Market Overview

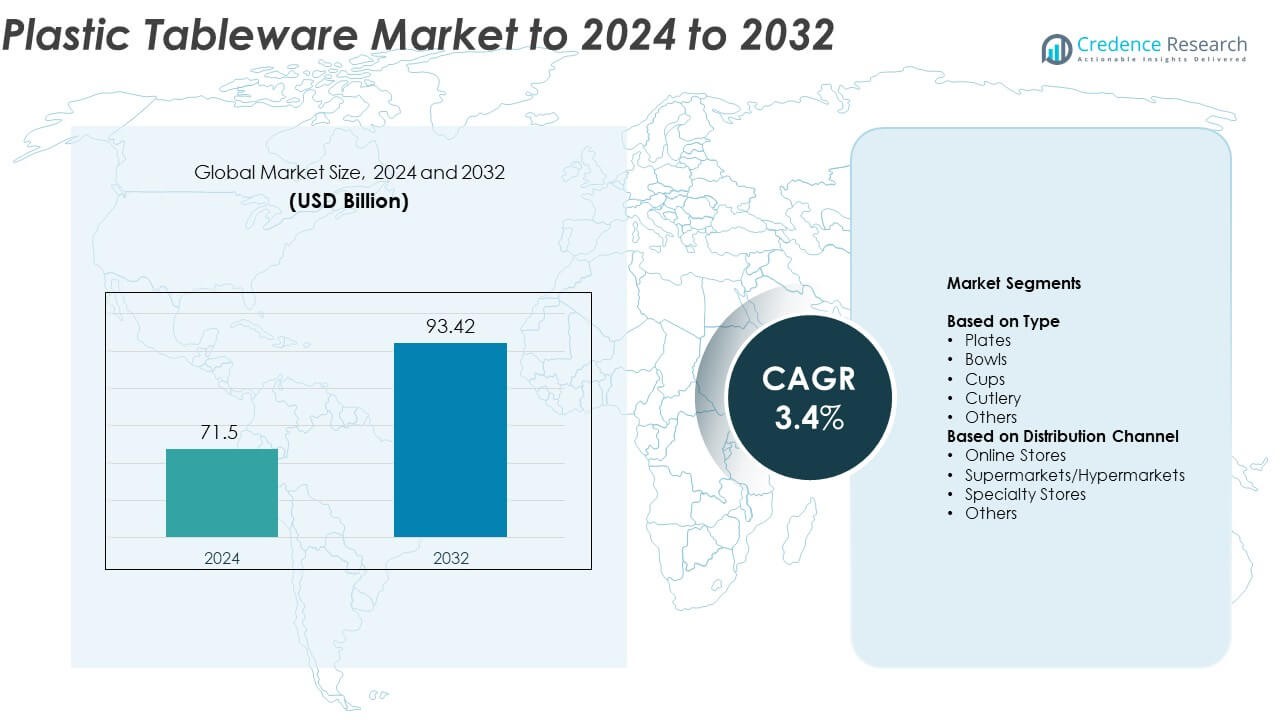

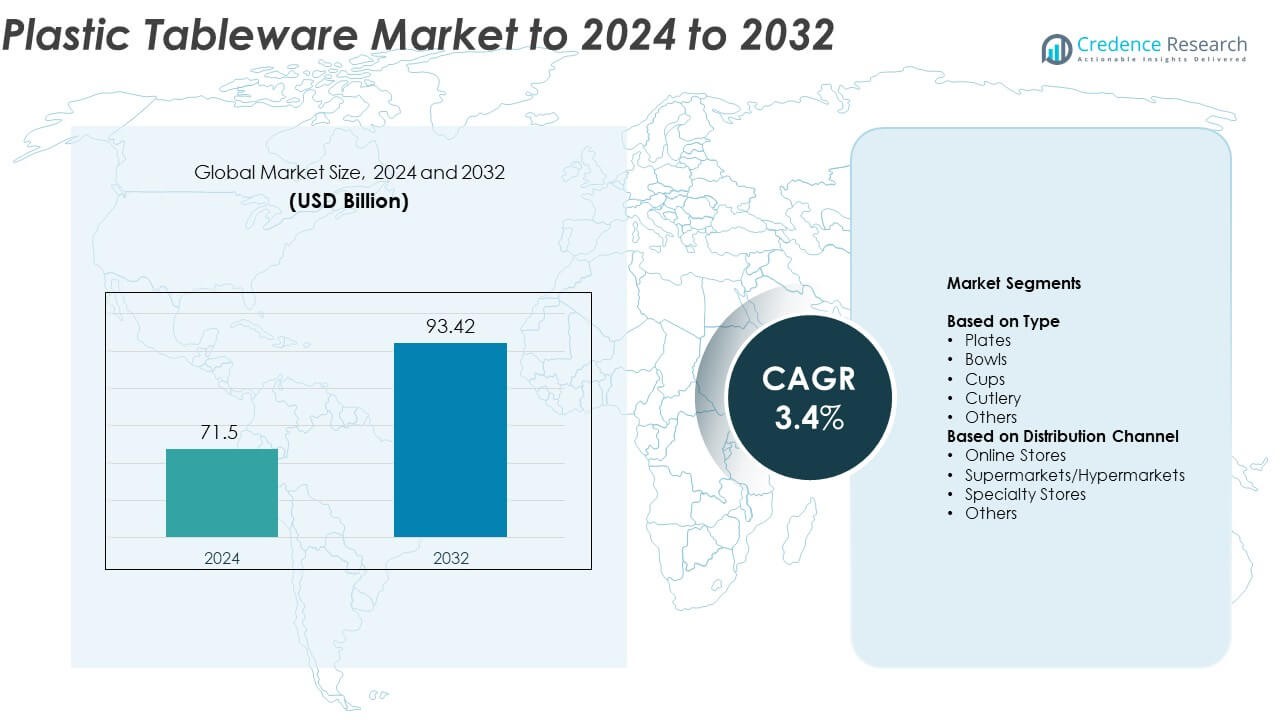

Plastic Tableware Market size was valued at USD 71.5 Billion in 2024 and is anticipated to reach USD 93.42 Billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Tableware Market Size 2024 |

USD 71.5 Billion |

| Plastic Tableware Market, CAGR |

3.4% |

| Plastic Tableware Market Size 2032 |

USD 93.42 Billion |

The plastic tableware market features strong competition among major players such as Berry Global Inc., Genpak LLC, Eco-Products Inc., Sabert Corporation, Anchor Packaging Inc., Pactiv LLC, Lollicup USA Inc., D&W Fine Pack LLC, Dart Container Corporation, and Huhtamaki Oyj. These companies dominate through product innovation, sustainable manufacturing practices, and large distribution networks across retail and foodservice sectors. North America leads the market with approximately 37% share in 2024, supported by high consumer demand and robust commercial usage. Europe and Asia-Pacific follow, driven by sustainability initiatives, urbanization, and the expanding hospitality and food delivery industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The plastic tableware market was valued at USD 71.5 Billion in 2024 and is projected to reach USD 93.42 Billion by 2032, growing at a CAGR of 3.4%.

- Rising demand for convenient, lightweight, and disposable products across the foodservice and hospitality industries drives market expansion globally.

- Manufacturers are focusing on biodegradable and recyclable plastics, responding to sustainability trends and stricter environmental regulations.

- The market is competitive with strong presence of global brands emphasizing product innovation, eco-friendly materials, and strategic partnerships in retail and catering channels.

- North America holds 37% of the market share, followed by Europe at 28% and Asia-Pacific at 25%, while plates dominate the type segment with nearly 38% share in 2024.

Market Segmentation Analysis:

By Type

Plates dominate the plastic tableware market, accounting for nearly 38% share in 2024. Their dominance is driven by extensive use across household dining, catering, and food service sectors. The segment benefits from rising demand for lightweight, disposable, and cost-effective serving options. Growing popularity of ready-to-eat meals and outdoor dining further supports plate consumption. Innovation in biodegradable and microwave-safe designs also strengthens product appeal. Bowls and cups follow closely, supported by expanding quick-service restaurant operations and an increasing preference for convenience-oriented tableware in both residential and commercial environments.

- For instance, Dart Container runs more than 35 production, distribution, and office facilities primarily across the United States, Canada, and Mexico.

By Distribution Channel

Supermarkets and hypermarkets lead the plastic tableware market with approximately 46% share in 2024. The wide availability of diverse brands, bulk purchasing options, and frequent promotional discounts drive their dominance. These stores provide consumers with easy access to single-use and reusable plastic tableware for both household and commercial needs. Organized retail growth in urban areas and expanding product assortments across global chains have accelerated sales. Online stores are rapidly gaining traction due to e-commerce penetration, product variety, and doorstep delivery convenience, particularly among younger consumers seeking hassle-free shopping experiences.

- For instance, Walmart operates over 10,750 stores across 19 countries, enabling broad shelf presence for plastic tableware.

Key Growth Drivers

Rising Demand for Convenient and Disposable Products

The growing popularity of quick-service restaurants, takeout culture, and outdoor dining is driving strong demand for disposable plastic tableware. Consumers prefer lightweight, low-cost, and easy-to-use options for convenience in both personal and commercial settings. Events, catering, and travel activities further support this trend, as single-use plastic plates and cups offer practicality and hygiene. The shift toward on-the-go lifestyles across urban populations continues to propel consumption, particularly in developing economies with expanding food delivery and hospitality sectors.

- For instance, DoorDash handled 2,161 million orders in 2023, reflecting massive volumes of off-premise foodservice packaging.

Expanding Foodservice and Hospitality Industry

The global expansion of the foodservice and catering sector significantly boosts the plastic tableware market. Hotels, restaurants, and event organizers rely on durable, disposable, and affordable tableware to manage large-scale operations efficiently. The rise in tourism and the growing frequency of social gatherings amplify product use. Moreover, the increase in outdoor catering and quick-serve dining formats enhances adoption. As hospitality brands expand into emerging regions, plastic tableware suppliers benefit from steady volume growth and evolving product design requirements.

- For instance, Sodexo provides catering and facility services in approximately 45 countries and serves around 80 million consumers every day (as of its Fiscal Year 2024 reporting).

Innovation in Sustainable and Biodegradable Plastics

Technological progress in biodegradable and recyclable plastics is a key growth factor. Manufacturers are increasingly adopting eco-friendly materials such as polylactic acid (PLA) and bioplastics to meet environmental standards and consumer expectations. This innovation allows companies to balance functionality with sustainability while maintaining affordability. Brands introducing compostable and reusable designs are gaining strong traction among environmentally conscious consumers. Government incentives promoting green packaging solutions are further accelerating the use of sustainable plastic tableware across major markets.

Key Trends & Opportunities

Shift Toward Eco-friendly Tableware Solutions

Growing environmental concerns are creating a major shift toward recyclable and biodegradable plastic tableware. Brands are focusing on materials that meet new sustainability regulations without compromising durability. The rising preference for compostable tableware in restaurants, cafes, and catering businesses is expanding market opportunities. Regulatory pressures and consumer awareness are prompting innovation in circular design and material recovery, allowing companies to enhance brand value and achieve long-term compliance in a competitive market landscape.

- For instance, BioPak’s RAC Arena program diverted almost 38 tonnes of organics and compostable packaging from landfill in 2023, evidencing real circular outcomes.

Customization and Product Aesthetics

Manufacturers are increasingly offering customizable plastic tableware to appeal to modern consumers and hospitality businesses. Personalized printing, color variety, and design innovations enhance brand identity and user experience. Premium aesthetics combined with practical features like temperature resistance and lightweight construction drive adoption. The growing demand for decorative, party-themed, and occasion-specific products provides manufacturers with new avenues for growth, particularly in retail and event-based applications across both developed and emerging regions.

- For instance, Starbucks operated 40,199 stores in 2024, each relying on branded drinkware and packaging that reinforces design-led presentation at scale.

Key Challenges

Environmental Regulations and Plastic Bans

Stringent regulations on single-use plastics across several countries present a major challenge for market players. Governments are enforcing bans and imposing sustainability standards to curb plastic waste, impacting the availability of traditional plastic tableware. Compliance with these evolving policies requires manufacturers to invest in alternative materials and new production technologies. The shift to eco-friendly solutions increases production costs, putting pressure on margins and slowing market expansion in regions with strict environmental laws.

Competition from Alternative Materials

The growing adoption of paper, bamboo, and metal tableware is creating strong competition for plastic-based products. Consumers are shifting toward sustainable and reusable options driven by environmental awareness. Retailers and restaurants increasingly prefer eco-friendly substitutes to align with green initiatives and public perception. This transition challenges traditional plastic manufacturers to innovate and diversify product lines to retain market share. The rise of hybrid materials and changing consumer expectations further intensify competitive pressures in this evolving sector.

Regional Analysis

North America

North America held the largest share of around 37% in the plastic tableware market in 2024. Strong consumer spending, widespread adoption of disposable tableware, and a thriving food delivery culture drive regional growth. The United States leads demand, supported by large-scale restaurant chains, fast-food outlets, and outdoor event catering. Growing awareness of sustainable packaging is also encouraging the shift toward recyclable and biodegradable alternatives. Manufacturers are investing in innovative designs and environmentally friendly materials to align with regional regulations, ensuring consistent market expansion across both retail and commercial sectors.

