Market Overview

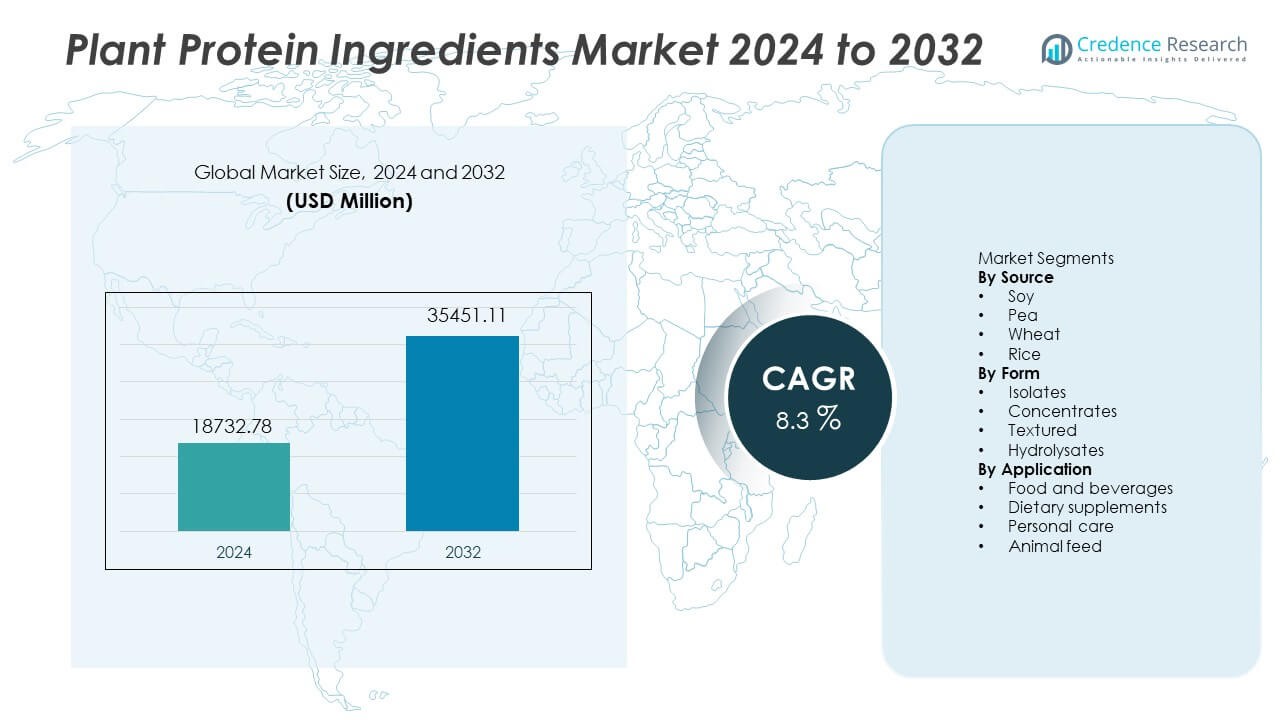

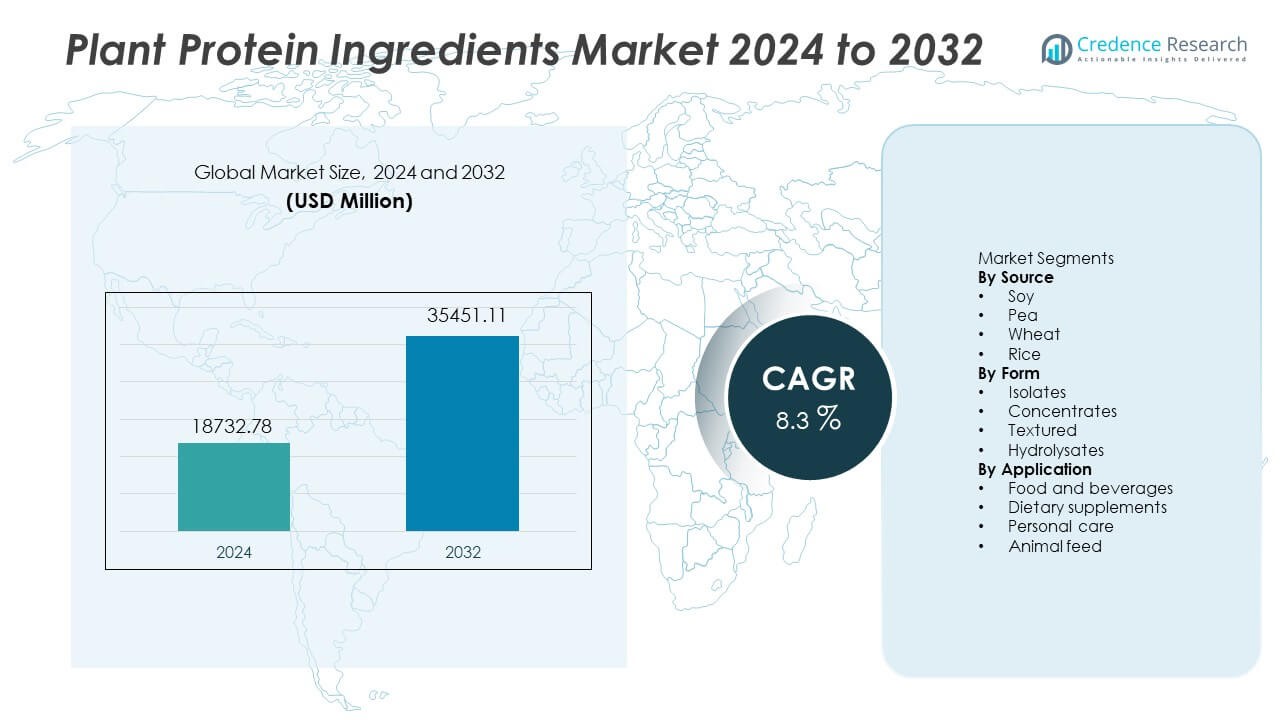

The Plant Protein Ingredients Market was valued at USD 18,732.78 million in 2024 and is expected to reach USD 35,451.11 million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Protein Ingredients Market Size 2024 |

USD 18,732.78 Million |

| Plant Protein Ingredients Market, CAGR |

8.3% |

| Plant Protein Ingredients Market Size 2032 |

USD 35,451.11 Million |

Cargill, Archer Daniels Midland Company, Roquette Frères, Kerry Group, Ingredion, Glanbia, DuPont Nutrition & Biosciences, Tate & Lyle, Burcon NutraScience, and Axiom Foods lead the competitive environment in the Plant Protein Ingredients market. These players expand soy and pea portfolios, invest in allergen-free solutions, and strengthen supply partnerships with major food brands. North America remains the leading region with a 32% share, supported by high adoption of plant-based meat and dairy alternatives across retail and foodservice channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plant Protein Ingredients market reached USD 18,732.78 million in 2024 and is set to touch USD 35,451.11 million by 2032 at a CAGR of 8.3.

- Demand rises due to strong plant-based diets and sustainability goals, while soy leads the source segment with a 38% share supported by established supply and wider food use.

- Key trends include expansion of dairy and meat alternatives, growth in clean-label and allergen-free products, and rising sports nutrition adoption among young consumers.

- Competition remains strong as Cargill, ADM, Roquette, and Ingredion invest in new protein formats and better taste performance, while smaller firms develop novel sources such as chickpea.

- North America leads with a 32% share, followed by Europe at 28% and Asia Pacific at 27%, while isolates hold a 48% share by form, driven by high purity and wide product integration.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Source

Soy holds a 38% share of the source segment and leads demand. Soy dominates due to wide availability and balanced amino acid content. Pea ranks second and grows through allergen-free and clean-label use. Wheat and rice serve niche functions in specialized blends. Food makers rely on soy for consistent texture and protein quality. Strong global supply chains keep soy competitively priced versus other plant sources. Growing food security programs also strengthen soy usage in major regions.

- For instance, Cargill operates numerous soybean processing facilities worldwide and processes a substantial amount of soybeans each year. The company continues to invest in expanding and modernizing its global oilseeds operations to meet growing demand.

By Form

Isolates account for a 48% share of the form segment and lead adoption. Isolates provide high purity and neutral sensory traits across product formats. Concentrates support value-focused buyers that need lower formulation cost. Textured proteins enable appealing meat analog structures in plant burgers. Hydrolysates serve rapid absorption needs in sports and medical nutrition. Food and beverage companies prioritize isolates for consistent solubility. Rising protein fortification in ready beverages continues to support isolate demand.

- For instance, Ingredion made a significant investment to transform its Nebraska facility to produce plant protein isolates, which substantially increased its manufacturing capabilities and expanded its product portfolio.

By Application

Food and beverages hold a 52% share of the application segment and remain dominant. Demand grows across dairy substitutes, meat alternatives, and functional drinks worldwide. Dietary supplements attract users focused on fitness and wellness lifestyles. Personal care formulators adopt plant proteins for clean cosmetic claims. Animal feed uses plant proteins to reduce reliance on traditional feed sources. Food brands choose plant proteins to replace animal ingredients. Expanding vegan product portfolios reinforce food and beverage leadership.

Key Growth Drivers

Rising Shift Toward Plant-Based Diets

Global consumers shift diets to reduce animal protein. Plant proteins support health claims and clean labels. Food brands expand dairy and meat alternative lines to meet new demand. Growth comes from wider retail access and improved product taste. Social media raises awareness of plant nutrition among young users. Fast adoption in urban markets supports steady industry expansion.

- For instance, Beyond Meat, Inc. made its plant-based burger and chicken products available in numerous retail outlets in the United States and across many international retail outlets as of the end of 2024.

Sustainability and Ethical Sourcing Focus

Food producers lower emissions by replacing animal ingredients. Plant proteins need fewer resources and offer better land use. Companies invest in sustainable crops to meet climate goals. Ethical farming improves brand trust and supports long term supply. Policy support in major regions encourages lower carbon protein choices. These actions help scale plant protein sourcing.

- For instance, Unilever PLC committed to regenerative-agriculture projects and piloted four crop-sourcing initiatives to improve soil health and lower carbon footprint.

Expanding Sports and Nutrition Demand

Fitness users choose plant proteins for muscle recovery. Brands develop blends to match amino needs. Product makers offer ready drinks and bars for easy intake. Growth increases through online channels and gym partnerships. Medical nutrition segments consider plant sources for easy digestion. Rising youth interest in sports enlarges the buyer base.

Key Trends and Opportunities

Clean Label and Allergen-Free Innovation

Producers remove additives to meet clean label rules. Allergen-free pea and rice proteins attract sensitive consumers. Companies test natural flavor solutions to reduce sugar use. Multinational food groups invest in simple ingredient lists for trust. Clean snacks and ready drinks show strong repeat buying. These shifts create openings for new private labels.

- For instance, Cargill Incorporated expanded its alternative protein portfolio in 2024 through new collaborations and the launch of innovative textured pea protein solutions that blend pea and wheat to achieve a meat-like texture.

Growth of Meat and Dairy Alternatives

Manufacturers design plant formats that mimic animal texture. Advanced extrusion improves bite and chew in meat substitutes. Dairy lines expand into cheese, creamers, and ice cream. Supermarkets give more shelf space for plant items. Foodservice chains add vegan menus in major cities. This trend drives large volume orders for suppliers.

- For instance, Impossible Foods uses high-moisture extrusion and launched new plant-based chicken and pork alternatives in prior years.

Key Challenges

Taste and Texture Limitations

Some plant proteins show strong flavor notes. Product developers mix sources to improve mouthfeel. Texture gaps slow adoption for some meat alternatives. Flavor masking raises cost for budget items. Producers need new processes to reach broader consumers. These concerns challenge repeat buying when options taste uneven.

Supply Chain and Cost Pressure

Crop yields change with weather risks across regions. Price swings affect margins for food brands. Companies depend on stable sourcing for big product lines. Cost pressure limits access in price-sensitive markets. Investment in local farming reduces foreign exposure. These limits challenge long term contracts and regular supply.

Regional Analysis

North America

North America holds a 32% share of the Plant Protein Ingredients market and continues to expand through strong adoption of plant-based meat, dairy alternatives, and functional beverages. Foodservice chains add vegan products across major cities, while retail launches increase shelf visibility. Sports nutrition brands promote plant-based formulations across online channels and fitness stores. The United States leads with high consumer awareness and strong plant-focused food startups. Canada expands demand through sustainability programs and growing vegan lifestyles. Investments in pea and soy processing support long-term domestic supply.

Europe

Europe accounts for a 28% share of the market driven by strong regulatory support for sustainable proteins and cleaner food categories. Countries such as Germany, the United Kingdom, and the Netherlands show strong vegan trends influenced by environmental and ethical awareness. Large food manufacturers reformulate dairy and bakery products with plant proteins to improve sustainability performance. Government support for lower-carbon food production encourages switching from animal protein. Clean label rules also promote natural ingredient profiles. Growing retail sales of plant drinks strengthen future protein sourcing.

Asia Pacific

Asia Pacific holds a 27% share supported by rising plant-based food consumption in China, India, Japan, and South Korea. Younger consumers adopt plant proteins to manage wellness and fitness goals. Local dairy alternatives increase usage of soy and rice ingredients due to familiar taste and cultural acceptance. Food manufacturers invest in plant-based snacks and beverages across urban markets. Expanding e-commerce improves distribution for dietary supplements. Rising food security programs in major economies also encourage plant protein sourcing. Growing sports nutrition participation strengthens long-term demand.

Latin America

Latin America holds a 7% share of the market and grows as countries adopt plant-based beverages and fortified foods. Brazil and Mexico lead demand supported by rising fitness activities and expanding health-focused retail channels. Food manufacturers integrate soy and pea proteins into snacks and dairy-style drinks targeting younger users. Agricultural strengths encourage cost-effective sourcing for soy-based formulation. Urban demand for lactose-free and vegan beverages expands retail shelf space. Growing awareness of sustainability encourages gradual switch from animal proteins.

Middle East and Africa

The Middle East and Africa represent a 6% share strengthened by increasing demand for imported plant-based foods, dairy alternatives, and sports nutrition. Gulf countries witness strong foodservice uptake and rising vegan lifestyle interest among residents and expatriates. African markets adopt plant proteins in nutrition programs supporting dietary needs. Limited local processing requires reliance on international suppliers and global ingredient brands. Food manufacturers introduce plant-based dairy to meet lactose-free demand. Investments in local agriculture support long-term protein availability as market maturity improves.

Market Segmentations:

By Source

By Form

- Isolates

- Concentrates

- Textured

- Hydrolysates

By Application

- Food and beverages

- Dietary supplements

- Personal care

- Animal feed

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the market is Cargill, Archer Daniels Midland Company, Roquette Frères, Kerry Group, Ingredion, Glanbia, DuPont Nutrition & Biosciences, Tate & Lyle, Burcon NutraScience, and Axiom Foods remain the main companies shaping competition in the Plant Protein Ingredients market. The competitive landscape reflects active investment in new processing technologies, higher protein purity, and better flavor performance in plant-based applications. Companies expand capacity in soy and pea protein processing to secure long-term supply for global food manufacturers. Strategic partnerships with dairy alternative, meat substitute, and sports nutrition brands help strengthen market presence. Firms also broaden product portfolios by adding allergen-free and non-GMO offerings to meet clean label priorities. Sustainability programs and local crop sourcing become key differentiators as buyers move toward low-carbon production. New entrants test alternative protein sources like fava and chickpea to broaden market choice and create future innovation paths.

Key Player Analysis

- Cargill

- Archer Daniels Midland Company

- Roquette Frères

- Kerry Group

- Ingredion

- Glanbia

- DuPont Nutrition & Biosciences

- Tate & Lyle

- Burcon NutraScience

- Axiom Foods

Recent Developments

- In July 2024, Ingredion launched new pea protein under its brand VITESSENCE Pea 100 HD, optimized for cold-pressed bars and expanded its line of protein fortification solutions.

- In February 2024, Roquette Frères launched a new line of high-purity plant protein isolates and hydrolysates, including NUTRALYS® H85 and NUTRALYS® Pea F853M.

- In October 2023, Tyson Foods, Inc. partnered with Protix, a leading producer of insect-based ingredients, to advance sustainable protein production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Future expansion will come from wider plant-based meat and dairy launches.

- Food companies will invest in improved taste and neutral flavor profiles.

- Sports nutrition will grow as young users seek plant protein recovery.

- Allergen-free options will expand demand in sensitive consumer groups.

- Brands will add local sourcing to reduce global supply risks.

- Product makers will adopt new crops such as fava and chickpea.

- Advanced extrusion will improve texture in meat alternative formats.

- Retail shelves will expand plant-based ready meals and drinks.

- Clean label rules will push natural ingredients in global markets.

- Regional processing facilities will strengthen long-term production capacity.

Market Segmentation Analysis:

Market Segmentation Analysis: