom-fit inserts using advanced foam-cutting, 3D printing, and automated design technologies offer precise protection and reduce material waste. Additionally, smart packaging—integrating QR codes, RFID tags, and sensors—is being used in high-value goods packaging to enhance tracking and user engagement. These technological advancements present opportunities for innovation and differentiation in a competitive packaging market landscape.

Key Challenges

Environmental Concerns Associated with Plastic Usage

Despite its functional advantages, plastic continues to pose major environmental challenges due to its non-biodegradable nature and contribution to pollution. Regulatory bodies and consumers are pressuring manufacturers to reduce reliance on plastic inserts like air pillows and bubble wraps. Transitioning to sustainable alternatives, however, can involve higher costs and performance trade-offs, presenting a challenge for companies striving to balance functionality, cost, and eco-compliance in their packaging strategies.

- For instance, Smurfit Kappa reported a 13,000-ton reduction in plastic use in 2023 by substituting fiber-based cushioning solutions across its customer base.

High Raw Material and Production Costs

The cost of raw materials such as specialized foams, biodegradable plastics, and recycled paper can significantly impact profit margins. Fluctuations in crude oil prices, energy costs, and supply chain disruptions further exacerbate pricing instability. Small- and medium-sized enterprises in particular face challenges in adopting costlier sustainable materials or investing in automation for custom inserts, which may slow down widespread market transformation and innovation.

Supply Chain Disruptions and Logistics Constraints

Global supply chain instability continues to affect the availability and timely delivery of packaging materials. Transportation bottlenecks, raw material shortages, and geopolitical tensions are key factors contributing to inconsistent supply, increased lead times, and elevated operational costs. These disruptions hinder manufacturers’ ability to meet growing demand efficiently and maintain consistent quality, especially during peak e-commerce seasons or export surges, thereby posing a significant operational challenge in the packaging insert and cushion market.

Regional Analysis

North America:

North America held a substantial share of the global packaging insert and cushion market in 2024, accounting for approximately 28% of the total market. The region’s dominance stems from high e-commerce penetration, particularly in the U.S., coupled with strong demand from electronics and personal care industries. The presence of established packaging manufacturers and continuous innovation in protective solutions contribute to market growth. Additionally, increasing focus on sustainable packaging materials and compliance with regulatory standards are pushing companies toward eco-friendly insert alternatives. The trend toward customized packaging and automation further accelerates product adoption across various end-use sectors.

- For instance, Sealed Air operates over 30 packaging design and testing labs in the U.S. to develop high-performance cushioning solutions for regional clients.

Europe:

Europe accounted for around 24% of the packaging insert and cushion market in 2024, driven by stringent environmental regulations and a strong push for sustainable materials. Countries like Germany, France, and the UK are leading in the adoption of paper-based and biodegradable cushioning solutions. Demand from the food & beverage and electronics sectors remains high, especially in Western Europe. Regulatory compliance with the EU Green Deal is influencing packaging practices, encouraging innovation and the use of recyclable materials. Increasing cross-border e-commerce activities and consumer preference for low-impact packaging are shaping regional market trends.

- For instance, DS Smith recycled 5 million tons of paper across Europe in 2023 to support its fiber-based cushioning solutions

Asia Pacific:

Asia Pacific dominated the global packaging insert and cushion market in 2024, capturing approximately 34% of the total market share. The region’s leadership is attributed to high manufacturing activity, growing e-commerce penetration, and expanding electronics and automotive industries in China, India, Japan, and Southeast Asia. Rising consumer awareness and supportive government initiatives on sustainable packaging are fostering growth in paper and foam-based inserts. Rapid urbanization, coupled with increased retail logistics, is boosting demand for lightweight, protective, and cost-effective packaging solutions. Local players and global manufacturers are expanding operations across the region to meet escalating demand.

Latin America:

Latin America contributed nearly 7% to the global packaging insert and cushion market in 2024. Growth in the region is supported by the expanding e-commerce sector and increasing consumption of packaged goods, particularly in Brazil and Mexico. Rising demand for cost-effective and functional packaging solutions in food and electronics industries is fueling the adoption of air pillows, bubble wraps, and foam inserts. However, limited availability of advanced manufacturing facilities and lower adoption of sustainable materials may restrain rapid growth. Nonetheless, regional investments and trade partnerships are expected to strengthen the supply chain and enhance packaging capabilities.

Middle East & Africa:

The Middle East & Africa held a market share of approximately 7% in 2024 in the global packaging insert and cushion market. Growth is primarily driven by increasing industrial activity, retail expansion, and rising e-commerce logistics in countries like the UAE, Saudi Arabia, and South Africa. The demand for protective packaging in electronics, cosmetics, and consumer goods is growing steadily. However, market growth is somewhat constrained by limited local production capacities and dependency on imports for advanced materials. Gradual adoption of eco-friendly packaging, supported by sustainability awareness and regulatory initiatives, is likely to influence future market expansion.

Market Segmentations:

By Material:

By Product Type:

- Insert Trays

- Die-cut Insert

- Air Pillow

- Bubble Wrap

- Foam

- Others

By End-use Industry:

- Food & Beverages

- Electrical & Electronics

- E-commerce

- Personal Care & Cosmetics

- Automotive

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Packaging Insert and Cushion market is characterized by the presence of both global and regional players striving to enhance their market position through innovation, sustainability, and strategic expansion. Leading companies such as DS Smith, Smurfit Kappa, Pregis, Sonoco, Reflex Packaging Inc., and Huhtamaki are focusing on developing eco-friendly and customizable packaging solutions to meet the growing demand across e-commerce, electronics, and food industries. These players are investing in R&D to produce recyclable and biodegradable materials, aligning with evolving regulatory standards and consumer preferences. Strategic mergers, acquisitions, and partnerships are common as companies aim to broaden their product portfolios and geographical presence. Smaller players like Salazar Packaging, Visipak, EcoEnclose, and Index Packaging, Inc. are gaining traction by offering niche solutions with a focus on sustainability and cost-efficiency. The market remains moderately fragmented, with innovation in material technology and digital printing playing key roles in gaining competitive advantage.

- For instance, Pregis invested over USD 80 million in 2023 in North American manufacturing and innovation centers dedicated to protective packaging development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Salazar Packaging

- DS Smith

- Pregis

- Visipak

- Smurfit Kappa

- Reflex Packaging Inc.

- EcoEnclose

- Index Packaging, Inc.

- Huhtamaki

- Sonoco

Recent Developments

- In November 2023, Pregis announced the launch of carbon-neutral film for Protective packaging. Its sustainability focuses on protective packaging with a new carbon-neutral air-cushioning film called Renew Zero.

- In April 2023, U.K.-based Tesco launched new fresh mince packaging with 70% less plastic for its fresh mince product. The new pillow packs were launched to replace the conventional trap or top wrap packs.

- In August 2022, the protective packaging specialist Storapak launched a new air pillow film that is made from 100% recycled material. The products offer the same resistant protective properties as conventional air pillows. The production is of 100% recycled film with a mixture of post-consumer and post-industrial waste.

- In February 2022, Mondi launched 100% recyclable corrugated packaging solutions. The new monocorr box is created from 100% recyclable corrugated board, with inserts that cushion the packaged products. The last Warmhaus packaging used expanded polystyrene foam inserts, which had low recycling rates.

Market Concentration & Characteristics

The Packaging Insert and Cushion Market exhibits moderate to high market concentration, with several well-established global players maintaining a competitive edge through scale, innovation, and strategic partnerships. It features a mix of large multinational corporations and niche regional firms, each focusing on specific end-use industries such as electronics, e-commerce, food, and personal care. The market structure favors companies with advanced manufacturing capabilities, sustainable material portfolios, and supply chain efficiency. It shows characteristics of steady demand, driven by rising product protection requirements and the need for customized packaging. Regulatory pressure on plastic use and increasing environmental awareness are shaping product development and material choices. Innovation in biodegradable materials and automation in production play a key role in differentiating offerings. It tends to reward companies that respond quickly to shifts in consumer behavior and regulatory frameworks. Players that invest in R&D and maintain flexible production lines are better positioned to capture market share and sustain long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The packaging insert and cushion market is expected to witness steady growth due to the rising demand for protective packaging across e-commerce and retail sectors.

- Increasing environmental concerns are pushing manufacturers to invest in sustainable and recyclable cushion materials.

- The shift toward customized and branded unboxing experiences is boosting the demand for personalized packaging inserts.

- Growth in fragile product shipments such as electronics and glassware is driving the need for advanced cushioning solutions.

- Innovations in biodegradable and compostable cushioning materials are gaining traction among environmentally conscious consumers.

- Expansion of online food delivery and meal kit services is creating new opportunities for insulated and moisture-resistant inserts.

- The rise in cross-border e-commerce is encouraging companies to adopt lightweight and cost-efficient packaging inserts.

- Automation in packaging processes is influencing the design and material selection of inserts for easier handling and integration.

- Industries such as healthcare and electronics are demanding higher performance inserts to ensure product safety during transit.

- Growing regulatory focus on packaging waste is likely to accelerate the adoption of eco-friendly cushioning alternatives.