Market Overview

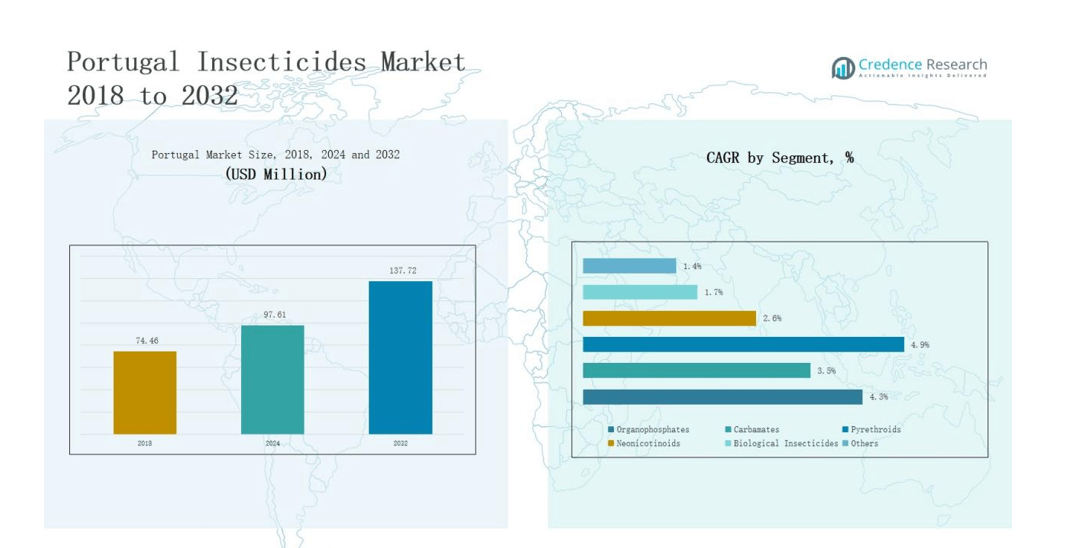

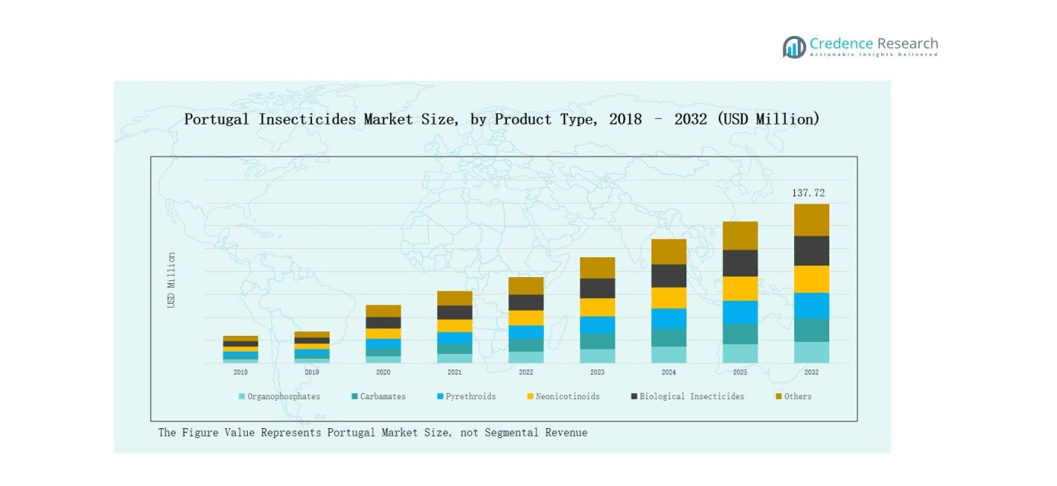

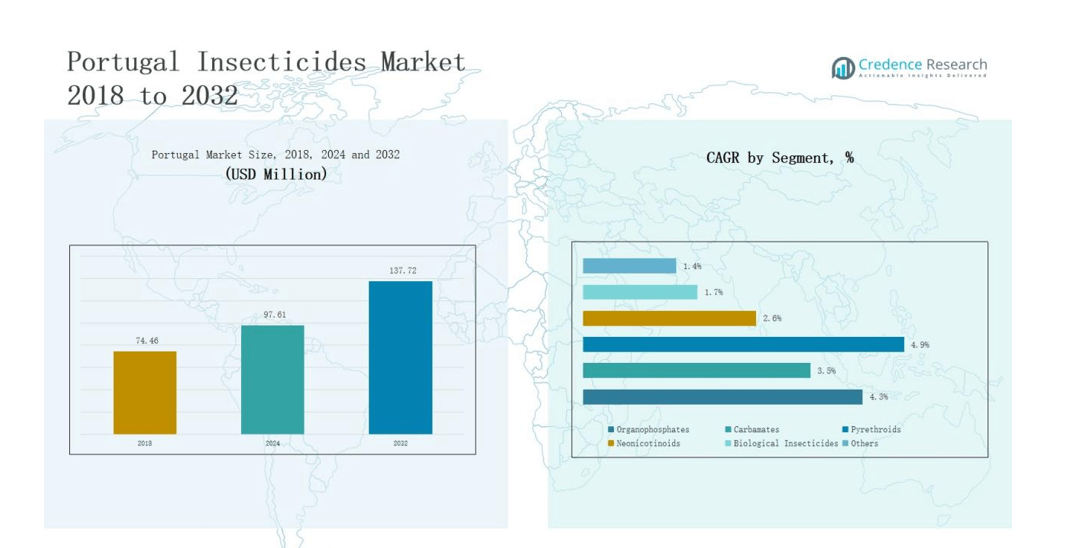

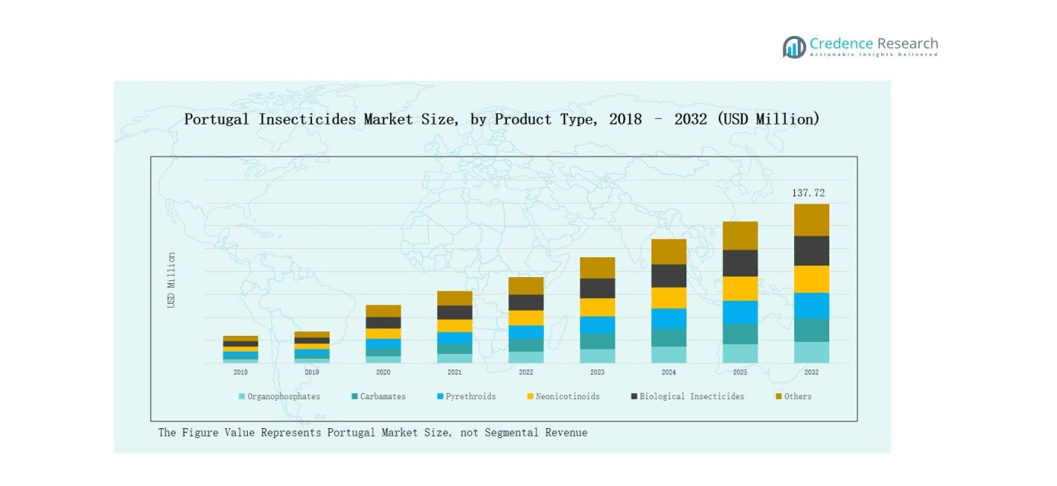

Portugal Insecticides Market size was valued at USD 74.46 million in 2018 to USD 97.61 million in 2024 and is anticipated to reach USD 137.72 million by 2032, at a CAGR of 4.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portugal Insecticides Market Size 2024 |

USD 97.61 million |

| Portugal Insecticides Market, CAGR |

4.31% |

| Portugal Insecticides Market Size 2032 |

USD 137.72 million |

The Portugal Insecticides Market is shaped by the presence of global leaders and strong regional firms, each competing through innovation, regulatory compliance, and product diversification. Key players include Bayer CropScience, BASF SE, Syngenta, Corteva Agriscience, ADAMA, FMC Corporation, UPL Limited, Sipcam Portugal, Nufarm, and Valagro. These companies emphasize sustainable formulations and integrated pest management to address evolving agricultural needs. Among regions, Northern Portugal led the market in 2024, commanding 34% share, supported by intensive viticulture, horticulture, and high export-oriented crop production.

Market Insights

- The Portugal Insecticides Market grew from USD 74.46 million in 2018 to USD 97.61 million in 2024 and will reach USD 137.72 million by 2032.

- Organophosphates led by product type in 2024 with 32% share, followed by pyrethroids at 24% and neonicotinoids at 18%, while biological insecticides captured 15%.

- Agriculture dominated applications with 61% share in 2024, supported by vineyards, olive groves, and horticultural crops, while public health accounted for 17% and turf & landscape 9%.

- Northern Portugal commanded the highest regional share at 34% in 2024, driven by viticulture and horticulture, followed by Central at 27%, Southern at 22%, and Islands at 17%.

- Key players include Bayer CropScience, BASF SE, Syngenta, Corteva Agriscience, ADAMA, FMC Corporation, UPL Limited, Sipcam Portugal, Nufarm, and Valagro.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Organophosphates dominated the Portugal insecticides market in 2024 with a 32% share, driven by broad-spectrum effectiveness in controlling pests across cereals, vegetables, and vineyards. Pyrethroids followed at 24%, favored for affordability and reliability in both crop protection and urban pest control. Neonicotinoids held 18%, primarily used in horticulture and fruit farming. Biological insecticides gained 15%, reflecting EU-driven sustainability trends. Carbamates captured 7%, while niche formulations under Others contributed 4%.

- For instance, Syngenta launched its biological insecticide Taegro in European markets, including Portugal, to support integrated pest management in horticulture and vineyards.

By Application

Agriculture remained the leading application, contributing 61% of Portugal’s insecticides revenue in 2024, supported by strong demand from vineyards, olive groves, and horticultural crops vital to exports. Public Health applications represented 17%, linked to mosquito and pest control programs. Turf & Landscape followed with 9%, covering sports fields and municipal spaces. Forestry accounted for 7%, focused on pine and eucalyptus protection. The Others category, including storage and domestic use, comprised 6% of market revenue.

- For instance, Syngenta supported Portugal’s national mosquito control campaigns with Actellic® 300CS, which the World Health Organization endorsed for vector control programs.

Market Overview

Rising Agricultural Intensification

Agricultural intensification in Portugal is a major driver for insecticide demand, accounting for the expansion of vineyards, olive groves, and horticultural crops. These sectors require reliable pest control to protect yields and maintain export quality standards. Farmers continue to adopt advanced formulations to address seasonal pest outbreaks. Increasing mechanization and modern irrigation further boost insecticide efficiency, strengthening their role in improving productivity and ensuring consistent supply to both domestic and international markets.

- For instance, Corteva Agriscience introduced the Closer insecticide in Portugal, designed to control sap-feeding pests in crops such as olives and citrus, using its sulfoxaflor active ingredient for targeted performance.

Government and EU Support for Crop Protection

The Portugal insecticides market benefits from supportive agricultural policies and EU-funded programs promoting crop productivity. Subsidies and grants aimed at modernizing farming practices encourage adoption of integrated pest management and selective insecticides. In addition, research initiatives foster innovation in eco-friendly formulations that comply with strict EU directives. Such support not only helps farmers balance pest control with environmental sustainability but also strengthens Portugal’s competitiveness in global agricultural exports, particularly in wine, olive oil, and fruit.

- For instance, Corteva Agriscience introduced Zorvec™ Active fungicide solutions across Southern Europe, including Portugal, to support sustainable vineyard protection with EU-compliant chemistry.

Increasing Pest Resistance and Climate Change

Rising pest resistance and climate variability are significant growth drivers for insecticide consumption in Portugal. Warmer temperatures, irregular rainfall, and longer growing seasons are enabling pest populations to thrive and spread, especially in vineyards and olive plantations. This scenario pushes farmers to adopt both chemical and biological insecticides in rotation. Demand for innovative solutions is expected to increase, as growers need sustainable pest management strategies that mitigate resistance while maintaining crop quality and productivity.

Key Trends & Opportunities

Shift Toward Biological Insecticides

A major trend shaping the Portugal insecticides market is the rapid shift toward biological solutions, which accounted for a growing share in recent years. Driven by EU’s Farm to Fork strategy and consumer demand for residue-free produce, farmers are integrating microbial and plant-based products into pest management practices. This transition creates opportunities for international and local players to introduce eco-friendly formulations, positioning biological insecticides as a key growth avenue in sustainable agriculture.

- For instance, Syngenta introduced its synthetic TYMIRIUM® nematicide/fungicide technology first in Argentina, providing long-lasting control of soil-borne pests and nematodes.

Integration of Precision Agriculture

The integration of precision agriculture technologies offers strong opportunities for insecticide optimization in Portugal. Tools such as drones, GPS-guided spraying, and AI-based pest monitoring are enhancing application efficiency while reducing wastage. These technologies allow farmers to target specific infestations with accurate doses, lowering costs and environmental impact. As adoption grows across vineyards and horticultural farms, precision agriculture will open new avenues for insecticide manufacturers, enabling customized solutions aligned with sustainable farming practices.

- For instance, EOSDA (EOS Data Analytics) partnered with local cooperatives in Alentejo to deploy satellite-based pest monitoring systems, allowing farmers to detect early outbreaks and optimize insecticide spraying schedules with higher accuracy.

Key Challenges

Stringent EU Regulations

Strict EU regulations on chemical usage present a significant challenge for Portugal’s insecticides market. Active ingredient bans, residue limits, and compliance checks restrict the use of several conventional insecticides, particularly organophosphates and carbamates. Farmers often face higher costs as they transition to approved alternatives. For manufacturers, the need to constantly reformulate products to meet compliance requirements delays product launches and increases R&D expenses, putting pressure on profitability while slowing market growth.

Rising Consumer Preference for Organic Produce

Growing consumer preference for organic and residue-free produce poses a challenge to traditional insecticides. Retailers and exporters increasingly demand certified products, forcing farmers to reduce reliance on chemical-based insecticides. This trend pressures conventional formulations while creating a competitive push for biological alternatives. For companies heavily dependent on chemical portfolios, adapting to evolving consumer demand requires restructuring strategies and investing in new technologies, which may strain resources and profitability in the short term.

Escalating Pest Resistance

Escalating pest resistance to widely used insecticides remains a persistent challenge in Portugal’s agriculture. Frequent application of similar active ingredients in vineyards, olive groves, and horticulture accelerates resistance buildup. As pests adapt, farmers need higher dosages or new products, raising costs and environmental risks. Manufacturers must continuously innovate resistance-management solutions, including integrated pest management and hybrid formulations. Without effective strategies, resistance threatens crop yields, reduces farmer confidence, and weakens long-term market sustainability.

Regional Analysis

Northern Portugal

Northern Portugal accounted for 34% share of the Portugal Insecticides Market in 2024, making it the leading regional segment. The dominance is supported by intensive viticulture in the Douro Valley and horticulture production. Farmers in this region adopt organophosphates and pyrethroids widely to protect vineyards from pest outbreaks. Biological insecticides are also expanding due to strict EU residue policies. The region’s role in wine exports sustains high demand for consistent pest management. Its diversified agriculture creates opportunities for both traditional and eco-friendly products.

