Market Overview:

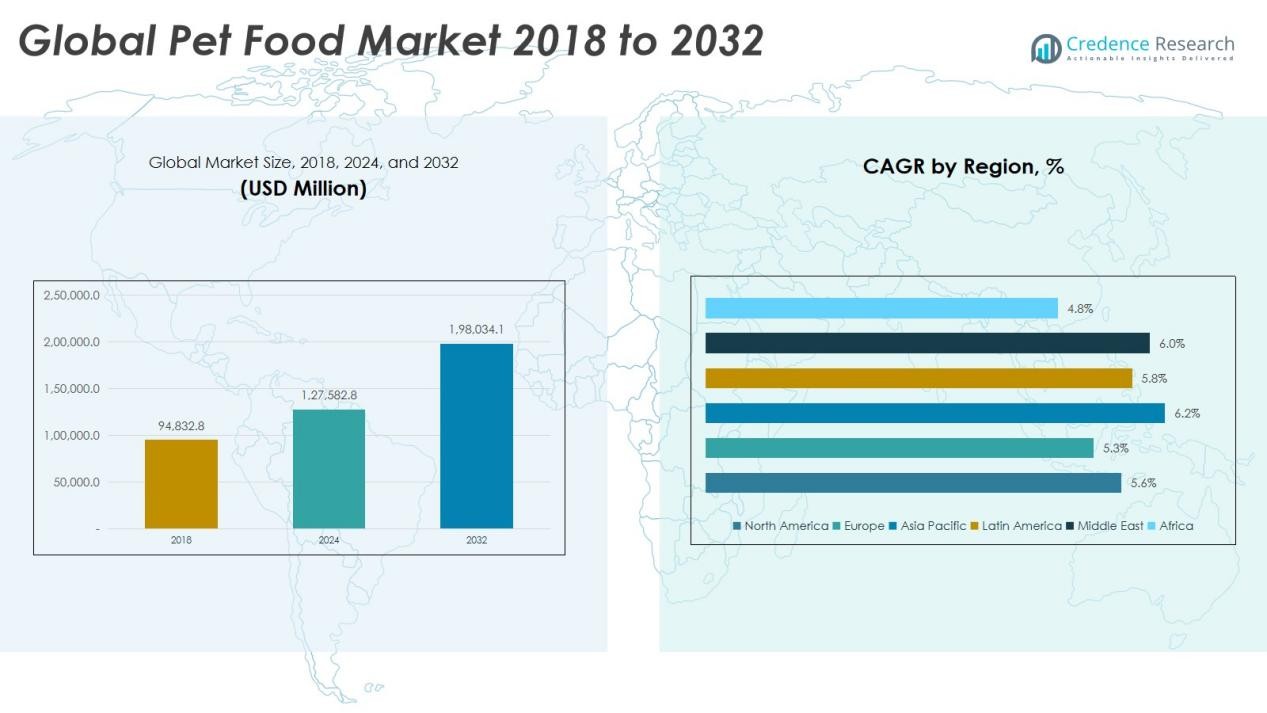

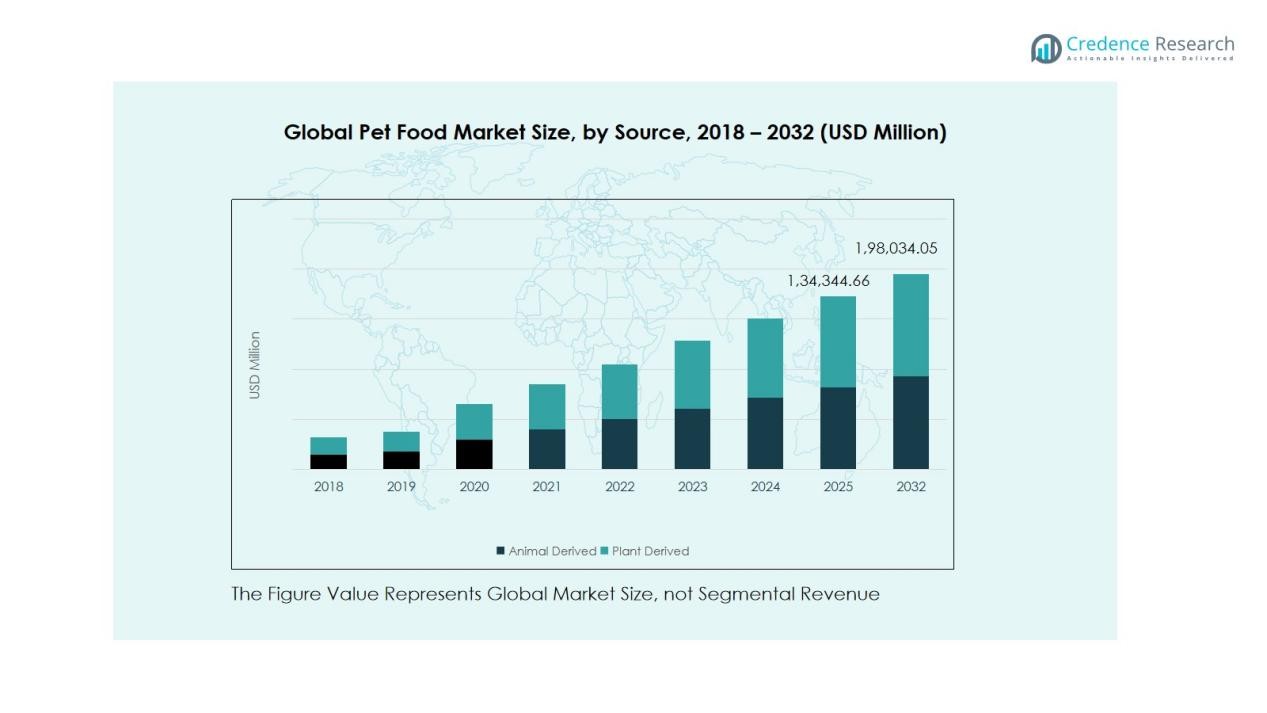

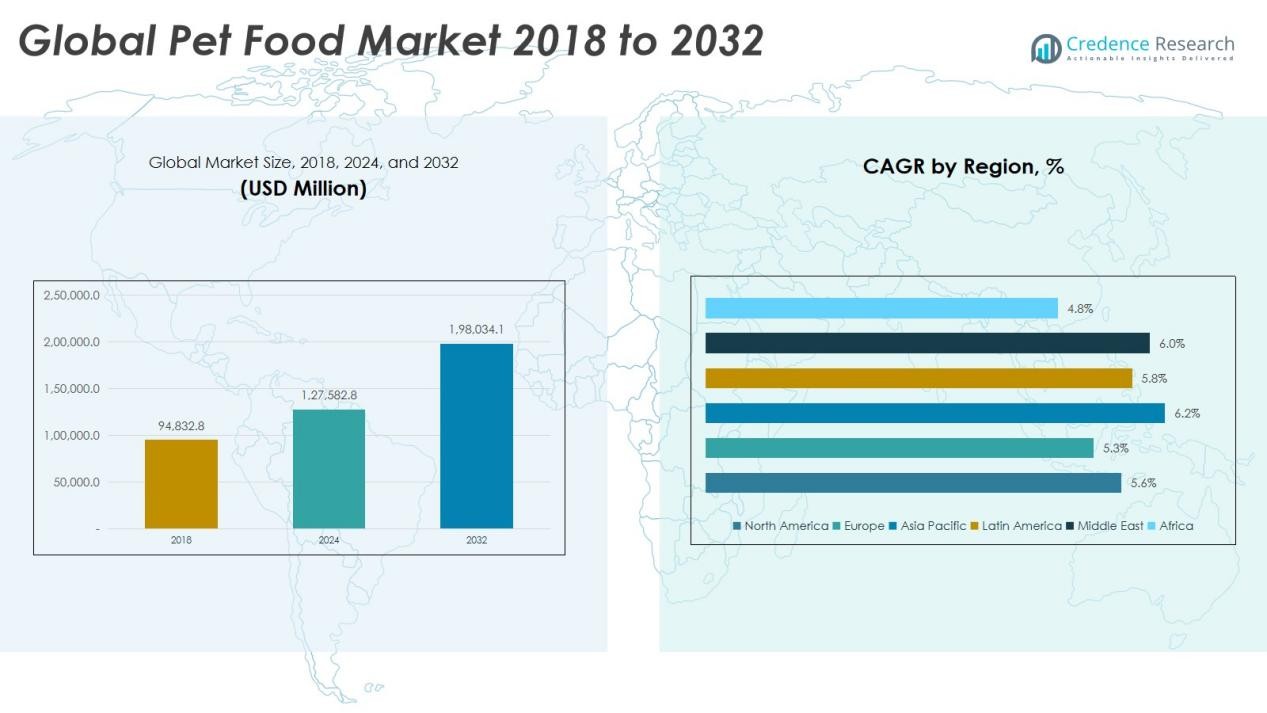

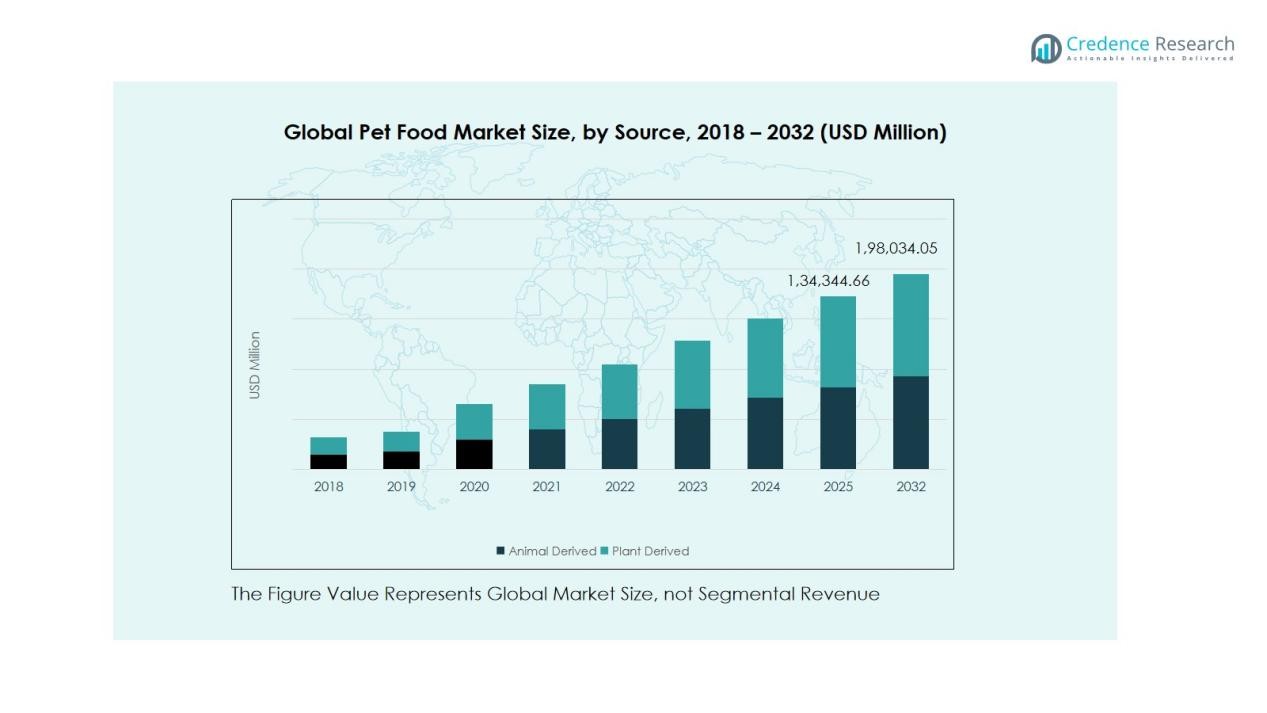

The Global Pet Food Market size was valued at USD 94,832.8 million in 2018 to USD 1,27,582.8 million in 2024 and is anticipated to reach USD 1,98,034.1 million by 2032, at a CAGR of 5.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Food Market Size 2024 |

USD 1,27,582.8 Million |

| Pet Food Market, CAGR |

5.70% |

| Pet Food Market Size 2032 |

USD 1,98,034.1 Million |

Rising disposable incomes and urban lifestyles are driving demand for functional and natural ingredients in pet food formulations. The growing prevalence of obesity and chronic conditions in pets has also boosted interest in specialized diets that promote health and wellness. E-commerce growth and direct-to-consumer sales channels further enhance market accessibility and brand visibility.

