Market Overview

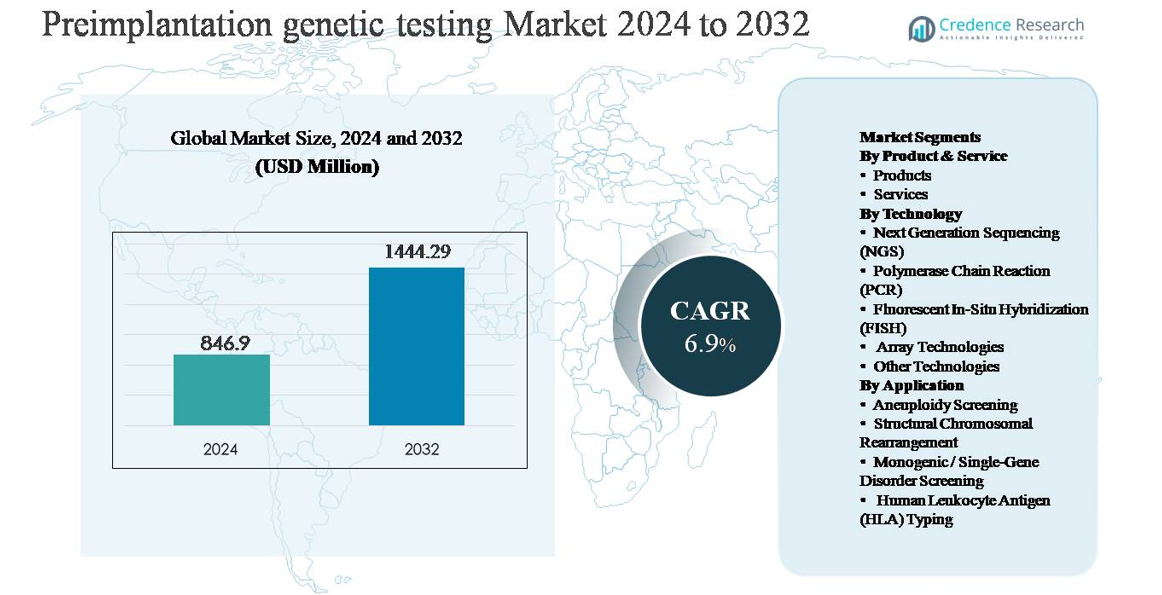

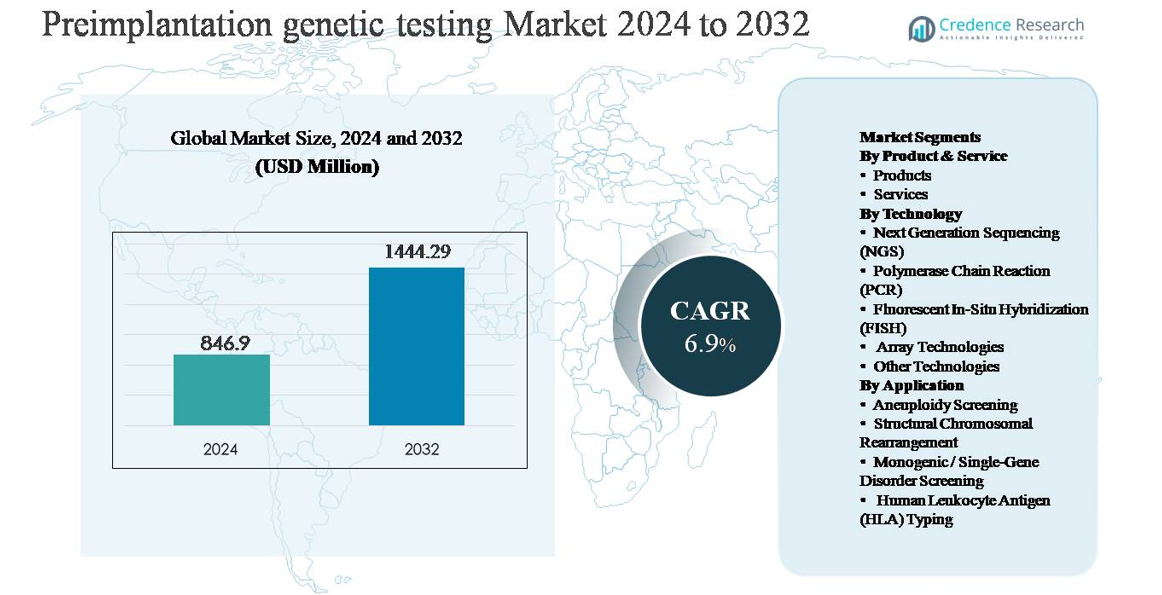

The preimplantation genetic testing (PGT) market was valued at USD 846.9 million in 2024 and is projected to reach USD 1,444.29 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Preimplantation Genetic Testing Market Size 2024 |

USD 846.9 million |

| Preimplantation Genetic Testing Market, CAGR |

6.9% |

| Preimplantation Genetic Testing Market Size 2032 |

USD 1,444.29 million |

The preimplantation genetic testing market is led by a group of globally established diagnostics and genomics companies, including Illumina, Thermo Fisher Scientific, Agilent Technologies, Natera, Fulgent Genetics, Takara Bio, Revvity, Medicover Genetics, Genea BIOMEDX, and RGI. These players compete through advanced sequencing platforms, validated PGT workflows, and strong integration with fertility clinics and reference laboratories. North America is the leading regional market, accounting for approximately 39% of global market share, driven by high IVF adoption, advanced genetic testing infrastructure, and early uptake of NGS-based PGT. Europe follows with around 31% share, supported by established reproductive medicine networks and genetic disease prevention programs, while Asia-Pacific holds about 21%, reflecting rapid expansion of private fertility services and improving access to advanced diagnostics.

Market Insights

- The preimplantation genetic testing market was valued at USD 846.9 million in 2024 and is projected to reach USD 1,444.29 million by 2032, growing at a CAGR of 6.9% during the forecast period, supported by increasing integration of genetic screening in IVF workflows.

- Market growth is primarily driven by rising IVF procedure volumes, increasing maternal age, and higher clinical emphasis on reducing implantation failure and miscarriage risks through aneuploidy and monogenic disorder screening.

- Key trends include the dominance of NGS technology with ~45-50% segment share, growing preference for comprehensive PGT panels, and increasing outsourcing of testing services, which account for ~60–65% of the product & service segment.

- The competitive landscape is shaped by global genomics and diagnostics players focusing on high-throughput sequencing, faster turnaround times, clinic partnerships, and scalable service models to strengthen market presence.

- Regionally, North America leads with ~39% market share, followed by Europe at ~31% and Asia-Pacific at ~21%, with Asia-Pacific showing the fastest growth due to expanding fertility clinics and improving access to advanced diagnostics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product & Service:

Within the preimplantation genetic testing market, services represent the dominant sub-segment, accounting for an estimated ~60-65% market share. This dominance is driven by the complexity of embryo biopsy interpretation, stringent quality requirements, and the need for certified laboratories with advanced bioinformatics capabilities. Fertility clinics increasingly outsource testing to specialized service providers to ensure diagnostic accuracy, regulatory compliance, and faster turnaround times. Meanwhile, products including reagents, consumables, and testing kits maintain steady demand, supported by rising IVF procedure volumes and continuous improvements in assay sensitivity and workflow standardization.

- For instance, Natera’s PGT services utilize high-depth NGS workflows capable of analyzing whole-genome amplified embryo samples with read lengths of 2 × 150 base pairs, enabling reliable detection of chromosomal copy number variations. Meanwhile, products such as reagents, consumables, and kits sustain steady demand as IVF volumes rise.

By Technology:

Next Generation Sequencing (NGS) is the leading technology sub-segment, holding approximately 45-50% market share, due to its high resolution, scalability, and ability to simultaneously detect aneuploidies, segmental imbalances, and single-gene mutations. NGS adoption is driven by declining sequencing costs, improved data analytics, and its compatibility with comprehensive PGT workflows. PCR and FISH remain relevant in targeted or legacy applications, while array-based technologies continue to serve structural variation analysis. However, limited multiplexing and lower resolution constrain their growth relative to NGS-driven platforms.

- For instance, Illumina’s NovaSeq X platform can generate up to 16 terabases of data per run, enabling high-depth embryo analysis with consistent coverage.

By Application:

Aneuploidy screening dominates the application segment, contributing nearly 50% of overall market revenue, as it is routinely integrated into IVF cycles to improve implantation rates and reduce miscarriage risk. The primary drivers include rising maternal age, higher IVF success optimization goals, and growing clinical consensus on PGT-A benefits. Monogenic/single-gene disorder screening is expanding steadily, supported by increased awareness of inherited diseases and carrier screening programs. Structural chromosomal rearrangement testing and HLA typing remain niche but critical, particularly for recurrent pregnancy loss and sibling donor selection cases.

Key Growth Drivers

Rising Global IVF Procedure Volumes

The steady increase in in vitro fertilization (IVF) procedures worldwide is a primary growth driver for the preimplantation genetic testing (PGT) market. Factors such as delayed parenthood, rising infertility prevalence, lifestyle-related reproductive disorders, and greater social acceptance of assisted reproductive technologies are expanding the IVF patient pool. As IVF cycles increase, clinicians increasingly integrate PGT to improve implantation rates, reduce miscarriage risk, and minimize the likelihood of genetic abnormalities. Fertility clinics view PGT as a value-enhancing adjunct that supports better clinical outcomes and patient confidence. The growing number of private fertility centers, particularly in emerging economies, further reinforces routine PGT adoption as part of standardized IVF protocols.

- For instance, Genea BIOMEDX supports IVF laboratories with time-lapse incubation systems capable of capturing over 5,000 embryo images per cycle, enabling precise embryo selection workflows that complement genetic testing.

Increasing Maternal Age and Genetic Risk Awareness

Rising maternal age is significantly increasing demand for PGT, as the risk of chromosomal abnormalities escalates with age. Couples and clinicians are becoming more proactive in mitigating genetic risks associated with advanced maternal age, recurrent pregnancy loss, and repeated IVF failure. Improved genetic counseling and wider access to carrier screening programs are strengthening awareness of heritable conditions, encouraging pre-emptive embryo testing. This shift toward preventive reproductive care positions PGT as a critical clinical tool rather than an optional add-on. As patient education improves, demand continues to rise for comprehensive genetic screening prior to embryo implantation.

- For instance,”Fulgent Genetics offers expanded carrier screening (ECS) panels covering more than 700 inherited conditions, which aids in early risk identification and helps inform reproductive decisions.

Technological Advancements in Genetic Testing Platforms

Rapid advances in molecular diagnostics, particularly next generation sequencing (NGS), are driving strong growth in the PGT market. Improved sequencing accuracy, higher throughput, faster turnaround times, and declining per-sample costs have expanded clinical adoption. Enhanced bioinformatics pipelines enable more reliable detection of aneuploidies, segmental imbalances, and single-gene mutations within a single workflow. These innovations are improving diagnostic confidence while supporting scalable testing models for high-volume fertility centers. Continuous innovation by test developers and service providers is accelerating clinical acceptance and expanding the addressable patient base for PGT.

Key Trends & Opportunities

Shift Toward Comprehensive PGT Workflows

A key trend in the PGT market is the shift from single-indication testing toward comprehensive, multi-condition screening approaches. Clinics increasingly prefer platforms capable of simultaneously assessing aneuploidy, monogenic disorders, and structural chromosomal abnormalities. This integrated testing model improves clinical efficiency, reduces the need for multiple assays, and supports personalized embryo selection strategies. The trend creates strong opportunities for technology providers offering scalable, all-in-one PGT solutions with advanced data interpretation tools. As fertility clinics seek to differentiate through success rates, comprehensive PGT workflows are becoming a competitive necessity.

- For instance, Thermo Fisher Scientific’s bioinformatics pipelines for reproductive genetics can process hundreds of embryo samples per sequencing run, enabling scalable, all-in-one PGT solutions that improve clinical efficiency and consistency across high-volume fertility centers.

Expansion in Emerging Fertility Markets

Emerging markets across Asia-Pacific, Latin America, and parts of the Middle East present significant growth opportunities for PGT. Expanding middle-class populations, improving healthcare infrastructure, and rising investments in private fertility clinics are increasing access to advanced reproductive services. Governments and insurers in select regions are also gradually recognizing infertility as a medical condition, improving affordability. These markets offer strong potential for service-based PGT models, where centralized laboratories support multiple clinics. Strategic partnerships and regional laboratory expansion are expected to accelerate market penetration.

- For instance, Medicover Genetics has expanded its reproductive genetics laboratory network across Europe, the Middle East, and Asia, operating facilities capable of processing thousands of reproductive genetic tests per month to support cross-border clinic demand.

Key Challenges

High Cost and Limited Reimbursement Coverage

The high cost of PGT remains a significant barrier to broader adoption, particularly in price-sensitive regions. Testing expenses add substantially to overall IVF cycle costs, limiting access for many patients. In most countries, PGT is not fully reimbursed by public or private insurers, positioning it as an out-of-pocket expense. This financial burden restricts utilization despite demonstrated clinical benefits. Cost sensitivity also pressures clinics to carefully justify testing recommendations, slowing adoption in routine IVF cycles. Addressing affordability remains critical for sustained market expansion.

Ethical, Regulatory, and Standardization Constraints

Ethical concerns surrounding embryo selection and genetic screening present ongoing challenges for the PGT market. Regulations governing embryo testing vary widely across countries, creating compliance complexity for laboratories and clinics operating internationally. Inconsistent testing standards and reporting criteria can also affect result interpretation and clinical decision-making. Public debates around genetic selection further influence policy development and patient perception. These regulatory and ethical constraints can delay technology adoption, limit test scope, and increase operational costs, requiring continuous stakeholder engagement and regulatory alignment.

Regional Analysis

North America

North America dominates the preimplantation genetic testing market, accounting for approximately 38-40% of global market share. The region benefits from high IVF procedure volumes, advanced genetic testing infrastructure, and early adoption of next generation sequencing based PGT. The United States leads regional demand, supported by a strong network of specialized fertility clinics, well-established reference laboratories, and high patient awareness of genetic risk screening. Favorable clinical guidelines, strong private insurance penetration for infertility services, and continuous technological innovation further reinforce market leadership. Canada contributes steadily, supported by expanding private fertility centers and growing acceptance of PGT in routine IVF cycles.

Europe

Europe represents around 30-32% of the global preimplantation genetic testing market, supported by widespread IVF adoption and strong clinical emphasis on genetic disease prevention. Countries such as the UK, Germany, France, Spain, and Italy drive regional demand through advanced reproductive medicine infrastructure and growing maternal age trends. Public and private healthcare systems increasingly integrate PGT for high-risk pregnancies, particularly for aneuploidy and monogenic disorder screening. However, market growth varies by country due to differing regulatory frameworks governing embryo testing. Despite regulatory complexity, strong clinical research activity and expanding private fertility services sustain Europe’s significant market share.

Asia-Pacific

Asia-Pacific accounts for approximately 20-22% of the global market and represents the fastest-growing regional segment. Rising infertility rates, delayed parenthood, and expanding access to assisted reproductive technologies are driving PGT adoption across China, Japan, India, South Korea, and Australia. Rapid growth in private fertility clinics, increasing medical tourism, and improving affordability of genetic testing technologies support market expansion. While awareness levels vary across countries, urban centers are rapidly adopting advanced PGT workflows. Government initiatives to address declining birth rates in select countries further strengthen long-term growth prospects for preimplantation genetic testing in the region.

Latin America

Latin America holds an estimated 5-6% market share, driven by gradual expansion of private fertility clinics and increasing awareness of genetic screening benefits. Brazil, Mexico, and Argentina are the primary contributors, supported by growing middle-class populations and rising demand for advanced reproductive care. While cost sensitivity and limited reimbursement constrain adoption, high-risk IVF patients increasingly opt for PGT to improve outcomes. Cross-border fertility travel within the region also supports demand for specialized testing services. Continued investment in laboratory infrastructure and clinician training is expected to steadily improve penetration across major Latin American markets.

Middle East & Africa

The Middle East & Africa region accounts for approximately 3-4% of the global market, reflecting early-stage but steadily growing adoption. Gulf countries such as the UAE and Saudi Arabia lead regional demand due to high healthcare spending, strong private fertility centers, and cultural emphasis on family planning. In Africa, market growth remains limited but is improving in urban hubs with expanding private healthcare access. Genetic disease prevalence in certain populations is encouraging selective PGT adoption. However, regulatory variability and affordability challenges continue to restrict widespread use, keeping overall market share comparatively modest.

Market Segmentations:

By Product & Service

By Technology

- Next Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Fluorescent In-Situ Hybridization (FISH)

- Array Technologies

- Other Technologies

By Application

- Aneuploidy Screening

- Structural Chromosomal Rearrangement

- Monogenic / Single-Gene Disorder Screening

- Human Leukocyte Antigen (HLA) Typing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the preimplantation genetic testing (PGT) market is characterized by a mix of specialized genetic testing laboratories, molecular diagnostics companies, and fertility-focused service providers competing on accuracy, turnaround time, and technological depth. Leading players emphasize next generation sequencing–based platforms, robust bioinformatics pipelines, and validated clinical workflows to support comprehensive embryo screening. Strategic partnerships with fertility clinics and IVF networks are central to market positioning, enabling consistent sample volumes and long-term service contracts. Companies also invest in laboratory expansion, automation, and quality certifications to ensure scalability and regulatory compliance. Continuous assay refinement, expanded test menus covering aneuploidy and monogenic disorders, and enhanced data interpretation tools are key competitive differentiators. As demand grows, competition increasingly centers on service reliability, clinical integration, and the ability to deliver high-throughput, cost-efficient PGT solutions across diverse regulatory environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Illumina launched its 5-base sequencing solution, enabling simultaneous high-resolution detection of genomic variants and DNA methylation from a single workflow using proprietary chemistry and DRAGEN algorithms, greatly expanding multiomic insight capabilities for genetic analysis. This platform supports comprehensive genomic and epigenomic profiling that can be leveraged in research workflows including reproductive genetics.

- In July 2025,Takara Bio strengthened its support for preimplantation genetic testing workflows with the expansion of its SMARTer® PicoPLEX® whole-genome amplification technology, validated for single-cell and sub-100 pg DNA inputs. This development improved genome uniformity and coverage consistency, supporting reliable downstream NGS analysis from embryo biopsy samples used in PGT applications.

- In March 2025, Fulgent Genetics expanded its reproductive genetics portfolio by enhancing its NGS-based carrier screening and embryo-related testing workflows, integrating updated bioinformatics pipelines capable of analyzing over 500 clinically relevant genes from low-input DNA samples. The upgrade improved variant calling accuracy and turnaround time for laboratories supporting IVF and embryo screening programs.

Report Coverage

The research report offers an in-depth analysis based on Product&Service, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Preimplantation genetic testing will become a standard component of IVF protocols as clinics focus on improving implantation success and reducing miscarriage risk.

- Adoption of next generation sequencing will continue to expand, supported by higher accuracy, faster analysis, and broader clinical utility.

- Demand for comprehensive testing covering aneuploidy, monogenic disorders, and structural abnormalities will increase across fertility centers.

- Service-based testing models will strengthen as clinics rely on specialized laboratories for advanced genetic analysis and interpretation.

- Automation and bioinformatics integration will improve testing consistency, turnaround time, and scalability.

- Emerging markets will contribute a larger share as access to assisted reproductive technologies expands.

- Genetic counseling will play a more prominent role in guiding patient decision-making and test selection.

- Regulatory frameworks will gradually evolve to support standardized testing and reporting practices.

- Cost optimization efforts will improve affordability and support broader patient access.

- Strategic partnerships between technology providers and fertility networks will shape long-term market development.