What are the diagnosis and treatment options commonly available in Prosthetic Joint Infections?

Prosthetic joint infection (PJI), also known as peri-prosthetic infection, is an infection that affects the joint prosthesis and surrounding tissue. It is one of the major complications and aetiologies of implant failure after joint replacement, resulting in a significant financial burden on the healthcare system and significant physical and psychological morbidity for patients.

Most PJs that occur within one year of surgery are caused by the introduction of microorganisms during surgery, which can happen through direct contact or aerosolized contamination of the prosthesis or periprosthetic tissue.

According to the Orthobullets, Epidemiology of Prosthetic Joint Infection 2020, the infection rate for primary joint replacement surgeries for total hip Hospitals (THA) and total knee Hospitals (TKA) is around 3% and 2%, respectively. Pain, swelling in the joint or effusion, erythema or warmth around the joint, fever, drainage, or the presence of a sinus tract communicating with a Hospital are all clinical manifestations of PJ. Clinical findings, laboratory results from peripheral blood and synovial fluid, microbiological data, histological evaluation of periprosthetic tissue, intraoperative inspection, and, in some cases, radiographic results can all be used to help diagnose PJ.

The current PJI therapeutic landscape typically necessitates a combination of medical and surgical strategies, such as open or arthroscopic debridement without removal of the prosthesis, resection of the prosthesis with or without reimplantation either at the time of removal or weeks to months later.

Additional arthrodesis, amputation, or antimicrobial suppression without surgery is also advised. Antimicrobial therapy should be pathogen-directed and guided by antimicrobial susceptibility testing results, if applicable. Cefazolin, Rifampin, Ciprofloxacin, Vancomycin, Penicillin, Ceftriaxone, Ampicillin, Gentamicin, Clindamycin, and other antibiotics are commonly used. Depending on the type of microorganism, these antibiotics can be used as monotherapy or combination.

What is the Market Size of Prosthetic Joint Infections in terms of value?

The global Prosthetic Joint Infections Market is projected to increase at a significant CAGR of 13.70% in the coming years. In 2021, the global Prosthetic Joint Infections market was valued at USD 482.9 million and is projected to reach USD 1043.33 million by 2028. The demand for Prosthetic Joint Infections is projected to increase substantially in the coming years and is presumed to generate revenue opportunities for the key industry players worth USD 560.43 million during the forecast period of 2022 and 2028.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

What is the key emerging drug for Prosthetic Joint Infections?

Sodium Fusidate: Arrevus

Sodium Fusidate (Arrevus) is the only antibiotic in a class of antibiotics known as fusidanes, and it works in a way that no other antibiotic does. It inhibits protein synthesis by interfering with the activity of elongation factor G (EF-G), which is active against gram-positive bacteria, particularly methicillin-resistant Staphylococcus aureus strains (RSA). The medication has completed I/Ill trials for the treatment of JPL and has been designated as an orphan drug. It has been approved in Europe but not in the United States. As a result of its clearance, it will have a large market share in the United States.

Interesting Facts about the Prosthetic Joint Infections Industry

- As the incidence of knee and hip replacement procedures rises, so does the risk of infection, which is likely to drive market expansion during the projection period.

- The rising demand for prosthetic joint infection treatment has prompted key firms to increase their research and development efforts to develop new creative products for treating prosthetic joint infection.

- Clinical trials for therapeutic molecules to treat PJI are now underway. A few companies have been successful in obtaining regulatory approval for clinical trials.

- North America region had a significant share in terms of volume as well as value in the global Prosthetic Joint Infections market in 2021 and is projected to continue its dominance over the forecast period.

- Molecular biology techniques enable rapid microbiological identification in the treatment of prosthetic joint infection.

- Companies and academics are collaborating to assess challenges and identify opportunities that could influence Prosthetic joint infection (PI) research and development.

- The therapies in development are centered on novel approaches to treating or improving disease conditions. Major players are involved in the development of PJ therapies.

- The introduction of new therapies will have a significant impact on the Prosthetic joint infection (PJI) market.

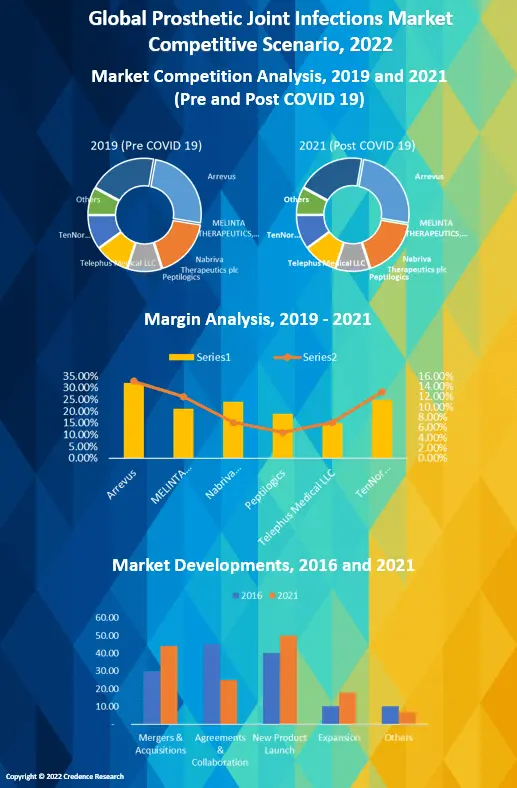

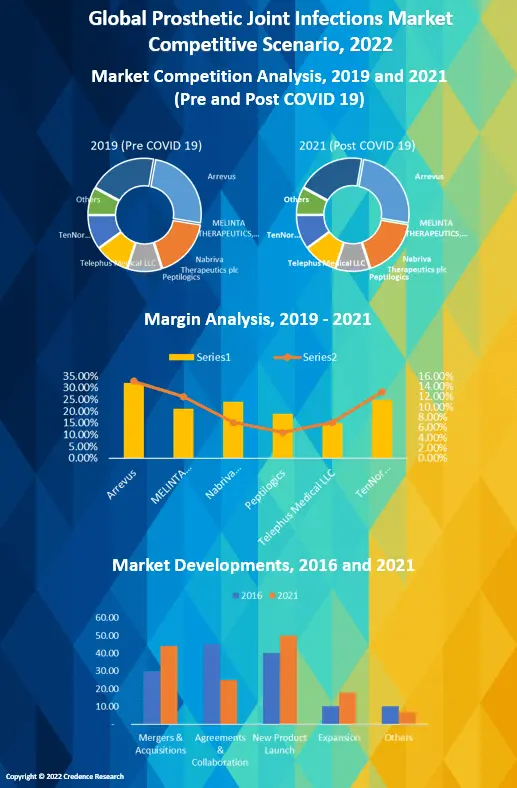

Who are the Top 10 players/companies in the Prosthetic Joint Infections market regarding value?

The key players in the global Prosthetic Joint Infections market in terms of value include Arrevus, MELINDA THERAPEUTICS, INC., Nabriva Therapeutics plc, Peptilogics, Telephus Medical LLC, TenNor Therapeutics Ltd, and others. These key players are concentrating on new product developments as well as technological innovation to enhance their production in Prosthetic Joint Infections to gain competitive market share at a global level.

For instance, in January 2020, TNP-2092, a treatment for PJI, was given FDA Orphan Drug Designation by TenNor Therapeutics Ltd. TNP- 2092 for the treatment of ABSSSI was just completed in clinical phase II by the business. On the other hand, in 2019, Melinta Therapeutics completed the acquisition of fusidic acid by Arrevus. Arrevus increased the number of joint infections treated as a result of this. This fusidic acid is present in the clinical trial’s development phase.

Who are the Top 10 Countries in the Prosthetic Joint Infections Market?

In the global Prosthetic Joint Infections market, the major countries are the US, China, Japan, India, South Korea, Germany, France, Italy, Spain, and the UK. The largest market share is in the United States.

The annual cost of revision surgery for an infection in hospitals in the United States is expected to exceed $1.62 billion (€1.49 billion) by 2020. In 2020, the total number of incident cases of Prosthetic Joint Infection was estimated to be 72,131. With 44,659 cases in 2020, the United States had the highest Prosthetic Joint Infection incident population. The increased number of knee and hip replacement surgeries increases the risk of infection, which is expected to boost market growth during the forecast period.

The incidence rate of infection for primary joint replacement surgeries for total hip Hospitals (THA) is around 3% and for total knee Hospitals (TKA) is around 2%. The risk of injection for revision joint replacement surgeries is higher than for primary joint replacement surgeries; the reported risk of infection for THA is around 6%, while that for TKA is around 4%. These factors are expected to drive the prosthetic joint infection treatment market during the forecast period.

The rising demand for the treatment of prosthetic joint infection has prompted major players to invest more in research activities aimed at developing new innovative products for the treatment of prosthetic joint infection. Pharmaceutical companies are conducting clinical trials for drug compounds to treat PJI. A few players have been successful in obtaining regulatory approval for clinical trials. For instance, Arrevus has ARV 1801 in Phase II clinical trials. Other players, such as Mellinta Therapeutics and Telephus Medical, have compounds in the pipeline to indicate prosthetic joint infection. This is expected to drive market growth over the next few years.

Which is the Key Treatment segment in the Prosthetic Joint Infections Market?

The market has been segmented into antibiotics, debridement, and irrigation with implant retention. The debridement segment is expected to hold a significant market share during the forecast period because it takes less time, is easier to perform than other surgeries, and requires fewer physiologic effects, hastening recovery.

Debridement with prosthesis retention, also known as debridement, antibiotics, and implant retention (DAIR), should be performed via open arthrotomy. The previous surgical incision is opened, and any necrotic or infected soft tissue is irrigated and debrided, any encountered hematoma is removed, and any purulence surrounding the prosthesis is evacuated. Debridement must be thorough and complete for this treatment strategy to be effective.

Moreover, the antibiotics segment is expected to grow during the forecast period, as new antibiotics on the market result in successful outcomes in terms of function and quality of life. Antibiotic therapy should be pathogen-directed and guided by antibiotic susceptibility testing results, if applicable. General antibiotic treatment principles apply, with the prioritized least toxic, most efficacious, narrow-spectrum antibiotic regimen.

What are the Major Driving Factors for the Prosthetic Joint Infections Market?

Factors such as the rising prevalence of road accidents and serious sports injuries, as well as the rising incidence of prosthetic joint infection, are driving the market (PJI). Manufacturers are concentrating their efforts on developing novel pharmaceuticals for the treatment of PJI, as well as technological innovation and the creation of novel treatment alternatives for the disease, which is propelling the market forward. The significant potential in this market includes the integration of government reimbursement policies with hospitals and clinics, as well as the launch of innovative medications for the treatment of PJI.

What are the Major Restraints for the Prosthetic Joint Infections Market?

The high cost of PJI treatment and a lack of trained pathologists to perform histological analysis are factors limiting the growth of the prosthetic joint infection market. People’s lack of awareness also impedes the growth of the prosthetic joint infection market. In addition, the lack of proper medical attention in developing countries limits the market for prosthetic joint infections.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Which Region Dominated the World Prosthetic Joint Infections Market?

In 2021, North America is expected to dominate the prosthetic joint infection market over the forecast period. Increased acceptance of novel treatments and technological advancements in the United States are expected to drive demand for prosthetic joint infection treatment in the country over the forecast period.

The increased number of knee and hip replacement surgeries raises the risk of infection, which is expected to drive market growth during the forecast period in this region. Manufacturers are focused on developing innovative drugs for the treatment of prosthetic joint infection, as well as technological advancement and development of innovative treatment options for the ailment, which is propelling the market growth.

The key opportunities in this market are the integration of government reimbursement policies with hospitals and clinics, as well as the launch of innovative products for the treatment of prosthetic joint infection. The US has the largest market share. In the United States, the annual cost of revision surgery for an infection in hospitals is expected to exceed $1.62 billion (€1.49 billion) by 2020. The total number of incident cases of Prosthetic Joint Infection is expected to be 72,131 in 2020. The United States had the highest Prosthetic Joint Infection incident population in 2020, with 44,659 cases.

The Asia Pacific market is expected to proliferate as people become more aware of the benefits of prosthetic joint infection treatment. Factors driving the market include an increase in the number of road accidents and severe sports injuries, as well as an increase in the number of cases of prosthetic joint infection (PJI).

The rising demand for the treatment of prosthetic joint infection has prompted significant players to invest more in research activities aimed at developing new innovative products for the treatment of prosthetic joint infection. Pharmaceutical companies are conducting clinical trials for drug compounds to treat PJI. A few players have been successful in obtaining regulatory approval for clinical trials.

Segmentation of Global Prosthetic Joint Infections Market-

Global Prosthetic Joint Infections Market – By Treatment

- Debridement

- Antibiotics

- Irrigation with Implant Retention

Global Prosthetic Joint Infections Market – By Distributional Channel

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Others