Market Overview

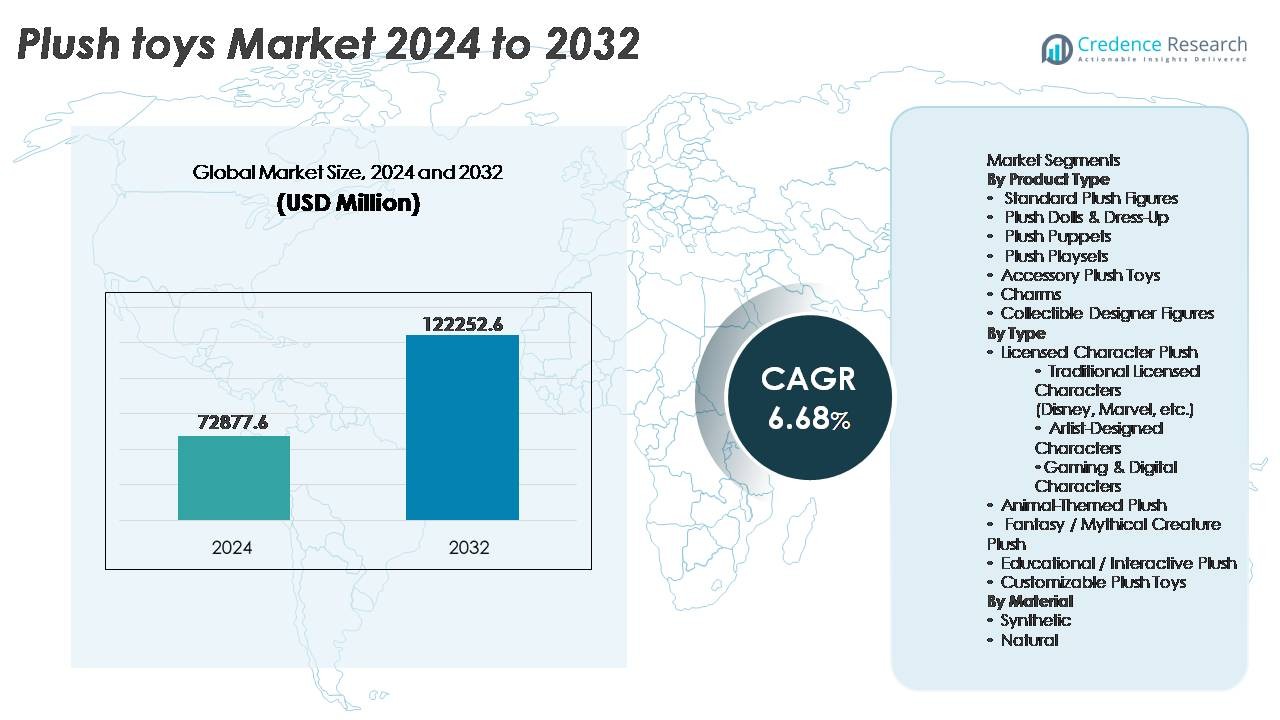

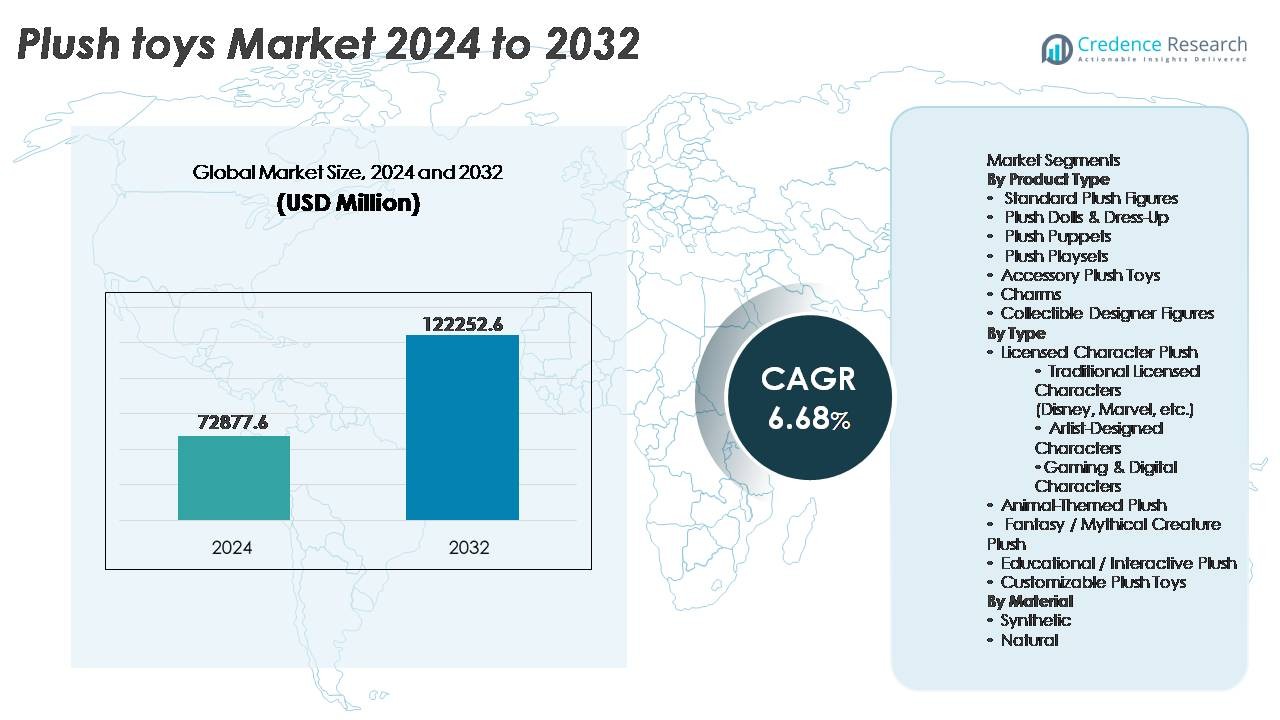

The global plush toys market was valued at USD 72,877.6 million in 2024 and is projected to reach USD 122,252.6 million by 2032, reflecting a CAGR of 6.68% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plush Toys Market Size 2024 |

USD 72,877.6 Million |

| Plush Toys Market, CAGR |

6.68% |

| Plush Toys Market Size 2032 |

USD 122,252.6 Million |

The plush toys market is shaped by established global brands and emerging design-centric labels, with leading players including Jellycat, Hasbro, Fiesta Toy, Mattel, Aurora World, POP MART, Melissa & Doug, Build-A-Bear Workshop, Gund, and Douglas Company. These companies compete through licensed character portfolios, premium designer plush lines, and customization-based consumer engagement models. Asia-Pacific leads the global market with 34% share, driven by manufacturing capabilities and strong anime and gaming-led merchandise demand, followed by North America at 32%, supported by high purchasing power and strong franchise ecosystems, while Europe accounts for 27%, led by sustainability-driven premium plush adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global plush toys market was valued at USD 72,877.6 million in 2024 and is projected to reach USD 122,252.6 million by 2032, growing at a CAGR of 6.68% during the forecast period.

- Market drivers include expanding character licensing across film, OTT, gaming, and anime ecosystems, alongside rising demand for personalized and gift-oriented plush products appealing to both children and adult collectors.

