Market Overview

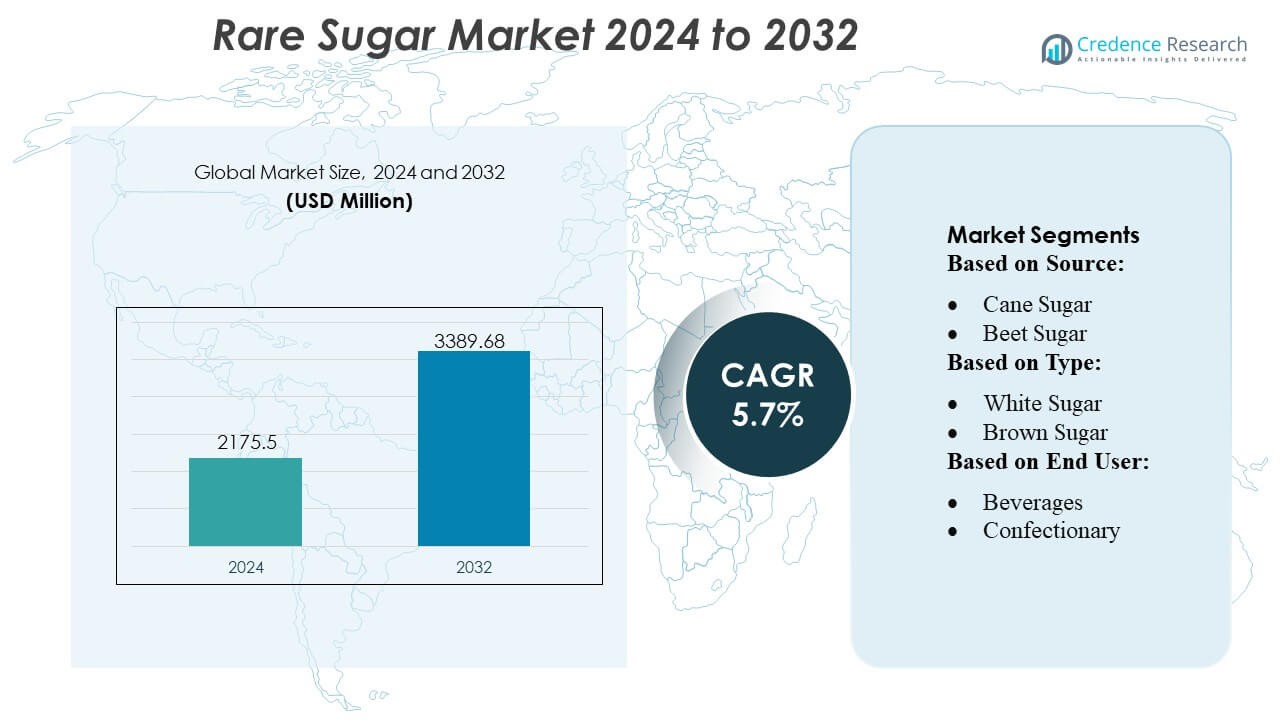

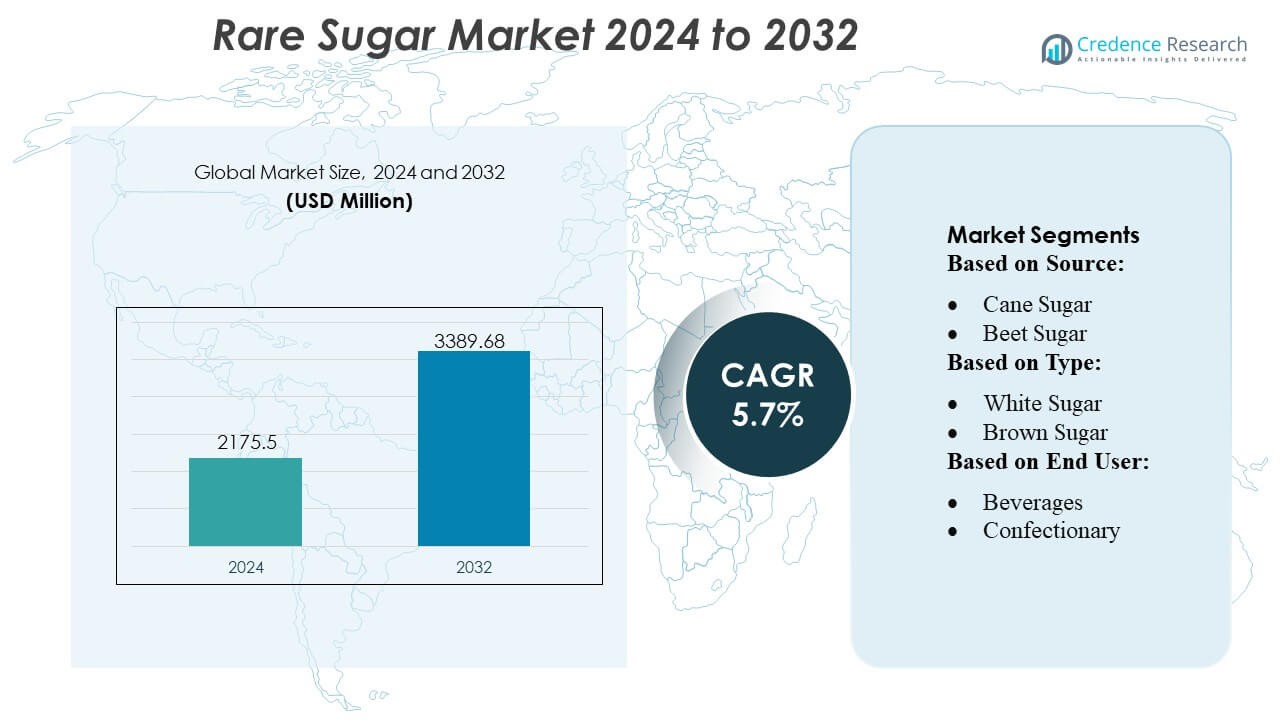

Rare Sugar Market size was valued USD 2175.5 million in 2024 and is anticipated to reach USD 3389.68 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rare Sugar Market Size 2024 |

USD 2175.5 Million |

| Rare Sugar Market, CAGR |

5.7% |

| Rare Sugar Market Size 2032 |

USD 3389.68 Million |

The Rare Sugar Market is shaped by globally established ingredient manufacturers that focus on advanced enzymatic conversion, bioprocessing efficiency, and large-scale commercial supply of allulose, tagatose, trehalose, and other specialty sugars. These companies strengthen competitiveness through innovation pipelines, clean-label product development, and partnerships with major food and beverage brands driving sugar-reduction strategies. North America emerges as the leading region with an exact 38% market share, supported by strong regulatory clarity, high adoption of low-calorie sweeteners, and rapid reformulation activity across beverages, bakery, and nutrition categories. Robust production capabilities and continuous R&D investments reinforce the region’s dominant position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rare Sugar Market reached USD 2175.5 million in 2024 and USD 68 million in 2032 is projected to grow at a 5.7% CAGR reflecting consistent expansion across major food and beverage applications.

- Rising demand for low-calorie and metabolic-friendly sweeteners drives market growth, as manufacturers integrate allulose, tagatose, and trehalose into beverages, bakery, and nutrition products.

- Clean-label trends and enzymatic production innovations shape market advancement, strengthening competitive positioning among ingredient suppliers.

- High production costs and limited large-scale availability restrain rapid adoption, though technological improvements continue to ease constraints.

- North America leads with an exact 38% share, while beverages hold the dominant segment share due to strong use of rare sugars in reformulated low-sugar drink portfolios, reinforcing regional and category-level leadership.

Market Segmentation Analysis:

By Source

Cane sugar holds the dominant position in the Rare Sugar Market with an estimated 65% share, driven by its widespread cultivation, higher sucrose yield, and strong processing infrastructure across tropical regions. Its availability, cost-efficiency, and established supply chains support consistent production volumes, enabling manufacturers to scale specialty and rare sugar derivatives with greater efficiency. Rising consumer preference for naturally derived sweeteners and cleaner-label formulations strengthens demand for cane-based rare sugars, while beet sugar grows steadily due to expanding adoption in temperate regions and improved extraction technologies that enhance purity and functional performance.

