Market Overview

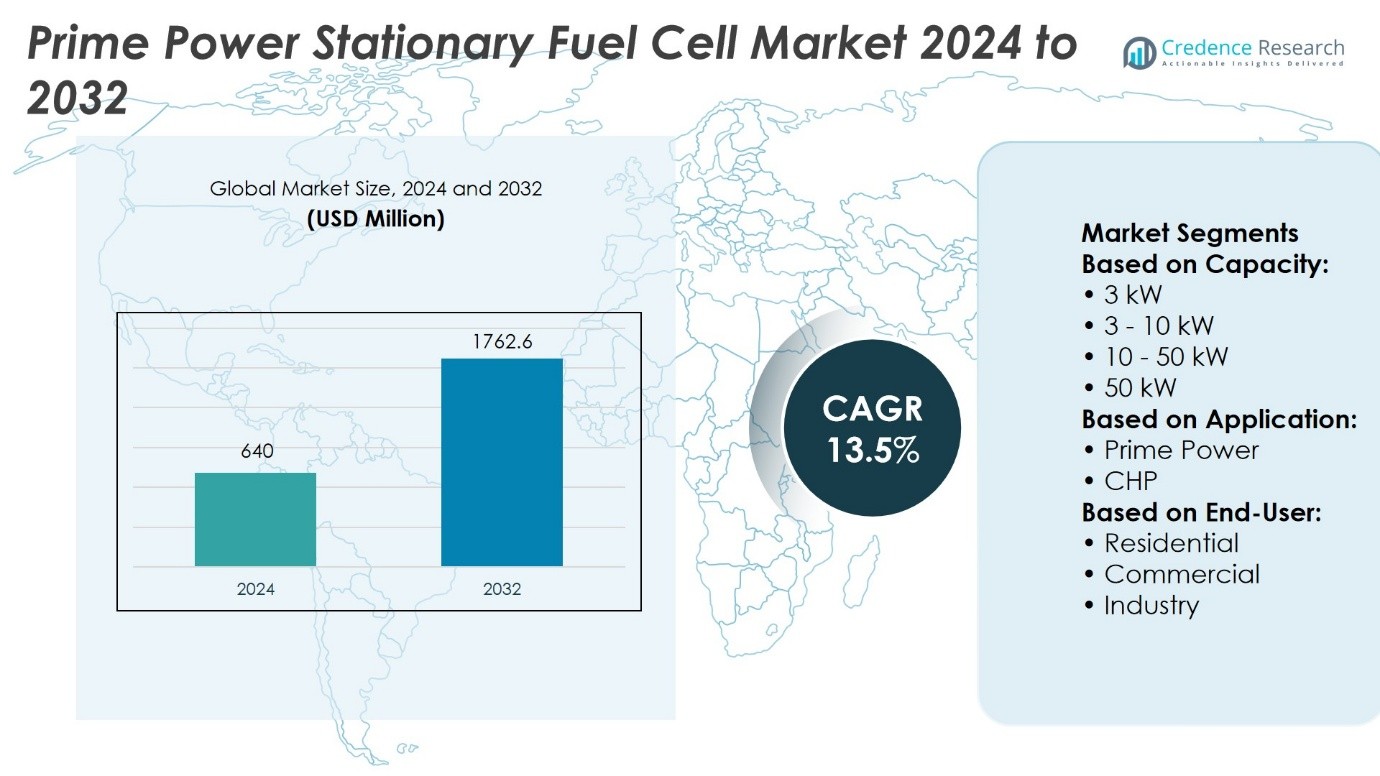

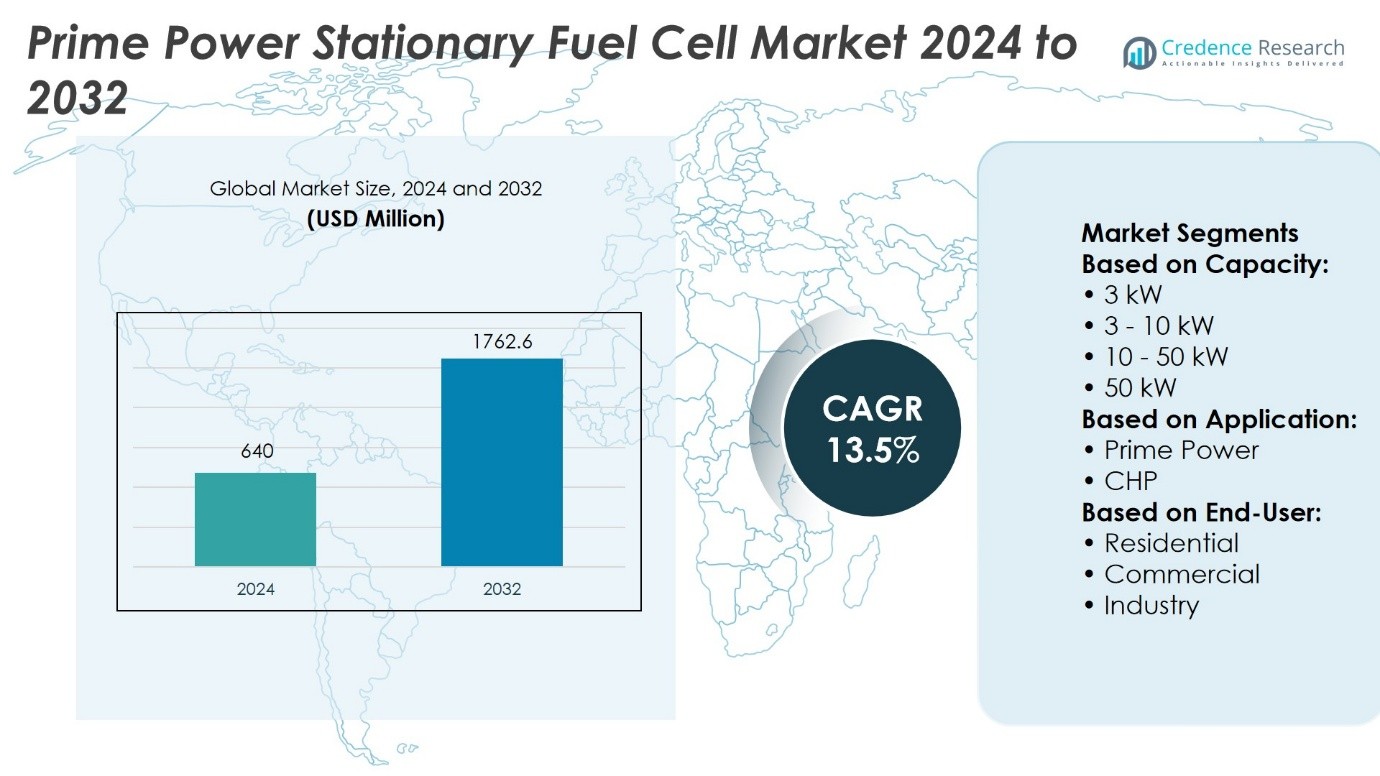

Prime Power Stationary Fuel Cell Market size was valued at USD 640 million in 2024 and is anticipated to reach USD 1762.6 million by 2032, at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prime Power Stationary Fuel Cell Market Size 2024 |

USD 640 Million |

| Prime Power Stationary Fuel Cell Market, CAGR |

13.5% |

| Prime Power Stationary Fuel Cell Market Size 2032 |

USD 1762.6 Million |

The Prime Power Stationary Fuel Cell Market advances through strong drivers such as rising demand for reliable, low-emission power, government incentives supporting clean energy adoption, and growing investments in hydrogen infrastructure. It gains traction from industries and commercial facilities seeking resilient alternatives to conventional generators. Key trends include integration with renewable energy systems, expansion of green hydrogen as a preferred fuel source, and adoption of digital monitoring for predictive maintenance. It also benefits from increasing large-scale deployments across utilities, data centers, and industrial hubs, positioning fuel cells as a critical enabler of global decarbonization and long-term energy security.

