Market Overview

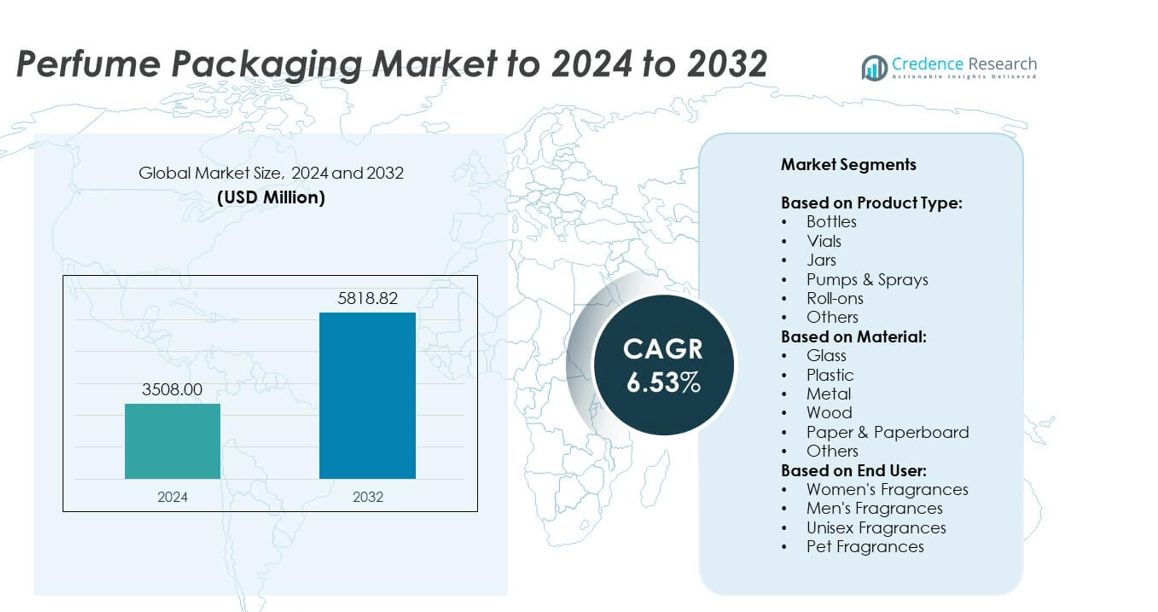

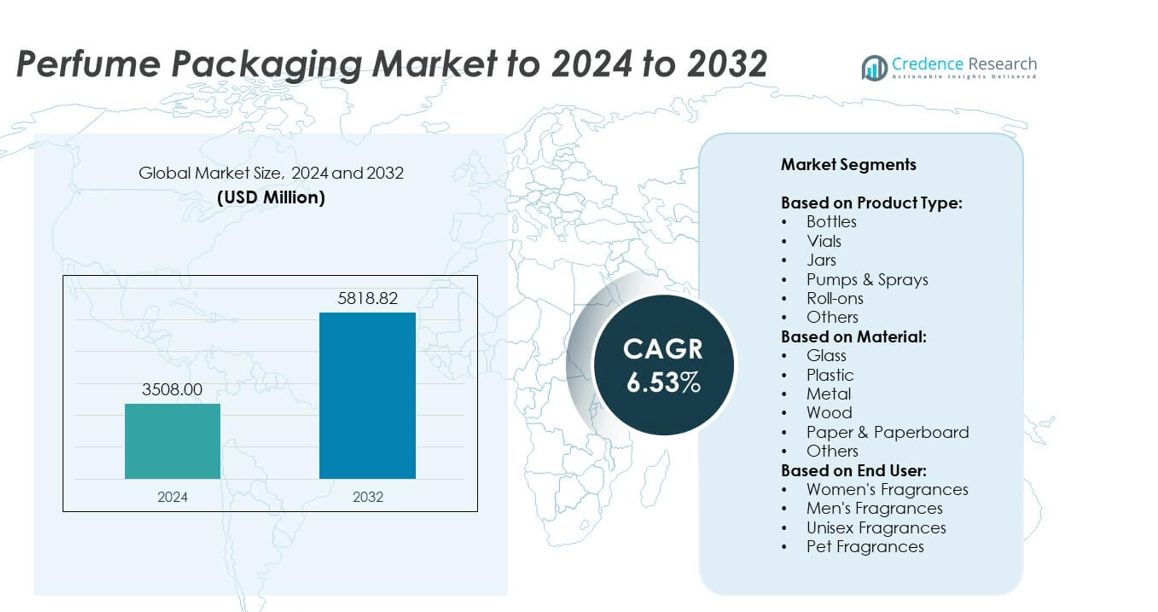

Perfume Packaging market size was valued at USD 3,508.00 million in 2024 and is anticipated to reach USD 5,818.82 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Perfume Packaging Market Size 2024 |

USD 3,508.00 million |

| Perfume Packaging Market, CAGR |

6.53% |

| Perfume Packaging Market Size 2032 |

USD 5,818.82 million |

The perfume packaging market is driven by major players such as Gerresheimer AG, Albea S.A, Vitro Corporation, AptarGroup Inc., Berry Global, Stölzle Glass Group, Verescence, and Zignago Vetro. These companies focus on premium glass bottle production, innovative closure systems, and sustainable packaging solutions to meet evolving consumer preferences. Strategic investments in lightweight glass manufacturing, refillable packaging formats, and decorative technologies strengthen their market position. North America led the market with around 35% share in 2024, supported by high demand for luxury fragrances and strong adoption of eco-friendly packaging. Europe followed closely with a 30% share, driven by luxury fragrance houses emphasizing premium aesthetics and sustainability.

Market Insights

- The perfume packaging market was valued at USD 3,508.00 million in 2024 and is projected to reach USD 5,818.82 million by 2032, growing at a CAGR of 6.53%.

- Growing demand for premium and luxury fragrances, along with sustainability initiatives, drives adoption of glass bottles and refillable packaging formats.

- Key trends include rising use of eco-friendly materials, lightweight glass production, and smart packaging technologies like NFC and QR codes for product authentication.

- The market is competitive with players focusing on innovation, decorative finishes, and partnerships with fragrance brands to launch personalized and limited-edition packaging.