- Key trends highlight eco-friendly plush manufacturing using organic cotton and recycled filling, as well as premium collectible designer plush gaining traction through limited drops and artist collaborations.

- Competitive dynamics are shaped by global brands launching customizable digital-first product lines, while price-sensitive markets and high counterfeit circulation remain notable restraints impacting margin stability.

- Asia-Pacific holds 34% share, leading production and character demand, followed by North America (32%) and Europe (27%); Standard Plush Figures dominate product share due to affordability and gifting appeal.

Market Segmentation Analysis:

By Product Type

Within the plush toys market, Standard Plush Figures remain the dominant sub-segment, holding the leading market share due to their universal appeal, affordability, and suitability for mass gifting and collectibles. Plush Dolls & Dress-Up and Plush Playsets are witnessing rising adoption among younger age groups driven by role-play and character-based storytelling trends. Collectible Designer Figures are emerging as premium niche offerings, attracting adult collectors and enthusiasts. Accessory Plush Toys, Charms, and Other categories such as keychain plush and plush puzzles support incremental revenue through novelty-oriented impulse purchases and seasonal merchandise.

- For instance, Kidrobot’s limited artist collaborations routinely cap production at between 500 and 1,000 pieces per drop, with exclusive vinyl and plush models reaching large scales (up to 12-inch formats and beyond), which reflects the significant market demand for designer collectibles among adult enthusiasts and general consumers alike.

