Market Overview:

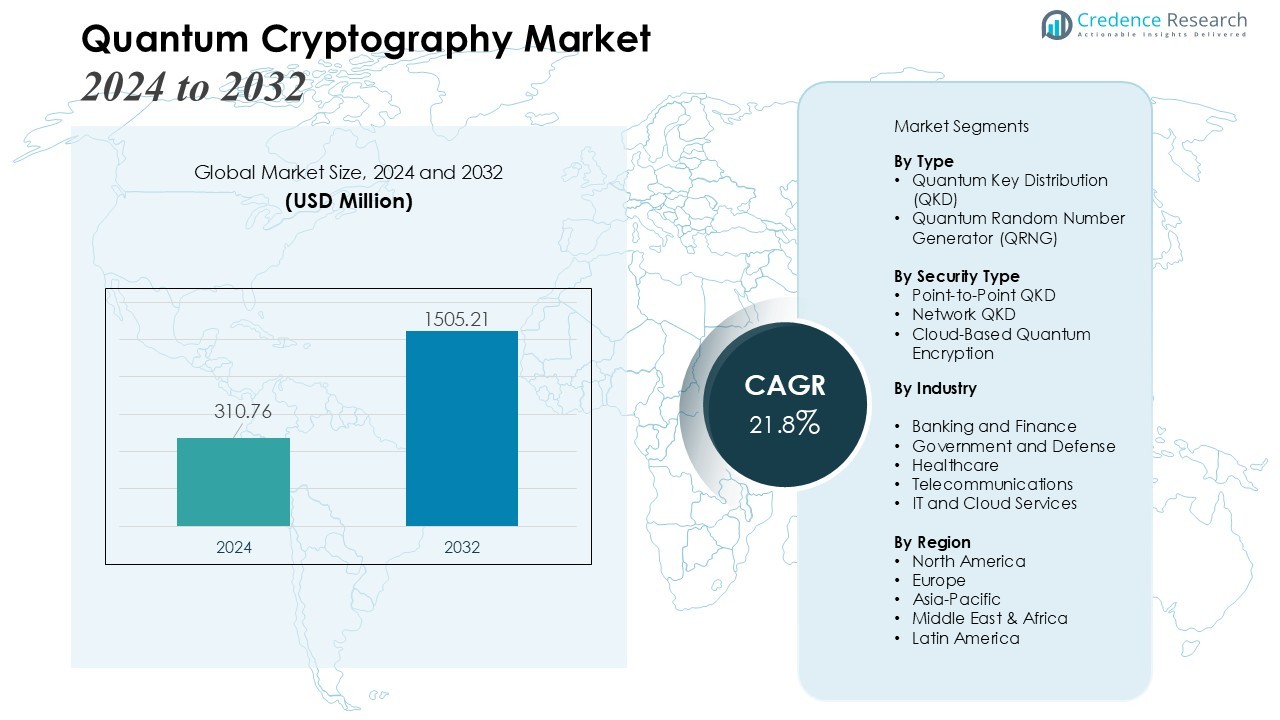

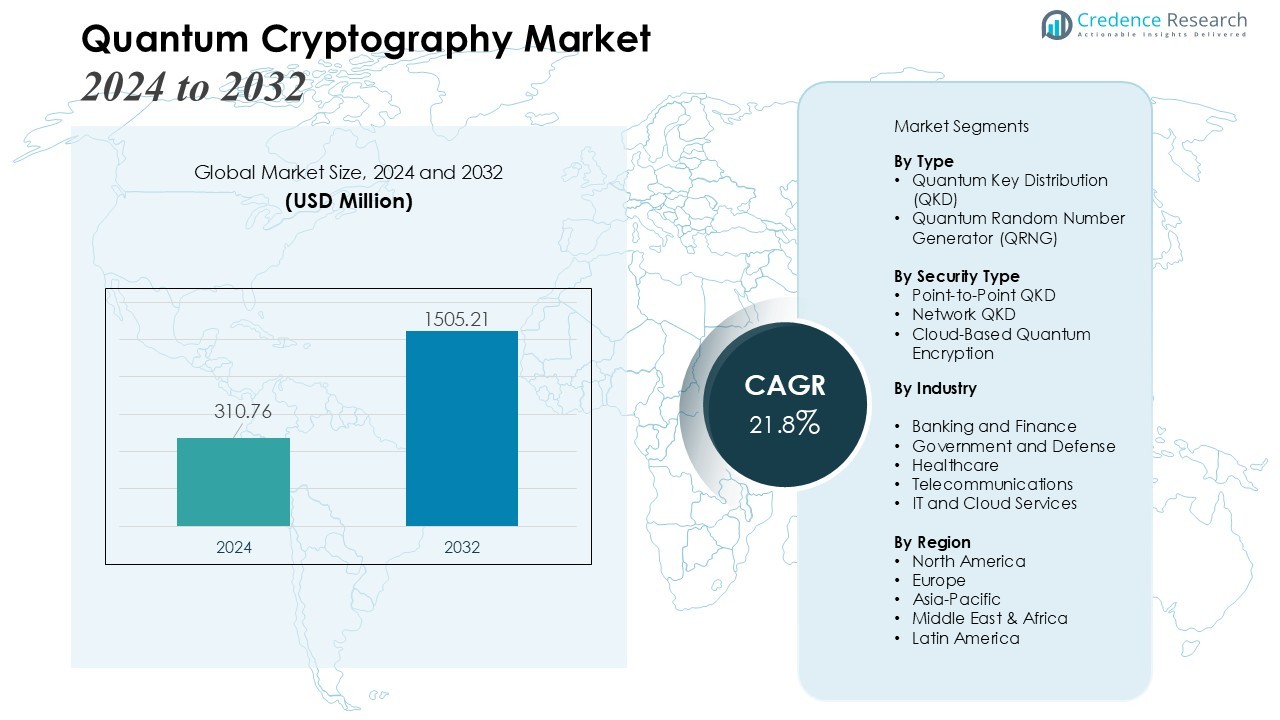

The Quantum Cryptography Market size was valued at USD 310.76 million in 2024 and is anticipated to reach USD 1505.21 million by 2032, at a CAGR of 21.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quantum Cryptography Market Size 2024 |

USD 310.76 Million |

| Quantum Cryptography Market, CAGR |

21.8% |

| Quantum Cryptography Market Size 2032 |

USD 1505.21Million |

This growth is being driven by escalating cybersecurity threats and the growing inadequacy of classical encryption in the face of advancing quantum computing capabilities. Organizations across sectors — including finance, defense, telecommunications, and government — are increasingly adopting quantum‑secure communication solutions such as quantum key distribution (QKD) and other quantum‑safe technologies to safeguard sensitive data and communications. Additionally, expanding deployment of cloud services, proliferation of IoT devices, and stringent data‑privacy regulations further propel demand for quantum cryptography.

From a regional perspective, North America currently dominates the market, owing to high investment in quantum research, robust cybersecurity infrastructure, and strong governmental support for quantum initiatives. Meanwhile, the Asia–Pacific region is emerging as the fastest‑growing geography, driven by increasing cybersecurity awareness, rising technological adoption across industries, and accelerated investments in quantum communication infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Quantum Cryptography Market size was valued at USD 310.76 million in 2024 and is projected to reach USD 1505.21 million by 2032, with a CAGR of 21.8% during the forecast period (2024‑2032).

- Escalating cyberattacks and data breaches are driving organizations to adopt quantum-secure solutions, particularly quantum key distribution (QKD), to protect sensitive information across finance, healthcare, and government sectors.

- Advances in quantum computing threaten classical encryption methods, increasing demand for quantum cryptography as a forward-looking safeguard for long-term data security.

- High-security industries such as finance, defense, telecom, and government are major adopters, focusing on secure communications, regulatory compliance, and risk mitigation.

- Governments and private enterprises are investing heavily in quantum infrastructure, research, and collaborative ecosystems, enabling scalable deployment of quantum cryptography solutions.

- The market faces challenges due to high implementation costs, complex integration with legacy systems, technical limitations, and evolving regulatory frameworks, which may slow widespread adoption.

- Regionally, North America leads with a 42% market share, Europe holds 28%, and Asia-Pacific accounts for 25%, driven by investment in research, cybersecurity awareness, and strategic initiatives in quantum communication networks.