- North America leads with 35% share, followed by Europe at 30% and Asia Pacific at 25%; bottles dominate the product segment with over 40% share, driven by their strong presence in luxury and mass-market fragrances.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Bottles dominated the perfume packaging market in 2024, capturing over 40% of the market share. Their dominance is driven by premiumization trends and consumer preference for aesthetically appealing, durable packaging for luxury fragrances. Glass bottles with intricate designs and customizable shapes enhance brand identity and shelf appeal. The growing demand for refillable and sustainable bottles further boosts adoption, especially among luxury brands promoting eco-conscious packaging. Pumps and sprays are also witnessing steady growth, driven by convenience and precise dosing requirements for fine fragrances across both mass and premium product categories.

- For instance, Verescence has an annual production capacity of up to 600 million glass bottles for the perfumery and cosmetics industry. The company has partnered with L’Oréal on several products, including the refillable CREMA NERA Dual Essence Foundation for Armani Beauty. In September 2023, Verescence collaborated with Albéa on a 50ml refillable glass jar called TWIRL. Dior, meanwhile, has offered its own line of refillable travel bottles for its La Collection Privée, independent of Verescence.

By Material

Glass led the market with more than 50% share in 2024, driven by its premium look, barrier properties, and recyclability. High-end fragrance brands prefer glass packaging for its ability to preserve fragrance integrity and deliver a luxury experience. Rising consumer demand for sustainable and recyclable packaging materials has encouraged brands to invest in lightweight glass bottles with reduced carbon footprints. Plastic holds a significant secondary share due to its cost-effectiveness and design flexibility, particularly for travel-size products and mass-market fragrances, where weight reduction and affordability are key drivers.

- For instance, SGD Pharma produces more than 2 billion vials and bottles per year for the pharmaceutical industry. The company has a strong focus on sustainability, highlighted by initiatives like the Nova lightweight glass bottle and an award-winning CSR strategy, including achieving an EcoVadis Platinum rating. In 2024, SGD Pharma successfully produced glass bottles containing 20% post-consumer recycled glass at its Zhanjiang plant in China during its first PCR campaign.

By End User

Women’s fragrances held the largest market share at over 55% in 2024, supported by high product launches and strong consumer spending on premium perfumes. Brands invest heavily in unique and elegant packaging designs to attract female consumers, focusing on personalization and luxury appeal. The rise of limited-edition collections and influencer-driven marketing campaigns further supports demand. Men’s fragrances are growing rapidly, supported by increasing grooming awareness and rising disposable incomes, while unisex fragrances are emerging as a niche segment driven by Gen Z consumers seeking gender-neutral and inclusive products.

Market Overview

Growing Demand for Premium and Luxury Fragrances

Growing demand for premium and luxury fragrances is the leading driver for the perfume packaging market. Brands are focusing on innovative, high-quality packaging to enhance shelf appeal and brand differentiation. Consumers increasingly prefer sophisticated, personalized, and sustainable packaging solutions that reflect exclusivity. This trend pushes manufacturers to invest in advanced design technologies and premium materials like glass and metal. Rising disposable incomes and urbanization, especially in emerging markets, further boost sales of premium fragrances, driving steady demand for visually appealing and durable perfume packaging.

- For instance, Interparfums Inc. reported net sales of $1.45 billion in 2024, a 10% increase over the previous year. The company’s portfolio is heavily reliant on prestige fragrances, which are typically packaged in glass bottles. Interparfums has announced corporate social responsibility initiatives, with its Paris-based subsidiary, Interparfums SA, reporting that it recovered 90% of the 30 metric tonnes of waste it generated in 2023.

Rising Sustainability Initiatives

Rising sustainability initiatives are another major growth driver shaping the market. Brands are moving toward eco-friendly materials such as recyclable glass, bio-based plastics, and paperboard to meet consumer and regulatory expectations. Circular economy practices, including refillable perfume bottles and reduced plastic use, are gaining traction. These initiatives align with global sustainability goals, improving brand image and customer loyalty. Companies adopting green packaging benefit from competitive advantages and increasing acceptance among environmentally conscious consumers.

- For instance, Chanel has implemented refillable initiatives for products like the N°1 DE CHANEL cream and the 31 LE ROUGE lipstick to reduce packaging waste. The company has a stated goal of achieving net-zero greenhouse gas emissions by 2040 and reported a 1% reduction in Scope 1 and 2 emissions in 2024, alongside a 9% reduction in Scope 3 emissions. In 2024, Chanel also assessed over 90% of its Fragrance and Beauty suppliers for sustainability management systems, leveraging platforms like EcoVadis.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes act as a key driver for innovation in perfume packaging. Digital printing, 3D modeling, and automation enable faster production, cost efficiency, and mass customization. Smart packaging solutions, such as NFC-enabled tags and QR codes, allow brands to enhance consumer engagement and product authenticity verification. These technologies help brands improve supply chain efficiency and develop unique designs to differentiate their offerings. Advancements in lightweight materials and coating technologies also contribute to reduced environmental impact and better performance of perfume packaging.

Key Trends & Opportunities

Rise of Refillable and Reusable Packaging

The rapid adoption of refillable and reusable perfume packaging is a major market trend. Brands like Dior and Chanel are introducing refillable bottle systems to reduce waste and appeal to eco-conscious consumers. This trend also provides opportunities for new revenue streams through refill packs and loyalty programs. Growth in unisex fragrances further opens opportunities for minimalistic, gender-neutral packaging designs, catering to younger consumers seeking inclusivity. Customizable packaging for limited editions and personalized gifting segments is becoming a significant differentiator for premium fragrance brands globally.

