Market Overview

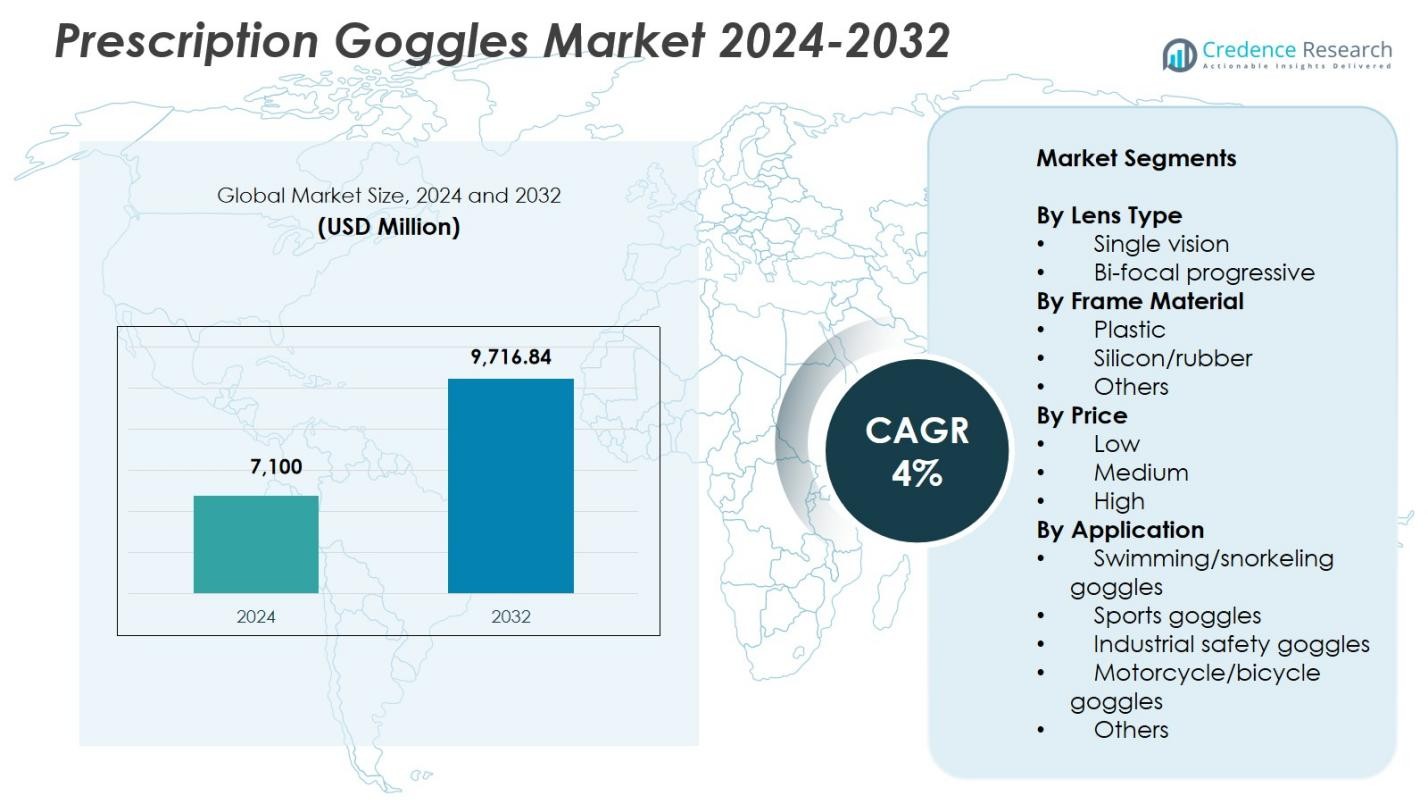

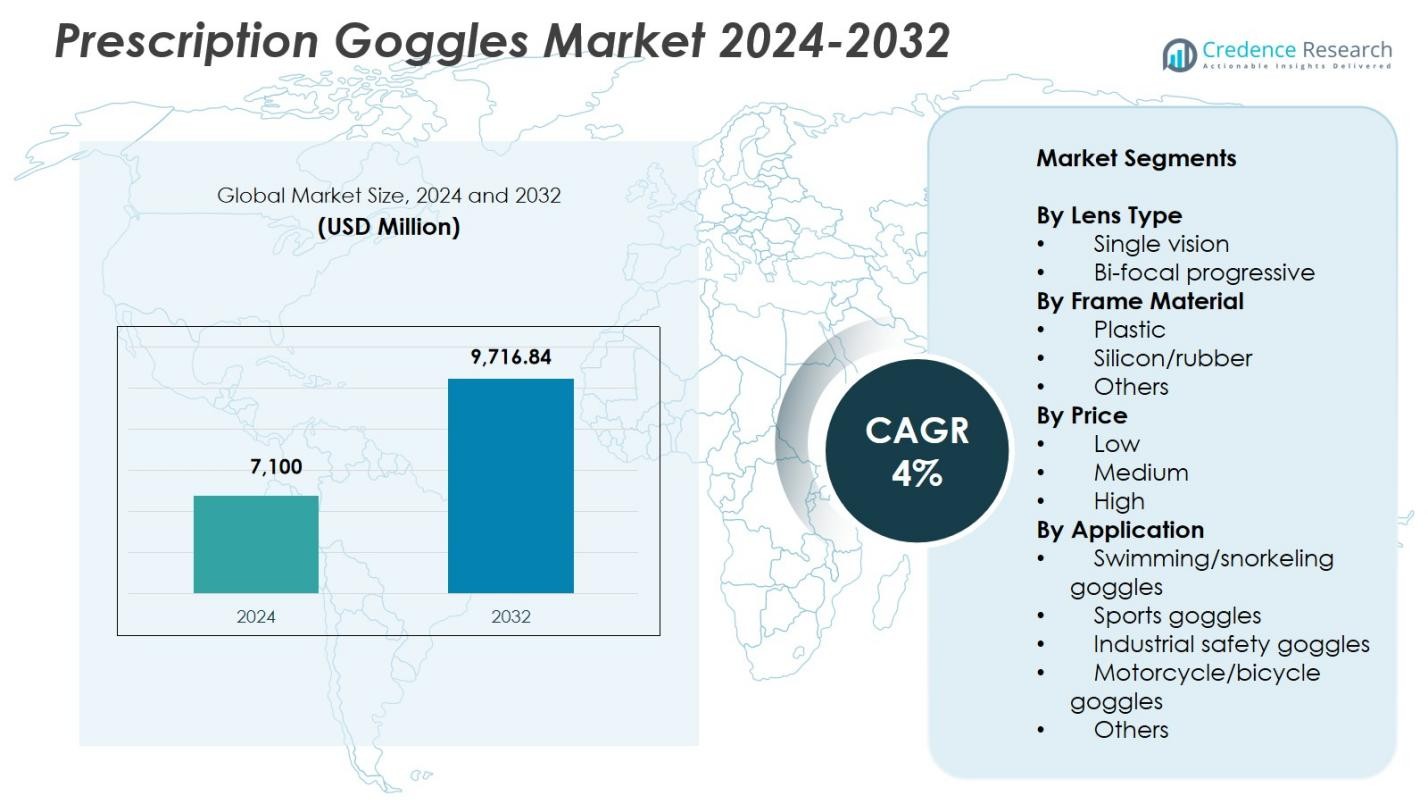

Prescription Goggles Market size was valued at USD 7,100 Million in 2024 and is anticipated to reach USD 9,716.84 Million by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prescription Goggles Market Size 2024 |

USD 7,100 Million |

| Prescription Goggles Market, CAGR |

4% |

| Prescription Goggles Market Size 2032 |

USD 9,716.84 Million |

Prescription Goggles Market features leading players such as Oakley, Liberty Sport, SafeVision, GOGGLEMAN, RxSport, John Jacobs, Safety-RX, First Lens, Arena, and MSA Safety, all driving market growth through advanced lens technologies, ergonomic frame designs, and expanded customization options for sports and industrial users. These companies focus on enhancing durability, anti-fog performance, and impact resistance to meet rising safety and recreational demands. Regionally, North America led the market with a 34.6% share in 2024, supported by strong sports participation and stringent workplace safety standards, followed by Europe and Asia-Pacific, which continue to witness increasing adoption across recreational and occupational applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prescription Goggles Market reached USD 7,100 Million in 2024 and will grow at a CAGR of 4% through 2032.

- Growing demand from sports participants and industrial workers drives the market as single-vision lenses lead with a 62.4% share due to affordability and wide optical compatibility.

- Premiumization, advanced anti-fog coatings, and customized digital lens surfacing are shaping key trends, with brands focusing on durable, lightweight materials to enhance user comfort.

- Leading players such as Oakley, Liberty Sport, SafeVision, and GOGGLEMAN strengthen market presence by expanding product lines featuring impact resistance, UV protection, and improved fit.

- North America holds a 34.6% share, followed by Europe at 28.3% and Asia-Pacific at 25.7%, while medium-priced products dominate with a 47.6% share, reflecting strong adoption across sports and workplace safety applications.

Market Segmentation Analysis:

By Lens Type:

The Prescription Goggles Market by lens type is led by the single-vision segment, which accounted for 62.4% share in 2024, driven by rising demand among swimmers, industrial workers, and recreational users requiring precise correction for myopia or hyperopia. Single-vision lenses offer clarity, affordability, and wide availability across sports and safety eyewear categories, strengthening adoption globally. The bi-focal/progressive segment continues to gain traction as aging populations and multifocal vision needs grow, but its share remains secondary due to higher product costs and limited availability in certain sports-specific prescription goggles.

- For instance, Rec Specs offers the Shark model swimming goggles with standard clear single-vision prescription lenses featuring a patent-pending Rx’Able insertion design, adjustable bridge, and soft silicone strap for swimmer comfort.

By Frame Material:

In the frame material segment, plastic dominated the Prescription Goggles Market with a 54.8% share in 2024, supported by its lightweight structure, durability, and cost-effectiveness that align well with sports and everyday prescription eyewear requirements. Plastic frames also allow greater design flexibility and compatibility with high-prescription lenses, making them a preferred choice among leading brands. Silicon/rubber frames follow due to superior comfort, anti-slip properties, and suitability for high-impact environments, while the others category serves niche applications requiring advanced composites or enhanced chemical resistance.

- For instance, PROGEAR Eyeguard sports goggles use super tough polycarbonate plastic frames with interior side cushions, removable straps, and expanded thermo-plastic rubber nose pads, rated ASTM F803 for impact protection in sports like basketball and soccer.

By Price:

The medium-price segment held the dominant position in 2024 with a 47.6% share, driven by rising consumer preference for goggles that balance performance, durability, and affordability. This segment benefits from strong adoption across sports, industrial, and recreational users who seek premium features such as anti-fog coatings, UV protection, and impact-resistant lenses without entering the high-end price bracket. Low-price options continue to attract cost-conscious buyers, particularly in emerging markets, while high-price prescription goggles appeal to professional athletes and specialized safety applications requiring enhanced customization and advanced lens technologies.

Key Growth Drivers

Increasing Vision Correction Needs Among Sports and Industrial Users

Demand for prescription goggles is rising as more individuals with refractive errors participate in swimming, cycling, skiing, and other activities where standard eyewear is unsuitable. Industrial environments also require protective goggles with built-in prescription support to meet occupational safety regulations. This shift is driven by growing awareness of eye protection, expanding workforce participation in manufacturing and construction, and increasing vision impairment prevalence globally. As employers and consumers prioritize both clarity and safety, integrated prescription solutions continue to gain momentum across recreational and professional applications.

- For instance, Specsmakers offers customized power swimming goggles with prescription lenses, featuring UV protection and an adjustable fit for clear vision during pool laps or open-water swims.

Advancements in Lens Technologies and Customization

Continuous innovation in lens materials, coatings, and digital surfacing technologies significantly strengthens market adoption. High-precision prescription lenses with anti-fog, UV protection, impact resistance, and hydrophobic coatings enhance performance in demanding environments. Customization capabilities such as digitally optimized single-vision and progressive lenses allow manufacturers to address diverse user needs. These advancements improve visual clarity, durability, and comfort, encouraging consumers to upgrade from standard protective goggles to tailored prescription-enabled solutions that deliver superior optical accuracy and safety.

- For instance, HOYA utilizes free-form backside surfacing in SafeVision designs for prescription safety lenses, enabling smooth focus transitions and optimization for individual prescriptions with permanently attached anti-reflective coated side shields.

Growing Adoption in Healthcare and Occupational Safety Programs

Healthcare professionals, laboratory workers, and first responders increasingly rely on prescription goggles to meet strict safety and hygiene requirements. Regulatory agencies emphasize eye protection in chemical handling, infection control, and high-risk medical procedures, creating consistent demand for compliant products. Corporate safety programs also expand procurement of prescription-enabled goggles to reduce workplace injuries and enhance employee productivity. The integration of personalized vision correction within protective equipment ensures better compliance, reduces accidents, and positions prescription goggles as an essential component of modern occupational safety ecosystems.

Key Trends & Opportunities

Rising Shift Toward Premium and Smart Prescription Goggles

A significant trend shaping the market is the growing shift toward premium goggles featuring advanced materials, modular lens systems, and enhanced comfort features. Opportunities are emerging in smart prescription goggles integrating heads-up displays, activity tracking, and adaptive tinting for sports and industrial use. As consumers seek multifunctional eyewear that blends vision correction, protection, and digital capabilities, manufacturers have the opportunity to expand into technologically advanced segments that command higher margins and strengthen brand differentiation.

- For instance, Julbo’s EVAD.2 smart sports goggles incorporate a head-up display that projects real-time performance data like heart rate, speed, cadence, power, time, and elevation directly into the user’s field of view.

Expansion of E-Commerce and Virtual Try-On Technologies

Digital retail platforms and virtual try-on solutions are transforming the purchasing experience for prescription goggles. AR-enabled fitting tools allow users to visualize lens compatibility, frame geometry, and comfort profiles before purchase, reducing return rates and boosting consumer confidence. E-commerce expansion enables global brands to reach wider audiences, especially in regions with limited offline optical stores. This trend creates opportunities for direct-to-consumer models, subscription-based eyewear programs, and customization-driven online sales, accelerating market penetration and enhancing customer engagement.

- For instance, Warby Parker offers a lifelike Virtual Try-On tool accessible via its mobile app and website, using augmented reality to overlay frames on users’ faces in real-time while accounting for facial features and lighting effects on materials like acetate.

Key Challenges

High Cost of Advanced Prescription and Specialty Lenses

The cost of prescription goggles remains a significant barrier for price-sensitive consumers, particularly when products incorporate high-precision optics, progressive lenses, or impact-resistant materials. Premium coatings such as anti-fog or hydrophobic treatments also increase overall price, limiting adoption in low-income markets. Manufacturers face challenges balancing affordability and performance while maintaining margins. This cost barrier slows penetration in emerging regions and creates the need for cost-efficient manufacturing approaches, flexible pricing models, and broader insurance or reimbursement coverage.

Limited Standardization Across Sports and Industrial Compliance Requirements

Diverse safety standards across sports, industrial, and medical sectors create challenges for manufacturers seeking uniform product development. Prescription goggles must comply with varying regional and application-specific guidelines related to impact resistance, optical clarity, chemical exposure, and fit. This lack of standardization increases testing costs, complicates global expansion, and restricts mass production efficiencies. Ensuring consistent performance across different environments remains a key hurdle, prompting industry players to invest heavily in certification processes and adaptable design frameworks.

Regional Analysis

North America

North America dominated the Prescription Goggles Market with a 34.6% share in 2024, driven by strong participation in water sports, skiing, cycling, and outdoor recreational activities. The region benefits from high consumer spending on premium eyewear, widespread vision correction needs, and stringent workplace safety regulations that encourage adoption among industrial workers. Growing demand from healthcare professionals and first responders further accelerates uptake. Well-established eyewear brands, advanced retail infrastructure, and rapid integration of digital customization tools continue to strengthen market expansion across the United States and Canada.

Europe

Europe accounted for a 28.3% share in 2024, supported by a large population with refractive vision needs and high adoption of protective eyewear in regulated industrial sectors. The region’s strong sports culture, particularly in swimming, mountaineering, and winter sports, fuels consistent demand for prescription goggles offering durability and enhanced optical clarity. Technological innovation in lens coatings and eco-friendly frame materials also contributes to market growth. Expanding online optical retail channels, along with increased awareness of occupational safety programs across Germany, France, the UK, and Nordic countries, reinforces the region’s steady expansion.

Asia-Pacific

Asia-Pacific held a 25.7% share in 2024, emerging as one of the fastest-growing regions due to rising vision impairment prevalence, expanding middle-class spending, and growing engagement in recreational sports. Countries such as China, Japan, Australia, and India increasingly adopt prescription goggles across sports, industrial applications, and healthcare environments. Government initiatives promoting workplace safety and growing investments in manufacturing and construction sectors further support market penetration. Rapid digitalization, increased availability of affordable prescription eyewear, and strong growth in e-commerce channels strengthen the regional outlook, making Asia-Pacific a pivotal market for future expansion.

Latin America

Latin America captured a 6.4% share in 2024, with growth driven by expanding industrial sectors requiring protective prescription eyewear and increasing consumer interest in swimming and outdoor sports. Countries such as Brazil, Mexico, and Argentina are witnessing greater adoption of mid-range prescription goggles as awareness of eye protection improves. Economic recovery, rising optical retail penetration, and availability of cost-effective goggles contribute to regional progress. However, price sensitivity in several markets encourages demand for low- and medium-priced products, shaping manufacturer strategies focused on affordability and distribution expansion.

Middle East & Africa

The Middle East & Africa region held a 5.0% share in 2024, supported by growing industrialization, particularly in oil and gas, construction, and mining sectors that require prescription-compatible protective eyewear. Increasing recreational swimming participation and rising awareness of eye safety among professionals contribute to market development. Urban centers such as the UAE, Saudi Arabia, and South Africa lead regional adoption due to stronger healthcare access and higher disposable incomes. Although growth is steady, limited local manufacturing and high import dependency influence pricing dynamics, creating opportunities for regional distribution partnerships and localized production.

Market Segmentations:

By Lens Type

- Single vision

- Bi-focal progressive

By Frame Material

- Plastic

- Silicon/rubber

- Others

By Price

By Application

- Swimming/snorkeling goggles

- Sports goggles

- Industrial safety goggles

- Motorcycle/bicycle goggles

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Prescription Goggles Market features key players such as Oakley, Liberty Sport, SafeVision, GOGGLEMAN, RxSport, John Jacobs, Safety-RX, First Lens, Arena, and MSA Safety, all of whom actively strengthen their portfolios through product innovation and category expansion. These companies focus on integrating advanced lens technologies, including anti-fog, UV-protective, impact-resistant, and hydrophobic coatings, to meet diverse user needs across sports, industrial, and healthcare environments. Brands increasingly invest in lightweight, ergonomic frame designs and customizable prescription solutions to enhance comfort and optical accuracy. Strategic partnerships with optical retailers, e-commerce platforms, and sports organizations help extend market presence, while continuous R&D supports premium offerings targeted at athletes and professionals. Growing emphasis on durability, precise vision correction, and regulatory compliance further intensifies competition, prompting players to differentiate through specialized lens options, enhanced digital fitting tools, and region-specific product launches that align with evolving consumer preferences and workplace safety requirements.

Key Player Analysis

- Liberty Sport

- Oakley

- GOGGLEMAN

- Arena

- RxSport

- John Jacobs

- SafeVision

- Safety-RX

- First Lens

- MSA Safety

Recent Developments

- In June 2025, Meta partnered with Oakley to launch “Oakley Meta HSTN” AI-powered smart glasses with built-in camera, speakers, and Meta AI support.

- In June 2025, HOYA Vision Care announced the acquisition of Centennial Optical, a Canadian distributor of ophthalmic frames, eyeglass lenses, and optical accessories, to expand its capabilities in advanced lens design and AR coatings for prescription eyewear.

- In June 2025, Oakley introduced a new specialized line of sport-centric eyewear designed to meet particular athletic requirements across frames and lenses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Lens Type, Frame Material, Price, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as sports and industrial users increasingly prioritize integrated vision correction and eye protection.

- Advancements in lens coatings and impact-resistant materials will enhance product performance and adoption.

- Digital customization and virtual try-on tools will streamline consumer purchasing experiences.

- Demand for premium prescription goggles will rise with growing interest in high-end sports and outdoor activities.

- Occupational safety programs will drive higher adoption across manufacturing, healthcare, and construction sectors.

- Smart eyewear technologies will create new opportunities for connected and performance-tracking goggles.

- E-commerce platforms will continue to strengthen market penetration globally.

- Manufacturers will focus on lightweight, ergonomic frame innovations to boost comfort and appeal.

- Expanding awareness of eye health and vision protection will support long-term growth.

- Regional markets in Asia-Pacific and Latin America will gain momentum due to rising recreational and industrial demand.