Market Overview

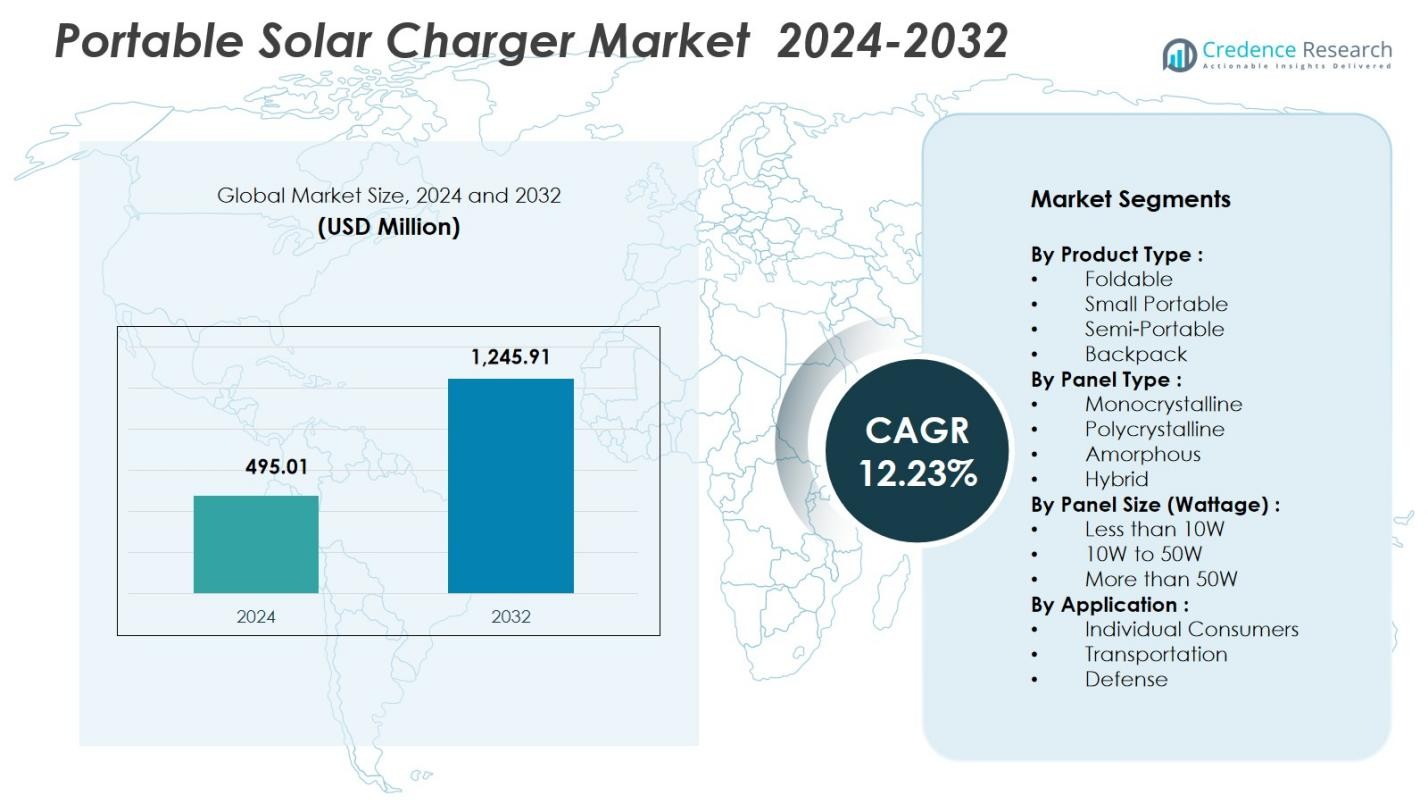

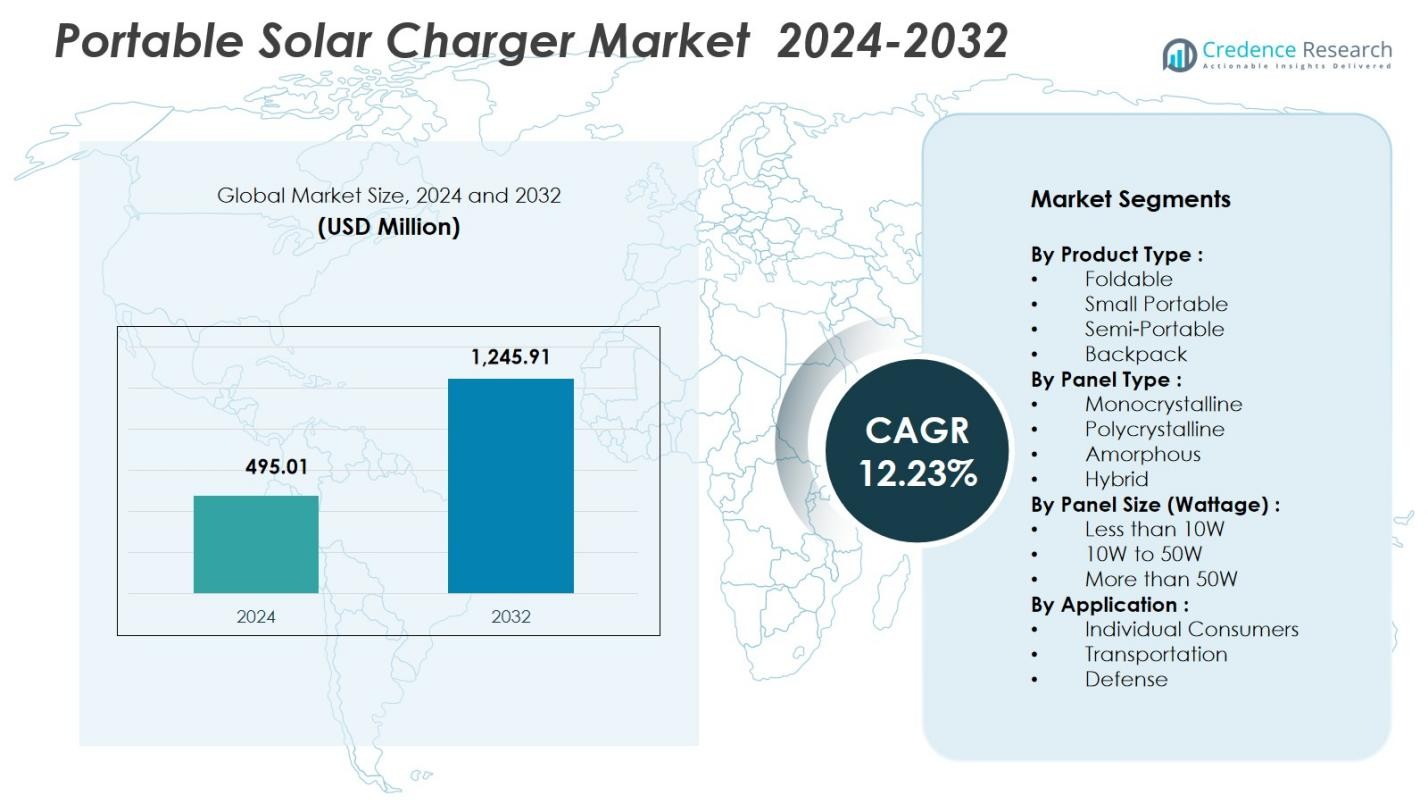

Portable Solar Charger Market size was valued at USD 495.01 Million in 2024 and is anticipated to reach USD 1,245.91 Million by 2032, at a CAGR of 12.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Solar Charger Market Size 2024 |

USD 495.01 Million |

| Portable Solar Charger Market, CAGR |

12.23% |

| Portable Solar Charger Market Size 2032 |

USD 1,245.91 Million |

Portable Solar Charger Market features leading players such as Suntactics, Jackery Inc., Goal Zero LLC, Instapark, Zamp Solar, Voltaic Systems, Powertraveller International Ltd., GigaWatt Inc., Gomadic Corporation, and Renogy LLC, all focusing on high-efficiency panels, durable designs, and advanced charging technologies. These companies strengthen their presence through product innovation in foldable, monocrystalline, and hybrid chargers tailored for outdoor, emergency, and off-grid use. Regionally, North America led the market with a 34.2% share in 2024, supported by strong adoption across recreational activities and emergency preparedness programs, followed by Asia-Pacific and Europe, which continue expanding due to rising solar adoption and outdoor mobility trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Portable Solar Charger Market reached USD 495.01 Million in 2024 and is set to grow at a 23% CAGR through 2032, driven by rising off-grid and outdoor power needs.

- Strong growth is fueled by increasing outdoor recreation, adventure travel, and off-grid energy demand, with foldable chargers leading the product type segment with a 6% share.

- Key trends include upgrades in monocrystalline and hybrid efficiency, lightweight foldable designs, and integration of MPPT, USB-C fast charging, and hybrid solar-plus-storage systems.

- Major players such as Jackery Inc., Goal Zero LLC, Renogy LLC, Zamp Solar, and Suntactics focus on enhancing durability, performance, and multifunctional charging features to strengthen their market presence.

- Regionally, North America led with a 2% share, followed by Asia-Pacific at 29.6% and Europe at 27.8%, driven by outdoor adoption, strong renewable policies, and rising use of portable charging solutions across consumer and field applications.

Market Segmentation Analysis:

By Product Type

The Foldable portable solar chargers dominated the product type segment in 2024 with a 41.6% share, driven by their high portability, multi-panel efficiency, and suitability for outdoor, travel, and emergency uses. Consumers prefer foldable models for their lightweight construction, faster charging capability, and compatibility with smartphones, power banks, and compact appliances. Small Portable units maintained demand for urban mobility, while Semi-Portable and Backpack chargers gained traction among campers and trekkers. Rising adoption by hikers, military professionals, and remote workers continues to reinforce foldable chargers’ leading position.

- For instance, BigBlue’s 28W solar charger features three USB-A ports delivering a total maximum output of 5V/4.8A, enabling simultaneous charging of multiple devices like smartphones with smart technology that optimizes speed for each. Its SunPower panels ensure efficient performance even in partial shade, making it ideal for hikers and backpackers.

By Panel Type

Monocrystalline solar chargers led the panel type segment with a 52.4% share in 2024, supported by superior conversion efficiency, longer operational lifespan, and reliable performance in low-light conditions. This dominance is strengthened by falling silicon prices and increasing consumer preference for high-efficiency portable charging. Polycrystalline panels remain relevant for cost-focused buyers, while Amorphous panels appeal to users seeking flexible and lightweight options. Hybrid panels are emerging solutions combining improved durability and charging consistency, but monocrystalline panels maintain clear leadership due to better efficiency in outdoor and rugged environments.

- For instance, Trina Solar’s Vertex series uses monocrystalline cells and advanced manufacturing technologies like high-density interconnection (which involves non-destructive cutting into multiple pieces, often referred to as half-cut or one-third-cut designs) in bifacial dual-glass panels.

By Panel Size (Wattage)

The 10W to 50W wattage range dominated the market in 2024 with a 48.7% share, offering an ideal blend of power output, portability, and broad device compatibility. These chargers efficiently support smartphones, GPS devices, tablets, cameras, and other small electronics, making them the preferred choice for camping, travel, and emergency readiness. Less than 10W chargers remain limited to low-load applications, while units above 50W cater to high-demand uses such as RV batteries and portable refrigerators. Rising outdoor recreation, adventure travel, and remote connectivity needs continue strengthening the leadership of the 10W–50W category.

Key Growth Drivers

Rising Outdoor Recreation and Off-Grid Power Demand

Growing participation in camping, hiking, trekking, and adventure tourism is significantly boosting the demand for portable solar chargers. Consumers increasingly seek lightweight, renewable power sources for charging smartphones, GPS devices, wearables, and cameras in off-grid environments. The expanding culture of digital connectivity during outdoor activities further accelerates adoption, as travelers prefer reliable solar charging to avoid battery depletion. In addition, government promotions of eco-friendly tourism and the rising popularity of RV and caravan travel continue to strengthen market growth for efficient portable solar charging solutions.

- For instance, Goal Zero offers the Nomad 50 Solar Panel, a 50-watt foldable charger that, when paired with their Sherpa 100 AC battery, supports the power needs of families or mountaineers on extended outdoor trips.

Rapid Advancements in Solar Panel Efficiency

Technological improvements in monocrystalline and hybrid solar panel designs are driving strong market expansion. Higher conversion efficiencies, improved low-light performance, and enhanced durability enable portable solar chargers to deliver faster and more consistent charging for multiple devices. Manufacturers are leveraging MPPT controllers, lightweight composites, and integrated storage options to boost usability. These advancements make portable solar chargers attractive for both consumer and professional applications, especially for military, disaster-response, and remote field operations requiring dependable, renewable energy supplies.

- For instance, Aiko Solar’s NEOSTAR 3P54 series, released in 2025, achieves 25.0% module efficiency through near-gapless cell spacing and optimized string connectors, allowing portable solar chargers to offer higher power output in smaller form factors.

Growing Sustainability Awareness and Declining Solar Costs

Consumers and enterprises are increasingly shifting toward clean energy products, making portable solar chargers a preferred alternative to power banks and fuel-based generators. Falling costs of photovoltaic materials and mass production efficiencies have made compact solar chargers more affordable and accessible. Corporate ESG initiatives and personal sustainability preferences further encourage adoption. Additionally, the rising use of solar-powered devices in emergency kits, humanitarian missions, and preparedness programs contributes to demand, as users prioritize renewable, maintenance-free power sources with minimal environmental impact.

Key Trends & Opportunities

Integration of Smart Features and Energy Storage

A major trend shaping the market is the integration of smart charging technologies, including USB-C fast charging, wireless charging, and built-in MPPT controllers for optimizing power flow. Manufacturers are incorporating compact lithium-ion or LiFePO₄ battery packs to enable hybrid solar-plus-storage designs. These intelligent chargers offer uninterrupted charging even during cloud cover, expanding usability for urban commuters, remote workers, and outdoor travelers. Opportunities are rising for brands offering multifunctional, rugged chargers with LED lighting, IoT tracking, and power-management apps to differentiate their portfolios.

- For instance, Victron Energy’s SmartSolar MPPT 75/10 controller uses advanced tracking algorithms to extract maximum energy from sunlight, even in partial shade, while automatically switching between bulk, absorption, and float stages for efficient battery charging.

Growing Adoption in Emergency Preparedness and Humanitarian Missions

Portable solar chargers are increasingly used in disaster-prone regions and emergency response operations due to their reliability, independence from grid power, and ability to function during outages. Governments and NGOs are integrating solar chargers into relief kits to support communication, lighting, and medical equipment in vulnerable areas. This trend creates strong opportunities for manufacturers providing durable, high-output, weather-resistant chargers. As climate-related disasters rise, demand from humanitarian agencies, defense forces, and off-grid communities will continue to expand, positioning portable solar chargers as essential emergency tools.

- For instance, EcoFlow’s portable solar panels have been applied in disaster relief to charge phones, power lights, and run small appliances in emergency shelters without needing fuel deliveries.

Key Challenges

Intermittent Solar Availability and Weather Dependence

One of the most significant challenges is the heavy dependence of portable solar chargers on sunlight, which affects charging efficiency during cloudy weather, shading, or low-light conditions. Users often experience inconsistent performance compared to battery-based chargers, limiting adoption in regions with limited sun exposure. This challenge increases the need for integrated energy storage or hybrid solar-battery systems. Seasonal variations, geographic limitations, and unpredictable weather patterns continue to restrict performance reliability, making technological innovation essential to mitigate variability in solar output.

Competition from Power Banks and Alternative Charging Solutions

The market faces strong competitive pressure from high-capacity power banks, fast-charging technologies, and compact portable generators that offer predictable and immediate power. Many consumers prioritize convenience and faster charging speeds, reducing preference for solar-only solutions during short trips or urban use. Additionally, falling lithium-ion battery prices allow power banks to offer greater capacity at lower costs. The challenge for the solar charger industry lies in differentiating through efficiency improvements, rugged designs, smart features, and hybrid models that ensure greater value and reliability compared to alternative power sources.

Regional Analysis

North America

North America held a 34.2% share of the Portable Solar Charger Market in 2024, driven by strong adoption across outdoor recreation, defense operations, and emergency preparedness programs. High participation in camping, hiking, RV travel, and off-grid adventures continues to stimulate demand for lightweight and durable chargers. The U.S. leads the region due to government support for renewable products and widespread consumer spending on portable electronics. Growth is further supported by disaster-response agencies integrating solar-powered equipment into emergency kits. Increasing sustainability awareness and technological innovation reinforce North America’s position as a leading market.

Europe

Europe captured a 27.8% share in 2024, supported by rising eco-tourism, stringent environmental policies, and growing consumer preference for clean energy products. Countries such as Germany, the UK, and the Nordics exhibit strong demand for high-efficiency monocrystalline and hybrid portable chargers due to extensive outdoor activities and renewable-friendly lifestyles. The region benefits from supportive government incentives promoting solar adoption and high penetration of premium outdoor gear brands. Cross-border travel, caravan tourism, and emphasis on sustainable mobility solutions further strengthen demand. Europe’s focus on reducing carbon footprints continues to expand opportunities for advanced portable solar technologies.

Asia-Pacific

Asia-Pacific accounted for a 29.6% share in 2024 and represents the fastest-growing region, driven by large-scale adoption among trekkers, rural consumers, and tech-savvy travelers. China, India, Japan, and South Korea lead due to high production capabilities, rising disposable incomes, and increasing demand for off-grid power solutions. Expanding outdoor recreation, growing smartphone dependency, and large populations in remote areas fuel adoption of portable solar chargers. Government initiatives supporting renewable energy integration and disaster management preparedness also contribute to growth. The region’s rapid urbanization and affordability of compact solar devices position Asia-Pacific as a major expansion hub.

Latin America

Latin America held a 5.1% share in 2024, with growing demand driven by increasing outdoor tourism, remote-area electrification needs, and expanding use of portable devices. Countries such as Brazil, Chile, Argentina, and Colombia are witnessing rising preference for renewable charging solutions for camping and fieldwork activities. Solar-powered equipment is gaining traction in rural communities where grid access remains limited. Disaster-prone regions are also adopting portable solar chargers for emergency communication and lighting. Market growth is supported by improving retail access and government interest in solar programs, though pricing sensitivity remains a key challenge.

Middle East & Africa

The Middle East & Africa region accounted for a 3.3% share in 2024, supported by high solar irradiation levels and increasing adoption of off-grid energy tools. Demand is rising in countries like the UAE, Saudi Arabia, South Africa, and Kenya for outdoor, commercial, and humanitarian applications. Communities in remote and rural areas rely on portable solar chargers for essential device powering due to limited grid connectivity. Growing use in safaris, field research, and desert expeditions further drives adoption. While awareness and affordability issues persist, expanding renewable initiatives and NGO-driven energy programs strengthen market potential.

Market Segmentations:

By Product Type :

- Foldable

- Small Portable

- Semi-Portable

- Backpack

By Panel Type :

- Monocrystalline

- Polycrystalline

- Amorphous

- Hybrid

By Panel Size (Wattage) :

- Less than 10W

- 10W to 50W

- More than 50W

By Application :

- Individual Consumers

- Transportation

- Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Portable Solar Charger Market includes major players such as Suntactics, Jackery Inc., Goal Zero LLC, Instapark, Zamp Solar, Voltaic Systems, Powertraveller International Ltd., GigaWatt Inc., Gomadic Corporation, and Renogy LLC. The market remains moderately fragmented, with companies focusing on high-efficiency panels, rugged designs, and multifunctional charging features to strengthen their positions. Leading brands compete through innovation in monocrystalline and hybrid technologies, integration of MPPT controllers, and enhanced durability for outdoor use. Strategic partnerships with outdoor gear distributors, e-commerce expansion, and continuous product upgrades support their market presence. Manufacturers increasingly invest in foldable and lightweight designs to target travelers, campers, and emergency users. Sustainability-driven consumers also push companies to adopt eco-friendly materials and promote renewable charging solutions. As demand rises for high-output and smart-enabled chargers, players emphasize differentiation through design advancements, reliability, portability, and expanded device compatibility, intensifying competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GigaWatt Inc.

- Zamp Solar

- Renogy LLC

- Goal Zero LLC

- Powertraveller International Ltd.

- Instapark

- Suntactics

- Voltaic Systems

- Jackery Inc.

- Gomadic Corporation

Recent Developments

- In September 2024, Jackery Inc. completed the acquisition of Geneverse, expanding its product and service portfolio in the portable energy segment.

- In January 2025, Jackery announced a new lineup at CES including a “solar roof” option and enhanced solar generators extending their reach beyond portable chargers to home and mobile solar power systems.

- In January 2025, EcoFlow launched a new Alternator Charger for on-the-road charging, expanding its product range for adventurers and mobile power users.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Panel Type, Panel Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as outdoor recreation, adventure travel, and off-grid activities continue to increase globally.

- Advancements in monocrystalline and hybrid solar technologies will enhance charging efficiency and durability.

- Integration of smart features such as MPPT controllers, wireless charging, and USB-C fast charging will become standard.

- Hybrid solar-plus-storage models will gain traction for uninterrupted power supply in varying weather conditions.

- Military, disaster-response, and humanitarian sectors will expand adoption of rugged high-output portable solar chargers.

- Growth of eco-friendly consumer behavior will strengthen demand for renewable portable charging solutions.

- Lightweight, ultra-compact, and foldable designs will remain key product development priorities.

- Emerging markets in Asia-Pacific, Africa, and Latin America will offer significant expansion opportunities.

- E-commerce and direct-to-consumer brands will drive competitive pricing and product accessibility.

- Manufacturers will increasingly collaborate with outdoor gear brands and mobility solution providers for product integration.