- For instance, LVMH’s Perfumes & Cosmetics division reported 4% organic revenue growth in 2024, driven by brand innovations and the success of flagship fragrances, including Christian Dior’s Sauvage and Miss Dior Parfum.

Growth of E-commerce and Digital Packaging Solutions

E-commerce growth is creating new opportunities for innovative perfume packaging designs. With rising online fragrance sales, brands are investing in secure, tamper-proof, and visually appealing packaging that ensures safe delivery while maintaining premium aesthetics. Compact and travel-friendly packaging formats are gaining popularity to meet convenience needs. Digital-first campaigns are also driving demand for packaging with interactive features such as scannable codes and augmented reality, which enhance online shopping experiences and boost brand engagement across platforms.

- For instance, in December 2022, Puig introduced the digital platform WikiParfum, which at that time included approximately 19,600 scents and enabled users to browse, compare, and choose fragrances. The platform’s library is regularly updated.

Key Challenges

High Production and Material Costs

High production and material costs remain a major challenge for perfume packaging manufacturers. The use of premium materials like glass, metal caps, and decorative finishes significantly increases production expenses. Small and mid-sized brands face margin pressures due to limited economies of scale. Fluctuations in raw material prices and rising energy costs further impact profitability. To address this, companies are focusing on lightweighting, optimizing designs, and exploring alternative materials that balance cost efficiency without compromising quality or consumer appeal.

Rising Counterfeit Products

Counterfeit products pose a growing challenge in the perfume packaging market. Fake fragrances often mimic original packaging, damaging brand reputation and consumer trust. This issue drives companies to adopt advanced anti-counterfeiting technologies such as holograms, NFC chips, and serialization on packaging. However, these solutions add extra costs to production and require constant technological updates. Regulatory authorities are also tightening compliance requirements, compelling manufacturers to invest in traceability systems and secure supply chains to prevent product duplication and safeguard brand integrity.

Regional Analysis

North America

North America held the largest share of the perfume packaging market with around 35% in 2024. Growth is driven by strong demand for premium and luxury fragrances, particularly in the United States, where consumer spending on personal care products remains high. The region benefits from established fragrance brands, high purchasing power, and significant adoption of sustainable and refillable packaging solutions. E-commerce channels further boost sales by offering convenient access to niche and designer perfumes. Manufacturers are focusing on innovative glass bottle designs and eco-friendly materials to cater to the growing preference for sustainability among environmentally conscious consumers.

Europe

Europe accounted for nearly 30% of the market share in 2024, supported by the presence of global luxury fragrance houses in France, Italy, and the UK. The region’s focus on craftsmanship and premium aesthetics drives demand for high-quality glass bottles and decorative closures. Regulatory emphasis on sustainability and recyclability encourages the use of eco-friendly materials and refillable formats. Rising popularity of artisanal and niche perfumes also contributes to growth. European manufacturers invest in design innovation and personalization features, making the region a key hub for premium packaging exports to other global markets.

Asia Pacific

Asia Pacific captured around 25% of the perfume packaging market share in 2024, emerging as the fastest-growing region. Increasing disposable incomes, rapid urbanization, and rising adoption of Western beauty and grooming trends are driving perfume consumption. Countries like China, India, and Japan are witnessing a surge in demand for both luxury and affordable fragrances. Local players are focusing on affordable, innovative packaging to cater to a diverse consumer base. Growth in e-commerce platforms and duty-free retail also supports expansion, while global brands are establishing manufacturing bases in the region to reduce costs and serve local demand.

Latin America

Latin America accounted for about 6% of the market share in 2024, driven by rising fragrance usage in Brazil and Mexico. The region is witnessing increasing demand for mid-range perfumes and packaging innovations that balance cost-effectiveness with aesthetic appeal. Local manufacturers are adopting lightweight materials and simple designs to cater to price-sensitive consumers. Growth in organized retail and expansion of international fragrance brands are supporting market development. Seasonal promotions and gifting culture further boost perfume sales, encouraging packaging manufacturers to focus on attractive, small-size, and travel-friendly formats to appeal to a wider customer base.

Middle East & Africa

Middle East & Africa held nearly 4% of the perfume packaging market share in 2024, supported by strong cultural preferences for fragrances. The region shows high demand for premium and luxury perfumes, particularly in Gulf countries, where spending on personal grooming is significant. Packaging trends lean toward ornate glass bottles and metal closures that reflect regional aesthetics and traditions. Growing tourism and duty-free sales further contribute to demand. Manufacturers are also introducing refillable packaging options and high-end customization to appeal to affluent consumers seeking exclusivity and sustainability in fragrance purchases.

Market Segmentations:

By Product Type:

- Bottles

- Vials

- Jars

- Pumps & Sprays

- Roll-ons

- Others

By Material:

- Glass

- Plastic

- Metal

- Wood

- Paper & Paperboard

- Others

By End User:

- Women’s Fragrances

- Men’s Fragrances

- Unisex Fragrances

- Pet Fragrances

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The perfume packaging market is characterized by the presence of key players such as Gerresheimer AG, SKS Bottle and Packaging Inc., Albea S.A, Vitro Corporation, Stölzle Glass Group, Zignago Vetro, SGD Pharma, Silgan Holdings Inc., Verescence, Coverpla S.A, AptarGroup Inc., Trivium Packaging, HCP Packaging, Premi Industries, Berry Global, and SGB Packaging Inc. The market is highly competitive, with companies focusing on innovation, premium design aesthetics, and sustainable solutions to capture consumer attention. Leading manufacturers invest in advanced manufacturing technologies such as lightweight glass production, digital printing, and automated decoration processes to enhance efficiency and reduce environmental impact. Strategic collaborations with fragrance brands, development of refillable and recyclable solutions, and expansion into emerging markets remain key growth strategies. Players are also prioritizing research and development to deliver unique shapes, decorative finishes, and eco-friendly materials, strengthening their market position while meeting evolving consumer preferences for personalization and sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gerresheimer AG (Germany)

- SKS Bottle and Packaging Inc. (U.S.)

- Albea S.A (France)

- Vitro Corporation (Mexico)

- Stölzle Glass Group (Austria)

- ZIGNAGO VETRO (Italy)

- SGD Pharma

- Silgan Holdings, Inc. (U.S.)

- VERESCENCE (France)

- Coverpla S.A. (France)

- AptarGroup, Inc. (U.S.)

- Trivium Packaging (U.S.)

- HCP Packaging (China)

- Premi Industries (Italy)

- Berry Global (U.K.)

- SGB Packaging Inc. (U.S.)

Recent Developments

- In 2024, Aptar Beauty has released a new plastic fragrance pump made with post-consumer recycled resin (PCR).

- In 2024,Stoelzle Glass Group invested in R&D to develop lightweight glass bottles that maintain the desired luxury feel and durability. Lightweighting reduces material use, energy consumption during production, and transportation costs and emissions.

- In 2023, SGD Pharma company continued to emphasize the inherent recyclability of glass and collaborated with customers to optimize bottle designs for efficient recycling streams.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for sustainable and recyclable perfume packaging solutions.

- Refillable and reusable packaging formats will gain significant traction among premium brands.

- Digital printing and 3D modeling will enable faster customization and unique designs.

- Smart packaging with NFC and QR codes will enhance consumer engagement and authenticity checks.

- Lightweight glass production will reduce carbon footprints and transportation costs.

- E-commerce growth will boost demand for durable, tamper-proof, and travel-friendly packaging.

- Gender-neutral and minimalist packaging designs will attract younger consumers and unisex fragrance buyers.

- Emerging markets in Asia-Pacific and Latin America will drive new growth opportunities.

- Strategic partnerships between fragrance brands and packaging suppliers will increase innovation speed.

- Automation and advanced manufacturing technologies will lower production costs and improve efficiency.