Market Drivers:

Market Drivers:

Escalating Cybersecurity Threats Prompt Shift to Quantum‑Secure Solutions

Rapid growth in cyberattacks and data breaches is pushing organizations to reconsider conventional encryption methods. Many sectors face persistent threats to data confidentiality, integrity, and privacy. In this context, quantum cryptography — especially quantum key distribution (QKD) — offers security grounded in the laws of physics, making it practically immune to decryption by classical or quantum‑powered attackers. This shift drives demand from enterprises handling sensitive data, including finance, healthcare, and government systems.

- For Instance, a collaboration between the University of Geneva, ID Quantique, and Corning Incorporated achieved a record distance for quantum key distribution (QKD) over optical fiber of 421 kilometers (262 miles) in a laboratory experiment in 2018, publishing the results in Physical Review Letters

Rising Quantum‑Computing Capabilities Undermine Classical Encryption

Advances in quantum computing accelerate the risk that classical cryptographic algorithms (RSA, ECC etc.) may become obsolete or breakable. With this looming threat, businesses and state actors seek encryption techniques resilient to future quantum attacks. Quantum cryptography thus gains strategic importance as a forward‑looking safeguard for long‑term data security.

- For instance, IBM’s quantum processors achieved 1,121 qubits in their late 2023 Condor system, demonstrating an industry-first level of scale in physical qubits (over 1,000), but these capabilities do not pose an immediate threat to RSA-2048 encryption via Shor’s algorithm as fault-tolerant quantum computers with millions of high-quality, error-corrected logical qubits are still required.

Surging Demand from High‑Security Sectors Such as Finance, Government, Defense and Telecom

Industries that manage highly confidential or mission‑critical data increasingly adopt quantum cryptography to protect communications and transactions. Financial institutions, defense agencies, telecom operators, and government establishments represent major demand drivers. Their focus on secure communication, regulatory compliance, and risk mitigation strengthens market uptake of quantum encryption.

Growing Investments in Quantum Infrastructure, R&D and Collaborative Ecosystem

Governments and private enterprises worldwide are allocating resources toward quantum technology research, infrastructure build‑out, and development of quantum communication networks. These investments support scaling quantum cryptography solutions and integrating them into existing systems. Partnerships between quantum technology firms, telecom providers, and research institutions further accelerate adoption and commercialization.

Market Trends:

Significant Expansion of QKD Networks and Hybrid Security Deployments

The deployment of quantum key distribution (QKD) networks is gaining momentum globally. Many metropolitan regions now host pilot QKD networks, and more installations are underway. Operators in telecom, finance, and critical infrastructure increasingly enable QKD over existing fiber‑optic or satellite channels. The shift toward hybrid security frameworks — combining quantum‑safe encryption with classical protocols — helps organisations integrate cutting‑edge protection without fully overhauling legacy systems. This trend broadens accessibility of quantum cryptography and supports gradual migration toward more secure communications.

- For instance, QNu Labs under India’s National Quantum Mission achieved a 500 km QKD network over optical fibers, marking the longest such demonstration in the country.

Rise of Quantum‑Safe Cloud Services and Enterprise‑Grade Encryption Offerings

Cloud platforms and large enterprises have begun embedding quantum‑resistant encryption and key‑management solutions to protect distributed data networks and remote access systems. Demand for managed quantum‑security services grows because many organisations lack in‑house quantum‑expertise. The shift reflects recognition that traditional encryption may soon face threats from quantum computing advances. Industries such as banking, healthcare, and telecom lead adoption, prioritizing secure data transmission and compliance with evolving regulations. This movement elevates quantum cryptography from niche deployments to mainstream cybersecurity architecture.

- For Instance, Thales products are PQC-ready and support quantum-safe capabilities, leveraging algorithms like CRYSTALS-Kyber (ML-KEM) and FALCON, selected by NIST for standardization.

Market Challenges Analysis:

High Implementation Costs and Infrastructure Complexity Limit Widespread Adoption

The Quantum Cryptography Market faces significant hurdles due to high initial investment requirements for quantum hardware, secure networks, and specialized equipment. Many organizations encounter challenges integrating quantum encryption with existing legacy systems. It requires skilled personnel to manage and maintain QKD networks and quantum communication infrastructure. Limited standardization of protocols across industries further complicates deployment. These factors slow adoption despite growing demand for quantum‑secure solutions. Organizations must balance cost considerations with the long-term benefits of enhanced cybersecurity.