Central Portugal

Central Portugal held 27% share of the national insecticides market in 2024. The region benefits from a strong concentration of olive groves and cereal cultivation that require reliable pest control. Neonicotinoids and organophosphates remain common, while biological alternatives are gaining traction. Public health programs addressing urban pests also support regional demand. It is experiencing rising adoption of integrated pest management techniques, driven by regulatory compliance. The region’s stable agricultural base ensures steady market growth for suppliers.

Southern Portugal

Southern Portugal represented 22% of the Portugal Insecticides Market in 2024. The Alentejo and Algarve areas dominate production of olives, citrus, and vegetables, creating sustained demand for targeted pest control. Farmers rely on pyrethroids and neonicotinoids, but biological insecticides are expanding rapidly to meet export quality standards. Public health usage for vector control also supports insecticide consumption. The hot climate contributes to higher pest activity, requiring frequent application cycles. This dynamic maintains the region’s importance for market participants.

Islands (Azores and Madeira)

The islands of Azores and Madeira accounted for 17% share of the Portugal Insecticides Market in 2024. Agriculture is specialized, with a focus on fruit crops, dairy, and ornamental plants. Pest control practices emphasize eco-friendly formulations to support biodiversity. Biological insecticides gain strong acceptance due to limited land resources and regulatory pressure. Public health applications are vital in maintaining tourism safety. The islands continue to represent a smaller but strategically significant segment for sustainable insecticide solutions.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region.

- Northern Portugal

- Central Portugal

- Southern Portugal

- Islands (Azores and Madeira)

Competitive Landscape

The Portugal Insecticides Market is characterized by the presence of global leaders and strong regional firms competing through product diversity, regulatory compliance, and innovation. Multinational companies such as Bayer CropScience, BASF SE, Syngenta, Corteva Agriscience, ADAMA, FMC Corporation, and UPL Limited dominate the landscape with broad-spectrum chemical and hybrid formulations. These players invest heavily in R&D to comply with strict EU directives and support sustainable agriculture. Regional firms, including Sipcam Portugal, Nufarm, and Valagro, enhance competitiveness by focusing on tailored solutions and expanding biological insecticide portfolios that align with rising eco-friendly demand. Competition is further shaped by strategic partnerships, product launches, and acquisitions aimed at strengthening distribution networks and addressing evolving pest challenges. Market participants emphasize integrated pest management and precision agriculture compatibility to maintain relevance. Overall, the market reflects a balance between established global brands and agile local companies responding to Portugal’s specific agricultural and regulatory environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Sipcam Portugal

- ADAMA

- Bayer CropScience

- BASF SE

- Syngenta

- FMC Corporation

- UPL Limited

- Corteva Agriscience

- Nufarm

- Valagro

Recent Developments

- In July 2025, Vestaron gained emergency approval in Portugal for its bioinsecticide SPEAR LEP to control Tuta absoluta in tomato crops, supported by partner LAINCO.

- In July 2025, ADAMA introduced its insecticide Trinalor™, offering rapid feeding cessation and up to three weeks of protection with low impact on beneficial insects.

- In March 2025, Syngenta launched the biological insecticide NETURE targeting corn leafhoppers and sap-sucker pests, enhancing control in corn and soybean crops.

- In October 2024, ADAMA gained registration for Sonavio®, a selective herbicide based on Bifenox, for broadleaf weed control in vegetables in Portugal.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will rise due to strict EU sustainability policies.

- Adoption of precision agriculture tools will enhance insecticide application efficiency.

- Farmers will increasingly rotate insecticides to manage growing pest resistance.

- Vineyards and olive groves will remain the leading consumers of insecticides.

- Public health programs will sustain demand for vector control products.

- Regulatory reforms will encourage faster transition to eco-friendly formulations.

- Partnerships between global and local firms will expand product availability.

- Digital monitoring systems will guide pest control decisions more effectively.

- Export-oriented crops will push adoption of residue-free pest management solutions.

- Regional players will gain ground by focusing on customized biological offerings.