North America dominated the global market in 2024, holding over 40% of the share due to strong pet ownership rates and high spending per pet. Europe followed with significant demand for sustainable and organic pet food products. The Asia Pacific region is expected to record the fastest growth, driven by increasing pet ownership, rapid urbanization, and rising awareness of pet care across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Pet Food Market was valued at USD 127,582.8 million in 2024 and is projected to reach USD 198,034.1 million by 2032, growing at a CAGR of 5.70%.

- Rising disposable incomes and urbanization are driving demand for functional, natural, and premium pet food products.

- North America held over 40% market share in 2024, supported by high pet ownership and advanced retail networks.

- Europe accounted for 28% share, with strong demand for sustainable, organic, and eco-friendly formulations.

- The Asia Pacific region, with a 22% share, is the fastest-growing market driven by increasing pet ownership in China and India.

- Key challenges include fluctuating raw material prices, supply chain disruptions, and stringent regulatory standards.

- Expanding e-commerce platforms, sustainable production practices, and personalized pet nutrition create strong future growth opportunities.

Market Drivers:

Rising Pet Humanization and Growing Focus on Pet Health

The Global Pet Food Market is driven by the growing perception of pets as family members. Pet owners increasingly demand high-quality, nutritious, and tailored food products that support pet health and wellness. This trend has fueled innovation in premium, organic, and functional food formulations. It encourages brands to invest in research to develop products with balanced nutrition, immunity support, and specific dietary benefits.

- For instance, Elanco launched Pet Protect in February 2025, a veterinarian-formulated supplement line backed by over 25 years of veterinary experience.

Increasing Disposable Income and Willingness to Spend on Premium Products

Rising household incomes have strengthened consumer spending on pet care, particularly in developed regions. Pet owners now prioritize quality over price, driving strong demand for premium, grain-free, and protein-rich diets. It has led to the expansion of specialty and customized food segments targeting breed-specific and age-specific needs. This shift supports strong revenue growth across urban and suburban markets worldwide.

- For instance, General Mills completed its acquisition of Whitebridge Pet Brands’ North American business for $1.45 billion in late 2024, expanding its premium pet food portfolio with Tiki Pets and Cloud Star brands.

Expansion of E-commerce and Direct-to-Consumer Distribution Channels

The surge in digital retail platforms has transformed product accessibility and purchasing behavior in the pet food sector. Online marketplaces and brand websites offer convenience, product variety, and subscription options. It allows consumers to explore and compare nutrition profiles easily. Companies now leverage data analytics and targeted marketing to strengthen customer engagement and loyalty.

Growing Awareness of Sustainable and Ethical Production Practices

Consumers increasingly favor brands adopting sustainable sourcing, recyclable packaging, and cruelty-free production. The market reflects this shift through the introduction of eco-friendly packaging and plant-based protein options. It aligns with global sustainability goals and strengthens brand reputation. Companies investing in transparency and ethical supply chains continue to gain competitive advantages in the evolving pet food landscape.

Market Trends:

Shift Toward Functional, Natural, and Personalized Pet Nutrition

The Global Pet Food Market is witnessing a clear shift toward functional and natural formulations that address specific health concerns such as digestion, joint health, immunity, and weight management. Pet owners are increasingly drawn to ingredients with visible health benefits, including probiotics, omega fatty acids, and superfoods. Brands now emphasize transparency by disclosing ingredient sourcing and production practices. It encourages consumer trust and long-term loyalty. Personalized pet nutrition based on breed, age, and health data is also expanding rapidly. Companies are using digital platforms and subscription services to tailor meal plans, reflecting a strong alignment with human wellness trends.

- For Instance, Purina’s Pro Plan LiveClear cat food is the first formula clinically proven to reduce the major cat allergen (Fel d 1) on cat hair and dander, with studies showing an average reduction of 47% after three weeks of use.

Rise of Sustainability, Plant-Based Diets, and Technological Integration

Sustainability has become a defining trend across the global pet food supply chain. Companies are replacing animal-derived ingredients with plant-based or insect protein alternatives to reduce environmental impact. It supports eco-conscious consumers and aligns with the circular economy model. Technological innovation, including smart feeders, AI-based diet tracking, and precision formulation tools, is transforming product development and consumer interaction. The growing preference for sustainable packaging, recyclable materials, and ethically sourced raw inputs reinforces this movement. These advancements strengthen competitiveness and brand differentiation in a rapidly evolving marketplace.

- For Instance, Petnet’s SmartFeeder device leveraged algorithms to automate and personalize meal schedules, aiming to support data-driven nutrition management, and the company went out of business by 2020 after shipping far fewer than 100,000 units and encountering widespread technical issues, including feeder jams and app failures.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Supply Chain Disruptions

The Global Pet Food Market faces persistent challenges from volatile raw material prices and supply chain instability. Dependence on agricultural commodities such as meat, grains, and plant proteins exposes manufacturers to price fluctuations caused by climate change and trade disruptions. It pressures production margins and limits affordability for consumers. Logistical bottlenecks and rising transportation costs further affect product availability across regions. Companies are investing in local sourcing and alternative protein options to mitigate risks, but consistent supply remains difficult to maintain.

Regulatory Compliance and Product Safety Concerns

Strict international regulations on labeling, ingredient quality, and safety testing create hurdles for market expansion. The pet food sector must comply with varying regional standards, which increases production costs and slows product launches. It demands continuous monitoring of ingredients to ensure safety and traceability. Rising incidents of product recalls have increased consumer scrutiny of brand reliability. Small and medium producers face added pressure due to limited testing infrastructure. Regulatory harmonization remains essential for promoting trust and facilitating smoother global trade.

Market Opportunities:

Expansion in Emerging Markets and Growing Pet Ownership Rates

The Global Pet Food Market offers strong growth potential in emerging economies where pet ownership is rapidly increasing. Rising urbanization, income growth, and exposure to global pet care trends are fueling higher spending on premium and functional pet foods. It enables global brands to expand into untapped regions across Asia Pacific, Latin America, and the Middle East. Local manufacturers are also scaling operations to meet demand with affordable, region-specific formulations. Expanding distribution networks and e-commerce adoption further support accessibility and market penetration.

Innovation in Product Formulation and Sustainable Solutions

Continuous innovation in ingredients and packaging presents major opportunities for differentiation and brand value creation. Companies are investing in plant-based proteins, clean-label products, and specialized diets that address pet allergies or health conditions. It allows brands to attract environmentally conscious consumers seeking transparency and ethical sourcing. Sustainable packaging solutions, including biodegradable or recyclable materials, enhance corporate responsibility and appeal. Partnerships with veterinary professionals and technology firms also open new avenues for product personalization and precision nutrition.

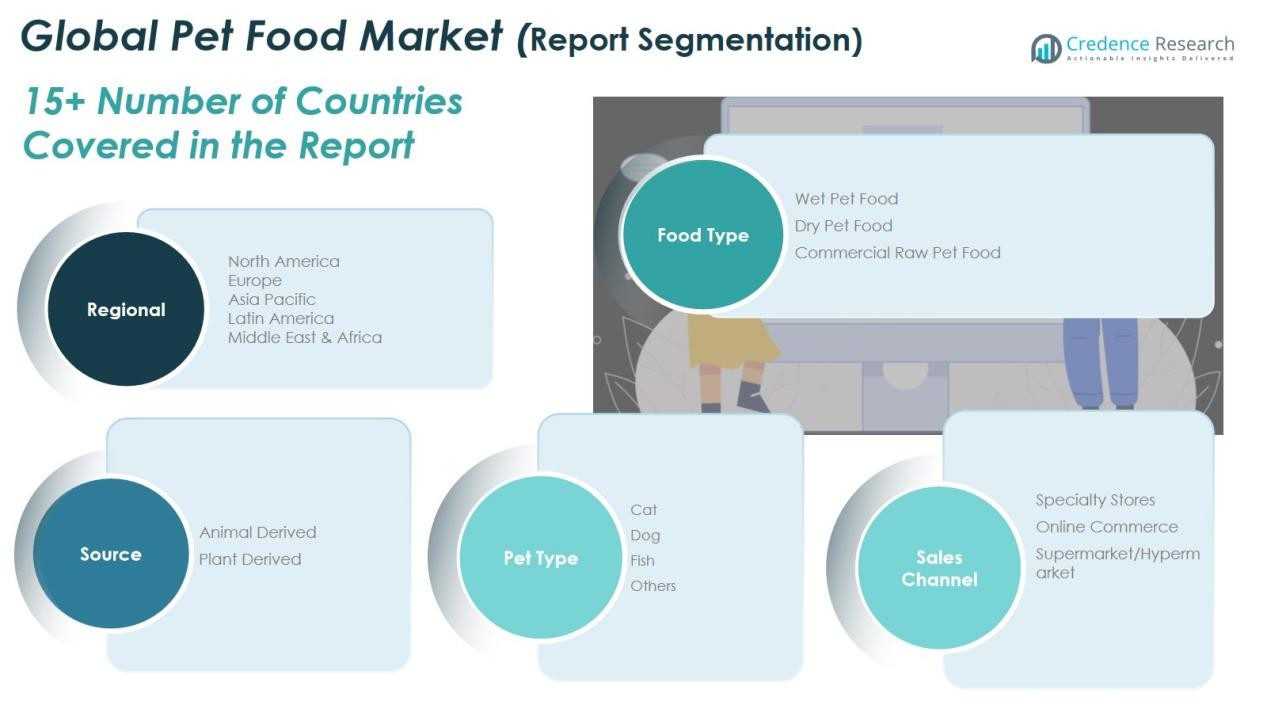

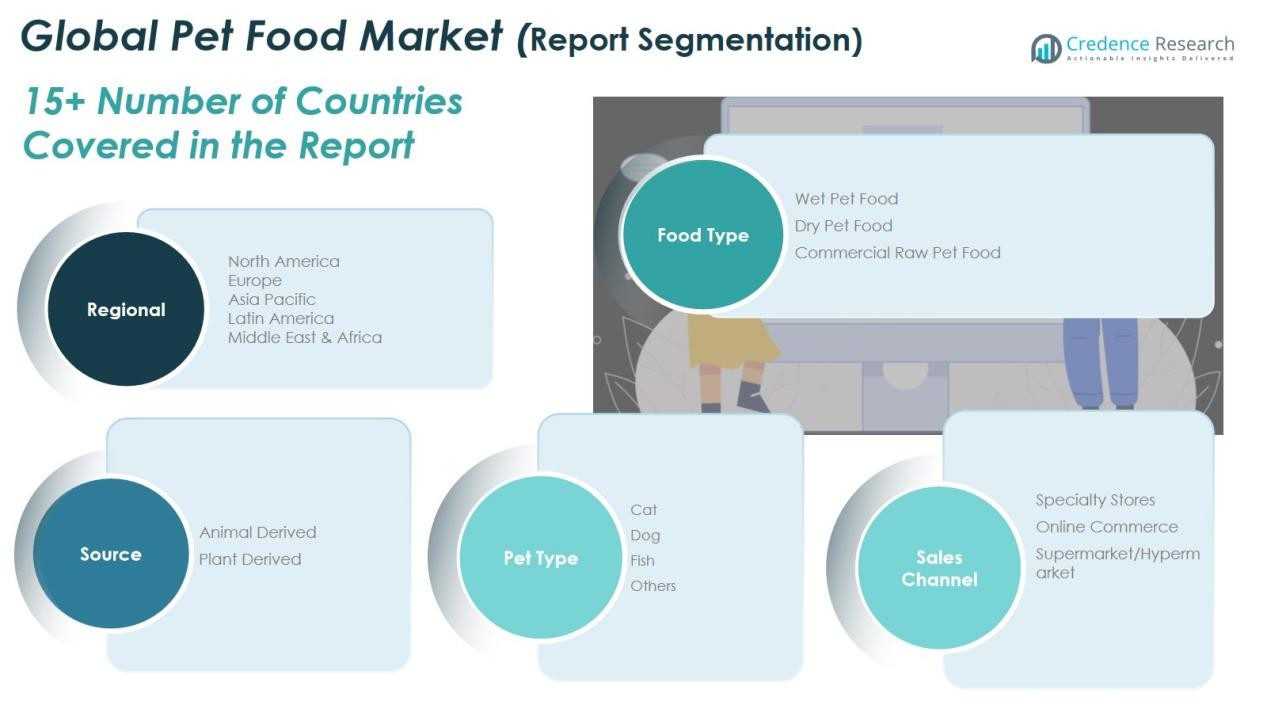

Market Segmentation Analysis:

By Food Type

Dry food leads the Global Pet Food Market due to its convenience, cost-effectiveness, and long shelf life. Wet and canned food follow, offering higher palatability and hydration benefits for pets. Treats and snacks are gaining popularity as owners focus on pet indulgence and training rewards. It continues to expand across specialty diets such as grain-free, high-protein, and functional formulations tailored for health management.

- For Instance, Nestlé Purina is increasing wet pet food production at its Wisbech, UK plant with a £150 million investment announced in September 2024 to expand capacity and efficiency.

By Source

Animal-derived ingredients dominate because of their protein density and taste appeal. Plant-based and novel protein sources are growing fast, driven by sustainability awareness and pet allergies. Organic and natural ingredient-based formulations are expanding across premium categories, supported by owner preference for clean-label products. It reflects a clear market shift toward transparency, ethical sourcing, and nutritional innovation.

- For instance, Castor & Pollux’s ORGANIX line achieved USDA Organic certification for its recipes, with their Organic Chicken & Sweet Potato recipe comprising 95% certified organic ingredients, meeting strict organic production standards.

By Pet Type

Dog food holds the largest market share due to strong ownership rates and premium product adoption. Cat food follows, driven by demand for tailored nutrition in urban households. Products for other pets such as birds, fish, and small mammals represent a smaller but growing segment. It gains traction through niche innovations, customized diets, and fortified formulations promoting health and longevity.

Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

The North America Pet Food Market size was valued at USD 32,356.96 million in 2018, increased to USD 43,405.48 million in 2024, and is anticipated to reach USD 67,113.74 million by 2032, at a CAGR of 5.6% during the forecast period. North America accounted for a 34% share of the Global Pet Food Market, supported by high pet ownership and advanced retail networks. The region is driven by strong consumer preference for premium, organic, and functional products. It benefits from established brands like Mars, Nestlé Purina, and Hill’s Pet Nutrition, which dominate through innovation and wide distribution. The United States remains the key contributor, driven by high disposable income and strong awareness of pet nutrition. E-commerce and subscription-based services continue to enhance accessibility and convenience for pet owners.

Europe

The Europe Pet Food Market size was valued at USD 27,074.77 million in 2018, increased to USD 35,577.37 million in 2024, and is anticipated to reach USD 53,469.19 million by 2032, at a CAGR of 5.3% during the forecast period. Europe held a 28% share of the Global Pet Food Market, supported by a strong demand for sustainable and organic formulations. The region is characterized by strict food safety and labeling regulations that ensure high product quality. It benefits from growing consumer focus on eco-friendly packaging and ethical ingredient sourcing. The United Kingdom, Germany, and France lead consumption due to rising urban pet ownership and demand for health-specific food products. Private-label brands and e-commerce growth further support competitive expansion across the region.

Asia Pacific

The Asia Pacific Pet Food Market size was valued at USD 20,768.39 million in 2018, increased to USD 28,848.29 million in 2024, and is anticipated to reach USD 46,656.82 million by 2032, at a CAGR of 6.2% during the forecast period. Asia Pacific captured a 22% share of the Global Pet Food Market, emerging as the fastest-growing regional segment. Rising urbanization, expanding middle-class income, and growing awareness of pet health drive regional growth. China, Japan, and India lead demand with increasing pet adoption rates and evolving dietary preferences. It benefits from strong online retail growth and localized manufacturing efforts. Global brands are entering partnerships with regional players to expand their reach and adapt product offerings to local tastes.

Latin America

The Latin America Pet Food Market size was valued at USD 8,307.35 million in 2018, increased to USD 11,236.40 million in 2024, and is anticipated to reach USD 17,565.62 million by 2032, at a CAGR of 5.8% during the forecast period. Latin America represented a 9% share of the Global Pet Food Market, with strong consumption in Brazil, Mexico, and Argentina. The region is driven by growing awareness of pet health and the availability of affordable premium products. It benefits from expanding modern retail formats and improved online accessibility. Regional manufacturers are offering fortified and cost-effective formulations to attract value-focused consumers. Government initiatives supporting animal welfare and veterinary care are boosting market confidence and long-term growth potential.

Middle East

The Middle East Pet Food Market size was valued at USD 4,533.01 million in 2018, increased to USD 6,218.75 million in 2024, and is anticipated to reach USD 9,901.70 million by 2032, at a CAGR of 6.0% during the forecast period. The Middle East held a 5% share of the Global Pet Food Market, supported by rising pet ownership and disposable income. The region’s demand is concentrated in the UAE, Saudi Arabia, and Qatar, where consumers prefer premium imported brands. It benefits from expanding retail channels and greater access to specialized pet stores. Functional and grain-free formulations are gaining popularity among health-conscious consumers. Market players are focusing on online sales and product education to build consumer trust and awareness.

Africa

The Africa Pet Food Market size was valued at USD 1,792.34 million in 2018, increased to USD 2,296.49 million in 2024, and is anticipated to reach USD 3,326.97 million by 2032, at a CAGR of 4.8% during the forecast period. Africa accounted for a 2% share of the Global Pet Food Market, remaining in an early growth stage. Rising urbanization and growing middle-income households are driving gradual adoption of packaged pet food. South Africa leads regional demand due to higher awareness of pet nutrition and established retail structures. It faces challenges related to limited manufacturing capacity and import dependency. Market expansion efforts center on affordability, localized production, and consumer education to sustain long-term development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Hartz Mountain Corporation

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- M. Smucker Co.

- United Petfood

- Simmons Pet Food

- Unicharm Corporation

- Real Pet Food Co.

- Delicious Food Factory (DFF)

- Other Key Players

Competitive Analysis:

The Global Pet Food Market is highly competitive, with global and regional players focusing on innovation and product quality. Leading companies such as The Hartz Mountain Corporation, Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, Inc., J.M. Smucker Co., United Petfood, and Simmons Pet Food dominate through extensive portfolios and strong brand equity. It emphasizes nutritional advancements, sustainable sourcing, and premiumization to strengthen market presence. Companies invest in research, digital marketing, and e-commerce platforms to expand consumer reach and brand loyalty. Regional manufacturers focus on affordability, private-label production, and local ingredient sourcing to compete effectively with multinational corporations. The industry continues to witness consolidation through acquisitions and partnerships aimed at expanding production capacity, improving supply chains, and enhancing formulation diversity.

Recent Developments:

- In February 2025, Hill’s Pet Nutrition, through Colgate-Palmolive, agreed to acquire Care TopCo Pty Ltd, owner of the Prime100 fresh pet food brand, to expand its presence in Australia’s fresh pet food market.

- In January 2025, J.M. Smucker Co. announced an agreement to divest Cloverhill, Big Texas, and select private label brands to JTM Foods LLC for $40 million, shifting ownership of trademarks and its Chicago production facility.

Report Coverage:

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Pet Food Market will continue expanding with rising pet adoption and humanization trends.

- Demand for organic, functional, and health-oriented pet food will strengthen across global markets.

- Emerging regions such as Asia Pacific and Latin America will lead future growth through urbanization and higher incomes.

- Personalization in pet nutrition and AI-driven feeding technologies will transform product development.

- E-commerce growth and subscription models will enhance consumer convenience and retention.

- Sustainability will remain central, driving innovation in recyclable packaging and ethical ingredient sourcing.

- Manufacturers will diversify protein sources, focusing on plant-based, insect-based, and lab-grown alternatives.

- Global players will pursue acquisitions and collaborations to expand their distribution and product portfolios.

- Regulatory tightening around labeling, safety, and nutrition standards will improve quality and consumer trust.

- Investment in research, smart feeding devices, and precision nutrition will shape the industry’s next growth phase.