Market Overview:

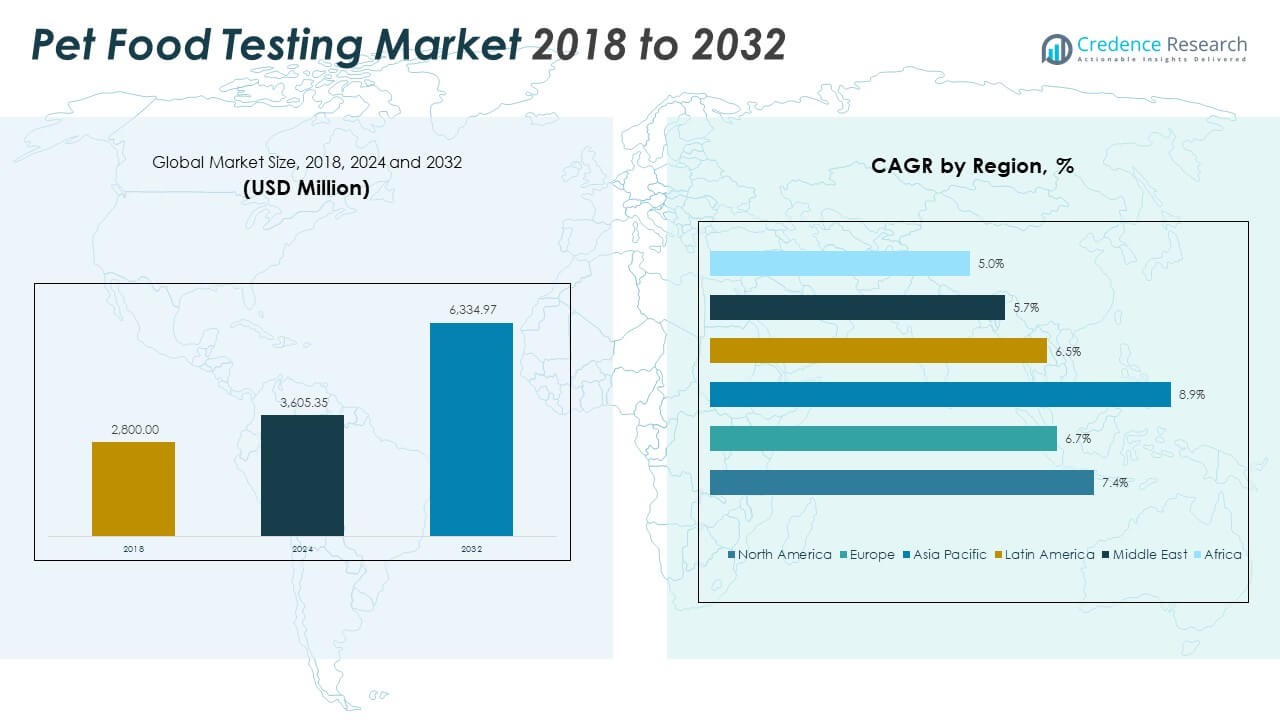

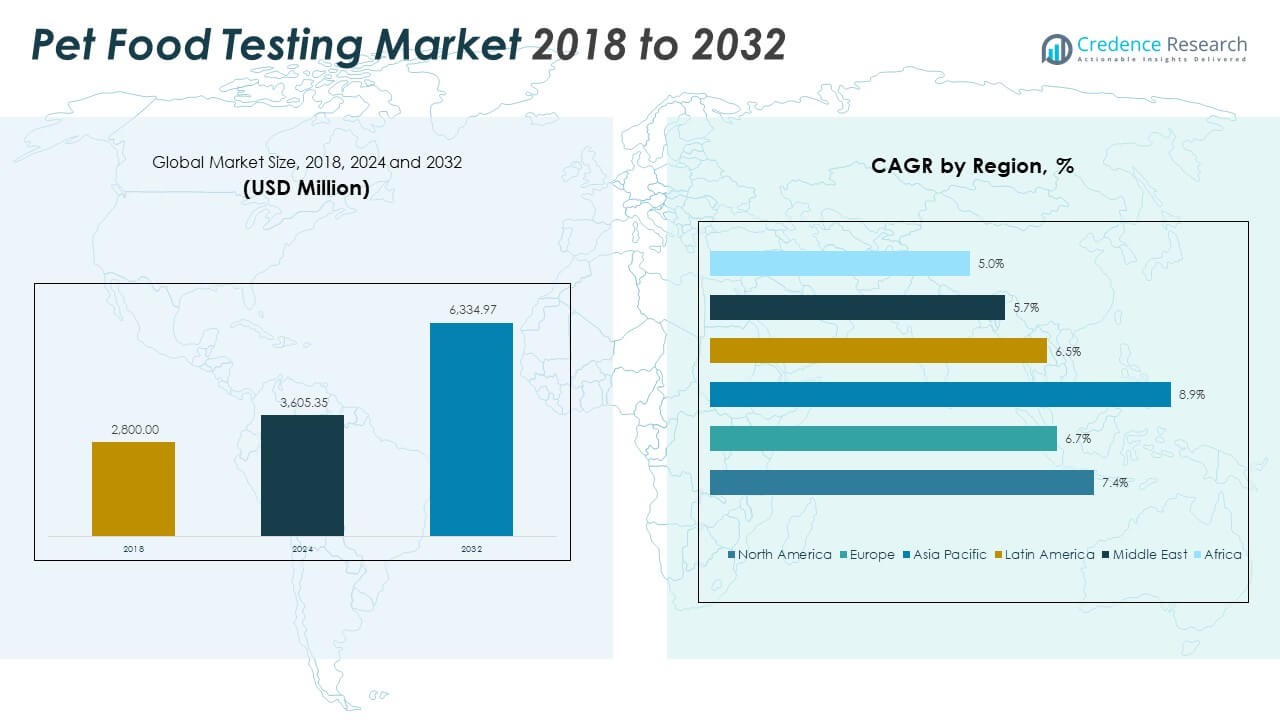

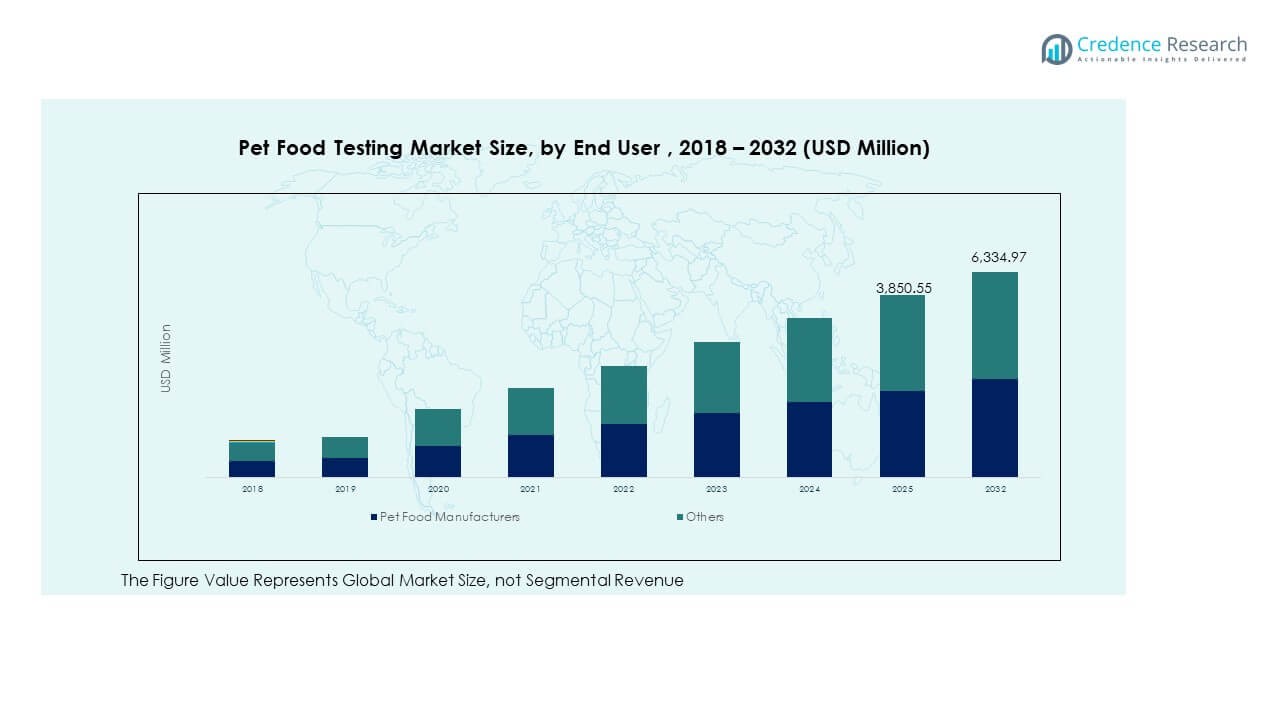

The Pet Food Testing Market size was valued at USD 2,800.00 million in 2018 to USD 3,605.35 million in 2024 and is anticipated to reach USD 6,334.97 million by 2032, at a CAGR of 7.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Food Testing Market Size 2024 |

USD 3,605.35 Million |

| Pet Food Testing Market, CAGR |

7.37% |

| Pet Food Testing Market Size 2032 |

USD 6,334.97 Million |

The market is driven by rising pet ownership, increasing awareness of food safety, and stricter regulatory standards. Manufacturers focus on ensuring product quality through advanced testing methods to detect contaminants, pathogens, and nutritional imbalances. Regulatory frameworks enforce high safety standards, encouraging the adoption of certified laboratory testing services. Growing demand for premium and functional pet food further strengthens the need for robust testing infrastructure and technologies.

North America leads the market due to strict regulatory enforcement, a large pet population, and advanced testing capabilities. Europe follows with strong labeling compliance and sustainable sourcing initiatives. Asia Pacific is an emerging hub, supported by urbanization and rising disposable incomes. Latin America, the Middle East, and Africa show steady growth with increasing pet food imports and gradual regulatory development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Pet Food Testing Market size was USD 2,800.00 million in 2018, USD 3,605.35 million in 2024, and is projected to reach USD 6,334.97 million by 2032, growing at a CAGR of 7.37%.

- North America holds 31.1% share, supported by strong regulatory frameworks and advanced testing infrastructure. Europe follows with 21.8% due to strict labeling standards. Asia Pacific accounts for 18.3%, driven by rising urbanization and pet ownership.

- Asia Pacific is the fastest-growing region, supported by increasing local manufacturing capacity, regulatory upgrades, and expanding laboratory networks that address rising demand for food quality and safety testing.