- For instance, Nutrinova operates a dedicated, single-purpose manufacturing facility in Germany certified to FSSC 22000 and ISO 9001 standards which produces its flagship high-intensity sweetener Acesulfame potassium (Ace-K) under the brand Sunett.

By Type

White sugar leads the market with an approximate 55% share, supported by its high purity, neutral flavor profile, and suitability for processing rare sugar variants such as allulose, tagatose, and trehalose. Its consistency and ease of refinement make it the preferred input for manufacturers targeting large-scale formulations in beverages, bakery, and functional foods. Brown sugar shows moderate growth due to rising interest in minimally processed sweeteners, while liquid sugar gains traction in industrial applications for its solubility, processing convenience, and compatibility with high-throughput production systems.

- For instance, Ajinomoto Co., Inc. applies its deep expertise in amino-acid fermentation and enzyme technologies developed over more than 100 years of research to produce a full portfolio of 20 amino acids using sugar-derived feedstocks.

By End User

The beverages segment dominates with an estimated 40% share due to increasing adoption of low-calorie and functional sweeteners in sports drinks, ready-to-drink beverages, energy drinks, and flavored waters. Producers leverage rare sugars to reduce calorie content while maintaining sweetness intensity and functional stability. Confectionery and bakery segments follow closely, supported by rare sugars’ browning behavior, moisture retention, and reduced glycemic impact. Dairy products incorporate rare sugars to enhance flavor balance and texture, while other food applications grow as manufacturers explore sugar-reduction strategies across sauces, spreads, and nutritional products.

Key Growth Drivers

Growing Demand for Low-Calorie and Functional Sweeteners

The Rare Sugar Market expands rapidly as consumers seek low-calorie, low-glycemic, and functional sweeteners that support weight management and metabolic health. Rare sugars such as allulose and tagatose deliver sweetness profiles close to sucrose while enabling sugar reduction in beverages, bakery, and dairy products. Food manufacturers adopt these alternatives to meet clean-label expectations and comply with reformulation guidelines. Steady product launches in sports nutrition, flavored waters, and reduced-sugar confectionery strengthen demand and accelerate integration across mainstream food and beverage categories.

- For instance, The NutraSweet Company documents that its neotame molecule delivers a sweetness intensity between 7,000 and 13,000 times that of sucrose, enabling microgram-level inclusion rates in formulations, and its manufacturing specifications confirm a minimum assay purity of 98.0 under FCC requirements parameters that support high-efficiency use in low-calorie and functional product development.

Rising Shift Toward Clean-Label and Naturally Derived Ingredients

Clean-label preferences drive the adoption of rare sugars sourced from natural raw materials such as cane and beet sugar. Consumers show strong interest in sweeteners that offer transparency, minimal processing, and plant-based origins. Rare sugars meet these expectations while providing functional advantages such as improved browning, enhanced texture, and reduced caloric impact. Manufacturers respond by increasing investments in enzymatic conversion and biotransformation technologies to scale natural sugar derivatives. This shift strengthens market positioning across premium and health-focused food segments.

- For instance, Roquette Frères operates its Lestrem bio-refinery, which is publicly documented as the world’s largest polyols production site. The company announced a €25 million investment in the facility in March 2022 to improve efficiency and strengthen its position in the market, though specific annual output figures in metric tons are not publicly disclosed.

Expansion of Food and Beverage Innovation Using Advanced Sugar Alternatives

Innovation in product formulation plays a central role in market acceleration as rare sugars become key ingredients in reformulated and next-generation food products. Brands use allulose, trehalose, and tagatose to enhance sweetness stability, reduce crystallization, and improve mouthfeel without compromising taste. Their compatibility with high-temperature processing enables broader applications in syrups, frozen desserts, and baked goods. Continuous investments in R&D and ingredient optimization fuel adoption in functional foods, where reduced sugar content and metabolic benefits support premium positioning.

Key Trends & Opportunities

Integration of Biotechnological and Enzymatic Production Technologies

Biotechnological advancements shape a significant trend as producers adopt enzymatic conversion, microbial fermentation, and controlled isomerization to manufacture rare sugars efficiently. These methods allow selective transformation of sucrose and fructose into high-value sugar derivatives with superior purity and consistency. Improved process yields reduce production costs and expand scalability, making rare sugars more competitive with traditional sweeteners. The focus on sustainable feedstocks and low-energy pathways enhances long-term market potential and supports regulatory alignment in major food markets.