The Prime Power Stationary Fuel Cell Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America and Asia-Pacific leading adoption through large-scale industrial and utility projects. Europe advances under strict climate targets, while emerging regions explore pilot deployments. Key players include Bloom Energy, Ballard Power Systems, Plug Power, FuelCell Energy, Cummins, AFC Energy, GenCell, Nuvera Fuel Cells, Fuji Electric, and Aris Renewable Energy, each driving growth through innovation and strategic partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prime Power Stationary Fuel Cell Market size was valued at USD 640 million in 2024 and is projected to reach USD 1762.6 million by 2032, growing at a CAGR of 13.5%.

- Rising demand for reliable and low-emission power solutions drives adoption across industrial, commercial, and utility sectors.

- Integration with renewable energy systems and expansion of green hydrogen fuel use define major market trends.

- Competition intensifies with leading players focusing on innovation, strategic partnerships, and scalable project deployments.

- High capital costs and underdeveloped hydrogen infrastructure act as restraints to wider adoption.

- North America and Asia-Pacific dominate deployment, Europe follows with strong climate targets, and Latin America along with Middle East & Africa explore early-stage projects.

- Key players such as Bloom Energy, Ballard Power Systems, Plug Power, FuelCell Energy, Cummins, AFC Energy, GenCell, Nuvera Fuel Cells, Fuji Electric, and Aris Renewable Energy reinforce global market growth.

Market Drivers

Rising Demand for Reliable and Sustainable Energy Sources

The Prime Power Stationary Fuel Cell Market grows on the urgent need for uninterrupted and sustainable power generation. Energy-intensive industries, commercial complexes, and critical infrastructure demand long-duration solutions that minimize downtime. It offers a stable alternative to diesel generators, reducing dependency on fossil fuels while ensuring consistent energy supply. Government policies that encourage decarbonization support its adoption in industrial and utility-scale projects. Investors prioritize such systems to align with sustainability commitments and regulatory compliance. The ability to deliver clean, on-site electricity positions fuel cells as a central element in energy transition strategies.

- For instance, Bloom Energy deployed a 10 MW solid oxide fuel cell installation at the SK ecoplant facility in South Korea, capable of generating over 63 million kilowatt-hours of electricity annually, enough to power nearly 20,000 households while reducing reliance on conventional grid supply.

Government Incentives and Supportive Regulatory Frameworks

Policy initiatives and funding programs serve as a strong driver for the Prime Power Stationary Fuel Cell Market. Governments across regions allocate subsidies, tax benefits, and research grants to accelerate deployment. It gains momentum where national energy strategies emphasize zero-emission power generation and net-zero goals. Utility-scale installations benefit from carbon credit mechanisms, which improve project feasibility. Regulatory bodies streamline approval processes for hydrogen and fuel cell infrastructure, reducing project lead times. Such measures strengthen confidence among manufacturers and end-users, creating favorable conditions for market expansion.

- For instance, Doosan Fuel Cell secured government-backed contracts to supply 4.84 MW of stationary fuel cells for Korea Hydro & Nuclear Power in 2021.

Advancements in Hydrogen Infrastructure and Supply Chain Development

The Prime Power Stationary Fuel Cell Market benefits from rapid progress in hydrogen production, storage, and distribution. Expansion of green hydrogen projects enhances system viability by providing cleaner fuel options at scale. It reduces operational constraints by ensuring a steady supply chain that supports commercial and industrial applications. Partnerships between technology providers and energy suppliers accelerate deployment of refueling networks. Investment in large-scale electrolyzers enables integration of renewable energy sources with fuel cell systems. Improved logistics and transportation frameworks allow greater adoption across geographically diverse markets.