Europe

Europe accounted for nearly 28% share of the plastic tableware market in 2024. Growth is influenced by stringent environmental regulations and the strong presence of eco-conscious consumers. Countries such as Germany, France, and the United Kingdom are driving demand for reusable and recyclable tableware solutions. Manufacturers are focusing on bioplastics and compostable materials to comply with EU directives on single-use plastics. The hospitality sector’s focus on sustainability and premium dining experiences continues to fuel market innovation, while partnerships between retailers and green packaging firms enhance regional product diversification.

Asia-Pacific

Asia-Pacific captured around 25% share of the global plastic tableware market in 2024. Rapid urbanization, expanding foodservice chains, and the rise of quick-service restaurants drive strong demand across the region. China, India, and Japan are major contributors, supported by population growth and rising disposable incomes. Increasing online food delivery platforms further accelerate product consumption. Manufacturers are expanding production capacity to meet large-scale demand while introducing affordable biodegradable alternatives. The shift toward sustainable and convenient dining solutions makes Asia-Pacific a key region for long-term market growth and investment opportunities.

Latin America

Latin America represented about 6% share of the plastic tableware market in 2024. The region benefits from increasing use of disposable tableware in foodservice and event industries. Brazil and Mexico lead demand due to growing restaurant networks and urbanization. Economic development and expansion of modern retail channels have supported greater product penetration. However, challenges such as inconsistent recycling infrastructure and fluctuating raw material costs slightly restrain market potential. Rising environmental awareness and regulatory discussions are encouraging a gradual shift toward eco-friendly materials and sustainable production practices.

Middle East & Africa

The Middle East & Africa accounted for approximately 4% share of the plastic tableware market in 2024. Growth is supported by the expanding hospitality and catering sectors, particularly in the Gulf Cooperation Council (GCC) countries. Demand increases during festivals, outdoor events, and tourism-driven activities. Governments are promoting initiatives to reduce plastic waste, pushing producers toward biodegradable alternatives. South Africa and the UAE are emerging as key markets due to rising retail modernization and dining culture transformation. Continuous investment in eco-packaging and sustainable manufacturing practices is shaping future regional dynamics.

Market Segmentations:

By Type

- Plates

- Bowls

- Cups

- Cutlery

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Berry Global Inc., Genpak LLC, Eco-Products Inc., Sabert Corporation, Anchor Packaging Inc., Pactiv LLC, Lollicup USA Inc., D&W Fine Pack LLC, Dart Container Corporation, and Huhtamaki Oyj are the key players shaping the competitive landscape of the plastic tableware market. The market is characterized by strong competition, driven by product innovation, sustainability initiatives, and extensive distribution networks. Companies are emphasizing eco-friendly materials, recyclable packaging, and lightweight product designs to meet changing regulatory and consumer expectations. Continuous investments in advanced manufacturing and automation are helping enhance operational efficiency and cost competitiveness. Strategic mergers, acquisitions, and collaborations with foodservice chains and retailers are expanding global reach and product portfolios. Market participants are also prioritizing custom designs and branding solutions to strengthen partnerships within the hospitality and catering industries. The growing emphasis on circular economy principles continues to influence long-term strategies and product development efforts across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Huhtamaki launched innovative ice cream cups that are both home and industrial compostable as well as recyclable, expanding their sustainable packaging portfolio for the ice cream industry.

- In January 2025, Genpak launched its “Grab-A-Bowl” series made from durable polypropylene designed to support both dining and delivery needs, showcasing innovation in reusable and durable plastic tableware for fast food service.

- In 2025, Lollicup USA Inc. continued to strengthen its presence in the biodegradable tableware market, focusing on plant-based materials like PLA and bagasse for compostable product lines, responding to growing environmental regulations and consumer demand for sustainable foodservice products.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and biodegradable plastic tableware will continue to rise globally.

- Manufacturers will focus on developing recyclable and compostable materials to meet green regulations.

- Online retail and e-commerce platforms will play a larger role in product distribution.

- Innovation in design and lightweight materials will improve product functionality and appeal.

- Food delivery services and outdoor dining trends will sustain strong market growth.

- Customization and aesthetic product design will gain importance among hospitality brands.

- Strategic partnerships with eco-friendly packaging firms will increase across major regions.

- Asia-Pacific will emerge as the fastest-growing market due to rapid urbanization and retail expansion.

- Technological advancements in bioplastics will enhance performance and durability of tableware.

- Global regulations on single-use plastics will push companies toward circular economy models.