Market Overview:

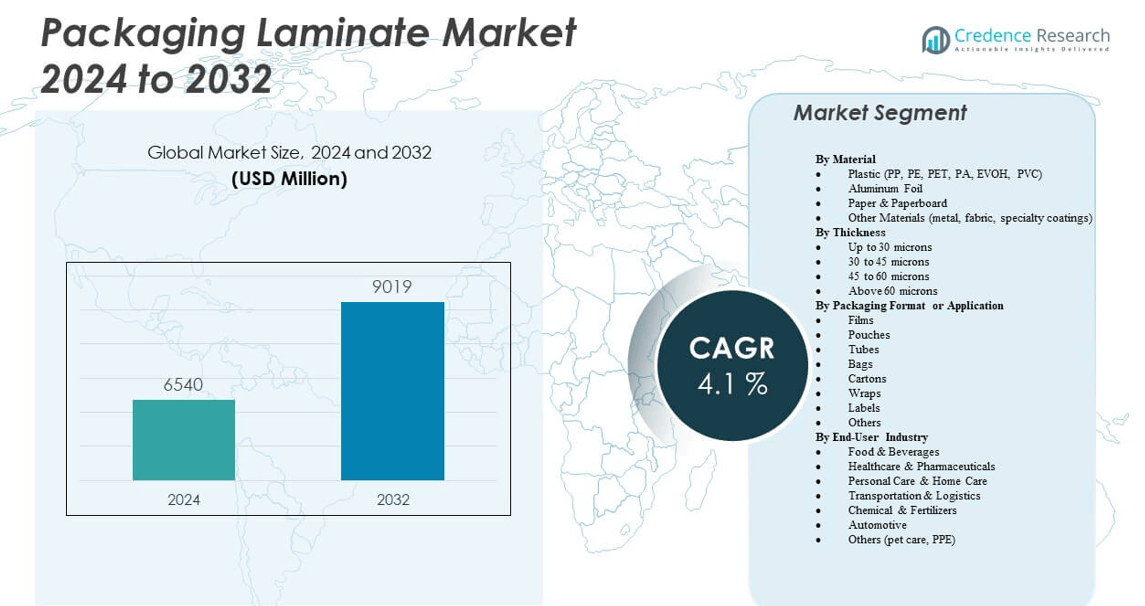

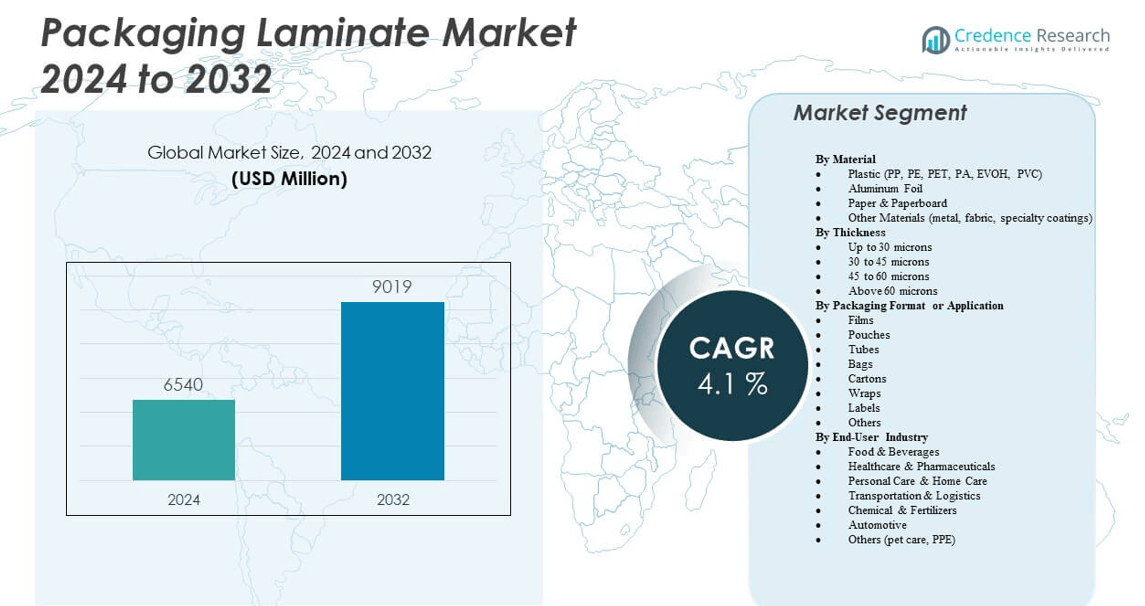

The Packaging Laminate Market is projected to grow from USD 6540 million in 2024 to an estimated USD 9019 million by 2032, with a compound annual growth rate (CAGR) of 4.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Laminate Market Size 2024 |

USD 6540 million |

| Packaging Laminate Market, CAGR |

4.1% |

| Packaging Laminate Market Size 2032 |

USD 9019 million |

The market growth is driven by the rising demand for lightweight, durable, and cost-effective packaging solutions across food, pharmaceutical, and personal care sectors. Manufacturers are increasingly adopting multi-layer laminates to enhance barrier properties, improve shelf life, and meet regulatory standards for safety and sustainability. In addition, the growing trend of convenient and portable packaging formats, such as pouches and sachets, has further fueled market expansion. Continuous innovation in materials and printing technologies has also strengthened the adoption of advanced packaging laminates.

Regionally, Asia-Pacific dominates the Packaging Laminate Market due to rapid urbanization, industrial expansion, and increasing consumption of packaged goods, particularly in China and India. North America and Europe maintain significant market shares owing to established FMCG and pharmaceutical industries, coupled with a strong emphasis on product safety and environmental compliance. Latin America and the Middle East & Africa are emerging as growth regions, driven by expanding retail infrastructure, rising consumer awareness, and increasing investments in flexible packaging technologies to support local manufacturing and export-driven industries.

Market Insights:

- The Packaging Laminate Market was valued at USD 6540 million in 2024 and is projected to reach USD 9019 million by 2032, growing at a CAGR of 4.1%.

- Rising demand for lightweight, durable, and barrier-efficient packaging is driving adoption across food and pharmaceutical sectors.

- Increasing focus on sustainability and recyclability is influencing material innovation and laminate structure redesign.

- Complex recycling processes and limited infrastructure for multi-material laminates restrict widespread circularity.

- Asia-Pacific leads the market with a 38% share due to high consumption and cost-effective manufacturing capabilities.

- North America holds a 26% share, supported by strong demand for high-performance and sustainable packaging.

- Europe captures 21% of the market, driven by strict environmental regulations and growing mono-material adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from Food and Beverage Industry Boosts Adoption of Flexible Laminates

The food and beverage industry drives significant growth in the Packaging Laminate Market due to its need for secure, lightweight, and extended shelf-life packaging solutions. Flexible laminates offer strong barrier properties that protect against oxygen, moisture, and light, essential for preserving freshness and flavor. It supports high-speed filling operations and reduces transportation costs due to lower weight. Increased consumption of processed foods, ready-to-eat meals, and snack items boosts demand for multilayer laminates. The rise of e-commerce grocery and meal delivery platforms also encourages adoption of high-performance laminates. It enables clear branding and labeling through advanced printing compatibility. Shelf appeal and consumer convenience further elevate demand for resealable and easy-tear features. These trends continue to elevate the relevance of laminate structures in retail packaging formats globally.

- For example, leading companies like ExxonMobil have commercialized fully recyclable, thermoformed cheese packages composed of 95wt.% polyethylene (PE), incorporating only 5% Kuraray EVAL™ EVOH for exceptional oxygen and moisture barrier properties.

Rising Preference for Sustainable and Lightweight Packaging Materials

Sustainability concerns have prompted a shift toward eco-friendly packaging solutions in the Packaging Laminate Market. Manufacturers are investing in recyclable, compostable, and bio-based materials that reduce the environmental impact of packaging waste. It allows companies to meet evolving government regulations and corporate sustainability goals. Lightweight laminate structures lower emissions across the supply chain through reduced fuel consumption and efficient logistics. Demand for minimal material usage and high performance has increased the focus on downgauging without compromising strength. Brands are seeking laminates that deliver recyclability while retaining essential protective and aesthetic properties. This growing environmental consciousness among consumers influences purchase decisions and packaging innovation. It drives continuous improvements in recyclable film layers, solvent-free adhesives, and mono-material formats. Regulatory frameworks in Europe and North America further accelerate the push toward sustainable laminate development.

Advancements in Barrier Technology and Material Engineering

Technological advancements in barrier layers have enhanced the functionality of packaging laminates, supporting market expansion. New materials such as EVOH, aluminum foil substitutes, and high-barrier coatings extend product shelf life and reduce food spoilage. It enables flexible packaging to replace rigid formats in more product categories. Multi-functional laminates now provide chemical resistance, odor retention, and mechanical stability, allowing their application in demanding sectors. Developments in nanocomposite films and plasma coatings deliver superior barrier performance with reduced thickness. The Packaging Laminate Market benefits from such innovations, which help meet changing industry needs. Integration of oxygen and moisture scavengers within laminates improves product protection. Customized solutions for different product types, such as dairy, confectionery, and condiments, expand the addressable market. Innovation in adhesives and extrusion processes also strengthens laminate strength and printability.

Pharmaceutical Sector’s Growing Reliance on High-Integrity Laminates

The pharmaceutical and healthcare industries require high-barrier laminates to ensure product integrity, dosage accuracy, and tamper resistance. The Packaging Laminate Market addresses these requirements through multilayer films that prevent contamination and moisture ingress. It supports compliance with global medical packaging regulations. High-performance laminates are used in blister packs, sachets, and pouches for tablets, capsules, and powders. The growing consumption of over-the-counter medications and wellness supplements drives demand for such solutions. It facilitates easy-to-open, unit-dose packaging formats for improved patient safety. Anti-counterfeiting features such as holographic layers, serialized printing, and tamper-evident seals are incorporated into laminates. Temperature-sensitive pharmaceuticals benefit from laminates offering controlled permeability and thermal resistance. These needs continue to position laminates as a preferred solution in the pharmaceutical packaging segment.

- For example, ACG’s Aclar laminates, certified for both U.S. and European pharmaceutical standards, provide ultra-high barrier options (water vapor transmission rates under 0.06g/m²/day at 38°C, 90%RH), ideal for humidity- and oxygen-sensitive drugs. Typical thermoforming occurs at 110–140°C with sealing at 160–190°C, enabling production without loss of barrier integrity.

Market Trends

Shift Toward Digital Printing for Short Runs and Customization

The Packaging Laminate Market is experiencing a transformation through the adoption of digital printing technologies. It enables faster turnaround, lower minimum order quantities, and greater flexibility for versioning. Brands use digitally printed laminates for targeted marketing, regional campaigns, and seasonal promotions. The rise of small-batch and specialty product lines increases the relevance of short-run packaging. It reduces the need for costly plate changes and setup time associated with traditional printing methods. Digital printing supports intricate designs, QR codes, and personalization features that enhance consumer engagement. The market sees growing investment in inkjet and electrophotographic printing systems integrated into lamination lines. It allows faster prototyping and time-to-market, which benefits brands operating in competitive, fast-moving categories. These capabilities drive new business models in packaging services.

- For example, HP Indigo digital presses such as the HP Indigo 200K and 25K are commercially used for direct digital printing on flexible packaging laminates. These systems enable brands and converters to produce digitally printed laminated pouches and films (using substrates from 10–400 microns thick, including PE, PP, PET, etc.) with rapid turnaround and without minimum order restrictions.

Expansion of High-Performance Laminates for Industrial and Technical Applications

Beyond consumer goods, the Packaging Laminate Market sees increasing penetration into industrial and technical segments. Applications such as construction chemicals, agrochemicals, motor oils, and electronics require durable, puncture-resistant, and chemically stable packaging. It benefits from high-strength laminates that offer advanced moisture, UV, and grease resistance. Custom-engineered structures now cater to high-speed filling, high-barrier, or form-fill-seal operations. The growth of industrial bulk packaging drives demand for laminated pouches, liners, and heavy-duty bags. Flexible intermediate bulk containers (FIBCs) and formable laminates expand use in B2B logistics. It provides printing capabilities for clear hazard communication, branding, and traceability. The market is witnessing innovation in multilayered constructions that reduce delamination risk and improve mechanical properties under stress.

Integration of Smart and Functional Layers in Laminate Structures

The Packaging Laminate Market is moving toward smart functionality through the integration of intelligent materials. Laminates embedded with indicators, such as time-temperature labels and freshness sensors, are gaining adoption in food and pharma sectors. It enhances product safety and supply chain transparency. RFID-enabled laminates support track-and-trace capabilities for high-value goods. Augmented reality and interactive packaging features are also being added to laminated surfaces to increase consumer interaction. Barrier films with antimicrobial or oxygen-scavenging properties are being embedded into packaging laminate layers. It enables active packaging that responds to environmental conditions and extends product usability. Brands and manufacturers see functional laminates as a competitive differentiator in premium segments. These smart features create added value beyond conventional protection and aesthetics.

Rising Popularity of Clear and Transparent Laminates for Product Visibility

The trend toward transparent packaging has influenced the design of laminate structures across several sectors. Consumers prefer to see the actual product before purchase, especially in snacks, pet food, and health supplements. The Packaging Laminate Market reflects this shift by incorporating clear barrier films such as BOPP, PET, and nylon. It provides product visibility while maintaining barrier protection. The use of anti-fog, UV-blocking, and abrasion-resistant coatings allows clear laminates to function in diverse environments. Transparent laminates also support minimalist design aesthetics that convey product purity and quality. Flexible pouches with window panels or fully transparent constructions now replace opaque formats in many applications. Brands use transparency to build trust and highlight natural or clean-label formulations. It strengthens the emotional appeal and purchase likelihood of packaged goods.

- For example, Toray Industries’ Lumirror™ polyester (PET) films are widely used in flexible transparent packaging, offering excellent transparency, scratch resistance, and suitability for food and health products. The latest grades can be heat-sealed, printed, laminated, and provided in high-clarity, low-haze forms.

Market Challenges Analysis

Complex Recycling Process Limits Material Circularity and Eco-Friendly Adoption

Recycling of multi-layer laminates presents a key challenge in the Packaging Laminate Market due to the complexity of separating different materials. Most laminates combine plastic films, foils, adhesives, and coatings that are difficult to process through standard recycling streams. It hinders efforts to achieve circular economy goals and restricts post-consumer waste recovery. Consumers and recyclers lack standardized infrastructure to handle such materials efficiently. Regulatory bodies increasingly target non-recyclable packaging, forcing manufacturers to redesign structures. The need for high performance often outweighs recyclability, creating tension between functionality and sustainability. High cost of mono-material development and limited commercial viability of biodegradable options also restrict the adoption of greener alternatives. These issues delay widescale transition toward fully sustainable laminate packaging formats.

Volatile Raw Material Prices and Supply Chain Disruptions Impact Cost Stability

The Packaging Laminate Market is sensitive to fluctuations in raw material prices, especially petroleum-based resins, aluminum foils, and specialty coatings. It leads to unpredictable cost structures for converters and end-users. Supply chain disruptions due to geopolitical tensions, shipping constraints, or trade regulations further amplify procurement challenges. Tight margins in fast-moving consumer goods restrict price pass-through to end customers. Smaller converters face difficulties absorbing volatility compared to vertically integrated players. Inconsistent supply of critical materials affects production scheduling and order fulfillment timelines. Long lead times and limited local sourcing options also increase exposure to global market risks. These challenges require strategic sourcing, inventory management, and risk mitigation planning to ensure competitiveness.

Market Opportunities

Emergence of Bio-Based and Recyclable Laminates Creates Sustainable Growth Potential

The Packaging Laminate Market holds significant opportunity in the development of bio-based and recyclable structures. Rising environmental concerns and regulatory actions drive interest in compostable films and mono-material laminates. It enables brands to meet consumer expectations for eco-conscious packaging without compromising performance. Industry leaders invest in PLA, PHA, and cellulose-based alternatives to traditional plastics. Advancements in solvent-free adhesives and extrusion coating technologies support the creation of fully recyclable laminates. Early adoption by premium food and wellness brands signals broader market acceptance. Governments and NGOs are promoting pilot programs and subsidies to accelerate green material adoption. These factors align with ESG goals and open new revenue streams for innovators in laminate design and manufacturing.

Growing Demand from Emerging Economies Offers Expansion Avenues

Rapid urbanization, rising disposable income, and retail modernization in emerging economies present untapped growth for the Packaging Laminate Market. Countries across Southeast Asia, Africa, and Latin America are witnessing a surge in packaged food, pharmaceuticals, and personal care consumption. It boosts demand for affordable, durable, and visually appealing packaging formats. Increasing infrastructure for flexible packaging manufacturing supports localized production. International players seek to expand presence through partnerships and investments in regional facilities. The shift from traditional to branded retail formats strengthens market penetration of laminate-based solutions. Demographic trends such as younger populations and growing e-commerce adoption further stimulate packaging innovation. These dynamics create scalable growth opportunities for both global and regional laminate producers.

Market Segmentation Analysis:

The Packaging Laminate Market is segmented

By material, with plastic-based laminates such as PP, PE, PET, PA, EVOH, and PVC dominating due to their versatility, cost-efficiency, and barrier performance. Aluminum foil is used in high-barrier applications, especially in pharmaceuticals and food, while paper & paperboard gain traction for sustainable and recyclable formats. Other materials, including metal composites, specialty coatings, and fabrics, support niche, high-value applications.

- For example, Constantia Flexibles manufactures pharmaceutical-grade blister laminates such as NEXA, offering oxygen transmission rates below 005 cc/m²/day and water vapor transmission rates under 0.05 g/m²/day. These aluminum-based structures provide over 99% light barrier, ensuring high protection for sensitive drug formulations.

By thickness, the 30 to 45 microns segment holds a major share due to its balance of flexibility, strength, and cost-effectiveness. Thinner laminates up to 30 microns are common in light-duty wraps and labels, while above 60 microns are used in heavy-duty and industrial packaging.

- For instance, Avery Dennison’s Fasson® PET30 labels use a 23-micron BOPET film laminate for pressure-sensitive label applications, offering a high clarity and conformability for beverage and personal care product wraps

By format or application, pouches and films lead due to their wide use across food, personal care, and healthcare products. Bags and tubes follow closely, while wraps, labels, and cartons serve branding and protective functions across retail and logistics chains.

By end-user industry, food & beverages dominate the Packaging Laminate Market owing to their demand for moisture, aroma, and contamination barriers. Healthcare and pharmaceuticals follow, requiring stringent protection and regulatory compliance. Personal care, logistics, chemicals, and automotive industries contribute steadily. Emerging categories like pet care and PPE continue to expand demand across specialized formats.

Segmentation:

By Material

- Plastic (PP, PE, PET, PA, EVOH, PVC)

- Aluminum Foil

- Paper & Paperboard

- Other Materials (metal, fabric, specialty coatings)

By Thickness

- Up to 30 microns

- 30 to 45 microns

- 45 to 60 microns

- Above 60 microns

By Packaging Format or Application

- Films

- Pouches

- Tubes

- Bags

- Cartons

- Wraps

- Labels

- Others

By End-User Industry

- Food & Beverages

- Healthcare & Pharmaceuticals

- Personal Care & Home Care

- Transportation & Logistics

- Chemical & Fertilizers

- Automotive

- Others (pet care, PPE)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific holds the leading position in the Packaging Laminate Market with a market share of 38%. The region’s dominance is driven by strong manufacturing activity, growing consumption of packaged food and pharmaceuticals, and the rapid rise of retail and e-commerce sectors. China and India account for the majority of regional demand due to large populations and expanding middle-class consumers. The presence of numerous local converters and increasing investments in sustainable packaging technologies further support market growth. It benefits from lower production costs, which make Asia-Pacific a preferred hub for global exports. Government support for industrial development and food safety regulations also strengthens the market in this region.

North America ranks second with a market share of 26%, supported by mature food, healthcare, and personal care packaging industries. The United States contributes the majority of regional demand, driven by high standards for product safety, advanced manufacturing, and strong retail infrastructure. Demand for high-barrier and sustainable laminate structures remains strong across key end-use segments. It benefits from ongoing R&D in recyclable materials, solvent-free adhesives, and functional coatings. Canada also sees increased adoption of flexible laminates in response to rising health-consciousness and clean-label packaging. Stringent regulatory frameworks and consumer awareness around sustainability continue to shape market preferences in the region.