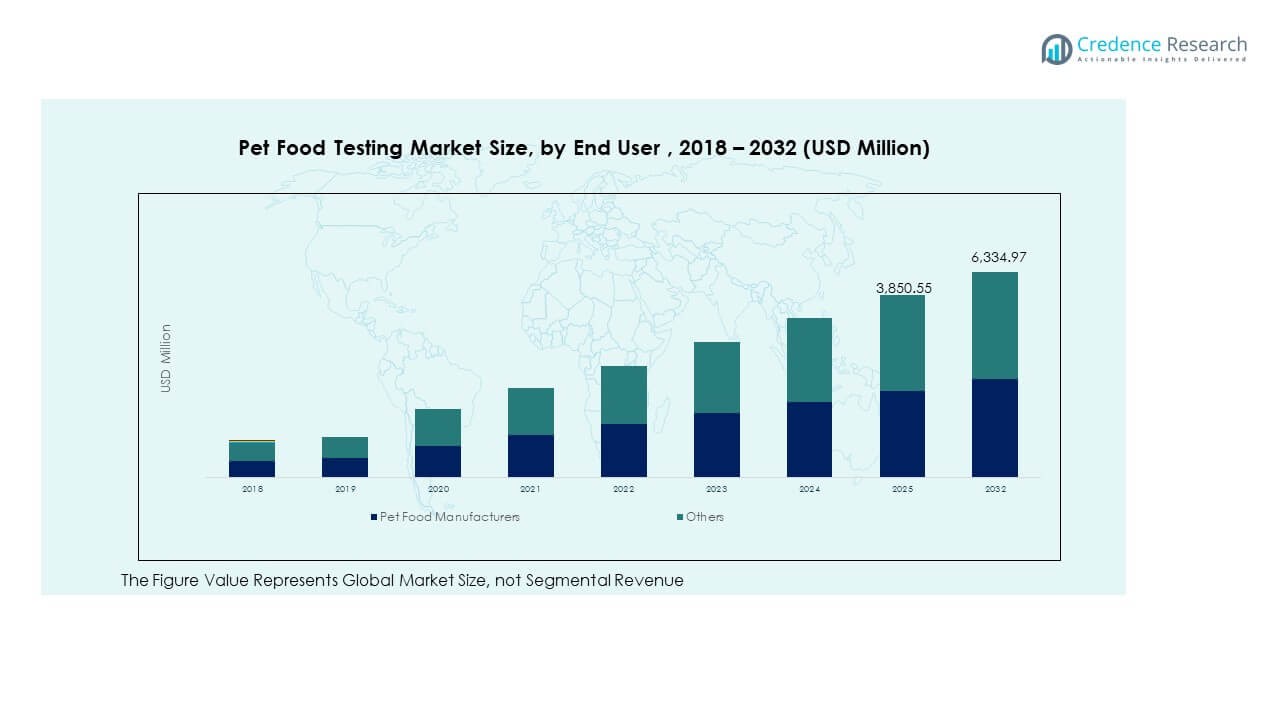

- Pet food manufacturers represent the largest end-user segment, accounting for approximately 60% of the market, driven by compliance and large-scale production needs.

- Other end users, including veterinary clinics and pet owners, make up the remaining 40%, reflecting growing awareness of product safety and testing services.

Market Drivers

Rising Pet Ownership and Humanization of Pets Creating Strong Demand for Quality Assurance

Growing global pet ownership is driving the demand for safer, healthier pet food products. Consumers treat pets like family members, creating strong expectations for product safety. Manufacturers must meet high quality and nutritional standards, increasing the need for reliable testing solutions. The Pet Food Testing Market benefits from this consumer shift, as pet parents demand transparency and safety assurances. It pushes companies to adopt modern testing tools for ingredients and final products. Regulatory pressure also reinforces testing protocols. Safety-focused marketing and strict labeling standards make testing a core operational priority. This behavioral change strengthens the industry’s foundation and future growth.

- For example, in September 2024, Mars Petcare announced a $1 billion investment in AI and data technologies to strengthen its global pet care business. The company uses Microsoft’s Azure AI through its RapidRead solution to support veterinary diagnostics and improve radiology efficiency. This initiative reflects Mars’ broader strategy to integrate advanced analytics into pet health services.

Stringent Food Safety Regulations and International Quality Standards Boosting Testing Demand

Regulatory agencies have tightened guidelines for contamination control and quality checks. Governments in key regions have introduced strict safety rules for pet food production and distribution. It compels manufacturers to conduct advanced microbiological and chemical testing. International trade of pet food further enforces compliance with multiple quality certifications. Companies use standardized testing procedures to reduce product recalls and brand damage. Third-party laboratories play an increasing role in maintaining compliance. The Pet Food Testing Market grows through high demand for accredited testing services. Strong regulatory frameworks encourage long-term industry investments and improve product integrity.

Growing Consumer Awareness of Nutrition, Ingredients, and Label Transparency

Consumers are more aware of the ingredients and nutritional profiles of pet food products. Rising concerns about allergens, preservatives, and toxins push companies to verify safety claims. Testing ensures accurate labeling and builds trust between brands and buyers. It supports clean-label movements and reduces risks of false claims. Manufacturers adopt advanced analytical methods to detect even low-level contaminants. Increased media coverage of contamination events has elevated consumer expectations. The Pet Food Testing Market aligns with these shifts by expanding its testing scope. Strong labeling compliance boosts brand reputation and customer loyalty.

- For example, Nestlé Purina conducts more than 100,000 quality checks daily through its seven-step global quality assurance system. This process includes supplier audits, ingredient inspections, and final product verification to ensure traceability and compliance. It reinforces strong safety standards and consumer trust across global markets.

Expansion of Premium Pet Food Segment Driving Product Testing Requirements

Premium pet food products are growing in demand due to rising disposable incomes and lifestyle changes. These products use specialized ingredients and formulations that require thorough testing. It creates a strong push for advanced quality control measures. Brands focus on ingredient traceability and safety to maintain their premium image. Any contamination issue can cause major reputation damage and financial loss. Testing ensures compliance with strict standards in premium segments. Global pet food companies invest in innovative testing solutions for competitive advantage. The Pet Food Testing Market gains strong momentum from the premiumization trend.

Market Trends

Technological Integration and Automation Enhancing Testing Precision and Efficiency

Testing processes are evolving through the integration of automated systems and smart technologies. High-throughput testing platforms reduce time and increase sample accuracy. It allows labs to process larger volumes without compromising quality. Robotics and AI-powered analytics support faster detection of contaminants and pathogens. IoT integration improves data tracking and real-time monitoring across production chains. Labs enhance predictive capabilities through machine learning applications. The Pet Food Testing Market adopts automation to meet regulatory expectations and cost efficiency. This trend reshapes testing operations and improves long-term scalability.

Rise in Genomic and Proteomic Techniques for Advanced Ingredient Verification

Modern testing methods now include DNA barcoding and proteomic analysis to confirm product authenticity. Genomic tools allow precise identification of animal proteins and allergen detection. It improves the ability to trace ingredients and avoid mislabeling issues. These methods are gaining strong acceptance in global quality control programs. Advanced molecular techniques detect even minor adulteration in raw materials. Manufacturers depend on these solutions to meet safety commitments. The Pet Food Testing Market leverages these innovations to strengthen trust. This shift toward molecular-level precision supports regulatory alignment and consumer confidence.

- For example, in 2023, a South Korean study used DNA barcoding of the COI gene to analyze commercial pet food products. The researchers found 4 out of 10 products were potentially mislabeled. The study demonstrated that COI barcoding is an effective tool for verifying species authenticity in pet food.

Increased Outsourcing of Testing Services to Accredited Laboratories

Many manufacturers now rely on third-party labs to reduce operational costs. Outsourcing offers access to specialized testing technologies and regulatory expertise. It allows brands to focus on core production while maintaining compliance. Accredited labs ensure faster turnaround times and high testing accuracy. Global trade expansion also drives the need for standardized international testing protocols. It encourages partnerships between manufacturers and global testing networks. The Pet Food Testing Market benefits from this structural shift toward outsourcing. This trend increases service demand and laboratory network expansion worldwide.

- For instance, Alex Stewart Agriculture’s DEFRA-approved pet food testing laboratory in the UK, accredited to ISO 17025, offers microbiological and chemical tests including salmonella and amino acids, ensuring compliance with EU and FEDIAF safety standards.

Focus on Clean-Label Products and Sustainability Across the Supply Chain

The demand for clean-label pet food has surged across major markets. Consumers prefer natural and organic ingredients with transparent sourcing. It encourages companies to improve traceability and sustainability practices. Testing ensures compliance with clean-label claims and verifies ingredient origin. Brands use testing to strengthen eco-friendly messaging and meet regulatory needs. This trend pushes industry players to adopt non-destructive and eco-conscious testing methods. The Pet Food Testing Market aligns with this transition to cleaner production processes. It supports sustainable supply chains and builds stronger consumer trust.

Market Challenges Analysis

High Testing Costs and Limited Infrastructure in Emerging Markets

The cost of advanced analytical testing remains high for small and medium producers. Specialized equipment, skilled labor, and lab setup demand heavy investment. It creates a gap between large global players and smaller local firms. Emerging economies lack widespread access to accredited testing labs. It restricts regulatory compliance and slows market penetration. Price-sensitive manufacturers face difficulty in maintaining consistent testing schedules. Limited infrastructure also delays turnaround time for test results. The Pet Food Testing Market faces growth barriers in regions with weak lab networks. Cost pressure reduces testing adoption in price-sensitive markets.

Complex Regulatory Frameworks and Lack of Global Standardization Affecting Operations

Pet food safety regulations differ widely across countries and regions. Manufacturers face difficulties meeting multiple compliance requirements. It complicates export strategies and increases operational burden. Constant regulatory updates also demand frequent testing process upgrades. Smaller firms often struggle to keep up with these changing standards. Inconsistent labeling rules create confusion in cross-border trade. Companies must navigate complex documentation and certification processes. The Pet Food Testing Market experiences compliance challenges that increase time and cost of market entry. These regulatory gaps create operational inefficiencies and competitive disadvantages.

Market Opportunities

Growing Demand for Specialized Testing Solutions for Functional and Novel Pet Food

The rise of functional pet food creates a strong demand for targeted testing solutions. Products with probiotics, vitamins, and novel proteins require advanced safety validation. It opens new service areas for laboratories and technology providers. Manufacturers seek precision testing to protect brand credibility. It strengthens compliance with strict labeling and ingredient claims. Partnerships between labs and producers can enhance product innovation cycles. The Pet Food Testing Market gains new opportunities in functional product segments. Expanding applications offer steady revenue growth for testing providers.

Expansion of Testing Services in High-Growth Emerging Economies

Rapid urbanization and rising pet ownership in emerging markets create new testing opportunities. Manufacturers in these regions are upgrading production to meet international standards. It drives demand for local accredited labs and advanced testing technologies. Governments support infrastructure development to ensure food safety. Companies can expand service networks to capture new regional demand. Building local capabilities lowers operational costs and improves speed. The Pet Food Testing Market can scale its reach through strategic expansions. Emerging economies provide fertile ground for sustained market development.

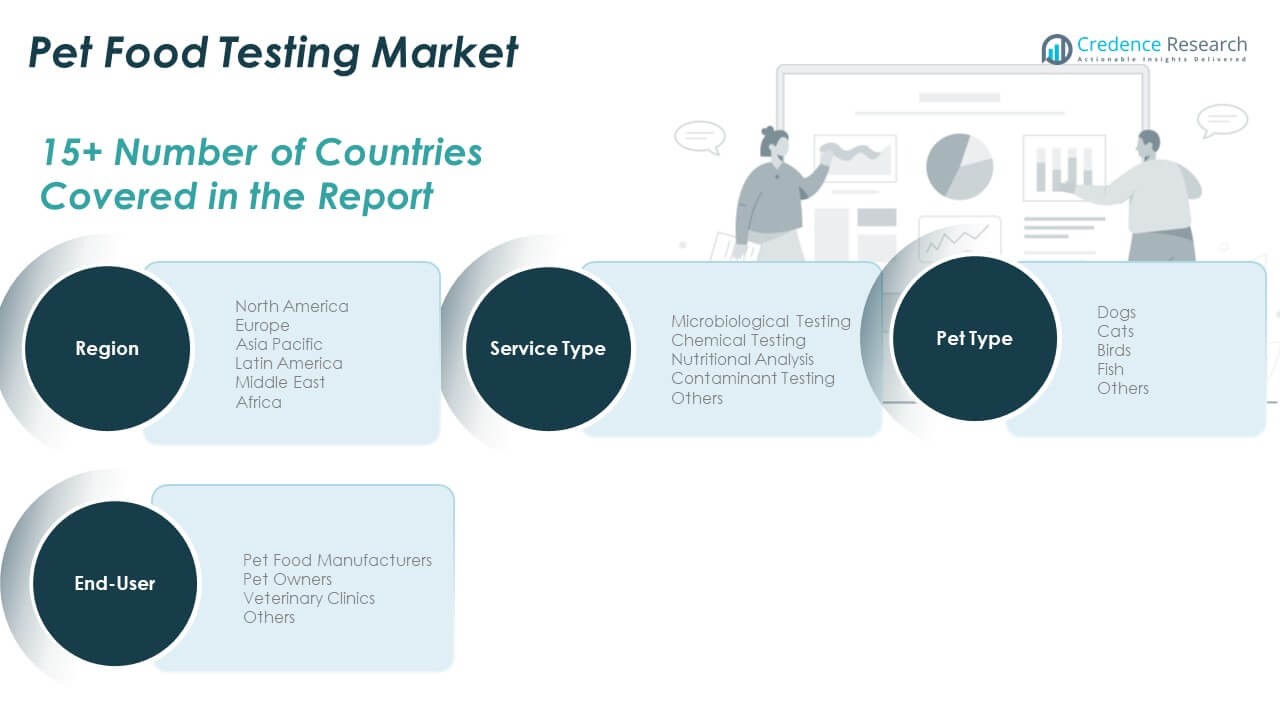

Market Segmentation Analysis:

By Service Type

Microbiological testing holds a major share due to its critical role in detecting pathogens and ensuring food safety. Chemical testing gains traction with rising concerns over preservatives, additives, and toxins. Nutritional analysis supports product labeling and premium positioning of pet food brands. Contaminant testing addresses growing awareness of heavy metals, pesticides, and other hazardous substances. It strengthens compliance with strict regulatory frameworks across developed and emerging markets. Other testing services focus on specialized parameters such as allergens and shelf-life verification.

- For example, Eurofins Scientific provides ISO/IEC 17025-accredited testing services that include PCR-based screening for key pathogens such as Salmonella, Listeria monocytogenes, and E. coli. Its laboratories support food safety and quality assurance for multiple industries, including pet food. These molecular methods strengthen product safety verification and regulatory compliance.

By Pet Type

Dogs dominate the segment due to their high population and strong spending patterns on food products. Cats represent a fast-growing category with increasing adoption in urban areas. Birds and fish segments expand steadily, supported by niche demand for customized diets. Others include small mammals and exotic pets that require tailored testing solutions. It supports a broad range of nutritional and safety evaluations across animal categories.

- For example, Royal Canin confirms that every production batch goes through ten sequential quality checks to ensure safety and consistency. Its in-house laboratories conduct around 500,000 analyses annually on cat and dog formulations. These controls support strict quality assurance across its global manufacturing sites.

By End-User

Pet food manufacturers form the largest end-user group, driven by the need to comply with regulatory and quality standards. Pet owners are becoming more aware of food safety, boosting direct testing demand. Veterinary clinics contribute significantly through preventive health checks and diet assessments. Others include research institutions and testing agencies that support specialized services. It ensures broad adoption of testing solutions across the entire value chain. The Pet Food Testing Market reflects balanced growth across all segments, supported by evolving consumer expectations and compliance needs.

Segmentation:

By Service Type

- Microbiological Testing

- Chemical Testing

- Nutritional Analysis

- Contaminant Testing

- Others

By Pet Type

- Dogs

- Cats

- Birds

- Fish

- Others

By End-User

- Pet Food Manufacturers

- Pet Owners

- Veterinary Clinics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Pet Food Testing Market size was valued at USD 1,083.60 million in 2018 to USD 1,379.39 million in 2024 and is anticipated to reach USD 2,420.60 million by 2032, at a CAGR of 7.4% during the forecast period. North America holds the largest market share of 31.1%, supported by a strong regulatory framework and advanced testing infrastructure. High pet ownership rates and consumer awareness create consistent demand for testing services. It benefits from widespread use of microbiological and chemical testing methods to ensure product safety. Pet food manufacturers in the U.S. and Canada adopt strict compliance strategies to meet FDA and AAFCO standards. Rising demand for premium and organic pet food increases testing frequency. Strong distribution networks and lab expansions improve testing coverage. High investments in advanced diagnostic technologies strengthen market competitiveness.

Europe

The Europe Pet Food Testing Market size was valued at USD 778.40 million in 2018 to USD 965.42 million in 2024 and is anticipated to reach USD 1,607.51 million by 2032, at a CAGR of 6.7% during the forecast period. Europe holds a 21.8% market share and benefits from strict safety regulations under EFSA and FEDIAF frameworks. Strong consumer preference for sustainable and traceable ingredients boosts testing adoption. It maintains high testing volumes across premium and private-label brands. The region focuses on clean-label product claims, driving demand for contaminant and nutritional testing. Germany, the UK, and France lead with advanced testing capabilities. Manufacturers prioritize quality assurance and product differentiation. Lab consolidation and technology integration enhance operational efficiency.

Asia Pacific

The Asia Pacific Pet Food Testing Market size was valued at USD 599.20 million in 2018 to USD 810.65 million in 2024 and is anticipated to reach USD 1,591.98 million by 2032, at a CAGR of 8.9% during the forecast period. Asia Pacific accounts for 18.3% of the global market and is the fastest-growing region. Rising disposable incomes and urban pet adoption support rapid market expansion. It benefits from growing local manufacturing capacity and export activity. Regulatory bodies strengthen food safety standards across key economies such as China, Japan, and India. Manufacturers adopt advanced testing to align with international trade rules. Demand for nutritional and contaminant testing increases in premium product categories. Regional investments in laboratory infrastructure accelerate testing availability.

Latin America

The Latin America Pet Food Testing Market size was valued at USD 190.40 million in 2018 to USD 242.96 million in 2024 and is anticipated to reach USD 398.28 million by 2032, at a CAGR of 6.5% during the forecast period. Latin America holds a 5.3% market share and shows steady testing adoption in emerging economies. Brazil leads with growing pet ownership and rising investments in pet food production. It benefits from increasing alignment with global safety and labeling standards. Contaminant and nutritional testing see strong adoption among large manufacturers. Infrastructure development improves access to testing facilities in urban centers. Demand for certified testing services grows among exporters. Government support for safety compliance strengthens market structure.

Middle East

The Middle East Pet Food Testing Market size was valued at USD 86.80 million in 2018 to USD 103.09 million in 2024 and is anticipated to reach USD 159.04 million by 2032, at a CAGR of 5.7% during the forecast period. The region represents 2.1% of the global market and shows gradual expansion. Rising pet ownership in GCC countries drives steady demand for testing services. It benefits from increasing imports of premium pet food, creating the need for compliance testing. Governments strengthen regulatory oversight to protect consumer interests. Growth in specialized testing services supports regional product safety. Companies adopt basic testing methods to align with international trade partners. Infrastructure modernization improves testing accessibility across major cities.

Africa

The Africa Pet Food Testing Market size was valued at USD 61.60 million in 2018 to USD 103.85 million in 2024 and is anticipated to reach USD 157.55 million by 2032, at a CAGR of 5.0% during the forecast period. Africa accounts for 2.0% of the global market with growing but uneven adoption rates. Rising pet population and increased import activity drive demand for safety testing. It experiences regulatory improvements aimed at protecting public and animal health. Limited infrastructure challenges testing expansion in rural regions. Urban centers in South Africa and Egypt show stronger testing adoption. Manufacturers and distributors seek accredited labs to meet export standards. Strengthening regulatory frameworks creates growth potential for future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Eurofins Scientific

- SGS SA

- Intertek Group plc

- Bureau Veritas

- ALS Limited

- TÜV SÜD

- Merieux NutriSciences

- Microbac Laboratories, Inc.

- Romer Labs

- NSF International

- Neogen Corporation

- Symbio Laboratories

- Sciex

- Covance Inc.

- IDEXX Laboratories, Inc.

Competitive Analysis:

The Pet Food Testing Market is characterized by strong competition among global and regional players. It features established companies with advanced testing technologies, global lab networks, and extensive regulatory expertise. Key players such as Eurofins Scientific, SGS SA, Intertek Group plc, Bureau Veritas, ALS Limited, and TÜV SÜD hold a significant market share through strategic partnerships and service expansions. Companies focus on portfolio diversification across microbiological, chemical, and contaminant testing. Investments in automation, molecular testing, and digital platforms strengthen operational efficiency. Mergers, acquisitions, and geographic expansion help widen customer reach. Regional labs compete through cost-effective solutions and faster turnaround times. Compliance with international safety standards remains a key differentiator, enabling leading players to secure long-term contracts with major pet food manufacturers. Strategic innovation and regulatory expertise maintain a high entry barrier for new entrants, supporting strong market consolidation and sustained competitive intensity.

Recent Developments:

- In September 2025, Mérieux NutriSciences announced the completion of its global acquisition of Bureau Veritas’ Food Testing Business. This strategic acquisition spans across 15 countries, including markets in the Americas, Africa, and Asia Pacific, and adds over 2,000 professionals and specialized laboratories focused on food safety testing, including segments such as pet food safety.

- In July 2025, Eurofins Scientific expanded its global testing infrastructure by establishing six new laboratories and 19 blood collection points as part of its ongoing strategic growth initiatives. These new facilities enhance Eurofins’ capabilities in food and feed testing across North America and Asia, addressing the rising demand for high-quality analytical services within the pet food testing segment.

- In October 2024, Mérieux NutriSciences finalized the acquisition of Bureau Veritas’ global food testing business for approximately €360 million (USD 393.4 million). This acquisition, encompassing 34 labs across 15 countries, significantly enhances Mérieux NutriSciences’ presence in pet and animal feed testing domains, especially in the Asia-Pacific and Canadian regions.

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Pet Type and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of advanced microbiological and chemical testing capabilities will strengthen industry quality standards.

- Growing regulatory scrutiny will drive higher compliance adoption across all production stages.

- Rising consumer demand for premium and clean-label pet food will increase testing volume.

- Automation, AI, and molecular diagnostic tools will reshape laboratory operations and accuracy.

- Strategic collaborations between testing labs and manufacturers will accelerate innovation.

- Regional infrastructure development will expand access to certified testing in emerging markets.

- Specialized testing for functional and novel ingredients will open new revenue streams.

- Strict labeling regulations will create strong demand for nutritional verification testing.

- Outsourcing to accredited laboratories will increase, supporting operational efficiency.

- Global trade growth will enhance the need for internationally standardized testing frameworks.