| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Purity Nickel Wire Market Size 2024 |

USD 1,440.0 million |

| Purity Nickel Wire Market, CAGR |

6.87% |

| Purity Nickel Wire Market Size 2032 |

USD 2,451.7 million |

Market Overview:

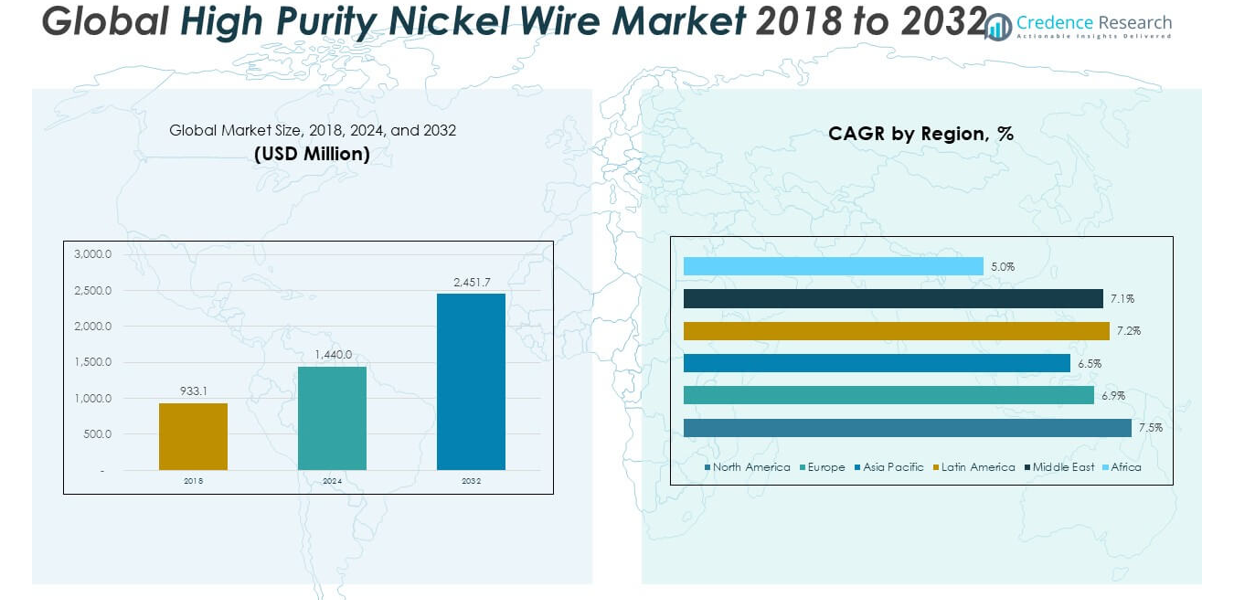

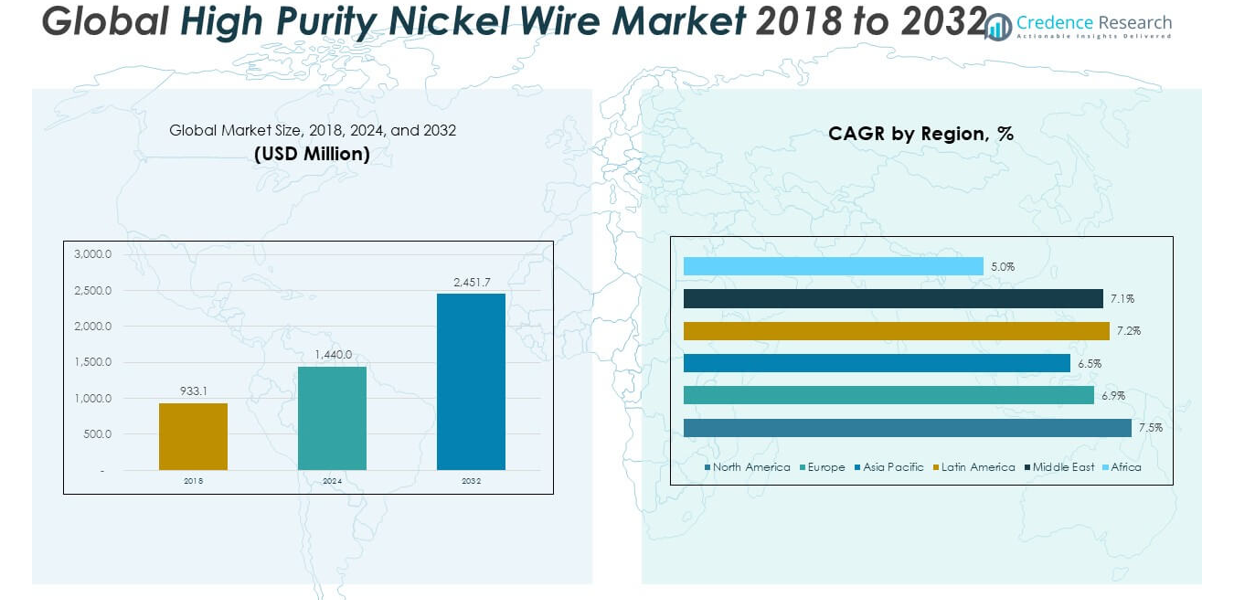

The Purity Nickel Wire Market size was valued at USD 933.1 million in 2018 to USD 1,440.0 million in 2024 and is anticipated to reach USD 2,451.7 million by 2032, at a CAGR of 6.87% during the forecast period.

The growth of the Purity Nickel Wire Market is primarily driven by its increasing application across diverse industries such as electronics, automotive, aerospace, healthcare, and energy. Nickel wire’s superior electrical and thermal conductivity, along with its resistance to corrosion and mechanical wear, makes it ideal for high-performance uses including heating elements, battery electrodes, resistance wires, and medical devices. The rising adoption of electric vehicles has significantly increased the demand for nickel-based components, especially in battery systems. Similarly, the electronics and telecommunications industries are incorporating nickel wire in compact, high-efficiency devices. Moreover, the need for biocompatible materials in medical technologies and durable materials in aerospace further supports market expansion. Technological advancements and ongoing innovation in manufacturing processes are also contributing to improved product quality and broader application scope.

Asia-Pacific leads the Purity Nickel Wire Market due to its well-established electronics manufacturing ecosystem, expanding industrial base, and growing investments in electric mobility and infrastructure. Countries in the region benefit from strong production capabilities and rising domestic demand, particularly in consumer electronics and automotive sectors. North America follows, supported by technological advancements, a robust aerospace industry, and increasing focus on renewable energy systems. Europe also maintains a strong market presence with demand concentrated in automotive, defense, and medical equipment manufacturing. Latin America, the Middle East, and Africa are gradually emerging as potential markets, spurred by industrial development and rising investment in energy and transportation infrastructure. These regions are expected to gain traction as global supply chains diversify and localized manufacturing becomes a strategic priority.

Market Insights:

- The Purity Nickel Wire Market was valued at USD 1,440.0 million in 2024 and is projected to reach USD 2,451.7 million by 2032, growing at a CAGR of 6.87%.

- Rising demand from electronics and semiconductor industries is boosting adoption, driven by the need for high-purity, corrosion-resistant materials in microelectronic assemblies.

- Electric vehicles and battery manufacturing continue to be major growth drivers, with nickel wire used in thermal control systems and battery electrodes.

- Medical and aerospace sectors are increasing consumption due to the wire’s biocompatibility, thermal stability, and mechanical resilience.

- Technological advancements in metallurgy and precision wire-drawing are enhancing product performance, expanding usage across high-spec industrial systems.

- The market faces challenges from high production costs and raw material price volatility, which limit accessibility for smaller producers.

- Asia-Pacific dominates the global market, followed by North America and Europe, while Latin America, the Middle East, and Africa show emerging potential with rising industrial investment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Electronics and Semiconductor Applications

The electronics industry continues to drive significant demand for high-purity nickel wire due to its excellent electrical conductivity and resistance to corrosion. Nickel wire is widely used in semiconductors, integrated circuits, and other microelectronic components where precision and purity are essential. It plays a critical role in circuit interconnections and bonding processes in advanced electronic assemblies. With ongoing miniaturization and complexity in devices, the need for stable, reliable materials like nickel wire is increasing. The Purity Nickel Wire Market benefits from growing investments in consumer electronics, telecom infrastructure, and industrial automation. It remains a material of choice for manufacturers seeking durability and long-term performance in compact electronic systems.

- For example, EOS Nickel NiCP, a commercially pure nickel alloy with a minimum purity of 99.0%, is engineered specifically for semiconductor applications where exceptional corrosion resistance and nanometer-level precision are required.

Expanding Use in Electric Vehicles and Battery Systems

The transition toward electric mobility is creating sustained opportunities for nickel-based components across battery manufacturing and electrical systems. High-purity nickel wire is used in battery electrodes, especially in lithium-ion configurations, where it contributes to thermal and electrical efficiency. It supports the growing demand for longer-range, safer, and faster-charging batteries in electric vehicles. The shift toward electrified transportation is also prompting innovation in powertrains and charging technologies, all of which depend on materials with high conductivity and stability. The Purity Nickel Wire Market gains momentum from these evolving industry requirements and the continuous rise in EV production across global markets. It enables critical functions in battery management systems, connectors, and conductive pathways.

Increased Utilization in Medical and Aerospace Sectors

The medical device industry is steadily incorporating high-purity nickel wire into devices that require biocompatibility, structural integrity, and precise performance. Applications include catheter reinforcement, neurostimulation leads, and implantable components, where material safety and reliability are vital. In aerospace, nickel wire is used in sensors, actuators, and resistance-based heating systems in aircraft, where it must withstand extreme temperatures and vibrations. The demand for lightweight yet resilient materials in both sectors positions nickel wire as a key component in advanced engineering solutions. It also supports compliance with stringent safety and quality standards that govern healthcare and aviation products. The Purity Nickel Wire Market continues to gain from the technical sophistication and regulation-driven innovation in these high-growth sectors.

Support from Technological Advancements and Industrial Growth

Advancements in metallurgy and wire-drawing technologies are improving the consistency, purity levels, and dimensional precision of nickel wire. These developments enable broader usage across complex industrial applications, where tolerances and performance standards are high. The adoption of automation and smart manufacturing practices is increasing the need for dependable conductive materials within control systems and sensor networks. It provides industries with the capacity to build efficient, integrated systems that enhance productivity and monitoring. The Purity Nickel Wire Market reflects this shift toward high-tech, quality-driven supply chains that require consistent and certified input materials. It remains essential to industries seeking improved reliability, energy efficiency, and operational resilience.

- For instance, according to Atotech and MacDermid Alpha, advanced electroplating techniques and automation platforms have led to significant improvements in nickel coating uniformity, production efficiency, and defect reduction.

Market Trends:

Growing Emphasis on Ultra-High Purity and Precision Engineering

Manufacturers are increasingly focusing on achieving ultra-high purity grades of nickel wire to meet the rigorous demands of advanced applications. Industries such as aerospace, medical, and semiconductor require wire with minimal contamination and exceptional structural integrity. This trend is driving investments in refining techniques and quality control processes to ensure consistent chemical composition and microstructure. The demand for precision-drawn wire with exact dimensional tolerances is rising across sectors that rely on high-performance components. The Purity Nickel Wire Market reflects this shift toward specialization, where product quality and traceability have become competitive differentiators. It is evolving to accommodate the complex standards set by end-use industries.

- For instance, AMETEK Specialty Metal Products (SMP) highlighted its wrought powder metallurgy nickel strip and wire with an impressively high purity of 99.98%. The company claimed the ultra-high purity improves electrical conductivity by 15–20% compared to traditional cast materials boosting power transmission in battery applications and enabling the design of smaller, thinner connectors. This not only reduces material costs but also maintains performance standards

Integration of Nickel Wire in Emerging Clean Energy Technologies

The global focus on clean energy is expanding the application scope of nickel wire across hydrogen fuel cells, solar panels, and wind energy systems. High-purity nickel wire is used in connectors, sensors, and electrode assemblies that demand efficient thermal and electrical properties. Manufacturers are exploring wire-based solutions for energy storage systems and next-generation batteries that can support grid stability and sustainability goals. This trend aligns with broader efforts to decarbonize industrial operations and transportation networks. The Purity Nickel Wire Market is adapting to these energy transition requirements by aligning product development with low-emission, high-efficiency technologies. It supports critical performance in harsh and variable environmental conditions.

Shift Toward Miniaturized and High-Density Components

Across sectors such as electronics, automotive, and aerospace, there is a clear trend toward compact and lightweight system designs. This shift necessitates the use of fine-gauge nickel wire that can maintain conductivity and durability in restricted spaces. High-density circuitry, microelectromechanical systems (MEMS), and wearable technologies increasingly rely on micro-scale wire assemblies. The Purity Nickel Wire Market is responding by offering products suitable for microfabrication and precision interconnects. It is reinforcing its relevance by meeting the evolving demands for space efficiency, reduced weight, and mechanical flexibility in next-generation devices. Manufacturers are refining wire-drawing techniques to achieve finer diameters without compromising structural integrity.

- For example, Heraeus manufactures fine nickel wire (diameters down to 15 microns, purity > 99.7%) for automotive sensor wiring, tested for durability over 1000 thermal cycles, supporting miniaturization and high-density harnesses.

Increased Adoption of Automation and Smart Manufacturing

Industries are modernizing production lines through automation and digital control systems, which require robust, reliable wiring for data and power transmission. High-purity nickel wire serves as a critical component in sensors, actuators, and embedded control units in automated environments. This trend is particularly strong in high-tech manufacturing sectors, including robotics, industrial machinery, and process control. The Purity Nickel Wire Market is benefiting from this shift, supplying precision materials for environments where uptime, accuracy, and system integration are priorities. It continues to gain relevance as factories invest in connectivity and intelligence to enhance productivity and responsiveness. The move toward Industry 4.0 is reinforcing demand for durable, high-conductivity materials.

Market Challenges Analysis:

High Production Costs and Technical Complexity Limit Market Accessibility

The production of high-purity nickel wire involves advanced refining, alloy control, and wire-drawing techniques, all of which contribute to elevated manufacturing costs. Maintaining consistent purity levels and microstructural uniformity demands stringent process controls and precision equipment, increasing capital and operational expenses. These high costs can restrict smaller manufacturers from entering or scaling within the market, reducing overall supply diversity. The Purity Nickel Wire Market faces pressure to balance performance demands with cost-effectiveness, particularly in price-sensitive sectors. It must also address challenges in maintaining product integrity during long manufacturing cycles and post-processing steps. Cost optimization without compromising quality remains a persistent barrier to broader market adoption.

Supply Chain Vulnerabilities and Raw Material Constraints

Global supply chains for nickel and related alloys are subject to volatility due to geopolitical tensions, mining regulations, and resource concentration in a few countries. Disruptions in raw material sourcing can affect production continuity and lead to price instability. The Purity Nickel Wire Market must navigate these uncertainties while ensuring consistent delivery timelines and compliance with regional import-export policies. It also depends on reliable downstream logistics to maintain the purity and condition of the wire during transport and storage. Environmental regulations related to nickel mining and processing may further constrain access to high-grade raw materials. It requires resilient supply strategies to manage these risks and ensure uninterrupted operations.

Market Opportunities:

Rising Demand from Electric Mobility and Energy Storage Sectors

The global transition toward electric vehicles and renewable energy infrastructure is opening new avenues for high-purity nickel wire. Its use in battery components, power connectors, and electrical control systems positions it as a vital material for high-efficiency energy technologies. Manufacturers are expanding capacity to support demand from battery gigafactories and EV supply chains. The Purity Nickel Wire Market is well-placed to capitalize on this momentum by aligning with long-term electrification trends. It offers the thermal and electrical performance required for next-generation storage solutions and high-voltage applications. This creates sustained opportunities across both OEM and aftermarket supply networks.

Expansion into Advanced Medical and Aerospace Applications

Advancements in medical technology and aerospace systems are driving demand for materials with superior purity, precision, and biocompatibility. High-purity nickel wire meets these criteria and finds use in implantable devices, surgical tools, aerospace sensors, and actuation mechanisms. Innovation in minimally invasive procedures and satellite miniaturization continues to create specific material requirements. The Purity Nickel Wire Market can leverage this demand by offering customized, application-specific grades that meet evolving industry certifications. It supports safety-critical performance where reliability and longevity are essential. This unlocks growth potential in regulated, high-margin sectors seeking dependable materials for complex environments.

Market Segmentation Analysis:

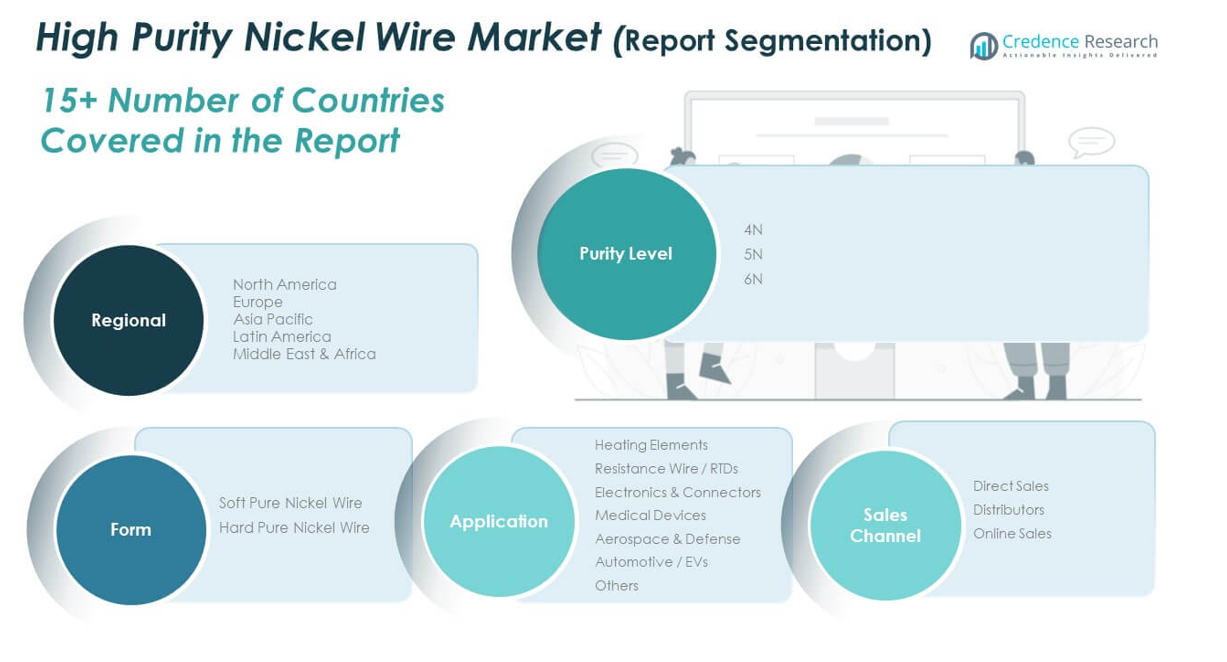

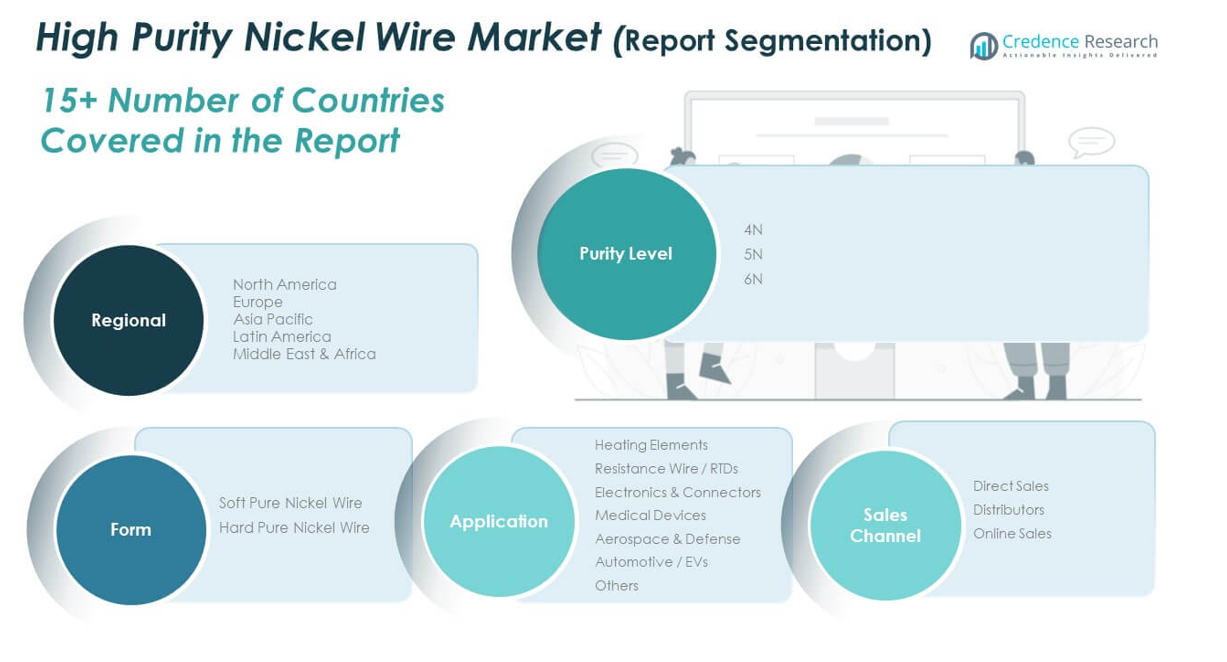

The Purity Nickel Wire Market is segmented by purity level, form, application, and sales channel to reflect its diverse use across industries.

By purity level, the market includes 4N (99.99%), 5N (99.999%), and 6N (99.9999%) categories, with higher grades gaining traction in critical applications such as aerospace, semiconductors, and medical devices due to stringent performance requirements.

By form, it comprises soft pure nickel wire, used in flexible electronic assemblies, and hard pure nickel wire, preferred for its strength and resistance in structural and industrial applications.

- For example, Goodfellow offers nickel spooled wire in a range of forms, including soft pure nickel wire for flexible electronic assemblies and hard pure nickel wire for applications requiring strength and resistance, such as structural and industrial components.

By application, the market serves a wide range of sectors. Heating elements and resistance wires, including RTDs, use nickel wire for its excellent thermal and electrical conductivity. Electronics and connectors demand high precision and purity, while medical devices and aerospace applications prioritize biocompatibility and reliability. Automotive and EV segments are expanding rapidly, using nickel wire in battery components and electronic systems. Others include niche uses in research and instrumentation.

- For example, Sandvik (Alleima) provides fine nickel alloy wire, available in sizes down to 10 microns, used in resistance heating elements (such as RTDs), voice coils, actuator coils, and lead wires.

By sales channel, the market includes direct sales to OEMs, distributors for broader industrial supply, and online sales catering to smaller-scale or specialty buyers. The segmentation reflects how the Purity Nickel Wire Market aligns its offerings with varying technical, commercial, and distribution requirements across global industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Purity Level

- 4N (99.99% purity)

- 5N (99.999% purity)

- 6N (99.9999% purity)

By Form

- Soft Pure Nickel Wire

- Hard Pure Nickel Wire

By Application

- Heating Elements

- Resistance Wire / RTDs (Resistance Temperature Detectors)

- Electronics & Connectors

- Medical Devices

- Aerospace & Defense

- Automotive / EVs

- Others

By Sales Channel

- Direct Sales

- Distributors

- Online Sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Purity Nickel Wire Market size was valued at USD 187.65 million in 2018 to USD 301.25 million in 2024 and is anticipated to reach USD 539.38 million by 2032, at a CAGR of 7.50% during the forecast period. North America accounts for a significant share of the Purity Nickel Wire Market, supported by a well-established industrial infrastructure and a strong presence of advanced electronics and aerospace manufacturers. The region is witnessing rising demand for high-performance materials in electric vehicles, medical technologies, and renewable energy systems. The United States remains the dominant contributor, driven by investments in R&D and high-grade manufacturing capabilities. It benefits from a steady shift toward localized supply chains and innovation in battery and sensor technologies. Strategic partnerships between material suppliers and OEMs are further enhancing market traction. The region’s share continues to expand as high-purity specifications become standard across applications.

The Europe Purity Nickel Wire Market size was valued at USD 262.21 million in 2018 to USD 405.33 million in 2024 and is anticipated to reach USD 691.63 million by 2032, at a CAGR of 6.90% during the forecast period. Europe holds a substantial market share, with growth supported by regulatory focus on sustainable materials and high-performance engineering. Countries such as Germany, France, and the UK are key contributors, driven by the strength of their automotive, medical device, and aerospace sectors. The Purity Nickel Wire Market in Europe benefits from technological innovation and quality compliance standards that demand ultra-pure inputs. It supports applications in EV battery modules, aircraft systems, and healthcare implants. The region is also focusing on circular economy principles, encouraging the use of recyclable and durable metals. This aligns with the market’s positioning as a sustainable material solution.

The Asia Pacific Purity Nickel Wire Market size was valued at USD 342.45 million in 2018 to USD 518.00 million in 2024 and is anticipated to reach USD 858.10 million by 2032, at a CAGR of 6.50% during the forecast period. Asia Pacific dominates the global Purity Nickel Wire Market, driven by high-volume manufacturing and a growing demand for advanced electronics and electric vehicles. China, Japan, South Korea, and India lead regional demand, supported by government initiatives, industrial expansion, and rising consumer electronics consumption. It serves as a key supplier of both raw materials and finished products, creating a vertically integrated market ecosystem. The electronics and automotive supply chains in the region increasingly rely on high-purity conductive materials. With increasing investments in semiconductor fabrication and clean energy infrastructure, regional demand continues to surge. The market benefits from cost-effective production and rapid technological adoption.

The Latin America Purity Nickel Wire Market size was valued at USD 46.66 million in 2018 to USD 73.24 million in 2024 and is anticipated to reach USD 127.49 million by 2032, at a CAGR of 7.20% during the forecast period. Latin America represents a growing opportunity for the Purity Nickel Wire Market, led by Brazil and Mexico’s developing manufacturing sectors. The region is witnessing increased demand from the energy, transportation, and medical industries. It is gradually adopting high-purity materials in local production, supported by industrial policy reforms and foreign investments. Manufacturers are expanding their presence to tap into infrastructure projects and electronics assembly lines. While the region still trails behind major markets in volume, it shows consistent year-over-year growth. It continues to evolve with rising technical standards and regional collaboration on supply chain resilience.

The Middle East Purity Nickel Wire Market size was valued at USD 63.45 million in 2018 to USD 98.97 million in 2024 and is anticipated to reach USD 170.88 million by 2032, at a CAGR of 7.10% during the forecast period. The Middle East is emerging as a promising market, driven by diversification efforts in the Gulf economies and strategic investment in advanced industries. The region is witnessing increased activity in medical manufacturing, energy infrastructure, and electronics assembly. The Purity Nickel Wire Market in the Middle East is benefiting from import substitution programs and the establishment of high-technology parks. It supports a shift toward local sourcing of high-grade materials for critical industries. Countries like the UAE and Saudi Arabia are investing in manufacturing clusters that utilize specialty metals. The market is expected to grow steadily as regional industrial capabilities expand.

The Africa Purity Nickel Wire Market size was valued at USD 30.70 million in 2018 to USD 43.24 million in 2024 and is anticipated to reach USD 64.23 million by 2032, at a CAGR of 5.00% during the forecast period. Africa accounts for a smaller share of the global market but holds long-term potential as its industrial base strengthens. Demand is gradually increasing in telecommunications, energy, and infrastructure development, particularly in countries such as South Africa, Nigeria, and Egypt. The Purity Nickel Wire Market in Africa faces challenges related to supply chain logistics and material certification but benefits from untapped natural resources. It is positioned to grow with greater regional focus on manufacturing self-sufficiency and value addition. Government-led industrialization initiatives and foreign partnerships are supporting market awareness. The region is poised for gradual uptake as product standards and technical expertise improve.

Key Player Analysis:

- Zhongnuo Advanced Material

- Sumitomo Electric Industries Ltd.

- California Fine Wire Company

- Sandvik AB

- AMETEK Inc.

- Goodfellow Cambridge Limited

- ESPI Metals

- Special Metals Corporation

- Heanjia Super-Metals Co. Ltd.

- Heraeus Holding GmbH

- Other

Competitive Analysis:

The Purity Nickel Wire Market features a competitive landscape driven by material quality, production precision, and application-specific customization. Leading players include American Elements, ALA Industries, Goodfellow, and Metal Cutting Corporation, which focus on high-purity grades and advanced manufacturing capabilities. Companies differentiate through proprietary refining methods, micro-diameter wire drawing, and compliance with medical and aerospace standards. Strategic partnerships with end-use industries enable manufacturers to tailor solutions for evolving performance demands. It requires continuous investment in R&D, technical certifications, and cleanroom production environments to maintain competitive positioning. Regional players in Asia are expanding global reach through cost-effective production and aggressive export strategies. The market remains fragmented, with niche suppliers serving specialized sectors while large firms leverage scale and brand credibility to secure long-term contracts. The ability to deliver consistent quality across varied applications remains central to maintaining leadership in this evolving market.

Recent Developments:

- In March 2025, Sumitomo Electric Industries Ltd. entered into an assembly agreement with 3M to advance expanded beam optical interconnect technology for data centers. This partnership aims to deliver next-generation, reliable, and scalable connectivity solutions, leveraging 3M’s expanded beam optical ferrule technology.

- In April 2025, Tri Star Metals signed a letter of intent to acquire Siri Wire to expand its production and market reach. The deal will integrate Siri Wire’s fine-gauge expertise into Tri Star’s operations, strengthening its position in high-purity nickel and specialty wire sectors.

- In June 2025, Canada Nickel announced a partnership with NetCarb to leverage next-generation carbon sequestration in nickel extraction. This collaboration aims to reduce carbon emissions from refining processes and integrate sustainable practices into high-purity nickel wire production.

Market Concentration & Characteristics:

The Purity Nickel Wire Market demonstrates moderate concentration, with a mix of established global players and specialized regional manufacturers. It is characterized by high entry barriers due to stringent purity standards, complex production processes, and the need for precision equipment. The market caters to demanding applications in aerospace, electronics, medical devices, and energy systems, requiring consistent quality and certification compliance. It favors suppliers with strong R&D capabilities, vertically integrated operations, and the ability to meet custom specifications. Demand trends reflect a growing preference for ultra-fine wire and application-specific alloys. The market operates under long-term supply agreements and strict audit protocols, reinforcing supplier-client dependencies. Technological advancements and material innovation continue to shape competition and product development across the value chain.

Report Coverage:

The research report offers an in-depth analysis based on purity level, form, application, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand from electric vehicle and battery manufacturers will drive long-term market expansion.

- Advances in semiconductor and microelectronics technologies will increase usage of ultra-fine nickel wire.

- Rising investments in renewable energy systems will support applications in sensors and electrical connectors.

- Medical device innovations will create new opportunities for biocompatible, high-purity nickel wire.

- Aerospace sector will continue to rely on nickel wire for lightweight, high-performance systems.

- Emerging markets in Asia, Latin America, and the Middle East will contribute to volume growth.

- Automation and Industry 4.0 adoption will fuel demand for precision wiring in control systems.

- Supply chain resilience and localized production strategies will influence sourcing patterns.

- Regulatory focus on material purity and sustainability will shape product development priorities.

- Strategic partnerships and technology licensing will become key to expanding market presence.