Europe accounts for 21% of the global Packaging Laminate Market, led by Germany, the UK, France, and Italy. The market is driven by the region’s focus on reducing packaging waste and transitioning to circular packaging solutions. It sees high demand for recyclable, mono-material laminates in response to EU packaging directives. The region’s advanced converting technology, strong design standards, and regulatory enforcement support innovation in sustainable laminate production. Eastern Europe shows emerging potential as investments in localized production and FMCG sectors increase. Latin America and the Middle East & Africa collectively hold a 15% share, driven by rising disposable incomes, growing packaged food sectors, and infrastructure development. These regions are gradually expanding their footprint in the global laminate supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc

- Berry Global Inc.

- Mondi Plc

- ProAmpac LLC

- Constantia Flexibles Group

- Coveris Holdings S.A.

- Schur Flexibles Holding GmbH

- Uflex Ltd.

- Cosmo Films Ltd.

- Jindal Poly Films Limited

- WINPAK LTD

- Huhtamaki Oyj

- Sonoco Products Company

- C-P Flexible Packaging

Competitive Analysis:

The Packaging Laminate Market features a competitive landscape with a mix of global players and regional converters. Key companies include Amcor plc, Mondi Group, Huhtamaki Oyj, Constantia Flexibles, and Uflex Ltd. These firms focus on innovation, sustainable material development, and capacity expansion to strengthen market presence. Strategic partnerships with FMCG and pharmaceutical brands help secure long-term contracts and drive revenue growth. Emerging players in Asia-Pacific are gaining traction by offering cost-efficient solutions tailored to local needs. It reflects high innovation intensity, especially in recyclable and high-barrier laminate segments. Competitive dynamics are shaped by investments in printing, extrusion, and coating technologies to improve product performance and visual appeal.

Recent Developments:

- In March 2025, ProAmpac LLC made significant strides in active and intelligent packaging by launching new sustainable, moisture-adsorbing solutions within its ProActive Intelligence Moisture Protect series. This line includes foil-based and foil-free films that offer customizable levels of protection and sustainability, tailored for a range of applications. The company also partnered with Aptar CSP Technologies to further advance these solutions.

- In March 2025, Constantia Flexibles Group completed the acquisition of a majority stake in Aluflexpack AG, a prominent European flexible packaging supplier for food and pharma. This acquisition is expected to strengthen Constantia’s leadership in innovation and sustainability and expand its portfolio of flexible packaging solutions.

- In July 2024, Mondi Plc cemented its role in sustainable eCommerce packaging through a strategic partnership with CMC Packaging Automation. This collaboration is focused on integrating Mondi’s specialty kraft paper into CMC’s automated packaging systems, delivering enhanced sustainability and product quality for eCommerce clients.

Market Concentration & Characteristics:

The Packaging Laminate Market shows moderate concentration, with top players accounting for a significant portion of global revenue. It is characterized by high product differentiation, technical customization, and strong end-user alignment. Regional players compete by offering localized production, flexible order sizes, and faster turnaround times. Innovation in sustainable laminates and barrier technologies remains a key differentiator. Market dynamics favor companies that balance cost efficiency with regulatory compliance and environmental performance. Strategic M&A activities and technology licensing agreements further shape the competitive environment. Continuous investment in advanced materials and automation enhances scalability and operational efficiency.

Report Coverage:

The research report offers an in-depth analysis based on Material, Thickness, Packaging Format or Application and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Packaging Laminate Market will see rising demand for recyclable and mono-material solutions driven by global sustainability regulations and brand commitments.

- Expansion in e-commerce and retail will increase the need for durable, lightweight, and visually impactful laminated packaging formats.

- Advanced barrier technologies will be further developed to improve product protection, extend shelf life, and support downgauging.

- The pharmaceutical and nutraceutical sectors will adopt high-barrier laminates for secure, moisture-resistant, and tamper-evident packaging formats.

- Digital printing will become more integrated into laminated structures, enabling mass customization, versioning, and promotional agility.

- Asia-Pacific will continue to lead global growth due to a combination of high consumption, expanding manufacturing bases, and favorable cost dynamics.

- Brand demand for compostable and bio-based laminates will accelerate material innovation across food, beverage, and personal care categories.

- Flexible packaging formats such as stand-up pouches and stick packs will replace rigid containers across many applications.

- Strategic collaborations between global converters and end-use brands will drive tailored packaging innovations and long-term supply agreements.

- Investments in smart lamination systems and automation will enhance throughput, reduce waste, and support scalability for high-volume production.