Rising Focus on Operational Efficiency and Total Cost Optimization

Industrial and commercial users drive the Prime Power Stationary Fuel Cell Market by prioritizing efficient and cost-optimized energy solutions. Fuel cells operate with higher efficiency compared to combustion-based systems, lowering lifecycle energy costs. It provides predictable maintenance schedules, reducing long-term operational risks for enterprises. The modular design of modern systems allows scalability, adapting to varying power demands with minimal disruption. Manufacturers emphasize durability and extended system lifetimes, enhancing return on investment for end-users. Continuous innovation in component design supports broader application across multiple industries.

Market Trends

Integration of Fuel Cells with Renewable Energy Ecosystems

The Prime Power Stationary Fuel Cell Market reflects a strong trend toward integration with renewable energy systems. Hybrid projects combine fuel cells with solar or wind power to ensure stable supply in variable conditions. It enhances grid resilience and supports continuous operations in critical infrastructure. Developers view hybrid models as a solution for balancing intermittency while reducing carbon intensity. Energy providers position such projects to align with regional decarbonization strategies. Growing deployment of renewable-linked fuel cell plants demonstrates the market’s shift toward hybrid and sustainable solutions.

- For instance, Toshiba Energy Systems installed a 3.5 MW hydrogen fuel cell system integrated with a solar power plant in Fukushima, Japan, which supplies more than of electricity annually to the local grid, demonstrating effective hybridization of renewable and fuel cell technologies.

Expansion of Green Hydrogen as a Preferred Fuel Source

The Prime Power Stationary Fuel Cell Market benefits from the rising availability of green hydrogen. Large-scale electrolyzer projects provide clean hydrogen that strengthens adoption in industrial and utility-scale applications. It allows operators to achieve lower emissions while improving energy independence from fossil fuels. Strategic partnerships between hydrogen producers and fuel cell companies accelerate commercial projects. Expansion of international hydrogen trade creates opportunities for cross-border adoption. This trend positions fuel cells as a cornerstone technology in the hydrogen economy.

- For instance, Siemens Energy and Air Liquide commissioned a 20 MW proton exchange membrane (PEM) electrolyzer in Oberhausen, Germany in 2023, producing up to 2,900 tonnes of green hydrogen per year, directly supporting industrial fuel cell deployment in the region.

Focus on Digital Monitoring and Predictive Maintenance Capabilities

The Prime Power Stationary Fuel Cell Market shows a trend of integrating digital tools for system management. Advanced monitoring platforms enable predictive maintenance, ensuring higher uptime and reliability. It reduces operational costs by detecting performance deviations before failure. Manufacturers integrate IoT sensors, real-time analytics, and AI-driven diagnostics into modern fuel cell systems. These innovations support data-driven decision-making for industrial operators and utility providers. Growing emphasis on digital intelligence strengthens the long-term efficiency of fuel cell installations.

Scaling of Commercial and Industrial Deployments Across Regions

The Prime Power Stationary Fuel Cell Market highlights expansion beyond pilot projects into full-scale deployments. Industrial complexes, data centers, and healthcare facilities invest in fuel cells to secure reliable prime power. It demonstrates scalability through modular designs that adapt to varying load requirements. Regional initiatives in Asia-Pacific, North America, and Europe strengthen adoption through large commercial installations. Partnerships between utilities and private enterprises accelerate regional project pipelines. This shift toward broad deployment underlines the transition of fuel cells into mainstream prime power solutions.

Market Challenges Analysis

High Capital Costs and Limited Commercial Viability for Broad Adoption

The Prime Power Stationary Fuel Cell Market faces a major challenge in the form of high upfront investment requirements. Deployment costs remain significantly higher than conventional power systems, limiting widespread adoption in cost-sensitive industries. It creates barriers for small and medium enterprises that cannot justify large capital expenditures. The long payback period discourages potential investors despite the operational efficiency of fuel cells. Manufacturers strive to reduce production costs, but advanced materials and complex system designs keep prices elevated. Limited access to affordable financing further restricts the pace of market expansion.

Infrastructure Gaps and Supply Chain Constraints in Hydrogen Ecosystem

The Prime Power Stationary Fuel Cell Market also struggles with underdeveloped hydrogen infrastructure. Fuel supply networks remain sparse, preventing consistent access to reliable hydrogen sources in several regions. It forces operators to depend on costly logistics, raising operating expenses. Supply chain vulnerabilities, including limited electrolyzer capacity and inadequate storage, slow down project execution. Safety concerns and regulatory delays add complexity to infrastructure development. Regional disparities in hydrogen availability create uneven adoption, reducing the market’s ability to scale uniformly across global industries.

Market Opportunities

Rising Demand for Decarbonized Prime Power Solutions Across Industries

The Prime Power Stationary Fuel Cell Market holds strong opportunities in sectors seeking reliable and clean alternatives to conventional generators. Industrial plants, healthcare facilities, and data centers prioritize zero-emission technologies to meet strict sustainability goals. It provides a dependable source of power while aligning with corporate decarbonization agendas. Growing regulatory mandates for emission reduction create favorable conditions for large-scale adoption. Companies exploring energy independence view fuel cells as a resilient solution against grid instability. Expansion of clean energy commitments across industries ensures a broad base of demand for advanced fuel cell systems.

Technological Innovation and Expansion of Global Hydrogen Ecosystem

The Prime Power Stationary Fuel Cell Market benefits from rapid advancements in system design, fuel flexibility, and integration with renewable energy. Continuous improvement in efficiency and durability strengthens its competitiveness against conventional prime power solutions. It gains further potential from the global build-out of hydrogen infrastructure, which lowers fuel costs and enhances accessibility. Collaboration between governments, utilities, and private enterprises accelerates opportunities for scalable deployment. Emerging markets with growing energy demand present attractive avenues for international fuel cell manufacturers. Ongoing innovation combined with a maturing hydrogen ecosystem sets the stage for long-term market growth.

Market Segmentation Analysis:

By Capacity

The Prime Power Stationary Fuel Cell Market demonstrates varied adoption across capacity ranges that cater to different operational needs. Systems under 3 kW primarily support small-scale residential use, offering backup solutions for households and compact buildings. Units in the 3–10 kW range serve light commercial facilities and small enterprises, ensuring stable power supply in areas prone to outages. The >10–50 kW segment addresses mid-scale demand from healthcare centers, retail complexes, and educational institutions that require reliable prime power. It gains importance for applications where continuity of operations directly impacts service quality. Large installations above 50 kW dominate industrial and utility-scale projects, where demand for high-capacity generation drives deployment of multi-megawatt systems to support grids and critical infrastructure.

- For instance, Panasonic has deployed more than 370,000 IN-FARM residential fuel cell units in Japan, each typically rated, collectively generating over of electricity since program launch, highlighting strong adoption in the sub-3 kW segment.

By Application

The market divides into prime power generation and combined heat and power (CHP) applications. Prime power represents the leading segment, addressing industries and facilities that prioritize continuous, independent electricity supply. It provides resilience against unstable grids and supports operations with high uptime requirements. CHP applications gain traction due to their dual advantage of electricity generation and heat recovery, which improves efficiency in industrial and commercial environments. It allows enterprises to optimize energy use, lowering operational costs while enhancing sustainability. Growth in distributed energy networks creates favorable ground for CHP systems that integrate fuel cells with heating and cooling infrastructure.

- For instance, Bloom Energy installed a 6 MW solid oxide fuel cell system at a Microsoft data center in California, delivering more than 48,000 MWh of reliable prime power annually, ensuring uninterrupted operations for critical digital infrastructure.

By End User

End-user adoption illustrates the diverse role of stationary fuel cells across residential, commercial, and industrial settings. Residential demand focuses on compact systems under 10 kW, ensuring secure and clean electricity for households, particularly in regions with strong incentives for green energy. Commercial users invest in mid-scale installations that power offices, healthcare facilities, and data centers where reliability and emissions reduction drive decision-making. Industry and utility operators deploy large-scale units above 50 kW, often extending to multi-megawatt systems, to stabilize grids, supply manufacturing hubs, and meet decarbonization goals. It strengthens adoption across diverse sectors by aligning with requirements for efficiency, resilience, and environmental compliance.

Segments:

Based on Capacity:

- 3 kW

- 3 – 10 kW

- 10 – 50 kW

- 50 kW

Based on Application:

Based on End-User:

- Residential

- Commercial

- Industry

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Prime Power Stationary Fuel Cell Market, accounting for 38% of the global market. The region benefits from advanced fuel cell technology development, significant government incentives, and strong participation from companies such as Bloom Energy and Plug Power. It supports widespread adoption through state-level clean energy mandates, particularly in California and New York, where zero-emission power systems form part of long-term grid decarbonization plans. Data centers, healthcare facilities, and corporate campuses drive large-scale deployments due to their high demand for reliable and clean power. Strong partnerships between private enterprises and utility providers further expand adoption across both commercial and industrial sectors. The presence of leading fuel cell manufacturers reinforces the regional dominance and strengthens the innovation pipeline.

Europe

Europe accounts for 27% of the Prime Power Stationary Fuel Cell Market, driven by strict environmental regulations and aggressive climate neutrality goals under the European Green Deal. Countries such as Germany, the UK, and France lead adoption, supported by hydrogen strategies that integrate fuel cells into both power generation and heating networks. It gains momentum from combined heat and power (CHP) applications, particularly in urban centers with district energy systems. Utility-scale fuel cell projects expand under supportive funding programs like Horizon Europe and national hydrogen roadmaps. Industrial users adopt fuel cells to meet decarbonization goals, with emphasis on reducing reliance on fossil fuels in manufacturing operations. Growing collaboration between regional governments and private enterprises enhances the commercialization of fuel cell systems across the continent.

Asia-Pacific

Asia-Pacific holds 24% of the Prime Power Stationary Fuel Cell Market, supported by large-scale investments in hydrogen infrastructure and government-led initiatives. South Korea and Japan remain leaders in stationary fuel cell installations, with South Korea operating multiple projects above 100 MW capacity. Japan’s ENE-FARM program drives residential adoption by subsidizing household fuel cell systems, while commercial and industrial users integrate fuel cells for reliable prime power. China accelerates its presence with significant funding in hydrogen and fuel cell pilot zones, targeting both grid support and industrial applications. It benefits from strong partnerships between domestic energy providers and global technology suppliers. The region’s strong manufacturing ecosystem lowers costs and accelerates deployment across multiple end-user categories.

Latin America

Latin America represents 6% of the Prime Power Stationary Fuel Cell Market, with adoption concentrated in Brazil, Chile, and Mexico. The region invests in stationary fuel cell projects to diversify energy supply and reduce dependence on fossil fuel imports. It supports early-stage deployments through pilot programs in industrial facilities and government-backed renewable energy initiatives. Chile promotes hydrogen and fuel cell use through its National Green Hydrogen Strategy, linking stationary applications with its renewable energy surplus. Brazil explores fuel cell deployment for commercial complexes and industrial hubs as part of its grid modernization programs. Growth opportunities remain high due to rising demand for reliable power and favorable renewable energy potential across the region.

Middle East & Africa

The Middle East & Africa holds 5% of the Prime Power Stationary Fuel Cell Market, with adoption driven by national diversification strategies and clean energy targets. Gulf countries such as the UAE and Saudi Arabia invest in hydrogen-based projects to reduce reliance on oil and gas revenues. Stationary fuel cell systems serve as reliable prime power sources for large-scale infrastructure, including smart cities, commercial zones, and utility projects. Africa explores fuel cell deployment through off-grid and distributed power solutions, particularly in South Africa, where energy shortages create demand for resilient alternatives. It gains momentum from international partnerships focused on exporting green hydrogen while using stationary fuel cells to stabilize domestic supply. Long-term prospects remain strong due to government-driven hydrogen roadmaps and rising focus on sustainable infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GenCell

- AFC Energy

- Bloom Energy

- NUVERA FUEL CELLS

- Cummins

- PLUG POWER

- Aris Renewable Energy

- Fuel Cell Energy

- Ballard Power Systems

- Fuji Electric

Competitive Analysis

The Prime Power Stationary Fuel Cell Market features including Bloom Energy, Ballard Power Systems, Plug Power, FuelCell Energy, Cummins, AFC Energy, GenCell, Nuvera Fuel Cells, Fuji Electric, and Aris Renewable Energy. The Prime Power Stationary Fuel Cell Market is characterized by rapid innovation, strong project pipelines, and increasing collaboration across the energy value chain. Companies compete by advancing fuel cell efficiency, scaling system capacity, and lowering lifecycle costs through improved materials and manufacturing techniques. Strategic partnerships with utilities, governments, and industrial operators strengthen deployment opportunities across residential, commercial, and utility-scale applications. Competition intensifies around hydrogen integration, with firms focusing on supply chain development and long-term contracts to secure stable fuel access. Continuous investment in research and demonstration projects enhances market positioning and accelerates commercialization. The competitive landscape remains defined by the ability to deliver reliable, scalable, and low-emission solutions that align with global energy transition goals.

Recent Developments

- In March 2025, the global fuel cell for stationary power market is expected to experience a high growth rate over the period of 2025 to 2035. Targeting material handling, telecom, and on-road mobility sectors with a strong sustainability focus.

- In October 2024, SFC Energy purchased the stationary business assets, technology, intellectual property, and customer base from Ballard Power Systems Europe. The company is broadening its own power range with two proven hydrogen fuel cell systems of 1.7 kW and 5 kW in output.

- In May 2023, Plug Power introduced a new stationary fuel cell system which supports high power denominations to charge commercial EV fleets. These systems are designed for low-cost charging so that the emissions zero EVs can be deployed to sustain the fleet operators endeavors.

- In March 2023, Cummins launched a new brand Accelera to its New Power business unit. It provides a varied portfolio of zero-emissions solutions for vital industries, thereby empowering customers to accelerate their transition toward a sustainable future.

Market Concentration & Characteristics

The Prime Power Stationary Fuel Cell Market displays a moderately concentrated structure, with a few established manufacturers holding significant technological expertise and project portfolios. It is shaped by companies that invest heavily in research and development to enhance efficiency, durability, and scalability of fuel cell systems. Market concentration is reinforced by long-term contracts, government-backed programs, and partnerships with utilities and industrial operators that favor proven technologies. It features high entry barriers due to complex engineering requirements, capital-intensive production, and dependence on hydrogen infrastructure. Competition centers on system capacity expansion, cost reduction, and integration with renewable energy ecosystems. It continues to evolve with increasing collaboration across global supply chains, while regional policies and incentive frameworks influence adoption rates and strategic positioning.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Prime Power Stationary Fuel Cell Market will expand with rising investments in hydrogen infrastructure and large-scale electrolyzer projects.

- Governments will strengthen adoption through stricter emission targets and subsidy programs for clean energy technologies.

- Commercial and industrial users will increase deployment to secure reliable prime power for critical operations.

- Residential demand will grow in regions with strong incentives for decentralized and sustainable energy systems.

- Technological improvements will enhance system efficiency, durability, and overall performance.

- Partnerships between fuel cell manufacturers and utilities will accelerate integration into distributed energy networks.

- Digital monitoring and predictive maintenance solutions will improve operational reliability and reduce lifecycle costs.

- Asia-Pacific will lead expansion with large government-backed projects, while North America and Europe will maintain strong adoption momentum.

- Cost reduction in fuel cell production and hydrogen supply will support wider scalability.

- The market will evolve as a central enabler of the global transition toward low-carbon prime power solutions.