- For instance, JK Sucralose Inc. reports that its Jiangsu production campus operates a closed-loop chlorination and crystallization system with an annual installed capacity of 1,200 metric tons of sucralose, supported by a multi-stage purification process documented to achieve a minimum assay purity of 98.0 under FCC standards and a residual solvent specification below 0.01 according to its global regulatory submission files.

Growing Applications Across Nutritional and Specialty Food Categories

The market benefits from rising use of rare sugars in nutritional bars, protein beverages, sports supplements, and diabetic-friendly foods. Their favorable metabolic profile and lower caloric contribution make them attractive for health-oriented formulations. Food scientists leverage rare sugars to improve freeze protection, stabilize proteins, and enhance moisture retention, enabling new product formats. This trend creates opportunities for premium positioning, particularly among brands targeting weight management, fitness nutrition, and functional wellness categories.

- For instance, Archer Daniels Midland Company (ADM) operates a massive bioprocessing complex in Decatur, Illinois, which serves as a global hub for corn processing and innovation. This complex houses fermentation capabilities for large-scale production of various bio-products, including ethanol (processing hundreds of thousands of bushels of corn daily for approximately 350 million gallons of ethanol annually) and other ingredients.

Key Challenges

High Production Costs and Limited Commercial-Scale Availability

Production of rare sugars remains constrained due to complex enzymatic pathways, costly catalysts, and limited commercial fermentation capacity. These factors elevate price points compared with conventional sugar and restrict adoption in mass-market categories. Many manufacturers face challenges in achieving consistent yields and purity at industrial scale, slowing downstream integration. The scarcity of large-scale facilities limits supply reliability for global brands, making expansion dependent on continued technological advancements and investment in scalable, cost-efficient processing methods.

Regulatory Uncertainties and Labeling Constraints in Key Markets

Regulatory variations across regions create challenges for manufacturers, particularly regarding health claims, GRAS approvals, and labeling requirements for alternative sweeteners. Differences in permitted usage levels and classification of rare sugars influence formulation strategies and market access. Some rare sugars still face limited recognition in emerging markets, affecting adoption by multinational food companies. These regulatory inconsistencies increase compliance costs and slow multinational rollout, requiring coordinated efforts to secure approvals and harmonize labeling standards to ensure broader market penetration.

Regional Analysis

North America

North America holds a strong 38% share of the Rare Sugar Market, driven by high consumer demand for low-calorie sweeteners, strong adoption of clean-label ingredients, and rapid reformulation activity across beverages and functional foods. Food manufacturers integrate rare sugars such as allulose and tagatose into reduced-sugar products to comply with nutritional guidelines and capitalize on wellness-driven consumption patterns. Supportive regulatory frameworks, rising interest in diabetes-friendly alternatives, and expanded commercial-scale production capacity further enhance regional growth. Strong retail penetration and active product innovation also reinforce North America’s leading position.

Europe

Europe maintains a substantial 28% market share, supported by strict sugar-reduction regulations, rising demand for natural sweeteners, and increasing adoption of rare sugars in bakery, confectionery, and dairy segments. Health-conscious consumers and manufacturers’ focus on clean-label formulations accelerate the shift toward allulose, tagatose, and trehalose. Ongoing reformulation mandates, combined with advancements in enzymatic processing technologies, enhance supply availability within key markets such as Germany, the U.K., and France. Growing investments in specialty ingredients and sustainability-focused production methods strengthen regional competitiveness.

Asia-Pacific

Asia-Pacific accounts for 25% of the market, driven by expanding food and beverage manufacturing, rising disposable income, and growing awareness of low-calorie sweeteners. The region experiences increasing adoption of rare sugars in functional beverages, bakery products, and nutritional supplements, supported by rapid urbanization and evolving dietary preferences. Strong production ecosystems in countries like Japan, South Korea, and China accelerate technological advancements in enzymatic sugar conversion. As major players scale output to meet global demand, Asia-Pacific emerges as a rapidly growing hub for both consumption and manufacturing.

Latin America

Latin America captures an estimated 5% share, supported by expanding use of natural sweeteners in beverages and dairy products, particularly in markets such as Brazil and Mexico. Growing consumer interest in healthier alternatives and rising incidences of diabetes encourage adoption of low-glycemic rare sugars. Local manufacturers steadily incorporate allulose and tagatose into reduced-calorie beverages and confectionery items. However, limited large-scale production infrastructure and price sensitivity temper faster market penetration, keeping growth moderate yet promising as regulatory support and health awareness continue to strengthen.

Middle East & Africa

The Middle East & Africa region holds a 4% share, driven by increasing demand for low-calorie sweeteners in premium beverages, bakery products, and specialty foods. Rising urbanization, growing interest in Western-style diets, and expanding retail distribution channels support the gradual adoption of rare sugars. However, higher import dependence, limited regional production capabilities, and cost barriers constrain rapid uptake. Despite these challenges, rising awareness of metabolic health and the expanding presence of multinational food manufacturers create growth avenues, positioning the region for steady long-term development.

Market Segmentations:

By Source:

By Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Rare Sugar Market features a diverse group of global ingredient leaders, including GLG Life Tech Corp., Ingredion Incorporated, Cargill, Incorporated, Nutrinova, Ajinomoto Co., The NutraSweet Company, Roquette Frères, JK Sucralose Inc., Archer Daniels Midland Company (ADM), and Tate & Lyle. the Rare Sugar Market is defined by strong innovation, expanding production capacity, and increasing technological investments aimed at improving efficiency and purity in rare sugar manufacturing. Companies focus on enzymatic conversion, microbial fermentation, and advanced bioprocessing methods to scale the production of allulose, tagatose, trehalose, and other specialty sugars that support sugar-reduction strategies across food and beverage applications. The market sees rising collaboration between ingredient manufacturers, research institutions, and food brands to accelerate product development and regulatory approvals. Competition intensifies as firms enhance supply reliability, diversify product portfolios, and target clean-label, low-calorie, and metabolic health segments. This shift toward high-performance, health-aligned sweeteners strengthens competitive differentiation and drives continued market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Samyang Corporation became the first company worldwide to secure approval from Food Standards Australia New Zealand (FSANZ) for its rare sugar sweetener Allulose, allowing it to be officially used as a food ingredient in Australia and New Zealand. Allulose is recognized as a low-calorie sweetener, as it is a rare sugar with 70% of the sweetness of sucrose, yet with nearly zero calories.

- In October 2024, Tate & Lyle and Manus Bio formed a strategic partnership launching “The Natural Sweetener Alliance” to commercially produce all-Americas sourced, bioconverted Reb M stevia, offering a stable, high-quality, natural sugar reduction solution for food & beverage brands, leveraging Manus’ bio-manufacturing in Georgia and Tate & Lyle’s global reach to meet consumer demand for healthier options.

- In April 2024, Ingredion announced the launch of its new plant‑based sweetening solution called PURECIRCLE Clean Taste Solubility Solution (CTSS), a clean‑label stevia extract that boasts over 100× solubility improvement relative to traditional Reb M stevia.

- In March 2024, Tagatose producer Bonumose and distributor ASR Group have announced that the monosaccharide sweetener has received NutraStrong Prebiotic Verified certification, meeting rigorous prebiotic activity standards set by a third-party verifier.

Report Coverage

The research report offers an in-depth analysis based on Source, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low-calorie and low-glycemic sweeteners will continue to rise across beverages, bakery, and nutrition products.

- Manufacturers will expand enzymatic and fermentation-based production to improve yield, purity, and scalability.

- Regulatory approvals for rare sugars in additional regions will accelerate commercial adoption.

- Food brands will increase reformulation initiatives to replace conventional sugar with healthier alternatives.

- Clean-label product development will strengthen the shift toward naturally sourced rare sugars.

- Innovation in metabolic health and diabetic-friendly foods will boost rare sugar integration.

- Cost optimization and process efficiency improvements will make rare sugars more competitive with traditional sweeteners.

- Partnerships between ingredient companies and food manufacturers will drive faster product commercialization.

- Growing consumer awareness of functional sweeteners will expand demand in premium and specialty food categories.

- Expansion of production facilities in Asia-Pacific and North America will support global supply stability and market growth.