By Type

Licensed Character Plush represents the largest market share, propelled by continued success of global entertainment franchises, cross-media promotions, and high renewal value of characters from animation, films, and gaming. Traditional licensed characters from companies like Disney and Marvel remain most dominant, whereas Gaming & Digital Characters are expanding rapidly due to esports fandom and streaming culture. Fantasy and mythical creature plush appeal to imaginative play, while Educational and interactive plush support cognitive development. Customizable plush toys are gaining momentum in personalization-driven consumer segments, reflecting growing demand for emotionally meaningful and gift-centric products.

- For instance, The Walt Disney Company generates more than 100,000 unique merchandise SKUs annually, with plush representing a core category of its licensing engine supported by over 40 global manufacturing partners supplying character-based plush across retail and theme park channels.

By Material

The plush toy market is primarily dominated by synthetic material-based plush, driven by cost-effectiveness, durability, ease of mass manufacturing, and compatibility with diverse filling and fabric finishes including microfiber, polyester, and faux fur textiles. Synthetic plush also aligns with modern designs and washable requirements for children’s toys. Meanwhile, natural material plush toys particularly cotton and wool-based are steadily gaining preference among eco-conscious and allergy-sensitive buyers as brands emphasize sustainability, non-toxic dyes, and biodegradable components. This shift is reinforced by parental purchasing trends favoring organic materials, especially in infant and toddler categories.

Key Growth Drivers

Expansion of Global Licensing and Media Franchises

The rapid proliferation of global entertainment franchises remains a major driver of plush toys demand. Streaming platforms, cinematic universes, and anime series continually introduce characters that transition into merchandise revenue streams. Plush toys have become an essential licensing category due to low manufacturing complexity and high brand recall among children and adult collectors. Character-driven consumer engagement, coupled with multi-platform storytelling movies, gaming, OTT series, and social media creates sustained product relevance. Limited editions, commemorative series, and cross-franchise collaborations further stimulate repeat purchases. The success of character plush merchandise reinforces the synergy between entertainment content and collectible consumer products, translating intellectual property strength into high-volume retail performance across international markets.

- For instance, Sanrio’s Hello Kitty ecosystem has expanded into more than 50,000 licensed product formats, reaching distribution in over 130 countries, while the brand has executed collaborations with more than 100 global corporate partners a scale that has directly contributed to the consistent release of character plush items as part of its cross-category licensing portfolio.

Rise of Gift Culture, Personalization, and Emotional Value

The growing significance of emotional value and personalized gifting is driving plush toy purchases beyond traditional child-centric demographics. Plush toys symbolize sentiment, memory, and nostalgia, making them popular among teenagers and adults for occasions such as birthdays, anniversaries, and friendship gifting. Custom embroidery, photo-based personalization, and mix-and-match components support the rising consumer preference for individualized products. Manufacturers leverage online configuration tools that enable consumers to design plush characters, select fabrics, and customize features. The psychological association of plush toys with comfort and emotional wellness also supports demand, particularly in stress-relief and therapy-based applications. This shift expands the customer base and lengthens product lifecycle engagement in mature markets.

- For instance, Build-A-Bear Workshop has enabled the customization of more than 200 million plush creations across its design platform and physical stores, offering over 400 accessory components and sound modules with up to 20 seconds of personalized voice recording embedded into each plush unit.

E-commerce Penetration and Digital-First Brand Strategies

E-commerce and direct-to-consumer models significantly enhance the accessibility and variety of plush toys. Online marketplaces enable long-tail product availability, including premium collectibles, global character plush, and niche handmade designs. Social media marketing, influencer-led launches, and live-commerce streams amplify product discovery and impulse buying. Small-scale creators and independent artists utilize digital storefronts and print-on-demand manufacturing to produce low-volume, high-margin product lines without traditional retail barriers. Subscription boxes, themed merchandise drops, and online-only collections accelerate customer loyalty. These digital-first strategies give brands immediate access to real-time consumer insights, enabling personalized promotions, faster product iterations, and stronger brand communities.

Key Trends & Opportunities

Sustainable and Eco-Friendly Plush Manufacturing

Sustainability represents a growing opportunity across the plush toys ecosystem. Consumers and regulatory bodies are pressuring manufacturers to reduce reliance on synthetic fibers, plastics, and chemical-based dyes. Brands increasingly adopt organic cotton, recycled polyester stuffing, and biodegradable packaging. Circular economy models, including repair kits, recyclable components, and textile take-back programs, create differentiation opportunities. Transparent sourcing and certifications such as OEKO-TEX or GOTS strengthen consumer trust and premium positioning. Eco-friendly plush products particularly appeal to parents purchasing for infants and toddlers and urban buyers prioritizing environmentally conscious consumption. This trend encourages manufacturers to innovate across material science, packaging, and lifecycle design.