Technical Limitations and Regulatory Uncertainty Hinder Market Expansion

Quantum cryptography relies on sensitive hardware and precise conditions, which can affect performance over long distances or in adverse environmental conditions. It requires high-fidelity photon sources and detectors, limiting scalability and coverage. Regulatory frameworks for quantum communications remain under development, creating uncertainty for enterprises seeking compliance assurance. Interoperability between different quantum and classical systems remains a challenge. Companies must navigate these technical and legal constraints to implement effective, reliable quantum encryption strategies.

Market Opportunities:

Expanding Demand from Finance, Healthcare, and Government Sectors Offers Growth Potential

The Quantum Cryptography Market presents substantial opportunities driven by increasing demand from high-security industries. Finance, healthcare, and government organizations seek advanced encryption to protect sensitive data and ensure compliance with evolving regulations. It enables secure communications and transactions over critical networks, reducing risks of cyberattacks and data breaches. Rising awareness of quantum-safe solutions encourages adoption across enterprise and public sectors. Growing digital transformation initiatives further support the integration of quantum encryption into existing infrastructure. Companies providing scalable and interoperable solutions can capture significant market share.

Innovation in Quantum Communication Technologies and Global Collaborative Initiatives

Advancements in quantum communication, including satellite-based QKD and hybrid quantum-classical networks, create avenues for market growth. It allows secure data transmission over longer distances and across diverse network architectures. Investments from governments and private organizations worldwide drive research and development, accelerating commercialization of quantum cryptography solutions. Collaborative efforts between technology firms, telecom operators, and research institutions strengthen the ecosystem. Expansion of quantum-safe cloud services and enterprise-grade encryption offerings opens new revenue streams. Continuous technological innovation ensures sustained opportunities for market participants in emerging geographies.

Market Segmentation Analysis:

By Type

The Quantum Cryptography Market is categorized primarily into quantum key distribution (QKD) and quantum random number generators (QRNG). QKD dominates the market due to its ability to provide highly secure communication channels resistant to conventional and quantum-powered cyberattacks. It enables enterprises and government organizations to exchange sensitive data with high confidence. QRNG, while smaller in adoption, supports secure cryptographic operations by generating truly random numbers for encryption keys. Demand for both types grows in line with cybersecurity requirements and digital transformation initiatives across multiple sectors.

- For instance, scientists at IIT Delhi achieved trusted-node-free QKD over 380 km in standard telecom fiber with a very low quantum bit error rate.

By Security Type

Market segmentation by security type includes point-to-point QKD, network QKD, and cloud-based quantum encryption. Point-to-point QKD holds significant adoption due to secure direct communication between two nodes. Network QKD supports broader deployment across metropolitan or regional networks, enabling multiple endpoints to share quantum-secured communication. Cloud-based quantum encryption is gaining traction among enterprises seeking scalable and cost-effective solutions. It allows integration with existing IT infrastructure while maintaining high standards of data confidentiality.

- For instance, IIT Delhi scientists achieved trusted-node-free QKD over 380 km in standard telecom fiber with a very low quantum bit error rate.

By Industry

Key industry segments include banking and finance, government and defense, healthcare, and telecommunications. Banking and finance lead adoption due to the critical need for secure transactions and compliance with regulatory mandates. Government and defense sectors invest heavily to safeguard sensitive information and national infrastructure. Healthcare relies on quantum cryptography to protect patient data and research records. Telecommunications providers implement it to ensure secure data transmission across networks. Overall, industry-specific requirements drive tailored adoption, strengthening market growth across diverse applications.

Segmentations:

By Type

- Quantum Key Distribution (QKD)

- Quantum Random Number Generator (QRNG)

By Security Type

- Point-to-Point QKD

- Network QKD

- Cloud-Based Quantum Encryption

By Industry

- Banking and Finance

- Government and Defense

- Healthcare

- Telecommunications

- IT and Cloud Services

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Robust Investment in Quantum Research and Cybersecurity Infrastructure

North America holds a 42% share of the global Quantum Cryptography Market, reflecting its leadership in technology adoption and investment. Strong funding in research programs and pilot QKD networks supports growth in this region. It enables organizations in finance, defense, and critical infrastructure sectors to adopt advanced encryption solutions. High cybersecurity awareness and supportive regulatory frameworks further accelerate adoption. The presence of leading technology providers and strategic partnerships strengthens deployment across multiple industries. Continuous innovation reinforces North America’s position as a market leader.

Europe Focuses on Secure Communication Networks and Regulatory Compliance

Europe accounts for 28% of the global Quantum Cryptography Market, driven by its emphasis on data protection regulations and secure communications. It promotes adoption in sectors such as finance, healthcare, and government services. Collaborative projects between EU nations and private companies advance regional QKD infrastructure. Investments in research and pilot programs enhance technological maturity and interoperability. The region benefits from a skilled workforce and advanced telecommunications networks, supporting adoption across diverse use cases. Proactive regulatory standards encourage market expansion.

Asia-Pacific Emerges as a Rapidly Growing Market with Strategic Initiatives

Asia-Pacific represents 25% of the global Quantum Cryptography Market, driven by government and enterprise investment in quantum technologies. It facilitates deployment of solutions across telecom, banking, and defense sectors. Countries including China, Japan, and South Korea actively develop QKD networks and support large-scale research programs. Rising digitalization, cybersecurity awareness, and infrastructure development fuel adoption in emerging economies. Collaborative efforts with global technology firms enhance regional capabilities and knowledge transfer. Strategic initiatives and strong market demand position Asia-Pacific as a key growth hub.

Key Player Analysis:

- QuintessenceLabs (Australia)

- Quside Technologies (Spain)

- MagiQ Technologies (U.S.)

- Toshiba Digital Solutions Corporation (Japan)

- QNu Labs Private Limited. (India)

- KETS QUANTUM SECURITY LTD. (U.K.)

- LuxQuanta Technologies S.L. (Spain)

- Quantum Xchange. (U.S.)

- ID Quantique (Switzerland)

- Qrypt (U.S.)

- Terra Quantum (Switzerland)

- QuSecure, Inc. (U.S.)

Competitive Analysis:

The Quantum Cryptography Market is highly competitive, with key players focusing on technological innovation, strategic partnerships, and expansion of quantum communication networks. Leading companies include ID Quantique, Toshiba Corporation, QuintessenceLabs, MagiQ Technologies, Qubitekk, and QuintessenceLabs. It drives market growth through continuous development of quantum key distribution (QKD) solutions, cloud-based quantum encryption, and hybrid security offerings. Companies invest in research and development to enhance performance, scalability, and interoperability of their solutions. Collaborations with telecom operators, government agencies, and enterprise clients strengthen market presence and accelerate adoption. Competitive strategies also include regional expansion, patent acquisitions, and participation in pilot projects and quantum network initiatives. Continuous innovation and strategic alliances ensure that companies maintain leadership positions while meeting evolving security needs across finance, defense, healthcare, and telecommunications sectors.

Recent Developments:

- In October 2025, QuintessenceLabs, CSIRO, and AARNet demonstrated a live 12.7 km quantum-secure link using qOptica continuous variable QKD over standard optical fiber at CSIRO’s Marsfield site in Sydney, achieving strong secret key rates for practical quantum cybersecurity.

- In April 2025, QNu Labs launched Q-Shield, a platform empowering enterprises to protect critical infrastructure with quantum-safe security solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Security Type, Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Quantum cryptography will become a critical component of enterprise and government cybersecurity strategies worldwide.

- Adoption will increase in sectors handling sensitive data, including finance, healthcare, defense, and telecommunications.

- Organizations will integrate quantum encryption with existing IT and cloud infrastructures to enhance data protection.

- Development of hybrid quantum-classical networks will allow broader deployment without replacing legacy systems.

- Advances in satellite-based quantum key distribution (QKD) will enable secure communication over long distances.

- Growing investments in research and development will accelerate commercialization of scalable and cost-effective quantum cryptography solutions.

- Regulatory frameworks and international standards for quantum-safe communication will become more defined, supporting market expansion.

- Strategic partnerships between technology providers, telecom operators, and research institutions will strengthen the quantum cryptography ecosystem.

- Emerging economies will increase adoption as digitalization, cybersecurity awareness, and infrastructure development rise.

- Continuous innovation in quantum devices, including photon sources, detectors, and random number generators, will drive next-generation encryption capabilities and market growth.

Market Drivers:

Market Drivers: