Market Overview

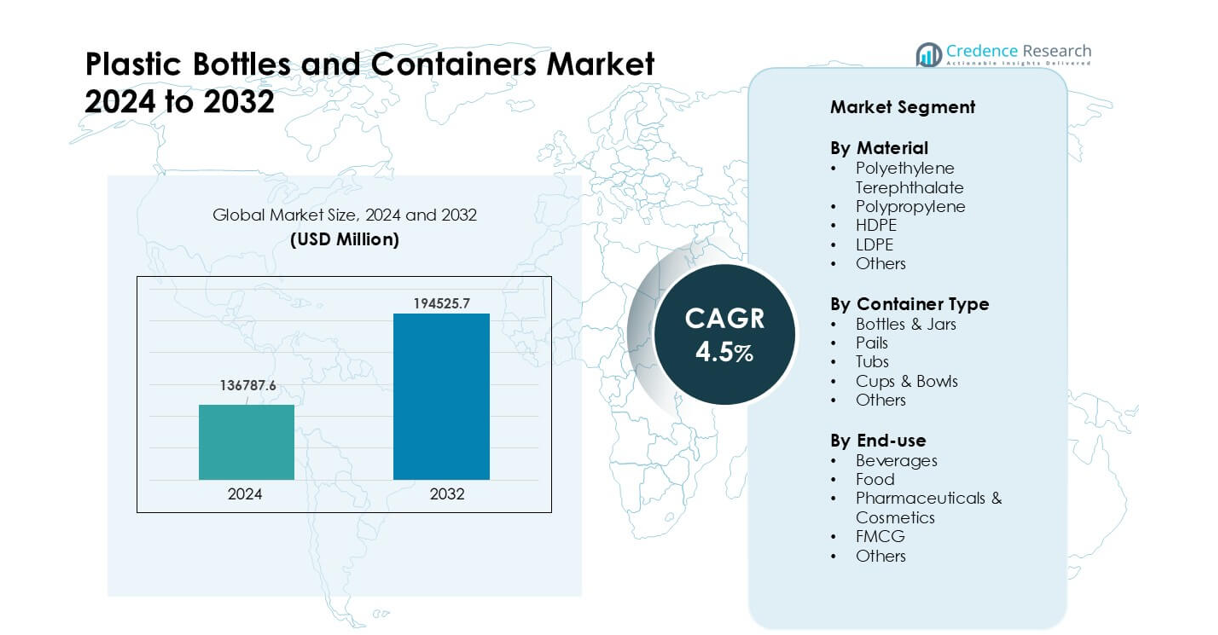

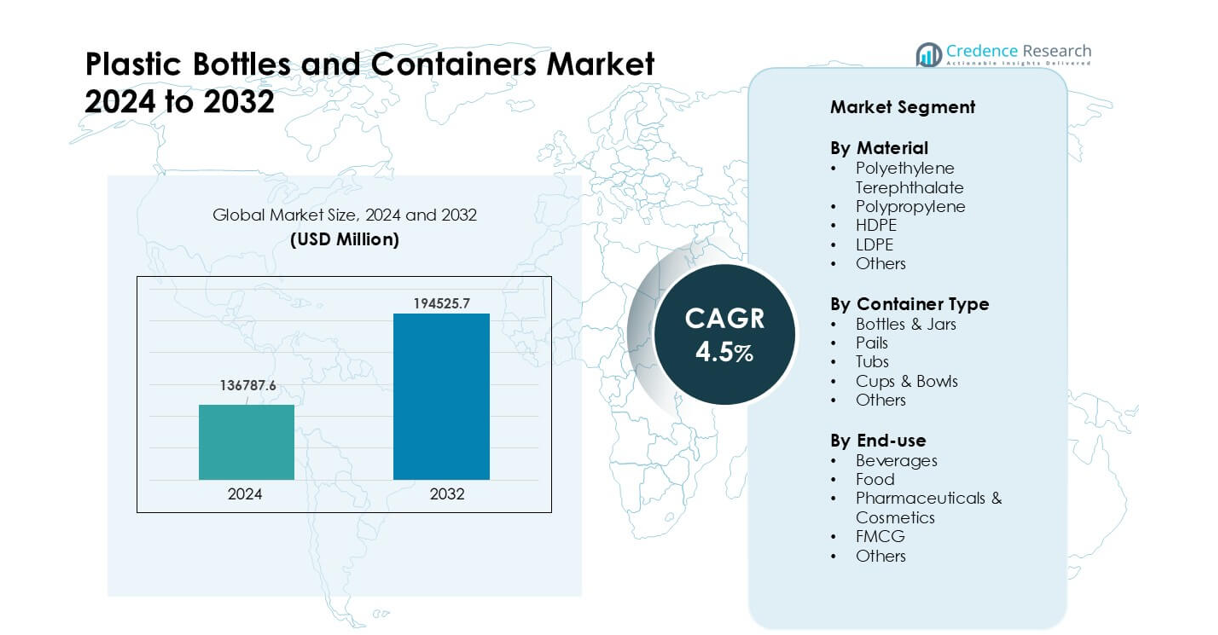

Plastic Bottles and Containers Market was valued at USD 136787.6 million in 2024 and is anticipated to reach USD 194525.7 million by 2032, growing at a CAGR of 4.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Bottles and Containers Market Size 2024 |

USD 136787.6 million |

| Plastic Bottles and Containers Market, CAGR |

4.5% |

| Plastic Bottles and Containers Market Size 2032 |

USD 194525.7 million |

The Plastic Bottles and Containers Market features key players such as Greiner Packaging, Zhuhai Zhongfu Industrial, Winpak, Graham Packaging, Huhtamaki, Plastipak Packaging, Visy, Pretium Packaging, ALPLA, and Amcor. These companies compete through innovations in lightweight designs, high-clarity PET solutions, recycled-content integration, and advanced molding technologies that support food, beverage, pharmaceutical, and FMCG applications. Asia Pacific emerged as the leading region in 2024 with about 39% share, driven by strong manufacturing capacity, rising packaged beverage consumption, and rapid expansion of FMCG and healthcare products across major economies.

Market Insights

- The Plastic Bottles and Containers Market reached USD 6 million in 2024 and is projected to grow at a 4.5% CAGR of through 2032.

- Strong demand for PET bottles drove segment leadership with about 41% share, supported by high use in beverages, food, and personal care items.

- Rising adoption of rPET, lightweight designs, and mono-material structures shaped key market trends, with FMCG and pharmaceutical packaging showing faster growth.

- Competition intensified among major players focusing on recycled-content integration, advanced molding systems, and long-term supply partnerships with beverage and healthcare brands.

- Asia Pacific led the global market with nearly 39% share, followed by North America at 32%, driven by strong consumption of packaged beverages and expanding FMCG demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Polyethylene terephthalate held the dominant share in 2024 with about 41%. Brands preferred PET due to strong clarity, high strength, and wide approval for beverage and food packaging. Demand rose as companies shifted toward lightweight designs and higher recycling rates. HDPE followed due to strong use in household chemicals and personal care goods. Polypropylene grew in closures and hot-fill applications, while LDPE and other materials served niche flexible formats. Rising focus on cost-efficient packaging and stronger regulatory support for recycled content helped PET maintain its lead across global markets.

- For instance, The Coca‑Cola Company reported in 2024 that 48% of its primary packaging was plastic bottles (primarily PET), of which 18% was recycled PET globally.

By Container Type

Bottles and jars led this segment in 2024 with nearly 63% share. Beverage and food producers relied on these formats due to easy handling, strong barrier properties, and wide filling compatibility. Growth increased as brands expanded single-serve and on-the-go packaging lines. Pails and tubs gained steady demand in industrial chemicals and bulk food items. Cups and bowls expanded in ready-to-eat meals. Rising demand for convenient packaging and faster filling speeds kept bottles and jars at the top of the segment.

- For instance, in the North America beverage segment alone, companies such as PepsiCo and The Coca-Cola Company procured PET bottles “in bulk” for bottling operations, highlighting how bottles dominated demand in that region for 2024.

By End-use

Beverages dominated the end-use segment in 2024 with around 46% share. Soft drink, bottled water, and juice brands drove high consumption due to heavy reliance on PET bottles. Food products followed with rising use in sauces, dairy, and edible oils. Pharmaceuticals and cosmetics showed strong growth due to improved hygiene standards and wider plastic compatibility. FMCG brands expanded demand for personal care and cleaning products. Strong retail penetration, higher consumption of packaged drinks, and growth in organized food chains supported beverage packaging leadership.

Key Growth Drivers

Rising Demand for Packaged Beverages and Convenience Products

Demand for bottled water, soft drinks, juices, and ready-to-drink items continues to rise across global markets. Beverage firms prefer plastic bottles because the format offers low weight, strong durability, and safe transport, which helps reduce breakage and logistics cost. Rapid urban growth further boosts demand for convenience packaging as consumers seek portable options for daily use. Expanding retail networks and quick-commerce platforms support higher sales of single-serve packs. Growth strengthens as major brands increase product launches in functional drinks and flavored water. The shift toward healthier beverages also drives stronger adoption of PET bottles for both affordability and clarity.

- For instance, global data shows that the market for PET bottles reached approximately USD 45,500 million in 2024 reflecting the high demand from beverages, juices, and bottled water segments.

Expanding Use Across Pharmaceuticals, Cosmetics, and FMCG

Pharmaceutical and cosmetic brands use plastic containers widely due to strong chemical resistance, high hygiene standards, and flexible shapes. Demand grows as companies invest in new skincare lines, OTC medicines, and health supplements. FMCG brands continue to push large-volume sales of personal care and cleaning products, which rely heavily on HDPE and PP bottles. Plastic packaging supports fast filling speeds and offers strong protection from moisture and contamination. Rising disposable income, wider product portfolios, and new e-commerce channels boost packaging volumes. Growth also improves as companies adopt tamper-evident and child-resistant designs in healthcare packaging.

- For instance, the global plastic bottles and containers market (covering pharmaceuticals, personal care, etc.) is projected to reach 229.67 billion in 2025, underscoring strong demand beyond beverages.

Lightweighting, Cost Efficiency, and High Recyclability Efforts

Plastic bottles remain favored due to lower transportation cost, reduced emissions, and strong performance in automated filling lines. Lightweighting technology helps brands cut resin consumption while keeping container strength high. Many companies shift toward recycled PET content as global recycling systems expand. Regulations that encourage circular economy practices drive higher adoption of recyclable formats. Production flexibility allows quick design changes, making plastic packaging ideal for frequent product launches. Cost advantages over glass and metal help maintain strong demand, especially in high-volume consumer goods. These factors strengthen market growth and support continuous expansion across industries.

Key Trends & Opportunities

Shift Toward rPET and Sustainable Packaging Innovations

Brands increase the use of recycled PET due to policy pressure and consumer demand for eco-friendly packaging. Advanced recycling systems allow higher food-grade rPET output, which supports safe use in beverages and food items. Companies launch bottle-to-bottle programs and invest in closed-loop supply chains to reduce waste. New designs such as mono-material containers enable easier recycling. Technology improvements support refillable and returnable packaging models across retail networks. These moves help brands improve sustainability ratings and meet global commitments on emissions. The trend creates strong opportunities for material suppliers offering high-quality recycled content.

- For instance, The Coca‑Cola Company reported that in 2024 globally it used 28% recycled material in its primary packaging, of which 18% of PET used was recycled-PET (rPET).

Growth of E-commerce and Customized Packaging Needs

Online retail expands the need for durable, tamper-evident plastic containers that protect items during transport. Personal care, cosmetics, and food brands increasingly prefer lightweight bottles due to lower shipping cost and better impact resistance. Companies invest in unique shapes and small-volume packs tailored for subscription services and sample kits. Digital printing and faster mold-change technologies allow brands to design limited-edition packaging for promotions. E-commerce growth also increases demand for leak-proof closures and high-strength containers. These shifts create new business opportunities for manufacturers that offer improved design flexibility and quick production turnaround.

- For instance, a global report on e-commerce packaging estimated the industry size at USD 91.22 billion in 2024, highlighting a surge in demand for protective, customizable packaging formats as online retail expands.

Key Challenges

Rising Environmental Concerns and Regulatory Pressure

Many countries tighten rules on single-use plastics, which directly affects bottle and container demand. Regulations encourage higher recycling rates, reduced resin use, and bans on certain formats. Public concerns about plastic pollution increase scrutiny on fast-moving consumer goods companies. Producers must invest more in sustainable materials, redesign packaging, and shift toward circular systems. Collection and recycling infrastructure remains uneven across regions, which limits the supply of quality recycled PET. These pressures raise production cost and slow adoption in some markets. Companies must balance regulatory compliance with performance needs and pricing expectations.

Volatility in Raw Material Prices and Supply Disruptions

Plastic bottles rely on petrochemical feedstocks, and fluctuating oil and resin prices create cost uncertainty for manufacturers. Periodic supply shortages disrupt production schedules and raise procurement risks. Price volatility affects profit margins, especially for high-volume FMCG and beverage brands that operate on tight cost structures. Manufacturers must adjust inventory plans, diversify sourcing, and use lightweight designs to reduce resin use. Economic slowdowns and geopolitical events also influence global supply chains. These factors challenge stable production and require strong risk management strategies to maintain long-term competitiveness.

Regional Analysis

North America

North America held about 32% share of the Plastic Bottles and Containers Market in 2024, supported by strong demand from beverages, pharmaceuticals, and personal care products. Brands in the U.S. and Canada leaned on PET and HDPE containers because they offer high durability, strong clarity, and easier recycling. Growth improved as companies invested in rPET integration and lightweighting programs to meet sustainability goals. Expanding ready-to-drink categories, broader e-commerce activity, and strict quality standards in healthcare drove steady packaging consumption across the region.

Europe

Europe accounted for nearly 28% share in 2024, driven by strict regulations promoting recyclable and low-impact packaging. PET bottles gained high adoption as brands increased recycled-content usage to comply with EU circular economy targets. Demand grew across beverages, cosmetics, and household care products due to strong consumer preference for sustainable packaging. Lightweight designs and mono-material structures gained traction, helping companies reduce waste and improve recyclability. Western Europe led consumption, while Central and Eastern Europe showed rising growth from expanding FMCG and food sectors.

Asia Pacific

Asia Pacific dominated the global market with about 39% share in 2024, supported by large-scale beverage production, expanding FMCG demand, and strong manufacturing capacity. China, India, Japan, and Southeast Asia relied on PET and HDPE containers for food, drinks, and personal care items due to low cost and high availability. Rapid urbanization and rising disposable incomes increased packaged product consumption. The region also saw fast expansion in pharmaceutical packaging. Growing investments in recycling plants and rPET production further improved regional competitiveness.

Latin America

Latin America captured around 7% share in 2024, driven by rising bottled water consumption and strong demand for affordable FMCG packaging. Brazil, Mexico, and Argentina led adoption as brands used PET bottles for beverages and HDPE containers for household and personal care products. Economic recovery supported moderate growth in packaged foods and cosmetics. Local manufacturers increased investments in recycling systems to meet emerging sustainability goals. Expanding retail networks and urban population growth also supported stronger packaging demand across the region.

Middle East & Africa

The Middle East & Africa region held nearly 6% share in 2024, supported by growing beverage consumption, expanding urban centers, and rising demand for personal care products. PET bottles gained wide use in bottled water due to low cost and strong shelf performance in hot climates. FMCG and pharmaceutical packaging demand increased as regional healthcare access improved. Investments in manufacturing plants and trade zones strengthened supply capacity. Sustainability adoption grew slowly but improved as countries introduced recycling initiatives and waste-reduction policies.

Market Segmentations:

By Material

- Polyethylene Terephthalate

- Polypropylene

- HDPE

- LDPE

- Others

By Container Type

- Bottles & Jars

- Pails

- Tubs

- Cups & Bowls

- Others

By End-use

- Beverages

- Food

- Pharmaceuticals & Cosmetics

- FMCG

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Plastic Bottles and Containers Market features companies such as Greiner Packaging, Zhuhai Zhongfu Industrial, Winpak, Graham Packaging, Huhtamaki, Plastipak Packaging, Visy, Pretium Packaging, ALPLA, and Amcor. These players compete through advances in lightweight designs, higher recycled-content integration, and improved barrier technologies for beverages, food, pharmaceuticals, and FMCG sectors. Many firms invest in rPET production, faster molding systems, and automated inspection to raise efficiency and meet sustainability targets. Partnerships with beverage and personal care brands strengthen long-term supply agreements, while regional expansion helps reduce logistics cost and improve service reach. Growing focus on mono-material structures, circular economy models, and closed-loop recycling further shapes competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Greiner Packaging (Austria)

- Zhuhai Zhongfu Industrial Co., Ltd (China)

- Winpak LTD. (Canada)

- Graham Packaging (U.S.)

- Huhtamaki (Finland)

- Plastipak Packaging (U.S.)

- Visy (Australia)

- Pretium Packaging (U.S.)

- ALPLA (Austria)

- Amcor Plc (Switzerland)

Recent Developments

- In November 2025, Plastipak Packaging (U.S.): Plastipak announced a $53.8 million expansion of its Central Louisiana manufacturing facility to add warehousing space and upgrade lines that increase the use of recycled plastic in its packaging, supporting higher-output PET bottles and containers for beverage and household customers.

- In April 2024, Pretium Packaging (U.S.): Pretium released its Europe brochure highlighting new 2-stage reheat-and-blow assets designed to produce lighter-weight PET bottles, expanding its sustainable rigid-packaging range for food, personal care, and household chemicals.

- In April 2024, Amcor Rigid Packaging (ARP) launch a 1-liter polyethylene terephthalate (PET) bottle for carbonated soft drinks (CSD) made from 100% post-consumer recycled (PCR) material.

Report Coverage

The research report offers an in-depth analysis based on Material, Container type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PET and HDPE containers will rise due to higher packaged beverage and food consumption.

- Recycled-content bottles will gain wider use as brands commit to stronger sustainability targets.

- Lightweighting and mono-material designs will expand to improve recyclability and reduce resin use.

- Pharmaceutical and cosmetic applications will grow with new product launches and stricter hygiene needs.

- Automation in molding and inspection lines will increase output and cut production cost.

- E-commerce growth will drive demand for durable, leak-resistant packaging formats.

- Regional recycling programs will improve supply of food-grade rPET for bottle-to-bottle applications.

- Custom shapes and short-run digital printing will expand for brand differentiation.

- Regulations on single-use plastics will push companies toward circular economy models.

- Partnerships between resin suppliers, recyclers, and converters will strengthen long-term value chains.