Market Overview

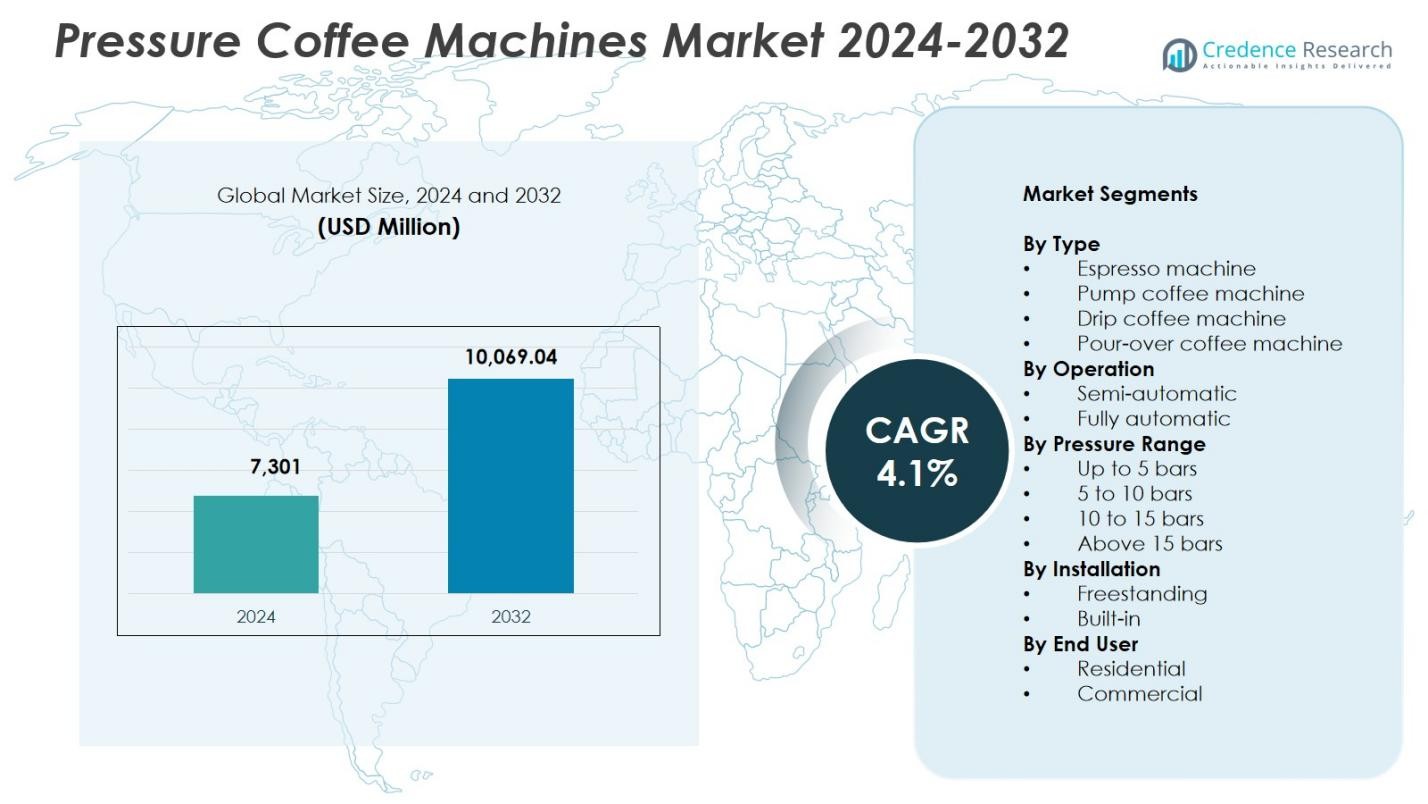

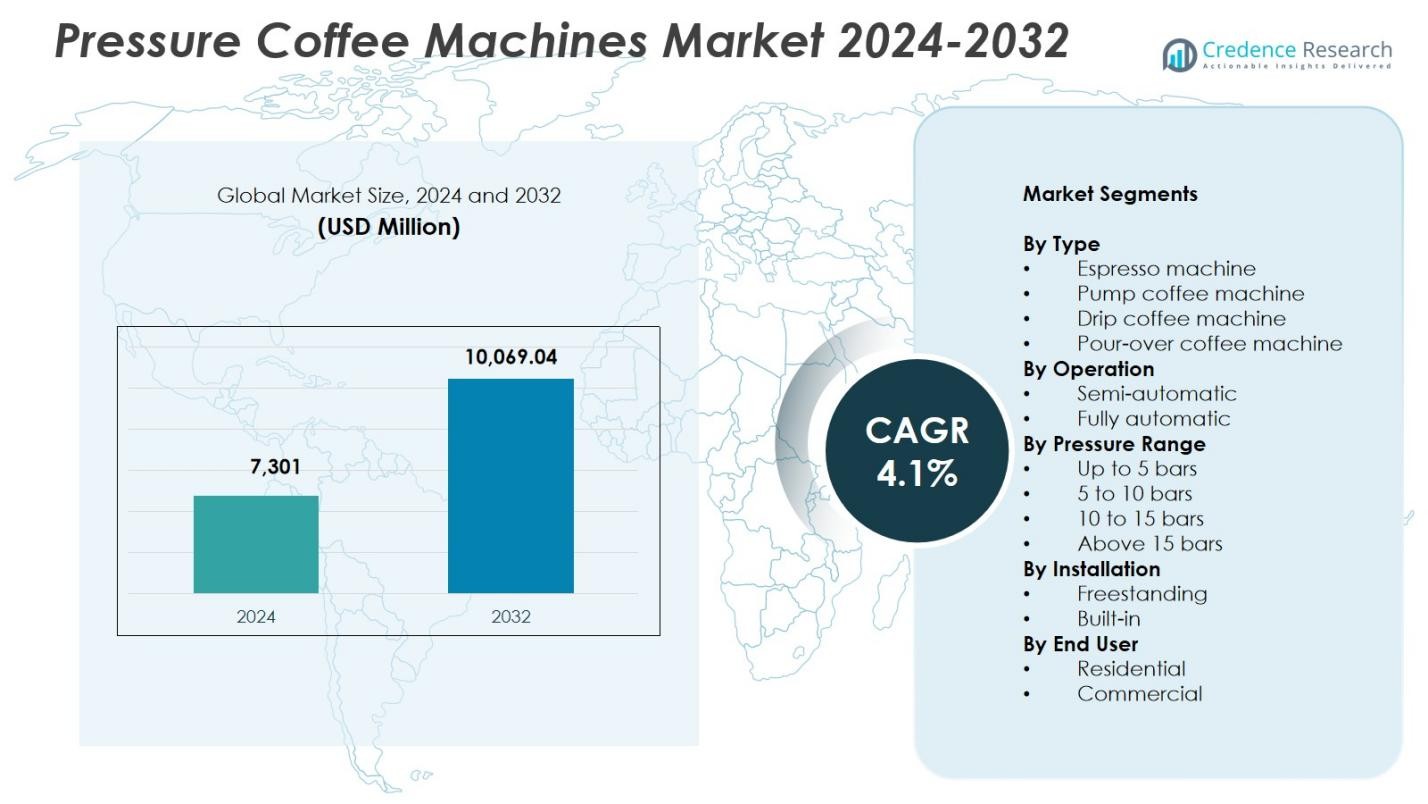

Pressure Coffee Machines Market size was valued at USD 7,301 Million in 2024 and is anticipated to reach USD 10,069.04 Million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pressure Coffee Machines Market Size 2024 |

USD 7,301 Million |

| Pressure Coffee Machines Market, CAGR |

4.1% |

| Pressure Coffee Machines Market Size 2032 |

USD 10,069.04 Million |

Pressure Coffee Machines Market is driven by strong participation from leading manufacturers such as GEVI, Breville, Honica Technology Co., Ltd., BRIM, AGARO, ECM GmbH, Miele, BLACK+DECKER, Continental, and Koninklijke Philips N.V., each expanding their portfolios with advanced brewing technologies, smart automation, and energy-efficient designs. These companies strengthen their market presence through product innovation and wider retail and e-commerce reach. Regionally, North America led the market with 36.4% share in 2024, supported by high adoption of premium home coffee systems, while Europe followed with 31.8% share, driven by its deep-rooted espresso culture and strong demand for high-pressure brewing machines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Pressure Coffee Machines Market reached USD 7,301 Million in 2024 and will grow at a CAGR of 4.1% through 2032.

- Rising demand for espresso-based beverages and strong adoption of fully automatic machines, which held 55.8% share in 2024, continue to drive steady market expansion.

- Key trends include increasing integration of smart controls, customizable pressure profiles, and sustainable, energy-efficient machine designs gaining traction among residential and commercial users.

- Leading players such as GEVI, Breville, BRIM, AGARO, Miele, and Philips focus on advanced brewing technology, product innovation, and expansion of online distribution channels to strengthen market presence.

- Regional growth is led by North America with 36.4% share, followed by Europe at 31.8% and Asia-Pacific at 22.7%, while espresso machines dominated the type segment with 42.6% share in 2024.

Market Segmentation Analysis:

By Type:

The Pressure Coffee Machines Market shows strong differentiation across product categories, with espresso machines dominating the segment with 42.6% share in 2024. Their leadership is driven by growing consumer preference for barista-style beverages, rising café culture, and increasing adoption of premium home brewing systems. Pump coffee machines follow due to their consistent extraction quality, while drip and pour-over machines attract users seeking convenience and affordability. Continuous product innovations such as integrated grinders, temperature-stability features, and smart connectivity further reinforce espresso machines’ leadership across residential and commercial environments.

- For instance, LaCimbali’s M40 commercial espresso machine uses an advanced thermal system that pre-heats and stabilizes water before it reaches the groupheads, improving extraction consistency while reducing energy and water waste in busy café environments.

By Operation:

Within the operation-based segmentation, fully automatic machines accounted for 55.8% share in 2024, making them the leading sub-segment. Their dominance stems from strong consumer demand for convenience, consistent extraction quality, and reduced manual intervention. These machines appeal to both households and offices seeking quick, reliable, and customizable brewing. Semi-automatic machines retain a loyal user base among enthusiasts who prefer manual control over pressure and extraction, but rising disposable income, increasing smart appliance adoption, and expanding product availability in retail and online channels continue to strengthen the uptake of fully automatic models.

- For instance, De’Longhi’s Rivelia model features a Bean Switch System that alternates between two bean types without cross-contamination, alongside one-touch hot and iced coffee functions with customizable strength and temperature.

By Pressure Range:

In the pressure range segment, 10 to 15 bars emerged as the dominant category with 47.3% share in 2024, driven by its alignment with optimal espresso extraction standards. Machines in this range deliver balanced crema formation, aroma retention, and flavor consistency, making them highly preferred among both home users and professional cafés. Models below 10 bars cater to basic brewing needs, while premium machines above 15 bars target specialty coffee consumers seeking advanced extraction profiles. Growing awareness of pressure’s impact on cup quality and increasing availability of mid-range espresso machines bolster the leadership of the 10–15-bar segment.

Key Growth Drivers

Rising Consumer Preference for Specialty Coffee

Growing global demand for specialty coffee continues to strengthen the Pressure Coffee Machines Market, as consumers increasingly seek café-style beverages at home and in workplaces. The popularity of espresso-based drinks such as lattes, cappuccinos, and macchiatos drives the adoption of high-pressure systems that ensure consistent extraction and crema quality. Rising urban café culture, increasing exposure to premium coffee experiences, and expanding barista training programs accelerate preference for advanced brewing equipment. Manufacturers respond with machines offering stable pressure, temperature precision, and customizable brewing profiles, boosting overall market growth.

- For instance, Rocket Espresso’s R9 One features a pressure profiling system programmable for up to five distinct profiles or manual paddle control, paired with PID temperature stability for precise espresso shots.

Expansion of Smart and Automated Coffee Machines

The integration of smart features and automation significantly drives market penetration, especially among tech-savvy consumers. Fully automatic coffee machines with programmable brewing, self-cleaning systems, and app-based controls enhance convenience and product appeal. These systems reduce the need for manual operation while ensuring consistent taste and quality. Growth in smart homes, rising disposable incomes, and rapid innovation in IoT-enabled appliances encourage adoption across residential and commercial settings. Manufacturers increasingly introduce AI-powered personalization features, strengthening demand for intelligent pressure-based coffee machines.

- For instance, Bosch fully automatic coffee machines integrate Home Connect for smartphone control, letting users remotely start brews like espresso and access CoffeeWorld recipes for global specialties.

Increasing Penetration in Commercial Foodservice

Rapid expansion of cafés, restaurants, hotels, and quick-service chains fuels strong demand for commercial-grade pressure coffee machines. Foodservice operators prioritize machines that deliver high throughput, durability, and consistent beverages during peak hours. The market benefits from rising global coffee consumption, growing franchise networks, and increased investment in premium beverage offerings. Commercial environments require high-pressure ranges and automated features to maintain drink quality and reduce labor dependency. As hospitality and corporate sectors upgrade their beverage stations, demand for advanced pressure-based machines continues to rise.

Key Trends & Opportunities

Growth of Premiumization and Customization Technologies

Premiumization trends create significant opportunities as consumers increasingly prefer machines that mimic professional barista performance. Manufacturers introduce models with multi-temperature controls, customizable pressure profiles, integrated grinders, and specialty beverage presets to enhance user experience. Demand rises for aesthetically designed, stainless-steel machines that combine performance with modern styling. Opportunities expand for brands offering high-end features such as dual boilers, PID temperature controllers, and noise-reduction technologies. As consumers shift toward personalized brewing, companies emphasizing advanced customization gain a competitive advantage.

- For instance, Ascaso’s Steel Duo PID employs dual thermoblocks for independent brew and steam circuits, delivering fast 5-10 minute heat-up times with PID temperature adjustments and volumetric programming for consistent single or double shots.

Rising Adoption of Sustainable and Energy-Efficient Designs

Sustainability is becoming a major trend, encouraging manufacturers to adopt eco-friendly materials, energy-efficient heating systems, and recyclable components. Consumers increasingly evaluate machines based on longevity, repairability, and environmental footprint. Opportunities emerge for companies developing low-energy standby modes, reusable filter systems, and reduced-waste brewing technologies. Certifications for energy efficiency and sustainable design help brands differentiate in a crowded market. As governments promote resource-efficient appliances and consumers prioritize green products, sustainability-focused innovations significantly expand market opportunities.

- For instance, Gaggia La Solare employs an energy-efficient heating system paired with automatic standby functionality and durable materials to minimize waste in commercial settings.

Key Challenges

Key Challenges

High Cost of Advanced Coffee Machines

The premium pricing of fully automatic and high-pressure espresso machines poses a key challenge, particularly in price-sensitive markets. Advanced technologies such as integrated grinders, pressure modulation systems, dual boilers, and smart connectivity elevate manufacturing costs and retail prices. This limits adoption among middle-income households and small cafés with budget constraints. Despite rising interest in specialty coffee, cost remains a barrier preventing mass penetration. Manufacturers must focus on modular designs, scalable features, and incremental cost-saving innovations to address affordability concerns.

Maintenance Complexity and Technical Issues

Pressure coffee machines require regular maintenance, including descaling, filter replacement, and cleaning of high-pressure components, which can hinder long-term user satisfaction. Complex internal mechanisms make repairs costly and time-consuming, particularly for fully automatic and commercial models. Frequent technical issues related to pump wear, heating elements, and pressure regulation add to operating challenges. Inadequate customer service or limited availability of replacement parts further impacts user experience. Manufacturers must improve durability, design simpler maintenance processes, and enhance service networks to overcome these operational limitations.

Regional Analysis

North America

North America led the Pressure Coffee Machines Market with 36.4% share in 2024, driven by strong consumer preference for specialty beverages, high adoption of smart home appliances, and widespread café culture. The U.S. remains the primary revenue generator due to high household penetration of fully automatic and espresso machines. Growth in premium at-home brewing, office coffee upgrades, and expanding artisanal coffee chains further support market expansion. Manufacturers benefit from strong distribution networks, rising e-commerce sales, and demand for connected, energy-efficient models that cater to convenience-focused consumers.

Europe

Europe accounted for 31.8% share in 2024, supported by its longstanding espresso culture, strong presence of premium machine manufacturers, and high acceptance of pressure-based brewing systems. Countries such as Italy, Germany, and France drive substantial demand for both home and commercial machines. The region benefits from increasing interest in sustainability-focused designs and energy-efficient appliances. Growth in specialty cafés, rising consumer spending on premium kitchen appliances, and technological innovations such as adjustable pressure systems and integrated grinders reinforce Europe’s leadership in the global pressure coffee machines market.

Asia-Pacific

Asia-Pacific captured 22.7% share in 2024, propelled by rising urbanization, expanding middle-class incomes, and a rapidly evolving café and coffee shop ecosystem. Demand is rising sharply in China, Japan, South Korea, and Australia as consumers shift toward premium and Western-style coffee beverages. Growing interest in home brewing, increased exposure to global coffee culture, and greater availability of affordable automatic machines strengthen regional adoption. Manufacturers capitalize on localization strategies, e-commerce expansion, and product innovations tailored to compact living spaces, supporting robust long-term market growth in this region.

Latin America

Latin America held 5.6% share in 2024, driven by growing café chains, expanding urban consumer base, and rising adoption of pressure-based brewing equipment in commercial settings. Countries such as Brazil and Mexico witness increasing preference for espresso-style drinks as global coffee trends influence consumption habits. Improved availability of mid-range automatic machines and growth in hospitality and tourism contribute to higher market penetration. Although price sensitivity persists, rising disposable incomes and stronger retail distribution networks gradually accelerate demand for pressure coffee machines across residential and commercial segments.

Middle East & Africa

The Middle East & Africa region represented 3.5% share in 2024, supported by rising premium café culture, rapid expansion of hospitality infrastructure, and growing consumer interest in specialty coffee brewing. Urban centers such as the UAE, Saudi Arabia, and South Africa experience increasing adoption of automatic and high-pressure espresso machines among both households and foodservice operators. Demand is reinforced by luxury lifestyle trends, rising tourism, and growing preference for international coffee brands. While market growth remains moderate, improving retail presence and rising coffee consumption among young populations offer strong future potential.

Market Segmentations:

By Type

- Espresso machine

- Pump coffee machine

- Drip coffee machine

- Pour-over coffee machine

By Operation

- Semi-automatic

- Fully automatic

By Pressure Range

- Up to 5 bars

- 5 to 10 bars

- 10 to 15 bars

- Above 15 bars

By Installation

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Pressure Coffee Machines Market features leading players including GEVI, Breville, Honica Technology Co., Ltd., BRIM, AGARO, ECM GmbH, Miele, BLACK+DECKER, Continental, and Koninklijke Philips N.V. These companies strengthen their presence through technological innovation, product differentiation, and continuous portfolio expansion across residential and commercial segments. Manufacturers increasingly focus on integrating smart connectivity, multi-pressure brewing systems, energy-efficient designs, and enhanced automation features to meet evolving consumer expectations for convenience and premium taste quality. Many brands invest heavily in R&D to introduce models with advanced temperature stability, customizable extraction profiles, and maintenance-friendly components, driving stronger customer engagement. Strategic initiatives such as global distribution partnerships, e-commerce expansion, and targeted marketing campaigns further enhance market reach. Moreover, premium European brands emphasize high-end craftsmanship and durability, while Asian manufacturers gain traction with competitively priced smart models. This diverse competitive environment encourages constant innovation and intensifies focus on product performance, reliability, and user experience.

Key Player Analysis

- GEVI

- Breville

- Honica Technology Co., Ltd.

- BRIM

- AGARO

- ECM GmbH

- Miele

- BLACK+DECKER

- Continental

- Koninklijke Philips N.V.

Recent Developments

- In September 2025, illycaffè acquired an 80% stake in Capitani, an Italian single-serve coffee machine manufacturer based in Como.

- In November 2025, Wega introduced its new connected-tech grinder and the “Polar” espresso machine at the HostMilano expo.

- In October 2025, Mahlkönig launched its first home espresso machine, the Mahlkönig Xenia, marking its entry into domestic espresso brewing.

- In October 2025, Franke Coffee Systems unveiled the new “A Line” fully automatic machines models A600 and A800 designed for high-quality in-cup performance with lower operating costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Pressure Range, Installation, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for specialty and premium coffee beverages.

- Adoption of fully automatic and smart-connected machines will continue to increase across households and offices.

- Manufacturers will focus on advanced pressure control technologies to enhance extraction quality.

- Sustainability and energy-efficient machine designs will become central to product development strategies.

- Commercial segments will expand further as cafés, restaurants, and QSR chains upgrade brewing equipment.

- Compact and multifunctional machines will gain traction among urban consumers with limited kitchen space.

- AI-enabled personalization and app-based brewing controls will strengthen user experience.

- Premiumization will accelerate as consumers prioritize quality, customization, and professional-grade features.

- Market penetration will deepen in emerging economies due to rising disposable incomes and evolving coffee culture.

- Partnerships between appliance brands and coffee chains will increase to expand brand visibility and product innovation.

Key Challenges

Key Challenges