- For instance, Build-A-Bear Workshop introduced plush lines made with fabric and stuffing derived from 100% recycled PET bottles, with internal documentation confirming that each unit repurposes approximately seven 500-ml plastic bottles.

Adult Collectibles and Designer Plush Segment Expansion

Plush toys are no longer limited to the children’s market, as adult collectors, anime fans, and pop-culture enthusiasts drive accelerated growth in designer and limited-edition plush categories. Collaborations with visual artists, indie creators, gaming licensors, and fashion brands elevate plush toys into lifestyle and art collectibles. Drop culture, signed editions, and convention-exclusive products foster resale value and community engagement. Premium plush toys with intricate craftsmanship, cultural storytelling, and unique aesthetics establish new revenue channels at higher price points. The fusion of plush toys with fandom, nostalgia, décor, and identity expression creates long-term opportunities for global and artisan manufacturers.

- For instance,”The Pokémon Company’s plush line includes a large-scale model of ‘Wailord’ measuring about 57 inches (145-147 cm) in length, which is approximately one-tenth the size of an actual Wailord in the games and animation, and is made of standard plush materials such as polyester and polyurethane foam.

Key Challenges

Counterfeit Merchandise and Intellectual Property Risks

The plush toy market faces persistent challenges from counterfeit products that exploit licensed character demand without quality or safety compliance. Unauthorized toys undermine brand reputation and divert revenue from licensors and manufacturers. Substandard materials, detachable small parts, and toxic dyes further amplify safety concerns, risking regulatory penalties and consumer backlash. Digital commerce platforms complicate monitoring, as small-batch counterfeit sellers operate across multiple marketplaces. Addressing this requires stronger IP enforcement, traceability solutions, and authentication-driven technology. Partnerships with customs authorities, blockchain-based tagging, and consumer awareness initiatives are essential to mitigate the risks of counterfeit infiltration.

Price Sensitivity and Competitive Margin Pressure

Price sensitivity remains a significant challenge, particularly in markets dominated by mass-produced plush toys manufactured through low-cost labor supply chains. Competitive pricing pressures reduce margins for premium or specialized plush lines that incorporate sustainable materials or advanced customization capabilities. Economic uncertainty and fluctuating raw material costs further weaken retailers’ ability to maintain stable pricing structures. Brands must balance affordability and innovation while managing distribution costs and return logistics in e-commerce models. To remain profitable, manufacturers must adopt lean production practices, modular designs, and diversified product lines that cater to both value-driven buyers and premium niche customers.

Regional Analysis

North America

North America holds an estimated 32% market share and remains a leading region driven by strong consumer spending, widespread adoption of licensed character merchandise, and robust e-commerce penetration. The United States is the primary contributor, supported by high demand for collectibles, pop-culture plush figures, and personalized plush gifts. Extensive entertainment franchise ecosystems, including film, gaming, and sports merchandising, reinforce consistent product turnover. The growing culture of themed gifting, along with premium designer plush collaborations, drives specialty retail and online sales. Rising interest from adult collectors and nostalgia-oriented consumers further accelerates market growth across North American distribution channels.

Europe

Europe accounts for approximately 27% of market share, led by Germany, the United Kingdom, France, and Italy, where premiumization and sustainability trends strongly influence purchasing decisions. European consumers increasingly prefer eco-friendly plush toys produced using organic textiles and recyclable stuffing. Strict toy safety regulations and chemical compliance standards elevate product quality perceptions and drive brand trust. Additionally, tourism-driven souvenir plush toys and region-specific character merchandise contribute notable seasonal revenue. The region’s well-developed specialty toy retail and handmade artisan markets support demand for designer plush, particularly in fashion-forward and cultural heritage product lines.

Asia-Pacific

Asia-Pacific holds the largest regional share at approximately 34%, fueled by population density, expanding middle-class purchasing power, and rapid licensing growth across anime, gaming, and digital character franchises. Japan, China, and South Korea dominate production and consumption, reinforced by strong pop-culture influence and collector communities. Local manufacturing ecosystems enable cost-efficient mass production, enhancing export capabilities. Festival-based gifting culture especially in China and Southeast Asia supports volume-based demand. Asia-Pacific also drives innovation in themed plush, interactive plush electronics, and custom-made designs, making the region a global hub for production specialization and character merchandise development.

