Market Overview

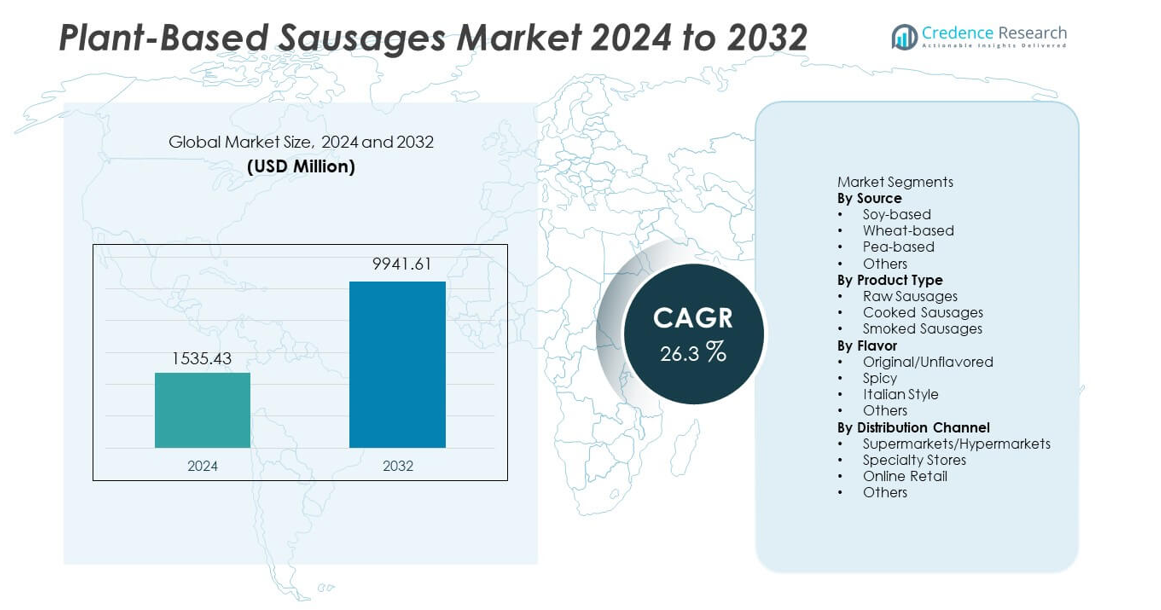

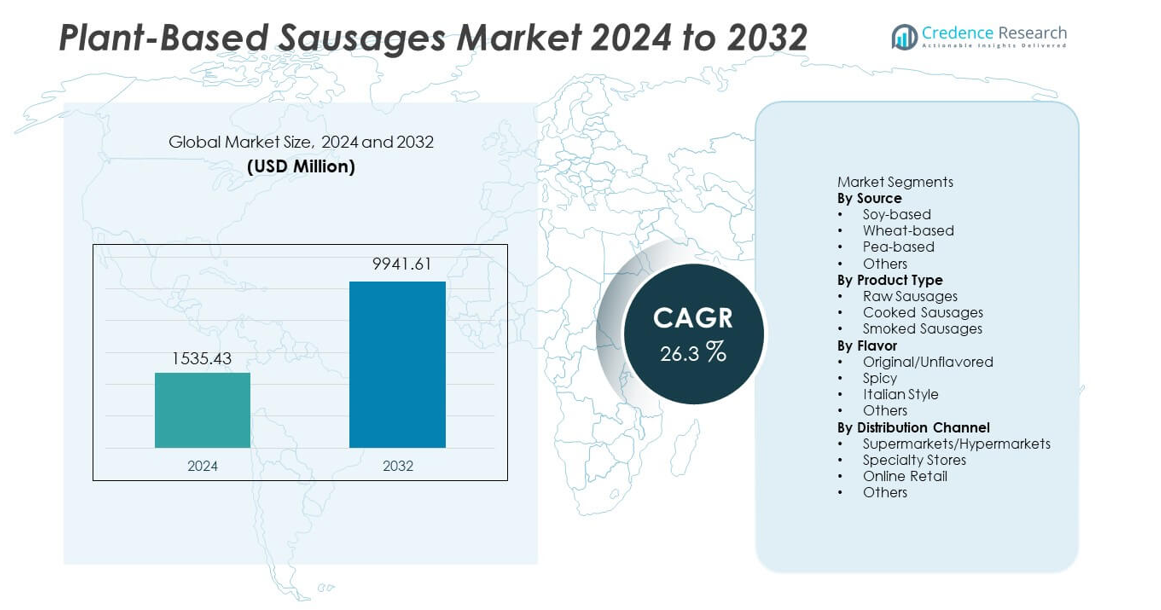

The Plant-Based Sausages Market reached USD 1,535.43 million in 2024 and is projected to grow to USD 9,941.61 million by 2032, expanding at a CAGR of 26.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant-Based Sausages Market Size 2024 |

USD 1,535.43 million |

| Plant-Based Sausages Market, CAGR |

26.3% |

| Plant-Based Sausages Market Size 2032 |

USD 9,941.61 million |

The Plant-Based Sausages market is shaped by leading innovators such as Beyond Meat, Impossible Foods, Nestlé’s Garden Gourmet, The Vegetarian Butcher, MorningStar Farms, Tofurky, Lightlife Foods, Quorn Foods, Alpha Foods, and Moving Mountains, all of which focus on advanced protein engineering, wider flavor portfolios, and stronger retail and foodservice partnerships. These companies expand global reach through upgraded textures, clean-label recipes, and regional product customization. North America leads the market with 36% share, driven by strong flexitarian adoption, large supermarket presence, and active restaurant collaborations, making it the dominant region in accelerating product penetration and consumer acceptance.

Market Insights

- The Plant-Based Sausages market reached USD 1,535.43 million in 2024 and will grow to USD 9,941.61 million by 2032 at a 26.3% CAGR, driven by strong consumer adoption.

- Demand rises due to health awareness, cleaner protein choices, and strong performance of soy-based products, which hold 42% share supported by stable texture and broad consumer acceptance.

- Trends highlight rapid flavor innovation, improved extrusion technologies, and growing interest in spicy and Italian variants, while cooked sausages lead product type with 47% share.

- Competition intensifies as global brands expand distribution and strengthen product realism through advanced processing, while cost pressures and texture gaps remain key restraints.

- North America holds 36% share, Europe has 31%, and Asia Pacific accounts for 22%, driven by retail expansion and rising flexitarian diets across major urban markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Soy-based sausages hold the dominant position with 42% share, driven by strong protein density, wider consumer acceptance, and mature supply chains that support large-scale production. Soy ingredients deliver firm texture and neutral taste, which help manufacturers develop products that match traditional pork or beef formats. Pea-based sausages gain steady traction due to allergen-friendly appeal and cleaner labels, while wheat-based formats retain moderate demand in bakery-linked brands. Other emerging plant sources expand niche demand, yet soy continues to lead the segment due to consistent performance in flavor retention, cooking stability, and cost efficiency across retail and foodservice channels.

- For instance, Impossible Foods states that its Impossible Sausage contains protein and uses leghemoglobin to deliver meat-like aroma validated through sensory scores with trained panelists.

By Product Type

Cooked sausages lead this segment with 47% share, supported by their ready-to-use format, longer shelf life, and strong presence in supermarkets and quick-service restaurants. These products reduce preparation time and fit well into rapid meal routines, which boosts adoption among younger consumers. Raw sausages gain interest from home cooks who prefer flexible seasoning and texture control, while smoked variants attract buyers seeking richer flavor profiles. Cooked options remain the dominant choice because they meet convenience needs, align with modern lifestyle trends, and offer consistent quality across various plant-protein bases.

- For instance, Lightlife launched a plant-based bratwurst sausage as part of its new line of plant-based products, which were developed to deliver the sensory experience consumers crave from traditional meat.

By Flavor

Original or unflavored sausages hold the largest share at 39%, driven by demand from health-focused buyers and foodservice operators who prefer neutral profiles for versatile use in multiple recipes. This flavor segment supports broad adoption because it allows seasoning customization and reduces concerns over strong or unfamiliar tastes. Spicy and Italian-style flavors expand quickly as brands experiment with regional and bold seasonings, appealing to adventurous buyers. However, original variants maintain dominance because they suit both traditional and fusion meals, align with clean-label preferences, and perform well in high-volume retail and institutional channels.

Key Growth Drivers

Rising Shift Toward Plant-Based Protein Consumption

Consumers move toward healthier and ethical eating patterns, which drives strong demand for plant-based sausages. Health awareness, reduced meat intake, and preference for cholesterol-free protein influence buying choices across retail and foodservice channels. Brands respond with improved taste, texture, and clean-label formulas that align with wellness trends. This shift expands the customer base beyond vegans to flexitarians, who now form the largest growth group. Broader acceptance of plant-based diets supports steady category expansion and strengthens product presence in mainstream supermarkets and quick-service outlets.

- For instance, Beyond Meat confirmed that each Beyond Sausage link contains a substantial amount of plant protein and less saturated fat than traditional pork sausage per a standard serving, supported by protein digestibility data evaluated under recognized testing methods.

Advancements in Flavor, Texture, and Processing Technologies

Manufacturers invest in advanced extrusion, fermentation, and fat-structuring technologies to create products that mimic traditional sausages. These improvements enhance bite, juiciness, and aroma, which boost consumer satisfaction and repeat purchases. Better ingredient engineering also enables wider flavor profiles and reduced reliance on artificial additives. Foodservice operators adopt these products more easily when texture accuracy improves, especially in grilling and cooking applications. Continuous innovation raises product credibility, making plant-based sausages competitive with premium meat options.

- For instance, Redefine Meat documented that its Plant-Based Bratwurst uses multi-nozzle 3D food printing to replicate anisotropic meat fiber alignment across cooked samples, allowing for a realistic texture and mouthfeel without compromising on quality or sustainability.

Expansion of Retail and Foodservice Distribution Networks

Supermarkets, convenience stores, and online platforms increase shelf space for plant-based sausages, enabling broader reach across regions. Foodservice chains introduce meat-free menu options to meet rising customer expectations, which strengthens category visibility. Promotions, bundle offers, and strategic partnerships accelerate product trials among new buyers. Improved cold-chain logistics and co-manufacturing agreements also support large-scale supply. This expansion enhances product accessibility and creates strong volume growth across both developed and emerging markets.

Key Trends & Opportunities

Growing Demand for Clean-Label and Allergen-Friendly Formulations

Consumers prefer plant-based sausages with minimal additives, transparent ingredient lists, and allergen-friendly protein sources such as pea and fava bean. Brands shift toward natural binders, fermented flavors, and organic seasoning blends to match this trend. This change opens opportunities for manufacturers to target health-conscious buyers seeking simple and recognizable components. Clean-label demand also encourages premium pricing, supporting higher margins for differentiated products. As regulatory scrutiny around additives increases, cleaner formulations offer long-term competitive advantage.

- For instance, Field Roast’s plant-based sausages use whole-food ingredients like eggplant, onions, and herbs and spices instead of chemical binders; one sausage provides a significant amount of protein and dietary fiber.

Rising Innovation in Regional and Culinary Flavor Profiles

Brands develop global and region-inspired flavors to attract consumers who seek variety beyond traditional sausage formats. Spicy, smoky, and herb-infused blends gain traction, while Asian, Mediterranean, and Latin flavors enter mainstream shelves. This trend supports product diversification and encourages wider adoption among non-vegetarian shoppers looking for novelty. Foodservice players also integrate these variants into fusion dishes and specialty menus. Flavor-led innovation creates opportunities to capture younger consumers and expand brand loyalty through differentiated taste experiences.

- For instance, OZO Foods confirmed that its plant-based sausage lineup includes various flavors, and each serving provides a good source of pea and rice protein, with the company using a fermentation step involving shiitake mushrooms to enhance flavor and create a desirable eating experience.

Key Challenges

High Production Costs and Ingredient Price Volatility

Plant-based sausages rely on specialized proteins, natural binders, and advanced processing methods that raise production expenses. Ingredient fluctuations for soy, pea, and canola oil influence pricing stability, which limits competitiveness in cost-sensitive markets. Smaller manufacturers struggle to achieve economies of scale, leading to inconsistent retail pricing. These cost pressures affect profit margins and slow penetration in regions where traditional meat remains cheaper. Addressing supply chain efficiencies remains essential for long-term growth.

Taste, Texture, and Consumer Perception Barriers

Although technology improves product quality, many consumers still find plant-based sausages different from traditional options. Gaps in juiciness, chew, and flavor authenticity influence repeat purchases. Negative perceptions about processed plant foods also limit adoption among health-minded buyers. Meat-eating consumers compare these products directly with animal-based sausages, raising expectations for sensory accuracy. Brands must balance clean formulas with taste performance to overcome these perception hurdles and drive sustained market acceptance.

Regional Analysis

North America

North America leads the market with 36% share, supported by strong flexitarian adoption, advanced retail distribution, and high visibility of plant-based brands. Consumers favor clean-label protein options, which drives steady demand across supermarkets and online channels. Foodservice chains expand meat-free menus, increasing product penetration in fast-casual and quick-service formats. Innovation in texture, fat structuring, and flavor systems also accelerates growth. Regulatory support for sustainable protein solutions further strengthens market expansion across the United States and Canada.

Europe

Europe holds 31% share, driven by strong regulatory backing for sustainable foods, high vegan population concentration, and rising environmental awareness. Germany, the United Kingdom, and the Netherlands show strong uptake due to developed plant-based ecosystems and wide supermarket listings. Manufacturers benefit from supportive labeling norms and government programs promoting alternative protein innovation. Foodservice operators across major cities add plant-based sausage options to meet rising flexitarian preference. Growth improves as brands enhance sensory performance and diversify culinary flavor offerings.

Asia Pacific

Asia Pacific accounts for 22% share, fueled by rapid urbanization, expanding middle-class spending, and rising health-conscious behavior. Consumers adopt plant-based sausages due to interest in low-fat protein and growing awareness of sustainable diets. Major markets such as China, Japan, and Australia witness strong retail rollout and increasing foodservice trials. Local producers develop soy- and pea-based blends tailored to regional preferences. E-commerce channels strengthen distribution reach, helping global and regional brands scale quickly across diverse markets.

Latin America

Latin America captures 7% share, supported by rising interest in meat alternatives among younger consumers and stronger visibility in major supermarkets. Brazil, Mexico, and Argentina drive demand as plant-based diets gain traction in urban centers. Local brands introduce cost-effective products using regional protein sources, improving affordability. Growing exposure through quick-service restaurants and cafés increases trial rates. Marketing campaigns highlighting health and environmental benefits encourage broader consumer acceptance across the region.

Middle East & Africa

The Middle East & Africa region holds 4% share, expanding steadily as awareness of plant-based nutrition rises across urban populations. Demand strengthens in the UAE, South Africa, and Saudi Arabia due to premium retail formats and increasing expatriate influence. Foodservice operators incorporate meat-free options to meet shifting dietary expectations. However, higher product pricing and limited local manufacturing slow wider adoption. Growth improves as brands expand halal-certified plant-based sausages and strengthen cold-chain distribution networks.

Market Segmentations:

By Source

- Soy-based

- Wheat-based

- Pea-based

- Others

By Product Type

- Raw Sausages

- Cooked Sausages

- Smoked Sausages

By Flavor

- Original/Unflavored

- Spicy

- Italian Style

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Beyond Meat, Impossible Foods, Nestlé (Garden Gourmet), The Vegetarian Butcher, MorningStar Farms, Tofurky, Lightlife Foods, Quorn Foods, Alpha Foods, and Moving Mountains. These companies focus on improving texture, flavor, and clean-label profiles to meet rising flexitarian demand. Leading brands invest in extrusion and fat-structuring technologies to enhance juiciness and authenticity, which helps them compete with traditional meat sausages. Many players expand distribution across supermarkets, online platforms, and foodservice chains to strengthen visibility. Partnerships with quick-service restaurants accelerate category penetration, while limited-edition flavors and regional variants support product diversification. Companies also invest in sustainable ingredient sourcing and advanced protein blends to reduce formulation costs. R&D efforts continue to target allergen-friendly formulations, improved cooking performance, and wider application in global cuisines, ensuring a competitive edge in a rapidly expanding alternative protein market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sushi Mushi

- New Wave Foods

- Kuleana

- Sophie’s Kitchen

- Akua

- Loma Linda

- Good Catch Foods

- Wild Type

- TUNO

- Ocean Hugger Foods

Recent Developments

- In August 2024, Akua shut down after seven years, citing logistical issues and plant-based meat declines, despite earlier kelp burger expansions.

- In May 2023, Current Foods (formerly Kuleana) was acquired by Wicked Kitchen to bolster plant-based raw seafood offerings.

Report Coverage

The research report offers an in-depth analysis based on Source, Product Type, Flavor, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more consumers adopt flexitarian and low-meat diets.

- Product quality will improve with better fat-structuring and extrusion technologies.

- Clean-label and allergen-friendly formulations will gain stronger preference.

- Foodservice chains will expand plant-based sausage options across global menus.

- Regional flavor innovation will support higher customer engagement and repeat buying.

- Retailers will increase shelf space for premium and value-tier plant-based products.

- Supply chain optimization will help reduce production costs and improve pricing.

- Partnerships between manufacturers and ingredient companies will accelerate R&D progress.

- Emerging markets will show faster adoption due to rising health awareness.

- Sustainability messaging will strengthen brand loyalty and shape long-term market growth.