Latin America

Latin America represents nearly 4% of market share, with Brazil and Mexico acting as principal markets influenced by cultural celebrations and gift-giving traditions. Economic variability and price sensitivity shape consumer behavior, supporting strong demand for value-segment plush toys. However, rising exposure to international animation content and local character licensing partnerships is gradually expanding the mid-premium plush category. The growth of online marketplaces is improving access to diverse product ranges, although counterfeit merchandise remains a challenge. Localized manufacturing incentives and brand collaborations with regional entertainment franchises present emerging opportunities for market penetration.

Middle East & Africa

The Middle East & Africa region holds approximately 3% of market share, characterized by growing urbanization, increasing toy retail development, and rising interest in international character merchandise. The United Arab Emirates and Saudi Arabia are key markets benefiting from tourism-driven retail sales and premium gift purchasing. Expanding hypermarket chains and international toy stores are improving product accessibility. In Africa, affordability remains central to consumer decision-making; however, rising birth rates and expanding middle-income populations support gradual market growth. Cultural preferences for soft infant toys and educational plush formats offer opportunities for targeted product positioning.

Market Segmentations:

By Product Type

- Standard Plush Figures

- Plush Dolls & Dress-Up

- Plush Puppets

- Plush Playsets

- Accessory Plush Toys

- Charms

- Collectible Designer Figures

By Type

- Licensed Character Plush

- Traditional Licensed Characters (Disney, Marvel, etc.)

- Artist-Designed Characters

- Gaming & Digital Characters

- Animal-Themed Plush

- Fantasy / Mythical Creature Plush

- Educational / Interactive Plush

- Customizable Plush Toys

By Material

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the plush toys market is characterized by a blend of global entertainment licensors, mass-market manufacturers, artisanal creators, and emerging digital-first brands. Major players compete through character licensing agreements, diversified product portfolios, sustainability initiatives, and direct-to-consumer online retail strategies. Entertainment-driven merchandise, particularly associated with film, animation, and gaming franchises, forms a critical competitive advantage, reinforcing brand recognition and repeat purchase behavior. Independent designers and customizable plush producers are gaining traction by targeting niche collector communities and personalization-focused gifting segments. Sustainable materials, organic textiles, and recycled stuffing have become key differentiators as environmentally conscious buyers influence product development. Competitive strategies increasingly incorporate social media promotion, influencer partnerships, and limited-edition product drops to boost engagement. Market consolidation through licensing partnerships and cross-industry collaborations further intensifies competition, while price sensitivity in emerging markets requires cost-efficient manufacturing and agile supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jellycat

- Hasbro

- Fiesta Toy

- Mattel

- Aurora World

- POP MART

- Melissa & Doug

- Build-A-Bear Workshop

- Gund

- Douglas Company

Recent Developments

- In August 2025, POP MART launched new “mini” versions of its designer-toy line Labubu including pendant charms and a new long-fur plush edition slated to go on sale.

- In June 2025, Jellycat the company stopped supplying to about 100 independent shops in the UK as part of a “brand elevation strategy,” affecting longtime stockists.

- In June 2024, Aurora World The company acquired legacy plush-toy brand Mary Meyer, known for quality baby and general plush products, adding its product portfolio and heritage licensing under Aurora’s management.

Report Coverage

The research report offers an in-depth analysis based on Product type, Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand through stronger integration between entertainment franchises and merchandise strategies.

- Eco-friendly fabrics and recycled stuffing will increasingly replace synthetic inputs across product lines.

- Customizable and personalized plush toys will gain traction as gifting and emotional value drive purchase behavior.

- Digital-first brands and influencer partnerships will shape consumer engagement and launch cycles.

- Adult collector communities will fuel growth in premium designer and limited-edition plush segments.

- Interactive and sensory-enhanced plush toys will evolve to support developmental and educational outcomes.

- Supply chain optimization and nearshoring will reduce lead times and improve product freshness.

- Licensing diversification into indie animation and gaming IPs will reduce dependence on legacy franchises.

- Retailers will adopt hybrid fulfillment and subscription-based merchandise models.

- Companies will prioritize traceability and compliance to address safety and counterfeit concerns.